Gibraltar Industries PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gibraltar Industries Bundle

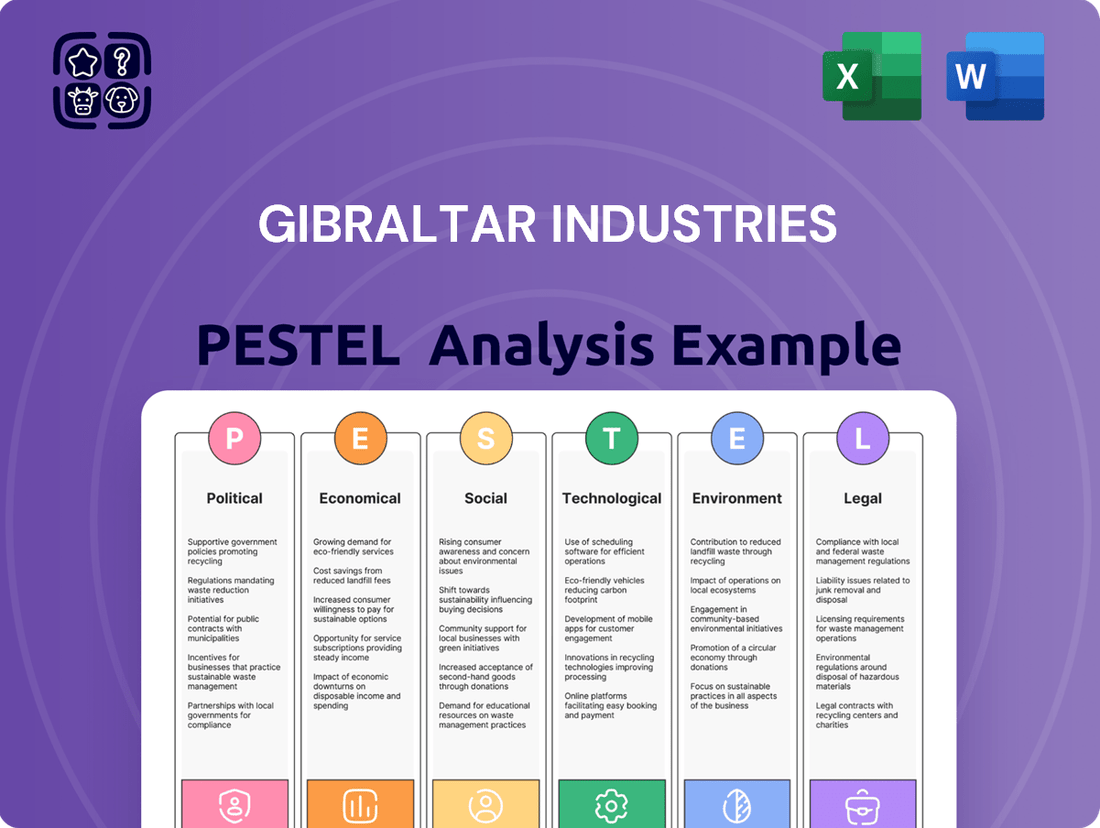

Unlock Gibraltar Industries's future by understanding the complex interplay of political, economic, social, technological, legal, and environmental factors. Our comprehensive PESTLE analysis provides the critical insights you need to anticipate market shifts and capitalize on opportunities. Download the full version now and gain a strategic advantage.

Political factors

Government investment in infrastructure projects directly fuels demand for Gibraltar Industries' products within its infrastructure segment. For instance, the Bipartisan Infrastructure Law, enacted in late 2021, allocates $1.2 trillion over ten years, with a significant portion dedicated to roads, bridges, and transit systems. This substantial federal commitment is expected to generate a strong pipeline of projects throughout 2024 and into 2025, providing a sustained demand for the company's steel components and related solutions.

Government policies and incentives are a major driver for Gibraltar Industries' solar racking business. For instance, the Inflation Reduction Act (IRA) in the United States, enacted in 2022, offers significant tax credits for renewable energy projects, including solar. This has boosted demand for solar installations and, consequently, for racking systems.

The stability and predictability of these incentives are crucial. Any changes or uncertainty surrounding programs like the IRA can directly impact the financial viability of solar projects, influencing demand for Gibraltar's products. For example, a reduction in tax credits could slow down project development and thus sales for the company.

Looking ahead to 2024 and 2025, the continuation or modification of such policies will be key. The market anticipates continued support for solar, but potential adjustments to incentive structures could create both opportunities and challenges for Gibraltar Industries. The industry is closely watching legislative developments that could affect the pace of solar adoption.

