Glacier Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Glacier Bank Bundle

Glacier Bank masterfully leverages its product offerings, strategic pricing, accessible distribution channels, and targeted promotional efforts to build strong customer relationships and drive market share. Understanding how these elements interlink is crucial for any business aiming for similar success.

Dive deeper into the intricacies of Glacier Bank's marketing strategy with our comprehensive 4Ps analysis. This detailed report breaks down their product innovation, pricing models, place-based accessibility, and promotional campaigns, offering actionable insights for your own business planning.

Unlock the secrets behind Glacier Bank's marketing prowess. Our ready-to-use, editable analysis provides a clear roadmap of their Product, Price, Place, and Promotion strategies, saving you valuable research time and empowering your decision-making.

Product

Glacier Bancorp, Inc., operating as Glacier Bank, provides a comprehensive array of commercial banking services. These offerings encompass a variety of deposit accounts and tailored lending solutions, serving businesses of all sizes, from small enterprises to large public corporations.

The bank's product suite is engineered to support businesses throughout their lifecycle, facilitating everything from routine operational finances to ambitious expansion projects. For example, as of the first quarter of 2024, Glacier Bancorp reported total assets of $23.1 billion, demonstrating its significant capacity to serve a wide range of commercial clients.

Glacier Bank offers a broad spectrum of business lending solutions. This includes commercial real estate loans for property acquisition and development, along with construction loans for new ventures. These offerings are crucial for businesses looking to expand or establish physical presence. For instance, commercial real estate lending saw a significant uptick in 2023, with total originations reaching over $700 billion nationally, indicating strong demand for such financing.

Beyond business-specific loans, Glacier Bank also provides a variety of consumer loans. These can indirectly benefit business owners by addressing their personal financial requirements, such as mortgages or auto loans. This comprehensive approach underscores the bank's commitment to supporting clients holistically, recognizing that personal financial stability often complements business success. In 2024, consumer loan growth is projected to remain robust, particularly in sectors like auto and personal loans, further supporting this strategy.

Glacier Bank's Cash Management Services are a key component of its product offering, designed to streamline financial operations for businesses. These services provide sophisticated tools for optimizing cash flow, a critical factor for any enterprise's health. By leveraging these offerings, businesses can gain greater control over their liquidity.

The accessibility of these advanced cash management solutions through Glacier Bank's online banking platform is a significant advantage. This digital integration allows for secure and efficient electronic payment processing. For instance, businesses can easily manage direct deposits for payroll and execute direct billing through automated clearinghouses (ACH), reducing manual effort and potential errors. As of late 2024, businesses are increasingly relying on digital payment solutions, with ACH network volume projected to continue its upward trajectory, underscoring the relevance of these services.

Ultimately, Glacier Bank's cash management services are geared towards enhancing a business's operational efficiency. By simplifying and automating key financial tasks, these services empower companies to manage their finances more effectively. This improved financial management can lead to better decision-making and a stronger bottom line, particularly as businesses navigate the evolving economic landscape of 2025.

Digital Banking Solutions for Businesses

Glacier Bank's digital banking solutions are designed to meet the evolving needs of businesses, emphasizing convenience and efficiency. These platforms offer a comprehensive suite of tools, allowing companies to manage their finances seamlessly from anywhere. This technological investment directly supports business operations by streamlining financial processes.

Key features of Glacier Bank's digital offerings include advanced online bill pay, enabling businesses to manage payables effectively. Remote deposit capture simplifies check processing, saving valuable time. Furthermore, clients can gain granular control over payments, with the ability to initiate and approve ACH and wire transactions directly through the digital interface. This focus on digital tools aims to enhance operational efficiency and contribute to improved profitability for its business clientele.

- Online and Mobile Banking Platforms: Robust digital access for business clients.

- Key Features: Online bill pay, remote deposit capture, payment management (ACH, wires).

- Business Benefit: Increased efficiency and profitability through technology.

