Georgia Healthcare Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Georgia Healthcare Group Bundle

Georgia Healthcare Group navigates a complex landscape shaped by intense competition and evolving patient demands. Understanding the influence of suppliers, the threat of new entrants, and the bargaining power of buyers is crucial for strategic advantage. This brief overview hints at the underlying forces, but the full picture is essential for informed decisions.

The complete report reveals the real forces shaping Georgia Healthcare Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of specialized pharmaceuticals and advanced medical equipment can wield considerable power, especially in concentrated markets. For Georgia Healthcare Group, this means that if only a few companies produce essential drugs or cutting-edge medical devices, those suppliers can dictate terms. This is particularly true for patented medications or unique technologies where alternatives are scarce, allowing suppliers to command higher prices or impose stricter conditions.

The scarcity of qualified medical personnel, especially nurses, in Georgia significantly bolsters the bargaining power of the healthcare workforce. This shortage means providers like Georgia Healthcare Group face increased pressure to meet wage demands and overcome recruitment hurdles.

In 2024, Georgia, like many regions, experienced persistent shortages in nursing staff, with some reports indicating vacancy rates exceeding 15% in critical care units. This imbalance directly translates to higher labor costs and can impede the group's ability to expand services or maintain optimal staffing levels, impacting operational efficiency and patient care quality.

The bargaining power of technology and digital health providers is growing significantly for Georgia Healthcare Group. As healthcare increasingly integrates advanced digital solutions and artificial intelligence, companies offering specialized health information systems, telehealth platforms, and AI-driven patient care are gaining leverage. Their specialized expertise and the critical nature of these technologies allow them to command higher prices.

For instance, the demand for interoperable electronic health records (EHRs) and sophisticated data analytics platforms is high. Providers of these systems can negotiate favorable terms due to the significant investment and operational reliance healthcare groups place on them. The trend is underscored by major healthcare systems investing in these tech firms, recognizing their strategic importance and revenue-generating potential.

Infrastructure and Real Estate Providers

The bargaining power of infrastructure and real estate providers for Georgia Healthcare Group is considerable, especially given the geographic concentration of healthcare facilities in urban areas like Tbilisi. This concentration means that owners of suitable land and experienced construction firms specializing in healthcare development can exert significant influence.

Developing or expanding healthcare infrastructure demands substantial capital for land acquisition and specialized construction. In 2024, the cost of commercial real estate in Tbilisi saw an upward trend, particularly in prime locations suitable for medical facilities. Specialized construction companies capable of meeting stringent healthcare building codes and requirements may face limited competition, especially for large-scale projects.

- Geographic Concentration: Healthcare infrastructure is heavily weighted towards urban centers, granting leverage to local real estate owners.

- High Capital Investment: The significant upfront costs for land and specialized construction empower providers with unique capabilities.

- Limited Specialized Contractors: A scarcity of construction firms experienced in healthcare facilities can increase their bargaining power.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers hold significant sway due to the ever-changing healthcare landscape. New rules concerning staffing and licensing, for instance, necessitate expert guidance, amplifying their bargaining power.

Businesses in Georgia's healthcare sector, like Georgia Healthcare Group, often depend on these specialists to navigate intricate mandates, such as those affecting digital health data security or long-term care operations. This reliance makes it harder for healthcare providers to negotiate lower fees for these essential services.

- Increased Demand: The complexity of healthcare regulations, including evolving data privacy laws and new operational standards, drives demand for specialized legal and compliance expertise.

- High Switching Costs: For healthcare organizations, switching compliance providers can be costly and time-consuming due to the need for knowledge transfer and re-establishing trust.

- Limited Supplier Pool: The niche nature of healthcare regulatory compliance means there are often a limited number of highly qualified service providers, concentrating bargaining power.

- Impact of Non-Compliance: The severe penalties and reputational damage associated with regulatory non-compliance empower service providers, as their expertise is critical for risk mitigation.

