GERRY WEBER International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GERRY WEBER International Bundle

GERRY WEBER International navigates a competitive landscape shaped by intense rivalry and evolving consumer preferences. Understanding the bargaining power of both buyers and suppliers is crucial for its strategic positioning.

The threat of new entrants and the availability of substitute products present significant challenges that require constant adaptation. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore GERRY WEBER International’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The fashion industry's reliance on textile and material suppliers means GERRY WEBER's dependence on specific fabric types or sustainable materials can significantly amplify supplier power. If the availability of high-quality or specialized textiles is limited, GERRY WEBER faces reduced leverage in price negotiations, especially concerning innovative or ethically sourced materials with fewer certified producers.

Labor costs and conditions in manufacturing countries are a significant factor in supplier power for apparel companies like GERRY WEBER. For instance, in 2024, countries with robust labor unions or increasing minimum wages, such as Bangladesh or Vietnam, might see suppliers passing on higher labor expenses, impacting GERRY WEBER's cost of goods sold.

Furthermore, the increasing global emphasis on ethical sourcing and fair labor practices adds another layer of complexity. Suppliers who must invest in compliance with these standards may have less flexibility in pricing, potentially increasing the cost of raw materials or manufacturing for GERRY WEBER, and limiting the pool of readily available, compliant suppliers.

Technology providers for e-commerce platforms, logistics, and supply chain management significantly influence GERRY WEBER. Given GERRY WEBER's e-commerce focus, reliance on specialized software vendors and logistics partners for efficient distribution grants these suppliers considerable bargaining power. High switching costs associated with integrated systems further solidify their leverage.

Supplier Power 4

The bargaining power of suppliers for GERRY WEBER International is influenced by the uniqueness of their offerings. If a supplier provides distinctive designs, exclusive patterns, or proprietary manufacturing methods, their leverage grows. GERRY WEBER's product differentiation is often tied to the innovation and skill of its suppliers, making exclusive partnerships a double-edged sword, potentially increasing reliance.

In 2024, the fashion industry continued to see a demand for unique and sustainable materials. Suppliers who could offer these, such as those specializing in organic cotton or innovative recycled fabrics, likely commanded higher prices. GERRY WEBER's reliance on a consistent supply of quality textiles means that suppliers with specialized capabilities, particularly in design and material sourcing, hold significant bargaining power. This is especially true if these suppliers are few and far between, or if their production capacity is limited.

- Supplier Differentiation: Suppliers offering unique designs, patterns, or proprietary manufacturing techniques increase their bargaining power.

- Product Dependence: GERRY WEBER's ability to differentiate its products is often dependent on the creative and manufacturing capabilities of its partners.

- Exclusive Agreements: While beneficial for product uniqueness, exclusive agreements with key suppliers can heighten GERRY WEBER's reliance on them.

- Industry Trends: In 2024, the demand for specialized and sustainable materials empowered suppliers in those niches, potentially increasing their pricing power with brands like GERRY WEBER.

Supplier Power 5

The concentration of suppliers in the textile and apparel manufacturing sector significantly influences GERRY WEBER's bargaining power. In 2024, the global textile industry saw a continued trend of consolidation, with a few large players dominating the supply of specialized fabrics and high-quality materials. This concentration means these key suppliers are in a stronger position to dictate terms and pricing, potentially increasing costs for GERRY WEBER.

Conversely, a more fragmented supplier base, particularly for more common materials, provides GERRY WEBER with greater negotiation leverage. The company's ability to source from multiple vendors for certain components can mitigate the impact of any single supplier's market dominance.

- Supplier Concentration: A few dominant suppliers in specialized textile markets can exert considerable pricing power.

- Material Sourcing: GERRY WEBER's ability to diversify its supplier base for standard materials enhances its negotiation strength.

- Industry Trends: Consolidation within the textile manufacturing sector in 2024 has generally shifted power towards larger suppliers.

The bargaining power of suppliers for GERRY WEBER is amplified when they offer unique or differentiated products, such as exclusive fabric designs or proprietary manufacturing processes. This is particularly true in 2024, as the fashion industry continues to value innovation and distinctiveness. For example, if GERRY WEBER relies heavily on a specific supplier for a signature fabric that drives its product appeal, that supplier gains significant leverage in pricing and terms. This dependence limits GERRY WEBER's ability to switch suppliers without impacting its brand identity or product quality, thereby strengthening the supplier's position.

