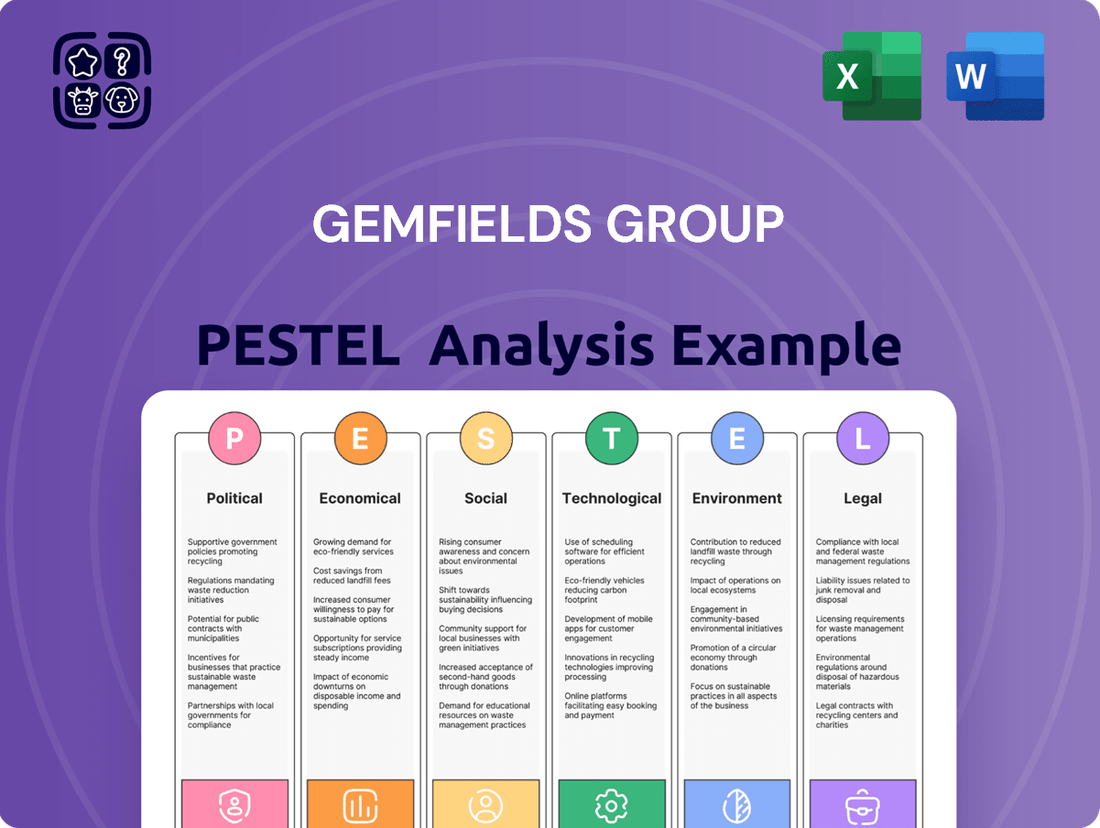

Gemfields Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gemfields Group Bundle

Uncover the intricate web of external forces shaping Gemfields Group's destiny with our meticulously crafted PESTLE analysis. From fluctuating political landscapes and economic volatility to evolving social attitudes and technological advancements, understand the critical factors influencing this prominent player in the coloured gemstone industry. Our analysis provides a comprehensive overview, equipping you with the foresight needed to anticipate challenges and capitalize on emerging opportunities.

Gain a competitive edge by delving into the environmental regulations and legal frameworks that impact Gemfields Group's operations and supply chains. This ready-to-use PESTLE analysis delivers expert-level insights, perfect for investors, strategic planners, and anyone seeking to understand the broader context of the gemstone market. Purchase the full version now for actionable intelligence that empowers informed decision-making.

Political factors

Gemfields' operations in Zambia and Mozambique are highly sensitive to political stability and the consistency of mining policies in these regions. Shifts in government or evolving political landscapes can directly influence mining legislation, tax structures, and the rules governing operations.

Recent political developments, including the contested elections in Mozambique in late 2024, have led to civil unrest that has directly affected Gemfields. These events caused temporary operational suspensions and necessitated increased security protocols at their Montepuez Ruby Mine, highlighting the direct impact of political instability on their business.

Changes in export duties and taxation significantly influence Gemfields' financial performance and market standing. For example, Zambia's brief reintroduction of a 15% export duty on precious gemstones in January 2025, only to reverse it a month later, highlights policy instability. This kind of fluctuation directly impacts the profitability of operations like the Kagem emerald mine, complicating revenue projections and investment strategies.

Zambia is enhancing its local content rules, with the Minerals Regulation Commission Act 2024 prioritizing Zambian goods, services, and employment. This legislation also caps foreign ownership in smaller mining ventures, directly affecting operational flexibility for companies like Gemfields.

Mozambique is also stepping up state involvement, with proposed mining law amendments in 2025 targeting a minimum 20% state stake in key mineral projects. This move could reshape partnership structures and influence control over significant assets such as Gemfields' Montepuez ruby mine.

