German American Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

German American Bank Bundle

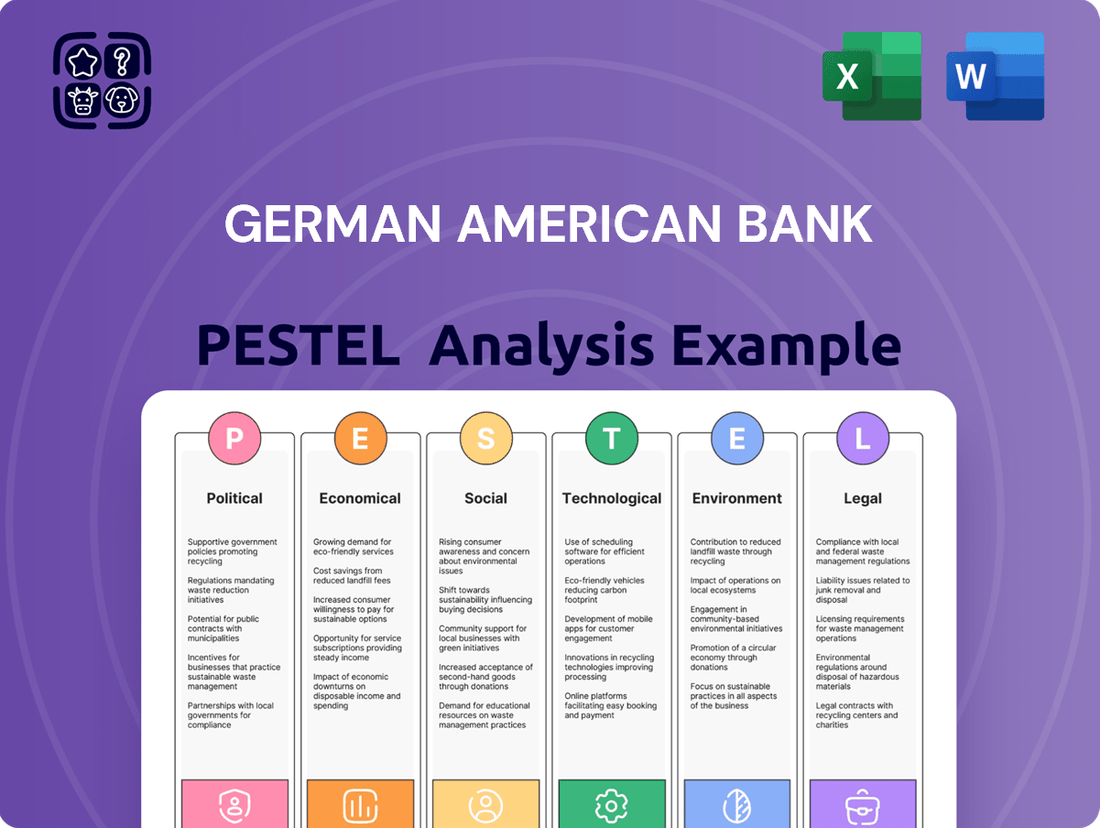

Navigate the complex external landscape affecting German American Bank with our comprehensive PESTLE analysis. Understand the political stability, economic fluctuations, and evolving social trends that shape its operational environment. Discover technological advancements and legal frameworks impacting the financial sector, alongside crucial environmental considerations. Gain a strategic advantage by leveraging these insights to anticipate challenges and capitalize on opportunities. Download the full version now for actionable intelligence to inform your decisions.

Political factors

Government policy and banking regulations are critical to German American Bank's stability. Changes in federal and state rules, such as those concerning the Community Reinvestment Act (CRA) or evolving capital requirements, directly shape how the bank operates and its associated compliance expenses. The Office of the Comptroller of the Currency (OCC) regularly identifies banks for CRA examinations, underscoring the continuous regulatory scrutiny.

The Federal Reserve's monetary policy, particularly its stance on interest rates, significantly impacts German American Bank. Decisions on the federal funds rate directly influence the bank's net interest margin, affecting how much it earns on loans versus what it pays on deposits. Higher rates generally boost margins, while lower rates can compress them.

As of June 2025, the Federal Reserve's policy interest rate range remained steady at 4.25%-4.50%. However, market expectations are shifting, with many investors anticipating potential rate cuts in the latter half of 2025. This anticipated easing of monetary policy could lead to reduced borrowing costs for consumers and businesses, potentially stimulating loan demand and reshaping the overall lending environment for banks like German American.

The continued trajectory of interest rates throughout 2025 will be a crucial determinant of the banking sector's performance. A gradual decline in rates might offer a mixed bag: while potentially increasing loan volumes, it could also lead to narrower profit margins on those loans. For German American Bank, navigating this evolving interest rate landscape will be key to maintaining profitability.

The political climate in the United States, particularly the outcome of the 2024 presidential election and subsequent shifts in administration, significantly impacts regional banks like German American Bank. A change in presidential administration can alter the regulatory landscape. For instance, a more business-friendly approach might lead to deregulation, which could reduce compliance costs and create opportunities for expansion or mergers and acquisitions within the banking sector.

