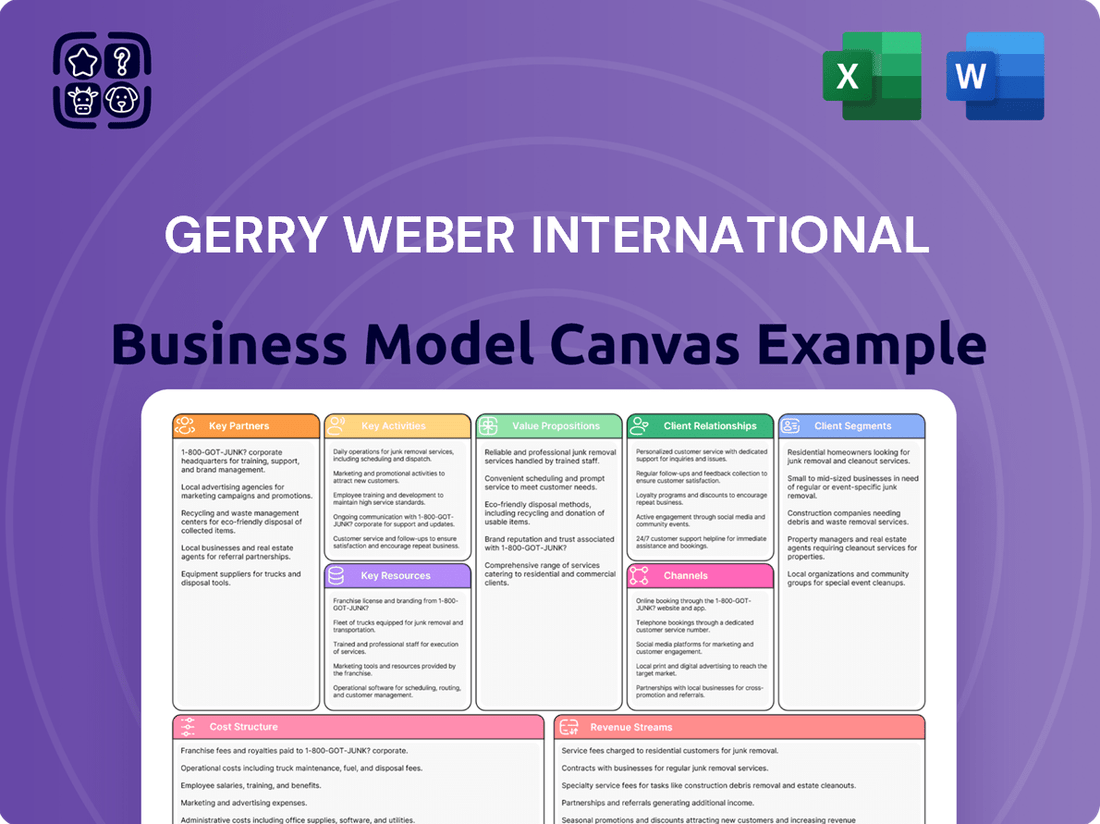

GERRY WEBER International Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GERRY WEBER International Bundle

Unlock the strategic blueprint behind GERRY WEBER International’s success with our comprehensive Business Model Canvas. This detailed analysis reveals how they connect with their target audience, build key partnerships, and generate revenue in the fashion industry. Gain actionable insights for your own ventures.

Partnerships

GERRY WEBER's business model heavily leans on wholesale partners, particularly multi-brand retailers, for its global product distribution. This strategy is vital for extending market reach and ensuring product availability across varied retail landscapes, especially as the company reduces its own brick-and-mortar presence.

In 2023, GERRY WEBER reported that wholesale accounted for a significant portion of its sales, with a strategic focus on expanding this channel. The company is actively working to solidify relationships with existing retail partners and forge new alliances within the retail sector to bolster its market penetration.

GERRY WEBER’s success hinges on robust collaborations with fabric suppliers and garment manufacturers, ensuring the production of high-quality apparel. These partnerships are fundamental to delivering on the brand's promise of style and durability.

The company places a strong emphasis on responsible sourcing, actively working with its partners to uphold human rights and social standards across the entire supply chain. This commitment involves ongoing assessment of human rights risks and a strict requirement for suppliers to adhere to a comprehensive Code of Conduct, fostering an ethical and sustainable production environment.

GERRY WEBER's operational efficiency hinges on robust logistics and distribution partners. These collaborations are crucial for ensuring products reach wholesale clients, former retail locations, and online shoppers promptly. For instance, in 2024, the global logistics market was valued at over $10 trillion, highlighting the critical infrastructure that companies like GERRY WEBER depend on to maintain their supply chain integrity.

Technology and E-commerce Platform Providers

GERRY WEBER relies on technology and e-commerce platform providers to power its online presence and drive sales. These partnerships are crucial for maintaining and enhancing its digital storefronts, digital marketing campaigns, and overall operational efficiency. For instance, in 2024, the fashion retail sector saw continued investment in e-commerce infrastructure, with companies like GERRY WEBER seeking robust solutions for online customer acquisition and ensuring a consistent, engaging brand experience across all digital touchpoints.

To stay competitive, GERRY WEBER must continually enhance its e-commerce capabilities. This involves integrating online and offline channels seamlessly, a trend that gained significant momentum in 2024. Such integration allows for a unified customer journey, from online browsing to in-store purchasing or vice-versa, thereby boosting customer satisfaction and sales.

- E-commerce Platform Enhancement: Partnerships with providers offering scalable and feature-rich e-commerce solutions are vital for managing product catalogs, processing transactions, and personalizing customer experiences.

- Digital Marketing Tools: Collaboration with analytics and marketing technology firms enables targeted customer acquisition and retention strategies, optimizing spend and maximizing reach.