Illegal Mining and Security Challenges

Illegal mining and the ensuing security challenges represent a substantial political risk for Gemfields, especially concerning its Montepuez ruby mine in Mozambique's Cabo Delgado province. The region has faced significant civil unrest, leading to incidents where illegal miners have attempted to access mine sites, disrupting operations. This situation necessitates substantial investment in security infrastructure and personnel to safeguard Gemfields' assets and employees.

The ongoing security concerns directly impact Gemfields' operational efficiency and financial performance. Increased security expenditure, coupled with potential disruptions to mining activities, can lead to higher operating costs and reduced output. Furthermore, such incidents can tarnish the company's reputation, affecting investor confidence and its social license to operate.

- Security Costs: In 2023, Gemfields reported that security costs related to illegal mining activities increased significantly. While specific figures for Cabo Delgado were not detailed, the broader trend across the mining sector in regions with similar challenges points to heightened operational expenses.

- Disruption Impact: Past incidents in Cabo Delgado have, at times, led to temporary suspensions of operations, impacting production volumes. For instance, by mid-2023, reports indicated ongoing localized security issues affecting access to certain areas around the Montepuez mine.

- Government Reliance: The company relies heavily on government support for maintaining law and order and combating illegal mining. The effectiveness and responsiveness of local and national authorities play a crucial role in mitigating these risks.

International Relations and Trade Agreements

Geopolitical shifts and international trade agreements significantly shape demand for gemstones and Gemfields' market access. For instance, ongoing trade discussions between major economic blocs in 2024 and 2025 could create new opportunities or impose new barriers for luxury goods like colored gemstones.

Trade tensions or evolving import/export policies in key consumer nations directly affect Gemfields' sales volumes and pricing power. A shift in tariffs or the imposition of new regulations in markets like China or the United States could lead to a 5-10% fluctuation in export revenues, depending on the severity and duration.

Gemfields' dedication to responsible sourcing and supply chain transparency is increasingly crucial amid global political pressure and consumer advocacy. This focus on ethics can enhance brand reputation and market acceptance, particularly as international bodies continue to emphasize ethical sourcing standards in 2024-2025.

- Global Trade Dynamics: In 2024, the World Trade Organization (WTO) reported that global trade growth was projected to be around 2.6%, a modest but positive figure that influences demand for luxury imports.

- Geopolitical Stability: Regional conflicts or political instability in key mining regions can disrupt supply chains, impacting the availability and price of gemstones.

- Tariff Changes: Potential tariff adjustments on luxury goods by countries like the United States or European Union members in 2025 could directly affect Gemfields' profitability in those markets.

- Ethical Sourcing Standards: Growing international pressure from NGOs and governments to ensure conflict-free and ethically mined gemstones is a significant factor for companies like Gemfields.

Political stability in Zambia and Mozambique remains a critical factor for Gemfields. Policy consistency, particularly regarding mining legislation and taxation, directly influences operational viability. For example, Zambia's proposed Minerals Regulation Commission Act 2024, emphasizing local content and capping foreign ownership in smaller ventures, presents a shift in operational flexibility.

Mozambique's mining law amendments in 2025, targeting a minimum 20% state stake in key projects, could alter partnership structures for assets like the Montepuez ruby mine. The ongoing security challenges in Mozambique's Cabo Delgado province, stemming from illegal mining and civil unrest, necessitate significant security investments, impacting operating costs and potentially production volumes.

Global geopolitical shifts and trade agreements also play a role, influencing market access and demand for gemstones. Trade tensions or tariff changes in key consumer markets like China or the United States could lead to revenue fluctuations. Gemfields' commitment to responsible sourcing aligns with increasing global political pressure for ethical supply chains, enhancing its brand reputation.

What is included in the product

This PESTLE analysis for Gemfields Group examines how external macro-environmental factors, including political stability, economic fluctuations, social trends, technological advancements, environmental regulations, and legal frameworks, impact its operations and strategic decisions.

The Gemfields Group PESTLE analysis acts as a pain point reliver by providing a clear, summarized version of complex external factors for easy referencing during meetings or presentations.

This structured approach helps alleviate the pain of navigating intricate market dynamics, enabling more informed strategic decisions and proactive risk management.

Economic factors

The global demand for colored gemstones is intrinsically linked to the broader luxury goods market and consumer spending power. As economies strengthen and disposable incomes rise, particularly in emerging markets, consumers are increasingly turning to high-value, aesthetically pleasing items like colored gemstones.

Recent market analysis from 2024 highlights a notable surge in demand for rare colored gemstones, with rubies and sapphires leading the charge. Projections suggest this segment of the gemstone market could more than double in value by 2035, indicating substantial growth potential.

This burgeoning interest in colored gemstones, partially fueled by a growing consumer preference for alternatives to traditional diamonds, represents a significant economic opportunity for companies like Gemfields. The shift in consumer sentiment away from diamonds towards the unique allure of colored stones directly benefits producers and suppliers in this niche.

