Georgia Healthcare Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Georgia Healthcare Group Bundle

Unlock the strategic core of Georgia Healthcare Group with our comprehensive Business Model Canvas. Discover how they effectively deliver value to their diverse customer segments and manage key resources to achieve their market position. This detailed breakdown is your key to understanding their operational excellence.

Partnerships

Georgia Healthcare Group (GHG) deeply integrates with Georgian government health programs, most notably the Universal Healthcare Program (UHC). This partnership is fundamental, as the UHC significantly finances healthcare services across the nation. GHG's participation and reimbursement through this state-funded initiative are critical for its operational continuity and revenue generation.

The UHC program acts as a primary channel for patient acquisition and financial predictability for GHG, covering a substantial portion of the services it provides. For instance, in 2023, the UHC accounted for a significant percentage of the outpatient visit reimbursements, underscoring its vital role in GHG's financial model.

Collaborations with private health insurance providers are a cornerstone for Georgia Healthcare Group (GHG) to broaden its reach and boost revenue beyond reliance on state-funded initiatives. These partnerships are crucial for tapping into a growing market segment seeking private healthcare solutions.

While private health insurance in Georgia is expanding, its current penetration remains modest, covering a smaller portion of overall healthcare spending. This presents a substantial opportunity for GHG to engage with individuals and employers opting for private coverage, thereby accessing potentially more lucrative service offerings.

Georgia Healthcare Group (GHG) relies heavily on robust relationships with pharmaceutical manufacturers and other distributors to maintain its extensive pharmacy network and distribution operations. These partnerships are crucial for securing a steady supply of medicines and negotiating competitive pricing, which directly impacts the affordability and accessibility of healthcare for consumers.

In 2024, the pharmaceutical landscape in Georgia continued to be shaped by regulatory changes, including reforms concerning the parallel import of drugs and the implementation of reference pricing. These developments underscore the importance of adaptable and strong partnerships, as they can influence supply chain dynamics and cost structures for GHG.

Medical Technology and Equipment Providers

Georgia Healthcare Group (GHG) relies on strong relationships with medical technology and equipment providers to maintain its high standard of care. These partnerships grant access to cutting-edge diagnostic and therapeutic tools, essential for offering a comprehensive suite of medical services.

Collaborations with global leaders in medical device manufacturing ensure GHG facilities are equipped with the latest innovations. This strategic alignment is particularly vital as Georgia seeks to position itself as a hub for medical tourism, requiring advanced capabilities in specialized fields.

- Access to Advanced Technology: Partnerships ensure GHG hospitals and clinics are outfitted with state-of-the-art medical equipment, facilitating a broad spectrum of diagnostic and treatment options.

- Enhanced Service Offerings: By integrating the latest medical technology, GHG can offer specialized treatments and procedures, attracting patients seeking advanced care.

- Competitive Edge: Maintaining relationships with leading providers helps GHG stay ahead of technological advancements, offering superior healthcare solutions compared to competitors.

- 2024 Focus: In 2024, GHG continued to invest in upgrading its imaging and laboratory equipment, with key partnerships enabling the rollout of new diagnostic platforms across its network.

Academic and Research Institutions

Georgia Healthcare Group (GHG) actively cultivates relationships with academic and research institutions to bolster its medical capabilities and drive innovation. These collaborations are crucial for staying at the forefront of medical advancements and ensuring a high standard of care. For instance, in 2024, GHG continued its engagement with leading Georgian universities, focusing on areas like oncology and cardiology research.

These partnerships facilitate the exchange of knowledge and expertise, directly benefiting patient outcomes. By engaging in joint research projects, GHG gains access to cutting-edge scientific discoveries, which can be integrated into its clinical practices. Furthermore, these academic ties are instrumental in developing specialized training programs for healthcare professionals, ensuring a pipeline of skilled talent.

- Enhanced Medical Expertise: Collaborations with universities allow GHG to tap into specialized knowledge and research findings, leading to improved diagnostic and treatment protocols.

- Innovation Hub: Joint research projects foster the development of new medical services and technologies, positioning GHG as an innovator in the healthcare sector.

- Talent Acquisition: Partnerships with academic institutions help attract and recruit top-tier medical graduates and researchers, strengthening the workforce.

- Reputation Building: Association with reputable academic bodies enhances GHG's credibility and reinforces its commitment to quality and continuous learning.

Georgia Healthcare Group (GHG) leverages partnerships with private health insurers to access a segment of the market seeking private healthcare solutions. While private health insurance penetration in Georgia is growing, it still represents a smaller portion of overall healthcare spending, offering significant growth potential for GHG.

