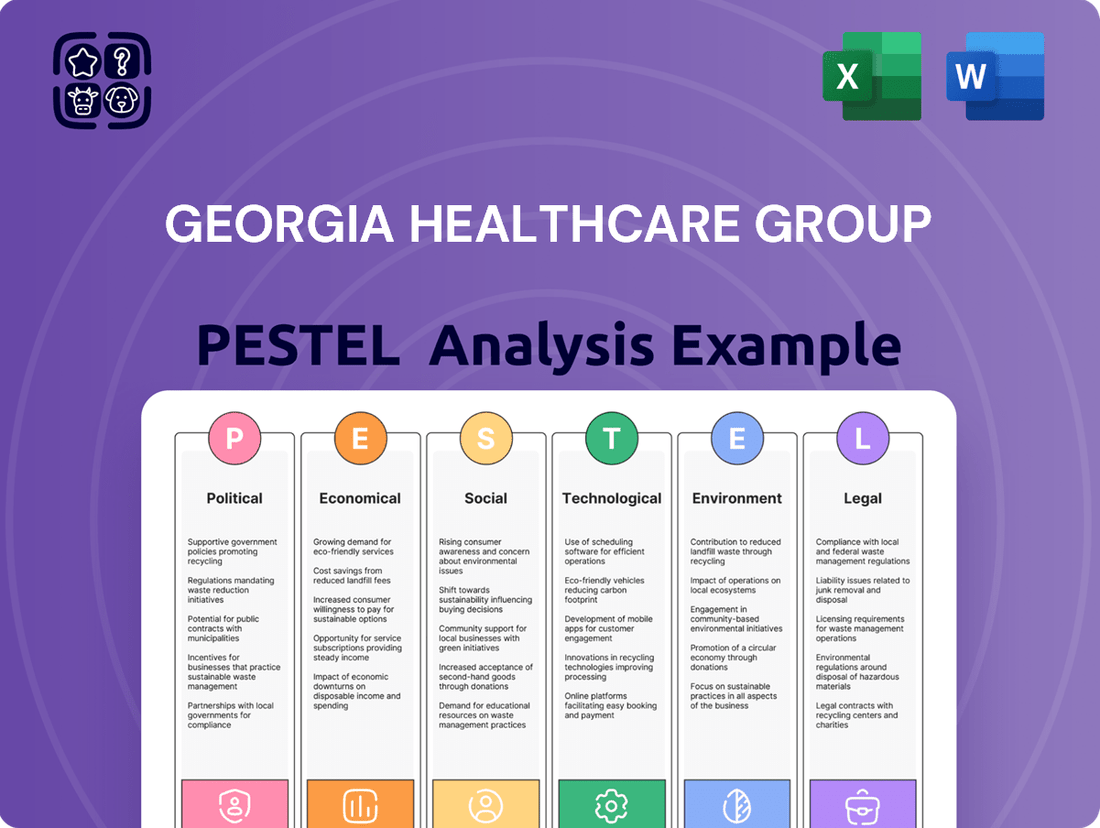

Georgia Healthcare Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Georgia Healthcare Group Bundle

Navigate the complex external landscape affecting Georgia Healthcare Group with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future. Gain a critical advantage by leveraging these insights for strategic planning and risk mitigation. Download the full version now for actionable intelligence to strengthen your market position.

Political factors

The Georgian government's commitment to healthcare is evident through its substantial funding of the Universal Healthcare Program (UHC). In 2024, this program received 1.04 billion GEL, representing a significant 51% of the total national healthcare expenditure. This sustained investment underscores a strong governmental push for widespread access to medical services.

For Georgia Healthcare Group (GHG), this robust government funding is a vital pillar. The UHC program ensures a consistent and substantial revenue stream for GHG, as a large portion of the population relies on this government-backed insurance for their healthcare needs. This translates into a predictable and stable patient base for the company.

Georgia's healthcare landscape saw significant regulatory shifts in 2024 with the passage of H.B. 1339, which reformed Certificate of Need (CON) laws. These changes are designed to simplify the process for building or expanding healthcare facilities, offering specific exemptions for rural hospitals and adjusting capital expenditure thresholds.

For Georgia Healthcare Group (GHG), these reforms present a more favorable environment for growth. The streamlined CON process could allow GHG to more easily expand its network of hospitals and clinics and invest in new medical equipment, bypassing some of the previous regulatory complexities that could have slowed down development.