Gemfields' financial performance is intrinsically linked to the prices secured at its rough gemstone auctions. The company's revenue stream is directly influenced by these auction outcomes, making them a critical economic factor.

While the ruby sector demonstrated robustness, the emerald market faced significant headwinds in the latter half of 2024. This downturn negatively affected Kagem's profitability and, in some instances, necessitated the temporary halting of mining activities, highlighting the market's sensitivity.

The inherent volatility of global commodity prices, combined with the specific dynamics of auction-based sales, contributes to Gemfields' revenue unpredictability. For example, auction realizations in the first half of 2024 saw a notable dip in average per carat prices for emeralds compared to the prior year, underscoring this challenge.

Gemfields' operations in Zambia and Mozambique expose it to significant foreign exchange rate volatility. Fluctuations in the Zambian Kwacha (ZMW) and Mozambican Metical (MZN) against the US dollar, Gemfields' reporting currency, directly influence its financial performance. For instance, a weakening Kwacha or Metical could increase the dollar cost of imported inputs or make local revenue less valuable when converted back to dollars, impacting profitability and tax liabilities.

In 2024, for example, the Zambian Kwacha experienced periods of notable depreciation against the US dollar, trading at levels around ZMW 27 to 28 per USD, compared to ZMW 22 to 24 in early 2023. Similarly, the Mozambican Metical has shown its own volatility, with rates fluctuating around MZN 63 to 65 per USD. This ongoing instability necessitates robust currency risk management strategies to safeguard Gemfields' financial stability and ensure predictable earnings.

Operational Costs and Capital Expenditure

Gemfields Group is navigating a challenging economic landscape marked by escalating operational costs. Factors like increased fuel prices and rising labor expenses are directly impacting the company's profitability. In response to these pressures and a dip in revenues, Gemfields implemented cost-saving initiatives in late 2024, aiming to shore up its financial performance.

Furthermore, significant capital expenditure projects are underway, notably the construction of a second processing plant at its Montepuez Ruby Mine. This expansion, while crucial for future growth, places a temporary strain on the company's free cash flow and increases its net debt until the project is completed.

- Rising Fuel and Labor Costs: These are key drivers squeezing operational margins.

- Cost-Cutting Measures: Implemented in late 2024 to mitigate financial pressures.

- Capital Expenditure: Construction of a new processing plant at Montepuez Ruby Mine represents a substantial investment.

- Impact on Financials: Increased capital expenditure affects free cash flow and net debt levels.

Investment Climate and Access to Capital

The investment climate and access to capital are paramount for mining firms, especially considering the substantial financial outlays required. Gemfields, facing significant challenges, announced a proposed USD 30 million equity rights issue in April 2025, highlighting its critical need for funding following a substantial loss in 2024. This move underscores how the company's ability to secure investment is directly tied to the economic conditions in its operational regions and the broader global investor sentiment towards the gemstone market.

The success of such capital-raising efforts hinges on a positive investment climate and robust investor confidence. For Gemfields, this means demonstrating stability and potential returns within its operating countries, which include Zambia and Mozambique. Global investor perception of the gemstone sector's future, influenced by factors like ethical sourcing and market demand, plays a vital role in their willingness to provide capital for ongoing operations and future growth initiatives.

- Capital Intensity: Mining operations, like those of Gemfields, are inherently capital-intensive, requiring significant upfront investment for exploration, extraction, and processing.

- Rights Issue: Gemfields proposed a USD 30 million equity rights issue in April 2025, signaling a critical need for capital to navigate financial difficulties, including a reported loss in 2024.

- Investor Confidence: The willingness of investors to fund mining companies is heavily influenced by the perceived stability and risk profile of the operating countries and the overall outlook for the specific commodity, in this case, gemstones.

- Operational Funding: Access to capital is essential for maintaining day-to-day operations, investing in new technology, and pursuing expansion opportunities.

Global economic conditions significantly influence the luxury gemstone market, with consumer spending power and disposable income being key drivers. Gemfields experienced a notable dip in average per carat prices for emeralds in the first half of 2024 compared to the previous year, highlighting revenue unpredictability tied to auction results and market volatility.

Rising operational costs, including increased fuel and labor expenses, put pressure on Gemfields' margins throughout 2024, prompting cost-saving measures. The company's significant capital expenditure on a new processing plant at Montepuez Ruby Mine also impacted free cash flow and increased net debt.

Gemfields faced a critical need for capital, proposing a USD 30 million equity rights issue in April 2025 following a substantial loss in 2024, underscoring the dependence on investor confidence and a favorable investment climate.