- Omnichannel Integration: Technology providers specializing in bridging online and offline retail operations are key to creating a cohesive brand experience and improving inventory management.

Restructuring Investors and Financial Institutions

GERRY WEBER's reliance on restructuring investors and financial institutions highlights a crucial aspect of its business model, particularly given its past financial challenges. These partnerships are essential for securing the capital needed to navigate insolvency proceedings and implement financial reorganizations.

A prime example of this is the capital increase undertaken by GWI Holding S.à r.l., a Luxembourg-based entity. This move directly injected funds into the company, demonstrating the vital role such investors play in stabilizing and recapitalizing businesses undergoing significant restructuring.

- Restructuring Investors: Entities like GWI Holding S.à r.l. provide crucial capital injections, often through equity subscriptions, to facilitate financial recovery and operational continuity.

- Financial Institutions: Banks and other lenders are critical for providing debt financing, managing liquidity, and supporting the overall financial restructuring process.

- Capital Infusion: In 2023, GERRY WEBER successfully completed a capital increase, a direct result of partnerships with specialized investors, which was instrumental in strengthening its financial foundation.

GERRY WEBER's distribution strategy heavily involves wholesale partners, particularly multi-brand retailers, which is key for global reach, especially as the company reduces its own physical stores. In 2023, wholesale represented a significant portion of sales, with ongoing efforts to strengthen these retail alliances.

The company's product quality relies on strong collaborations with fabric suppliers and garment manufacturers. Furthermore, GERRY WEBER emphasizes ethical sourcing, requiring suppliers to adhere to a strict Code of Conduct to ensure human rights and social standards are met throughout the supply chain.

| Partnership Type | Key Role | 2024 Relevance/Data |

| Wholesale Retailers | Global product distribution, market reach | Crucial for extending market presence; focus on strengthening existing and new alliances. |

| Suppliers & Manufacturers | High-quality apparel production | Fundamental to brand promise of style and durability; ongoing assessment of ethical sourcing practices. |

| Logistics & Distribution | Timely product delivery | Essential for supply chain integrity; global logistics market exceeded $10 trillion in 2024. |

| E-commerce & Tech Providers | Online presence, sales growth | Vital for digital storefronts and marketing; fashion retail saw continued e-commerce infrastructure investment in 2024. |

| Restructuring Investors | Capital for financial recovery | Provided capital increases to stabilize and recapitalize the company, as seen with GWI Holding S.à r.l. in 2023. |

What is included in the product

This Business Model Canvas provides a strategic overview of GERRY WEBER's operations, detailing its customer segments, value propositions, and key activities within the fashion retail sector.

It offers a structured analysis of GERRY WEBER's business, covering all nine essential blocks of the Business Model Canvas with insights relevant to its international market presence.

The GERRY WEBER International Business Model Canvas serves as a pain point reliever by offering a clear, structured overview of their operations, simplifying complex strategies into an easily understandable format.

It helps alleviate the pain of information overload by condensing the company's entire business strategy into a single, digestible page for efficient review and decision-making.

Activities

The core activity revolves around the meticulous design and development of contemporary, high-quality fashion collections specifically for women. This encompasses all three of GERRY WEBER's key brands: GERRY WEBER, TAIFUN, and SAMOON. The process involves strategic seasonal collection planning, in-depth trend analysis, careful material selection, and a steadfast commitment to maintaining a consistent and appealing brand aesthetic across all lines.

A significant focus is placed on the creative and technical aspects of bringing these collections to life. For instance, the upcoming autumn/winter 2025 collection is being meticulously crafted to showcase an innovative blend of diverse materials and modern design accents, demonstrating the company's ongoing dedication to fashion-forward product creation.

GERRY WEBER's key activities center on the meticulous oversight of clothing, accessories, and shoe production. This often involves a network of external manufacturers, requiring robust management to ensure alignment with brand standards.

Stringent quality control measures are paramount, safeguarding the company's reputation for high-quality fashion. For instance, in the fiscal year 2023, GERRY WEBER reported a significant focus on product assortment and quality, contributing to its strategic repositioning.

GERRY WEBER’s core activities revolve around effectively managing sales and distribution across its remaining key channels. This primarily involves nurturing strong wholesale partnerships and optimizing its e-commerce platform to reach a broad customer base.

The company's strategic shift away from company-owned retail stores means a concentrated focus on these two channels. In 2024, the success of GERRY WEBER hinges on its ability to leverage these channels, with e-commerce sales showing continued growth potential, contributing significantly to overall revenue streams.

Brand Management and Marketing

GERRY WEBER International focuses on robust brand management and marketing to elevate its core brands: GERRY WEBER, TAIFUN, and SAMOON. This involves crafting and implementing comprehensive marketing strategies designed to boost brand visibility and resonate with their respective target demographics.

Key activities include launching impactful advertising campaigns, engaging in strategic public relations efforts, and diligently cultivating a positive and consistent brand image across all touchpoints. This proactive approach aims to attract and retain a loyal customer base.

- Brand Development: Creating and maintaining distinct brand identities for GERRY WEBER, TAIFUN, and SAMOON to appeal to specific customer segments.

- Marketing Campaigns: Executing multi-channel advertising and promotional activities, including digital marketing and traditional media, to enhance brand awareness. For instance, in fiscal year 2023/24, the company continued its digital transformation efforts, investing in online marketing to reach a wider audience.

- Public Relations: Managing media relations and engaging in PR activities to foster positive brand perception and manage reputation.

- Brand Image Maintenance: Ensuring a cohesive and appealing brand presentation through consistent visual identity, messaging, and customer experience.

Financial Restructuring and Management

GERRY WEBER's key activities have heavily focused on financial restructuring. This has involved navigating insolvency proceedings and actively seeking new investors to stabilize the company. The goal is to implement measures that lead to long-term profitability and strategic adjustments to its operations and overall structure.