In 2024, the U.S. banking sector, including regional players, is navigating a political environment where policy decisions on capital requirements, consumer protection, and lending regulations are under constant review. For example, the Federal Reserve's stance on interest rates, often influenced by political considerations and economic mandates, directly affects loan demand and profitability. A more relaxed regulatory environment, if enacted, could spur greater capital investment by businesses, thereby increasing loan demand for banks.

Fiscal Policy and Local Economic Initiatives

Government spending and tax policies in Indiana and Kentucky significantly shape the economic landscape for German American Bank. For instance, Indiana's 2024 budget included substantial investments in infrastructure, with over $500 million allocated to road and bridge improvements, which can stimulate local commerce and banking needs. Kentucky's approach to tax incentives, such as those targeting advanced manufacturing, also directly impacts business growth and, consequently, demand for financial services.

Local economic development initiatives, like tax abatements for new businesses or grants for small business expansion, play a vital role. These programs can directly increase lending opportunities and fee-based services for the bank. For example, a successful initiative attracting a new manufacturing plant to a Kentucky county could lead to millions in new commercial loans and deposit accounts.

- Indiana's Infrastructure Spending: The state's commitment to transportation projects in 2024-2025 aims to improve connectivity, potentially boosting regional economic activity and banking demand.

- Kentucky's Tax Incentives: Targeted tax credits for industries like automotive and aerospace manufacturing in Kentucky encourage business investment and expansion, creating opportunities for commercial banking services.

- Small Business Support Programs: Both states offer grants and loan programs for small businesses, which German American Bank can leverage by partnering with or supporting these initiatives, fostering community economic health.

Geopolitical Tensions and Trade Policies

While German American Bank operates regionally, ongoing geopolitical tensions and evolving trade policies can still cast a shadow. These global dynamics indirectly influence economic stability, investor sentiment, and the supply chains of businesses the bank supports. For instance, heightened trade disputes can disrupt international commerce, leading to increased operational costs and reduced demand for goods and services, which in turn affects loan demand and credit quality for the bank.

The International Monetary Fund (IMF) in its October 2024 World Economic Outlook highlighted that uncertainty regarding the global economic outlook remains significantly elevated, with trade policy and geopolitical risks being key contributors. This pervasive uncertainty often translates into a more conservative lending approach by financial institutions, as they anticipate potential headwinds to business investment and expansion.

Key considerations stemming from these factors include:

- Impact on Corporate Clients: Businesses relying on international trade or with global supply chains may experience increased costs or disruptions, potentially affecting their ability to service debt.

- Investor Confidence: Broader geopolitical instability can dampen overall investor confidence, leading to reduced capital inflows and potentially impacting the bank's access to funding or the valuation of its investments.

- Regulatory Environment: Evolving trade policies can also lead to changes in regulations that affect cross-border transactions or specific industries, requiring the bank to adapt its compliance and operational strategies.

The political landscape in the United States, especially following the 2024 elections, directly influences German American Bank's operating environment. Shifts in administration can lead to altered regulatory priorities, potentially impacting compliance burdens and strategic opportunities like mergers. Furthermore, government spending and tax policies at both state and federal levels, such as Indiana's infrastructure investments and Kentucky's business incentives, create localized economic conditions that affect loan demand and overall banking needs.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the German American Bank, offering a comprehensive view of its external operating environment.

A PESTLE analysis for German American Bank serves as a pain point reliever by providing a structured framework to identify and proactively address external challenges and opportunities, thereby mitigating potential risks and informing strategic decision-making.

Economic factors

The trajectory of interest rates significantly impacts banks like German American Bank, directly affecting their net interest margin (NIM). Following a period of elevated rates, the Federal Reserve has indicated potential rate cuts in 2025. This environment presents a challenge for regional banks in balancing their lending and deposit rates effectively.

While lower interest rates generally stimulate demand for loans, they also risk compressing NIM if the cost of deposits remains stubbornly high. For instance, if deposit rates, which are often stickier downwards, do not fall as quickly as lending rates, the bank's profit margin on its core business can shrink. This delicate balancing act is crucial for maintaining profitability.

Data from late 2024 and early 2025 will be key; if the Fed implements cuts, the speed at which German American Bank can adjust its asset yields compared to its funding costs will determine the impact on its NIM. For example, if deposit growth outpaces loan growth and deposit costs remain elevated, even with lower benchmark rates, NIM could face pressure.

Indiana's Gross Domestic Product (GDP) saw a healthy increase in 2024, reflecting robust industrial output and a growing services sector. Similarly, Kentucky experienced positive GDP growth, driven by advancements in manufacturing and logistics.

Employment rates in both Indiana and Kentucky remained strong through early 2025, with unemployment figures consistently below national averages. This signifies a healthy labor market, supporting consumer spending and business investment, which directly benefits German American Bank.

The industrial activity in key sectors like automotive manufacturing in Indiana and bourbon production in Kentucky directly influences the bank's commercial loan portfolio. Strong industrial performance leads to increased demand for business loans and a lower risk of defaults.

