German American Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

German American Bank Bundle

German American Bank navigates a landscape shaped by intense rivalry, where product differentiation and customer loyalty are key battlegrounds.

The threat of new entrants is moderate, as regulatory hurdles and capital requirements present significant barriers to entry in the banking sector.

Buyer power is substantial, with customers easily switching between financial institutions for better rates and services.

Suppliers, primarily technology providers and data services, hold some leverage due to the specialized nature of their offerings.

The threat of substitutes, though present in fintech solutions, is currently limited for core banking services.

The complete report reveals the real forces shaping German American Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

German American Bancorp, like many financial institutions, depends heavily on specialized technology and software. This includes everything from the core banking platforms that manage daily transactions to crucial cybersecurity solutions protecting sensitive data. The highly technical and often proprietary nature of these services concentrates power in the hands of a limited number of vendors.

The critical importance of these systems to a bank's operations means that switching providers can be a costly and complex undertaking. This reliance gives technology and software suppliers significant leverage. For instance, in 2023, the average cost for a financial institution to upgrade its core banking system could range from tens of millions to hundreds of millions of dollars, reflecting the substantial investment and vendor dependency.

Consequently, these providers can influence pricing, contract terms, and the pace of technological adoption for German American Bancorp. Their ability to dictate terms can directly impact the bank's operational costs and its capacity to innovate in a rapidly evolving digital landscape.

The bargaining power of suppliers, when considering human capital for German American Bank, is significantly influenced by the availability of skilled employees. In 2024, the demand for expertise in areas such as cybersecurity, data analytics, and digital banking solutions remains exceptionally high across the financial industry. This scarcity directly translates into higher salary expectations and more competitive benefit packages, impacting the bank's operational expenses.

Competition for top talent in the financial sector, especially within regional markets where German American Bank operates like Indiana and Kentucky, further amplifies this bargaining power. For instance, in 2023, the average salary for experienced IT professionals in the Midwest saw an increase of approximately 5-7%, reflecting the intense competition. This upward pressure on labor costs can strain recruitment budgets and necessitate innovative retention strategies to maintain service quality and operational efficiency.

German American Bank, while largely funded by customer deposits, also taps into wholesale funding markets and interbank lending to manage its liquidity. The bargaining power of liquidity providers in these wholesale markets is a key consideration. For instance, in early 2024, the cost of wholesale funding saw fluctuations influenced by central bank policy shifts and overall market sentiment, directly impacting banks’ borrowing costs.

Data and Information Services

The bargaining power of suppliers in the data and information services sector for German banks, including German American Bank, is significant. Access to accurate, timely financial data, credit reporting, and market intelligence is not just helpful; it's absolutely vital for risk assessment, meeting regulatory compliance, and making smart strategic choices. Without reliable data, a bank can't effectively gauge creditworthiness, monitor market trends, or even operate legally.

This reliance grants considerable leverage to data providers, especially those offering proprietary or highly specialized information that banks cannot easily replicate or substitute. For instance, major financial data terminals like Bloomberg and Refinitiv are almost indispensable for many financial institutions, giving them substantial pricing power. In 2024, the global market for financial data and analytics was valued at over $35 billion, with a significant portion attributed to essential data services that banks depend on.

- High Switching Costs: Banks often invest heavily in integrating data services into their existing systems, making it costly and disruptive to switch providers.

- Proprietary Data: Many data and information service providers possess unique datasets or analytical tools that are not available elsewhere, creating a unique selling proposition.

- Concentration of Providers: The market for certain types of financial data can be concentrated among a few key players, limiting competitive alternatives for banks.

- Regulatory Mandates: Sometimes, regulatory requirements necessitate the use of specific data sources or reporting formats, further strengthening the position of those providers.

Regulatory Compliance Vendors

Regulatory compliance vendors hold significant bargaining power, especially for financial institutions like German American Bank. The ever-changing global regulatory environment, including stringent anti-money laundering (AML) and know-your-customer (KYC) requirements, means banks cannot afford non-compliance. This dependence gives specialized vendors a strong negotiating position.

