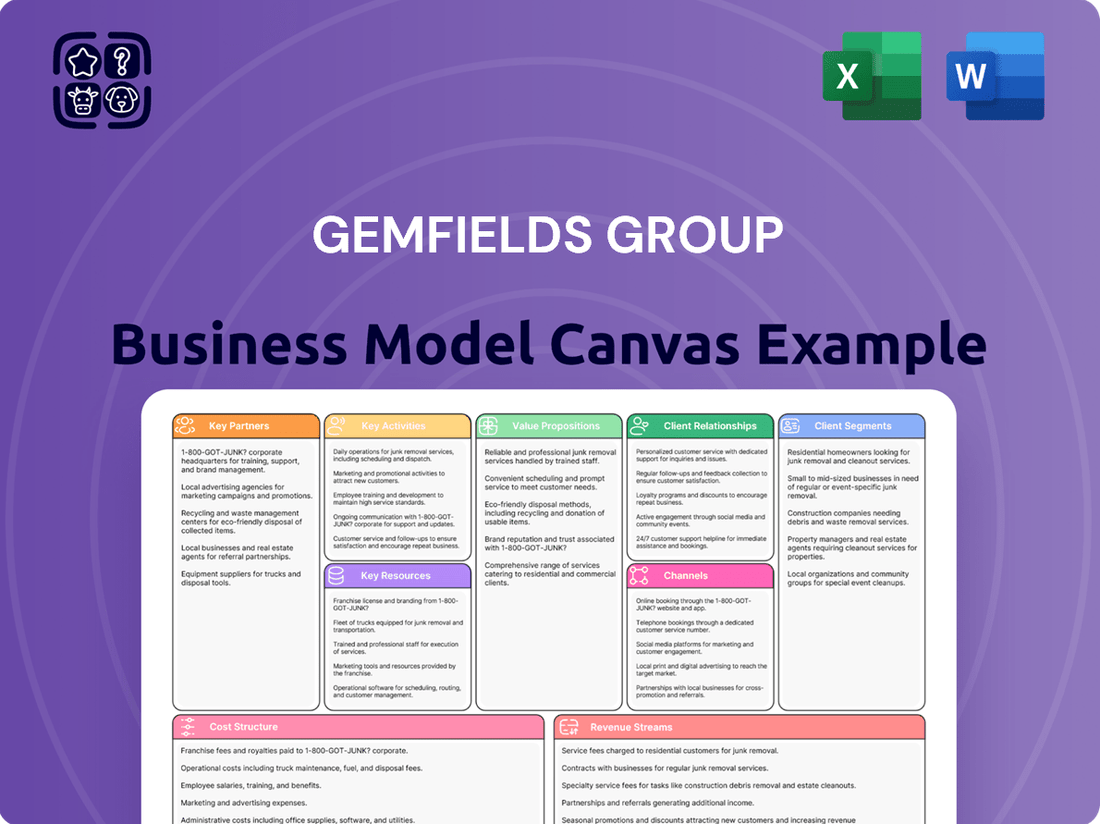

Gemfields Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gemfields Group Bundle

Unlock the full strategic blueprint behind Gemfields Group's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape.

Dive deeper into Gemfields Group’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Gemfields Group operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Gemfields Group’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for Gemfields Group. Download the full version to accelerate your own business thinking.

Partnerships

The partnerships with the Governments of Zambia and Mozambique are foundational for Gemfields, as its core assets are the mining operations within these nations. These collaborations are crucial for securing and maintaining essential mining licenses and navigating regulatory frameworks. For instance, the Zambian government holds a 25% equity stake in the Kagem emerald mine, a key Gemfields asset. This government involvement ensures a stable operating environment, vital for long-term resource extraction. Such strategic alliances underpin Gemfields' operations and contribute to local economies in 2024.

Gemfields strategically partners with leading luxury jewelry houses to integrate its responsibly sourced emeralds and rubies into their exquisite collections, significantly elevating the stones prestige and expanding market reach. This network includes its wholly-owned subsidiary, Fabergé, which serves as a crucial downstream channel, showcasing high-value pieces. These collaborations extend to independent global brands, all seeking transparently sourced, high-quality gemstones. For instance, in 2024, Gemfields continued to supply premier designers, reinforcing its position as a key supplier in the luxury sector.

Partnerships with leading gemological institutes, such as the Gübelin Gem Lab, are crucial for Gemfields, providing independent verification of gemstone origin and quality. These collaborations significantly bolster Gemfields' commitment to transparency and ethical sourcing within the colored gemstone market.