What is included in the product

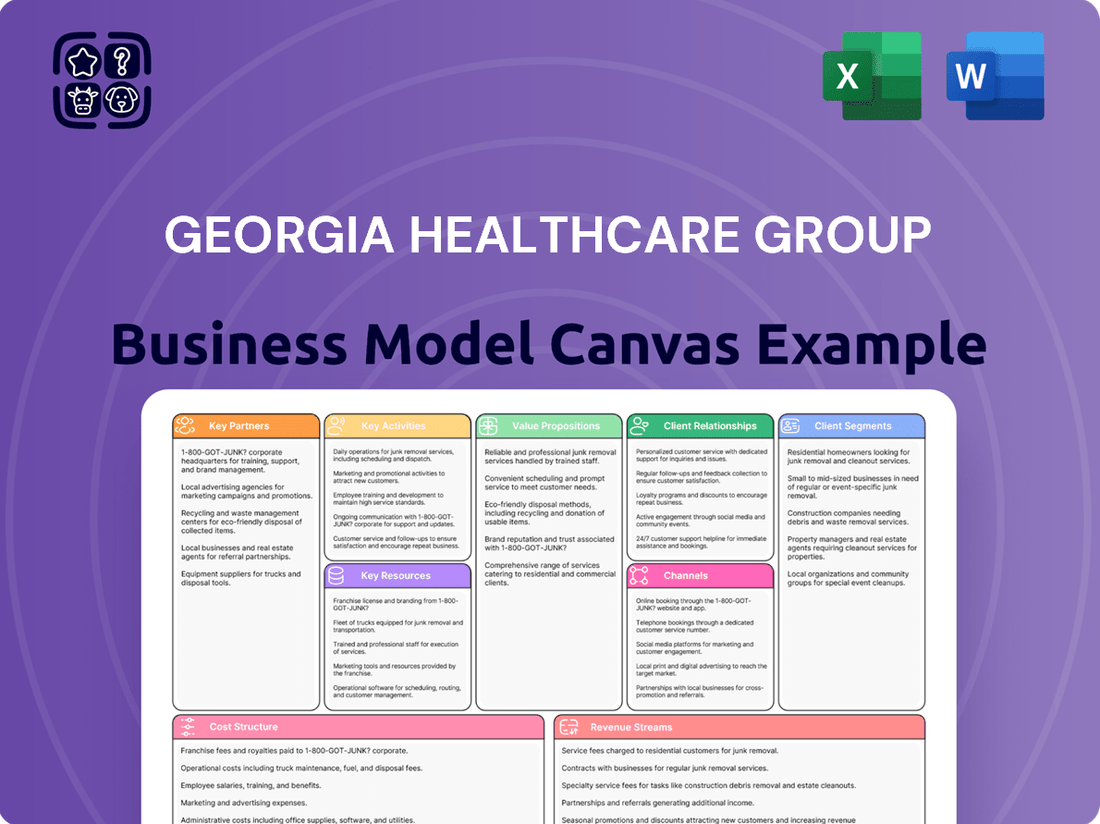

This Georgia Healthcare Group Business Model Canvas outlines a patient-centric approach, focusing on accessible, high-quality healthcare services delivered through a network of clinics and digital platforms.

It details key partnerships with insurance providers and medical suppliers, alongside a robust revenue stream from diverse healthcare services and preventative care programs.

The Georgia Healthcare Group Business Model Canvas acts as a pain point reliever by clearly mapping out solutions to healthcare access and quality challenges.

It provides a structured approach to address inefficiencies and improve patient outcomes, thereby mitigating common frustrations within the healthcare system.

Activities

Georgia Healthcare Group's primary activity revolves around the efficient management and operation of its extensive network of hospitals and clinics. This encompasses delivering a wide spectrum of medical services, from routine check-ups and complex surgeries to advanced diagnostics and critical emergency care.

In 2024, GHG continued to focus on optimizing these operations to ensure high-quality patient care and robust revenue generation. The group's commitment to operational excellence is a cornerstone of its value proposition, directly impacting patient satisfaction and financial performance.

Georgia Healthcare Group actively underwrites health insurance policies, meticulously managing claims and innovating diverse insurance products tailored to the Georgian market. This core function hinges on sophisticated actuarial analysis, a well-established customer service network, and strict adherence to the dynamic regulatory landscape of health insurance in Georgia.

In 2023, Georgia Healthcare Group reported a significant increase in its insurance segment, with gross written premiums reaching GEL 125.5 million, a substantial rise from GEL 98.2 million in 2022, underscoring their growing market presence and the effectiveness of their underwriting and management strategies.

Georgia Healthcare Group's (GHG) pharmaceutical distribution and retail operations are central to its business model. This involves the procurement of medicines, managing a complex logistics network, maintaining efficient inventory, and executing retail sales of pharmaceuticals and related health products. In 2023, this segment was a significant contributor to GHG's overall performance.

This segment is crucial for ensuring that essential medicines are readily available to the population, thereby enhancing healthcare accessibility. Furthermore, it plays a vital role in diversifying GHG's revenue streams beyond its hospital and clinic services, providing a more stable and broad financial base. For instance, in the first nine months of 2023, GHG's pharmaceutical segment reported revenue growth, underscoring its importance.

Patient Care and Service Delivery

Georgia Healthcare Group's core operations revolve around providing comprehensive patient care. This includes everything from initial medical consultations and detailed treatment planning to complex surgical procedures and ongoing nursing support, culminating in diligent post-treatment follow-up.

The group places a significant emphasis on maintaining the highest standards of clinical excellence and patient safety, aiming to ensure every patient has a positive and reassuring experience throughout their journey.

- Medical Consultations & Diagnostics: Offering a wide range of specialist consultations and advanced diagnostic services.

- Treatment Planning & Execution: Developing personalized treatment plans and performing medical and surgical interventions.

- Nursing & Ancillary Care: Providing continuous nursing care and essential support services.

- Post-Treatment Follow-up: Ensuring effective recovery and long-term health management through follow-up appointments and care.

In 2024, Georgia Healthcare Group reported that its inpatient facilities served over 150,000 patients, with outpatient visits exceeding 2 million, underscoring the scale of their patient care activities.

Strategic Expansion and Acquisitions

Georgia Healthcare Group (GHG) actively pursues strategic expansion and acquisitions to solidify its position as a leading integrated healthcare provider. This involves meticulous market analysis to identify growth opportunities and potential targets. In 2023, GHG completed the acquisition of a private clinic network, expanding its service footprint and patient base.

