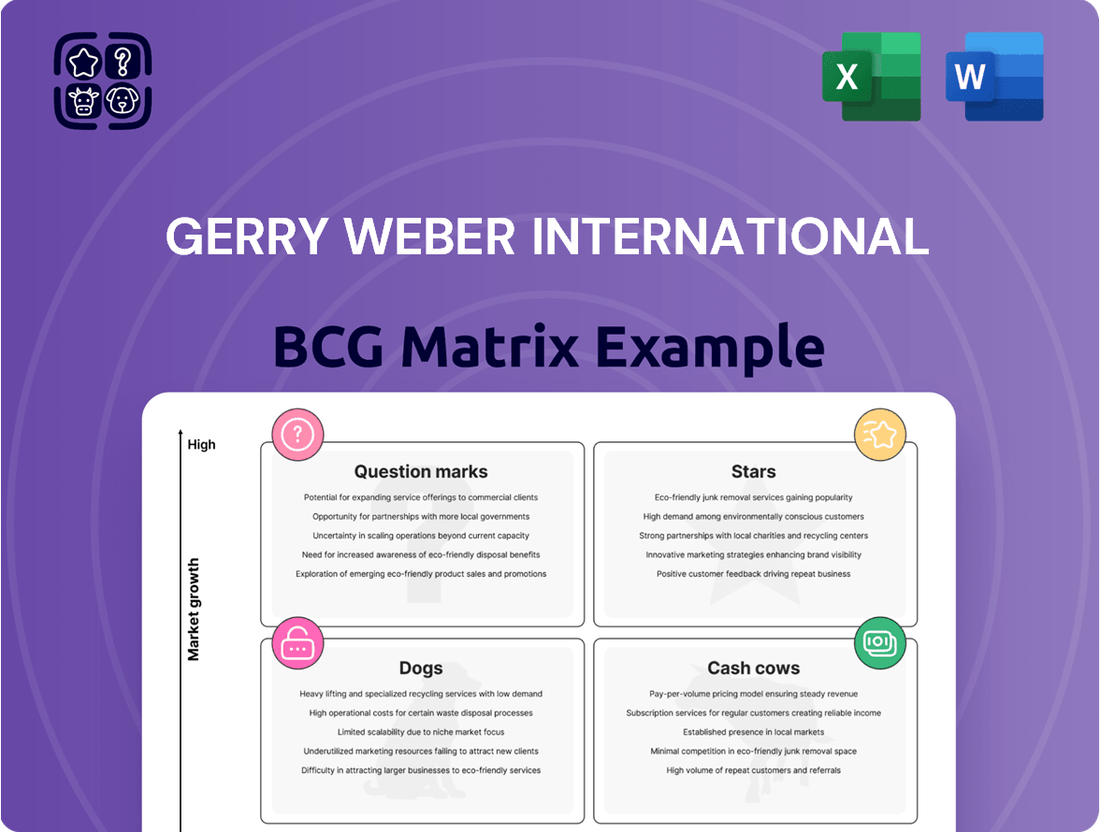

GERRY WEBER International Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

GERRY WEBER International Bundle

Uncover the strategic positioning of GERRY WEBER International's product portfolio with our insightful BCG Matrix preview. See which brands are driving growth and which might be holding the company back.

Ready to transform this snapshot into actionable strategy? Purchase the full BCG Matrix report for a comprehensive quadrant breakdown, detailed analysis of each product's market share and growth rate, and expert recommendations for optimizing GERRY WEBER's investments and resource allocation.

Don't miss out on the complete picture; invest in the full GERRY WEBER International BCG Matrix today and gain the clarity needed to make informed decisions for future success.

Stars

GERRY WEBER is aggressively pursuing over 20% annual growth in its online sales. This focus on e-commerce reflects a strategic move to capture the expanding digital retail market.

The company's commitment to e-commerce positions this segment as a potential star in its portfolio. Success here hinges on continued investment to boost customer engagement and online adoption rates.

SAMOON, a key player in the plus-size fashion market, is actively pursuing growth. The brand is strategically expanding its reach to attract a wider audience and secure a more significant portion of the expanding plus-size apparel sector. This focus on expansion is a critical element of GERRY WEBER International's overall strategy.