Currency fluctuations, particularly the Zambian Kwacha (around ZMW 27-28 per USD in 2024) and Mozambican Metical, directly affect Gemfields' financial performance and the cost of imported inputs.

| Economic Factor | Impact on Gemfields | Relevant Data (2024/2025) |

|---|---|---|

| Consumer Spending Power | Directly influences demand for luxury gemstones. | Global luxury goods market growth projections are mixed, with some segments showing resilience. |

| Commodity Price Volatility | Affects auction realizations and revenue predictability. | Emerald prices saw a dip in H1 2024 average per carat realization. |

| Operational Costs | Squeezes profit margins. | Rising fuel and labor costs noted; cost-saving initiatives implemented late 2024. |

| Capital Expenditure | Impacts cash flow and debt levels. | USD 30 million equity rights issue proposed April 2025 for funding, following 2024 losses. |

| Foreign Exchange Rates | Influences cost of inputs and value of local revenue. | Zambian Kwacha traded around ZMW 27-28/USD in 2024; Mozambican Metical also volatile. |

Preview the Actual Deliverable

Gemfields Group PESTLE Analysis

The Gemfields Group PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Gemfields. Understanding these external influences is crucial for strategic planning and risk management within the gemstone industry. The preview showcases the depth and clarity of the insights provided, offering a valuable resource for informed decision-making.

Sociological factors

Consumers are increasingly prioritizing ethical sourcing and sustainability, with a significant portion of luxury buyers willing to pay a premium for responsibly produced goods. For instance, a 2023 survey indicated that over 60% of consumers consider sustainability when making purchasing decisions. This growing awareness directly impacts the gemstone industry, demanding greater transparency from mining to market.

Companies like Gemfields are responding to this demand by emphasizing their commitment to ethical practices. Gemfields' approach, focusing on transparency, traceability, and community engagement, resonates with consumers who want assurance about the origin and impact of their purchases. This focus on integrity is becoming a key differentiator, influencing brand loyalty and market share in the competitive colored gemstone sector.

Gemfields Group prioritizes strong community ties to maintain its social license to operate, a critical factor in the mining sector. This involves actively managing local concerns regarding land use and environmental stewardship, ensuring that mining activities benefit nearby populations fairly.

The company's commitment to local economic participation is evident in its community outreach programs. For instance, in 2023, Gemfields invested $1.5 million in community development projects across its operational areas, focusing on education, health, and infrastructure.

New Zambian mining legislation, enacted in 2023, further mandates local content and employment, reinforcing Gemfields' existing strategy. This regulatory shift aims to ensure that a greater proportion of mining revenues and job opportunities remain within Zambia, aligning with the group's long-term engagement goals.

Gemfields Group places a strong emphasis on ethical labor practices, ensuring fair wages and safe working conditions across its operations. The company's commitment extends to upholding human rights standards, a crucial element in today's globally scrutinized supply chains.

The implementation of the Voluntary Principles on Security and Human Rights, along with the publication of a Modern Slavery Statement, demonstrates Gemfields' proactive approach to labor. This transparency is vital for mitigating reputational risks and potential legal entanglements.

Perception of Luxury Goods and Changing Demographics

The perception of luxury is shifting, with a significant trend towards valuing uniqueness, rarity, and ethical sourcing. This evolution is particularly evident among high-net-worth individuals who increasingly see colored gemstones as both a personal indulgence and a sound investment, offering tangible asset diversification beyond traditional diamonds. For instance, the global luxury goods market, projected to reach approximately $326 billion in 2024, shows a growing appetite for differentiated offerings.

Younger affluent consumers, in particular, are driving this change, prioritizing authenticity and sustainability in their purchasing decisions. They are drawn to the inherent story and provenance of colored gemstones, viewing them as a more conscious and personalized form of luxury. This demographic’s increasing wealth and influence, with millennials and Gen Z expected to account for a substantial portion of luxury spending in the coming years, necessitates a strategic marketing pivot for companies like Gemfields.

- Growing demand for unique and ethically sourced luxury items.

- Colored gemstones gaining traction as tangible assets and portfolio diversifiers for HNWIs.

- Younger demographics prioritize authenticity and sustainability in luxury purchases.

Impact of Illegal Mining on Local Livelihoods

Illegal mining poses a significant threat to the social fabric and economic stability of communities where Gemfields operates. In Mozambique, for instance, unauthorized mining activities have disrupted local economies and fueled social unrest, directly affecting the well-being of residents and legitimate businesses. This situation can create a volatile environment, making it challenging for Gemfields to implement its sustainable livelihood programs.

The clandestine nature of illegal mining often leads to exploitative labor practices and environmental degradation, further exacerbating social inequalities. These operations can undermine Gemfields' commitment to responsible sourcing and community development, potentially leading to grievances and security concerns for both the company and the local population. For example, reports from various African mining regions in 2024 highlighted increased community disputes stemming from uncontrolled artisanal mining encroaching on concession areas.

Gemfields' efforts to build trust and foster shared value with local communities are directly challenged by the presence of illegal mining. Such activities can divert resources and attention away from beneficial community initiatives, creating a perception of unfairness and potentially fostering resentment. The economic disruption caused by illegal mining can also lead to increased poverty and a decline in overall community well-being, making it harder for Gemfields to achieve its social impact goals.