The complexity and critical nature of regulatory adherence, particularly in areas like data privacy (e.g., GDPR) and financial crime prevention, create high switching costs for banks. Vendors providing essential compliance software and services often have deep integration into a bank's operations. For instance, in 2024, the global RegTech market was projected to reach over $13.5 billion, indicating substantial investment and reliance on these specialized providers.

- High Dependence: Banks require specialized software for AML, KYC, and fraud detection, making them reliant on compliant vendors.

- Switching Costs: Integrating new compliance systems is time-consuming and expensive, deterring banks from easily changing providers.

- Risk of Non-Compliance: Failure to meet regulatory standards can result in severe penalties, increasing the perceived value of reliable compliance vendors.

- Evolving Regulations: Continuous updates to regulations necessitate ongoing support and upgrades from vendors, solidifying their position.

The bargaining power of suppliers for German American Bank is notably strong in areas demanding specialized expertise and technology. Critical dependencies on core banking software, cybersecurity solutions, and data analytics platforms mean a few vendors hold significant sway. This leverage is amplified by the substantial costs and complexity involved in switching providers, a reality underscored by the multi-million dollar investments required for core system upgrades, a common scenario in 2023.

Human capital is another area where supplier power is evident. The intense competition for skilled professionals in fields like data analytics and digital banking, particularly in regions like Indiana and Kentucky where German American Bank operates, drives up labor costs. In 2023, Midwest IT professionals saw salary increases of 5-7%, reflecting this competitive talent market and increasing operational expenses for banks.

Furthermore, providers of essential financial data and regulatory compliance services wield considerable influence. Banks rely heavily on these entities for risk assessment, market intelligence, and adherence to complex regulations like AML and KYC. The global RegTech market, projected to exceed $13.5 billion in 2024, highlights the significant investment and dependence on these specialized vendors, whose services are critical for avoiding severe penalties.