In 2024, the concentration of suppliers in key material markets also plays a crucial role. A market dominated by a few large textile manufacturers or specialized material providers means these entities can exert considerable influence over pricing and supply availability. GERRY WEBER's ability to diversify its sourcing for more common materials offers a counter-balance, but for specialized components, a concentrated supplier base inherently shifts power towards the suppliers.

The cost of switching suppliers is another critical factor. If GERRY WEBER has invested heavily in integrating a particular supplier's materials or technologies into its production lines, the cost and disruption associated with changing to a new supplier can be substantial. This creates a sticky situation where suppliers can leverage these switching costs to maintain favorable terms, even if alternative suppliers exist.

| Factor | Impact on GERRY WEBER | 2024 Relevance |

| Supplier Differentiation | Increased leverage for suppliers offering unique materials/processes. | High, as fashion demands distinctiveness. |

| Supplier Concentration | Higher prices and less negotiation power for GERRY WEBER in concentrated markets. | Significant, with ongoing consolidation in textile sectors. |

| Switching Costs | Suppliers with integrated offerings can command better terms due to high exit barriers. | Moderate to High, depending on supply chain integration. |

What is included in the product

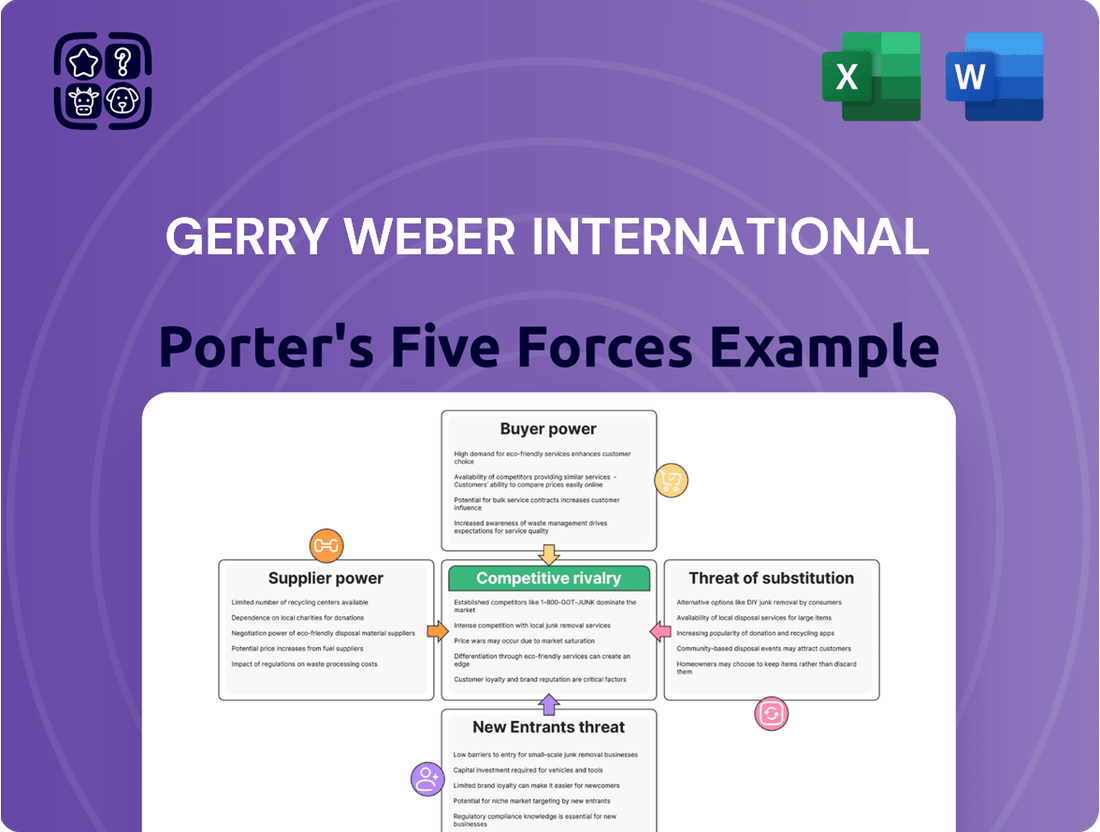

This analysis dissects the competitive forces impacting GERRY WEBER International, examining the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, to inform strategic decision-making.