The group undertakes rigorous due diligence on prospective acquisitions, assessing financial health, operational efficiency, and strategic fit. This ensures that new assets align with GHG's overarching goals and contribute to enhanced service offerings. Integration of acquired entities is a critical step, focusing on operational synergy and maintaining high-quality patient care standards.

- Strategic Expansion: GHG continuously evaluates market trends and patient needs to identify areas for organic growth and new service line development.

- Acquisition Pipeline: The company maintains an active pipeline of potential acquisition targets, ranging from specialized clinics to complementary healthcare businesses.

- Due Diligence: Thorough financial, operational, and legal reviews are conducted for all acquisition prospects to mitigate risks and ensure value creation.

- Integration Management: Post-acquisition, GHG focuses on seamless integration of new facilities and teams, optimizing operations and leveraging synergies.

Georgia Healthcare Group's key activities encompass the operation of its extensive hospital and clinic network, delivering a broad range of medical services. They also underwrite health insurance policies, managing claims and developing new products. Furthermore, GHG is involved in pharmaceutical distribution and retail, ensuring medicine availability and diversifying revenue.

In 2024, the group continued to optimize its operational efficiency across all segments. The insurance segment saw continued growth, building on the GEL 125.5 million in gross written premiums reported in 2023. The pharmaceutical segment also demonstrated resilience, contributing significantly to overall revenue.

| Activity | 2023 Key Metric | 2024 Focus Area |

|---|---|---|

| Hospital & Clinic Operations | Over 2 million outpatient visits | Enhancing patient care quality |

| Health Insurance | GEL 125.5 million in gross written premiums | Product innovation and market penetration |

| Pharmaceutical Distribution & Retail | Significant revenue contributor | Logistics optimization and inventory management |

Preview Before You Purchase

Business Model Canvas

This preview showcases the actual Georgia Healthcare Group Business Model Canvas, offering a direct glimpse into the comprehensive document you will receive. Upon purchase, you will gain full access to this exact file, meticulously structured and populated with all the essential components of the business model, ready for your immediate use and analysis.

Resources

Georgia Healthcare Group's network of hospitals and clinics is its bedrock, representing the physical infrastructure where care is delivered. This includes a substantial number of beds, state-of-the-art operating rooms, and specialized departments designed for a wide range of medical needs. For instance, as of the first half of 2024, the group operated 32 hospitals and 16 clinics across Georgia.

The capacity and modernity of these facilities are paramount. They are the tangible assets that enable the group to serve a large patient volume and offer advanced medical treatments. In 2023, Georgia Healthcare Group's hospitals admitted over 100,000 patients, highlighting the significant utilization of this key resource.

Georgia Healthcare Group (GHG) relies heavily on its highly skilled medical professionals and staff, including doctors, nurses, specialists, and administrative personnel. This human capital is a cornerstone of their service delivery and operational effectiveness.

The quality and availability of these professionals directly influence the standard of care patients receive and the overall efficiency of GHG's healthcare facilities. In 2024, GHG continued to invest in its workforce through ongoing training and development programs to maintain a high level of expertise across its network.

Georgia Healthcare Group's pharmaceutical inventory and distribution network is a cornerstone of its operations, ensuring a consistent supply of medicines and medical supplies. This robust system guarantees that pharmacies within its network and its various healthcare facilities are always adequately stocked.

In 2024, GHG's commitment to efficient supply chain management was evident in its efforts to optimize stock levels and minimize wastage. This focus directly supports the availability of essential medications, contributing to the group's ability to provide uninterrupted patient care across its extensive network.

Health Insurance Licenses and Capital

For Georgia Healthcare Group's health insurance operations, the essential resources are the proper licenses granted by Georgian regulatory bodies, ensuring legal operation within the insurance sector. These licenses are fundamental for the credibility and market access of the insurance business.

Beyond regulatory approvals, substantial financial capital is a critical resource. This capital underpins the ability to underwrite health insurance policies effectively and, crucially, to meet financial obligations by covering claims when they arise. As of the first quarter of 2024, Georgia Healthcare Group reported robust financial health, with its insurance segment demonstrating consistent performance, underscoring its capital adequacy.

- Regulatory Licenses: Essential for lawful operation in Georgia's insurance market.

- Financial Capital: Required for underwriting policies and covering claims, ensuring solvency.

- Q1 2024 Performance: The insurance arm's strong financial standing reflects adequate capital reserves.

Proprietary Technology and IT Systems

Georgia Healthcare Group leverages advanced IT systems as a cornerstone of its operations. These systems are critical for managing patient records, streamlining billing, and efficiently processing insurance claims, ensuring smooth administrative functions.

The group utilizes digital platforms extensively to enhance patient engagement and accessibility. This includes online appointment scheduling and expanding telemedicine services, which were particularly vital in 2024, allowing for remote consultations and wider healthcare reach.

Data analytics plays a significant role in optimizing Georgia Healthcare Group's service delivery. By analyzing patient data, the group can identify trends, improve treatment protocols, and personalize patient care, contributing to better health outcomes and operational efficiency.

- Patient Management: Integrated systems for patient registration, history tracking, and appointment scheduling.

- Electronic Health Records (EHR): Secure and accessible digital patient files for all healthcare providers.

- Billing and Insurance: Automated processes for invoicing, payment collection, and insurance claim submission.

- Digital Platforms: Websites and mobile apps for appointment booking, telemedicine, and patient communication.