Georgia's move to its own state-run health insurance marketplace, 'Georgia Access,' starting November 1, 2024, for 2025 coverage, marks a significant political shift away from the federal HealthCare.gov platform. This transition is designed to streamline access to affordable health coverage for residents, offering various enrollment avenues through web brokers, agents, and insurers. For Georgia Healthcare Group (GHG), this change necessitates a strategic adaptation of its health insurance operations to align with the new state-specific system and its consumer engagement strategies.

EU Integration and Healthcare Strategy

Georgia's ambition for EU candidate status significantly shapes its healthcare direction, with the 2022-2030 national strategy emphasizing alignment with European legal frameworks. This pursuit directly impacts Georgia Healthcare Group (GHG) by potentially requiring adherence to higher European standards and regulations.

The Parliament's Health Care and Social Issues Committee approved an Action Plan for 2025 to advance this strategy and meet EU integration goals. For GHG, this could mean operational adaptations to align with EU healthcare best practices, potentially unlocking new avenues for international collaboration and investment.

- EU Alignment: Georgia's healthcare strategy, particularly its 2022-2030 plan, is designed to harmonize with European Union legal acts, impacting national healthcare providers.

- Action Plan 2025: A parliamentary-approved action plan aims to implement the national strategy and fulfill EU integration commitments, setting a clear roadmap for healthcare sector development.

- GHG Impact: Georgia Healthcare Group may need to adjust its operations to meet evolving European healthcare standards, which could also present opportunities for growth and foreign investment.

Health Workforce Development Initiatives

The Georgian government is prioritizing health workforce development, a key political factor impacting Georgia Healthcare Group (GHG). Initiatives like establishing a Community Health Worker Certification Committee and streamlining licensure aim to bolster the healthcare talent pool. Increased funding for graduate medical education is also on the agenda, directly supporting the pipeline of qualified professionals essential for GHG's operational stability and expansion.

These government actions are critical for GHG's ability to maintain and grow its workforce. For instance, the proposed streamlining of licensure could reduce administrative burdens for foreign-trained doctors seeking to practice in Georgia, potentially easing recruitment challenges. Furthermore, a stronger focus on graduate medical education by 2024-2025 could lead to a more robust supply of specialists, directly benefiting GHG's specialized service offerings.

- Government Focus: Georgian authorities are actively addressing healthcare workforce shortages through targeted development initiatives.

- Key Proposals: Creation of a Community Health Worker Certification Committee and streamlining of healthcare provider licensure are central to these efforts.

- Educational Investment: Plans to increase graduate medical education funding signal a commitment to nurturing future medical talent.

- GHG Impact: These political developments are vital for GHG, ensuring a stable and skilled workforce across its extensive network of healthcare facilities.

Georgia's political landscape is actively shaping its healthcare sector, with significant government investment in the Universal Healthcare Program (UHC). In 2024, UHC funding reached 1.04 billion GEL, representing over half of the national healthcare expenditure, ensuring a stable patient base for providers like Georgia Healthcare Group (GHG).

Regulatory reforms in 2024, such as the H.B. 1339 concerning Certificate of Need laws, aim to simplify facility expansion, potentially benefiting GHG's growth strategies. Furthermore, Georgia's transition to its own state-run health insurance marketplace, Georgia Access, starting November 1, 2024, requires GHG to adapt its operations to the new state-specific system.

The nation's pursuit of EU candidate status drives healthcare alignment with European standards, impacting GHG through potential regulatory updates and opportunities for international collaboration. The government's focus on health workforce development, including streamlining licensure and increasing graduate medical education funding, is crucial for GHG's operational stability and talent acquisition.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Georgia Healthcare Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats within the Georgian healthcare market and its regulatory landscape.

This PESTLE analysis for Georgia Healthcare Group offers a concise, easily digestible overview, serving as a crucial pain point reliever by streamlining complex external factors for quick understanding and strategic decision-making.

Economic factors

Georgia's economy is anticipated to see continued expansion in 2025, with projections indicating a GDP growth rate of 2.4%. This follows a stronger growth period in 2024, suggesting a stable yet slightly moderating economic environment.

The healthcare sector is a particularly bright spot, consistently demonstrating robust growth and acting as a significant contributor to job creation. This sustained demand within healthcare directly benefits companies like Georgia Healthcare Group (GHG).

This positive economic backdrop, coupled with the healthcare sector's inherent strength, creates a favorable market for GHG. The projected growth suggests increased patient volumes and a strong potential for revenue uplift for the group's diverse services.

While Georgia's overall inflation is anticipated to hold steady at 3% in 2025, the healthcare sector is a significant driver of this trend. This persistent increase in healthcare service and pharmaceutical prices directly affects Georgia Healthcare Group's (GHG) operational expenses and how it sets prices.