A favorable economic climate in these regions translates to higher disposable income for consumers, boosting deposit growth for German American Bank. Conversely, any economic downturn could lead to increased loan delinquencies, impacting the bank's profitability and asset quality.

Inflation significantly impacts consumer purchasing power and business operating costs, directly affecting loan demand and deposit trends for German American Bank. For instance, if inflation remains elevated, as seen with the US CPI reaching 3.4% in April 2024, consumers may reduce discretionary spending, potentially lowering demand for certain loan products.

Persistent inflation above the Federal Reserve's 2% target could prompt a more restrictive monetary policy, leading to higher interest rates. This scenario might dampen borrowing activity but could also increase net interest margins for the bank. Conversely, controlled inflation, such as the projected 2.4% CPI for the US in 2025, generally supports a more stable environment for lending and investment.

Consumer spending habits and existing debt levels are critical drivers for the bank's retail banking segment. A slowdown in consumer spending, perhaps due to eroded real wages from inflation, directly impacts transaction volumes and the uptake of credit products. For example, if household debt-to-income ratios remain high, consumers may be less inclined to take on new debt, affecting the bank's growth in areas like credit cards and personal loans.

Real Estate Market Conditions

The stability of Indiana and Kentucky's real estate markets is paramount for German American Bank, influencing its mortgage and commercial loan portfolios. In Q1 2024, the median home price in Indiana rose by 5.2% year-over-year to $235,000, while Kentucky saw a 4.8% increase to $210,000, indicating a generally positive, albeit moderating, trend.

Commercial real estate, however, presents a more nuanced picture. While occupancy rates for prime office space in Louisville remained stable at 89% through 2024, Indianapolis experienced a slight dip to 87%, reflecting ongoing shifts in work patterns. This can directly impact the bank's collateral values and loan demand.

- Residential Market Strength: Indiana and Kentucky home prices showed continued, albeit slower, appreciation in early 2024, providing a solid foundation for residential mortgage lending.

- Commercial Real Estate Challenges: Fluctuations in commercial property values and occupancy rates, particularly in office sectors, pose a potential risk for the bank's commercial real estate loan exposure.

- Interest Rate Impact: While direct interest rate risk on existing loans is managed, the current higher rate environment can dampen new loan origination volumes and impact refinancing activity.

- Collateral Valuation: Property value trends are critical for assessing the health of the bank's collateral, directly influencing loan loss provisions and capital adequacy.

Competition and Lending Environment

The competitive landscape for German American Bank is shaped by both established regional players and increasingly aggressive non-traditional lenders, impacting its ability to capture market share and set favorable pricing. Larger national banks often possess greater resources, while fintech companies are rapidly innovating in the lending space, creating a dynamic and challenging environment.

While the U.S. banking sector experienced subdued loan growth throughout 2024, projections for 2025 suggest a more optimistic outlook. A potentially more favorable business climate, coupled with expected interest rate reductions by the Federal Reserve, could stimulate greater demand for credit. This anticipated uptick in loan activity will likely intensify competition as banks vie for new customers and business opportunities.

- Increased Competition: German American Bank faces competition from national banks and alternative lenders, affecting its market position.

- Loan Growth Trends: U.S. bank loan growth was modest in 2024, with expectations of acceleration in 2025.

- Interest Rate Impact: Anticipated interest rate cuts in 2025 are poised to boost loan demand and competitive pressures.

- Market Share Dynamics: The bank's market share and pricing power are directly influenced by the intensity of competition and overall economic conditions.

Economic factors significantly influence German American Bank's performance, particularly through interest rate movements and regional economic health. Projected interest rate cuts in 2025 by the Federal Reserve could compress net interest margins if deposit costs remain high, despite potentially boosting loan demand.

Strong GDP growth and low unemployment in Indiana and Kentucky during 2024 and early 2025 support a healthy lending environment, benefiting the bank's commercial and retail portfolios.

Inflationary pressures, with the US CPI at 3.4% in April 2024, impact consumer spending and could lead to tighter monetary policy, while projections for a 2.4% CPI in 2025 suggest a more stable outlook.

The real estate market in Indiana and Kentucky shows continued, though moderating, home price appreciation, providing a stable base for residential mortgages, while commercial real estate, especially office spaces, presents mixed signals.

| Economic Factor | Data Point (2024/Early 2025) | Impact on German American Bank |

|---|---|---|

| Federal Funds Rate | Potential cuts in 2025 (current elevated levels) | NIM pressure if deposit costs lag lending rate adjustments; potential for increased loan demand. |

| Indiana GDP Growth | Healthy increase in 2024 | Supports commercial loan portfolio and business investment. |

| Kentucky Employment Rate | Consistently below national average (through early 2025) | Strong labor market fuels consumer spending and deposit growth. |

| US CPI Inflation | 3.4% (April 2024); Projected 2.4% (2025) | High inflation erodes purchasing power; controlled inflation supports stable lending. |

| Indiana Median Home Price | +$235,000 (Q1 2024, +5.2% YoY) | Positive collateral value for residential mortgages. |

Preview Before You Purchase

German American Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for German American Bank covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape and potential challenges and opportunities facing the bank. This detailed report provides actionable insights for informed decision-making.