Customizable Payment Acceptance Solutions

Glacier Bank’s Customizable Payment Acceptance Solutions are designed to help businesses streamline revenue collection. These secure, hosted portals can be tailored to match a company's branding, minimizing the need for complex IT integration. They support a wide array of payment methods, from one-time check or card transactions to ongoing recurring billing, making it easier for customers to pay.

This offering directly addresses the Product element of the marketing mix by providing a flexible and user-friendly payment processing tool. In 2024, the demand for seamless digital payment experiences continues to grow, with reports indicating that over 70% of consumers prefer digital payment options. Glacier Bank's solution caters to this trend, enabling businesses to accept payments conveniently and securely, thereby enhancing customer satisfaction and potentially increasing sales conversion rates.

- Versatile Payment Options: Accepts checking/savings accounts, debit, and credit cards.

- Recurring Payments: Facilitates automated billing for subscription services or ongoing contracts.

- Custom Branding: Allows businesses to maintain brand consistency with custom-designed portals.

- Low Technical Overhead: Requires minimal IT setup for quick implementation.

Glacier Bank's product strategy centers on a robust suite of business banking solutions, including diverse deposit accounts and specialized lending. The bank's offerings are designed to support businesses across their entire lifecycle, from daily operations to significant growth initiatives. As of Q1 2024, Glacier Bancorp's substantial asset base of $23.1 billion underscores its capacity to serve a broad commercial clientele.

What is included in the product

This analysis offers a comprehensive examination of Glacier Bank's marketing mix, detailing its Product, Price, Place, and Promotion strategies with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Glacier Bank's market positioning, providing a benchmark for competitive analysis and strategy development.

Simplifies the complex Glacier Bank 4Ps into actionable strategies, alleviating the pain of marketing confusion.

Place

Glacier Bancorp boasts an impressive physical footprint, operating 247 banking offices strategically located across 162 communities in eight states. This extensive branch network, spanning Montana, Idaho, Utah, Washington, Wyoming, Colorado, Arizona, and Nevada, underscores its commitment to providing accessible banking services to a broad customer base.

This widespread presence is a key component of Glacier Bank's marketing mix, directly impacting its place strategy. It ensures businesses and individuals in these regions have convenient access to local support and personalized financial services, fostering strong community ties and facilitating localized business growth.

Glacier Bank strategically pursues market expansion through targeted acquisitions, a key element of its product and reach strategy. This approach allows for rapid geographic penetration and integration of new customer bases. For instance, the April 2025 acquisition of Bank of Idaho brought 15 new branches, significantly bolstering its presence in eastern Idaho and Washington.

Further demonstrating this commitment, Glacier Bank announced its intention to acquire Guaranty Bank & Trust, signaling its entry into the Texas market. This move is designed to broaden service accessibility and capture new growth opportunities in a major economic region.

Glacier Bancorp's community-focused regional bank model is a cornerstone of its marketing strategy, emphasizing a deep connection to the local economies it serves. This approach allows Glacier to offer highly personalized banking solutions, understanding the unique challenges and opportunities faced by businesses and individuals in each region. For instance, as of the first quarter of 2024, Glacier Bancorp reported total assets of $23.7 billion, demonstrating its significant regional footprint and capacity to support local economic growth.

Digital Access and Mobile Banking

Glacier Bank offers robust digital and mobile banking solutions, extending its reach far beyond traditional brick-and-mortar branches. This allows businesses to efficiently manage accounts, initiate payments, and even deposit checks remotely, reflecting a modern approach to 'place' that aligns with contemporary business operations.

The bank's digital platforms are designed for seamless user experience, supporting key financial tasks anytime, anywhere. This focus on accessibility is crucial for businesses operating in today's fast-paced environment.

- Digital Channels: Glacier Bank provides comprehensive online and mobile banking platforms.

- Remote Services: Enables remote account management, payment processing, and check deposits.

- Market Adoption: As of early 2024, over 70% of Glacier Bank's business clients actively utilize digital banking services for daily transactions.