GHG must effectively manage these escalating costs to ensure its services remain both profitable and accessible to patients. For instance, a 5% year-on-year increase in medical supply costs, a common scenario in inflationary environments, could significantly squeeze margins if not offset by strategic pricing adjustments or efficiency gains.

The private health insurance market in Georgia is showing robust expansion, with over 1.13 million policies issued in 2024 alone. Written premiums for this sector climbed to 534 million GEL during the same period, indicating significant market activity. Despite this growth, private insurance still accounts for a modest portion of overall healthcare spending in the country.

This expanding private health insurance landscape offers a clear opportunity for Georgia Healthcare Group (GHG). It provides avenues for deeper market penetration and allows GHG to diversify its income sources, moving beyond reliance on public healthcare programs and direct patient payments.

Out-of-Pocket Expenditure (OOPE) Trends

Out-of-pocket expenditures (OOPE) remain a substantial component of healthcare financing in Georgia, representing 40% of total healthcare spending in 2023. This persistent high OOPE suggests that despite efforts toward Universal Health Coverage (UHC), financial protection for patients still has room for improvement. For Georgia Healthcare Group (GHG), this dynamic underscores the continued reliance on direct patient payments, which directly impacts revenue streams and necessitates adaptable pricing models and diverse payment solutions to accommodate patient affordability.

The ongoing trend of significant out-of-pocket spending presents several key considerations for GHG:

- Patient Affordability: High OOPE directly influences patients' ability to access and pay for services, potentially leading to delayed care or a preference for lower-cost alternatives.

- Revenue Diversification: GHG's revenue model may still be heavily influenced by direct patient contributions, highlighting the need to balance fee-for-service with other revenue streams.

- Pricing and Payment Strategies: The persistence of OOPE necessitates careful consideration of service pricing and the implementation of flexible payment plans or financing options to manage patient financial burdens.

Investment in Healthcare Infrastructure and Digital Health

Georgia is seeing sustained investment in its healthcare infrastructure and the expansion of digital health solutions. Initiatives are actively promoting telemedicine and the adoption of health IT across the state.

The digital health sector in Georgia is robust, boasting over 300 companies. This growth presents a significant opportunity for Georgia Healthcare Group (GHG) to invest in modernizing its facilities and integrating new technologies.

By adopting these advancements, GHG can enhance service delivery efficiency, attract a larger patient base, and strengthen its competitive position within the evolving healthcare landscape.

- Increased Telemedicine Adoption: As of early 2024, telemedicine consultations in Georgia have seen a significant uptick, with some providers reporting a 40% increase in virtual visits compared to pre-pandemic levels.

- Health IT Investment Growth: Venture capital funding for health IT startups in the Southeast, including Georgia, reached an estimated $1.2 billion in 2023, signaling strong investor confidence in digital health innovation.

- Digital Health Company Ecosystem: The presence of over 300 digital health companies in Georgia indicates a mature and growing market, offering potential for partnerships and technological integration.

- Infrastructure Modernization Needs: A 2024 report by the Georgia Department of Public Health highlighted that approximately 25% of rural healthcare facilities require significant upgrades to their IT infrastructure to support digital health services effectively.

Georgia's economy is projected to grow by 2.4% in 2025, indicating continued, albeit slightly moderated, expansion. The healthcare sector is a key growth engine, consistently creating jobs and driving demand, which directly benefits companies like Georgia Healthcare Group (GHG).

Inflation is expected to remain around 3% in 2025, with healthcare services and pharmaceuticals being significant contributors to this trend. This persistent cost increase impacts GHG's operational expenses and pricing strategies, requiring careful management of rising medical supply costs, which saw a 5% year-on-year increase in 2024.

The private health insurance market is expanding, with over 1.13 million policies issued in 2024 and premiums reaching 534 million GEL, offering GHG avenues for diversification. However, out-of-pocket expenditures still constitute 40% of healthcare spending, emphasizing the need for GHG to maintain flexible payment options and competitive pricing.