What is included in the product

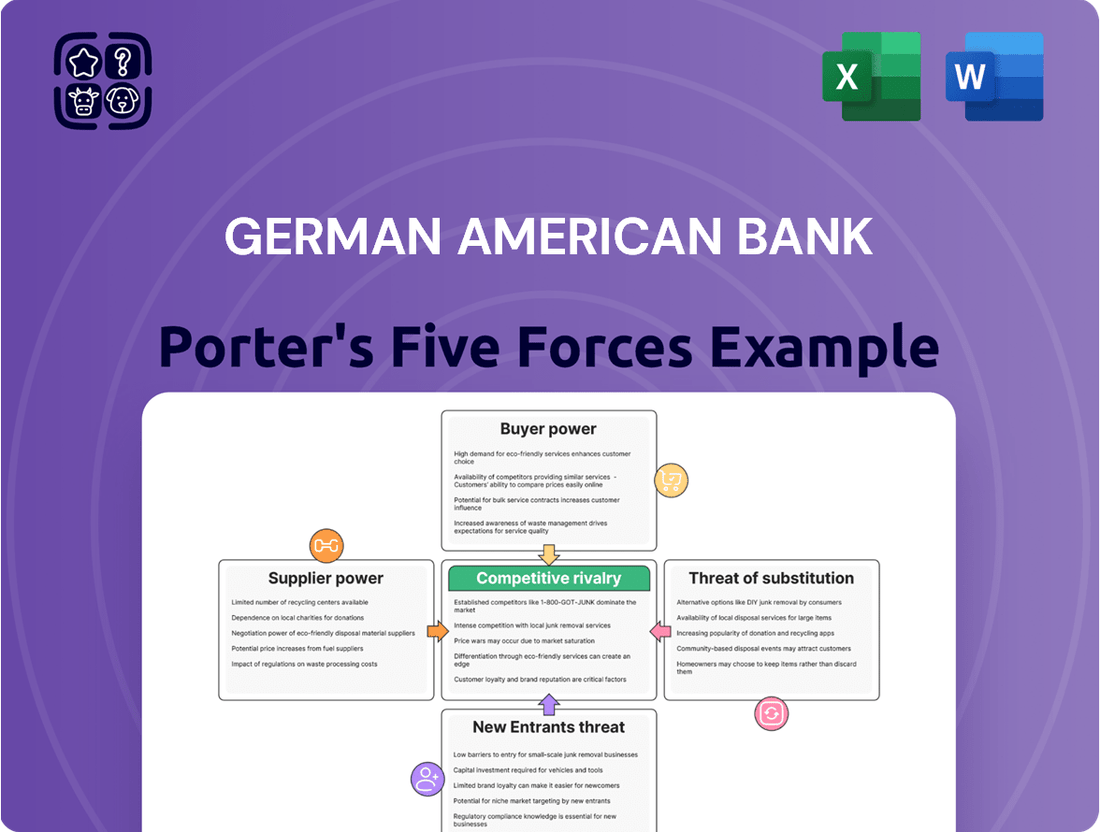

Tailored exclusively for German American Bank, this analysis dissects the intensity of rivalry, buyer and supplier power, the threat of new entrants and substitutes, providing strategic insights into its competitive positioning.

Effortlessly visualize competitive intensity with a dynamic spider chart, translating complex Five Forces data into actionable strategic insights for the German American Bank.

Customers Bargaining Power

Depositors, both individuals and businesses, wield considerable bargaining power. This strength stems from the increasing ease with which they can switch banking institutions, a trend amplified by digital banking advancements and the constant competition for favorable interest rates. For instance, in early 2024, the average interest rate on savings accounts saw a notable increase, prompting depositors to actively seek the best returns.

German American Bancorp, like other financial institutions, must actively cultivate and maintain a compelling value proposition to secure and retain these crucial deposits. This involves offering competitive interest rates, ensuring seamless and convenient banking services, and building a robust reputation for trust and reliability. The bank's ability to attract and hold deposits directly influences its cost of funds and overall financial stability.

Borrowers, whether individuals seeking mortgages or businesses needing commercial loans, possess significant bargaining power. They can easily compare rates and terms from various financial institutions, pushing German American Bancorp to offer competitive loan products and streamlined application processes to attract and retain them. In 2023, the average interest rate for a 30-year fixed-rate mortgage in the US hovered around 6.8%, illustrating the competitive landscape borrowers navigate.

Wealth management clients, particularly high-net-worth individuals and institutional investors, wield significant bargaining power. The sheer volume of assets they control allows them to negotiate favorable terms on fees and service packages. In 2024, the wealth management industry saw continued competition, with firms actively seeking to attract and retain these valuable clients by offering customized solutions and competitive pricing structures.

The availability of a wide array of wealth management providers, from large national banks to niche independent advisors and digital investment platforms, amplifies client leverage. This competitive landscape means clients can easily switch providers if their expectations regarding fees, investment performance, or service quality are not met. For instance, a 2023 survey indicated that over 60% of affluent investors would consider moving their assets if dissatisfied with their current advisor's fee structure.

Insurance Policyholders

The bargaining power of customers, specifically insurance policyholders, presents a significant force for German American Bancorp. Individuals looking for property and casualty insurance have a wide array of choices, easily comparing policies and premiums across numerous local, regional, and national providers. This easy comparability directly pressures German American Bancorp's insurance operations to maintain competitive pricing and robust coverage options to attract and retain clients.

This competitive landscape means policyholders can readily switch providers if they find better value elsewhere. For instance, in 2024, the average annual premium for a standard auto insurance policy in the U.S. hovered around $1,700, with significant variations based on coverage and location, highlighting the price-sensitive nature of this market for consumers.

- High customer price sensitivity: Policyholders actively shop around for the best rates.

- Availability of substitutes: A broad range of insurance companies offer similar products.

- Low switching costs: It is generally easy and inexpensive for customers to change insurers.

- Informed customer base: Online comparison tools empower customers with readily available information.

