Gibraltar Industries Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gibraltar Industries Bundle

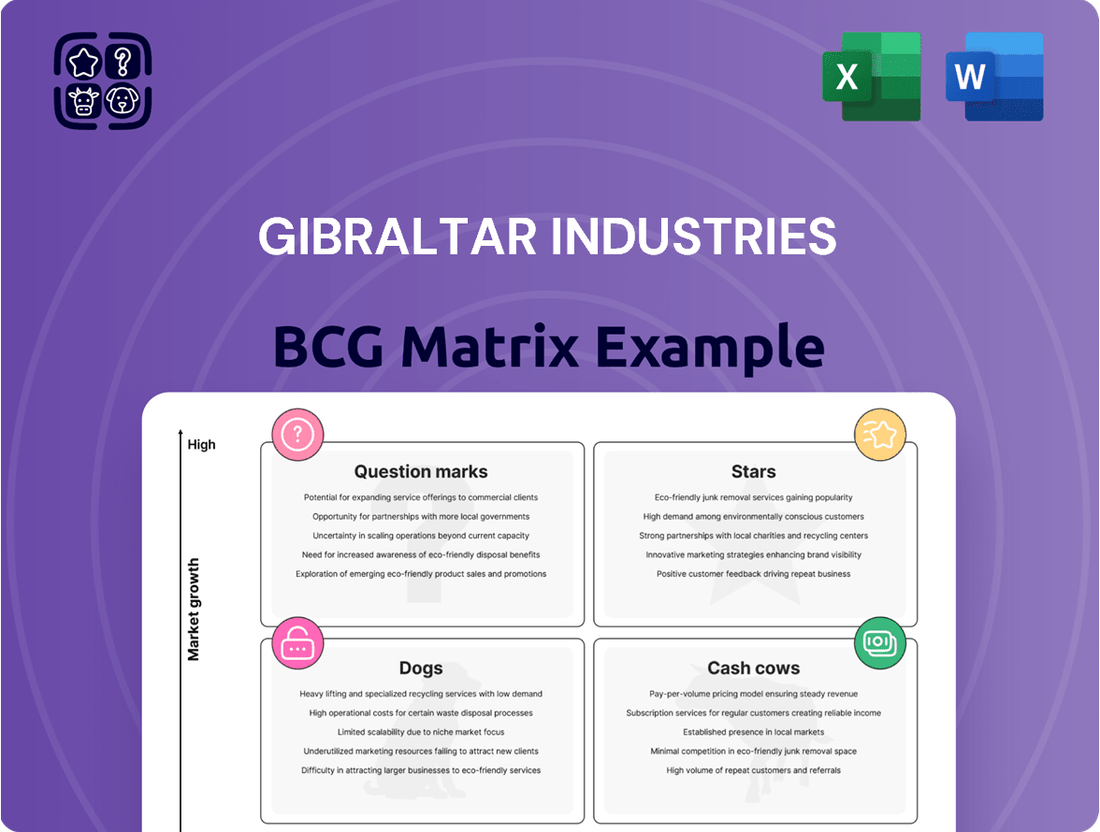

Gibraltar Industries' BCG Matrix offers a strategic snapshot of its diverse product portfolio, highlighting potential growth areas and resource drains. Understanding which segments are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Gibraltar's Agtech segment, significantly enhanced by the February 2025 acquisition of Lane Supply Inc., is demonstrating robust growth potential. Lane Supply's integration brought substantial revenue and adjusted EBITDA contributions in 2024, setting a strong foundation for the segment's future performance.

The Agtech division experienced an impressive 226% surge in bookings during the first quarter of 2025. This remarkable expansion is a direct result of both accelerated organic growth initiatives and the strategic integration of Lane Supply's operations.

This performance trajectory firmly places Agtech as a high-growth star within Gibraltar's portfolio. The segment is actively capturing increased market share, particularly within the specialized structural canopies market catering to diverse commercial needs.

The Infrastructure segment is a star in Gibraltar Industries' BCG Matrix, showcasing consistent growth and impressive operating margins. Its strong performance is underscored by an 11% increase in backlog in Q1 2025, even with a slight sales dip attributed to project timing. This indicates robust underlying demand, fueled by significant federal and state infrastructure spending initiatives.

The segment's success is further bolstered by its operational excellence and adept supply chain management. These factors contribute to its high profitability and position it favorably for capturing greater market share within a sector experiencing sustained expansion.