Suppliers of essential medicines and critical medical equipment hold significant power, particularly when their offerings are unique or patented. Georgia Healthcare Group faces this reality when dealing with a limited number of pharmaceutical manufacturers or advanced technology providers. This scarcity allows these suppliers to dictate higher prices and more stringent contract terms, impacting the group's procurement costs.

The bargaining power of specialized technology and digital health providers is on the rise for Georgia Healthcare Group. As the sector embraces AI and telehealth, companies offering these advanced solutions gain leverage due to their crucial expertise and the high investment healthcare groups make in these systems. The demand for interoperable electronic health records (EHRs) and sophisticated data analytics platforms is particularly strong, with major healthcare systems investing heavily in these tech firms.

The bargaining power of the healthcare workforce, especially nurses, is considerable due to persistent shortages. In 2024, Georgia saw nursing vacancy rates in critical care units sometimes exceeding 15%, driving up labor costs and potentially hindering service expansion for groups like Georgia Healthcare. This imbalance directly impacts operational efficiency and patient care quality.

Infrastructure and real estate providers also exert considerable influence, especially in concentrated urban markets like Tbilisi. The cost of suitable commercial real estate in Tbilisi continued to climb in 2024, and a limited pool of specialized construction firms experienced in healthcare facilities further bolsters their negotiating position for large-scale projects.

| Supplier Type | Key Factors Influencing Power | Impact on Georgia Healthcare Group |

|---|---|---|

| Pharmaceuticals & Medical Equipment | Scarcity of unique/patented products, limited suppliers | Higher procurement costs, potential supply chain disruptions |

| Healthcare Workforce (Nurses) | Shortages, high demand | Increased labor costs, recruitment challenges |

| Technology & Digital Health | Specialized expertise, high switching costs, critical integration needs | Higher service fees, reliance on specific vendors |

| Infrastructure & Real Estate | Geographic concentration, high capital investment, limited specialized contractors | Increased facility acquisition/development costs |