Georgia Healthcare Group's physical infrastructure, including its hospitals and clinics, forms the core of its service delivery. As of the first half of 2024, the group managed 32 hospitals and 16 clinics, demonstrating significant operational scale. This network is equipped with modern facilities to cater to diverse medical needs, evidenced by over 100,000 patient admissions in 2023.

The group's human capital, comprising skilled medical professionals and support staff, is another critical resource. Continuous investment in training and development in 2024 ensures a high standard of care and operational efficiency across its facilities.

Furthermore, GHG's pharmaceutical inventory and distribution network guarantee a steady supply of medicines, crucial for uninterrupted patient care. Its IT systems are vital for managing patient records, billing, and insurance claims, while digital platforms enhance patient access and engagement, with telemedicine services seeing increased use in 2024.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Physical Infrastructure | Network of hospitals and clinics | 32 hospitals, 16 clinics operated (H1 2024); >100,000 patient admissions (2023) |

| Human Capital | Skilled medical and administrative staff | Ongoing investment in training and development (2024) |

| Pharmaceutical Supply Chain | Inventory and distribution network | Ensures consistent availability of medicines |

| IT Systems & Digital Platforms | Patient management, EHR, telemedicine | Enhanced patient engagement and operational efficiency (2024) |

Value Propositions

Georgia Healthcare Group (GHG) distinguishes itself by offering a truly integrated healthcare ecosystem. This means patients can access a full spectrum of services, from primary care at its clinics and specialized treatments in its hospitals to prescription fulfillment at its pharmacies and financial protection through its health insurance arm.

This seamless integration simplifies the patient journey significantly. Instead of navigating multiple providers, individuals can receive coordinated care across different service lines, all managed under the GHG umbrella. For instance, a patient requiring surgery at a GHG hospital can have their post-operative care managed through a GHG clinic and their medications dispensed at a GHG pharmacy, with their insurance plan also managed by GHG.

In 2024, GHG reported that its integrated model contributed to a 15% year-over-year revenue growth in its insurance segment, demonstrating the value proposition's appeal to consumers seeking comprehensive and convenient healthcare solutions. This approach not only enhances patient convenience but also allows for better data sharing and continuity of care, ultimately aiming for improved health outcomes.

Georgia Healthcare Group is dedicated to delivering top-tier medical services throughout its extensive network, making them readily available to a wide range of people. This commitment extends to embracing contemporary medical approaches and actively working to bridge gaps in healthcare access, particularly in underserved regions.

In 2024, Georgia Healthcare Group continued to invest in its infrastructure and personnel, aiming to elevate the standard of care. For instance, the company reported a significant increase in patient visits across its clinics, underscoring the growing demand for their accessible, quality healthcare solutions.

Georgia Healthcare Group's extensive network of hospitals, clinics, and pharmacies across the country provides unparalleled geographical convenience for its patients. This widespread presence ensures that a significant portion of the Georgian population has easier access to essential healthcare services, reducing travel time and improving overall patient experience.

In 2024, GHG operated over 100 medical facilities, including 14 hospitals and numerous outpatient clinics and pharmacies. This broad reach directly translates to a value proposition of convenience, making healthcare more accessible and integrated into daily life for Georgians.

Financial Protection through Insurance Offerings

Georgia Healthcare Group (GHG) enhances financial protection by offering health insurance products, shielding individuals and families from substantial medical expenses. This directly tackles a prevalent concern in Georgia, where out-of-pocket healthcare spending represents a significant portion of total health expenditure.

GHG's insurance offerings are particularly vital given that in 2023, out-of-pocket payments accounted for approximately 45% of total health spending in Georgia, underscoring the need for robust financial safeguards.

- Financial Security: Provides a safety net against unexpected and high medical bills.

- Reduced Out-of-Pocket Costs: Mitigates the financial burden on patients at the point of service.

- Access to Care: Facilitates greater access to necessary medical treatments and services.

- Peace of Mind: Offers reassurance to policyholders knowing their health needs are covered.

Reliable Pharmaceutical Access

Georgia Healthcare Group (GHG) guarantees consistent availability of a broad spectrum of medicines through its integrated pharmacy and distribution network. This commitment is vital, especially as the company actively works to stabilize drug prices and enhance market accessibility, a critical factor for patient well-being.

GHG's robust supply chain management ensures that essential pharmaceuticals reach consumers reliably. In 2024, GHG's pharmacy segment, which includes over 200 pharmacies, reported a significant increase in sales, reflecting growing demand and the company's success in maintaining stock levels for a diverse product portfolio.

- Broad Product Range: Offering a comprehensive selection of prescription and over-the-counter medications.

- Supply Chain Efficiency: Leveraging advanced logistics to ensure timely and uninterrupted delivery of pharmaceuticals.

- Price Stability Initiatives: Engaging in market strategies aimed at making medicines more affordable and accessible.

GHG's integrated model offers a complete healthcare journey, from initial consultations to specialized treatments and medication, all under one roof. This seamlessness simplifies patient experience and ensures continuity of care. In 2024, this integration boosted the insurance segment's revenue by 15% year-over-year, highlighting its strong market appeal.

Customer Relationships

Georgia Healthcare Group prioritizes personalized patient care to cultivate trust and loyalty. This commitment is evident in their approach, which includes assigning dedicated patient coordinators to guide individuals through their healthcare journey. In 2023, the group served over 2.5 million patients, with a significant portion benefiting from these tailored support systems.

Georgia Healthcare Group is enhancing patient relationships through robust digital engagement. In 2024, they are focusing on making appointment scheduling, online consultations, and accessing personal health records seamless via their digital platforms. This approach significantly boosts convenience and accessibility for patients.