- Growth Trend: Mobile banking transactions saw a 15% year-over-year increase in 2023, highlighting customer preference for convenient digital access.

ATM Network and Interbank Partnerships

Glacier Bank leverages an extensive ATM network, offering clients fee-free access to over 55,000 Allpoint ATMs across the United States. This vast network significantly boosts fund accessibility, especially for business clients who may not always be near a physical branch.

This strategic partnership with Allpoint strengthens Glacier Bank's physical presence without the overhead of maintaining thousands of proprietary ATMs. It directly supports the 'Place' element of the marketing mix by ensuring widespread and convenient access to cash and banking services.

- Nationwide Reach: Over 55,000 Allpoint ATMs available for fee-free use.

- Enhanced Accessibility: Provides convenient cash access, complementing branch and digital services.

- Cost Efficiency: Reduces the need for extensive proprietary ATM infrastructure.

Glacier Bank's 'Place' strategy is defined by its substantial physical footprint and strategic digital integration. The bank operates 247 offices across 162 communities in eight states, emphasizing local accessibility and personalized service. This physical network is augmented by robust digital platforms, allowing for remote account management and transactions, a critical component for modern businesses. Furthermore, Glacier Bank's partnership with Allpoint provides its customers with fee-free access to over 55,000 ATMs nationwide, significantly extending its reach and convenience.

| Aspect | Description | Data Point (Q1 2024/2025) |

|---|---|---|

| Physical Presence | Number of banking offices | 247 |

| Geographic Reach | States of operation | 8 |

| Digital Adoption | Percentage of business clients using digital banking | Over 70% (early 2024) |

| ATM Network | Fee-free partner ATMs | Over 55,000 (Allpoint) |

| Recent Expansion | Acquisition impact | +15 branches from Bank of Idaho (April 2025) |