What is included in the product

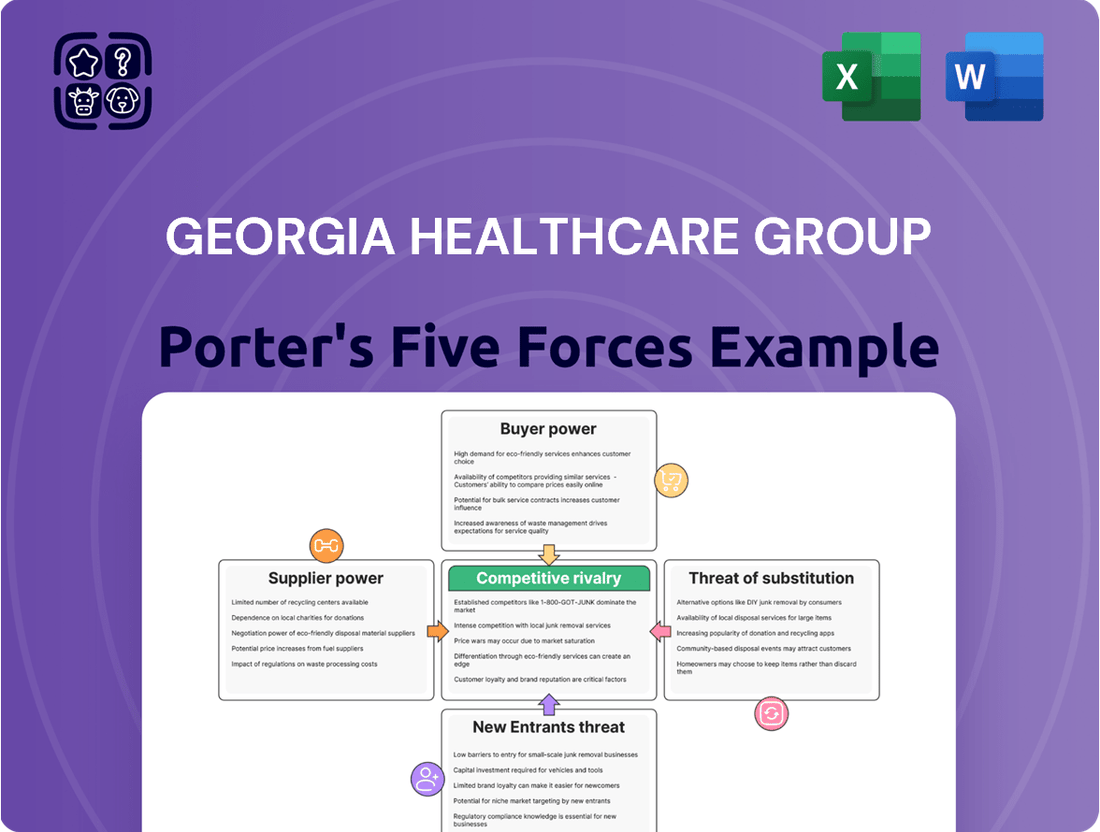

This analysis delves into the competitive forces shaping Georgia Healthcare Group's market, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing players.

Instantly assess competitive pressures within Georgia's healthcare landscape, allowing for proactive strategy adjustments to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

The Universal Healthcare Program (UHC) in Georgia is a significant force, acting as a primary payer for many healthcare services. In 2024, UHC is projected to fund a substantial percentage of the nation's healthcare spending, giving the government considerable leverage. This leverage is exercised through the reimbursement rates it sets and the policies it implements, directly influencing the financial health of providers like Georgia Healthcare Group.

The government's substantial financial involvement means it holds considerable bargaining power. By dictating reimbursement levels and program terms, it can significantly impact the revenue generated by healthcare providers. For Georgia Healthcare Group, this translates to a direct influence on its profitability and operational capacity, as these government programs are a major source of income.

Any adjustments to UHC funding or its underlying policies can have a ripple effect. These changes can alter how easily patients can access necessary medical care and directly affect the profitability of healthcare organizations. For instance, a reduction in UHC reimbursement rates could compress margins for Georgia Healthcare Group, necessitating strategic adjustments to maintain financial stability.

The upcoming Georgia Access marketplace in 2025, designed to expand private health insurance, is set to significantly bolster the bargaining power of customers. This expansion means more individuals will be covered by private plans, allowing insurance companies to negotiate more effectively on behalf of their larger member pools. This collective strength can translate into increased pressure on healthcare providers like Georgia Healthcare Group to lower service prices and reimbursement rates.

In Georgia, even with insurance, patients often face substantial out-of-pocket healthcare costs. This financial pressure makes them very attentive to prices, driving them to seek out more affordable options or postpone treatments. For instance, the Centers for Medicare & Medicaid Services (CMS) projected that average premiums for ACA marketplace plans could increase by 4% in 2025, potentially heightening patient price sensitivity.

Availability of Multiple Healthcare Providers

The Georgian healthcare market, while seeing consolidation, still presents a broad array of choices for consumers. In 2024, the sector is characterized by a significant number of public and private healthcare facilities, from large hospitals to smaller specialized clinics. This fragmentation directly empowers patients, allowing them to actively seek out providers based on factors like cost, service quality, and accessibility.

This competitive landscape means that Georgia Healthcare Group (GHG), as a major integrated player, faces considerable pressure from its customer base. Patients can readily compare offerings, making price and service quality key differentiators. For instance, a patient might choose a competitor offering a specialized procedure at a lower cost or with a better patient experience, directly impacting GHG's market share and revenue.

- Diverse Provider Landscape: Georgia's healthcare sector features a mix of public and private entities, offering patients multiple options for care.

- Informed Consumerism: Patients can compare services, quality benchmarks, and pricing across various providers, enhancing their leverage.