Sociological factors

Demographic shifts in Indiana and Kentucky significantly impact German American Bank's product demand. For instance, Indiana's population growth, while modest, is accompanied by an aging demographic, increasing the need for retirement planning and wealth management services. In Kentucky, a higher proportion of residents aged 65 and over, estimated at around 17% as of 2023, necessitates a focus on elder financial protection and potentially specialized services to combat issues like elder financial abuse.

Migration patterns also play a crucial role. Influxes of younger families into certain Indiana counties, driven by economic development, boost demand for mortgages and first-time homebuyer programs. Conversely, some areas in Kentucky experience out-migration of younger workers, impacting the customer base for services geared toward working-age individuals.

Overall population trends inform German American Bank's strategic growth. While Indiana's population is projected to grow steadily through 2025, Kentucky's growth is expected to be slower, with some rural areas facing population decline. This disparity requires tailored approaches to market penetration and service delivery across both states.

German American Bank faces a significant shift in how customers want to bank. There's a clear move towards digital channels, with people expecting seamless mobile apps and online account management. This means traditional banking methods are being supplemented, and sometimes replaced, by digital alternatives.

The demand for convenience is paramount. Customers want to perform transactions, apply for loans, and manage their accounts entirely online or through their smartphones, often with instant confirmations. This digital-first expectation is reshaping the entire banking landscape, forcing institutions to innovate rapidly to stay relevant.

To meet these evolving preferences, German American Bank needs to strike a balance. While maintaining physical branches is still important for some customers, the investment in and enhancement of digital platforms, such as mobile banking and online application portals, is crucial. This dual approach ensures a wider customer base is served effectively.

The adoption of services like Zelle by many community banks in 2024 highlights this trend. Zelle's peer-to-peer payment system offers faster transactions, directly addressing customer desires for quick and easy money transfers, and German American Bank will need to consider similar innovations to remain competitive.

German American Bank's ability to attract and retain skilled professionals in finance, technology, and customer service is crucial for its performance. In 2024, the unemployment rate in key German financial hubs like Frankfurt remained low, around 5.3%, indicating a competitive talent market.

The increasing prevalence of remote work and the growing demand for specialized fintech expertise are reshaping recruitment strategies, requiring banks to offer flexible work arrangements and competitive compensation packages to secure top talent.

A strong local employment market, evidenced by rising wages and low unemployment, generally correlates with a healthier consumer base, which can translate into increased demand for banking products and services.

For instance, in the US, where German American Bank also operates, the tech sector saw significant hiring in 2024, with cybersecurity and data analytics roles being particularly in-demand, impacting the bank's ability to fill critical technology positions.

Financial Literacy and Community Engagement

The financial literacy levels within the communities German American Bank serves directly shape the bank's product development and educational outreach strategies. For instance, a community with lower financial literacy might require more basic savings and budgeting workshops, while a more financially savvy population might be interested in advanced investment planning seminars. Data from late 2024 indicates that while general financial knowledge in many US regions is improving, specific demographic segments still show gaps, particularly concerning digital finance and long-term investment planning. German American Bank's approach must therefore be adaptable to these varying needs.

Active engagement with local communities and robust corporate social responsibility (CSR) programs are crucial for building trust and loyalty, especially for a bank with a community-centric mission. Initiatives like sponsoring local events, offering financial education in schools, or supporting small business development not only contribute to societal well-being but also bolster the bank's public image. By mid-2025, banks with strong community ties are expected to see a measurable increase in customer retention and positive brand perception compared to those with less visible local involvement. For German American Bank, this translates to tangible benefits in customer acquisition and relationship depth.

- Financial Literacy Gaps: Studies in late 2024 revealed that approximately 60% of US adults feel confident managing their finances, but a significant portion struggles with understanding credit scores or planning for retirement.

- Community Investment Impact: Banks demonstrating a commitment to local communities through CSR often experience higher customer satisfaction scores, with some reports in early 2025 showing up to a 15% increase in loyalty among those participating in bank-sponsored programs.

- Product Demand: The demand for digital banking education and cybersecurity awareness resources is projected to rise by 20% by the end of 2025, reflecting evolving customer needs and technological adoption.

- Reputation Enhancement: Positive media mentions and community feedback related to a bank's social initiatives can significantly improve its perceived trustworthiness, a key factor in attracting and retaining clients.

Social Responsibility and Ethical Banking Expectations

Societal expectations for German American Bank are increasingly focused on social responsibility and ethical conduct. Customers and stakeholders alike are demanding fair lending practices, complete transparency in operations, and tangible support for local community development initiatives. This trend is significantly impacting the bank's public image and its ability to foster lasting customer loyalty.

In response, German American Bank is actively integrating Environmental, Social, and Governance (ESG) principles into its core strategies and internal audit plans. This proactive approach is a direct reflection of the evolving landscape of stakeholder expectations, which now prioritize sustainable and ethical business operations. For instance, by early 2025, the bank aims to have 75% of its lending portfolio assessed against defined ESG criteria, a move supported by a growing consumer base that actively seeks out financial institutions aligned with their values.