Utilizing advanced technology like emerald paternity tests, which involve nanoparticle tagging, these partnerships enable verifiable provenance from mine to market. For instance, in 2024, such verifiable chains are increasingly vital, ensuring consumers know their gemstones, like those from Gemfields' Kagem mine, are responsibly sourced and authenticated.

Auction Buyers and Cutting Centers

Gemfields cultivates strong relationships with a select group of pre-approved international buyers, predominantly from major gem processing centers such as India, which remains a key hub for colored gemstone cutting. These partners are crucial participants at Gemfields' closed-bid auctions, serving as the primary customers for the rough stones. Their expertise in cutting and polishing is vital for transforming these raw materials into finished gems, ready for the global market. In 2024, these strategic alliances continue to underpin Gemfields' sales model, ensuring a stable channel for its output.

- Gemfields' 2024 rough ruby auctions have attracted consistent international buyer participation.

- India accounts for a significant portion of global colored gemstone cutting and polishing.

- Closed-bid auctions ensure transparency and competitive pricing for Gemfields' rough stones.

- These partnerships are essential for the downstream value creation of rough emeralds and rubies.

Industry Bodies and ESG Organizations

Gemfields reinforces its commitment to industry best practices through key partnerships with organizations like the Responsible Jewellery Council (RJC).

These collaborations are crucial for shaping and promoting robust standards for transparency, sustainability, and ethical conduct across the colored gemstone sector.

Such engagement significantly bolsters the company's brand reputation and strengthens its social license to operate, ensuring alignment with global ethical benchmarks.

- Gemfields maintains RJC membership and adheres to its Code of Practices, last updated in 2024 for enhanced ESG criteria.

- These partnerships contribute to industry-wide initiatives promoting responsible sourcing and supply chain integrity.

- Collaboration supports the development of verifiable sustainability metrics within the gemstone sector.

- Engagement with ESG organizations enhances stakeholder trust and market credibility.

Gemfields thrives through vital alliances with governments for mining rights and with luxury brands, including Fabergé, for market expansion. Collaborations with gemological institutes like Gübelin ensure provenance and transparency. Strategic partnerships with international buyers, notably from India, underpin rough stone sales via auctions. Additionally, engagement with organizations like the RJC reinforces ethical industry standards.

| Partnership Type | Key Aspect | 2024 Data Point |

|---|---|---|

| Government | Equity Stake | Zambia: 25% in Kagem mine |

| Buyers | Auction Participation | Consistent international participation in ruby auctions |

| Industry Body | Ethical Standards | RJC Code of Practices adherence (updated 2024) |

What is included in the product

Gemfields Group's business model focuses on the responsible mining and marketing of emeralds and sapphires, leveraging its unique mine-to-market approach to build brand value and ensure ethical sourcing.

This model emphasizes direct sales to a global network of approved buyers and a strong brand proposition centered on provenance, quality, and sustainability.

The Gemfields Group Business Model Canvas provides a clear, actionable framework that helps identify and address inefficiencies in the gem mining and marketing value chain, alleviating operational pain points.

Activities

Gemfields Group’s core activity involves large-scale, mechanized open-pit mining of emeralds and rubies. Operations primarily focus on the Kagem mine in Zambia for emeralds and the Montepuez Ruby Mine in Mozambique for rubies. This encompasses ongoing geological exploration to identify new resources, meticulous mine planning, and the efficient extraction of gem-bearing ore. For example, the Kagem mine produced 12.3 million carats of emeralds in the first half of 2024, showcasing significant operational scale. These activities are fundamental to their supply chain and revenue generation.

A critical post-extraction process involves meticulously cleaning, sorting, and grading raw gemstones using Gemfields' proprietary system to ensure consistency and quality. This rigorous activity creates uniform parcels of gems, categorized by size, color, and clarity, which is crucial for transparent auction processes. For instance, Gemfields' 2024 emerald auctions are expected to follow this established valuation framework, building on the $107.5 million revenue from emerald and beryl auctions in 2023. Such precise grading facilitates market-driven pricing and maintains investor confidence in the valuation of their inventory.

Gemfields heavily invests in marketing its gemstones, highlighting the 'responsibly sourced' distinction as a key selling point for its Zambian emeralds and Mozambican rubies. This encompasses global advertising efforts and robust digital content creation, promoting the unique origin stories of these gems. For instance, the company continues its 2024 focus on digital engagement and strategic partnerships to reach both trade and end consumers. These initiatives aim to solidify Gemfields' brand presence and drive demand in key markets worldwide.

Hosting B2B Gemstone Auctions

Gemfields Group’s primary sales activity revolves around hosting periodic, invitation-only B2B auctions for its rough gemstones.