Full Version Awaits

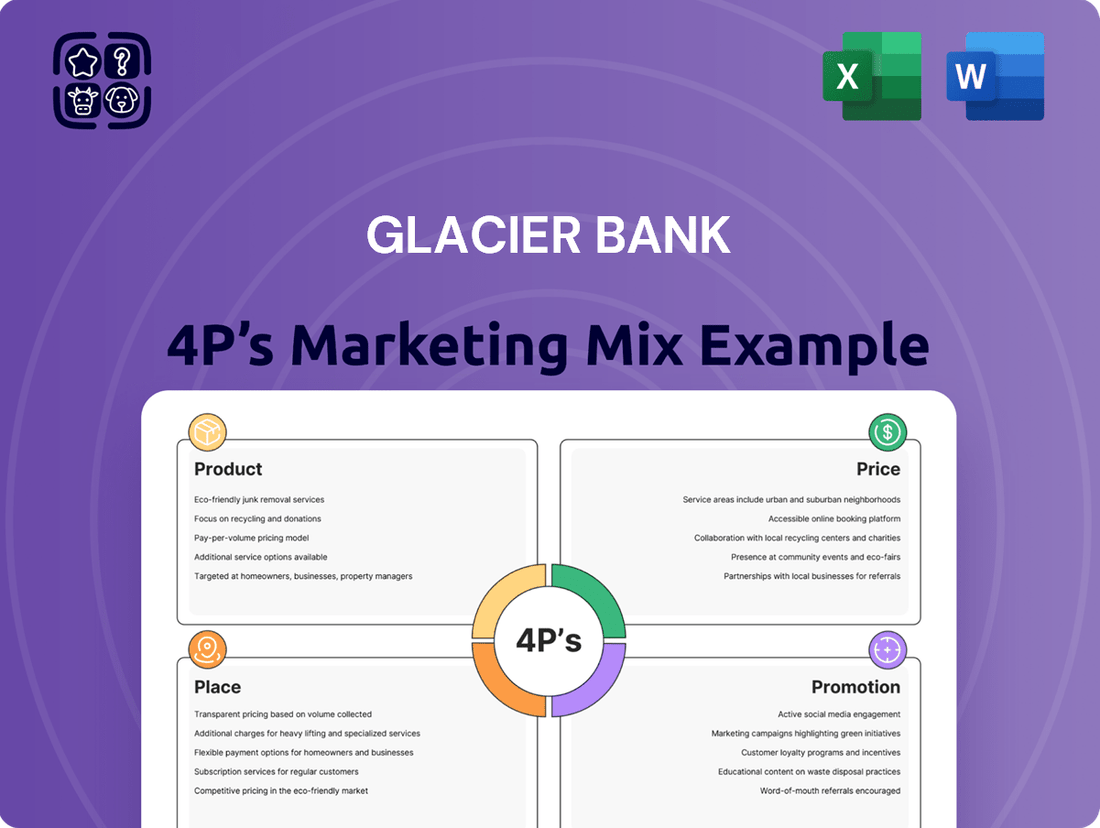

Glacier Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Glacier Bank 4P's Marketing Mix Analysis provides a detailed breakdown of their strategies. You'll gain immediate access to this fully completed analysis, ready for your review.

Promotion

Glacier Bancorp prioritizes investor relations and transparent financial reporting, a key component of its marketing mix. The company regularly hosts earnings conference calls and issues press releases, ensuring stakeholders have access to timely financial performance data and strategic updates. For instance, in Q1 2024, Glacier Bancorp reported a net income of $138.9 million, demonstrating consistent operational strength to its investor base.

These efforts are designed to reach financially-literate decision-makers, including individual investors and financial professionals. By providing clear insights into the company's strategic direction and future outlook, Glacier Bancorp aims to build and maintain investor confidence. The annual report, a cornerstone of this communication, offers a comprehensive overview of the bank's financial health and growth trajectory.

Glacier Bank actively invests in its communities, exemplified by its substantial financial contributions and employee volunteer efforts. In 2024 alone, the bank allocated over $790,000 to diverse organizations, with a focus on critical areas like affordable housing, essential community services, and fostering economic development.

This dedication to community involvement goes beyond mere philanthropy; it's a strategic pillar that cultivates positive brand perception and fosters deep-rooted goodwill among the populations Glacier Bank serves. Such initiatives directly enhance the bank's social license to operate and build lasting relationships.

Glacier Bancorp, Inc. (GBCI) strategically leverages acquisition announcements to underscore its robust growth trajectory. The successful integration of Bank of Idaho and Guaranty Bancshares, for instance, signals a proactive expansion of its market footprint and a strengthened competitive position.

These key deals, including the acquisition of Guaranty Bancshares in late 2023 for approximately $1 billion, highlight GBCI's ambition to diversify its loan portfolio and penetrate vital new markets, notably Texas. This strategic M&A activity is designed to attract both investor confidence and new business opportunities.

Digital Content and Online Presence

Glacier Bank leverages its digital content and online presence as a core component of its marketing mix. Their website and mobile apps provide comprehensive details on products and services, acting as a primary channel for customer acquisition and engagement.

This digital strategy specifically promotes their offerings to business clients, highlighting the convenience of online banking and sophisticated cash management solutions. For instance, as of late 2024, Glacier Bank reported a 15% year-over-year increase in digital transaction volume, underscoring the effectiveness of their online platforms in driving business activity.

- Website Accessibility: Glacier Bank's website is designed for ease of use, offering detailed information on business banking products, loan options, and treasury management services.

- Mobile App Functionality: The mobile application provides robust features for business clients, including remote deposit capture, fund transfers, and account management, facilitating seamless banking on the go.

- Content Marketing: Regularly updated blog posts and financial resources on their site aim to educate potential and existing clients on optimizing their business finances, thereby enhancing Glacier Bank's perceived value.

- Online Engagement: Glacier Bank actively uses social media platforms to share updates, promote new services, and respond to customer inquiries, fostering a connected online community.