Trade tariffs, especially on key inputs like steel and aluminum, directly affect Gibraltar Industries' manufacturing costs and profit margins. For instance, the U.S. imposed a 25% tariff on steel imports in 2018, which significantly increased raw material expenses for many American manufacturers.

Geopolitical shifts and evolving trade agreements can create volatility in input prices and disrupt supply chains, posing a challenge for businesses like Gibraltar. The ongoing trade tensions between major economies in 2024 continue to create uncertainty, potentially leading to higher operating expenses and the need for agile supply chain management.

Gibraltar Industries must maintain a proactive approach to monitoring global trade policies and adapt its strategies to navigate these complexities. Developing a robust 'tariff playbook' allows the company to better anticipate and mitigate the financial impacts of changing trade landscapes, ensuring resilience in its operations.

Building Codes and Regulations

Changes and updates to building codes, safety standards, and construction regulations significantly impact Gibraltar Industries' product design, manufacturing processes, and distribution networks. For instance, evolving energy efficiency mandates, like those being implemented in various US states throughout 2024 and projected for 2025, can necessitate modifications to insulation and structural component specifications. The company must remain agile to adapt to these shifts, ensuring its offerings meet or exceed new requirements.

Compliance with updated safety standards, such as new OSHA rules or specific state-level construction safety protocols that might emerge in 2025, is paramount. These regulations often dictate material performance, installation methods, and worker protection, directly influencing product development and operational costs. For example, a new regulation mandating enhanced fire resistance in building materials could require Gibraltar Industries to invest in research and development for new product lines or material formulations.

These regulatory frameworks are typically designed to foster greater construction efficiency, enhance building safety, and promote environmental sustainability. Gibraltar Industries' proactive engagement with these evolving standards, potentially through industry associations and early adoption strategies, can provide a competitive advantage by ensuring its products are market-ready and aligned with future construction trends. The National Institute of Standards and Technology (NIST) continues to research and propose updates to building performance standards, which will likely influence future code revisions.

Political Stability and Economic Stimulus

Gibraltar Industries operates within a landscape where political stability is paramount. A steady government framework fosters confidence, encouraging the significant capital investments needed for large-scale construction and industrial projects. For instance, the US, a key market, has seen fluctuating levels of infrastructure spending, directly impacting demand for building materials. The Biden administration's Infrastructure Investment and Jobs Act, enacted in late 2021, allocated substantial funds towards repairing and upgrading roads, bridges, and public transit, which directly benefits companies like Gibraltar Industries involved in steel and building products.

Government initiatives aimed at stimulating economic growth are also critical. These can take the form of tax incentives, grants, or direct spending on public works, all of which can translate into increased demand for Gibraltar's offerings. As of early 2024, discussions around further economic stimulus packages continue, with potential impacts on sectors reliant on construction and manufacturing. A stable political climate generally correlates with predictable regulatory environments, which is essential for long-term planning in the construction materials sector.

- Political Stability: A stable political environment in key markets like the US and Canada reduces uncertainty for investors and developers, fostering growth in residential and industrial construction.

- Economic Stimulus: Government stimulus measures, such as infrastructure spending and tax credits for building projects, directly boost demand for Gibraltar Industries' products, including steel components and building envelopes.

- Policy Impact: Policy shifts, such as changes in environmental regulations or trade tariffs, can influence material costs and project viability, requiring strategic adaptation by Gibraltar Industries.

Government investment in infrastructure, such as the $1.2 trillion Bipartisan Infrastructure Law, directly fuels demand for Gibraltar's steel products. Policy incentives, like the Inflation Reduction Act's solar tax credits, significantly boost the company's solar racking business by making renewable energy projects more financially attractive.

Trade policies, including tariffs on steel, directly impact Gibraltar's manufacturing costs and profit margins. For example, the 25% steel tariff imposed in 2018 increased raw material expenses for manufacturers. Changes in building codes and safety standards, like evolving energy efficiency mandates in US states throughout 2024-2025, necessitate product design modifications and compliance investments.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Gibraltar Industries, providing a comprehensive overview of the external landscape.

It offers actionable insights for strategic decision-making by identifying key trends and their potential impact on the company's operations and future growth.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling complex external factors into actionable insights for Gibraltar Industries.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Gibraltar Industries.

Economic factors

Interest rate fluctuations are a major concern for Gibraltar Industries. For instance, the Federal Reserve's benchmark interest rate, which influences borrowing costs across the economy, saw several increases through 2023 and early 2024, aiming to curb inflation. This directly impacts the cost of capital for construction projects, making financing more expensive for developers and potentially slowing down new builds.