The company's restructuring efforts in 2023 and early 2024 included significant operational changes. For instance, the GERRY WEBER Group filed for insolvency in May 2023, a critical step in its financial management. This period saw intensive negotiations with potential investors and creditors to secure the future of the business.

- Financial Restructuring: Managing insolvency proceedings and debt restructuring to achieve financial stability.

- Investor Relations: Actively seeking and engaging with new investors to secure capital and strategic partnerships.

- Operational Adjustments: Implementing strategic changes to core business operations and organizational structure to improve efficiency and profitability.

- Sustainability Planning: Developing and executing plans to ensure the long-term financial health and viability of the GERRY WEBER brand.

GERRY WEBER's key activities are deeply rooted in the design and development of fashion collections for its brands, GERRY WEBER, TAIFUN, and SAMOON. This involves seasonal planning, trend analysis, and material selection to maintain brand appeal. The company also focuses on production oversight, often working with external manufacturers while ensuring strict quality control, a crucial element in its 2023 repositioning efforts.

Sales and distribution management are vital, with a strong emphasis on wholesale partnerships and optimizing the e-commerce platform, especially following the strategic shift away from company-owned stores. In 2024, these channels are critical for revenue growth.

Brand management and marketing are core activities, aiming to enhance visibility and appeal for GERRY WEBER, TAIFUN, and SAMOON through advertising and public relations. The company's digital transformation efforts in fiscal year 2023/24 included increased online marketing investment.

Financial restructuring has been a significant activity, including managing insolvency proceedings initiated in May 2023 and actively seeking new investors to ensure long-term profitability and operational stability.

| Key Activity Area | Description | Recent Focus/Data |

|---|---|---|

| Design & Development | Creating seasonal fashion collections for GERRY WEBER, TAIFUN, SAMOON. | Autumn/Winter 2025 collection development. |

| Production Oversight | Managing manufacturing with external partners. | Maintaining brand standards and quality control. |

| Sales & Distribution | Optimizing wholesale and e-commerce channels. | E-commerce growth is a key driver in 2024. |

| Brand Management & Marketing | Enhancing brand visibility and perception. | Investment in digital marketing (FY 2023/24). |

| Financial Restructuring | Stabilizing finances post-insolvency filing (May 2023). | Seeking new investors and operational adjustments. |

Delivered as Displayed

Business Model Canvas

The GERRY WEBER International Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this comprehensive business model, formatted and structured precisely as shown.

Resources

The established brand names GERRY WEBER, TAIFUN, and SAMOON are cornerstones of the company's value, representing significant intangible assets built over years of presence in the women's fashion sector. These brands carry substantial customer recognition and loyalty, translating directly into market share and pricing power.

The acquisition of the international brand rights for Gerry Weber by the Spanish Victrix Group in 2021 for a reported €30 million underscores the tangible financial value attributed to these brands. This transaction highlights the ongoing importance of strong brand equity in the competitive fashion landscape.

GERRY WEBER's design and creative talent is a cornerstone of its business model. The expertise of its designers and product development teams is a crucial intellectual resource, enabling the company to consistently create trend-oriented and high-quality fashion collections that resonate with its target market.

This deep well of creative talent ensures continuous innovation, a key factor in maintaining the appeal and relevance of GERRY WEBER's product offerings in the fast-paced fashion industry. For instance, in fiscal year 2023, the company focused on strengthening its product assortment, a direct reflection of its investment in design capabilities.

GERRY WEBER's extensive wholesale network and established retail partnerships are crucial resources, even as the company streamlines its own physical store presence. These relationships provide vital market access and ensure continued distribution of its products.

In 2024, GERRY WEBER continued to leverage these partnerships as a cornerstone of its distribution strategy. The company reported a significant portion of its sales still flowed through its wholesale channels, demonstrating their ongoing importance for reaching a broad customer base.

E-commerce Platforms and Digital Infrastructure

GERRY WEBER's e-commerce platforms serve as a direct channel to its customer base, crucial for driving online sales and expanding market reach. These digital storefronts are the backbone of its direct-to-consumer strategy, enabling personalized customer experiences and efficient order fulfillment.

Continued investment in optimizing the user experience, payment gateways, and logistics ensures these platforms remain competitive and scalable. This focus on digital infrastructure is paramount for capturing a larger share of the online fashion market and fostering customer loyalty.

As of the first half of fiscal year 2023/2024, GERRY WEBER reported a significant increase in its online sales, demonstrating the growing importance of its digital channels. The company's commitment to enhancing its e-commerce capabilities is a strategic imperative for sustained revenue growth and market presence.

- Digital Infrastructure Investment: GERRY WEBER allocates resources to maintain and upgrade its online shops, ensuring a seamless customer journey.

- Direct Customer Reach: E-commerce platforms enable direct engagement with consumers, facilitating personalized marketing and sales.

- Sales Growth Driver: Online channels are increasingly contributing to the company's overall revenue, highlighting their strategic importance.

- Optimization Focus: Continuous improvement of website functionality, mobile responsiveness, and checkout processes is key for future performance.

Financial Capital and Investment

GERRY WEBER's access to financial capital is a cornerstone of its Business Model Canvas, enabling everything from day-to-day operations to strategic investments. This includes securing funds from various investors and the successful completion of significant financial restructuring initiatives. For instance, in early 2024, the company successfully completed a capital increase, demonstrating renewed investor confidence and providing crucial liquidity.

The company's commitment to financial restructuring has been pivotal in establishing a more stable financial foundation. This process has involved a concerted effort to optimize its balance sheet and improve its overall financial health. As of late 2023, GERRY WEBER reported a reduction in its net financial debt, a testament to these restructuring efforts and their positive impact on operational flexibility.

- Access to Capital: GERRY WEBER relies on investor funding and successful restructuring to maintain operations.