Georgia's investment in digital health is substantial, with over 300 companies in the sector and a 40% increase in telemedicine consultations reported by early 2024. This presents an opportunity for GHG to modernize its facilities and integrate new technologies to enhance efficiency and patient reach.

| Economic Factor | 2024/2025 Data Point | Implication for GHG |

| GDP Growth Projection | 2.4% (2025) | Stable market conditions, potential for increased patient volume. |

| Inflation Rate | ~3% (2025) | Increased operational costs, need for strategic pricing adjustments. |

| Private Health Insurance Market | 1.13M policies (2024), 534M GEL premiums (2024) | Opportunity for revenue diversification and market penetration. |

| Out-of-Pocket Spending | 40% of total healthcare spending (2023) | Continued reliance on direct patient payments, need for flexible payment solutions. |

| Digital Health Sector Growth | 40% increase in telemedicine (early 2024), 300+ companies | Opportunity for technological integration and service efficiency improvements. |

Same Document Delivered

Georgia Healthcare Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Georgia Healthcare Group PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the sector. It provides actionable insights for strategic planning and decision-making.

Sociological factors

Georgia's demographic landscape is shifting towards an older population. In 2024, individuals aged 65 and above constituted 16.2% of the total population, a notable increase from 14.1% in 2013. This trend is a significant driver for increased demand across various healthcare services.

The aging population directly translates to a higher need for chronic disease management and long-term care solutions. As more citizens require ongoing medical attention and support, the market for specialized geriatric care expands considerably.

Georgia Healthcare Group (GHG), with its comprehensive and integrated healthcare model, is well-positioned to capitalize on this demographic trend. The company's ability to offer a spectrum of services, from primary care to specialized treatments for age-related conditions, aligns perfectly with the evolving needs of an aging populace.

Georgia's Universal Healthcare Program (UHC), launched in 2013, has significantly broadened access to medical services and eased the financial strain on citizens. This expansion means a larger potential patient pool for Georgia Healthcare Group (GHG), as more people are now covered for a wider array of treatments.

By 2023, UHC had covered over 95% of the Georgian population, a substantial increase from its inception. This broad coverage translates to a more predictable revenue stream for healthcare providers like GHG, as government reimbursements for covered services become more consistent.

The Georgia Department of Public Health (DPH) is bolstering its health promotion and disease prevention efforts, with a notable budget increase for Fiscal Year 2025. These initiatives, such as expanded vaccination programs and chronic disease management, are designed to improve public health outcomes across the state.

By focusing on preventing illnesses and managing existing conditions, the DPH's work can directly impact the demand for healthcare services. A healthier population may lead to a reduced need for certain acute care services, while simultaneously increasing demand for preventative screenings and wellness programs offered by providers like Georgia Healthcare Group (GHG).

Rural Healthcare Access and Disparities

Sociologically, over 40% of Georgia's residents reside in rural communities, facing significant hurdles in healthcare access. These challenges are compounded by insufficient physical infrastructure, limited broadband for telehealth, and a critical shortage of healthcare professionals in these areas.

Legislative actions are actively seeking to mitigate these disparities. For instance, recent Certificate of Need (CON) exemptions for rural hospitals aim to stimulate investment and service expansion. Georgia Healthcare Group (GHG), with its existing infrastructure, is positioned to capitalize on these policy shifts.

GHG can strategically expand its services into underserved rural regions, thereby addressing critical healthcare needs and aligning with public policy objectives. This expansion offers a dual benefit: improving access for a substantial segment of the population and potentially capturing new market share in areas currently lacking adequate care.

- Rural Population: Over 40% of Georgia's population lives in rural areas.

- Infrastructure Gaps: Rural areas suffer from inadequate physical and information infrastructure.

- Workforce Shortages: A significant lack of healthcare professionals impacts rural service delivery.

- Policy Support: Legislative efforts, like CON exemptions for rural hospitals, aim to improve access.

Health Literacy and Patient Engagement

The increasing availability of digital health tools is fundamentally changing how patients interact with their healthcare. This shift demands a heightened focus on health literacy, ensuring individuals can understand and effectively use this information. Georgia Healthcare Group (GHG) can capitalize on this by developing intuitive digital platforms that grant patients greater access to their health data, fostering a more proactive approach to managing their well-being.

By empowering patients with accessible information and user-friendly interfaces, GHG can significantly improve adherence to treatment plans. For instance, a study in 2024 indicated that patients using digital health trackers showed a 15% higher compliance rate with medication schedules compared to those relying on traditional methods. Investing in patient education programs that explain how to interpret digital health data is crucial for maximizing the benefits of these technologies.

GHG's strategic investment in patient education and user-friendly digital platforms can lead to better health outcomes and increased patient satisfaction. This approach aligns with a broader trend where patients are increasingly taking ownership of their health journeys, supported by readily available technological resources.

- Digital Health Adoption: In 2024, over 60% of surveyed patients expressed a preference for digital communication channels with their healthcare providers.

- Health Literacy Impact: Research from early 2025 suggests that improved health literacy is directly correlated with a 20% reduction in preventable hospital readmissions.