Digital Sophistication and Expectations

Customers today are incredibly digitally savvy. This means they expect a smooth, intuitive experience whether they're banking on their phone or computer. For German American Bancorp, this translates directly into increased bargaining power.

If a bank's digital offerings lag behind competitors, customers have more options and are more likely to switch. For instance, in 2023, the financial services industry saw significant investment in digital transformation, with many institutions prioritizing enhanced mobile app functionality and personalized online experiences to retain and attract customers.

- Digital Reliance: Customer dependence on digital platforms for banking services is at an all-time high.

- Expectation of Seamlessness: Consumers demand effortless online and mobile interactions.

- Competitive Landscape: Superior digital capabilities are a key differentiator, giving customers more choice.

- Investment Imperative: German American Bancorp must consistently upgrade its technology to meet these evolving demands and avoid losing clients.

Customers, encompassing depositors, borrowers, and insurance policyholders, possess substantial bargaining power. This influence is magnified by the ease of switching providers, driven by digital advancements and a competitive marketplace offering favorable rates and services. For example, in early 2024, increased savings account interest rates prompted depositors to actively seek better returns, demonstrating their price sensitivity.

The digital landscape further empowers customers, as they expect seamless online and mobile experiences, making superior digital capabilities a key differentiator. German American Bancorp must continually invest in technology to meet these evolving demands and retain clients, as a 2023 survey showed over 60% of affluent investors would switch advisors for better fee structures.

| Customer Segment | Bargaining Power Driver | Example Impact (2023-2024 Data) |

|---|---|---|

| Depositors | Ease of switching, competitive rates | Savings account rates increased, driving deposit shifts. |

| Borrowers | Rate comparison, streamlined processes | 30-year mortgage rates around 6.8% in 2023 created a competitive environment. |

| Insurance Policyholders | Availability of substitutes, low switching costs | Auto insurance premiums averaged ~$1,700 annually in 2024, with significant price variation. |

| Wealth Management Clients | Volume of assets, demand for customization | Continued industry competition for high-net-worth individuals. |

Preview Before You Purchase

German American Bank Porter's Five Forces Analysis

This preview displays the identical, comprehensive German American Bank Porter's Five Forces Analysis you will receive upon purchase, ensuring full transparency. You're looking at the actual document, meticulously detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products for German American Bank. Once your purchase is complete, you'll gain instant access to this exact, professionally formatted file, ready for immediate application. What you see here is precisely what you get—a complete, ready-to-use strategic assessment without any hidden elements or placeholders.

Rivalry Among Competitors

German American Bancorp contends with a significant number of community and regional banks across Indiana and Kentucky. These institutions often leverage deep-rooted local connections and offer comparable service portfolios, intensifying the rivalry for customer acquisition and deposit growth. For instance, as of the first quarter of 2024, the U.S. banking industry saw over 4,000 community banks actively serving local markets, many of which operate within German American's core geographies.

Large national and super-regional banks present a formidable competitive challenge. These institutions, boasting substantial financial muscle and widespread brand recognition, can offer a more extensive suite of products and services than many smaller competitors. For instance, by the end of 2023, the top five U.S. banks held over $10 trillion in total assets, demonstrating their immense scale.

Their sheer size enables significant investment in cutting-edge technology and sophisticated marketing campaigns. This allows them to attract and retain customers by offering seamless digital experiences and competitive pricing, potentially siphoning market share from regional banks that may lack similar resources. The ability to leverage economies of scale in areas like IT infrastructure and compliance further strengthens their competitive position.

Credit unions present a significant competitive threat to German American Bank. These member-owned cooperatives often provide more favorable interest rates on loans and higher yields on deposits, directly impacting a bank's profitability on these core services. For example, in 2024, credit unions across the US continued to attract a growing membership base, often by emphasizing lower fees and a community-centric ethos that resonates with many consumers.

Their competitive edge often lies in their not-for-profit status, allowing them to pass cost savings onto their members through better pricing. This can be particularly impactful in local markets where credit unions have a strong presence, directly challenging German American Bank's customer acquisition and retention efforts. In 2023, the credit union industry saw continued growth in assets and membership, indicating their persistent strength as local competitors.