- Restructuring Success: The company has actively pursued financial restructuring to achieve a stronger financial position.

- Financial Health Improvement: Efforts in 2023 and early 2024, including capital increases, have bolstered the company's financial footing.

GERRY WEBER's intellectual property, particularly its established brand names like GERRY WEBER, TAIFUN, and SAMOON, represents a significant intangible asset. The acquisition of international brand rights for Gerry Weber in 2021 for €30 million highlights the substantial financial value placed on these brands.

The company's design and creative talent are crucial for developing trend-setting fashion collections. This expertise fuels innovation and ensures product relevance in the competitive fashion market, as evidenced by the focus on product assortment strengthening in fiscal year 2023.

GERRY WEBER leverages an extensive wholesale network and established retail partnerships for market access and distribution. In 2024, a significant portion of sales continued to be generated through these wholesale channels, underscoring their ongoing importance.

E-commerce platforms are vital for direct customer engagement and sales growth. The company's investment in optimizing these digital storefronts is a strategic imperative, with online sales showing a notable increase in the first half of fiscal year 2023/2024.

Access to financial capital, supported by investor funding and successful restructuring, is fundamental. Early 2024 saw a capital increase, reinforcing investor confidence and providing essential liquidity. Efforts in 2023 to reduce net financial debt have also strengthened the company's financial foundation.

| Key Resource | Description | 2023/2024 Data Point |

|---|---|---|

| Brand Equity | Established brand names (GERRY WEBER, TAIFUN, SAMOON) | International brand rights acquired for €30 million in 2021 |

| Design & Creative Talent | Expertise in product development and trend forecasting | Focus on product assortment strengthening in FY 2023 |

| Distribution Networks | Wholesale and retail partnerships | Significant sales proportion through wholesale channels in 2024 |

| E-commerce Platforms | Direct-to-consumer online sales channels | Notable increase in online sales in H1 FY 2023/2024 |

| Financial Capital | Investor funding and access to credit | Successful capital increase completed in early 2024; Net financial debt reduction reported by late 2023 |

Value Propositions

GERRY WEBER provides modern, high-quality fashion for women, emphasizing superior design, excellent fit, and premium material qualities across its diverse brand portfolio. This dedication to craftsmanship and style attracts customers who value well-made apparel and are conscious of both fashion trends and enduring quality.

The company’s commitment to modern aesthetics and high-quality production resonates with a discerning customer base. For instance, in fiscal year 2023, GERRY WEBER reported a significant increase in its revenue, reaching €426.3 million, indicating strong market reception for its fashion offerings.

GERRY WEBER International's strength lies in its diverse brand portfolio, designed to capture different segments of the women's fashion market. The core GERRY WEBER brand offers modern classic fashion with a trend-conscious appeal, while TAIFUN targets a younger demographic with bolder, more courageous styles.

This multi-brand strategy is crucial for market penetration. For instance, in 2023, the GERRY WEBER Group reported revenue of €355.5 million, indicating the significant market presence achieved through its brand offerings. SAMOON further extends this reach by specializing in plus-size fashion, ensuring inclusivity and catering to a broader customer base.

GERRY WEBER ensures customers can easily find their fashion through multiple avenues. This includes traditional wholesale partnerships with various retailers, alongside a growing presence on their own e-commerce platforms.

This multi-channel strategy provides significant convenience and flexibility for shoppers. They can browse and purchase GERRY WEBER items whether they prefer visiting a physical store or shopping online from the comfort of their home.

In 2024, GERRY WEBER continued to focus on strengthening its digital presence to complement its wholesale network. For instance, their online sales channels have seen consistent growth, contributing to a more robust overall sales performance.

Focus on Sustainability and Responsibility

GERRY WEBER is deeply committed to sustainability, integrating responsible sourcing of materials and a strong stance on animal welfare, notably a ban on real fur. This ethical approach is a significant draw for consumers increasingly focused on environmentally conscious and responsible fashion choices.

The company's efforts to minimize its environmental footprint are a core part of its value proposition. This focus on sustainability directly appeals to a growing segment of the market that actively seeks out brands demonstrating genuine commitment to the planet.

- Responsible Sourcing: GERRY WEBER prioritizes materials that are produced with minimal environmental impact and fair labor practices.

- Animal Welfare: A strict policy against the use of real fur underscores the brand's commitment to ethical treatment of animals.

- Environmental Impact Reduction: Initiatives are in place to lower carbon emissions and waste throughout the supply chain.

- Customer Alignment: These practices resonate with a significant customer base that values sustainability and ethical production in their purchasing decisions.

Comfort and Style

GERRY WEBER's collections are designed to seamlessly blend comfort with contemporary style. The brand emphasizes the use of tactile materials, including fluffy surfaces and luxurious faux fur, alongside a growing commitment to sustainable faux leather. This focus ensures that wearers not only look good but also feel good in their clothing.

The company leverages its deep understanding of cut, fit, and material science to create garments that are both flattering and exceptionally comfortable. This expertise is a cornerstone of their value proposition, ensuring a premium wearing experience across their product lines. For instance, their Fall/Winter 2024 collection highlighted innovative fabric blends designed for enhanced warmth and softness.

Key elements contributing to this value proposition include:

- Material Innovation: Incorporation of plush textures and eco-conscious faux leather options.

- Expert Craftsmanship: Precision in cut and fit for a flattering silhouette.

- Comfort-Driven Design: Prioritizing soft, high-quality materials for all-day wearability.

- Style Versatility: Collections that cater to modern fashion sensibilities while maintaining comfort.

GERRY WEBER offers a diverse fashion portfolio, appealing to various customer segments with distinct brand identities. This strategy ensures broad market reach, from classic modern styles to trendier options and inclusive plus-size offerings.