Instantly identify and address competitive threats with a clear, actionable breakdown of GERRY WEBER International's Porter's Five Forces, simplifying complex market dynamics.

Customers Bargaining Power

Individual retail customers wield considerable influence in the women's apparel sector, a landscape marked by intense competition and a vast array of options. This fragmentation means shoppers can easily move between brands, especially with the prevalence of online platforms that facilitate price and style comparisons.

The sheer volume of choices available, from fast fashion giants to high-end designers, makes consumers highly attuned to value and current trends. For instance, in 2024, the global apparel market is projected to reach over $1.7 trillion, with a significant portion attributed to women's fashion, underscoring the competitive intensity and customer leverage.

Wholesale partners, including department stores and independent boutiques, hold significant bargaining power over GERRY WEBER. These key buyers, often purchasing in large quantities, can negotiate for better pricing, extended payment terms, or enhanced promotional assistance. Their influence is amplified by their ability to stock competing brands or limit GERRY WEBER's product visibility.

GERRY WEBER operates in the mid-range fashion market, where customers are quite sensitive to price. This sensitivity intensifies during economic slowdowns, leading consumers to actively seek out discounts and better value, which puts considerable pressure on GERRY WEBER to keep its prices competitive.

For instance, in 2024, the fashion retail sector continued to grapple with inflationary pressures, impacting consumer spending power. Data from Statista indicated that a significant percentage of German consumers, a key market for GERRY WEBER, were prioritizing essential purchases and seeking promotions for non-essential items like apparel.

This dynamic forces GERRY WEBER to carefully balance the perceived quality of its products with its pricing strategy to ensure it doesn't alienate its core customer base while still attracting new buyers looking for affordable yet stylish options.

Buyer Power 4

The bargaining power of customers for GERRY WEBER is significantly amplified by the widespread availability of information. Online reviews, social media discussions, and fashion blogs empower consumers to research product quality, brand reputation, and pricing before making a purchase. This transparency means customers can easily compare GERRY WEBER's offerings with competitors, exerting considerable pressure on the company to deliver value.

Negative feedback or a tarnished brand image can spread rapidly, directly impacting sales and forcing GERRY WEBER to prioritize high product standards and exceptional customer service. For instance, in 2024, brands that experienced significant negative online sentiment often saw a noticeable dip in consumer trust and purchasing intent, highlighting the direct link between online perception and sales performance.

- Informed Purchasing Decisions: Customers leverage online platforms to gather extensive information about GERRY WEBER's products, pricing, and brand reputation, enabling informed choices.

- Impact of Negative Feedback: Poor reviews or social media criticism can quickly deter potential buyers, pressuring GERRY WEBER to maintain superior product quality and customer service.

- Enhanced Price Sensitivity: Increased transparency allows customers to easily compare prices across different brands, potentially leading to greater price sensitivity and demand for competitive pricing from GERRY WEBER.

- Brand Loyalty and Perception: GERRY WEBER must actively manage its online presence and customer interactions to cultivate positive brand perception, as this directly influences customer loyalty and purchasing behavior.

Buyer Power 5

The bargaining power of customers for GERRY WEBER is significant, primarily due to low switching costs. Customers can readily move to other women's apparel brands if they find GERRY WEBER's offerings unsatisfactory in terms of product quality, price point, or fashion relevance. There are no substantial hurdles preventing consumers from exploring alternative fashion choices.

This ease of switching means GERRY WEBER faces continuous pressure to maintain customer loyalty. The threat of customers easily moving to competitors necessitates ongoing product innovation and a keen awareness of evolving fashion trends to remain competitive in the market.

- Low Switching Costs: Customers can easily switch to competitor brands without incurring significant costs or effort.

- Ease of Brand Exploration: There are no major barriers for consumers to try different brands in the women's apparel sector.

- Pressure for Innovation: GERRY WEBER must constantly adapt to fashion trends to retain customers and avoid churn.

- Price Sensitivity: Customers often compare prices across brands, putting pressure on GERRY WEBER's pricing strategies.

The bargaining power of customers for GERRY WEBER is substantial, driven by the ease with which consumers can switch between brands in the highly competitive women's apparel market. With minimal switching costs, shoppers can readily explore alternatives if GERRY WEBER's offerings don't meet their expectations regarding quality, price, or style relevance.