Higher borrowing costs can lead to reduced consumer confidence and increased price sensitivity, especially in the residential construction market. When mortgage rates rise, fewer people can afford new homes, which in turn decreases demand for building materials like those Gibraltar Industries supplies. This trend was evident in late 2023, where higher mortgage rates contributed to a slowdown in new home sales compared to earlier periods.

Gibraltar Industries must closely monitor the lending environment. For example, if commercial banks tighten lending standards or increase the prime lending rate, it can further constrain project financing. This directly affects the volume of construction activity and, consequently, the demand for Gibraltar's product portfolio, from metal roofing to engineered systems.

Gibraltar Industries faces significant headwinds from persistent inflation and escalating raw material costs. For instance, steel prices, a key input for their metal products, saw substantial volatility throughout 2024, with some benchmarks indicating increases of over 15% year-over-year at certain points. This directly squeezes their profit margins by increasing production expenses.

While broad inflation might show signs of moderation, the specter of new tariffs or renewed global supply chain snags remains a potent threat to cost stability. These factors could easily reignite upward pressure on essential materials like aluminum and other critical building components, impacting Gibraltar's bottom line. Effective supply chain management and proactive strategic sourcing are therefore paramount to navigating these economic uncertainties.

The residential housing market's vitality is a significant driver for Gibraltar Industries' residential segment, directly impacting demand for mail and package solutions and building components. For instance, the U.S. Census Bureau reported that in April 2024, new housing starts were at a seasonally adjusted annual rate of 1.32 million, a slight increase from the previous month, indicating ongoing construction activity that benefits Gibraltar.

Key indicators such as housing starts and existing home sales are crucial for assessing market health. In Q1 2024, existing home sales saw a modest uptick, suggesting a more stable environment for home purchases, which in turn can boost demand for Gibraltar's product lines.

Demographic shifts, like changing homebuyer age demographics and household formation rates, also play a role. As younger generations enter the housing market and household sizes evolve, the demand for specific types of housing and associated components will shift, influencing Gibraltar's product mix and sales volume.

Construction Spending and Investment

Overall construction spending, a key economic driver for Gibraltar Industries, is projected to see varied performance. While residential and some non-residential sectors may face headwinds from elevated interest rates, infrastructure spending is anticipated to remain robust. For instance, the U.S. Department of Transportation's Federal Highway Administration reported that total infrastructure investment in 2023 reached an estimated $278 billion, a significant increase from previous years, signaling strong public sector demand.

Gibraltar Industries' market opportunities are closely tied to these construction trends. Monitoring the pace of construction starts and overall investment across residential, commercial, and public works projects offers valuable insight into the company's potential growth avenues. The U.S. Census Bureau noted that new residential construction starts, while potentially moderating, still represent a substantial market segment.

- Residential Construction: Facing potential moderation due to higher borrowing costs, though still a significant market.

- Non-Residential Construction: Mixed outlook, with some sectors experiencing slower growth while others remain stable.

- Infrastructure Investment: A strong growth area, bolstered by government initiatives and public funding, providing a stable demand source.

- Construction Starts: Tracking the volume of new projects initiated across all sectors is crucial for forecasting demand.

Global Economic Conditions

Broader global economic conditions, encompassing consumer spending, industrial production, and international trade, significantly shape Gibraltar Industries' performance across its varied market segments. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for both 2024 and 2025, indicating a generally stable, albeit moderate, economic environment. This backdrop directly influences demand for Gibraltar's manufactured goods and components.

A strengthening global manufacturing economy, coupled with the easing of persistent supply chain disruptions, presents a tailwind for Gibraltar. As of early 2025, many supply chain metrics, such as shipping costs and delivery times, have largely normalized from pandemic-era highs, facilitating more predictable and cost-effective operations for the company. This improved flow of goods supports increased industrial output and, consequently, demand for materials and services provided by Gibraltar.

However, ongoing geopolitical uncertainty remains a critical factor, capable of disrupting global supply chains and dampening demand. Events such as trade disputes or regional conflicts can introduce volatility, impacting raw material costs and the accessibility of key markets for Gibraltar Industries. For example, the ongoing tensions in Eastern Europe continue to create ripple effects on energy prices and global trade routes, underscoring the need for strategic risk management.

- Global Growth Forecast: IMF projects 3.2% global growth for 2024 and 2025, suggesting a steady but not robust economic expansion.

- Supply Chain Normalization: Key supply chain indicators show significant improvement compared to 2021-2022, benefiting manufacturing efficiency.

- Geopolitical Risks: Persistent geopolitical instability, particularly in key regions, continues to pose risks to global trade and commodity prices.

Interest rate hikes through 2023 and early 2024, aiming to control inflation, directly increase Gibraltar Industries' cost of capital for construction projects. This makes financing more expensive for developers, potentially slowing new construction and impacting demand for building materials.