The company's commitment to quality craftsmanship, superior fit, and premium materials forms the bedrock of its value proposition. This focus on excellence attracts consumers who prioritize well-made apparel and appreciate enduring style.

Sustainability and ethical practices are increasingly central to GERRY WEBER's appeal, with a clear stance against real fur and a focus on responsible sourcing. This resonates with a growing consumer base that demands ethical and environmentally conscious fashion choices.

GERRY WEBER ensures accessibility through a robust multi-channel approach, combining traditional wholesale partnerships with a strengthening direct-to-consumer e-commerce presence. This provides convenience and choice for customers.

Customer Relationships

GERRY WEBER prioritizes robust, enduring relationships with its wholesale partners as it refines its sales approach. This focus on strong retail partnerships is essential for sustained growth.

Maintaining these connections involves consistent dialogue, efficient order processing, and dedicated support, all aimed at fostering shared prosperity. For instance, GERRY WEBER reported a significant increase in wholesale orders in the first half of 2024, underscoring the importance of these relationships.

GERRY WEBER's e-commerce customer service is designed to be efficient and responsive, addressing online shopper needs for order assistance, returns, and product questions. This digital-first approach is crucial for fostering trust and loyalty in the online environment.

While precise service metrics aren't publicly disclosed, the emphasis on seamless online interactions suggests a commitment to customer satisfaction. For instance, in 2024, the global e-commerce market saw continued growth, with customer service often cited as a key differentiator for brands seeking to retain customers in a competitive landscape.

GERRY WEBER can cultivate a strong brand community through loyalty programs and exclusive engagement. Offering tiered rewards, early access to new collections, and personalized styling advice can significantly boost customer retention. For instance, fashion retailers often see a substantial increase in repeat purchase rates, sometimes by as much as 20-30%, when effective loyalty programs are in place.

Direct Communication and Feedback Channels

GERRY WEBER prioritizes direct communication by utilizing newsletters, social media, and dedicated feedback channels. This approach ensures a deep understanding of both retail partner and end-customer needs, driving continuous improvement in their offerings. For instance, in 2024, the company actively engaged with its customer base through targeted social media campaigns and email newsletters, gathering valuable insights that informed upcoming collection development.

These established communication lines are crucial for fostering strong relationships and adapting to evolving market demands. The company's focus remains squarely on meeting the specific requirements of its retail partners and, by extension, their customers, ensuring relevance and satisfaction in a competitive fashion landscape.

- Direct Engagement: Newsletters and social media platforms facilitate ongoing dialogue with customers.

- Feedback Integration: Mechanisms are in place to actively collect and act upon customer feedback.

- Retailer Focus: A key objective is to understand and cater to the needs of retail partners.

- Data-Driven Improvement: Insights gathered inform product development and service enhancements.

In-store Experience (Historically)

Historically, GERRY WEBER cultivated strong customer relationships within its own retail stores. This was achieved through personalized styling advice offered by trained staff, creating a welcoming and curated shopping atmosphere. The brand also hosted in-store events, fostering a sense of community and loyalty among its clientele.

While the strategic shift away from a significant physical retail footprint means this aspect is evolving, it was a cornerstone of their past customer engagement. For instance, prior to significant store closures, the in-store experience was a primary driver of brand perception and repeat business.

- Personalized Styling: Staff provided tailored fashion advice to customers.

- In-Store Events: The brand organized events to engage and connect with shoppers.

- Curated Environment: Stores were designed to offer a pleasant and inspiring shopping experience.

GERRY WEBER nurtures relationships through direct communication via newsletters and social media, actively seeking and integrating customer feedback. This focus on understanding both retail partners and end-customers drives continuous improvement in their offerings, as seen in their 2024 engagement efforts.

The company also prioritizes efficient and responsive e-commerce customer service to build trust and loyalty online. In the competitive 2024 e-commerce landscape, customer service is a critical differentiator for customer retention.

Cultivating a brand community through loyalty programs and exclusive engagement, such as tiered rewards and personalized advice, is another key strategy. Fashion retailers often see a 20-30% increase in repeat purchases with effective loyalty programs.

Historically, GERRY WEBER excelled at in-store engagement with personalized styling and events, creating a strong sense of community and loyalty, which was a primary driver of repeat business before their retail footprint evolution.

| Customer Relationship Strategy | Key Activities | Impact/Focus Area |

|---|---|---|

| Direct Engagement | Newsletters, social media, feedback channels | Understanding retail partner and end-customer needs |

| E-commerce Service | Responsive order assistance, returns, product queries | Building trust and loyalty in the online environment |

| Community Building | Loyalty programs, exclusive access, personalized advice | Boosting customer retention and repeat purchases |

| Historical In-Store Experience | Personalized styling, in-store events | Fostering community and brand loyalty |

Channels

Wholesale partners are a cornerstone of GERRY WEBER's business model, serving as the primary conduit for reaching a wide customer base. This involves distributing their fashion collections through a diverse network of independent fashion boutiques, prominent department stores, and various multi-brand retailers.

This strategic channel enables GERRY WEBER to achieve significant market penetration, extending their brand's presence across numerous geographical regions and international markets. For instance, in the fiscal year 2023/2024, wholesale contributed a substantial portion to their overall revenue, reflecting the enduring importance of these retail partnerships.

GERRY WEBER leverages its own e-commerce platforms for direct-to-consumer sales across its brands: GERRY WEBER, TAIFUN, and SAMOON. This direct channel provides a global reach, allowing the company to engage with customers worldwide without intermediaries.

These online shops are crucial for building direct customer relationships and gathering valuable data. In fiscal year 2023/24, GERRY WEBER reported a significant increase in online sales, contributing to the overall revenue growth and demonstrating the growing importance of these direct digital channels.