Fintech Companies and Digital-Only Banks

Fintech companies and digital-only banks are significantly intensifying competition for German American Bank. These agile players, often unburdened by legacy systems, are rapidly capturing market share in areas like payments, lending, and wealth management through innovative digital platforms and user-centric experiences. For instance, in 2024, the European fintech sector continued its robust growth, with digital payment solutions becoming increasingly mainstream, impacting traditional transaction revenues.

These disruptors are compelling incumbent banks to accelerate their digital transformation efforts. German American Bank faces pressure to enhance its mobile banking capabilities, streamline online onboarding processes, and offer more competitive digital lending products to retain customers. The digital-only banking segment, in particular, has seen substantial customer acquisition in recent years, with some neobanks reporting millions of users across Europe by mid-2024, directly challenging traditional banking models.

- Increased Competition: Fintechs and digital-only banks offer specialized, often cheaper, and more convenient services, directly siphoning customers from traditional banks.

- Digital Innovation Pressure: Incumbents must invest heavily in technology to match the seamless digital experiences provided by new entrants.

- Segment Disruption: Key banking functions such as payments, loans, and investments are being chipped away by specialized fintech solutions.

- Customer Expectations: The rise of these new players has fundamentally shifted customer expectations towards digital-first, personalized financial services.

Non-Bank Financial Service Providers

German American Bancorp faces intense competition from specialized non-bank financial service providers. These entities, including dedicated lenders, investment management firms, and insurance brokers, often target specific customer segments or financial product lines, fragmenting the market.

This unbundling strategy allows these competitors to offer highly tailored solutions, potentially at more attractive terms than a full-service bank. For instance, the rise of fintech lenders in 2024 has significantly disrupted traditional lending models, offering faster approvals and competitive rates for personal and small business loans. In 2023, the alternative lending market in the US alone was estimated to be worth over $200 billion, showcasing the scale of this competition.

- Specialized Lenders: Companies focusing solely on areas like mortgage origination or equipment financing can achieve greater efficiency and expertise.

- Investment Firms: Asset managers and wealth management firms directly compete for customer assets that might otherwise be held in bank deposits or managed by the bank's own investment arm.

- Insurance Brokers: Independent brokers offer a range of insurance products, capturing revenue that could be generated through a bank's insurance subsidiaries.

- Fintech Disruptors: Digital-first companies are increasingly offering payment processing, lending, and even deposit-like services, challenging traditional banking models.

German American Bancorp operates in a highly competitive environment, facing pressure from a diverse set of financial institutions. This includes numerous community banks that leverage local relationships, large national banks with significant scale, and member-focused credit unions often offering more attractive rates. Additionally, the rapid growth of fintech companies and specialized non-bank financial providers further intensifies this rivalry by offering innovative digital solutions and niche services, compelling traditional banks to adapt quickly.

| Competitor Type | Key Characteristics | Competitive Impact on German American Bank | Illustrative Data Point (2023-2024) |

|---|---|---|---|

| Community Banks | Deep local ties, comparable services | Direct competition for deposits and loans in core markets | Over 4,000 community banks active in U.S. markets (Q1 2024) |

| Large National Banks | Vast financial resources, broad product offerings, strong brand | Ability to invest heavily in technology and marketing, economies of scale | Top 5 U.S. banks held > $10 trillion in assets (End of 2023) |

| Credit Unions | Member-owned, often lower fees/better rates, community focus | Directly challenge deposit and lending profitability | Continued growth in membership and assets (2023) |

| Fintechs/Digital Banks | Agile, innovative digital platforms, user-centric experiences | Disrupting payments, lending, and wealth management; driving digital transformation | European fintech sector continued robust growth; digital payments mainstream (2024) |

| Specialized Non-Banks | Targeted product/segment focus, tailored solutions | Fragmenting market, offering competitive rates in specific areas like lending | U.S. alternative lending market estimated > $200 billion (2023) |

SSubstitutes Threaten

Digital payment platforms like PayPal and Venmo present a significant threat by offering user-friendly alternatives for everyday transactions, reducing reliance on traditional banking services. These services processed over $1.5 trillion globally in 2023, demonstrating their widespread adoption. Their convenience and often lower transaction fees for consumers can divert significant transaction volume away from banks.