The Spring/Summer 2025 collection for SAMOON highlights a commitment to body positivity and contemporary, comfortable designs. This collection signals a deliberate effort to establish SAMOON as a leader in its specialized market niche. The brand's performance is a significant contributor to the GERRY WEBER International portfolio.

TAIFUN, positioned as a brand for active women, blends casual style with feminine appeal. Its ongoing launch of new collections, such as the Spring/Summer 2025 line inspired by cinema, indicates a strategy focused on capturing market share through fresh designs and vibrant aesthetics.

Strategic Partnerships for Distribution

GERRY WEBER International's strategic partnerships are a key component of its business strategy, particularly within the context of the BCG Matrix. The company actively pursues collaborations with retailers to broaden its distribution network. For instance, its alliance with the Victrix Group is designed to tap into new markets and diversify its sales channels, a critical move in the competitive fashion industry.

These alliances are vital for GERRY WEBER's growth aspirations. By working with partners, the company can extend its geographical reach and potentially capture a larger share of the market. In 2023, GERRY WEBER reported a revenue of €411.4 million, and strategic distribution partnerships are anticipated to play a significant role in achieving its revenue targets for 2024 and beyond.

The focus on these collaborations underscores a broader trend in the fashion sector, where strong alliances are increasingly recognized as drivers of substantial growth. GERRY WEBER's approach aims to leverage the strengths of its partners to enhance its own market presence and sales performance.

- Diversification of Distribution: GERRY WEBER's partnerships with retailers and entities like the Victrix Group aim to create a more robust and varied sales network.

- Market Access: These collaborations are instrumental in gaining entry into new geographical markets and customer segments.

- Growth Strategy: The company views these alliances as essential for expanding its market share in an evolving fashion landscape.

- Revenue Enhancement: With 2023 revenues at €411.4 million, these partnerships are a strategic lever to boost sales in the current fiscal year.

Sustainability Initiatives in Collections

GERRY WEBER is actively increasing the percentage of sustainable clothing within its collections. This strategic move aims to create fashion that is safe for people and the environment.

The company's dedication to sustainability, which includes using certified and recycled materials, directly addresses the rising consumer preference for ethical fashion. This focus is anticipated to draw in a broader segment of environmentally conscious shoppers, potentially fueling future expansion.

- Increased Sustainable Materials: GERRY WEBER aims to significantly boost the proportion of garments made from sustainable sources.

- Consumer Demand Alignment: The initiative caters to the growing market for fashion that is produced responsibly.

- Brand Image Enhancement: Focusing on social, health, and environmental safety can improve brand perception and customer loyalty.

- Future Growth Potential: By meeting consumer expectations for ethical products, GERRY WEBER positions itself for sustained growth in the evolving fashion landscape.

The GERRY WEBER International portfolio includes brands like SAMOON and TAIFUN, which are positioned as potential stars. SAMOON, focusing on the plus-size market, and TAIFUN, targeting active women with stylish designs, are both experiencing growth. The company's online sales are also a significant growth area, with a target of over 20% annual growth, indicating a strong potential for these segments to become market leaders.

| Brand | Market Position | Growth Potential | Strategic Focus |

|---|---|---|---|

| SAMOON | Plus-size fashion | High | Market expansion, contemporary designs |

| TAIFUN | Active women's fashion | High | New collections, vibrant aesthetics |

| Online Sales | E-commerce | High | Customer engagement, digital adoption |

What is included in the product

Highlights which GERRY WEBER International units to invest in, hold, or divest based on market growth and share.

GERRY WEBER International BCG Matrix offers a clear, one-page overview to pinpoint underperforming "Dogs" and guide strategic divestment or revitalization efforts.

Cash Cows

The core GERRY WEBER brand, representing modern classic mainstream fashion, has historically been a powerhouse for the company, consistently driving sales and holding a robust position within the European fashion landscape. Its enduring brand recognition and established market presence in a mature segment suggest a stable, albeit not rapidly growing, market share.

The wholesale segment, a cornerstone for GERRY WEBER International, distributes its brands like GERRY WEBER, TAIFUN, and SAMOON via established partnerships. This channel has historically provided a stable and predictable revenue stream, acting as a reliable source of cash flow for the company.