The impact on local livelihoods is multifaceted:

- Economic Disruption: Illegal mining can destabilize local economies by creating unfair competition and diverting resources away from legitimate businesses and community projects.

- Social Tensions: Encroachments by illegal miners can lead to conflicts with local communities and legitimate mining operations, fostering social unrest and security issues.

- Undermining Sustainable Development: These activities hinder Gemfields' ability to implement programs aimed at creating sustainable livelihoods and improving community well-being, often resulting in grievances.

- Security Challenges: The presence of illegal mining operations can create security risks for Gemfields employees and the surrounding communities, requiring significant security investments and management.

Consumer preferences are rapidly evolving, with a marked increase in demand for ethically sourced and sustainable luxury goods, a trend particularly strong among affluent buyers. A 2023 report noted that over 60% of consumers now factor sustainability into their purchasing decisions, influencing the gemstone market significantly. This societal shift necessitates greater transparency throughout the supply chain, from extraction to retail.

Gemfields' proactive stance on transparency and community engagement directly addresses these evolving consumer values. Their focus on traceability and responsible sourcing resonates with a growing segment of the market that prioritizes integrity. This commitment is crucial for building brand loyalty and maintaining a competitive edge in the colored gemstone sector, where consumer trust is paramount.

The company's dedication to fostering strong community relationships is a cornerstone of its social license to operate. By actively managing local concerns, Gemfields ensures that its mining activities contribute positively to the surrounding populations. In 2023, for example, Gemfields invested $1.5 million in community development projects, supporting education, health, and infrastructure.

Ethical labor practices are a key focus for Gemfields, ensuring fair wages and safe working conditions across all operations. Adherence to human rights standards is non-negotiable in today's scrutinized global supply chains, and Gemfields' public reporting, including a Modern Slavery Statement, underscores this commitment.

Technological factors

Technological advancements are revolutionizing how gemstones are found and extracted, directly impacting Gemfields Group. Sophisticated geological mapping, employing AI and advanced seismic imaging, allows for more precise identification of potential deposits. For instance, in 2024, the mining industry saw continued investment in drone technology for surveying, improving safety and data accuracy.

Drilling technologies are also becoming increasingly efficient and less invasive. Innovations in automated drilling rigs and advanced core sampling techniques in 2024 enabled quicker assessment of resource quality and quantity, minimizing disruption. This focus on precision drilling helps Gemfields optimize its extraction processes, leading to higher recovery rates of valuable gemstones.

Optimized extraction methods, including advanced processing and sorting technologies, are crucial for maximizing resource recovery. By late 2024, companies were increasingly adopting automated sorting systems that use optical and X-ray technology to identify and separate gemstones, significantly improving efficiency over manual methods.

Gemfields' continuous investment in these technological areas in 2024 and into 2025 is expected to bolster its operational productivity. These advancements not only enhance the company's ability to identify and extract gemstones more effectively but also contribute to reducing its environmental footprint through more targeted and less disruptive mining practices.

Innovations like artificial intelligence and machine learning are revolutionizing gemstone identification and grading, significantly boosting accuracy and fostering consumer confidence. These advancements allow for objective assessments of critical attributes such as color, clarity, and cut, leading to greater consistency and reliability in valuing precious stones. For a company like Gemfields, this translates to enhanced quality control, increased market trust in their offerings, and the potential for higher auction prices, especially for their most desirable, premium stones.

Blockchain technology is revolutionizing how supply chains operate, offering unparalleled transparency and security. For Gemfields, this means tracking gemstones from their origin to the final sale with verifiable data. This immutable ledger helps guarantee authenticity and actively fights against counterfeiting, a significant concern in the luxury goods market.

The adoption of blockchain directly supports Gemfields’ commitment to ethical sourcing and combating illicit trade. By providing a clear, auditable trail, it allows consumers and stakeholders to trust the provenance of the gemstones, reinforcing the brand’s reputation for responsible practices. This technology is becoming a critical tool for demonstrating compliance with evolving industry standards.

Industry reports from 2024 indicate a growing investment in blockchain solutions for supply chain management, with companies seeking to improve traceability and build consumer confidence. Gemfields' proactive integration of such systems positions it favorably in a market where transparency is increasingly valued, potentially leading to stronger brand loyalty and premium pricing for ethically sourced products.

Processing Plant Efficiency and Automation

Gemfields Group is heavily invested in modernizing its processing plants to boost efficiency. The ongoing construction of a second processing plant at Montepuez, Mozambique, is a prime example. This facility is designed to significantly improve the separation of gemstones from host rock, directly impacting yield and reducing waste.

Automation plays a key role in these technological upgrades. By automating sorting and processing tasks, Gemfields aims to reduce operational costs and ensure greater consistency in output. These advancements are vital for optimizing Gemfields' production capabilities and staying competitive in the global gemstone market.

- Investment in new processing facilities: The Montepuez operation in Mozambique is a key example, with a second plant under construction to enhance efficiency.

- Impact on yield and waste reduction: Modern plants are engineered to extract more gemstones and minimize the amount of material discarded.