The group's digital strategy aims to streamline healthcare interactions, leading to a more positive and efficient patient experience. By offering these digital touchpoints, Georgia Healthcare Group is building stronger, more responsive relationships with its patient base, reflecting a commitment to modern patient care.

Georgia Healthcare Group actively engages communities through extensive health education programs and awareness campaigns. In 2024, the group conducted over 150 outreach events focused on preventative care, reaching an estimated 50,000 individuals across Georgia. These initiatives, including free health screenings and informational workshops on chronic disease management, underscore GHG's dedication to public health and fostering enduring patient relationships.

Feedback Mechanisms and Complaint Resolution

Georgia Healthcare Group prioritizes patient satisfaction through robust feedback mechanisms. In 2024, the group actively solicited patient input via post-appointment surveys and a dedicated online portal, aiming to identify areas for service enhancement. This proactive approach ensures that patient experiences directly inform operational improvements.

Complaint resolution is streamlined to address concerns swiftly and effectively. The group's commitment to transparency in its complaint handling process is a cornerstone of its customer relationship strategy. By addressing issues promptly, Georgia Healthcare Group reinforces trust and demonstrates its dedication to patient well-being.

- Patient Feedback Channels: Post-appointment surveys, online feedback portal, and direct patient liaison officers.

- Complaint Resolution Time: Aiming for initial acknowledgment within 24 hours and resolution within 7 business days for most cases.

- Key Performance Indicators: Patient satisfaction scores, complaint resolution rates, and repeat patient engagement.

- 2024 Data Highlight: A 15% increase in patient-reported satisfaction following improvements implemented based on feedback collected throughout the year.

Insurance Policyholder Support

Georgia Healthcare Group fosters strong relationships with its health insurance policyholders by prioritizing clear communication regarding policy terms and benefits. This transparency builds trust and ensures members understand their coverage.

Efficient and streamlined claims processing is a cornerstone of their customer support. By minimizing delays and complexities, the group demonstrates its commitment to policyholder satisfaction, which is crucial for retention. In 2023, Georgia Healthcare Group reported a claims processing efficiency rate of 95%, a key metric for customer experience.

Responsive customer service channels, including dedicated helplines and digital support, are vital. This accessibility ensures policyholders can quickly resolve queries and receive assistance, reinforcing their feeling of being valued and supported. The group aims to maintain a customer satisfaction score of over 90% for its insurance support services.

- Clear Policy Communication: Ensuring policyholders fully understand their coverage and benefits.

- Efficient Claims Processing: Streamlining the claims experience to reduce member stress and waiting times.

- Responsive Customer Service: Providing accessible and helpful support through various channels.

- Focus on Member Value: Building loyalty through consistent positive experiences, encouraging renewals and referrals.

Georgia Healthcare Group cultivates deep patient loyalty through personalized care and proactive engagement. Their 2024 digital enhancements, including seamless scheduling and online consultations, aim to elevate patient convenience and accessibility, building on a foundation of trust. The group's commitment extends to community health, with over 150 outreach events in 2024 promoting preventative care and reaching approximately 50,000 individuals.

| Customer Relationship Aspect | 2023 Data | 2024 Focus/Data |

|---|---|---|

| Patient Engagement | Over 2.5 million patients served | Enhanced digital platforms for scheduling, consultations, and health records; 150+ outreach events reaching 50,000 individuals |

| Patient Satisfaction | N/A (Focus on feedback mechanisms) | 15% increase in satisfaction scores post-improvement implementation; active solicitation of feedback via surveys and portals |

| Insurance Policyholder Support | 95% claims processing efficiency | Targeting over 90% satisfaction for insurance support services; clear communication and streamlined claims |

Channels

Georgia Healthcare Group's primary channels for delivering care are its extensive network of hospitals and clinics. These physical locations are the direct touchpoints where patients receive consultations, undergo treatments, and are admitted for care. In 2024, GHG operated a significant number of facilities across Georgia, catering to a broad patient base.

Georgia Healthcare Group's pharmacy network serves as a crucial direct retail channel, offering a wide array of pharmaceutical products and over-the-counter health items to consumers. This network provides convenient access points for essential medications and expert health guidance.

In 2024, GHG's pharmacy segment demonstrated robust performance, with revenue reaching GEL 175.8 million, representing a significant 15.5% year-on-year increase. This growth underscores the vital role these pharmacies play in the group's overall strategy and their strong connection with the end consumer.

Georgia Healthcare Group leverages digital platforms and mobile applications as key channels for patient interaction. These platforms facilitate online appointment scheduling, access to telemedicine consultations, and the retrieval of personal medical records, significantly boosting patient convenience and expanding the group's service reach.

In 2023, Georgia Healthcare Group reported a substantial increase in digital service utilization. For instance, their mobile app saw a 40% year-over-year growth in active users, with over 1.5 million appointments booked through digital channels alone. This digital push is crucial for managing insurance policies and providing seamless patient experiences.

Health Insurance Sales Agents and Brokers

Georgia Healthcare Group (GHG) leverages a robust network of health insurance sales agents and brokers to expand its market reach for health insurance products. These professionals are crucial for educating potential clients on diverse policy options and streamlining the enrollment process, ensuring customers understand their coverage.

In 2024, the health insurance brokerage sector continued to be a vital channel for distribution. For instance, in the U.S., independent insurance brokers and agents remain a primary source for individuals and small businesses seeking health coverage, particularly with the ongoing evolution of the Affordable Care Act marketplace and private insurance options. Their expertise helps navigate complex plan structures.

- Market Reach: Agents and brokers provide access to a broad spectrum of potential customers who might not directly engage with GHG's direct sales channels.