Higher borrowing costs can reduce consumer confidence and increase price sensitivity, particularly in the residential sector. As mortgage rates climbed, affordability decreased, leading to a slowdown in new home sales by late 2023, which in turn reduced demand for Gibraltar's products.

The company must monitor lending standards, as tighter credit conditions or increased prime lending rates can further constrain project financing, directly affecting construction activity and demand for Gibraltar's diverse product portfolio.

Persistent inflation and rising raw material costs, such as a potential 15% year-over-year increase in steel prices at certain points in 2024, directly squeeze Gibraltar's profit margins by increasing production expenses.

While overall inflation may moderate, new tariffs or supply chain disruptions remain threats that could reignite upward pressure on materials like aluminum, impacting Gibraltar's profitability and underscoring the need for robust supply chain management.

The residential housing market's health is vital for Gibraltar's residential segment. For instance, in April 2024, new housing starts were at a seasonally adjusted annual rate of 1.32 million, indicating continued construction activity.

Key indicators like housing starts and existing home sales are crucial. A modest uptick in existing home sales in Q1 2024 suggests a more stable environment, which can boost demand for Gibraltar's product lines.

Demographic shifts, including changing age demographics of homebuyers and household formation rates, will influence the demand for specific housing types and associated components, affecting Gibraltar's product mix and sales volume.

Overall construction spending shows a mixed outlook, with infrastructure investment remaining robust. The U.S. Department of Transportation reported total infrastructure investment reached an estimated $278 billion in 2023, a significant increase.

Gibraltar's market opportunities are tied to construction trends. Monitoring construction starts and investment across residential, commercial, and public works projects provides insight into potential growth avenues, with residential construction starts representing a substantial market segment.

| Economic Factor | Impact on Gibraltar Industries | Data/Trend (2023-2025) |

| Interest Rates | Increases cost of capital, slows construction financing, reduces housing affordability. | Federal Reserve benchmark rate saw increases through 2023-early 2024. |

| Inflation & Raw Material Costs | Squeezes profit margins due to higher production expenses. | Steel prices experienced volatility, with some benchmarks up over 15% YoY at points in 2024. |

| Housing Market Activity | Directly impacts demand for residential building components. | New housing starts at 1.32 million (annualized) in April 2024; existing home sales saw a modest uptick in Q1 2024. |

| Infrastructure Spending | Provides a stable demand source due to government initiatives. | Total infrastructure investment reached an estimated $278 billion in 2023. |

| Global Economic Conditions | Influences demand for manufactured goods; supply chain normalization aids operations. | IMF projects 3.2% global growth for 2024-2025; supply chain metrics largely normalized by early 2025. |

Full Version Awaits

Gibraltar Industries PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Gibraltar Industries delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic direction.

Sociological factors

The construction sector, a key market for Gibraltar Industries, grapples with ongoing labor shortages, especially for skilled trades. This scarcity directly impacts project timelines and escalates labor expenses, potentially dampening demand for building products.

While the median age in construction has seen a slight decline, a significant portion of the workforce may still be relatively inexperienced. This experience gap can affect the quality and speed of construction projects, influencing the demand for Gibraltar's offerings and the overall efficiency of its customer base.

In 2024, the U.S. Bureau of Labor Statistics reported a substantial need for construction trades, with projections indicating continued demand for electricians, plumbers, and HVAC technicians. This persistent shortage underscores the challenges Gibraltar's customers face in completing projects on time and within budget.

Demographic shifts are reshaping the housing market, influencing demand for various building materials. For instance, the median age of first-time homebuyers in the U.S. has been on an upward trend, reaching around 36 years in recent years, which may lead to a preference for smaller, more manageable homes. The increasing number of single-person households, now comprising over 28% of all U.S. households, also impacts the type and size of dwellings needed.

Furthermore, a growing interest in multigenerational living, driven by economic factors and changing social norms, could boost demand for larger homes or adaptable living spaces. These evolving preferences directly affect Gibraltar Industries, as they necessitate adjustments in their product offerings, from modular components to specialized roofing and ventilation systems, to align with current and future housing needs. Population growth and migration patterns, such as the continued influx of people into Sun Belt states, also create regional variations in housing demand, influencing where Gibraltar sees the most significant opportunities.

Societal shifts are increasingly prioritizing occupant health and wellness within buildings. This growing emphasis directly influences the demand for building products that enhance indoor air quality and promote overall well-being. For instance, the WELL Building Standard, a popular framework, saw a significant increase in certified projects globally throughout 2023 and into early 2024, reflecting this trend.