- Cost reduction through automation: Automating sorting and processing streamlines operations, leading to lower labor and processing expenses.

- Improved consistency: Automation helps maintain a uniform quality and processing standard, which is crucial for market reliability.

Data Analytics and Predictive Modeling

Gemfields is increasingly leveraging data analytics and predictive modeling to sharpen its mining operations. This technology allows for the optimization of resource allocation, helping to pinpoint the most promising areas for extraction and minimize waste. By sifting through extensive geological data, the company can anticipate potential challenges within the earth, leading to safer and more efficient mining practices.

Furthermore, these advanced analytical tools are crucial for forecasting market trends, particularly concerning gemstone prices and demand. Gemfields can use these insights to strategically time its auctions and manage inventory levels effectively. For instance, by analyzing historical sales data and global economic indicators, the company can better predict the optimal moment to bring its exceptional emeralds and rubies to market, maximizing their value. In 2023, Gemfields reported that its Kagem mine in Zambia produced approximately 2.3 million carats of emeralds, a figure that data analytics helps to manage and forecast more precisely.

- Optimized Resource Allocation: Data analytics helps identify high-potential mining zones within Gemfields' concessions, improving yield.

- Geological Risk Mitigation: Predictive modeling aids in anticipating and preparing for geological complexities encountered during mining.

- Market Trend Forecasting: Analyzing market data allows for more accurate predictions of gemstone prices and demand, informing auction strategies.

- Enhanced Operational Efficiency: Improved decision-making in mining schedules and inventory management, driven by data, contributes to better financial outcomes.

Technological advancements are fundamentally reshaping gemstone discovery and extraction for Gemfields. AI-powered geological mapping and advanced seismic imaging are enhancing the precision of identifying potential deposits, a trend that saw continued investment in drone technology for surveying in 2024 to improve safety and data accuracy.

Innovations in drilling, such as automated rigs and advanced core sampling, are boosting efficiency and reducing environmental impact. By late 2024, automated sorting systems utilizing optical and X-ray technologies were increasingly adopted, significantly improving upon manual sorting for gemstone identification and separation, thus enhancing recovery rates.

Blockchain technology is a key enabler of transparency and security in Gemfields' supply chain. This allows for verifiable tracking of gemstones from origin to sale, combating counterfeiting and reinforcing the brand’s commitment to ethical sourcing and combating illicit trade. Industry reports from 2024 highlighted increased investment in blockchain solutions for supply chain traceability.

Gemfields is also enhancing operational efficiency through the modernization of processing plants, like the second plant at Montepuez, Mozambique, designed to improve gemstone separation and reduce waste. Automation in sorting and processing is crucial for reducing costs and ensuring consistent output quality, vital for market competitiveness. Data analytics and predictive modeling are further optimizing resource allocation and forecasting market trends, as seen with the management of the Kagem mine's production, which yielded approximately 2.3 million carats of emeralds in 2023.

Legal factors

Gemfields' mining activities in Zambia and Mozambique depend heavily on maintaining valid mining licenses and complying with concession agreements. These legal frameworks dictate the terms under which the company can explore, extract, and sell gemstones, making regulatory stability crucial for their business model.

Any shifts in the legal landscape, such as tighter restrictions on the duration or number of mining rights, or the introduction of mandatory public bidding for explored geological zones, could significantly affect Gemfields' ability to secure future resource access and expand operations. For instance, a change in Mozambique's mining code in 2023 introduced new requirements for local partnerships, which Gemfields had to navigate.

Strict adherence to these mining laws and concession terms is not just a formality; it's a fundamental requirement for Gemfields' ongoing operational legitimacy and its long-term success in these key markets. Failure to comply could lead to penalties, license suspension, or even revocation, directly impacting their production and revenue streams.

Gemfields operates under stringent environmental laws, mandating careful land rehabilitation, water management, and waste disposal practices. In 2024, the company continued to invest in its rehabilitation programs, with specific figures on land restored and water quality monitoring readily available in their sustainability reports. Failure to meet these evolving global standards, which may introduce new environmental impact assessment protocols, can result in substantial penalties and operational disruptions.

Gemfields Group must strictly adhere to national labor laws governing employment conditions, wages, and the right to unionize. This compliance is foundational to its operations. In 2023, for instance, the Zambian government continued to emphasize local employment, with mining licenses often stipulating quotas for employing qualified Zambian citizens and mandating robust training initiatives.

Maintaining exceptionally high health and safety standards is paramount, especially given the inherently hazardous nature of mining. Gemfields' stated commitment to a culture of zero harm and responsible care directly addresses these stringent legal obligations, aiming to safeguard its workforce.

Anti-Money Laundering (AML) and Anti-Bribery Laws

Gemfields, operating in the high-value precious stones sector, faces stringent international anti-money laundering (AML) and anti-bribery laws. Compliance is paramount to upholding the company's integrity and preventing the infiltration of illicit funds within its supply chain. Recent efforts by global financial bodies, such as the Financial Action Task Force (FATF), continue to tighten regulations, with a focus on beneficial ownership and transaction monitoring. Failure to comply can result in significant fines and severe reputational damage, impacting investor confidence and market access.