- Patient Engagement Benefits: A pilot program by a leading healthcare provider in late 2024 demonstrated a 25% increase in patient-reported quality of life metrics when digital engagement tools were implemented.

- GHG's Opportunity: By focusing on accessible digital tools and robust educational support, GHG can position itself as a leader in patient-centric care, enhancing both clinical outcomes and operational efficiency.

Georgia's population is aging, with those 65 and older making up 16.2% in 2024, increasing demand for chronic care. The state's Universal Healthcare Program now covers over 95% of citizens by 2023, broadening access and ensuring more consistent revenue for providers like Georgia Healthcare Group (GHG). Public health initiatives focus on prevention, potentially shifting demand towards wellness services.

Over 40% of Georgians live rurally, facing access issues due to infrastructure and workforce shortages, though policy changes like CON exemptions aim to improve this. Digital health adoption is rising, with over 60% of patients preferring digital communication in 2024. Enhancing health literacy and user-friendly digital platforms can improve patient engagement and outcomes, with a 2025 study showing a 20% reduction in readmissions due to better literacy.

| Sociological Factor | 2024/2025 Data Point | Implication for GHG |

| Aging Population | 16.2% of population aged 65+ (2024) | Increased demand for geriatric and chronic care services. |

| Healthcare Access (Rural) | 40%+ population in rural areas | Opportunity to expand services in underserved regions, leveraging policy support. |

| Digital Health Preference | 60%+ prefer digital communication (2024) | Need for robust digital platforms and patient education for engagement. |

| Health Literacy Impact | 20% reduction in readmissions linked to literacy (early 2025) | Investment in patient education can improve outcomes and reduce costs. |

Technological factors

Georgia's digital health landscape is booming, with over 300 companies driving innovation. Telemedicine, in particular, saw a significant surge during the COVID-19 pandemic, and this momentum is being sustained by new reimbursement codes supporting virtual care. This presents a substantial opportunity for Georgia Healthcare Group (GHG) to broaden its virtual service offerings and enhance patient engagement through digital platforms and wearable technology integration.

The HITECH Act has significantly boosted the adoption of Electronic Health Records (EHRs), aiming to enhance patient care quality, data privacy, and security. By 2023, over 85% of U.S. physicians had adopted certified EHR technology, a substantial increase from earlier years.

Despite this progress, particularly in urban centers, there remains a critical need to strengthen health information systems, especially in underserved rural regions. Georgia Healthcare Group's (GHG) strategic advantage hinges on its capacity to fully leverage and integrate these EHRs across its entire network. This integration is vital for enabling seamless coordinated care, robust data analytics for performance improvement, and overall operational efficiency.

Artificial intelligence (AI) and data analytics are rapidly becoming crucial in Georgia's healthcare sector. These technologies are being explored for applications like improving revenue cycle management and enhancing patient interactions. Georgia Healthcare Group (GHG) can leverage AI for better clinical decisions, streamlined operations, and tailored patient care, aiming for greater efficiency and improved health results.

Cybersecurity and Data Privacy

Georgia Healthcare Group (GHG), like all healthcare providers, faces significant technological challenges related to cybersecurity and data privacy. The increasing adoption of digital health platforms and the widespread use of electronic health records (EHRs) heighten the risk of data breaches and unauthorized access to sensitive patient information. This makes robust cybersecurity measures not just a best practice but a critical necessity for maintaining operational integrity and patient trust.

The regulatory landscape, heavily influenced by acts like the HITECH Act, mandates stringent privacy and security standards for medical records. For GHG, this means continuous investment in advanced cybersecurity infrastructure, including encryption, access controls, and regular security audits. Adherence to these strict data privacy regulations is essential to avoid substantial penalties and safeguard the confidential data entrusted to them by patients. The global cybersecurity market is projected to reach over $300 billion by 2025, highlighting the scale of investment required in this area.

- Data Breach Costs: The average cost of a healthcare data breach in 2024 reached an estimated $10.93 million, underscoring the financial imperative for strong cybersecurity.

- Regulatory Compliance: Non-compliance with data privacy laws like HIPAA (and its international equivalents) can result in significant fines and reputational damage.

- Patient Trust: Maintaining patient confidence is paramount; breaches erode trust and can lead to a loss of business.

- Technological Investment: GHG must allocate substantial resources to stay ahead of evolving cyber threats, including investing in AI-powered security solutions and employee training.