This dynamic necessitates continuous innovation and a sharp focus on current fashion trends for GERRY WEBER to retain its customer base and mitigate churn. The global apparel market, valued at over $1.7 trillion in 2024, highlights the intense competition and the leverage customers hold.

In 2024, German consumers, a key demographic for GERRY WEBER, showed increased price sensitivity due to inflation, actively seeking promotions for non-essential items like clothing, as reported by Statista. This underscores the pressure on GERRY WEBER to maintain competitive pricing while delivering perceived value.

| Factor | Description | Impact on GERRY WEBER |

| Low Switching Costs | Customers can easily switch to other apparel brands without significant financial or effort-based barriers. | Continuous pressure to innovate and maintain customer loyalty. |

| Information Availability | Online reviews, social media, and blogs empower customers with extensive product and pricing information. | Forces GERRY WEBER to prioritize quality, customer service, and transparency. |

| Price Sensitivity | Consumers are highly attuned to value and readily seek discounts, especially during economic fluctuations. | Requires competitive pricing strategies and careful balancing of quality perception. |

| Brand Perception | Online sentiment and brand reputation directly influence purchasing decisions and loyalty. | Necessitates active management of online presence and customer interactions. |

Preview the Actual Deliverable

GERRY WEBER International Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It offers a comprehensive Porter's Five Forces analysis for GERRY WEBER International, detailing the competitive landscape and strategic implications. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the fashion retail industry.

Rivalry Among Competitors

The women's apparel market is incredibly crowded, with everyone from massive fast-fashion retailers to high-end designers vying for customer attention. GERRY WEBER faces direct competition from many brands offering similar styles, price ranges, and appealing to the same customer base. This intense rivalry often translates into aggressive advertising campaigns, a constant stream of new products, and significant pressure on pricing.

The fashion industry, particularly in mature markets, often experiences moderate growth rates. This limited expansion means companies like GERRY WEBER must actively fight for market share, intensifying rivalry among established brands. For example, in 2024, the global apparel market's growth, while positive, remained in the low single digits, forcing brands to innovate and differentiate aggressively to capture consumer spending.

When the market isn't growing rapidly, the competition becomes a zero-sum game where gaining sales directly impacts a rival's performance. This dynamic fuels more aggressive marketing campaigns and a constant drive to capture consumer attention through new collections, pricing strategies, and enhanced customer experiences, all aiming to steal share from competitors.

The fashion industry, including for brands like GERRY WEBER, faces intense competitive rivalry. Differentiation is key, but the rapid pace of fashion trends and the ease of design imitation make it a constant challenge. GERRY WEBER's focus on 'modern, high-quality fashion' necessitates ongoing investment in design innovation, marketing, and brand reinforcement to stand out.

Without strong differentiation, brands risk becoming commoditized, which inevitably escalates price-based competition. In 2023, the global apparel market saw significant price sensitivity, with many consumers prioritizing value. This environment demands that GERRY WEBER not only offer quality but also a unique brand proposition to avoid being drawn into a race to the bottom on price.

Competitive Rivalry 4

The fashion industry, including brands like GERRY WEBER, is characterized by high fixed costs spanning design, production, marketing, and the upkeep of both physical stores and online platforms. These substantial investments necessitate operating at high capacity to achieve economies of scale and spread costs effectively. In 2023, the global apparel market was valued at approximately $1.7 trillion, underscoring the significant capital required to compete.

This cost structure often compels companies to prioritize sales volume, sometimes leading to overproduction and subsequent price reductions. For instance, many fashion retailers engage in frequent sales events to clear inventory, a practice that can erode profit margins. The pressure to maintain sales momentum directly fuels aggressive competitive actions among players in the market.

- High Fixed Costs: Significant investments in design, production, marketing, and distribution infrastructure are common.

- Capacity Utilization Pressure: Companies aim for high production volumes to lower per-unit costs, increasing the risk of oversupply.

- Discounting Culture: Frequent sales and promotions are used to move inventory, impacting overall profitability.

- Intensified Competition: The drive to maintain sales volume often results in aggressive pricing and promotional strategies among competitors.