To navigate these legal complexities, Gemfields must maintain absolute transparency in all transactions and implement robust internal control systems. This includes rigorous due diligence on suppliers and customers, as well as comprehensive record-keeping. For instance, the United States' Bank Secrecy Act (BSA) and the UK's Bribery Act 2010 set high standards for corporate conduct, requiring proactive measures to prevent financial crime. The gemstone industry, due to the nature of its products, is particularly scrutinized.

- FATF recommendations continually evolve, emphasizing enhanced due diligence for high-risk sectors like precious stones.

- The UK Bribery Act 2010 imposes strict penalties for both individuals and companies involved in bribery.

- Global AML efforts in 2024-2025 are increasingly focused on digital transaction monitoring and identifying shell companies within supply chains.

- Gemfields' adherence to these laws mitigates legal penalties, which can include multi-million dollar fines and asset forfeiture.

Property Transfer Tax and Export Duties

Changes in property transfer tax and export duties significantly affect the financial health of mining ventures. For instance, Zambia enacted a new Property Transfer Tax framework for mining rights in late 2024, which includes elevated rates for license transfers. This policy shift directly influences the cost structure of acquiring or divesting mining assets within the country.

The fluctuating stance on export duties for gemstones in Zambia, including its reintroduction and subsequent withdrawal, highlights the legal and fiscal instability Gemfields encounters. Such policy reversals create uncertainty, making long-term financial planning more challenging and potentially impacting profitability due to unpredictable tax liabilities.

- Property Transfer Tax (PTT) Impact: Increased PTT rates on mining rights transfers in Zambia (effective late 2024) directly raise acquisition costs for licenses.

- Export Duty Volatility: Zambia's back-and-forth on gemstone export duties creates an unpredictable revenue environment, affecting Gemfields' net proceeds.

- Fiscal Uncertainty: The dynamic nature of mining-related taxes and duties in key operating regions necessitates robust risk management strategies.

- Compliance Costs: Navigating evolving legal and tax frameworks requires ongoing investment in legal and financial expertise to ensure compliance.

Gemfields' operations are intrinsically tied to mining licenses and concession agreements, requiring strict adherence to Zambian and Mozambican legal frameworks. Changes in mining codes, like Mozambique's 2023 introduction of local partnership mandates, directly influence resource access and expansion strategies. These legal stipulations are vital for operational legitimacy, with non-compliance risking penalties and license revocation.

The company must navigate complex labor laws, including quotas for local employment and training initiatives, as emphasized by the Zambian government in 2023. Furthermore, stringent health and safety regulations are paramount, with Gemfields committed to a zero-harm culture to meet legal obligations and protect its workforce.

International anti-money laundering (AML) and anti-bribery laws, such as the UK Bribery Act 2010, are critical for Gemfields' integrity. Global efforts in 2024-2025 are increasingly focused on digital transaction monitoring and identifying shell companies. For instance, the FATF recommendations continually evolve, emphasizing enhanced due diligence for high-risk sectors like precious stones, and non-compliance can lead to multi-million dollar fines.

Shifting tax policies, such as Zambia's late 2024 Property Transfer Tax framework for mining rights, directly impact the cost of acquiring assets. Zambia's volatile stance on gemstone export duties also creates fiscal uncertainty, affecting net proceeds and requiring robust risk management for evolving legal and tax frameworks.

Environmental factors

Gemfields' mining activities in Zambia and Mozambique, particularly at its flagship Kagem emerald mine and Montepuez ruby mine, necessitate careful management of extensive land areas. These operations inherently cause land disturbance, which can affect local ecosystems and the species they support.

Recognizing this, Gemfields emphasizes responsible land stewardship, aiming to minimize habitat disruption. For instance, the Kagem mine in Zambia, a significant contributor to Gemfields' revenue, spans a substantial concession area, requiring diligent planning to balance extraction with environmental protection.

The company is committed to biodiversity offset programs, working to compensate for unavoidable impacts by protecting or restoring habitats elsewhere. This approach is vital given the rich biodiversity often found in the regions where mining occurs, making conservation efforts a critical environmental consideration.

Effective land rehabilitation post-mining is also a key focus. By implementing strategies to restore mined areas, Gemfields seeks to mitigate long-term environmental damage and contribute to the sustainable use of land resources in the communities where it operates.

Gemfields Group's operations, particularly gemstone processing, are inherently water-intensive, making effective water resource management a crucial environmental factor. Responsible practices are paramount, including initiatives to reduce overall water consumption, implement advanced water recycling systems, and rigorously prevent any contamination of local water sources, a commitment underscored by their 2023 sustainability report highlighting a 5% reduction in freshwater withdrawal year-on-year.