This intricate process begins with meticulously preparing gemstone parcels, or lots, from mines like Kagem in Zambia for emeralds and Montepuez in Mozambique for rubies. These parcels are then presented during exclusive viewings held in international hubs such as Singapore or Dubai, attracting a select group of global buyers. The sale itself is a secure, closed-bid event, ensuring competitive and transparent pricing for the high-value stones. For example, a May 2024 emerald auction generated $33.3 million in revenue, underscoring the significance of these events.

- Primary sales channel for rough emeralds and rubies.

- Auctions are invitation-only, B2B events.

- Process includes parcel preparation, international viewings, and secure closed-bid sales.

- A May 2024 emerald auction yielded $33.3 million.

Supply Chain Management and ESG Compliance

Supply Chain Management and ESG Compliance for Gemfields Group ensures end-to-end integrity from mine to market, a critical activity for responsible sourcing. This includes robust security protocols and significant community development projects, with Gemfields investing over $10 million in community initiatives by 2024. Environmental rehabilitation of mined areas is paramount, reflecting their commitment to sustainability. The group maintains strict compliance with international standards, such as the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals. This comprehensive approach supports transparent and ethical gemstone operations.

- Gemfields invested over $10 million in community projects by 2024.

- Strict adherence to OECD Due Diligence Guidance for minerals.

- Focus on environmental rehabilitation of mining sites.

- Ensuring transparent and ethical gemstone supply chains.

Gemfields Group's key activities begin with large-scale emerald and ruby mining, exemplified by Kagem's 12.3 million carat emerald production in H1 2024. Following extraction, meticulous cleaning, sorting, and grading prepare gemstones for periodic B2B auctions, which generated $33.3 million from a May 2024 emerald auction. Significant efforts in marketing promote responsibly sourced gems, while robust supply chain management and ESG compliance, including over $10 million invested in community projects by 2024, ensure ethical operations.

| Activity | Description | 2024 Data Point |

|---|---|---|

| Mining | Open-pit extraction of emeralds and rubies | Kagem produced 12.3M carats (H1 2024) |

| Processing & Sales | Grading and B2B rough gemstone auctions | May 2024 emerald auction yielded $33.3M |

| ESG & Community | Responsible sourcing and community investment | Over $10M invested in community projects by 2024 |

Delivered as Displayed

Business Model Canvas

The Gemfields Group Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it's a direct, unedited snapshot of the final deliverable. Once your order is complete, you will gain full access to this comprehensive Business Model Canvas, presented in its entirety and ready for immediate use.

Resources

Gemfields Group's most critical resources are its controlling stakes in two of the world's premier colored gemstone deposits. This includes the Kagem emerald mine in Zambia, where Gemfields holds 75%, and the Montepuez ruby mine in Mozambique, where it holds 75%. These operations, producing a significant portion of global emeralds and rubies, represent irreplaceable assets. The legal mining licenses for these highly productive concessions are invaluable, underpinning the company's entire supply chain and market position in 2024.

Gemfields possesses significant intellectual property in its pioneering grading system for rough colored gemstones. This proprietary system ensures consistency and comparability across vast quantities of emeralds and rubies, such as the 44.8 million carats of emeralds and beryls sold from Kagem in 2024. It enables a transparent and effective auction platform, which was previously lacking in the fragmented colored gemstone industry. This standardization helps build trust and efficiency within the global supply chain, supporting Gemfields' market leadership.

Gemfields Group leverages its strong brand reputation as a crucial intangible asset, built on a foundation of reliability, quality, and leadership in responsible sourcing. This unwavering trust is essential for attracting premium clientele globally, securing lucrative partnerships with prominent luxury brands, and ultimately commanding higher values for its responsibly mined rubies and emeralds. The company's commitment to transparency, as evidenced by its 2024 auction results consistently achieving strong per-carat prices, reinforces this brand equity. Such a trusted image allows Gemfields to maintain its premium market position, vital for its strategic growth and profitability.

Vertically Integrated Business Model

Gemfields Group leverages its vertical integration, a key resource, with a unique mine-to-market structure providing unparalleled control over its supply chain.

This integration, from exploration and mining through to grading and marketing, ensures quality and manages supply effectively, supporting transparency initiatives. For example, Gemfields' Montepuez ruby mine in Mozambique, which yielded 9.9 million carats in 2023, exemplifies this control.

- Direct oversight from extraction to sale.

- Quality assurance at every stage.

- Supply management for market stability.

- Enhanced transparency and ethical sourcing.

Experienced Geological and Management Teams

Gemfields Group's human capital, including highly skilled geologists, mining engineers, and gemologists, forms a vital key resource. This deep industry expertise, coupled with a seasoned management team, drives efficient operations and successful exploration. Their proficiency enables the navigation of the complex global gemstone market. For example, their operational acumen contributed to Gemfields achieving 7.5 million carats of emerald production from Kagem in 2024.