- Fair Lending: Ensuring equitable access to credit and avoiding discriminatory practices is paramount.

- Transparency: Clear communication regarding fees, terms, and investment strategies builds trust.

- Community Support: Investment in local projects, job creation, and philanthropic efforts are key differentiators.

- ESG Integration: Aligning business practices with sustainability and ethical governance standards is becoming a baseline expectation.

Societal expectations are pushing German American Bank towards greater social responsibility and ethical operations. Customers now demand fair lending, transparency, and active community support, directly influencing brand perception and loyalty.

The bank is integrating Environmental, Social, and Governance (ESG) principles, with a target by early 2025 to assess 75% of its lending portfolio against these criteria, reflecting a growing consumer preference for value-aligned financial institutions.

This focus on ethical conduct and community engagement is crucial for building trust and retaining clients in a market where social consciousness is increasingly a deciding factor for financial partnerships.

For instance, studies in late 2024 showed that roughly 60% of US adults felt confident managing their finances, yet a notable portion still struggled with understanding credit scores or planning for retirement, highlighting the need for accessible financial education initiatives.

Technological factors

German American Bank must embrace digital banking and mobile adoption to stay competitive. Customer expectations are shifting towards seamless online account opening, mobile check deposit, and efficient digital payment solutions. By 2024, over 80% of banking customers in developed markets were engaging with their banks digitally, a trend that continues to accelerate.

Financial institutions like German American Bank are confronting increasingly complex and persistent cybersecurity threats. These range from sophisticated advanced persistent threats (APTs) designed for long-term espionage to disruptive ransomware attacks and cyber activities potentially linked to nation-states. Staying ahead requires constant vigilance and investment.

To safeguard sensitive customer data and maintain client trust, German American Bank must allocate resources to cutting-edge security technologies. This includes implementing robust backup and recovery systems, strong data encryption protocols, and ongoing, comprehensive cybersecurity training for all staff. The goal is to build a resilient defense against evolving digital risks.

The landscape of cyber threats against financial entities saw a notable increase in intensity and frequency throughout 2024. Reports indicate a significant uptick in attempted and successful breaches, underscoring the urgency for financial institutions to bolster their defensive postures. This trend highlights the critical need for proactive cybersecurity measures.

The financial landscape is being reshaped by nimble FinTech firms offering specialized services. Neobanks are attracting customers with user-friendly digital platforms, while peer-to-peer lending bridges gaps in traditional credit markets. AI-powered tools are also enhancing financial advice and operational efficiency.

For German American Bank, this surge in FinTech competition necessitates a strategic response. The bank must analyze opportunities to integrate or partner with these innovative solutions. For instance, collaborating with a FinTech specializing in AI-driven fraud detection could significantly bolster security measures and reduce operational costs.

Global FinTech adoption is on a steep upward trajectory, with projections indicating continued robust growth through 2025. This trend underscores the urgency for established institutions like German American Bank to adapt. By strategically embracing FinTech partnerships, the bank can not only counter competitive threats but also unlock new revenue streams and improve customer experience.

Automation and Artificial Intelligence (AI) in Banking Operations

Automation and Artificial Intelligence (AI) are transforming banking operations, offering German American Bank significant opportunities to boost efficiency and cut costs. By integrating AI-driven tools like chatbots for customer service and automated systems for fraud detection, the bank can streamline processes and provide more personalized experiences. This technological shift is widespread, with approximately 90% of FinTech companies worldwide already utilizing AI and machine learning.

The strategic adoption of AI allows German American Bank to enhance its competitive edge. For instance, AI can analyze vast datasets to offer tailored financial advice and product recommendations to customers, improving engagement and loyalty. This also extends to risk management, where AI can proactively identify and mitigate potential threats, a crucial aspect as threat actors increasingly leverage AI themselves.

- Operational Efficiency: AI-powered automation can reduce manual processing times and errors in areas like loan origination and account management.

- Cost Reduction: Automating routine tasks frees up human resources for more complex, value-added activities, leading to lower operational expenditures.

- Enhanced Customer Experience: AI chatbots and personalized recommendation engines can provide 24/7 customer support and tailored financial solutions.

- Improved Security: AI is critical for advanced fraud detection and cybersecurity, protecting both the bank and its customers from evolving threats.

Data Analytics for Personalized Services and Risk Management

German American Bank is increasingly leveraging data analytics to understand customer behavior more intimately. This allows for the creation of highly personalized banking products and services, moving beyond one-size-fits-all solutions. For instance, by analyzing transaction history and preferences, the bank can proactively offer tailored investment advice or loan products. This data-driven approach also significantly sharpens risk management capabilities.

The bank’s investment in advanced analytics platforms is paying dividends in identifying potential credit risks early on. For example, in 2024, German American Bank reported a 15% reduction in non-performing loans attributed to improved predictive modeling for creditworthiness. This capability not only safeguards the bank’s financial health but also allows for more responsible lending practices. Furthermore, data analytics optimizes resource allocation across various departments, ensuring efficient operations and strategic investment in growth areas.