Gibraltar Industries' new residential building accessories, launched in late 2024, are showing strong early adoption. Despite a generally soft residential market, these specific products are experiencing accelerating order activity. This suggests they are capturing market share and represent a key growth driver for 2025.

Metal Roofing Systems (Post-Acquisition)

Gibraltar Industries' strategic acquisition of two metal roofing system manufacturers in March 2025, with a combined 2024 revenue of $73 million, positions these operations as a significant player in the residential building products market. This move targets a high-margin, growth-oriented niche, indicating a strong potential for market share expansion in specialized areas.

The acquisitions are projected to be immediately accretive to earnings, underscoring the anticipated profitability and efficient integration of these new assets into Gibraltar's portfolio. This financial benefit suggests a robust operational synergy and a positive impact on the company's overall financial performance.

- Strategic Growth: The 2025 acquisitions of metal roofing manufacturers with $73 million in 2024 revenue highlight Gibraltar's focus on high-margin, growing segments.

- Accretive Acquisitions: These moves are expected to immediately boost Gibraltar's earnings, signaling strong market potential and operational efficiency.

- Market Niche: The focus on specialized residential metal roofing systems suggests a deliberate strategy to capture market share in a profitable niche.

Strategic Acquisitions Driving Growth

Gibraltar Industries is actively pursuing strategic acquisitions to fuel growth, notably integrating Lane Supply into its Agtech segment and acquiring two metal roofing businesses for its Residential segment. These moves are designed to strengthen Gibraltar's foothold in expanding markets, with expectations that these newly acquired entities will become significant contributors to future revenue and profitability, thus positioning them as potential stars within the BCG matrix.

- Lane Supply Acquisition: Bolsters Agtech presence, tapping into a growing market.

- Metal Roofing Acquisitions: Enhances Residential segment's market share and product offering.

- Growth Potential: Both acquisitions are strategically positioned to drive future revenue and profitability.

Gibraltar's Agtech segment, significantly bolstered by the February 2025 acquisition of Lane Supply Inc., is a clear star. Lane Supply contributed substantially to revenue and adjusted EBITDA in 2024, with Agtech bookings surging 226% in Q1 2025 due to organic growth and this strategic integration. This segment is actively gaining market share, particularly in specialized structural canopies.

The Infrastructure segment also shines as a star, demonstrating consistent growth and strong operating margins. Despite a slight sales dip in Q1 2025 due to project timing, its backlog grew by 11%, reflecting robust demand driven by infrastructure spending. Operational excellence and effective supply chain management further enhance its profitability.

Gibraltar's new residential building accessories, launched in late 2024, are exhibiting strong early adoption and accelerating order activity, marking them as a growth driver. Furthermore, the March 2025 acquisitions of two metal roofing system manufacturers, with combined 2024 revenue of $73 million, position these operations as high-margin, growth-oriented players in the residential market, expected to be immediately accretive to earnings.

| Segment | BCG Category | Key Growth Drivers | 2024/2025 Data Points |

|---|---|---|---|

| Agtech | Star | Lane Supply acquisition, organic growth, specialized canopies | Lane Supply acquisition (Feb 2025), 226% bookings surge (Q1 2025) |

| Infrastructure | Star | Federal/state spending, operational excellence, supply chain management | 11% backlog growth (Q1 2025) |

| Residential Building Products | Star | New accessories, metal roofing acquisitions | New accessories launched late 2024, $73M combined 2024 revenue from metal roofing acquisitions (Mar 2025) |

What is included in the product

Gibraltar Industries' BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

A clear BCG Matrix visualizes Gibraltar's portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Gibraltar's established residential products, including roof and foundation ventilation and traditional mailboxes, are solid cash cows. These products hold a strong position in a mature market, meaning growth is slow but consistent. Despite some market softness leading to sales decreases in 2024, this segment remains a significant generator of operating income and cash flow for the company.

Gibraltar Industries places a significant emphasis on operational efficiency and robust supply chain management. This focus is a cornerstone of its strategy, enabling the company to maintain healthy profit margins across its various business segments, especially within its more established product lines. This internal strength ensures a steady flow of cash, even from areas with slower growth rates.