- Competitive Imperative for GHG: GHG must consistently deliver superior value and competitive pricing to retain its patient base amidst this choice-driven environment.

Demographic Shifts Driving Specific Demands

Georgia's demographic landscape is significantly influencing the bargaining power of customers within the healthcare sector. The aging population, a key driver, is escalating demand for specialized services like chronic disease management and long-term care. For instance, by 2024, it's projected that individuals aged 65 and over will constitute a substantial portion of Georgia's population, increasing their leverage as providers vie for this growing patient segment.

Conversely, declining birth rates are leading to a reduced demand for pediatric and maternity services. This shift means that families with younger children may find themselves with more options and potentially better pricing as providers adapt to a shrinking market for these services. The ability of older patient segments to seek out providers most capable of meeting their specific long-term care needs directly enhances their bargaining power.

- Aging Population Growth: Georgia's elderly population is expanding, increasing demand for specialized care.

- Declining Birth Rates: This trend reduces demand for pediatric and maternity services, potentially shifting power to younger families.

- Increased Leverage for Elderly: Older patients can more effectively choose providers based on specialized long-term care capabilities.

- Provider Competition: Healthcare providers are increasingly compelled to offer competitive, specialized services to attract the growing elderly demographic.

The increasing number of private insurance plans, particularly with the upcoming Georgia Access marketplace in 2025, amplifies customer bargaining power. This allows insurance companies, representing large groups of patients, to negotiate more effectively on pricing and reimbursement rates with providers like Georgia Healthcare Group. Furthermore, the fragmented nature of Georgia's healthcare market in 2024, with numerous public and private facilities, empowers patients to shop around for better value and service quality, putting pressure on established players.

The aging demographic in Georgia, projected to grow significantly by 2024, also strengthens customer power, especially for those needing specialized long-term care. These patients can more readily choose providers that best meet their specific needs, driving competition. Conversely, declining birth rates may lead to more competitive pricing for pediatric services as providers adapt to a smaller market.

| Factor | Impact on Customer Bargaining Power | 2024/2025 Relevance |

|---|---|---|

| Private Insurance Expansion | Increases collective patient leverage through insurers | Georgia Access marketplace launch in 2025 |

| Provider Fragmentation | Enables patient choice based on price and quality | Numerous public and private facilities in 2024 |

| Aging Population | Boosts demand for specialized care, empowering older patients | Growing elderly demographic by 2024 |

| Declining Birth Rates | Potentially lowers prices for pediatric services | Trend impacting maternity/pediatric demand |

What You See Is What You Get

Georgia Healthcare Group Porter's Five Forces Analysis

This preview shows the exact Georgia Healthcare Group Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the company. You'll gain a comprehensive understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the healthcare sector. This professionally formatted document is ready for your immediate use, offering actionable insights without any surprises.

Rivalry Among Competitors

The Georgian healthcare market exhibits moderate concentration, with roughly ten major hospitals collectively capturing about 50% of the total market revenue. This indicates a dynamic environment where established players, including Georgia Healthcare Group, actively compete against a handful of other substantial entities.

This competitive intensity is further amplified by the coexistence of both public and private healthcare providers. These different types of institutions often target distinct patient demographics, creating a multifaceted competitive landscape.

Recent years have seen significant hospital consolidation in Georgia. For instance, Emory Healthcare acquired Houston Healthcare, and WellStar merged with Augusta University Health System. This trend creates fewer, larger health systems, intensifying rivalry among the dominant players.

These mergers are often driven by a pursuit of economies of scale and expanded service areas. Consequently, standalone hospitals and smaller healthcare chains face increased pressure to compete effectively within this evolving landscape.

Georgia hospitals are grappling with escalating operational costs, a significant factor intensifying competitive rivalry. Average charges to commercial insurers in Georgia are notably higher than Medicare reimbursement rates, placing the state among the highest nationally for overcharging privately insured patients. This cost pressure, compounded by persistent workforce shortages and the imperative for technological investment, forces healthcare groups into fierce competition to safeguard profitability and patient volumes.