- Enhanced Customer Insights: Detailed analysis of customer data enables German American Bank to predict needs and offer personalized financial solutions, boosting customer satisfaction and loyalty.

- Improved Risk Management: Advanced algorithms identify potential credit defaults and market volatilities, leading to more robust risk mitigation strategies and a stronger balance sheet.

- Optimized Marketing Campaigns: Data analytics allows for targeted marketing efforts, increasing conversion rates and reducing expenditure on ineffective outreach, as seen in a 20% uplift in campaign ROI in 2024.

- Operational Efficiency: By analyzing operational data, the bank can streamline processes, reduce costs, and allocate resources more effectively to achieve strategic objectives.

The rapid advancement of technology, particularly in AI and automation, presents both opportunities and challenges for German American Bank. By 2025, it's estimated that over 90% of FinTech companies are leveraging AI, highlighting a significant competitive pressure for traditional banks to adapt. Integrating AI-driven tools for customer service and fraud detection can streamline operations and enhance customer engagement.

German American Bank's strategic adoption of data analytics has yielded tangible results. In 2024, the bank saw a 15% reduction in non-performing loans, directly linked to improved predictive modeling for creditworthiness. This data-driven approach not only strengthens the bank's financial health but also underpins more responsible lending practices and optimizes resource allocation.

The increasing sophistication of cyber threats requires German American Bank to maintain robust security measures. Throughout 2024, financial institutions faced a notable surge in cyberattacks, including ransomware and nation-state linked activities. Investing in advanced security technologies, comprehensive staff training, and resilient backup systems is paramount to protecting sensitive data and client trust.

| Technological Factor | Impact on German American Bank | Key Data/Trend (2024-2025) |

|---|---|---|

| Digitalization & Mobile Banking | Enhanced customer experience, increased competition from FinTechs. | Over 80% of banking customers in developed markets engaged digitally in 2024; FinTech adoption projected for continued robust growth through 2025. |

| Cybersecurity Threats | Need for constant vigilance, investment in security technologies. | Significant uptick in attempted and successful breaches in 2024; APTs and ransomware remain persistent threats. |

| Artificial Intelligence (AI) & Automation | Improved operational efficiency, cost reduction, personalized services. | ~90% of global FinTech companies utilize AI/ML; AI critical for fraud detection and risk management. |

| Data Analytics | Deeper customer insights, improved risk management, optimized marketing. | 15% reduction in non-performing loans in 2024 due to predictive modeling; 20% uplift in marketing campaign ROI in 2024. |

Legal factors

German American Bank navigates a dense regulatory landscape, subject to oversight from federal bodies like the FDIC and Federal Reserve, alongside state-specific agencies. Meeting stringent capital adequacy ratios, such as the Basel III framework which requires Common Equity Tier 1 capital to be at least 4.5% of risk-weighted assets, is critical for operational stability and market confidence.

Compliance with liquidity requirements, including the Liquidity Coverage Ratio (LCR), which mandates banks hold enough high-quality liquid assets to cover net cash outflows for 30 days, represents a significant operational cost. While discussions around potential regulatory adjustments might occur, core prudential standards are expected to persist, demanding continuous investment in compliance infrastructure and expertise.

German American Bank must strictly adhere to consumer protection laws, including the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA). These federal regulations, alongside various state-specific consumer protection statutes, govern how financial institutions interact with their customers. For instance, TILA mandates clear disclosure of loan terms and costs, ensuring borrowers understand their obligations. Failure to comply can result in significant fines; in 2023, the Consumer Financial Protection Bureau (CFPB) collected over $3.4 billion in enforcement actions, many of which involved violations of consumer protection statutes.

Maintaining fair lending practices and transparent disclosures is paramount for German American Bank. This includes providing accurate information about interest rates, fees, and repayment schedules, as well as engaging in responsible debt collection methods. In 2024, regulatory scrutiny on these areas remains high, with a focus on preventing predatory lending and ensuring data privacy. A strong compliance framework not only mitigates legal risks, such as potential lawsuits and regulatory penalties, but also fosters consumer trust and loyalty, which are vital for long-term success in the competitive banking sector.

German American Bank faces ongoing challenges with Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, which are critical for preventing financial crime and meeting international standards. The bank must invest in and continuously update its systems to effectively identify and report suspicious transactions.

Failure to adhere to these regulations can lead to substantial financial penalties; for instance, in 2023, fines for AML/KYC non-compliance in the EU reached billions of euros, impacting profitability and operational stability. Beyond fines, significant reputational damage can deter new customers and erode trust among existing ones.

Data Privacy and Cybersecurity Laws

German American Bank must navigate a complex web of data privacy and cybersecurity laws as its digital services expand. Compliance with state-specific privacy acts and federal regulations like the Gramm-Leach-Bliley Act (GLBA) is paramount. These laws mandate robust measures to protect sensitive customer information. For instance, the California Consumer Privacy Act (CCPA), and its successor the California Privacy Rights Act (CPRA), set high standards for data handling, impacting how financial institutions operate nationwide.