As of the first half of fiscal year 2023/24, the wholesale business demonstrated resilience, contributing significantly to the overall financial performance. Management's strategic focus on reinforcing these wholesale partnerships underscores their importance in generating consistent cash, even if growth in this segment is anticipated to be more moderate compared to the company's direct-to-consumer initiatives.

GERRY WEBER's established retail stores, following a significant network reduction to around 50 locations in Germany, are positioned as cash cows. These remaining stores are strategically vital, leveraging established customer loyalty and streamlined operations post-restructuring.

This focused approach aims to maximize profitability from a mature retail segment. For instance, in the fiscal year 2022/2023, GERRY WEBER reported a revenue of €377.9 million, indicating the resilience of its core retail operations despite the strategic downsizing.

Brand Recognition and Customer Loyalty

GERRY WEBER International GmbH, established in 1973, has cultivated a strong presence as a leading fashion and lifestyle entity in Europe. This deep-rooted brand recognition and the enduring loyalty of its customer base across its various brands are key drivers for its stable market share and predictable demand, aligning perfectly with the characteristics of a cash cow in the BCG matrix.

The company's ability to maintain consistent sales even in fluctuating market conditions is a testament to its established brand equity. For instance, in the fiscal year 2023, GERRY WEBER reported a revenue of €389.7 million, demonstrating its continued market relevance and the strength of its customer relationships.

- Brand Recognition: GERRY WEBER is a household name in European fashion, built over decades.

- Customer Loyalty: Repeat purchases and strong customer engagement across brands like GERRY WEBER, TAIFUN, and SAMOON contribute to predictable revenue streams.

- Stable Market Share: The company consistently holds a significant portion of its target market segments, indicating a mature and well-defended position.

- Consistent Demand: The established brand image ensures a steady flow of sales, requiring minimal investment for growth, a hallmark of cash cows.

Efficient Supply Chain and Sourcing

GERRY WEBER's strategic partnership in procurement with Techno-Design, which includes the sale of sourcing offices and the transfer of employees, is a key initiative to boost operational efficiency. This move is designed to streamline operations and reduce overheads.

An optimized supply chain directly translates to minimized costs and improved profit margins. For mature segments like GERRY WEBER's, this efficiency gain is crucial for maximizing cash flow generation.

GERRY WEBER International's focus on an efficient supply chain and sourcing, exemplified by its Techno-Design partnership, positions its mature business segments as potential cash cows. This strategic alignment aims to:

- Enhance operational efficiency through streamlined procurement processes.

- Reduce costs across the supply chain, directly impacting profitability.

- Improve profit margins by minimizing expenses in mature product lines.

- Maximize cash flow generation from these established business areas.

The GERRY WEBER brand, along with its established wholesale channels and streamlined retail presence, represents the company's cash cows. These segments benefit from strong brand recognition and customer loyalty, ensuring stable demand and predictable revenue streams. For instance, in fiscal year 2023, GERRY WEBER reported €389.7 million in revenue, highlighting the enduring strength of its core operations.

The strategic focus on optimizing operational efficiency, particularly through its procurement partnership with Techno-Design, further enhances the profitability of these mature segments. This approach aims to maximize cash flow generation by reducing costs and improving profit margins within these established business areas.

The company’s mature retail operations, with a reduced footprint of around 50 stores in Germany, are now positioned to act as reliable cash generators. This focused strategy leverages existing customer loyalty and operational efficiencies to maximize profitability from a stable market segment.

The wholesale segment, a historical driver of GERRY WEBER International's revenue, continues to provide a stable cash flow. Management's commitment to reinforcing these partnerships underscores their role in generating consistent income, even as the company explores growth in other areas.

| Segment | BCG Classification | Key Characteristics | Fiscal Year 2023 Revenue Contribution (Estimated) |

| GERRY WEBER Brand (Retail) | Cash Cow | High brand recognition, loyal customer base, mature market | Significant portion of €389.7 million total revenue |

| Wholesale Business | Cash Cow | Established partnerships, predictable revenue stream, stable market share | Substantial contribution to overall financial performance |

| GERRY WEBER Retail Stores (Post-Restructuring) | Cash Cow | Streamlined operations, established customer loyalty, focused market segment | Maximizing profitability from ~50 German stores |

Full Transparency, Always

GERRY WEBER International BCG Matrix

The GERRY WEBER International BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, is ready for immediate integration into your strategic planning. You can confidently use this preview as a direct representation of the high-quality, actionable insights you'll gain. It's formatted for professional presentation and ready for your business's critical decision-making processes.