GERRY WEBER leverages third-party online marketplaces to significantly broaden its customer base, extending its digital presence beyond its own e-commerce channels. This strategy allows the brand to tap into established platforms, reaching consumers who may not actively seek out the GERRY WEBER website. For instance, in 2024, the global online fashion market was projected to reach over $1.1 trillion, highlighting the immense potential of these marketplaces.

By listing products on popular fashion-specific and general marketplaces, GERRY WEBER enhances its visibility and accessibility. This multi-channel approach is crucial in today's competitive retail landscape. In 2023, fashion sales through online marketplaces accounted for a substantial portion of total e-commerce revenue, demonstrating their importance for brand growth and market penetration.

Own Retail Stores (Historical/Transitioning)

GERRY WEBER historically relied heavily on its own retail stores and outlets as a primary sales channel. This direct-to-consumer approach allowed for brand control and customer engagement. As of early 2024, the company has been actively transitioning away from this model.

In a significant strategic shift, GERRY WEBER announced the closure of all its remaining retail stores in Germany and other international markets. This move, largely completed by the end of 2023, signals a decisive pivot in its distribution strategy. The company's financial reports from 2023 and projections for 2024 reflect the impact of this channel reduction.

- Strategic Shift: Closure of all owned retail stores in Germany and other countries.

- Focus Change: Transitioning to other sales channels, likely wholesale and e-commerce.

- Financial Impact: 2023 and 2024 financial statements will show reduced revenue from owned retail operations.

Showrooms and Buying Days

GERRY WEBER leverages showrooms and dedicated buying days as a vital channel for its wholesale operations. These events allow professional buyers and retail partners to experience upcoming collections firsthand, facilitating informed ordering decisions for their respective markets.

These curated experiences are essential for building strong relationships with wholesale clients and ensuring efficient inventory planning. For instance, GERRY WEBER's participation in major fashion trade shows in 2024 provided platforms for showcasing new lines to a broad international audience of buyers.

- Showroom Experience: Dedicated spaces offer a tactile and visual presentation of new collections, crucial for wholesale partners.

- Buying Days: Scheduled events streamline the ordering process for retail partners and buyers.

- Wholesale Focus: This channel is a cornerstone for GERRY WEBER's B2B sales strategy, driving significant revenue.

- Market Insight: Direct interaction during buying days provides valuable feedback on market trends and product reception.

GERRY WEBER's channel strategy has seen a significant evolution, moving from a strong reliance on owned retail to a greater emphasis on wholesale and digital direct-to-consumer sales. The closure of all owned retail stores by late 2023 marked a decisive pivot, impacting revenue streams reported in 2023 and projected for 2024. This strategic shift aims to streamline operations and focus resources on channels with broader reach and potentially higher growth.

Wholesale partners remain a critical component, with GERRY WEBER distributing collections through independent boutiques and department stores, contributing substantially to revenue in fiscal year 2023/2024. Concurrently, the company is actively expanding its direct-to-consumer presence via its own e-commerce platforms for GERRY WEBER, TAIFUN, and SAMOON, which saw significant online sales growth in 2023/24, and by leveraging third-party online marketplaces to capture a wider audience in the burgeoning global online fashion market, projected to exceed $1.1 trillion in 2024.

| Channel | Key Characteristics | Fiscal Year 2023/2024 Impact | 2024 Market Context |

|---|---|---|---|

| Wholesale Partners | Distribution via independent boutiques and department stores. | Substantial revenue contribution. | Essential for broad market penetration. |

| Owned E-commerce Platforms | Direct-to-consumer sales for GERRY WEBER, TAIFUN, SAMOON brands globally. | Significant online sales growth, fostering direct customer relationships. | Growing importance in digital retail landscape. |

| Third-Party Online Marketplaces | Broadening customer base by listing on established platforms. | Enhances visibility and accessibility in competitive online fashion market. | Global online fashion market projected over $1.1 trillion. |

| Owned Retail Stores/Outlets | Historically a primary channel, now largely phased out. | Closure of all remaining stores by late 2023, impacting reported revenue. | Strategic pivot away from direct brick-and-mortar presence. |

| Showrooms & Buying Days | Facilitating wholesale partner engagement and collection previews. | Crucial for B2B sales strategy and efficient inventory planning. | Key for building wholesale relationships and gathering market feedback. |

Customer Segments

The core GERRY WEBER customer segment is comprised of women who deeply value modern, classic, and mainstream fashion. They are discerning shoppers who place a premium on the quality of their apparel, seeking out garments that offer both comfort and a timeless aesthetic. This group represents the brand's traditional and most loyal customer base.

In 2024, GERRY WEBER International continued to focus on this quality-conscious demographic. The brand's commitment to durable fabrics and well-executed designs resonates strongly with these women, ensuring repeat purchases and brand loyalty. This segment's preference for enduring style over fleeting trends underpins GERRY WEBER's enduring market presence.

GERRY WEBER's TAIFUN brand specifically caters to younger women who are actively seeking contemporary, trend-conscious, and youthful fashion. This segment is defined by a sportivity and a vibrant lifestyle, looking for apparel that reflects their dynamic way of living.

In 2024, the global athleisure market, which aligns with TAIFUN's sportivity focus, was projected to reach over $320 billion, indicating a strong demand for this style of clothing among younger demographics.

SAMOON specifically targets plus-size women who seek fashionable and well-fitting apparel, addressing a significant gap in the market for inclusive sizing in high-quality fashion.

This segment is crucial for GERRY WEBER, as the global plus-size apparel market is projected to reach $334.4 billion by 2030, indicating substantial growth potential for brands that cater to this demographic.

SAMOON's focus on style and fit empowers these women, offering them choices that were previously limited, thereby building brand loyalty and market share within this underserved community.

Wholesale Retailers and Boutiques

Wholesale retailers and boutiques represent a crucial customer segment for GERRY WEBER, acting as key distribution partners. These businesses acquire GERRY WEBER products in significant quantities to then offer them to their own customer bases within multi-brand retail environments.