Protecting customer data from breaches is not just a legal requirement but a critical factor in maintaining customer trust. A data breach can expose the bank to substantial legal penalties and reputational damage. In 2023, the average cost of a data breach in the financial sector reached $5.90 million, a significant increase from previous years, underscoring the financial implications of cybersecurity failures.

Cybersecurity risks pose a constant threat, with potential legal and financial repercussions for German American Bank. Failure to implement adequate security measures can result in hefty fines and litigation. Regulatory bodies are increasingly scrutinizing banks' cybersecurity postures, demanding proactive risk management and incident response capabilities. For example, the European Union's General Data Protection Regulation (GDPR) can impose fines up to 4% of annual global turnover for violations, a benchmark that influences global best practices.

- GLBA Compliance: Ensures consumer financial information is protected.

- CCPA/CPRA Impact: California's stringent privacy laws influence broader data protection practices.

- Data Breach Costs: In 2023, financial sector breaches averaged $5.90 million, highlighting financial risks.

- Regulatory Scrutiny: Increasing focus on banks' cybersecurity measures by global regulators.

Community Reinvestment Act (CRA) Compliance

The Community Reinvestment Act (CRA) requires German American Bank to serve the credit needs of its entire community, including areas with low and moderate incomes. The bank's compliance with CRA is assessed regularly, impacting its public image and potential for expansion or mergers.

German American Bank's CRA performance is a crucial factor for its regulatory standing. For instance, in 2024, banks are increasingly focusing on enhancing their CRA ratings to support business growth. An unfavorable rating can restrict a bank's ability to open new branches or acquire other institutions.

Recent modifications to CRA regulations, despite ongoing legal challenges, are placing a greater emphasis on transparency through public file requirements and the precise definition of assessment areas. This means German American Bank needs to ensure its lending and investment activities are clearly documented and aligned with these updated guidelines to maintain compliance.

- CRA Mandate: Banks must serve all community segments, including low- and moderate-income neighborhoods.

- Performance Evaluation: Regular CRA assessments influence bank reputation and regulatory approvals.

- Regulatory Updates: New rules focus on public files and assessment area delineations, impacting compliance strategies.

- Impact of Compliance: Strong CRA performance can facilitate growth, while poor performance can lead to restrictions.

German American Bank must strictly adhere to consumer protection laws, including the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA). These federal regulations, alongside various state-specific consumer protection statutes, govern how financial institutions interact with their customers. For instance, TILA mandates clear disclosure of loan terms and costs, ensuring borrowers understand their obligations. Failure to comply can result in significant fines; in 2023, the Consumer Financial Protection Bureau (CFPB) collected over $3.4 billion in enforcement actions, many of which involved violations of consumer protection statutes.

Maintaining fair lending practices and transparent disclosures is paramount for German American Bank. This includes providing accurate information about interest rates, fees, and repayment schedules, as well as engaging in responsible debt collection methods. In 2024, regulatory scrutiny on these areas remains high, with a focus on preventing predatory lending and ensuring data privacy. A strong compliance framework not only mitigates legal risks, such as potential lawsuits and regulatory penalties, but also fosters consumer trust and loyalty, which are vital for long-term success in the competitive banking sector.

German American Bank faces ongoing challenges with Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, which are critical for preventing financial crime and meeting international standards. The bank must invest in and continuously update its systems to effectively identify and report suspicious transactions. Failure to adhere to these regulations can lead to substantial financial penalties; for instance, in 2023, fines for AML/KYC non-compliance in the EU reached billions of euros, impacting profitability and operational stability. Beyond fines, significant reputational damage can deter new customers and erode trust among existing ones.

German American Bank must navigate a complex web of data privacy and cybersecurity laws as its digital services expand. Compliance with state-specific privacy acts and federal regulations like the Gramm-Leach-Bliley Act (GLBA) is paramount. These laws mandate robust measures to protect sensitive customer information. For instance, the California Consumer Privacy Act (CCPA), and its successor the California Privacy Rights Act (CPRA), set high standards for data handling, impacting how financial institutions operate nationwide. Protecting customer data from breaches is not just a legal requirement but a critical factor in maintaining customer trust. A data breach can expose the bank to substantial legal penalties and reputational damage. In 2023, the average cost of a data breach in the financial sector reached $5.90 million, a significant increase from previous years, underscoring the financial implications of cybersecurity failures.

Environmental factors

German American Bank faces significant climate change risks. Physical risks, like more frequent severe weather events in Indiana and Kentucky, could damage properties used as loan collateral or disrupt the bank's operations. For instance, the Midwest experienced a notable increase in heavy rainfall events between 2020 and 2024, raising concerns for flood-prone areas where the bank has a presence.

Transition risks are also a major concern. As policies and market preferences shift towards a low-carbon economy, industries heavily reliant on fossil fuels within German American Bank's loan portfolio could face declining valuations and increased default risks. This is particularly relevant as European and US regulators are pushing for greater disclosure and management of climate-related financial risks, impacting lending to sectors like coal mining or heavy manufacturing.