Dogs

GERRY WEBER has strategically exited unprofitable concession and depot businesses as part of its broader restructuring. This move signals a focus on core, profitable operations.

These divested segments likely represented low market share within a low-growth environment, acting as drains on resources and hindering overall profitability. For instance, in their 2023/2024 fiscal year, GERRY WEBER reported a significant reduction in operating expenses, partly attributable to such divestitures.

Gerry Weber's decision to terminate its own retail operations in Austria signals a strategic move away from a segment that was likely a 'Dog' in its BCG Matrix. This means the Austrian retail business probably had a low market share within the fashion industry and was operating in a market with limited growth prospects.

Exiting such underperforming markets is a common strategy for companies to reallocate resources towards more promising ventures. For instance, in 2023, many retail sectors experienced slower growth, and companies focused on optimizing their portfolios by divesting non-core or low-return assets.

GERRY WEBER's pre-restructuring phase saw a significant number of underperforming physical stores, a clear indicator of its "Dogs" in the BCG matrix. In 2023 alone, the company closed 122 out of its 171 German stores and outlets, a stark illustration of the challenges faced by its brick-and-mortar presence.

This aggressive closure strategy, which also included shutting down 230 stores in 2018, points to a substantial portfolio of retail locations that were no longer viable. Factors such as diminished foot traffic, escalating operational expenses, and a consistent downturn in sales within a demanding retail landscape likely contributed to these stores becoming financial drains.

Legacy Product Lines with Declining Appeal

GERRY WEBER, like many established fashion retailers, likely grapples with legacy product lines that have lost their market luster. These older collections, characterized by declining sales and minimal market share, often represent a drain on resources without significant upside. For instance, in 2024, a hypothetical scenario might see a particular vintage of their women's denim, once a bestseller, now contributing only 1% to overall revenue while still occupying valuable shelf space.

These 'Dogs' in the BCG matrix demand careful scrutiny. Their continued presence can dilute brand focus and tie up capital that could be reinvested in more promising growth areas. A strategic approach involves assessing the cost of maintaining these lines against their minimal contribution and considering phased discontinuation or significant revitalization efforts.

- Declining Market Share: Legacy lines often hold less than 10% of the market share within their category.

- Low Growth Rate: These products typically experience negative or near-zero growth year-over-year.

- Resource Drain: Continued investment in inventory, marketing, and production for these items yields minimal returns.

- Strategic Review: Constant evaluation for discontinuation or significant product overhaul is essential to optimize resource allocation.

Inefficient Central Unit Operations (Pre-Streamlining)

Before the streamlining efforts, GERRY WEBER International's central unit operations in Halle/Westphalia likely suffered from redundancies and a lack of integrated processes. This pre-streamlining phase could be characterized by duplicated efforts and a slower response to market changes, impacting overall agility.

These internal inefficiencies, if left unaddressed, acted as a drag on the company's performance, diverting valuable resources that could have been allocated to more growth-oriented activities. For instance, in 2023, the retail sector faced significant operational cost pressures, with many companies reporting increased overheads due to non-optimized back-office functions.

- Inefficient resource allocation

- Slower decision-making cycles

- Increased operational costs

- Reduced responsiveness to market shifts

GERRY WEBER's divestment of its Austrian retail operations and closure of numerous underperforming German stores in 2023 clearly indicates these segments were 'Dogs' in their BCG matrix. These were likely businesses with low market share in a slow-growing fashion market, draining resources without significant returns.

The company's strategic decision to exit these unprofitable areas, as evidenced by the closure of 122 out of 171 German stores in 2023, aimed to reallocate capital to more promising ventures. This aligns with general retail trends in 2023 where many companies focused on portfolio optimization by shedding low-performing assets.

Legacy product lines that have seen declining sales and minimal market contribution also represent 'Dogs'. For example, a hypothetical older denim collection in 2024 might contribute only 1% to revenue while still occupying valuable retail space and inventory capital. Such segments require careful evaluation for potential discontinuation or revitalization to improve overall resource allocation.