Competitive Rivalry 5

The fashion industry, including companies like GERRY WEBER, often faces intense competitive rivalry due to significant exit barriers. These can include specialized manufacturing equipment and long-term leases for retail locations, which make it costly for struggling companies to leave the market. This situation can lead to persistent oversupply and aggressive price competition, challenging even established brands to maintain profitability.

For GERRY WEBER, navigating this landscape in 2024 and beyond requires continuous strategic adaptation and innovation to stand out. The presence of firms that remain in the market despite unprofitability due to these exit barriers intensifies the pressure on all players. This dynamic forces a constant need for differentiation and efficient operations to secure market share and achieve sustainable financial performance.

- High Exit Barriers: Specialized assets and long-term commitments in the fashion sector can trap unprofitable firms, exacerbating competition.

- Price Competition: The persistence of these firms often fuels price wars, impacting overall industry profitability.

- Innovation Imperative: Companies like GERRY WEBER must constantly innovate to overcome the challenges posed by market saturation and price pressures.

Competitive rivalry in the women's apparel sector, where GERRY WEBER operates, is fierce. Many brands compete on style, price, and brand image, leading to aggressive marketing and product launches. The global apparel market, valued at approximately $1.7 trillion in 2023, highlights the scale of this competition, with brands constantly striving to capture market share in a market with moderate growth, often in the low single digits as seen in 2024.

| Factor | Description | Impact on GERRY WEBER |

|---|---|---|

| Market Saturation | Numerous brands, from fast fashion to luxury, vie for consumers. | Requires strong differentiation and brand loyalty to avoid commoditization. |

| Price Sensitivity | Consumers often prioritize value, especially in uncertain economic times. | Puts pressure on GERRY WEBER to balance quality with competitive pricing, avoiding excessive discounting. |

| Innovation Pace | Rapidly changing fashion trends necessitate continuous new collections. | Demands significant investment in design and marketing to stay relevant and capture consumer attention. |

SSubstitutes Threaten

The threat of substitutes for GERRY WEBER's new women's apparel is significant, primarily stemming from the burgeoning second-hand clothing market. This includes a wide array of options like consignment stores, vintage boutiques, and increasingly popular online resale platforms such as Vinted and Depop.

The growing consumer interest in sustainable and circular fashion practices directly fuels this substitution. In 2024, the global second-hand apparel market was valued at approximately $177 billion, with projections indicating continued strong growth, directly competing with the demand for new garments from brands like GERRY WEBER.

These pre-owned options present a compelling alternative for consumers seeking more budget-friendly and environmentally responsible choices. The ability to acquire quality apparel at a lower price point, while also reducing textile waste, makes the second-hand market a potent substitute.

Clothing rental services are emerging as a significant substitute, especially for special occasions or fast-fashion items. These platforms offer access to a diverse wardrobe at a lower price point than outright purchase, potentially reducing demand for new garments.

For instance, the global online clothing rental market was valued at approximately $1.5 billion in 2023 and is projected to grow substantially. This trend diverts some consumer spending away from traditional retail, impacting brands like GERRY WEBER, particularly for event-specific or trend-driven apparel.

The threat of substitutes for GERRY WEBER is significant, as consumers can easily divert their discretionary spending to non-apparel categories. For instance, in 2024, global consumer spending on experiences, like travel and entertainment, continued to rise, directly competing with fashion purchases. If economic conditions tighten, as seen with inflationary pressures in early 2024, consumers might prioritize essential goods or savings over discretionary fashion items.

This means GERRY WEBER isn't just competing with other fashion retailers; it's vying for consumer dollars against technology gadgets, home improvements, and leisure activities. A shift in consumer priorities, perhaps towards digital subscriptions or personal development courses, further broadens this substitution landscape, impacting fashion’s share of wallet.

Threat of Substitution 4

The rise of Do-It-Yourself (DIY) fashion, encompassing activities like sewing, knitting, and upcycling, presents a growing, albeit niche, substitute for mass-produced apparel. This trend caters to consumers seeking unique, personalized, and sustainable clothing options, effectively bypassing conventional retail channels. For instance, the global handmade crafts market, which includes DIY fashion, was valued at approximately $60 billion in 2023 and is projected to grow, indicating a tangible consumer shift towards bespoke creations. This segment appeals to individuals who prioritize creativity, individuality, and a connection to their clothing.