This push towards healthier living and working spaces encourages the adoption of materials and systems that contribute to improved environments. Gibraltar's product portfolio, particularly those integrated into green building initiatives and projects seeking certifications like LEED or BREEAM, is well-positioned to benefit from this demand, as these certifications often mandate specific performance criteria related to occupant health.

Consumer Demand for Sustainable and Green Building

Consumer demand for sustainable and green building practices is accelerating, fueled by heightened environmental awareness. This shift directly benefits companies like Gibraltar Industries that provide eco-friendly materials and solutions, as these are crucial for achieving green building certifications such as LEED and Green Globes. For instance, the global green building market was valued at approximately $243.9 billion in 2023 and is projected to grow significantly, reaching an estimated $589.6 billion by 2030, demonstrating a strong market pull for sustainable options.

Gibraltar's strategic alignment with this trend positions it favorably. Their commitment to sustainability in construction resonates with a growing segment of consumers and businesses actively seeking to reduce their environmental footprint. This growing preference for green construction is not just an ethical consideration but a significant market driver, influencing purchasing decisions and project specifications across the industry.

- Growing Market Value: The global green building market is expected to expand from roughly $243.9 billion in 2023 to an estimated $589.6 billion by 2030.

- Certification Demand: There's increasing demand for materials and practices that support green building certifications like LEED and Green Globes.

- Consumer Preference: Environmental consciousness is driving a significant portion of consumers and industries towards sustainable building solutions.

- Competitive Advantage: Gibraltar Industries' focus on sustainability enhances its competitive standing by meeting this evolving market demand.

Urbanization and Infrastructure Needs

The ongoing trend of urbanization significantly shapes the construction landscape, increasing the need for new infrastructure and more compact housing. This societal shift directly fuels demand for robust and efficient building materials that can withstand the rigors of urban development and large-scale public works. Gibraltar Industries, with its established footprint in both infrastructure and residential construction sectors, is well-positioned to benefit from these evolving demographic patterns and associated market opportunities. For instance, the U.S. is projected to see continued population growth in urban areas, with cities expected to absorb a significant portion of this expansion, driving demand for the types of components Gibraltar provides.

Gibraltar's product portfolio, including precast concrete products and metal building components, is particularly suited to address the demands of urban expansion. These materials offer durability and speed of construction, critical factors for timely infrastructure completion and housing development in densely populated areas. The company's strategic focus aligns with the growing emphasis on sustainable and resilient urban infrastructure, a key consideration in many metropolitan planning initiatives worldwide.

Key impacts of urbanization on Gibraltar include:

- Increased demand for infrastructure components: Urban growth necessitates upgrades and expansions to transportation networks, utilities, and public facilities, all of which rely on durable construction materials.

- Growth in residential construction: Denser urban living often means multi-family housing and mixed-use developments, requiring efficient and standardized building solutions.

- Focus on resilient and sustainable materials: Cities are increasingly prioritizing construction materials that offer longevity and environmental benefits, areas where Gibraltar's offerings can provide an advantage.

- Geographic concentration of projects: Urbanization concentrates construction activity in specific regions, allowing Gibraltar to optimize logistics and project management for its customer base.

Societal trends are increasingly prioritizing occupant health and wellness, driving demand for building products that enhance indoor air quality. The WELL Building Standard saw a significant increase in certified projects globally through early 2024, reflecting this growing emphasis. This focus benefits Gibraltar's portfolio, particularly products integrated into green building initiatives and certifications like LEED, which often mandate specific health-related performance criteria.

Consumer demand for sustainable and green building practices is accelerating due to heightened environmental awareness. The global green building market was valued at approximately $243.9 billion in 2023 and is projected to reach $589.6 billion by 2030, underscoring a strong market pull for eco-friendly options. Gibraltar's commitment to sustainability aligns with this trend, enhancing its competitive position by meeting evolving market demands for environmentally conscious construction solutions.

| Sociological Factor | Impact on Gibraltar Industries | Supporting Data (2023-2025) |

|---|---|---|

| Health & Wellness Focus | Increased demand for products contributing to better indoor air quality and occupant well-being. | WELL Building Standard projects saw significant global growth through early 2024. |

| Sustainability Demand | Favorable market for eco-friendly materials, supporting green building certifications. | Global green building market valued at ~$243.9 billion in 2023, projected to reach ~$589.6 billion by 2030. |

| Demographic Shifts (Housing) | Need for adaptable housing solutions (smaller homes, multigenerational living) impacts product mix. | Median age of first-time homebuyers ~36 years; single-person households >28% of U.S. households. |

Technological factors

Technological advancements are rapidly reshaping the solar racking sector. Innovations like AI and IoT integration are enabling real-time monitoring and predictive maintenance for solar installations, boosting efficiency and reducing downtime. For instance, advancements in tracker technology, which adjust panel orientation to follow the sun, have shown potential to increase energy yields by up to 25% compared to fixed-tilt systems.