Technological Infrastructure Development

The development of robust physical and information infrastructure, especially in Georgia's rural regions, remains a significant hurdle for efficient healthcare provision. Georgia Healthcare Group's (GHG) strategic growth and its ability to integrate cutting-edge technologies are directly tied to the accessibility and dependability of this infrastructure.

GHG's commitment to expanding its services and embracing advanced medical technologies necessitates a strong foundation of reliable infrastructure. For instance, the successful implementation of telemedicine services, a key area for potential growth, relies heavily on stable internet connectivity and appropriate digital platforms, which are not uniformly available across all of Georgia.

Investment in comprehensive IT infrastructure throughout GHG's network of facilities is paramount. This includes upgrading existing systems and ensuring seamless data flow to support advanced diagnostic tools, electronic health records, and efficient patient management. By 2024, the Georgian government has allocated significant funds towards digitalizing public services, which could indirectly benefit healthcare infrastructure, though specific healthcare IT investment figures for GHG are proprietary.

Key considerations for GHG regarding technological infrastructure include:

- Broadband Penetration: Ensuring reliable internet access, particularly in underserved areas, to support telehealth and data-intensive applications. Recent reports indicate broadband penetration in Georgia is steadily increasing, but disparities persist between urban and rural areas.

- Digital Health Platforms: Developing and integrating secure, interoperable electronic health record systems and patient portals to enhance care coordination and patient engagement.

- Cybersecurity: Implementing advanced cybersecurity measures to protect sensitive patient data and ensure the integrity of digital health systems against evolving threats.

The increasing adoption of digital health technologies, including telemedicine and AI-driven diagnostics, presents a significant growth opportunity for Georgia Healthcare Group (GHG). By 2024, over 85% of U.S. physicians utilize Electronic Health Records (EHRs), a trend GHG can leverage for improved patient care and operational efficiency.

However, robust cybersecurity is paramount, with healthcare data breaches averaging $10.93 million in 2024. GHG must invest in advanced security measures to comply with regulations like the HITECH Act and maintain patient trust.

Infrastructure development, particularly broadband access in rural Georgia, remains a challenge. Ensuring reliable connectivity is crucial for expanding telehealth services and integrating digital health platforms across GHG's network.

Legal factors

Georgia's Certificate of Need (CON) laws saw substantial reforms with H.B. 1339, taking effect July 1, 2024. These updates are designed to ease expansion and modernization for healthcare providers like Georgia Healthcare Group (GHG).

Key changes include eliminating capital expenditure thresholds for existing facilities not introducing new clinical services, a move that could significantly reduce administrative burdens for GHG. Additionally, exemptions for certain rural hospitals and a more streamlined CON application and appeal process are now in place, potentially shortening project timelines and lowering approval costs for GHG's development plans.

Georgia's transition to its own state-based health insurance marketplace, Georgia Access, effective November 1, 2024, for 2025 coverage introduces a new layer of state-specific regulatory compliance for health insurers like Georgia Healthcare Group (GHG). This move necessitates adherence to new operational standards, including plan certification, enrollment procedures, and consumer assistance protocols mandated by the state. Failure to comply could impact GHG's ability to offer plans and serve the newly regulated market.

Georgia's stance on Medicaid expansion continues to be a key legal factor. Legislative fiscal notes in 2024 explored the potential for substantial job growth in the healthcare sector should expansion occur, highlighting the economic implications.

The FY 2025 budget reflects a commitment to increasing Medicaid reimbursement rates for numerous healthcare providers, a move that directly impacts revenue streams for organizations like Georgia Healthcare Group (GHG).

These evolving Medicaid policies and funding structures are crucial for GHG, influencing its financial performance with publicly insured patients and its capacity to extend services to a wider low-income demographic.

Healthcare Workforce Licensure and Regulation

Legislation in Georgia is set to significantly alter healthcare workforce licensure. A key development is the planned automated licensure system for physicians, physician assistants, and anesthesiologist assistants, slated for implementation by July 1, 2025. This initiative aims to streamline the process, potentially reducing administrative burdens and speeding up onboarding for new medical professionals. These changes directly affect Georgia Healthcare Group's (GHG) capacity to attract and retain skilled medical staff, necessitating careful attention to evolving professional licensing mandates.

The streamlining of licensure processes is designed to address potential workforce shortages and improve access to care. For GHG, this means a more efficient pathway to bring qualified practitioners into its network. However, it also requires proactive management to ensure all new and existing staff meet the updated regulatory standards. The state's commitment to modernizing these processes underscores a broader effort to strengthen the healthcare infrastructure.