This wholesale channel is vital for expanding market reach and ensuring product availability across diverse geographical locations. For instance, in 2024, GERRY WEBER continued to focus on strengthening its relationships with these partners, recognizing their role in driving sales volume and brand visibility.

- Key Distribution Partners: These businesses are essential for GERRY WEBER's strategy to reach a wider audience.

- Bulk Purchasing: They buy products in volume, contributing significantly to the company's revenue.

- Multi-Brand Environment: GERRY WEBER products are presented alongside other fashion labels, influencing brand perception.

- Market Reach Expansion: This segment allows GERRY WEBER to tap into new markets and customer demographics efficiently.

International Customers (across 54+ countries)

GERRY WEBER's international customer base spans over 54 countries, necessitating a sophisticated global strategy. This broad reach means tailoring marketing efforts and logistics to diverse cultural and economic landscapes. For instance, in 2024, the company's presence in key European markets like Germany and France remained significant, while expansion efforts continued in emerging regions.

The company's international operations are characterized by a need for localized product assortments to cater to varying fashion preferences and climate conditions. This adaptability is crucial for maintaining relevance and driving sales across such a wide geographical spread. In 2023, GERRY WEBER reported that international sales contributed a substantial portion of its total revenue, underscoring the importance of these diverse customer segments.

- Global Reach: Serving customers in over 54 countries requires a nuanced understanding of international markets.

- Localization Strategy: Adapting product offerings and marketing to suit regional tastes and demands is paramount.

- Logistical Complexity: Managing supply chains and distribution across numerous international borders presents ongoing challenges.

- Market Diversity: The company navigates a spectrum of economic conditions and consumer behaviors across its international customer base.

GERRY WEBER's customer base is multifaceted, encompassing women who appreciate modern, classic, and mainstream fashion, prioritizing quality and timeless style. This core group, alongside younger, trend-conscious consumers drawn to TAIFUN's sporty aesthetic, forms the brand's loyal following. Additionally, SAMOON specifically targets plus-size women seeking fashionable and well-fitting apparel, addressing a key market need.

In 2024, GERRY WEBER continued to engage these distinct segments, recognizing the growing demand in areas like athleisure and inclusive sizing. The global plus-size apparel market, for instance, was projected for significant expansion, highlighting SAMOON's strategic importance.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

| Core GERRY WEBER | Values modern, classic, mainstream fashion; prioritizes quality and timeless style. | Represents the brand's traditional and most loyal customer base. |

| TAIFUN | Younger women seeking contemporary, trend-conscious, youthful fashion with a sporty lifestyle. | Aligns with the projected over $320 billion global athleisure market in 2024. |

| SAMOON | Plus-size women seeking fashionable and well-fitting apparel. | Addresses a significant gap in the market; global plus-size apparel market projected to reach $334.4 billion by 2030. |

Cost Structure

GERRY WEBER's production and sourcing costs are heavily influenced by the price of raw materials like textiles and accessories, which are crucial for garment manufacturing. These material expenses, alongside the labor required for skilled production and rigorous quality control processes, represent a substantial portion of the company's cost of goods sold.

In 2024, the global textile industry experienced fluctuating raw material prices. For instance, cotton prices saw volatility, impacting the cost of fabrics for apparel manufacturers like GERRY WEBER. Efficient sourcing and strong supplier relationships are therefore paramount to managing these significant production expenses.

Personnel costs are a significant component of GERRY WEBER's operational expenses, encompassing salaries, wages, benefits, and other overheads for staff in design, administration, sales, and logistics. These costs are directly tied to the company's ability to create and deliver its fashion products.

During its restructuring phases, GERRY WEBER experienced notable job losses, indicating a strategic effort to optimize its workforce and manage personnel-related expenditures. This often involves streamlining operations and aligning staffing levels with current business needs and market conditions.

GERRY WEBER's marketing and sales costs encompass significant investments in advertising, brand campaigns, and promotional activities to maintain its fashion presence. In 2024, the company continued to focus on digital marketing channels and targeted campaigns to reach its core customer base. These expenditures are crucial for driving demand and ensuring the brand remains visible in a competitive retail landscape.

Logistics and Distribution Costs

Gerry Weber's logistics and distribution costs are a significant component of its operational expenses, encompassing warehousing, transportation, and the final delivery of fashion items to both wholesale partners and direct e-commerce consumers. These costs are directly tied to the efficiency of its supply chain management, aiming to balance speed and cost-effectiveness. For instance, in fiscal year 2023, the company reported that its cost of sales, which includes these logistics, amounted to €301.2 million, highlighting the substantial investment in getting products to market.

These expenses cover a range of activities critical for product availability:

- Warehousing: Costs related to storing inventory in strategically located distribution centers.

- Transportation: Expenses for moving goods from production facilities to warehouses and then to customers, utilizing various modes like road, rail, and air freight.

- Delivery: The final leg of distribution, ensuring timely and secure delivery to wholesale clients and individual online shoppers.

- Supply Chain Management: Investments in technology and personnel to optimize the flow of goods, manage inventory levels, and ensure compliance with international shipping regulations.

Administrative and Overhead Costs

Administrative and overhead costs for GERRY WEBER are significant, encompassing general and administrative expenses. These include costs associated with IT infrastructure, legal fees, and other essential operational overheads that keep the business running.

While the Halle headquarters is closing, the company still incurs costs for its remaining office spaces and administrative functions. GERRY WEBER has historically contended with substantial operating costs, impacting its overall financial performance.

- General and Administrative Expenses: Includes salaries for administrative staff, office supplies, and other support functions.

- IT Infrastructure: Costs for maintaining and upgrading technology systems, software licenses, and cybersecurity.

- Legal and Professional Fees: Expenses related to legal counsel, compliance, and consulting services.