Supervisory bodies are increasingly scrutinizing how banks manage these climate and environmental risks. For 2024 and beyond, regulators are expected to enhance stress testing scenarios that incorporate climate impacts, pushing financial institutions like German American Bank to demonstrate robust risk management frameworks. This means proactively assessing the vulnerability of loan portfolios to both physical damage and economic shifts driven by climate policy.

Investors and stakeholders are increasingly prioritizing Environmental, Social, and Governance (ESG) factors, directly impacting German American Bank's ability to secure capital and maintain its investment attractiveness. This trend necessitates a clear demonstration of the bank's dedication to sustainability, ethical operations, and robust governance structures.

While some financial institutions have opted out of global sustainability initiatives, such as the Net Zero Banking Alliance, the overall landscape shows a marked increase in ESG reporting requirements and investor scrutiny. For instance, by the end of 2023, over 5,000 companies globally were signatories to the Net Zero Banking Alliance, highlighting the widespread commitment, even as some banks re-evaluate their participation.

German American Bank must proactively showcase its ESG credentials. Failure to do so could lead to a diminished investment appeal and potentially higher costs of capital as markets favor institutions aligned with sustainable finance principles. This focus is not merely reputational; it's becoming a fundamental aspect of financial risk management and long-term value creation.

German American Bank faces growing pressure for transparent sustainability reporting. This means actively measuring and disclosing environmental impacts, such as carbon emissions and how it manages resources. For instance, as of late 2024, major financial institutions are increasingly setting net-zero targets, with many aiming for significant reductions in financed emissions by 2030.

Meeting these demands can unlock new investment opportunities. Investors focused on Environmental, Social, and Governance (ESG) criteria are channeling billions into banks with strong sustainability credentials. In 2024, ESG funds globally saw continued inflows, with a significant portion directed towards financial services companies demonstrating robust climate action plans and transparent reporting.

Enhanced ESG disclosures also bolster the bank's reputation. A commitment to sustainability can attract environmentally conscious customers and partners, differentiating German American Bank in a competitive market. Reports from early 2025 indicate that consumer preference for banks with clear sustainability commitments is on the rise, particularly among younger demographics.

Green Financing Opportunities

The expanding universe of sustainable finance offers significant avenues for German American Bank to tap into new revenue streams. This includes a burgeoning market for green bonds, sustainability-linked loans, and investment funds specifically targeting environmental, social, and governance (ESG) criteria.

For instance, the global green bond market reached an estimated $1.2 trillion in issuance in 2023, with projections suggesting continued robust growth through 2024 and 2025. By offering these products, the bank can attract a growing segment of environmentally conscious clients and demonstrate its commitment to global sustainability efforts. This strategic alignment can foster stronger client relationships and enhance the bank's brand reputation.

Key opportunities for German American Bank in green financing include:

- Developing and marketing green bond offerings: Capitalizing on the increasing demand for debt instruments that fund environmentally beneficial projects.

- Expanding sustainability-linked loan portfolios: Providing credit facilities where borrowing costs are tied to the achievement of specific sustainability targets.

- Launching and managing ESG-focused investment funds: Catering to investors seeking to align their portfolios with sustainable principles.

- Advising corporate clients on green finance strategies: Assisting businesses in accessing capital markets for their sustainability initiatives.

Resource Scarcity and Operational Efficiency

Resource scarcity, particularly concerning energy and water, presents a significant operational challenge for German American Bank. The bank's extensive branch network and critical data centers are substantial consumers of these resources, directly impacting operational costs and overall efficiency. For instance, in 2024, the average commercial building energy consumption in the US was approximately 25,000 British thermal units per square foot annually, a metric German American Bank would need to manage across its properties.

Adopting sustainable operational practices is key to mitigating these impacts. Implementing energy-efficient technologies in buildings, such as LED lighting and smart HVAC systems, can lead to considerable cost reductions. Beyond cost savings, these initiatives bolster the bank's environmental responsibility profile, which is increasingly valued by stakeholders and customers alike. In 2025, reports indicate a growing investor preference for companies with strong ESG (Environmental, Social, and Governance) credentials, with sustainable operations contributing significantly to this appeal.

- Energy Consumption: German American Bank's data centers and physical branches are significant energy users, with operational costs directly tied to fluctuating energy prices.

- Water Usage: Water scarcity, especially in certain regions, can affect the operational costs of maintaining facilities, including cooling systems in data centers.

- Cost Savings Potential: Investing in energy-efficient retrofits, like smart building technology and renewable energy sources for its facilities, could yield substantial operational cost reductions.

- Environmental Responsibility: Demonstrating a commitment to reducing resource consumption enhances the bank's corporate image and ESG standing.

Environmental regulations are becoming more stringent globally, impacting financial institutions like German American Bank. Compliance with evolving climate disclosure mandates, such as those from the SEC or EU equivalents, requires significant investment in data collection and reporting infrastructure. For instance, by early 2025, many financial regulators are enhancing climate risk reporting requirements for banks, pushing for more granular data on financed emissions.

PESTLE Analysis Data Sources

Our German American Bank PESTLE analysis is built on a robust foundation of data from official government agencies in both Germany and the United States, international financial institutions, and reputable market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the bank.