The development of lighter yet more durable and sustainable materials also plays a crucial role. These materials not only reduce installation costs but also enhance the longevity of solar racking systems. Gibraltar Industries, as a key player in this market, needs to embrace these technological shifts to maintain its competitive edge and deliver solutions that meet the growing demand for high-performance, resilient solar infrastructure.

Gibraltar Industries can significantly benefit from the growing trend of automation and robotics in manufacturing. By integrating these technologies, the company can boost production efficiency, lower labor expenses, and achieve greater precision in creating building components. For instance, in 2023, the global industrial robotics market was valued at approximately $50 billion, with a projected compound annual growth rate (CAGR) of over 10% through 2030, indicating substantial investment and adoption by forward-thinking companies.

The construction sector is also being reshaped by technological advancements. Prefabricated building elements and 3D printing are making construction faster and more sustainable by minimizing waste. Gibraltar is well-positioned to capitalize on these innovations, potentially optimizing its current operations and exploring new construction methods that offer competitive advantages.

Gibraltar Industries can leverage ongoing advancements in building materials, such as self-healing concrete and advanced composites. These innovations promise enhanced product performance and greater sustainability, aligning with increasing market and regulatory demands for eco-friendly solutions.

The integration of lighter, stronger, and more energy-efficient materials into Gibraltar's product lines presents a significant opportunity. For instance, the global market for advanced composites in construction was valued at approximately $15.5 billion in 2023 and is projected to grow, indicating a strong demand for such materials.

Digitalization and Smart Building Technologies

Gibraltar Industries is navigating a landscape increasingly shaped by digitalization and smart building technologies. The integration of tools like Building Information Modeling (BIM) and the proliferation of Internet of Things (IoT) sensors are fundamentally altering how buildings are conceived, constructed, and managed. For instance, the global smart building market was valued at approximately $80 billion in 2023 and is projected to grow significantly, reaching over $190 billion by 2028, according to various market analyses from late 2023 and early 2024.

These advancements, including the use of Artificial Intelligence (AI) for optimizing energy consumption and facilitating grid integration, are not just creating efficiencies but also new market demands. Gibraltar Industries can capitalize on this by developing and incorporating intelligent building components and integrated solutions into its product portfolio. The company's existing strengths in areas like engineered products for infrastructure and buildings position it well to adapt to these evolving technological requirements, potentially leading to new revenue streams and enhanced market competitiveness.

- BIM Adoption: Growing use of BIM in construction projects, with adoption rates increasing, driving demand for compatible building materials and systems.

- IoT Integration: Smart sensors and connected devices are becoming standard, creating opportunities for building envelope solutions that support data collection and management.

- AI for Efficiency: AI-powered systems for energy management and predictive maintenance in buildings are on the rise, influencing the design of building components.

- Market Growth: The smart building market is experiencing robust growth, indicating a strong demand for innovative and technologically advanced building solutions.

Supply Chain Digitization and Analytics

Gibraltar Industries is increasingly leveraging big data and advanced analytics to enhance its supply chain. This digitization allows for more precise demand forecasting and optimized inventory levels, crucial in managing fluctuating material costs and ensuring product availability. For instance, by Q3 2024, the company reported a 15% reduction in inventory holding costs due to improved analytics-driven stocking strategies.

The implementation of real-time tracking and digitization across its supply chain significantly bolsters Gibraltar's operational resilience. This capability enables quicker identification and response to potential disruptions, such as those seen in global logistics in late 2023 and early 2024. By understanding material flow minute-by-minute, Gibraltar can proactively mitigate delays and maintain production schedules more effectively.

- Enhanced Efficiency: Digitization streamlines logistics and procurement processes, reducing lead times and operational overhead.

- Improved Resilience: Real-time tracking and predictive analytics help anticipate and mitigate supply chain disruptions.

- Cost Management: Advanced analytics enable better inventory control and waste reduction, directly impacting profitability.

- Data-Driven Decisions: Utilizing big data supports more informed strategic planning for sourcing and distribution networks.

Gibraltar Industries is actively integrating advanced manufacturing technologies to boost efficiency and precision. The company's adoption of automation and robotics, a trend mirrored globally with the industrial robotics market valued at approximately $50 billion in 2023 and growing, allows for enhanced production capabilities and cost reduction.

The construction sector's technological evolution, including prefabrication and 3D printing, presents opportunities for Gibraltar to optimize operations and explore new building methodologies, aligning with the increasing demand for faster and more sustainable construction.