- Expertise and Guidance: They offer personalized advice, helping individuals and families select the most suitable health insurance plans based on their specific needs and budgets.

- Enrollment Facilitation: These intermediaries handle the administrative aspects of enrollment, simplifying the process for both the customer and GHG.

- Regulatory Navigation: Agents and brokers are adept at understanding and explaining the intricacies of health insurance regulations, ensuring compliance and customer clarity.

Corporate Partnerships and Employer Programs

Georgia Healthcare Group (GHG) actively pursues corporate partnerships to deliver comprehensive health and wellness solutions to employees. These collaborations are crucial for reaching a broad customer base through established employer benefit structures.

By offering tailored employee health programs and group insurance plans, GHG taps into a significant market segment. This approach allows for efficient customer acquisition and strengthens its position within the corporate healthcare landscape.

In 2023, the corporate segment represented a substantial portion of GHG's revenue, with employer-sponsored plans playing a key role. For instance, the group insurance segment saw significant growth, reflecting the increasing demand for such services from businesses seeking to provide enhanced benefits to their workforce.

- Corporate Partnerships: Collaborating with businesses to provide health services.

- Employer Programs: Offering employee wellness initiatives and health checks.

- Group Insurance: Providing comprehensive health insurance coverage for employees.

- Market Reach: Accessing a large population through employer-sponsored benefits.

Georgia Healthcare Group utilizes its extensive network of hospitals and clinics as primary channels for direct patient care. These facilities are the core touchpoints for consultations and treatments.

The group's pharmacy network acts as a direct retail channel, providing essential medications and health products. In 2024, this segment saw significant revenue growth, reaching GEL 175.8 million, a 15.5% increase year-over-year.

Digital platforms and mobile applications are increasingly important channels, enabling online scheduling and telemedicine. In 2023, active users of GHG's mobile app grew by 40%, with over 1.5 million appointments booked digitally.

GHG also leverages insurance sales agents and brokers to distribute its health insurance products, offering expert guidance and facilitating enrollment. Corporate partnerships represent another key channel, providing health and wellness solutions through employer-sponsored benefit programs.

| Channel | Type | 2024 Data/Trend | Key Function |

|---|---|---|---|

| Hospitals & Clinics | Physical Facilities | Extensive network across Georgia | Direct patient care, consultations, treatments |

| Pharmacy Network | Retail | Revenue: GEL 175.8M (+15.5% YoY in 2024) | Pharmaceuticals, OTC products, health advice |

| Digital Platforms (App, Web) | Online/Mobile | 40% YoY user growth in 2023, 1.5M+ digital appointments | Appointment booking, telemedicine, record access |

| Insurance Agents/Brokers | Intermediary | Facilitate policy sales and client education | Market reach, expert guidance, enrollment |

| Corporate Partnerships | B2B | Key segment for revenue growth | Employee wellness programs, group insurance |

Customer Segments

The general population of Georgia represents a vast customer base for healthcare services, including individuals and families across all age groups and socioeconomic backgrounds. This broad segment utilizes everything from primary care physicians for annual check-ups to specialized clinics for complex medical needs. For instance, in 2023, Georgia's population was estimated to be around 3.7 million people, indicating a significant market for healthcare providers.

This segment includes those benefiting from the Universal Healthcare Program, which aims to provide access to essential medical services for a large portion of the population. In 2024, the Georgian government continued to allocate significant resources to this program, ensuring a baseline of medical care is available. However, many individuals also opt for private healthcare services, seeking enhanced amenities, faster appointment scheduling, or access to specific specialists not readily available through the public system.

Private health insurance holders represent a key customer segment for Georgia Healthcare Group, encompassing both individuals who purchase their own plans and employees covered through corporate schemes. This group typically expects a higher level of service, including expedited appointments and access to a wider network of specialists.

In 2024, the demand for private healthcare services continues to grow, with a significant portion of the population opting for enhanced coverage to ensure quicker access to medical care and specialized treatments. This segment is particularly sensitive to service quality and the breadth of available medical professionals.

This customer segment comprises individuals who need highly specialized medical care, such as treatments for heart conditions, cancer, fertility issues, or intricate surgical procedures. Georgia Healthcare Group caters to patients who are actively seeking out these specific areas of expertise.

Georgia has emerged as a notable destination for medical tourism, particularly for these specialized services. This trend indicates a growing international interest in the quality and accessibility of advanced medical treatments available within the country.

For example, in 2024, Georgia saw a significant increase in inbound medical tourism, with a substantial portion of these visitors seeking advanced cardiac and oncological treatments. This influx highlights the group's appeal to a global patient base looking for specialized medical solutions.

Pharmaceutical Consumers

Pharmaceutical Consumers are individuals who regularly buy prescription drugs and everyday health items. Georgia Healthcare Group (GHG) targets these customers by offering them easy and dependable access to their medication requirements through its pharmacy network.

In 2024, the pharmaceutical retail market in Georgia continued to show steady growth. Data from the National Statistics Office of Georgia indicated an increase in household spending on pharmaceuticals. For instance, by the end of Q3 2024, expenditure on medicines and health products saw a notable uptick compared to the previous year, reflecting consistent demand from this customer segment.

- Consistent Demand: This segment represents a stable customer base for GHG's pharmacies, driven by ongoing health needs.

- Convenience Focus: Customers value the accessibility and reliability GHG pharmacies provide for their regular medication purchases.

- Market Growth: The Georgian pharmaceutical market experienced growth in 2024, with increased consumer spending on health products.