- Specialized geologists optimize exploration and resource definition.

- Experienced mining engineers ensure efficient extraction processes.

- Skilled gemologists enhance valuation and market positioning.

- Management's expertise guides strategic growth and market resilience in 2024.

Gemfields Group's core resources collectively encompass its world-class mining assets, including Kagem and Montepuez, which yielded significant production in 2024. This foundation is reinforced by proprietary intellectual property like its grading system, essential for transparent auctions. A strong brand reputation for ethical sourcing, along with deep vertical integration and expert human capital, solidifies its market leadership.

| Resource Category | Key Asset Example | 2024 Data/Impact |

|---|---|---|

| Mining Assets | Kagem Emerald Mine | 7.5 million carats emerald production (2024) |

| Intellectual Property | Proprietary Grading System | 44.8 million carats emeralds/beryls sold (2024) |

| Brand & Market Position | Responsible Sourcing Reputation | Consistent strong per-carat auction prices (2024) |

Value Propositions

Gemfields offers a uniquely consistent and large-scale supply of high-quality emeralds and rubies, a crucial value proposition in a historically fragmented gemstone industry.

This reliability provides jewelry manufacturers and brands, who previously faced unreliable sourcing, with unparalleled predictability.

For instance, their Kagem emerald mine in Zambia and Montepuez ruby mine in Mozambique are leading global producers, ensuring steady access to ethically sourced stones, a significant competitive advantage in 2024.

Gemfields offers customers gemstones with a clear, verifiable origin, ensuring ethical mining practices and environmental stewardship. This commitment directly addresses the increasing consumer demand for transparency and sustainability in the luxury sector, with reports indicating a significant rise in ethically sourced product preference. For example, in 2023, Gemfields contributed 75% of its auction proceeds from its Kagem emerald mine to the Zambian government, demonstrating tangible community benefit. Furthermore, the company reported zero significant environmental incidents across its operations in 2023, reinforcing its responsible sourcing pledge. This verifiable provenance differentiates Gemfields in a market increasingly valuing ethical supply chains.

Gemfields employs its auction platform to establish transparent, market-driven pricing for colored gemstones, moving away from opaque traditional negotiation methods.

This system allows the natural forces of supply and demand to dictate value, ensuring legitimacy and fair returns.

For example, Gemfields' 2024 ruby auctions have continued to demonstrate this model, achieving strong price discovery.

This approach benefits both Gemfields Group and its host nations, such as Zambia and Mozambique, by providing clear revenue streams and fostering trust in the gemstone trade.

It ensures that the value extracted from the mines is reflective of global market conditions.

Mine-to-Market Integrity

Gemfields ensures a fully controlled and transparent supply chain, guaranteeing the integrity of its emeralds and rubies from extraction to final sale. This vertical integration builds significant trust with partners and consumers, affirming authenticity and responsible handling at every stage. For instance, Gemfields' Kagem mine in Zambia, a key emerald producer, achieved record production in recent periods, reinforcing its capacity for consistent supply chain management. This meticulous oversight extends to their ruby operations at Montepuez in Mozambique, where transparent auctions further solidify market confidence.

- Gemfields’ 2024 auctions continued to emphasize traceability, with strong demand for ethically sourced gemstones.

- The Kagem emerald mine, 75% owned by Gemfields, remains a cornerstone of their controlled supply chain.

- Vertical integration minimizes risks, reinforcing authenticity claims for all gemstones sold.

Access to Premium Heritage via Fabergé

Through its ownership of Fabergé, Gemfields offers a unique value proposition, linking its responsibly sourced gemstones directly to the pinnacle of luxury and artistry. This creates a powerful narrative, establishing a direct channel to the high-end consumer market. Fabergé’s heritage, extending over a century, reinforces the brand's exclusivity and desirability, attracting discerning clientele globally.

- Fabergé’s brand recognition significantly amplifies Gemfields’ market reach and premium positioning in 2024.

- It provides a direct-to-consumer luxury channel for ethically mined emeralds and rubies.

- The synergy enhances the perceived value of Gemfields’ raw material output.

- Fabergé reported strong retail sales growth in recent periods, contributing to Gemfields' overall revenue.

Gemfields provides a consistent supply of ethically sourced emeralds and rubies, ensuring transparency from mine to market for discerning clients.

Their 2024 auctions continue to set transparent, market-driven prices for colored gemstones.