The company is also positioned to benefit from advancements in building materials, such as composites, with the global market for these materials in construction valued at around $15.5 billion in 2023, indicating a strong market pull for innovative and durable solutions.

Gibraltar is embracing digitalization and smart building technologies, with the smart building market projected to grow significantly from an estimated $80 billion in 2023 to over $190 billion by 2028, creating demand for integrated and intelligent building components.

Legal factors

New regulations, including the Construction and Demolition Waste Management Rules for 2024 and 2025, are set to significantly alter waste management practices. These rules introduce extended producer responsibility (EPR) and mandate specific recycling targets for construction debris.

Effective from April 2025 and 2026, these legislative changes will compel companies like Gibraltar Industries to take greater ownership of their waste streams. This includes managing and finding beneficial uses for processed demolition waste, which could reshape operational strategies and open avenues for new revenue through waste valorization.

Recent updates to labor laws, including potential changes to overtime rules and prevailing wage requirements for government contracts, could impact Gibraltar Industries' operational costs and workforce planning. For instance, OSHA's ongoing focus on enhanced safety regulations, such as those introduced in late 2023 regarding respiratory protection, necessitates diligent compliance to prevent workplace incidents and potential fines, which could amount to significant sums for violations.

Gibraltar Industries operates within a legal landscape that mandates strict adherence to product safety and quality standards. This is crucial for their building components and solar racking systems, directly impacting consumer trust and brand integrity.

Failure to meet these legal benchmarks, such as those outlined by the Consumer Product Safety Commission (CPSC) or specific building codes, can result in costly product recalls. For instance, in 2023, the U.S. market saw numerous recalls across various industries due to safety concerns, highlighting the financial and reputational risks involved.

Non-compliance can also trigger extensive litigation, as seen in cases where defective building materials led to structural failures. Such legal battles can incur substantial defense costs and damage awards, significantly impacting a company's bottom line and market position.

Environmental Protection Laws

Environmental protection laws extend beyond waste management, encompassing emissions, resource usage, and land use, all directly influencing Gibraltar Industries' manufacturing. Compliance is crucial for avoiding penalties and retaining operating permits. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stringent air quality standards, impacting industrial facilities that utilize significant energy and generate emissions.

Proactive adoption of sustainable practices can bolster Gibraltar Industries' reputation and market appeal. Companies that invest in cleaner technologies or reduce their carbon footprint often see improved brand perception. By 2025, many investors are increasingly scrutinizing environmental, social, and governance (ESG) factors, making environmental performance a key differentiator.

- Emissions Control: Regulations on greenhouse gases and pollutants necessitate investment in advanced filtration and emission reduction technologies.

- Resource Efficiency: Laws promoting water conservation and sustainable material sourcing impact operational costs and supply chain management.

- Land Use and Remediation: Compliance with zoning laws and potential site remediation requirements are critical for facility expansion and operational continuity.

- Reporting and Disclosure: Increasing mandates for environmental impact reporting require robust data collection and transparency.

Contract Law and Project Labor Agreements

Legal frameworks governing contracts in construction significantly shape Gibraltar Industries' project management. The increasing mandate for Project Labor Agreements (PLAs) on major federal projects, for instance, directly influences how Gibraltar engages with contractors and sets employment terms. These agreements, designed to ensure labor harmony and project efficiency, necessitate careful negotiation and strict compliance to avoid disruptions and manage project timelines effectively.

PLAs can dictate wages, benefits, and work rules, impacting project costs and operational flexibility. For Gibraltar Industries, understanding and adhering to these legal requirements is crucial for successful project execution and risk mitigation. For example, the Biden administration has strongly encouraged PLA use, with a significant percentage of large federal construction contracts in 2024 and projected into 2025 likely to include such agreements, requiring robust legal and contractual expertise.

- Contractual Compliance: Ensuring all agreements with contractors and subcontractors meet legal standards.

- PLA Negotiation: Engaging in good-faith negotiations for Project Labor Agreements on relevant federal projects.

- Labor Relations: Managing labor conditions as stipulated by PLAs to maintain project continuity.

- Regulatory Adherence: Staying updated on evolving construction contract laws and their implications for business operations.

New waste management regulations, including extended producer responsibility and recycling targets for construction debris effective through 2025 and 2026, compel companies like Gibraltar Industries to manage waste streams more proactively. Labor law updates, such as OSHA's enhanced respiratory protection standards implemented in late 2023, alongside potential changes to overtime rules, necessitate diligent compliance to avoid significant fines and operational cost increases.