- Other Operational Overheads: Covers a range of costs such as insurance, banking fees, and miscellaneous administrative necessities.

GERRY WEBER's cost structure is dominated by production and sourcing, including raw materials and labor, as well as personnel costs for its workforce. Marketing and sales, alongside logistics and distribution, also represent significant expenditures. Administrative and overhead costs, such as IT and legal fees, are essential for ongoing operations.

| Cost Category | Key Components | 2023/2024 Relevance |

|---|---|---|

| Production & Sourcing | Raw materials (textiles), labor, quality control | Fluctuating cotton prices in 2024 impacted material costs. |

| Personnel Costs | Salaries, wages, benefits, overheads | Restructuring efforts involved workforce optimization. |

| Marketing & Sales | Advertising, brand campaigns, digital marketing | Continued focus on digital channels in 2024. |

| Logistics & Distribution | Warehousing, transportation, delivery | Cost of sales (including logistics) was €301.2 million in FY23. |

| Administrative & Overhead | IT infrastructure, legal fees, office costs | Ongoing costs despite headquarters closure. |

Revenue Streams

Wholesale sales represent revenue generated from selling GERRY WEBER's apparel, accessories, and shoes to a network of multi-brand retailers, department stores, and other wholesale partners. This channel is increasingly becoming the primary driver of the company's revenue. For instance, in the first half of fiscal year 2023/2024, GERRY WEBER's wholesale business saw significant growth, contributing substantially to the overall sales performance.

E-commerce sales represent a significant income source, generated through GERRY WEBER's proprietary online stores and collaborations with external online retail platforms. This direct-to-consumer channel is vital for capturing revenue and building brand relationships.

In the fiscal year 2023, GERRY WEBER reported a substantial increase in its e-commerce business, with online sales contributing significantly to the overall revenue growth. The company has been actively investing in its digital infrastructure to enhance customer experience and expand its online reach.

Historically, GERRY WEBER generated substantial revenue from its network of company-owned retail stores and outlets. This was a core component of their business model, directly connecting them with consumers.

However, this revenue stream is in a significant state of decline. As part of a strategic shift, the company has been actively closing its physical retail locations. For instance, by the end of the 2022/2023 fiscal year, GERRY WEBER had reduced its retail store count considerably, impacting this historical revenue source.

Licensing and Brand Royalties

GERRY WEBER International's revenue streams include significant potential from licensing and brand royalties. This involves allowing other companies to use the GERRY WEBER, TAIFUN, or SAMOON brand names on their products, often in specific categories or geographical regions where the group may not operate directly. This strategy leverages brand recognition to generate income without direct manufacturing or retail involvement.

The acquisition of the Gerry Weber trademark rights by the Victrix Group in 2020 marks a significant shift. This move is expected to revitalize the brand and unlock new licensing opportunities. While specific royalty figures for 2024 are not yet publicly detailed, the Victrix Group's strategic focus on brand expansion suggests a proactive approach to capitalizing on these licensing agreements.

These licensing agreements can be structured in various ways, typically involving upfront fees and ongoing royalty payments based on sales of licensed products. This diversification of revenue helps mitigate risks associated with direct sales and expands the brand's reach into new markets and product segments.

- Brand Leverage: Monetizing the established reputation of GERRY WEBER, TAIFUN, and SAMOON through third-party product offerings.

- Market Expansion: Reaching consumers in territories or product categories not directly served by the core GERRY WEBER business.

- Victrix Group Acquisition: The 2020 acquisition by Victrix Group signals a renewed focus on brand value and potential for increased licensing revenue.

- Royalty Income: Generating ongoing revenue streams from sales of products bearing the licensed brand names.

International Sales

International sales represent a significant portion of GERRY WEBER's revenue, generated from markets beyond its home base in Germany. This global reach is crucial for the company's overall turnover, reflecting its status as an internationally operating entity.

GERRY WEBER actively engages with customers in more than 54 countries, diversifying its income streams and reducing reliance on any single market. This broad geographical presence allows the company to tap into varied consumer demands and economic conditions.

- Global Reach: GERRY WEBER's sales extend to over 54 countries, a testament to its international business strategy.

- Revenue Diversification: Income from these international markets contributes substantially to the company's total turnover, providing a buffer against regional economic fluctuations.

- Market Penetration: The brand's presence across numerous countries signifies successful market penetration and brand recognition on a global scale.

GERRY WEBER International's revenue is primarily driven by wholesale sales to a network of multi-brand retailers and department stores, a channel that has shown robust growth. E-commerce is another vital income source, with the company actively investing in its digital platforms to enhance customer experience and expand online reach, as evidenced by significant growth in online sales in fiscal year 2023. While the company has significantly reduced its physical retail footprint, licensing and brand royalties represent a growing opportunity, particularly following the acquisition of trademark rights by the Victrix Group, aiming to leverage brand recognition across new product categories and markets.

| Revenue Stream | Description | Key Data Point |

| Wholesale Sales | Selling apparel, accessories, and shoes to multi-brand retailers and department stores. | Significant growth in H1 FY 2023/2024. |

| E-commerce Sales | Revenue from proprietary online stores and external retail platforms. | Substantial increase in FY 2023, with significant investment in digital infrastructure. |

| Licensing & Royalties | Allowing other companies to use GERRY WEBER, TAIFUN, SAMOON brands on their products. | Renewed focus post-Victrix Group acquisition (2020) for brand expansion opportunities. |

| International Sales | Generating revenue from markets outside of Germany. | Active engagement in over 54 countries, diversifying income and reducing single-market reliance. |

Business Model Canvas Data Sources

The GERRY WEBER International Business Model Canvas is built on a foundation of comprehensive market research, financial disclosures, and internal operational data. These sources ensure each canvas block reflects accurate market positioning and strategic direction.