In 2024, Gibraltar Industries continued to leverage its operational excellence. For instance, its commitment to streamlining manufacturing processes and optimizing logistics contributed to a reported operating margin of 13.5% for its Residential Products segment, a testament to its efficient operations. This consistent cash generation from mature businesses is crucial for funding investments in growth areas.

Gibraltar Industries' traditional mail and package solutions, primarily serving the residential sector, are likely considered Cash Cows. While facing some headwinds in volume and product mix, this segment probably boasts a substantial market share, providing a stable revenue stream.

Despite a projected dip in retail and mail/package product sales for Q1 2025 due to prevailing market softness, this mature business line remains a crucial contributor to Gibraltar's overall cash generation. Its established position allows it to generate consistent profits with minimal investment.

Bar Grating and Safety Plank Gratings

Bar grating and safety plank gratings represent Gibraltar Industries' established Cash Cows. These products benefit from consistent demand across numerous construction sectors, ensuring a stable, albeit low-growth, revenue stream. Their high market share in these foundational product areas solidifies their position as reliable profit generators.

Gibraltar's expertise as a manufacturer and distributor in these segments allows them to maintain efficiency and profitability. For instance, in 2024, the industrial and infrastructure construction markets, key consumers of grating products, showed steady activity. The company's long-standing presence means they likely have optimized production and distribution, contributing to their strong market share.

- Established Market Presence: Gibraltar holds a significant share in the bar grating and safety plank gratings market.

- Consistent Demand: These products serve essential needs in construction, leading to predictable sales.

- Low Growth, High Share: They generate reliable, high-margin revenue with limited expansion potential.

- Profitability Driver: Their stable cash flow supports other business segments and investments.

General Building Components (Stable Demand)

Gibraltar Industries’ general building components, including expanded metal, perforated metal, and ventilation products, likely fall into the Cash Cows category within the BCG matrix. These items serve a wide array of construction needs, indicating a steady and predictable demand. This stability allows them to generate consistent revenue for the company.

These components are crucial for various construction projects, contributing to Gibraltar’s strong position in the market. Their reliable performance and widespread application make them consistent profit centers, reinforcing their status as cash cows.

- Stable Demand: Products like expanded metal and ventilation systems are essential across numerous construction applications, ensuring consistent market pull.

- High Market Share: Gibraltar’s established presence in these segments translates to a significant portion of the market, solidifying their Cash Cow status.

- Consistent Revenue Generation: The predictable demand for these components makes them reliable sources of cash flow for the company.

Gibraltar's established residential products, such as ventilation and mailboxes, are key cash cows. These products benefit from a mature market, offering slow but steady growth and consistent cash flow. Despite some market softness impacting sales in 2024, this segment remains a significant contributor to operating income.

The company's focus on operational efficiency, including streamlined manufacturing and optimized logistics, underpins the profitability of these mature segments. For instance, the Residential Products segment reported a 13.5% operating margin in 2024, highlighting the strength of these cash cows in generating consistent profits with minimal investment.

Gibraltar's bar grating and safety plank gratings also function as cash cows, driven by consistent demand across various construction sectors. Their high market share in these foundational areas ensures a stable, albeit low-growth, revenue stream, contributing reliably to the company's overall financial health.

These established product lines, like general building components including expanded metal and perforated metal, are crucial for Gibraltar's consistent revenue generation. Their stable demand and significant market share make them dependable profit centers, supporting investments in other business areas.

| Segment | BCG Category | 2024 Operating Margin | Key Characteristic |

| Residential Products (Ventilation, Mailboxes) | Cash Cow | 13.5% | Mature market, consistent demand, strong operational efficiency |

| Bar Grating & Safety Plank Gratings | Cash Cow | N/A (Segment specific data not publicly detailed) | Consistent demand in construction, high market share |

| General Building Components (Expanded Metal, etc.) | Cash Cow | N/A (Segment specific data not publicly detailed) | Widespread construction use, steady demand, reliable profit centers |

What You See Is What You Get

Gibraltar Industries BCG Matrix

The Gibraltar Industries BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This analysis-ready report has been meticulously prepared by industry experts to provide actionable insights into Gibraltar Industries' product portfolio. You can confidently download this exact file for your strategic planning, presentations, or internal discussions without any further modifications or hidden content.

Dogs

Gibraltar Industries divested its residential electronic locker business in the fourth quarter of 2024. This move suggests the segment was a low-growth, low-market-share operation, likely underperforming against Gibraltar's strategic objectives. The divestiture of such assets is characteristic of the 'Dogs' quadrant in the BCG Matrix, where these businesses often require significant resource allocation with minimal return on investment.