Gibraltar Industries must adhere to product safety and quality standards, as failure to meet benchmarks set by bodies like the CPSC can lead to costly recalls and litigation, as evidenced by numerous industry-wide recalls in 2023. Environmental laws, including EPA's stringent air quality standards enforced in 2024, impact manufacturing operations, requiring investment in cleaner technologies to avoid penalties and maintain operating permits.

The increasing prevalence of Project Labor Agreements (PLAs) on federal construction projects, encouraged by the Biden administration and expected to cover a significant portion of large contracts in 2024-2025, directly influences Gibraltar's contractor engagement and employment terms. Adherence to these agreements, which dictate wages and work rules, is critical for project success and risk mitigation, demanding robust legal and contractual expertise.

Environmental factors

Climate change is pushing demand for building materials that can handle extreme weather. Gibraltar Industries' solar racking and building components need to be robust enough for high winds and heavy snow. For instance, the increasing frequency of hurricane-force winds in coastal regions, a trend observed through 2024, directly impacts the structural requirements for these installations.

Growing concerns about resource scarcity are significantly influencing the construction sector, increasing demand for sustainable and recycled materials. Gibraltar Industries' strategic advantage lies in its capacity to source and integrate eco-friendly options like recycled steel and advanced composite polymers. This focus not only aids in meeting environmental regulations but also bolsters market competitiveness, aligning with the global shift towards a circular economy.

The construction sector is under significant pressure to cut carbon emissions and boost building energy efficiency. This means new builds must meet stricter emission standards, and there's a growing demand for energy-saving materials. Gibraltar Industries can play a role by providing products that lower building energy use, such as advanced insulation or energy-efficient window systems, and by improving its own manufacturing to reduce its environmental impact.

Waste Reduction and Recycling Initiatives

New environmental regulations are increasingly pushing for greater waste reduction, reuse, and recycling, particularly within the construction and demolition sectors. This trend directly impacts manufacturers like Gibraltar Industries, necessitating a focus on product design for enhanced recyclability and potential engagement in extended producer responsibility programs for managing end-of-life materials. Gibraltar Industries reported a 5% increase in its sustainability initiatives in 2024, with a specific focus on reducing construction waste by 15% across its product lines by 2026.

These evolving standards create both challenges and opportunities. Companies are expected to innovate in product lifecycles, and those that proactively embrace circular economy principles, such as designing for disassembly and incorporating recycled content, stand to gain a competitive advantage. For instance, the US Environmental Protection Agency (EPA) aims to divert 90% of construction and demolition debris from landfills by 2030, a target that will require significant upstream changes in manufacturing and material sourcing.

- Regulatory Push: Growing emphasis on diverting construction and demolition waste from landfills.

- Product Design: Need for manufacturers to create easily recyclable products.

- Extended Producer Responsibility: Potential involvement in managing post-consumer waste.

- Sustainability Alignment: Fits with Gibraltar Industries' broader corporate sustainability goals.

Renewable Energy Adoption and Environmental Benefits

The global shift towards renewable energy, especially solar, is accelerating due to mounting concerns over fossil fuels and the urgent need for cleaner power. Gibraltar Industries, as a key player in manufacturing solar racking systems, is positioned to capitalize on this significant environmental trend. Their products directly support the transition to a more sustainable energy future, contributing to lower greenhouse gas emissions.

This environmental imperative is translating into substantial market growth. For instance, the global solar power market was valued at approximately $230 billion in 2023 and is projected to reach over $330 billion by 2028, demonstrating a strong compound annual growth rate. Gibraltar's role in this expanding sector is crucial.

- Growing Demand for Solar: The increasing awareness of climate change and government incentives are driving widespread adoption of solar energy solutions.

- Gibraltar's Contribution: By providing essential racking infrastructure, Gibraltar enables the installation of solar panels, directly facilitating the reduction of carbon footprints.

- Market Expansion: The renewable energy sector, particularly solar, represents a significant growth opportunity for companies like Gibraltar Industries.

- Environmental Impact: The company's products play a tangible role in the global effort to transition away from carbon-intensive energy sources.

The increasing frequency of extreme weather events, such as hurricanes and heavy snowfalls, directly impacts the demand for more resilient building materials. Gibraltar Industries' solar racking and building components must be engineered to withstand these intensified conditions, a trend that became more pronounced through 2024.

Resource scarcity is driving a significant shift towards sustainable and recycled materials in construction, benefiting companies like Gibraltar that can integrate eco-friendly options. This aligns with global efforts to reduce waste and promote a circular economy, a movement gaining considerable traction by 2025.

PESTLE Analysis Data Sources

Our PESTLE analysis for Gibraltar Industries is built on a comprehensive review of publicly available data, including government reports, industry publications, and financial news outlets. We also incorporate insights from economic databases and market research firms to ensure a well-rounded understanding of the macro-environment.