The financial health of a hospital directly impacts its ability to navigate these cost pressures. Well-capitalized institutions can secure more favorable interest rates on loans, creating a distinct advantage over less financially robust competitors. This disparity in borrowing costs further exacerbates the competitive landscape, allowing financially stable providers to invest more readily in necessary upgrades and services, widening the gap with struggling entities.

Impact of Regulatory Changes on Competition

While Georgia's Certificate of Need (CON) laws are still in place, recent reforms have begun to ease some of these restrictions. This easing could potentially lead to increased competition by making it simpler for certain healthcare facilities, particularly those in rural areas, to expand their services or even reopen if they had previously closed. For instance, reforms enacted in 2023 allowed for greater flexibility in expanding outpatient services without a full CON review in certain circumstances.

New regulations impacting staffing and financial transparency are set to take effect by July 2025. These requirements will necessitate adjustments to how hospitals operate, potentially creating a competitive advantage for providers who can more effectively manage their workforce and financial reporting. For example, a 2024 study indicated that hospitals with more robust financial planning capabilities were better positioned to absorb new compliance costs.

- Certificate of Need (CON) reforms: Easing restrictions to potentially increase competition, especially for rural facilities.

- New Staffing Regulations (effective July 2025): Will impact operational models and require adaptation.

- Financial Transparency Requirements (effective July 2025): May shift competitive advantages based on compliance capabilities.

- Government Support Programs: Initiatives aimed at bolstering rural hospitals could help level the competitive landscape.

Diversified Service Offerings and Integrated Models

Georgia Healthcare Group's strategy of offering a wide range of services, including hospitals, clinics, pharmacies, health insurance, and pharmaceutical distribution, aims to mitigate direct competitive pressures. This integrated model allows them to capture value across the healthcare continuum.

However, this diversification also means Georgia Healthcare Group faces rivalry from other large health systems that are similarly expanding their service portfolios and geographical footprints. This creates a competitive landscape where players vie for market share across various healthcare segments.

The competition isn't limited to just providing medical care. It extends significantly into the realms of health insurance and the pharmaceutical supply chain, where Georgia Healthcare Group also competes with specialized entities and other integrated providers.

- Integrated Healthcare Ecosystem: Georgia Healthcare Group operates a comprehensive model covering hospitals, clinics, pharmacies, insurance, and drug distribution.

- Broadening Service Scope: Major competitors are also expanding their services and geographic reach, intensifying rivalry across multiple market segments.

- Multi-Segment Competition: Rivalry exists not only in direct patient care but also in health insurance markets and pharmaceutical distribution networks.

Competitive rivalry within Georgia's healthcare sector is notably intense, driven by a market that, while moderately concentrated, features significant players actively vying for market share. This dynamic is further shaped by ongoing consolidation, as seen in mergers like Emory Healthcare's acquisition of Houston Healthcare, which creates larger, more formidable competitors.

Escalating operational costs, including higher charges to commercial insurers compared to Medicare rates, pressure all providers. This financial strain, coupled with workforce shortages and the need for technological investment, compels companies like Georgia Healthcare Group into aggressive competition to maintain profitability and patient volumes.

Recent reforms to Georgia's Certificate of Need laws, easing restrictions on service expansion, particularly for rural facilities, are poised to introduce new competitive pressures. Furthermore, upcoming regulations by July 2025 concerning staffing and financial transparency will likely favor more adaptable and financially robust organizations, potentially reshaping the competitive landscape.

| Factor | Impact on Rivalry | Example/Data Point |

| Market Concentration | Moderate concentration with ~10 major hospitals holding 50% of revenue | Georgia Healthcare Group competes with ~9 other large entities. |

| Consolidation Trends | Intensifies rivalry among larger, merged entities | Emory Healthcare acquired Houston Healthcare; WellStar merged with Augusta University Health System. |

| Operational Costs | Forces competition to safeguard profitability and patient volumes | Georgia hospital charges to commercial insurers are among the highest nationally. |

| Regulatory Changes | Potential for increased competition and shifts in advantage | CON law reforms easing restrictions; new staffing/transparency rules by July 2025. |