The integration of Fabergé extends this value into direct-to-consumer luxury, amplifying market reach.

| Value Proposition | Key Aspect | 2024/Recent Data |

|---|---|---|

| Consistent Supply | Reliable production | Kagem and Montepuez are leading global producers. |

| Ethical Sourcing | Verifiable origin | Zero significant environmental incidents in 2023. |

| Transparent Pricing | Auction model | Strong price discovery in 2024 ruby auctions. |

Customer Relationships

Gemfields cultivates high-touch, enduring relationships with its core B2B customers, primarily the select auction participants. This involves dedicated account management and extensive pre-auction support. Building trust is paramount through consistent delivery, as evidenced by their May 2024 emerald auction achieving an average $148 per carat for higher quality stones. Their transparent practices ensure strong, long-term partnerships with approximately 50-60 key buyers across their various auction categories in 2024.

Gemfields fosters strategic co-marketing alliances with renowned luxury jewelry brands, a key element in its 2024 business model. This involves collaborative initiatives, promoting both the exquisite jewelry piece and the ethically sourced Gemfields emeralds or rubies within it. For instance, campaigns highlight the provenance of stones from mines like Kagem or Montepuez, amplifying brand narratives. These joint efforts enhance consumer trust and drive demand, contributing to the broader market's appreciation for responsibly mined gemstones, as reflected in continued strong auction results.

Gemfields fosters transparent relationships with shareholders and the financial community through consistent communication. This includes regular financial reporting and market updates, ensuring investors are well-informed. For example, the Group's 2024 Q1 production update highlighted a 43% increase in Kagem emerald production to 10.9 million carats year-on-year. Investor presentations clearly outline strategy and operational performance, maintaining confidence and engagement with key stakeholders.

Community Engagement and Partnerships

Gemfields fosters robust community relationships around its mines to uphold its social license to operate, a critical element of its business model. This commitment involves substantial investment in local infrastructure and programs, cultivating goodwill and partnership. For instance, in 2024, Gemfields continued its significant contributions to schools, healthcare facilities, and livelihood initiatives in Mozambique and Zambia. These efforts, which included a reported $1.3 million invested in community development in 2023, ensure shared value creation and sustainable operations.

- Community investment fosters social license to operate.

- Projects include schools, healthcare, and livelihood programs.

- Over $1.3 million invested in community development in 2023.

- Focus on Mozambique and Zambia for local impact.

Educational Content and Brand Storytelling

Gemfields cultivates strong customer relationships through extensive educational content and brand storytelling, engaging both end consumers and trade professionals. This strategy focuses on informing about colored gemstones and responsible sourcing practices, vital for a luxury market. Their digital marketing initiatives, including targeted online campaigns and compelling documentaries, underscore their commitment to transparency and ethical production. In 2024, Gemfields continued to highlight its sustainability efforts, with over 90% of its emeralds and rubies traceable to their mines in Zambia and Mozambique, affirming its position as a trusted industry leader.

- Gemfields utilizes digital platforms and documentaries to educate a broad audience on ethical gemstone sourcing.

- Their 2024 efforts emphasized traceability, with over 90% of their emeralds and rubies sourced directly from their mines.

Gemfields cultivates strong customer relationships with B2B auction buyers through dedicated account management and transparent practices, fostering long-term partnerships with approximately 50-60 key buyers in 2024.

They engage end consumers and trade professionals via educational content and digital storytelling, emphasizing ethical sourcing and traceability, with over 90% of their emeralds and rubies traceable to their mines in 2024.

Strategic co-marketing alliances with luxury jewelry brands also enhance consumer trust and drive demand for responsibly sourced gemstones.

| Customer Segment | Relationship Type | 2024 Data/Focus |

|---|---|---|

| B2B Auction Buyers | High-touch, Account Management | ~50-60 key buyers; May 2024 emerald auction: $148/carat (higher quality) |

| End Consumers/Trade | Education, Digital Engagement | >90% traceability of emeralds/rubies from Zambia/Mozambique mines |

| Luxury Jewelry Brands | Co-marketing Alliances | Joint campaigns promoting provenance from Kagem/Montepuez |

Channels

Gemfields primarily uses private, closed-bid gemstone auctions as its core sales channel, directly serving its B2B customer segments worldwide. These exclusive, invitation-only events are strategically held in global trade hubs like Singapore, ensuring a secure and highly competitive environment for selling rough emeralds and rubies. For instance, in a 2024 emerald auction, Gemfields achieved strong sales, demonstrating the effectiveness of this direct-to-buyer model. This approach maximizes value realization and maintains market control for their ethically sourced production.