The ease of peer-to-peer payments and online purchases through these platforms directly competes with core banking functions, potentially diminishing customer loyalty to traditional institutions. As of early 2024, mobile payment adoption in Germany was reported to be around 60% of smartphone users, highlighting the growing market for these substitute services.

Peer-to-peer (P2P) lending and crowdfunding platforms present a growing threat by offering alternative avenues for individuals and small businesses to secure capital, bypassing traditional bank loan processes. These platforms provide diverse funding structures and often faster access to funds, directly impacting German American Bank's traditional lending business.

In 2024, the P2P lending market continued its expansion, with platforms facilitating billions in loans globally. For instance, established P2P platforms in Europe saw a consistent year-over-year growth in loan origination volume, indicating a sustained shift in borrower behavior. This trend suggests that a significant portion of potential loan customers may opt for these digital alternatives, reducing the bank's market share in certain lending segments.

Online investment platforms and robo-advisors present a significant threat of substitution for German American Bank's traditional wealth management services. These digital solutions, offering lower fees and greater accessibility, directly compete for clients seeking investment management. For instance, robo-advisors often charge annual management fees around 0.25%, a stark contrast to the 1-2% typically seen with human advisors.

The rise of these platforms democratizes investment advice, making it affordable for a broader client base. This directly challenges the bank's fee-based wealth management model by providing a cost-effective alternative. As of early 2024, the assets under management for robo-advisors in the US alone were projected to exceed $2 trillion, highlighting the scale of this competitive force.

Direct-to-Consumer Insurance Providers

German American Bancorp's insurance offerings encounter substitution threats from a growing number of online-only insurance providers and large national direct insurers. These digital-first entities frequently present more aggressive pricing and simplified online application and management processes, which can draw customers seeking convenience and cost savings away from established, agency-based models.

For instance, the direct-to-consumer insurance market has seen significant growth, with companies like Lemonade and Root Insurance leveraging technology to offer personalized policies and rapid claims processing. In 2023, Lemonade reported a 44% increase in gross earned premiums compared to 2022, highlighting the appeal of their digital-native approach.

- Online-only insurers often boast lower overhead costs, enabling them to offer more competitive premiums.

- Streamlined digital platforms provide a user-friendly experience for policy comparison, purchase, and management.

- Direct insurers can leverage data analytics for more precise risk assessment and personalized pricing.

- The convenience of 24/7 online access appeals to a broad customer base, particularly younger demographics.

Cryptocurrencies and Digital Assets

The rise of cryptocurrencies and other digital assets presents a growing threat of substitutes for traditional banking services. These emerging technologies offer alternative ways to store value and conduct transactions, potentially bypassing conventional financial institutions. For instance, decentralized finance (DeFi) platforms are increasingly offering services like lending and borrowing without intermediaries.

The market capitalization of cryptocurrencies, while volatile, demonstrates their growing adoption. As of early 2024, the total market cap for all cryptocurrencies hovered around $1.5 trillion, indicating a significant pool of value outside traditional systems. This trend suggests a potential long-term shift in how individuals and businesses manage their assets.

- Growing Adoption: The total market capitalization of cryptocurrencies reached approximately $1.5 trillion in early 2024.

- DeFi Evolution: Decentralized finance platforms are offering a widening array of financial services, challenging traditional models.

- Store of Value: Digital assets like Bitcoin are increasingly viewed by some investors as a hedge against inflation, similar to gold.

- Transaction Alternatives: Cryptocurrencies provide a means for cross-border payments that can be faster and cheaper than traditional methods.