This DIY movement taps into a consumer desire for:

- Uniqueness and Personalization: Consumers can create garments that perfectly match their style and fit.

- Sustainability: Upcycling and making clothes from scratch can reduce textile waste.

- Cost Savings: For some, DIY can be more economical than purchasing new items.

- Hobby and Fulfillment: The creative process itself offers satisfaction and a sense of accomplishment.

Threat of Substitution 5

The growing acceptance of casual wear in professional and social environments presents a significant threat of substitution for GERRY WEBER. Consumers are increasingly choosing versatile, less formal clothing, potentially bypassing GERRY WEBER's more traditional offerings.

This shift in fashion norms favors athletic wear and highly casual garments from specialized brands, directly substituting for apparel categories where GERRY WEBER traditionally operates. For instance, the athleisure market, valued at over $350 billion globally in 2023, demonstrates this trend, impacting demand for more formal wear.

- Casualization Trend: Increased adoption of casual attire in workplaces and social events.

- Athleisure Dominance: Growing popularity of athletic-inspired clothing as everyday wear.

- Specialized Brands: Rise of niche brands focusing on specific casual or athleisure segments.

- Impact on Demand: Reduced demand for traditional or formal apparel categories.

The threat of substitutes for GERRY WEBER is multifaceted, extending beyond direct fashion competitors. The burgeoning second-hand market, valued at approximately $177 billion globally in 2024, offers budget-friendly and sustainable alternatives. Additionally, clothing rental services, with a global market around $1.5 billion in 2023, provide access to diverse wardrobes for specific occasions, diverting consumer spending from new purchases.

Consumers are also increasingly allocating discretionary spending to experiences, such as travel and entertainment, which saw continued rise in 2024, competing directly with fashion purchases. The DIY fashion movement, part of a global handmade crafts market worth about $60 billion in 2023, appeals to those seeking uniqueness and sustainability, bypassing traditional retail.

The widespread adoption of casual wear, particularly the athleisure trend which commanded over $350 billion globally in 2023, directly substitutes for more traditional apparel offerings by brands like GERRY WEBER.

| Substitute Category | Market Value (Approx.) | Year | Key Drivers |

| Second-hand Apparel | $177 billion | 2024 | Affordability, Sustainability |

| Clothing Rental | $1.5 billion | 2023 | Occasional wear, Variety |

| Experiences (Travel, Entertainment) | Growing | 2024 | Discretionary spending shift |

| DIY Fashion | $60 billion (Handmade Crafts) | 2023 | Uniqueness, Sustainability, Hobby |

| Athleisure Wear | >$350 billion | 2023 | Casualization, Comfort |

Entrants Threaten

The fashion industry, particularly for established brands like GERRY WEBER, presents significant capital requirements for new entrants. These costs span design, production, inventory, and establishing robust marketing and distribution networks. For instance, a new brand aiming for similar market penetration would likely need to invest tens of millions of euros to build brand recognition and secure shelf space.

While the rise of direct-to-consumer online models has lowered some barriers, particularly retail overhead, building a brand with the established equity of GERRY WEBER still demands substantial investment. Marketing campaigns alone can run into millions, and product development cycles require consistent funding to stay competitive. This financial hurdle acts as a considerable deterrent to many aspiring fashion companies.

Establishing strong brand recognition and customer loyalty presents a significant hurdle for newcomers in the women's apparel sector. GERRY WEBER, like many established brands, has cultivated trust and a dedicated customer base over decades, making it challenging for new entrants to quickly gain traction.

New companies require substantial investment in marketing and a considerable amount of time to carve out a market niche and build consumer confidence. This makes it difficult to immediately compete with established players on the basis of scale or reputation, especially in a market where brand loyalty is a key differentiator.

For instance, the global apparel market, valued at approximately $1.7 trillion in 2023, is highly competitive, with established brands benefiting from economies of scale in production and distribution. New entrants must overcome these existing advantages, often requiring innovative strategies and significant capital to make an impact.

Access to reliable and efficient supply chains, encompassing material sourcing, manufacturing, and logistics, presents a significant barrier for new entrants in the fashion retail sector. Established players like GERRY WEBER have cultivated robust, long-standing relationships with suppliers and meticulously optimized their production processes over years of operation. For instance, in 2024, the global apparel market saw continued consolidation of key manufacturing hubs, making it harder for newcomers to secure favorable terms and consistent quality.