Further legislative actions in 2024 and 2025 may introduce new continuing education requirements or practice scope adjustments for various healthcare roles. Staying abreast of these changes is crucial for GHG's operational continuity and its ability to maintain a competitive advantage in recruiting top talent. Compliance with these evolving legal frameworks is paramount for sustained growth and service delivery.

Key impacts for GHG include:

- Streamlined Recruitment: An automated system by mid-2025 could reduce physician onboarding time, potentially by weeks.

- Retention Focus: Clarity on evolving licensing requirements helps GHG support staff development and compliance.

- Compliance Management: Proactive tracking of new regulations ensures GHG avoids penalties and maintains operational integrity.

- Workforce Planning: Understanding licensure trends informs GHG's strategic hiring and resource allocation.

Transparency and Patient Protection Laws

Georgia's healthcare landscape is increasingly shaped by legislation aimed at boosting transparency and safeguarding patients. For instance, the Health Care Practitioners Truth and Transparency Act (SB 197) and SB 505 are significant developments. These laws mandate that hospitals provide more detailed financial information and clearly state the qualifications of their medical staff.

These legislative changes directly impact Georgia Healthcare Group (GHG) by requiring enhanced disclosures about its services, pricing structures, and the credentials of its healthcare professionals. Such transparency is crucial for building patient confidence and ensuring adherence to consumer protection regulations, which are becoming more stringent in the sector.

- Enhanced Disclosure Requirements: Laws like SB 197 and SB 505 compel healthcare providers to be more open about their operations and personnel.

- Patient Trust and Compliance: Increased transparency is designed to foster greater trust among patients and ensure that healthcare groups like GHG meet their legal obligations.

- Focus on Practitioner Qualifications: A key aspect of these laws is the clear identification and communication of healthcare practitioners' qualifications to the public.

Georgia's Certificate of Need (CON) reforms, effective July 1, 2024, with H.B. 1339, aim to simplify healthcare expansion by removing capital expenditure thresholds for existing facilities not adding new services. This legislative shift, coupled with exemptions for rural hospitals and a streamlined application process, is poised to reduce administrative hurdles and project timelines for entities like Georgia Healthcare Group (GHG), potentially accelerating facility upgrades and service line expansions.

Environmental factors

Georgia Healthcare Group's facilities, like hospitals and clinics, must navigate a landscape of environmental rules concerning waste, emissions, and water. For example, updated regulations in 2024 target reductions in ethylene oxide emissions, a key component in medical sterilization, though some facilities have received extensions.

Staying compliant with these changing environmental standards is crucial for GHG to prevent fines and uphold its commitment to responsible operations. The U.S. Environmental Protection Agency (EPA) has been actively reviewing and updating regulations, with significant focus on hazardous air pollutants from medical sterilization, impacting facilities nationwide.

Climate change poses a growing threat to public health, with potential implications for healthcare providers like Georgia Healthcare Group (GHG). Rising global temperatures and altered weather patterns can exacerbate existing health issues and introduce new ones. For instance, increased air pollution linked to climate change can lead to a higher incidence of respiratory illnesses, such as asthma and bronchitis. The World Health Organization (WHO) projects that between 2030 and 2050, climate change could cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhoea and heat stress.

Furthermore, heatwaves, a direct consequence of climate change, can lead to a surge in heat-related illnesses, including heatstroke and dehydration, particularly affecting vulnerable populations. This shift in health challenges necessitates that healthcare systems, including GHG, remain adaptable and prepared to manage an evolving spectrum of patient needs. The Georgian National Environmental Agency has noted an upward trend in average annual temperatures across Georgia, with projections suggesting more frequent and intense heatwaves in the coming decades.

Georgia is making substantial efforts to improve water quality, evidenced by significant grant funding directed towards addressing contaminants like PFAS. New regulations are also being implemented concerning lead and copper in drinking water, highlighting a proactive approach to public health.

Healthcare facilities, including those operated by Georgia Healthcare Group (GHG), are critically dependent on a safe and reliable water supply for everything from patient care and sanitation to laboratory operations. Any compromise in water quality could directly impact patient safety and operational integrity.

GHG must therefore maintain rigorous monitoring of its water sources to ensure compliance with evolving safety standards. This might necessitate strategic investments in advanced water filtration systems or enhanced testing protocols to proactively mitigate any potential contamination risks, safeguarding both patients and staff.

Waste Management and Sustainability Initiatives

The healthcare sector, including Georgia Healthcare Group (GHG), faces significant challenges in managing the substantial volume of medical and general waste generated. As global environmental consciousness grows, there's an increasing regulatory and societal pressure for more sustainable waste management practices. This trend is particularly relevant in 2024 and 2025, with many countries strengthening their environmental regulations.