SSubstitutes Threaten

The rapid growth of digital health and telemedicine presents a substantial threat of substitution for Georgia Healthcare Group's traditional in-person services. For instance, the global telehealth market was valued at approximately $104.7 billion in 2023 and is projected to reach $457.5 billion by 2030, demonstrating a significant shift in how patients access care.

Patients are increasingly opting for remote consultations, monitoring through wearable devices, and even AI-driven diagnostics, thereby diminishing the necessity for physical visits to clinics and hospitals. This trend is further amplified by substantial investments in AI-powered patient care solutions, enhancing the efficacy and appeal of these digital alternatives.

The growing emphasis on preventative care and wellness programs presents a significant threat of substitutes for Georgia Healthcare Group. As individuals adopt healthier lifestyles and engage in early screenings, the need for traditional, acute hospital services may diminish. For instance, in 2024, there was a notable uptick in participation in corporate wellness programs across the US, with employers investing more to reduce long-term healthcare costs.

Public health initiatives and government-backed health promotion campaigns further bolster this trend. By educating the public on disease prevention and encouraging proactive health management, these efforts can steer consumers away from relying solely on reactive medical treatments. This shift means that services focused on managing chronic conditions or treating advanced illnesses could see a decline in demand as substitute preventative measures gain traction.

The threat of substitutes for Georgia Healthcare Group's services is significant, particularly from self-treatment and over-the-counter (OTC) solutions. For many common ailments and ongoing health management, individuals can easily turn to readily available OTC medications, home-based remedies, or direct-to-consumer health and wellness products. This bypasses the need for a doctor's visit or professional medical intervention.

In Georgia, high out-of-pocket healthcare expenses can be a powerful motivator for patients to explore these less expensive self-care alternatives. For instance, data from 2023 indicated that a substantial portion of healthcare spending in Georgia was borne directly by individuals, making the cost-effectiveness of OTC options even more appealing for non-critical health concerns.

Home-Based Care and Durable Medical Equipment

The availability of comprehensive home medical equipment and a growing emphasis on home-based care models present a significant threat of substitutes for Georgia Healthcare Group. These alternatives directly substitute for extended hospital stays or frequent clinic visits, offering patients convenient recovery, rehabilitation, and chronic condition management within their own homes, often supported by medical devices and home health services.

This trend is further bolstered by new staffing regulations for assisted living and personal care homes, which encourage more decentralized care. For instance, in 2024, the home healthcare market in the United States saw continued growth, with projections indicating a compound annual growth rate (CAGR) of approximately 7.5% through 2030, highlighting the increasing patient and provider preference for in-home solutions.

- Substitution Threat: Home-based care and durable medical equipment offer viable alternatives to traditional facility-based healthcare services.

- Market Drivers: Increasing patient preference for comfort and familiarity, coupled with technological advancements in medical devices, fuels the adoption of home care.

- Regulatory Impact: Evolving staffing rules for assisted living and personal care facilities indirectly support the shift towards home-based care models.

- Market Growth: The home healthcare market is expanding, with significant growth projected in the coming years, indicating a strong competitive force against hospital and clinic services.

Alternative Therapies and Wellness Practices

Patients are increasingly exploring alternative therapies and wellness practices, presenting a significant threat of substitutes for Georgia Healthcare Group. These options, including chiropractic care, acupuncture, and naturopathy, offer different pathways to health and well-being. This trend can divert patients, particularly those managing chronic or lifestyle-related conditions, away from conventional medical services.