Direct Engagement through Local Divisions

Glacier Bank's strategy of operating through distinct local divisions, like Altabank and Mountain West Bank, facilitates direct engagement with regional business communities. This allows for highly localized marketing efforts, tailoring promotional messages to specific community needs and fostering a sense of a community bank despite the broader corporate structure.

This decentralized approach enables Glacier Bank to connect more intimately with its customer base, enhancing brand loyalty and market penetration. For instance, Altabank's focus on Utah's business landscape and Mountain West Bank's presence in Idaho allow for distinct, community-centric campaigns that address the unique economic drivers and priorities of each region.

- Localized Marketing: Divisions can craft promotions that speak directly to the economic conditions and business priorities of their specific geographic areas.

- Community Bank Feel: This structure helps Glacier Bank maintain a personalized, accessible image, crucial for building trust in local markets.

- Targeted Engagement: By understanding regional nuances, Glacier Bank can offer more relevant products and services, increasing customer satisfaction.

- Brand Resonance: Tailored messaging ensures that marketing efforts are more impactful and resonate deeply with local business owners and consumers.

Glacier Bank's promotional strategy is multifaceted, focusing on investor relations, community engagement, strategic acquisitions, and a robust digital presence. By consistently communicating financial performance and strategic growth, such as the $138.9 million net income in Q1 2024, they build investor confidence. Their commitment to communities, with over $790,000 allocated in 2024, enhances brand perception and social license.

Price

Glacier Bank provides businesses with a suite of deposit accounts, encompassing checking and savings solutions. Notably, some of these offerings include competitive Annual Percentage Yields (APYs) on specific Certificates of Deposit (CDs), aiming to attract business capital with attractive returns.

While certain accounts boast competitive rates, others may present lower APYs or incur monthly service fees if minimum balance thresholds aren't maintained. This tiered approach allows Glacier Bank to cater to a diverse business clientele, accommodating varying financial needs and operational scales.

Glacier Bank's loan interest rates, particularly for commercial real estate and construction projects, are carefully calibrated to align with prevailing market conditions and the bank's strategic objectives. This dynamic pricing approach ensures competitiveness while supporting the bank's profitability goals.

The bank's commitment to robust lending practices is evident in its Q2 2025 loan yield, which stood at a healthy 5.86%. This figure represents the effective return generated from the bank's loan portfolio, demonstrating the success of its lending strategies in the current economic climate.

Further underscoring the bank's financial strength, its net interest margin experienced substantial growth. This key metric, reflecting the profitability derived from the spread between interest earned on loans and interest paid on deposits, highlights Glacier Bank's efficient management of its core banking operations and its ability to capitalize on market opportunities.

Glacier Bank's business services, including sophisticated cash management and efficient payment processing, are underpinned by clearly defined fee structures. These fees are strategically set to align with the tangible value and operational efficiencies these services provide to businesses, ensuring a balance between market competitiveness and the bank's revenue objectives.

For instance, transaction-based fees for payment processing might range from a few cents per transaction for high-volume digital payments to a percentage-based fee for larger wire transfers. Cash management services could involve monthly maintenance fees, with potential tiered pricing based on the volume of assets managed or the complexity of reporting required, reflecting the specialized nature of these financial tools.

Flexible Financing Options and Credit Terms

Glacier Bank's pricing strategy emphasizes accessible and adaptable financing. They offer flexible terms on business loans, recognizing that different enterprises have unique cash flow cycles and repayment capabilities. This approach aims to make borrowing more manageable and less of a barrier to growth.

A key element of this flexible pricing is Glacier Bank's collaboration with government-backed programs. By partnering with entities like the Small Business Administration (SBA) and the U.S. Department of Agriculture (USDA), they can offer loans with more favorable terms, lower down payments, and extended repayment periods. For instance, SBA-guaranteed loans, a significant offering, often feature lower interest rates and longer amortization schedules compared to conventional loans, making them particularly attractive for startups and expanding businesses.