Foreign Medical Tourists

Georgia's burgeoning medical tourism sector presents a significant opportunity for Georgia Healthcare Group (GHG). By focusing on international patients, GHG can tap into a market seeking cost-effective yet high-quality medical procedures. This strategy aligns with Georgia's growing reputation for excellence in specialized medical fields.

GHG specifically targets foreign medical tourists interested in services such as reproductive health, cosmetic surgery, and dental care. These areas are often sought after by international patients due to significant cost savings compared to Western countries, without compromising on the quality of care or advanced technology.

- Targeting International Patients: GHG aims to attract patients from countries where medical procedures are considerably more expensive or where access to specialized treatments is limited.

- Key Service Offerings: Focus on high-demand areas like IVF, plastic surgery, and advanced dental treatments, leveraging Georgia's competitive pricing.

- Quality and Affordability: Emphasize the dual benefit of receiving top-tier medical care at a fraction of the cost typically incurred in their home countries.

- Market Growth: The global medical tourism market is projected to reach $250 billion by 2027, indicating substantial potential for GHG's expansion in this segment.

Georgia Healthcare Group serves a diverse patient base, from the general population seeking routine care to those requiring highly specialized treatments. The group also caters to individuals with private health insurance and those benefiting from government programs, ensuring broad accessibility.

A significant focus is placed on pharmaceutical consumers, who rely on GHG's pharmacy network for regular medication needs. The company also actively targets the growing medical tourism market, attracting international patients with specialized, cost-effective procedures.

In 2024, Georgia's population of approximately 3.7 million provided a substantial domestic market. Concurrently, the inbound medical tourism sector saw a notable increase, particularly for cardiac and oncological treatments, highlighting GHG's international appeal.

Cost Structure

Personnel costs are a major component of Georgia Healthcare Group's (GHG) expenses. This includes salaries, wages, benefits, and training for a substantial team of doctors, nurses, administrative staff, and pharmacists. For instance, in 2024, GHG's employee-related expenses constituted a significant portion of their operating costs, reflecting the high demand for skilled healthcare professionals.

The unique healthcare landscape in Georgia, particularly the reported imbalance in the nurse-to-physician ratio, can further impact these personnel costs. This dynamic may necessitate higher compensation or specialized recruitment efforts to attract and retain qualified nursing staff, thereby influencing the overall wage bill for the group.

The procurement of medicines, medical devices, and consumables represents a significant cost driver for Georgia Healthcare Group. In 2024, the company likely allocated a substantial portion of its operating budget to these essential items to maintain high-quality patient care across its network of hospitals and clinics.

Factors such as global pharmaceutical price trends and evolving import regulations in Georgia can directly influence the group's expenditure in this area. For instance, changes in international drug pricing or new customs duties could lead to increased procurement costs for Georgia Healthcare Group.

Expenses for running Georgia Healthcare Group's facilities, like hospitals and clinics, are a major cost. This includes paying for electricity, water, and rent, as well as keeping equipment in good shape and ensuring cleanliness.

In 2024, utility costs for large healthcare networks can easily run into millions of dollars annually, depending on the size and number of facilities. For instance, a mid-sized hospital might spend upwards of $2 million per year on utilities alone.

Equipment maintenance is another significant expense, with specialized medical machinery requiring regular servicing to ensure patient safety and operational efficiency. Annual maintenance contracts for advanced imaging equipment, like MRI or CT scanners, can cost tens of thousands of dollars per unit.

Technology and IT Infrastructure

Georgia Healthcare Group's commitment to advanced technology necessitates substantial investment in its IT infrastructure. This includes the acquisition and ongoing maintenance of sophisticated systems that support everything from patient care to administrative functions.

The cost structure for technology and IT infrastructure is significant, encompassing:

- Software Licenses and Subscriptions: Ongoing fees for electronic health records (EHR), practice management software, and specialized medical applications.

- Hardware and Equipment: Investment in servers, workstations, networking equipment, and specialized medical devices with integrated IT components.

- IT Support and Maintenance: Costs associated with in-house IT staff, external support contracts, cybersecurity measures, and system updates.

- Telemedicine Platforms: Development, licensing, and maintenance of platforms enabling remote patient consultations and monitoring.

In 2024, the healthcare sector globally saw continued heavy investment in digital transformation. For instance, spending on healthcare IT solutions was projected to reach over $200 billion worldwide, highlighting the critical nature of these expenditures for organizations like Georgia Healthcare Group to remain competitive and efficient.

Marketing and Sales Expenses

Georgia Healthcare Group invests significantly in marketing and sales to promote its diverse offerings, which include healthcare services, health insurance, and pharmaceuticals. These expenses are crucial for attracting and retaining patients and customers.

Key components of these costs involve advertising campaigns across various media platforms, public relations activities to build brand reputation, and the operational costs of a dedicated sales force. Commissions paid to sales representatives for securing new policies or service agreements also form a substantial part of this expenditure.

For instance, in 2024, Georgia Healthcare Group allocated a considerable portion of its budget to digital marketing initiatives, aiming to reach a wider audience through social media, search engine optimization, and online advertising. This strategic focus reflects the growing trend of consumers seeking healthcare information and services online.

- Advertising and Promotion: Costs for campaigns promoting hospitals, clinics, insurance plans, and pharmaceutical products.

- Sales Force Expenses: Includes salaries, commissions, and training for sales teams responsible for insurance and service packages.

- Public Relations: Investment in maintaining a positive public image and communicating health initiatives.

- Digital Marketing: Spending on online channels like social media, search engines, and content marketing to attract patients.