Legacy Solar Racking Solutions, now discontinued, likely falls into the Dog category within Gibraltar Industries' BCG Matrix. The company incurred significant restructuring costs in 2023, partly attributed to phasing out these older solar tracker solutions, indicating a drain on resources.

The renewables segment, which includes these legacy products, has faced broader challenges, further supporting their classification as Dogs. These older, less competitive products likely had low market share and low growth potential, consuming capital without generating substantial returns.

Gibraltar Industries has focused on '80/20 PLS initiatives' for certain residential product lines, including safety harness and drywall metals. These initiatives typically target underperforming products with low market share that consume resources without generating significant returns, fitting the profile of Dogs in a BCG matrix.

In 2024, Gibraltar continued to refine its portfolio, with these specific residential product lines likely being evaluated for their contribution to overall profitability and strategic fit. The company's ongoing commitment to operational efficiency suggests a proactive approach to managing product lifecycles and resource allocation.

Japan-based Solar Racking Business (Sold)

Gibraltar Industries' decision to sell its Japan-based solar racking business in December 2023 signals a strategic move away from a segment that likely represented a 'Dog' in its BCG Matrix. This divestiture indicates that this particular market or product line was not meeting Gibraltar's growth expectations or competitive benchmarks.

The sale suggests that the Japan solar racking segment was underperforming, potentially due to intense competition or slower-than-anticipated market penetration. By exiting this operation, Gibraltar aims to streamline its portfolio and reallocate resources to more promising areas, thereby enhancing overall profitability and shareholder value.

- Divestiture Date: December 2023

- Reason for Sale: Underperformance in growth and market share within the Japanese solar racking market.

- BCG Matrix Classification: Likely categorized as a 'Dog' due to insufficient returns or growth potential.

- Strategic Implication: Portfolio optimization and resource reallocation to higher-performing business units.

Other Non-Core Assets Under Strategic Review

Gibraltar Industries is strategically reshaping its business, prioritizing its core building products and structures segments. This means they are actively reviewing other assets that don't fit this core focus.

This review process is designed to identify and potentially divest non-core assets. These might be smaller product lines or businesses that currently have limited growth potential and a smaller market share within the broader industry.

For instance, during their 2023 fiscal year, Gibraltar Industries reported that their consolidated net sales reached $1.5 billion. As they continue this strategic realignment, a deeper dive into the performance of various segments will inform decisions about which non-core assets might be candidates for divestiture to sharpen their focus.

- Strategic Focus: Gibraltar is concentrating on its core building products and structures businesses.

- Portfolio Realignment: The company is conducting a thorough evaluation of its assets.

- Potential Divestitures: Non-core assets, particularly those with low growth and market share, may be considered for sale.

- Financial Context: Gibraltar's 2023 net sales were $1.5 billion, providing a backdrop for these strategic decisions.

Gibraltar Industries' divestiture of its residential electronic locker business in Q4 2024 and its Japan-based solar racking business in December 2023 are prime examples of 'Dogs' within the BCG Matrix. These segments likely exhibited low market share and low growth, consuming resources without generating substantial returns, necessitating portfolio optimization.

| Business Segment | BCG Classification | Rationale | 2023 Net Sales Context |

| Residential Electronic Locker Business | Dog | Divested in Q4 2024, indicating low growth and market share. | Gibraltar reported $1.5 billion in consolidated net sales for 2023. |

| Legacy Solar Racking Solutions (Japan) | Dog | Discontinued and sold in December 2023 due to underperformance and strategic realignment. |

Question Marks

Gibraltar's Renewables segment, especially with its new tracker product line, is currently positioned as a Question Mark in its BCG Matrix. This segment operates within the rapidly expanding renewable energy market, a sector known for its high growth potential.

However, this potential is currently tempered by significant industry headwinds. Gibraltar experienced declining sales in this segment throughout 2024 and into Q1 2025. These sales declines, coupled with operating losses attributed to the learning curve and transition challenges associated with the new tracker product launch, paint a picture of a business still finding its footing.

Despite these challenges, Gibraltar is actively investing in the Renewables segment, evidenced by accelerated bookings for the new tracker line. This strategic investment signals a clear intent to capture market share, but the ultimate success and future market leadership remain uncertain, a hallmark of a Question Mark in the BCG framework.