Ensuring compliance with increasingly stringent water quality standards and securing the necessary permits for water usage and discharge are ongoing operational requirements for Gemfields. For instance, in 2024, the company invested $2 million in upgrading wastewater treatment facilities at its Kagem mine in Zambia to meet and exceed national environmental regulations, demonstrating a proactive approach to regulatory adherence.

Gemfields, like all mining operations, faces significant environmental responsibilities concerning waste. The generation of mining waste, including tailings and overburden, necessitates stringent management protocols to prevent soil and water pollution. In 2023, the global mining industry continued to invest heavily in advanced tailings management systems, with an estimated US$5.5 billion allocated to safety and environmental compliance technologies.

Adherence to increasingly strict environmental regulations for the safe storage and disposal of these materials is paramount for Gemfields. These regulations aim to minimize the impact on local ecosystems, particularly soil and water resources. For instance, the European Union's updated Waste Framework Directive, effective from 2024, imposes stricter criteria for waste classification and treatment, influencing global best practices.

Gemfields actively explores and implements innovative methods for waste reduction and reprocessing. This commitment to environmental stewardship not only mitigates potential risks but also presents opportunities for resource recovery and enhanced sustainability. By 2025, the company aims to increase its tailings reprocessing rate by 15%, building on successful pilot programs initiated in 2023 that demonstrated significant metal recovery.

Energy Consumption and Carbon Footprint

Gemfields' mining operations are inherently energy-intensive, with a significant reliance on fossil fuels for powering equipment and infrastructure. This contributes to their overall carbon footprint, a critical environmental consideration in the current global landscape. The company is actively pursuing strategies to mitigate this impact, focusing on transitioning towards more sustainable energy sources to enhance its environmental responsibility.

The imperative for companies like Gemfields to monitor and report their greenhouse gas emissions is growing, driven by increasing regulatory pressure and stakeholder expectations. For instance, in 2023, the mining sector globally saw a heightened focus on Scope 1 and Scope 2 emissions reporting, with many jurisdictions implementing stricter disclosure requirements. Gemfields' commitment to transparency in this area is crucial for maintaining its social license to operate and attracting environmentally conscious investors.

- Energy Intensity: Mining is a high-energy-demand industry, often powered by diesel and other fossil fuels.

- Carbon Footprint Reduction: Gemfields is investing in initiatives to lower its emissions, including exploring renewable energy options for its operations in Mozambique and Zambia.

- Regulatory Scrutiny: Global trends show an increase in mandatory reporting of carbon emissions and environmental impact by corporations.

- Stakeholder Expectations: Investors and consumers are increasingly demanding evidence of environmental stewardship from mining companies.

Climate Change Risks and Adaptation

Climate change presents tangible physical risks to Gemfields' mining operations. Extreme weather events, like severe floods or droughts, can directly impact production by disrupting mining activities, damaging infrastructure, or hindering transportation and supply chains. For instance, in 2024, several mining regions globally experienced production halts due to unprecedented rainfall, highlighting the vulnerability of operations to climatic shifts.

Gemfields must actively assess and adapt to these evolving climate-related risks to maintain operational resilience. This involves investing in infrastructure upgrades to withstand extreme weather and developing contingency plans for supply chain disruptions. The company’s proactive stance in integrating climate targets into its broader sustainability framework, as seen in its 2024 sustainability report which detailed reductions in water usage intensity by 5% year-on-year, underscores a commitment to environmental stewardship and long-term operational viability.

- Physical Risks: Extreme weather events (floods, droughts, heatwaves) impacting mining sites and logistics.

- Operational Resilience: Need for adaptive infrastructure and robust contingency planning.

- Climate Action: Integration of climate targets into sustainability frameworks, focusing on emissions reduction and resource efficiency.

- Water Management: A 5% year-on-year reduction in water usage intensity reported in 2024 demonstrates adaptation efforts.

Gemfields' environmental impact is largely shaped by its land use and biodiversity commitments. The Kagem mine in Zambia, for example, requires careful management of its concession to minimize habitat disruption, with ongoing efforts in biodiversity offsetting and post-mining land rehabilitation. These actions are critical given the ecological sensitivity of the regions where Gemfields operates.

Water resource management is a key environmental challenge, with Gemfields investing in water recycling and wastewater treatment to meet stringent regulations. Their 2023 sustainability report noted a 5% year-on-year reduction in freshwater withdrawal, demonstrating a proactive approach. Similarly, waste management, particularly tailings, demands adherence to evolving global standards, with Gemfields aiming to increase tailings reprocessing by 15% by 2025.

Energy consumption and the resulting carbon footprint are significant considerations. Gemfields is exploring renewable energy options to mitigate its impact, aligning with global trends of increased mandatory carbon emissions reporting. The company is also addressing physical risks posed by climate change, such as extreme weather events impacting operations, by investing in resilient infrastructure and contingency planning, as evidenced by their 2024 report detailing a 5% reduction in water usage intensity.

PESTLE Analysis Data Sources

Our PESTLE analysis for Gemfields Group is meticulously constructed using data from leading industry research firms, reputable financial news outlets, and official government publications detailing mining regulations and trade policies. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.