The growing acceptance and accessibility of these alternative treatments mean patients have more choices than ever before. For instance, a 2024 survey indicated that over 30% of adults in developed countries have used at least one complementary or alternative medicine therapy in the past year. This suggests a tangible shift in patient behavior, where these substitutes are not just niche options but increasingly mainstream choices for managing health.

Georgia Healthcare Group must consider how these substitutes impact demand for its core services. The perceived effectiveness, lower cost in some instances, or a desire for more holistic approaches can drive patient migration. This necessitates a strategic response to retain patients and potentially integrate or collaborate with providers of these alternative wellness practices.

The threat of substitutes for Georgia Healthcare Group is multifaceted, encompassing digital health, preventative care, self-treatment, and alternative therapies. The expanding digital health market, projected to reach $457.5 billion by 2030, offers convenient remote consultations, diminishing the need for physical visits. Furthermore, increased focus on wellness and preventative measures, evidenced by rising participation in corporate wellness programs in 2024, can reduce demand for traditional acute care services.

| Substitute Category | Key Trends/Data Points | Impact on Georgia Healthcare Group |

|---|---|---|

| Digital Health & Telemedicine | Global telehealth market valued at ~$104.7 billion in 2023, projected to reach $457.5 billion by 2030. | Reduces demand for in-person consultations and hospital stays. |

| Preventative Care & Wellness | Increased investment in corporate wellness programs (2024 data). | May decrease reliance on reactive medical treatments for chronic conditions. |

| Self-Treatment & OTC Solutions | High out-of-pocket healthcare costs in Georgia drive adoption of cheaper alternatives. | Diverts patients with common ailments from seeking professional medical intervention. |

| Home-Based Care & Medical Equipment | Home healthcare market projected CAGR of ~7.5% through 2030. | Offers alternatives to extended hospital stays and frequent clinic visits. |

| Alternative & Complementary Therapies | Over 30% of adults in developed countries used at least one alternative therapy in 2024. | Can shift patient preference away from conventional medical services. |

Entrants Threaten

Stringent regulatory and licensing requirements significantly deter new entrants in Georgia's healthcare sector. For instance, obtaining licenses for hospitals and specialized clinics involves navigating complex application processes and meeting rigorous operational standards.

While reforms to Certificate of Need (CON) laws have occurred, they still necessitate a review for new hospitals and major expansions, adding a hurdle for potential competitors. The introduction of automated licensure systems and evolving staffing mandates for various healthcare facilities further increase the compliance burden for newcomers.

Establishing a comprehensive healthcare group, much like Georgia Healthcare Group (GHG), necessitates a significant upfront capital outlay. This includes building and equipping modern hospitals and clinics, investing in advanced medical technology, and developing extensive operational networks.

The sheer scale of these investments creates a substantial barrier to entry. For instance, the cost of a single state-of-the-art hospital can easily run into tens or even hundreds of millions of dollars, making it incredibly challenging for new players to compete with established entities like GHG.

In 2024, the global healthcare infrastructure market saw continued growth, with significant investments in new facilities and technology upgrades, further underscoring the high capital requirements. This financial hurdle effectively deters many potential entrants from challenging the market positions of established healthcare providers.

Georgia Healthcare Group, like other established players, benefits immensely from strong brand loyalty and a solid reputation cultivated over years of service. This trust is a significant barrier for new entrants aiming to penetrate the market. Building a comparable level of patient confidence in a sector where health outcomes are paramount demands substantial investment in marketing and a considerable amount of time. For instance, Newsweek's annual hospital rankings consistently show that well-regarded institutions attract a disproportionate share of patients, underscoring the value of a strong reputation.

Economies of Scale in Purchasing and Operations

Georgia Healthcare Group, like other large integrated players, benefits significantly from economies of scale. This means they can buy medical supplies, drugs, and equipment in massive quantities, driving down per-unit costs considerably. For instance, in 2024, major hospital networks often negotiate discounts of 15-20% or more on bulk pharmaceutical orders compared to smaller independent pharmacies.