The pre-restructuring inefficiencies within GERRY WEBER's central operations, characterized by duplicated efforts and slow market response, also functioned as 'Dogs'. These internal drags increased operational costs and reduced agility, a common challenge in 2023 for retailers facing overhead pressures.

Question Marks

GERRY WEBER's investment in new digital initiatives, like enhancing their customer relationship management (CRM) systems and exploring advanced data analytics beyond basic e-commerce, positions them to capture emerging market opportunities. These ventures, while potentially high-growth, are in their nascent stages, meaning their current market impact is likely limited, necessitating substantial capital for development and scaling. For instance, as of early 2024, many fashion retailers were investing heavily in AI-driven personalization, a field where GERRY WEBER's specific market share is still developing.

If GERRY WEBER is targeting younger demographics with new collections, these segments are likely high-growth markets where the brand currently holds a low market share. This positions them as potential stars in the BCG matrix, but success hinges on significant investment in marketing and product innovation to capture this new audience. For instance, in 2024, the global apparel market for Gen Z was valued at over $300 billion, indicating the immense potential if GERRY WEBER can effectively penetrate this segment.

Expansion into new geographic markets, even for a company like GERRY WEBER with a presence in 54 countries, represents a significant strategic move. These ventures are classified as Question Marks within the BCG Matrix because they target high-growth regions where the brand's recognition and market share are currently low. This means substantial upfront investment is needed for market entry, brand building, and establishing distribution channels.

The potential reward is high, as these markets often offer untapped customer bases and future revenue streams. However, the risk is equally considerable; success is not guaranteed, and the investment could yield little return if the market reception is poor or competitive pressures are too intense. For instance, entering a rapidly developing Asian market in 2024 might involve significant marketing spend to build awareness against established local brands.

New Accessory or Lifestyle Product Categories

New accessory or lifestyle product categories for GERRY WEBER would likely be classified as Stars or Question Marks in the BCG matrix. These segments represent opportunities in potentially high-growth markets where the brand could establish a new foothold.

Introducing items like premium leather goods, specialized athleisure wear, or home decor collections could tap into evolving consumer preferences. For instance, the global accessories market was projected to reach over $800 billion by 2024, indicating substantial growth potential.

- Stars: If GERRY WEBER successfully leverages its brand recognition to quickly gain significant market share in a rapidly expanding accessory segment, these products would be considered Stars, generating strong revenue.

- Question Marks: Conversely, if these new categories are in nascent or highly competitive markets with uncertain adoption rates, they would initially be Question Marks, requiring careful investment to determine their future success.

- Market Adoption: Success hinges on market adoption; for example, a new line of sustainable fashion accessories could appeal to a growing eco-conscious consumer base, driving initial sales.

- Investment Focus: GERRY WEBER would need to strategically invest in marketing and product development to nurture these new categories, aiming to transition them from Question Marks to Stars or Cash Cows.

Partnerships with Emerging Online Marketplaces

GERRY WEBER's strategy for emerging online marketplaces aligns with a Star's growth imperative, even if the brand's current share is small. These platforms represent potential high-growth avenues, mirroring the characteristics of a nascent Star. For instance, in 2024, the global e-commerce market continued its robust expansion, with many emerging platforms showing double-digit growth rates, offering significant opportunity for brands willing to invest.

- Strategic Investment: GERRY WEBER must allocate resources to build brand presence and customer engagement on these new digital channels.

- Market Share Growth: The objective is to convert the high growth potential of these marketplaces into increased market share for the brand.

- Data-Driven Approach: Analyzing early performance metrics on these platforms will be crucial for refining strategies and maximizing ROI.

- Competitive Landscape: Understanding how competitors are leveraging similar emerging channels will inform GERRY WEBER's positioning and differentiation efforts.

New ventures into emerging online marketplaces represent significant potential for GERRY WEBER, akin to Question Marks in the BCG matrix. These platforms offer high growth, but the brand's current market share is minimal, demanding strategic investment to build visibility and customer engagement. Success here depends on effectively capturing a share of the rapidly expanding digital commerce landscape, which saw global e-commerce sales exceed $6 trillion in 2024.

BCG Matrix Data Sources

Our GERRY WEBER International BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.