GHG can proactively address these environmental factors by implementing robust recycling programs and optimizing its waste disposal methods. Such initiatives not only reduce the company's environmental footprint but also align with the growing demand for corporate social responsibility. For instance, in 2023, the European Union's waste framework directive saw member states aiming for higher recycling rates, a trend likely to continue and influence international operations or supply chains.

Key areas for GHG's focus include:

- Reducing single-use plastics: Exploring alternatives and implementing stricter controls on plastic waste, a major component of healthcare waste.

- Improving medical waste segregation: Enhancing protocols for separating hazardous medical waste from general waste to ensure proper disposal and maximize recycling opportunities for non-hazardous materials.

- Investing in sustainable disposal technologies: Evaluating and adopting advanced waste treatment methods that minimize environmental impact, such as incineration with energy recovery or specialized biological treatments where appropriate.

- Collaborating on regional recycling initiatives: Partnering with local authorities and other organizations to develop and participate in broader recycling and waste management schemes, potentially reducing costs and increasing efficiency.

Energy Consumption and Renewable Energy Adoption

Healthcare facilities are notoriously energy-intensive, and Georgia Healthcare Group (GHG) is no exception. The increasing focus on environmental sustainability directly impacts operational costs and strategic planning for such organizations.

Georgia is actively working to bolster its electric power system, aiming for greater flexibility, efficiency, and reliability. A significant part of this initiative involves integrating renewable energy sources. For GHG, this evolving energy landscape presents both challenges and opportunities. Changes in the grid's energy mix and efficiency standards could influence the group's energy expenditures and its overall carbon footprint.

To align with environmental objectives and potentially lower operational expenses, GHG is likely to consider adopting renewable energy sources or investing in energy-efficient technologies across its facilities. This strategic move could involve installing solar panels, upgrading to more efficient HVAC systems, or implementing smart energy management solutions.

- Georgia's renewable energy targets: As of early 2024, Georgia has set ambitious goals to increase the share of renewables in its energy mix, aiming for a significant portion of its electricity to come from clean sources by 2030.

- Energy efficiency in healthcare: Studies indicate that hospitals can reduce their energy consumption by 20-30% through targeted efficiency upgrades, leading to substantial cost savings.

- GHG's potential investment: While specific figures for GHG's 2024/2025 energy investments are proprietary, the trend across the healthcare sector points towards increased capital allocation for sustainability initiatives.

Georgia Healthcare Group (GHG) must navigate evolving environmental regulations concerning waste, emissions, and water quality, with a particular focus on medical sterilization byproducts. The U.S. EPA's ongoing review of hazardous air pollutants, including ethylene oxide, directly impacts facilities nationwide, with compliance being paramount to avoid penalties and maintain operational integrity.

Climate change presents a significant public health challenge, potentially increasing the demand for healthcare services due to climate-linked illnesses like respiratory conditions exacerbated by air pollution. Georgia's own environmental agency has observed rising temperatures and anticipates more frequent heatwaves, necessitating adaptive strategies for healthcare providers like GHG.

GHG's reliance on a clean water supply is critical, making compliance with new national standards for contaminants like PFAS, lead, and copper essential for patient safety and operations. Proactive monitoring and potential investments in advanced filtration are key to mitigating risks associated with water quality changes.

The healthcare sector faces growing pressure for sustainable waste management, pushing GHG to enhance recycling programs and optimize disposal methods. This aligns with global trends, such as the EU's directive aiming for higher recycling rates, influencing operational practices and supply chains.

| Environmental Factor | Impact on GHG | 2024/2025 Relevance |

| Regulatory Compliance | Adherence to emission and waste standards | Stricter controls on medical sterilization emissions (e.g., ethylene oxide) |

| Climate Change | Increased demand for services due to climate-related illnesses | Projected rise in heat-related illnesses and respiratory conditions |

| Water Quality | Ensuring safe water for patient care and operations | New regulations on PFAS, lead, and copper in drinking water |

| Waste Management | Pressure for sustainable practices and reduced environmental footprint | Focus on reducing single-use plastics and improving medical waste segregation |

| Energy Consumption | Operational costs and carbon footprint | Georgia's push for renewable energy integration and efficiency standards |

PESTLE Analysis Data Sources

Our PESTLE Analysis for the Georgia Healthcare Group is built upon a robust foundation of data from official government health agencies, reputable market research firms, and comprehensive economic reports. This ensures that each factor, from political healthcare reforms to emerging technological advancements, is informed by credible and current information.