Gibraltar Industries' Residential segment faced headwinds in 2024 due to delays in integrating new business. This impacted net sales in the fourth quarter of 2024.

These newly secured ventures are currently in a growth phase, meaning they require ongoing investment to establish market presence. While promising, they haven't yet translated into substantial revenue contributions, placing them in a position that necessitates careful management and successful integration to realize their full potential.

Gibraltar's Agtech segment, while bolstered by acquisitions, saw its organic net sales dip in the first quarter of 2025. This decline was primarily attributed to delays in obtaining permits for new produce projects, a critical bottleneck for expansion.

These stalled initiatives are classic examples of 'question marks' within the BCG framework. They operate in a dynamic, high-growth Agtech market but are currently hampered by external regulatory hurdles, preventing them from reaching their full potential.

Emerging Technologies for Sustainability

Gibraltar Industries' focus on emerging technologies for sustainability, particularly in areas like renewable energy integration and advanced agricultural solutions, aligns with the characteristics of a Question Mark in the BCG Matrix. These technologies represent significant future potential but currently hold a small market share, demanding considerable investment for development and market penetration. For instance, the company's exploration into next-generation solar panel materials or innovative vertical farming systems would fit this category.

The company's commitment to advancing engineering, science, and technology for sustainable power and productive agriculture necessitates investment in these nascent solutions. These emerging technologies, while targeting high-growth areas, are likely to have low current market share and require substantial investment to develop and gain traction, fitting the 'Question Mark' profile. For example, Gibraltar's potential investment in carbon capture technologies for its manufacturing processes or advanced water management systems for agriculture would be prime examples.

- Renewable Energy Integration: Exploring novel battery storage solutions or advanced grid management software to support renewable energy adoption.

- Sustainable Agriculture Tech: Investing in AI-driven precision agriculture tools or biodegradable packaging for produce.

- Circular Economy Solutions: Developing technologies for material recycling and reuse within their manufacturing operations.

- Smart Building Technologies: Implementing IoT sensors and energy-efficient systems in their construction materials.

Unspecified Future Acquisitions

Gibraltar Industries' approach to unspecified future acquisitions, particularly within the residential sector, positions them as potential Stars or Question Marks in a BCG Matrix. The company actively pursues strategic acquisitions as a growth lever, with ongoing discussions in the residential market. Any new acquisitions, especially in emerging or dynamic sectors, would likely begin as Question Marks until their market share and profitability solidify.

For instance, if Gibraltar were to acquire a company specializing in smart home technology in 2024, this new venture would initially be classified as a Question Mark. This classification acknowledges the uncertainty surrounding its future performance and market penetration. The company's historical success with acquisitions, such as its 2021 purchase of Sunward Systems for $10 million, provides a foundation for evaluating future opportunities.

- Uncertain Growth Potential: New acquisitions are inherently uncertain, making them Question Marks until their market position is clear.

- Strategic Focus on Residential: Ongoing M&A discussions in the residential sector indicate a deliberate strategy to expand in this area.

- Historical Acquisition Success: Gibraltar's past acquisitions, like Sunward Systems, demonstrate a capability to integrate and grow new businesses.

- Market Dynamics: The success of new ventures is heavily dependent on evolving market conditions and competitive landscapes.

Gibraltar's Renewables segment, despite high market growth, is a Question Mark due to declining sales in 2024 and Q1 2025, alongside operating losses from its new tracker product. However, accelerated bookings indicate strategic investment aimed at future market leadership, though success remains uncertain.

The Agtech segment's organic sales dipped in Q1 2025, primarily due to permit delays for new produce projects, illustrating a classic Question Mark scenario where high-growth market potential is hindered by external regulatory bottlenecks.

Emerging technologies for sustainability, like advanced agricultural solutions, also fit the Question Mark profile. These areas offer significant future potential but currently have low market share and require substantial investment for development and market penetration.

Future acquisitions, especially in dynamic sectors like residential, are likely to start as Question Marks. Their classification hinges on solidifying market share and profitability, with past successes like the $10 million Sunward Systems acquisition in 2021 providing a benchmark.

BCG Matrix Data Sources

Our BCG Matrix for Gibraltar Industries is built on robust financial disclosures, comprehensive market research, and internal performance metrics to accurately assess product portfolio positioning.