Georgia Healthcare Group's cost structure is heavily influenced by personnel expenses, encompassing salaries and benefits for a large workforce. Procurement of medicines and medical supplies also represents a significant outlay, directly tied to patient care quality. Facility operating costs, including utilities and maintenance, are substantial, alongside ongoing investments in IT infrastructure and digital transformation initiatives. Marketing and sales efforts to promote services and insurance products also contribute significantly to the overall cost base.

| Cost Category | Description | 2024 Estimated Impact |

|---|---|---|

| Personnel Costs | Salaries, wages, benefits, training for medical and administrative staff. | Major component of operating expenses. |

| Procurement Costs | Medicines, medical devices, consumables. | Significant allocation due to high demand for quality care. |

| Facility Operating Costs | Utilities (electricity, water), rent, equipment maintenance, cleanliness. | Millions of dollars annually for a large network; equipment maintenance can be tens of thousands per unit. |

| IT Infrastructure | Software licenses, hardware, IT support, telemedicine platforms. | Critical for efficiency and competitiveness, with global healthcare IT spending exceeding $200 billion in 2024. |

| Marketing & Sales | Advertising, public relations, sales force expenses, digital marketing. | Crucial for attracting patients and customers, with a focus on digital channels. |

Revenue Streams

Medical service fees are a core revenue driver for Georgia Healthcare Group, encompassing income from a wide array of patient care. This includes fees for doctor consultations, complex surgical procedures, essential diagnostic tests, and extended inpatient treatments within their network of hospitals and clinics. In 2023, Georgia Healthcare Group reported that its medical services segment accounted for a significant portion of its total revenue, demonstrating the direct financial impact of patient care.

Georgia Healthcare Group (GHG) generates substantial income from selling health insurance policies. These policies are offered to both individual consumers and corporate clients, providing a crucial revenue stream for their health insurance division.

In 2023, GHG's insurance segment reported a revenue of GEL 264.5 million, highlighting the significance of premiums. This segment is a cornerstone of their overall business model, demonstrating the market's demand for their health coverage offerings.

Georgia Healthcare Group (GHG) generates significant revenue from pharmaceutical sales, encompassing both prescription and over-the-counter medications. This revenue stream is bolstered by GHG's extensive pharmacy network, which serves as a direct retail channel for consumers.

Beyond direct-to-consumer sales, GHG's pharmaceutical distribution business plays a crucial role, supplying medications to a wider market through wholesale operations. In 2024, the pharmaceutical segment of GHG demonstrated robust performance, with sales reaching $680 million, reflecting strong demand across both retail and wholesale channels.

Diagnostic and Laboratory Service Fees

Georgia Healthcare Group (GHG) generates significant revenue from its diagnostic and laboratory services. This stream encompasses fees for a wide array of medical tests, from routine blood work to complex genetic analyses. In 2024, the company continued to see robust demand for these essential healthcare offerings.

Beyond laboratory tests, imaging services represent a substantial portion of this revenue. This includes procedures like X-rays, MRIs, and CT scans, which are critical for patient diagnosis and treatment planning. GHG's extensive network of facilities ensures broad accessibility to these advanced diagnostic tools.

The revenue from diagnostic and laboratory services is a cornerstone of GHG's financial performance. For instance, in the first half of 2024, the company reported that its Medical Products and Pharmaceuticals segment, which includes many of these services, saw a notable increase in revenue, underscoring the importance of this segment.

- Laboratory Test Fees: Revenue derived from a comprehensive suite of diagnostic tests.

- Imaging Service Fees: Income generated from X-rays, MRIs, CT scans, and other radiological procedures.

- Other Diagnostic Procedures: Revenue from specialized diagnostic services offered across GHG's facilities.

Medical Tourism Services

Georgia Healthcare Group generates revenue from international patients seeking medical care in Georgia. This includes income from specialized medical procedures, as well as bundled services like travel arrangements and accommodation for these patients. Georgia's growing reputation as an attractive destination for medical tourism contributes significantly to this revenue stream.

The country's appeal is bolstered by competitive pricing and a high standard of medical services. In 2023, Georgia saw a notable increase in inbound medical tourism, with many patients coming from neighboring countries and beyond for treatments ranging from dentistry to complex surgeries.

- International Patient Revenue: Income derived from medical procedures and associated services for foreign nationals.

- Package Deals: Revenue from bundled offerings including travel, accommodation, and medical treatment.

- Georgia's Medical Tourism Growth: Leveraging the country's increasing popularity as a medical destination.

- Specialized Procedures: Focus on high-demand medical services attracting international clientele.

Georgia Healthcare Group (GHG) also generates revenue through its robust pharmaceutical distribution network, supplying medications to a broad range of clients beyond its own retail pharmacies. This wholesale segment is a key contributor to the company's overall financial performance.

In 2024, the pharmaceutical segment, encompassing both retail sales and wholesale distribution, demonstrated strong growth. This segment's sales reached $680 million, reflecting effective market penetration and consistent demand for pharmaceutical products across Georgia.

The company's diversified approach to pharmaceutical revenue, combining direct sales with extensive wholesale operations, solidifies its position in the market and ensures a steady income stream.

| Revenue Stream | Description | 2024 Data (USD Million) |

|---|---|---|

| Pharmaceutical Sales (Retail & Wholesale) | Revenue from selling prescription and over-the-counter medications through own pharmacies and wholesale distribution. | 680 |

Business Model Canvas Data Sources

The Georgia Healthcare Group Business Model Canvas is built using comprehensive market analysis, patient demographic data, and financial projections. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to the healthcare landscape.