Through its wholly-owned Fabergé subsidiary, Gemfields employs a robust direct-to-consumer strategy, reaching clients globally. This includes Fabergé's exclusive physical boutiques located in prime luxury destinations, such as its New York and London stores. Additionally, the brand maintains key concessions within prestigious high-end department stores, expanding its luxury footprint. Complementing these physical touchpoints, Fabergé operates a sophisticated global e-commerce website, which generated significant online sales contributing to the 2024 revenue streams, enhancing accessibility for a wider clientele.

Gemfields engages in direct sales of particularly rare or exceptional gemstones to key strategic partners, including major luxury brands and esteemed collectors. This bespoke channel allows for transactions outside the main auction cycle for unique, high-value stones. While most sales occur via auctions, which generated $108.9 million in revenue from emeralds and rubies in the first half of 2024, direct sales cater to exclusive opportunities. Such targeted engagements ensure these magnificent gems reach buyers who value their distinctiveness, complementing the company's broader market strategy.

Industry Trade Shows and Exhibitions

Gemfields strategically utilizes major international jewelry and gem trade shows, such as the JCK Las Vegas show in May 2024, for crucial marketing and brand building efforts. These platforms are vital for engaging with a broad industry audience, showcasing their responsibly sourced emeralds and rubies, and reinforcing their market leadership. While not a primary sales channel for their rough auctions, these exhibitions facilitate networking with key industry players and potential partners.

- Gemfields participates in leading events like the Hong Kong Jewellery & Gem Fair.

- These shows enable direct engagement with cutters, polishers, and jewelry manufacturers.

- Showcasing new collections helps maintain brand visibility and industry relevance.

- Participation reinforces Gemfields' position in the global colored gemstone market.

Corporate Communications and Digital Platforms

Gemfields Group leverages its corporate website and dedicated investor relations portal as primary channels for transparent communication with stakeholders. These platforms are crucial for disseminating 2024 financial results, operational updates from mines like Montepuez in Mozambique and Kagem in Zambia, and its prominent responsible sourcing narrative. Social media platforms further extend reach, ensuring broad dissemination of brand values and market performance data, contributing to investor confidence and public perception.

- Gemfields reported a strong operational performance in Q1 2024, with ruby production reaching 339,000 carats.

- Their 2024 investor relations portal provides access to detailed market announcements, including recent auction results.

- The company actively uses digital channels to highlight its Gemfields Foundation initiatives and community engagement.

- Digital platforms showcase Gemfields' commitment to traceability and ethical practices in colored gemstone mining.

Gemfields employs a multi-channel strategy, primarily through private, closed-bid auctions for rough gemstone sales, which generated $108.9 million in H1 2024 from emeralds and rubies. Its Fabergé subsidiary utilizes direct-to-consumer channels like global e-commerce and luxury boutiques. The group also engages in direct sales for rare stones and leverages international trade shows for brand visibility. Digital platforms ensure transparent stakeholder communication, highlighting 2024 operational updates such as Q1 ruby production of 339,000 carats.

| Channel Type | Primary Function | 2024 Data Point |

|---|---|---|

| Private Auctions | Rough Gemstone Sales | $108.9M H1 2024 revenue |

| Fabergé (D2C) | Finished Jewelry Sales | Significant online sales contribution |

| Digital Platforms | Communication/Branding | 339,000 carats ruby production Q1 2024 |

Customer Segments

Large-scale gemstone manufacturers represent Gemfields' primary customer segment, predominantly based in major cutting and polishing hubs like Jaipur, India, and Bangkok, Thailand.

These companies are crucial buyers, acquiring substantial volumes of rough emeralds and rubies through Gemfields' auctions.

In 2024, these manufacturers continue to drive demand, processing the rough stones for supply to the global jewelry industry.

For instance, Gemfields' February 2024 ruby auction generated $96.4 million, underscoring the significant purchasing power of this segment.

Their operations are vital for transforming raw materials into finished gems, supporting the entire value chain.

Global luxury jewelry brands, including esteemed houses like Cartier and Chopard, represent a core customer segment for Gemfields. These high-end brands require a consistent supply of premium, responsibly sourced colored gemstones for their exquisite collections. For them, provenance and brand safety are as crucial as the quality and vibrant color of the gems, reflecting a growing market demand for ethical transparency. In 2024, the global luxury jewelry market continues its upward trajectory, with an estimated value exceeding $300 billion, driven by discerning consumers prioritizing authenticity.

High-Net-Worth Individuals represent a key customer segment for Gemfields, primarily engaged through its luxury brand, Fabergé. These discerning clients are the ultimate consumers of exquisite finished jewelry and unique bespoke creations. They are drawn to Fabergé by its rich heritage, unparalleled artistry, and the proven ethical sourcing of its gemstones, a value increasingly important to luxury buyers in 2024. Fabergé's focus on unique pieces resonates with this segment's demand for exclusivity and craftsmanship.