Newcomers must invest substantial capital and time to construct these essential networks from the ground up. This involves not only identifying and vetting suppliers but also ensuring the quality of materials, achieving cost-effectiveness, and guaranteeing timely delivery to market. The logistical complexities alone can be daunting; a 2023 report indicated that average lead times for fashion goods from Asian manufacturing centers to European markets can range from 60 to 120 days, a timeframe that new entrants may struggle to manage efficiently without established infrastructure.

Threat of New Entrants 4

The threat of new entrants for GERRY WEBER International is moderately low, primarily due to significant barriers related to distribution. Establishing widespread wholesale partnerships with major retailers or developing a comprehensive e-commerce and physical retail footprint demands substantial capital and a proven brand reputation, making it challenging for newcomers to gain traction.

New entrants face considerable hurdles in securing shelf space with established retailers, often requiring significant upfront investment or a compelling sales history. GERRY WEBER's established multi-channel approach, encompassing both online and offline sales, grants it broad market reach and customer accessibility, which is difficult for emerging brands to replicate quickly.

- Distribution Channel Barriers: GERRY WEBER benefits from established relationships with retailers and a developed e-commerce platform, making it difficult for new brands to secure similar reach without substantial investment.

- Capital Investment: New entrants need significant capital to build their own retail infrastructure or to incentivize major retailers to stock their products, a barrier GERRY WEBER has already overcome.

- Brand Recognition: A proven track record and brand loyalty are often prerequisites for securing prime retail placement, a hurdle that nascent competitors must surmount.

Threat of New Entrants 5

The threat of new entrants in the fashion retail sector, particularly for a brand like GERRY WEBER, is moderated by several factors. Intellectual property protection for unique designs, while not always a formal patent, is crucial. However, the real barrier often lies in overcoming the steep learning curve associated with understanding rapidly evolving fashion trends and deeply ingrained consumer preferences. Established players like GERRY WEBER have spent years building this nuanced market insight.

Newcomers must not only replicate appealing designs but also quickly develop an intuitive grasp of what resonates with specific customer segments. This requires significant investment in market research and trend forecasting. For instance, in 2024, the global apparel market is projected to reach over $1.7 trillion, indicating substantial opportunity but also intense competition where brand loyalty and market understanding are paramount.

- Brand Recognition: GERRY WEBER benefits from established brand recognition, making it harder for new entrants to gain immediate market traction.

- Supply Chain Expertise: Years of operation have likely provided GERRY WEBER with optimized supply chain management and sourcing capabilities, a significant hurdle for new fashion brands.

- Capital Investment: Launching a successful fashion brand requires substantial initial capital for design, production, marketing, and retail presence, acting as a deterrent.

The threat of new entrants for GERRY WEBER International is considered moderate. Significant capital is required for design, production, marketing, and establishing distribution networks, with new brands needing millions to compete. Established brands like GERRY WEBER have cultivated strong brand loyalty and market understanding over decades, making it difficult for newcomers to quickly gain consumer trust and market share.

Securing favorable distribution channels, whether through wholesale partnerships or building a direct-to-consumer presence, presents a major hurdle. New entrants must overcome GERRY WEBER's existing market reach and established relationships with retailers. Furthermore, optimizing supply chains for cost-effectiveness and timely delivery, a process GERRY WEBER has refined over years, demands considerable investment and expertise from aspiring fashion companies.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for design, production, marketing, and distribution. | Significant deterrent; millions needed for initial market penetration. |

| Brand Recognition & Loyalty | Decades of established trust and customer base. | Difficult for new brands to quickly gain traction and replicate loyalty. |

| Distribution Channels | Established wholesale relationships and e-commerce infrastructure. | Challenging for newcomers to secure similar market reach without substantial investment. |

| Supply Chain Expertise | Optimized sourcing, manufacturing, and logistics. | New entrants need time and capital to build efficient and cost-effective supply networks. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for GERRY WEBER International is built upon a foundation of publicly available financial reports, including annual and quarterly statements, alongside insights from reputable industry analysis firms and market research databases.

We leverage data from company disclosures, competitor news, and market intelligence platforms to assess the bargaining power of buyers and suppliers, as well as the threat of new entrants and substitutes.