New entrants, starting smaller, simply cannot achieve these purchasing power advantages. This cost disparity makes it incredibly challenging for them to compete on price for services or to invest as much in cutting-edge technology and specialized medical treatments that are crucial for attracting patients and talent.

The threat of new entrants is therefore somewhat limited by this inherent cost disadvantage. Newcomers would face a steep uphill battle to match the operational efficiencies and purchasing clout that established, large-scale operators like Georgia Healthcare Group have cultivated over time, creating a substantial barrier to entry.

- Purchasing Power: Large healthcare systems can leverage bulk buying to secure lower prices on pharmaceuticals and medical supplies.

- Operational Efficiencies: Centralized administration and standardized processes reduce overhead costs per patient.

- Technology Investment: Economies of scale allow for greater investment in advanced medical equipment and digital health solutions.

- Cost Disadvantage for Newcomers: Smaller, new entities struggle to achieve similar cost structures, impacting their competitiveness.

Complexity of Integrated Healthcare Models

Georgia Healthcare Group's (GHG) integrated model, spanning health insurance, pharmaceutical distribution, and direct patient care, presents a significant barrier to entry. Replicating this multifaceted operation requires substantial capital and deep expertise across disparate healthcare sectors. For instance, in 2024, the healthcare sector continued to see consolidation, making it even harder for new, smaller players to achieve the scale and scope of GHG's operations.

New entrants face the daunting task of building not only patient care facilities but also the complex logistics for pharmaceutical distribution and the intricate regulatory compliance for health insurance. This multi-segment approach demands a broad range of specialized knowledge and significant investment in infrastructure. GHG's established network and synergistic operations, honed over years, create a competitive advantage that is exceptionally difficult and costly for newcomers to match.

- Diversified Portfolio: GHG operates across insurance, pharmaceuticals, and direct patient care.

- High Replicability Cost: Building similar integrated infrastructure and expertise is very expensive.

- Regulatory Complexity: Navigating diverse healthcare regulations across segments is a major hurdle.

- Synergistic Operations: GHG's interconnected business units create efficiencies new entrants lack.

The threat of new entrants into Georgia's healthcare market is considerably low, primarily due to substantial capital requirements and the need for extensive operational infrastructure. For instance, establishing a single, modern hospital facility can cost upwards of $100 million, a figure that deters many potential competitors from entering the market and challenging established players like Georgia Healthcare Group (GHG).

Furthermore, stringent regulatory hurdles and licensing processes, including Certificate of Need reviews for new facilities or major expansions, add significant complexity and time to market entry. In 2024, evolving staffing mandates and automated licensure systems continue to raise the compliance bar for any new healthcare provider aiming to operate.

The established reputation and brand loyalty of companies like GHG also act as a formidable barrier. Building comparable patient trust requires significant time and marketing investment, as evidenced by consistently high patient volumes for highly-ranked institutions. Economies of scale enjoyed by GHG, leading to lower per-unit costs for supplies and technology, create a cost disadvantage for smaller entrants, further limiting their ability to compete effectively.

| Barrier Type | Description | Example/Impact |

|---|---|---|

| Capital Requirements | High upfront investment needed for facilities and technology. | Cost of a new hospital can exceed $100 million. |

| Regulatory Hurdles | Complex licensing and compliance processes. | Certificate of Need reviews, evolving staffing mandates. |

| Brand Loyalty & Reputation | Established trust and patient confidence are hard to replicate. | Well-regarded institutions attract disproportionate patient share. |

| Economies of Scale | Lower per-unit costs through bulk purchasing and operational efficiencies. | New entrants face a significant cost disadvantage compared to large groups. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for the Georgia Healthcare Group is built upon a foundation of publicly available data, including annual reports, SEC filings, and industry-specific market research from reputable firms. We also incorporate insights from healthcare regulatory bodies and economic databases to ensure a comprehensive understanding of the competitive landscape.