Wholesalers and Gemstone Dealers

Wholesalers and gemstone dealers are vital intermediaries who acquire parcels directly from Gemfields' auctions, such as the February 2024 emerald auction which generated $22.2 million in revenue. These entities then resell the rough gemstones to a diverse network of smaller manufacturers and jewelry retailers globally. They are indispensable for providing significant liquidity to the market and extending Gemfields' reach into various downstream segments. Their participation ensures a robust and efficient distribution channel for newly mined emeralds and rubies.

- Crucial for distributing rough gemstones from Gemfields' auctions.

- Facilitate resale to smaller jewelry manufacturers and retailers.

- Provide essential market liquidity and broad distribution reach.

- Key participants in Gemfields' auction sales, like the February 2024 emerald auction.

The Investment Community

The Investment Community represents a crucial customer segment for Gemfields Group, encompassing equity analysts, portfolio managers, and individual investors seeking transparent financial insights. These stakeholders are targeted with detailed information on the company's financial performance, strategic growth initiatives, and its unique value proposition as a leading colored gemstone producer. For example, Gemfields' 2024 production updates and operational reports are vital for these groups to assess investment potential. They rely on consistent disclosure regarding auction results and responsible sourcing practices to inform their decisions.

- Gemfields' 2024 H1 production reports are key for analysts.

- Portfolio managers evaluate the company's ESG commitments for sustainable investing.

- Individual investors track auction revenues, like the Kagem emerald auction's strong performance.

- Financial professionals analyze the impact of market demand on gemstone prices.

Gemfields' core customer segments include large-scale gemstone manufacturers and global luxury jewelry brands, seeking ethically sourced emeralds and rubies. Wholesalers and high-net-worth individuals, primarily through Fabergé, also represent key buyers. The investment community is crucial, relying on transparent financial data like Gemfields' strong 2024 auction results. For example, their February 2024 ruby auction generated $96.4 million.

| Customer Segment | Key Value Proposition | 2024 Insight |

|---|---|---|

| Large Manufacturers | Volume rough gem supply | February 2024 ruby auction: $96.4M |

| Luxury Brands | Premium, ethically sourced gems | Global luxury market exceeds $300B |

| Wholesalers/Dealers | Auction access, market liquidity | February 2024 emerald auction: $22.2M |

| Investment Community | Financial transparency, growth data | H1 2024 production reports key |

Cost Structure

Mining operations and processing represent Gemfields Group's largest cost component, a direct consequence of open-pit mining's capital-intensive nature. These substantial expenses encompass fuel, explosives, and the ongoing procurement and maintenance of heavy equipment essential for extraction. Direct labor costs associated with both mining and processing activities also contribute significantly to this base. For instance, in their 2023 financial reports, Gemfields highlighted these operational costs as primary drivers of expenditure.

Government royalties and taxation represent a significant and variable cost for Gemfields Group, directly linked to their production and revenue. The company pays substantial royalties, typically a percentage of sales, and corporate taxes to the governments of Zambia and Mozambique.

For instance, in 2023, Gemfields contributed $88.5 million in total to host governments, reflecting the direct link to operational success. These payments form a key part of their contribution to the host countries, with statutory royalty rates for precious stones often around 6% of gross sales in both nations.

Employee compensation and benefits form a significant cost for Gemfields Group, covering salaries and comprehensive benefits for its diverse global workforce. This includes essential personnel like geologists, engineers, and mine workers at sites such as Montepuez in Mozambique, alongside security teams and expert gemologists. Corporate, marketing, and sales teams in international offices, including London, also contribute to these expenses. For the fiscal year ending December 2023, Gemfields reported total administrative expenses, which include significant staff costs, at $42.2 million. This investment in human capital is crucial for operational excellence and market outreach.

Marketing, Sales, and Auction Logistics

Gemfields Group incurs significant costs in its marketing, sales, and auction logistics, essential for maintaining its premium brand and global reach. This includes substantial investments in global marketing campaigns and brand promotion, vital for driving demand for emeralds and rubies. The logistical expenses of hosting international gemstone auctions are considerable, covering critical aspects like venue hire, stringent security measures, and extensive travel for staff and potential buyers. For instance, auction costs for 2024 continue to be a key component of operational expenditure, reflecting the company’s commitment to these vital sales channels.

- Global marketing campaigns and brand promotion are substantial cost drivers.

- Logistical expenses for international gemstone auctions are significant.

- Costs include venue hire, security, and travel.

- Auction promotion contributes to overall marketing and sales expenditure.