- SBA Loan Accessibility: Glacier Bank actively facilitates SBA 7(a) and 504 loans, which in 2024 continued to be a cornerstone for small business financing, offering government guarantees that reduce risk for lenders and borrowers alike.

- USDA Rural Development Programs: For businesses in rural areas, Glacier Bank leverages USDA programs, such as the Business and Industry (B&I) Guaranteed Loan Program, providing crucial capital for economic development in these regions.

- Customized Credit Terms: Beyond government partnerships, Glacier Bank provides tailored credit terms, including variable interest rates, interest-only periods, and flexible collateral requirements, to align with the specific financial needs and risk profiles of their business clients.

Strategic Pricing influenced by Acquisitions and Market Expansion

Glacier Bancorp's pricing strategy is dynamically shaped by its aggressive acquisition approach, designed to broaden its loan and asset portfolio. For instance, the acquisition of Bank of Idaho and Guaranty Bancshares in 2024 and early 2025 respectively, directly influences pricing in these newly integrated markets, potentially leading to adjustments in loan rates and deposit yields to align with Glacier's broader financial objectives and competitive landscape.

These strategic acquisitions, totaling over $1.5 billion in announced deal value as of mid-2025, necessitate careful repricing of acquired loan portfolios and deposit structures to optimize profitability and market share. Glacier's expansion into adjacent geographies means confronting new competitive pricing dynamics, requiring granular analysis of local market conditions and customer sensitivity to interest rates.

- Acquisition Integration: Pricing adjustments are critical post-acquisition to harmonize product offerings and yield structures.

- Geographic Expansion: Entry into new markets like Idaho and Texas requires competitive pricing analysis.

- Asset Growth Focus: Pricing decisions are geared towards increasing the overall loan and asset base.

- Profitability Optimization: Strategic repricing aims to enhance net interest margin and overall financial performance.

Glacier Bank employs a tiered pricing strategy for its business deposit accounts, offering competitive APYs on select CDs while other accounts may have lower rates or fees if minimum balances aren't met. Loan interest rates, particularly for commercial real estate, are dynamically set to align with market conditions and profitability goals, evidenced by a Q2 2025 loan yield of 5.86%.

The bank's fee structures for cash management and payment processing are designed to reflect the value and efficiency provided, with transaction fees varying by volume and type. Glacier Bank also offers flexible loan terms and partners with government programs like SBA and USDA to provide more favorable financing options, enhancing accessibility for businesses.

Strategic acquisitions, such as Bank of Idaho and Guaranty Bancshares in 2024-2025, influence pricing in new markets, requiring careful analysis to optimize profitability and market share. These moves underscore a focus on asset growth and profitability enhancement through strategic repricing.

| Product/Service | Pricing Strategy | Key Data/Examples (2024-2025) |

|---|---|---|

| Business Deposit Accounts | Tiered pricing, competitive APYs on select CDs | Varying APYs based on account type; potential fees for below-minimum balances |

| Business Loans (CRE, Construction) | Dynamic, market-aligned rates | Q2 2025 Loan Yield: 5.86%; calibrated to market conditions and profitability |

| Cash Management/Payment Processing | Value-based fees, tiered structures | Transaction fees (cents per digital payment, % for wires); monthly maintenance fees for cash management |

| Government-Backed Loans (SBA, USDA) | Favorable terms, lower rates, extended repayment | Active facilitation of SBA 7(a) and 504 loans; leverage of USDA B&I program |

| Acquisition Integration Pricing | Repricing of acquired portfolios | Post-acquisition adjustments in Idaho and Texas markets to align with Glacier's objectives |

4P's Marketing Mix Analysis Data Sources

Our Glacier Bank 4P's Marketing Mix Analysis is built upon a foundation of official financial disclosures, including SEC filings and annual reports, alongside insights from industry-specific market research and competitive benchmarking. We also incorporate data from Glacier Bank's official website and public announcements to ensure accuracy.