The threat of substitutes for German American Bank is substantial, stemming from digital payment platforms, P2P lending, online investment services, direct insurers, and cryptocurrencies. These alternatives offer convenience, lower costs, and increased accessibility, directly challenging the bank's core offerings and customer relationships.

Digital payment platforms like PayPal processed over $1.5 trillion globally in 2023, while mobile payment adoption in Germany reached about 60% of smartphone users by early 2024. Robo-advisors, charging around 0.25% annually, manage over $2 trillion in assets in the US alone. The cryptocurrency market cap was near $1.5 trillion in early 2024, illustrating the scale of these disruptive forces.

| Substitute Type | Key Offering | Customer Benefit | Market Indicator (Early 2024 Data) |

| Digital Payments | Convenient transactions, lower fees | Ease of use, cost savings | $1.5T+ global transaction volume (2023) |

| P2P Lending | Alternative capital access | Faster funding, diverse structures | Billions in global loan origination |

| Online Investments | Accessible wealth management | Lower fees, broader client reach | $2T+ AUM for US robo-advisors |

| Direct Insurers | Streamlined insurance | Competitive pricing, digital management | 44% premium growth for Lemonade (2023) |

| Cryptocurrencies | Alternative store of value/transactions | Potential inflation hedge, faster payments | ~$1.5T total market cap |

Entrants Threaten

Establishing a new bank in Germany, or indeed most developed economies, necessitates significant capital. For instance, under the Capital Requirements Regulation (CRR) and Capital Requirements Directive (CRD) framework, banks are subject to strict capital ratios, with Common Equity Tier 1 (CET1) capital often needing to be around 4.5% of risk-weighted assets, but supervisory expectations frequently push this much higher, potentially exceeding 10% for many institutions. This alone represents a substantial financial hurdle.

Beyond capital, the regulatory landscape is exceptionally complex. Obtaining a banking license from the German Federal Financial Supervisory Authority (BaFin) and the European Central Bank (ECB) involves rigorous vetting of business plans, management suitability, and risk management systems. This process can take years and involves extensive documentation and legal costs, effectively acting as a significant deterrent for many aspiring entrants.

Furthermore, compliance with ongoing regulations, such as those related to Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures, requires substantial investment in technology and personnel. In 2024, the cost of regulatory compliance for even established banks continues to rise, making it an even more formidable challenge for new players attempting to enter the market.

German American Bancorp has cultivated deep-rooted brand recognition and customer trust over many years, a significant barrier for new entrants. For instance, by the end of 2023, German American Bancorp reported total assets of $6.4 billion, demonstrating its substantial presence and established customer base. Newcomers struggle to replicate this level of credibility and loyalty, making it difficult to attract and retain customers from long-standing relationships.

The significant expense associated with establishing and maintaining robust technological infrastructure presents a substantial hurdle for potential new entrants into the banking sector. This includes the immense cost of core banking systems, advanced digital customer interfaces, and sophisticated cybersecurity measures, all of which are critical for operation and regulatory compliance.

For instance, in 2024, major banks continued to invest billions in digital transformation and cloud migration, with estimates suggesting that a significant portion of IT budgets are allocated to modernizing legacy systems. This high capital outlay effectively deters smaller or less-funded entities from entering the market, as they would struggle to match the technological capabilities of established players.

Customer Acquisition Challenges

The threat of new entrants for German American Bank is amplified by the significant hurdles in customer acquisition. Even with competitive offerings, new banks face substantial costs and time investments to build a meaningful customer base. For instance, a new entrant might spend millions on marketing campaigns and establishing a physical or robust digital presence to even begin matching the established reach of incumbent institutions like German American Bank.

This challenge is directly linked to the high capital requirements for building brand recognition and trust. Marketing expenses alone can be a major barrier. Consider that in 2024, the average customer acquisition cost (CAC) in the financial services sector, particularly for digital-first banks, has been reported to be in the hundreds of dollars, making it a significant hurdle for any new player attempting to gain market share.