ESG, Security, and Community Development

A critical cost category for Gemfields Group is maintaining its social license to operate, encompassing significant expenditure on ESG, security, and community development. This includes substantial investments in environmental rehabilitation efforts at mining sites and extensive on-site security to protect valuable assets, which are paramount in regions of operation. Furthermore, the company commits resources to community health, education, and livelihood projects, directly supporting local populations. For instance, in 2024, Gemfields continued to allocate a notable portion of its operational budget towards these areas, reflecting ongoing commitments.

- Significant expenditure on environmental rehabilitation initiatives.

- Robust on-site security measures for asset protection.

- Investments in community health and education programs.

- Support for local livelihood projects to foster sustainable development.

Gemfields Group's primary costs stem from capital-intensive mining operations, encompassing fuel, equipment, and direct labor. Significant government royalties and taxes, totaling $88.5 million in 2023, also form a major component. Additionally, employee compensation and administrative expenses, reaching $42.2 million in 2023, are substantial. In 2024, marketing, auction logistics, and crucial investments in ESG, security, and community development represent ongoing, significant operational expenditures for the company.

Revenue Streams

Rough gemstone auction sales are Gemfields Group's primary revenue driver, generating substantial income from its emerald and ruby operations. Revenue stems from selling rough emeralds and rubies, meticulously sorted into various grades and parcels, through periodic, closed-bid auctions to a global network of buyers. For instance, Gemfields' 2024 auctions continued to yield strong results, reinforcing this segment's financial importance. This system ensures competitive pricing and maximizes returns from its high-quality African gemstone output.

Fabergé significantly contributes as a growing revenue stream through global sales of high-end jewelry and timepieces. This includes sales from its exclusive boutiques and a robust online platform, alongside concessions within luxury department stores globally. In the first half of 2024, Fabergé continued to enhance Gemfields Group’s financial performance, demonstrating consistent demand for its luxury offerings. This diversified sales approach ensures a broad reach to affluent clientele worldwide.

While Gemfields primarily focuses on rough gemstone sales, it also generates revenue from a select inventory of cut and polished gemstones. This is often achieved through its exclusive Masterpiece Collection or specific high-profile collaborations with luxury brands. These sales capture a significantly higher margin per carat, leveraging the rarity and craftsmanship of the finished gems. For instance, in their recent financial updates, such polished sales contribute to premium segment growth, enhancing overall profitability beyond the rough auction model.

Management Fees from Mining Operations

Gemfields, leveraging its majority ownership and operational control of key mines like Kagem Mining Ltd, generates revenue through management fees. These fees are charged to its subsidiary mining operations for comprehensive technical, operational, and marketing services provided by the group. This structure ensures a consistent revenue stream beyond direct sales, reflecting the value of Gemfields' expertise and oversight across its portfolio.

- Gemfields' management fees contribute to its diversified revenue base, complementing direct gemstone sales.

- These fees cover essential services, ensuring efficient and compliant mining operations.

- For the six months ending June 30, 2024, such fees underscore the group’s integrated business model.

- This internal revenue stream highlights Gemfields' strategic control over its mining assets.

Interest and Dividend Income

Interest and dividend income represents a secondary revenue stream for Gemfields Group, stemming from its financial activities. This includes interest earned on cash holdings, which significantly increased to USD 12.3 million in 2023 from USD 4.9 million in 2022. Additionally, potential dividends from equity investments or joint venture partnerships contribute to this income. Such financial income diversifies the group's revenue beyond gemstone sales.

- Finance income for 2023 was USD 12.3 million.

- This marks a substantial increase from USD 4.9 million in 2022.

- Mainly comprises interest earned on cash and cash equivalents.

- Supplements core gemstone auction revenues.

Gemfields Group primarily generates revenue through rough emerald and ruby auctions, which continued strong performance in 2024. Fabergé's luxury jewelry sales also contribute significantly, with its H1 2024 results boosting group financial performance. Additionally, the group earns management fees from its mining operations and interest income, totaling USD 12.3 million in 2023.

| Revenue Stream | Primary Source | 2024/Recent Data Point |

|---|---|---|

| Rough Gemstone Sales | Emerald and ruby auctions | Continued strong results in 2024 |

| Fabergé Sales | Luxury jewelry and timepieces | Enhanced performance in H1 2024 |

| Interest Income | Cash holdings and investments | USD 12.3 million in 2023 |

Business Model Canvas Data Sources

The Gemfields Group Business Model Canvas is informed by a blend of internal financial reports, extensive market research on gemstone demand and pricing, and operational data from mining and distribution activities. These sources are crucial for accurately defining our value propositions, customer segments, and revenue streams.