Furthermore, new entrants must contend with the established customer relationships and loyalty that German American Bank and its peers have cultivated over years, if not decades. Overcoming this ingrained trust requires not just superior products but also extensive and expensive efforts in community outreach, digital engagement, and potentially offering more attractive introductory rates or bonuses, all of which add to the initial cost burden.

- High Marketing Costs: New banks face substantial marketing expenditures to build brand awareness and attract customers.

- Branch Network Investment: Establishing a physical presence, even if limited, requires significant capital outlay.

- Digital Outreach Expenses: Developing and maintaining a competitive digital platform and acquiring users online is costly.

- Customer Relationship Barriers: Entrenched customer loyalty with existing banks makes it difficult for new entrants to gain traction.

Talent Acquisition and Retention

The intense competition for experienced financial professionals presents a substantial barrier for new entrants. Staffing a new financial institution with seasoned individuals in banking, wealth management, and insurance is a significant challenge, especially in a tight labor market. In 2024, the financial services sector continued to see high demand for specialized roles.

The battle for top talent, particularly in specialized areas like cybersecurity, fintech integration, and complex financial modeling, can deter new banks. Many established institutions offer attractive compensation packages and robust career development programs, making it difficult for newcomers to compete. For instance, in 2024, average salaries for experienced financial analysts in major German financial hubs often exceeded €70,000 annually, with bonuses adding significantly to total compensation.

- High Demand for Niche Skills: Areas like data analytics, AI in finance, and compliance are particularly competitive.

- Established Employer Brands: Existing banks leverage their reputation to attract and retain talent.

- Compensation and Benefits: New entrants may struggle to match the comprehensive packages offered by incumbents.

- Talent Mobility: Professionals often move between established firms rather than joining entirely new ones.

The threat of new entrants for German American Bank is notably low due to the immense capital requirements and stringent regulatory environment in the German banking sector. Obtaining a banking license from BaFin and the ECB is a complex, lengthy, and costly process, demanding significant investment in compliance and robust risk management systems. For example, in 2024, the cost of regulatory adherence for financial institutions continued its upward trend, making it a formidable barrier for any aspiring new players seeking to enter the market.

Beyond capital and regulations, the established brand loyalty and deep customer relationships cultivated by incumbent banks like German American Bancorp present a significant challenge for newcomers. Replicating this trust and customer base requires substantial investment in marketing, digital outreach, and competitive product offerings, making customer acquisition a costly and time-consuming endeavor. By the close of 2023, German American Bancorp's substantial asset base of $6.4 billion underscored the scale of established market presence that new entrants must overcome.

The high cost of technological infrastructure and the intense competition for specialized talent further dampen the threat of new entrants. New banks must invest heavily in core banking systems, cybersecurity, and digital platforms, often struggling to match the capabilities of established players. In 2024, the financial services industry saw continued high demand for skilled professionals, with average salaries for experienced financial analysts in major German cities exceeding €70,000 annually, plus bonuses, making it difficult for new entities to attract and retain crucial expertise.

| Barrier | Description | Estimated Cost/Impact (2024) |

| Capital Requirements | Meeting CET1 ratios and other regulatory capital needs. | Often exceeding 10% of risk-weighted assets for CET1, with substantial initial investment. |

| Regulatory Compliance | Obtaining licenses, AML/KYC adherence, ongoing reporting. | Years of legal costs and extensive documentation; rising compliance costs for all banks. |

| Brand Recognition & Trust | Building customer loyalty and a strong reputation. | Millions in marketing; overcoming entrenched relationships. |

| Technology Infrastructure | Core banking systems, digital interfaces, cybersecurity. | Billions invested by major banks in digital transformation and modernization. |

| Talent Acquisition | Hiring experienced financial professionals. | Salaries for experienced analysts > €70,000 annually plus bonuses in major hubs. |

Porter's Five Forces Analysis Data Sources

Our analysis of German American Bank's competitive landscape is built upon data from annual reports, investor presentations, and industry-specific financial publications. We also incorporate insights from banking sector regulatory filings and macroeconomic data to provide a comprehensive view of the forces shaping the industry.