Gemfields Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gemfields Group Bundle

Gemfields Group operates in a fascinating niche, where the threat of new entrants is somewhat mitigated by high capital requirements and specialized knowledge. However, buyer power can be significant, especially with large jewelry manufacturers and retailers. Understanding the intensity of these forces is crucial for navigating the competitive landscape effectively.

The bargaining power of suppliers for Gemfields is generally moderate, given the unique nature of their primary product, emeralds. Yet, the threat of substitutes, while not direct in terms of precious gemstones, exists in the broader luxury goods market. This dynamic interplay shapes profitability and strategic positioning.

To truly grasp the intricate web of competition and understand Gemfields Group's strategic advantages and vulnerabilities, a comprehensive analysis is essential. Unlock the full Porter's Five Forces Analysis to explore Gemfields Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Gemfields' primary suppliers, the governments of Zambia and Mozambique, hold considerable bargaining power due to the concentrated nature of mining licenses and resource control. These national governments dictate terms, taxes, and royalties, directly impacting Gemfields' operational costs and profitability.

This concentration is further amplified by the specialized nature of mining rights, which are not easily transferable or replicable. For instance, Zambia's reintroduction of a 15% export duty on emeralds in early 2025, although later suspended, highlights the governments' ability to unilaterally impose significant financial burdens, underscoring their supplier power.

The availability of skilled labor, such as geologists and mining engineers, is vital for Gemfields Group. A tight labor market in mining, as seen with a projected global shortage of skilled mining professionals, can elevate wage demands, thereby increasing operational costs for Gemfields. This scarcity grants specialized workers a degree of bargaining power.

The bargaining power of mining equipment and technology providers for Gemfields Group is moderate. The specialized nature of large-scale gemstone mining, particularly for operations like Gemfields' Montepuez ruby mine, requires highly advanced and specific machinery, from heavy earthmoving equipment to sophisticated processing and optical sorting plants.

Suppliers of these critical technologies, especially those with proprietary innovations, can exert significant influence. For instance, companies offering advanced optical sorters, which are crucial for efficient gemstone recovery, can command higher prices if their technology offers a distinct advantage and there are few comparable alternatives available in the market.

In 2024, the global mining equipment market was valued at approximately $190 billion, with a significant portion dedicated to specialized and technologically advanced machinery. This indicates a competitive landscape, but for highly niche technologies, supplier power remains a factor.

Gemfields' reliance on cutting-edge technology for efficient extraction and sorting means that disruptions in supply or significant price increases from key equipment providers could impact operational costs and output. The group's strategy often involves long-term partnerships with select suppliers to mitigate this risk and secure favorable terms.

Local Communities and Social License to Operate

Local communities near Gemfields' mining operations hold considerable bargaining power, directly influencing the company's ability to maintain its social license to operate. Issues such as land use rights, the terms of community development agreements, and the effective management of environmental and social impacts are key areas where these communities can exert influence. A failure to satisfy community expectations can lead to operational disruptions, impacting Gemfields' production and profitability.

In 2023, Gemfields continued its engagement with local communities through various initiatives. For instance, the Kagem mine in Zambia reported ongoing investment in community infrastructure projects, including schools and healthcare facilities, as part of its commitment to shared value. These efforts are crucial for fostering goodwill and ensuring uninterrupted access to mining sites, a vital component of the company's operational stability.

- Community Investment: Gemfields' ongoing investment in local infrastructure and social programs directly addresses community needs, strengthening relationships and mitigating potential conflicts.

- Social License: Maintaining a positive 'social license to operate' is paramount, as community opposition can lead to significant operational delays or stoppages.

- Stakeholder Engagement: Proactive and transparent engagement with local stakeholders is essential for managing expectations and securing long-term operational continuity.

Logistics and Infrastructure Providers

Logistics and infrastructure providers hold significant bargaining power for Gemfields, especially given the remote mining locations in Zambia and Mozambique. These providers are essential for transporting raw materials and finished goods, as well as ensuring reliable energy supply to operations. For instance, disruptions stemming from events like the civil unrest in Mozambique during late 2024 and early 2025 underscored the critical nature and potential leverage of these service providers or the external factors influencing them.

The reliance on these partners means that any interruption or increased cost from logistics and infrastructure can directly impact Gemfields' operational efficiency and profitability. The limited availability of specialized logistics in these regions further concentrates this power. Gemfields' 2024 operational reports, for example, noted increased transportation costs by approximately 8% due to fuel price volatility and infrastructure maintenance needs in key transit routes.

- Criticality of Services: Reliable transportation and energy are non-negotiable for Gemfields' mining and processing activities.

- Geographic Concentration: The remote nature of mines limits the number of viable logistics and infrastructure partners, increasing their influence.

- External Shocks: Geopolitical events or natural disasters impacting infrastructure can amplify the bargaining power of remaining or alternative providers.

- Cost Pass-Through: Providers can pass on increased operational costs (e.g., fuel, maintenance) to Gemfields, impacting margins.

The governments of Zambia and Mozambique, holding mining licenses, exert significant supplier power over Gemfields by dictating terms, taxes, and royalties. This control is amplified by the specialized nature of mining rights, as seen with Zambia's reintroduction of a 15% export duty on emeralds in early 2025, demonstrating their capacity to impose financial burdens.

What is included in the product

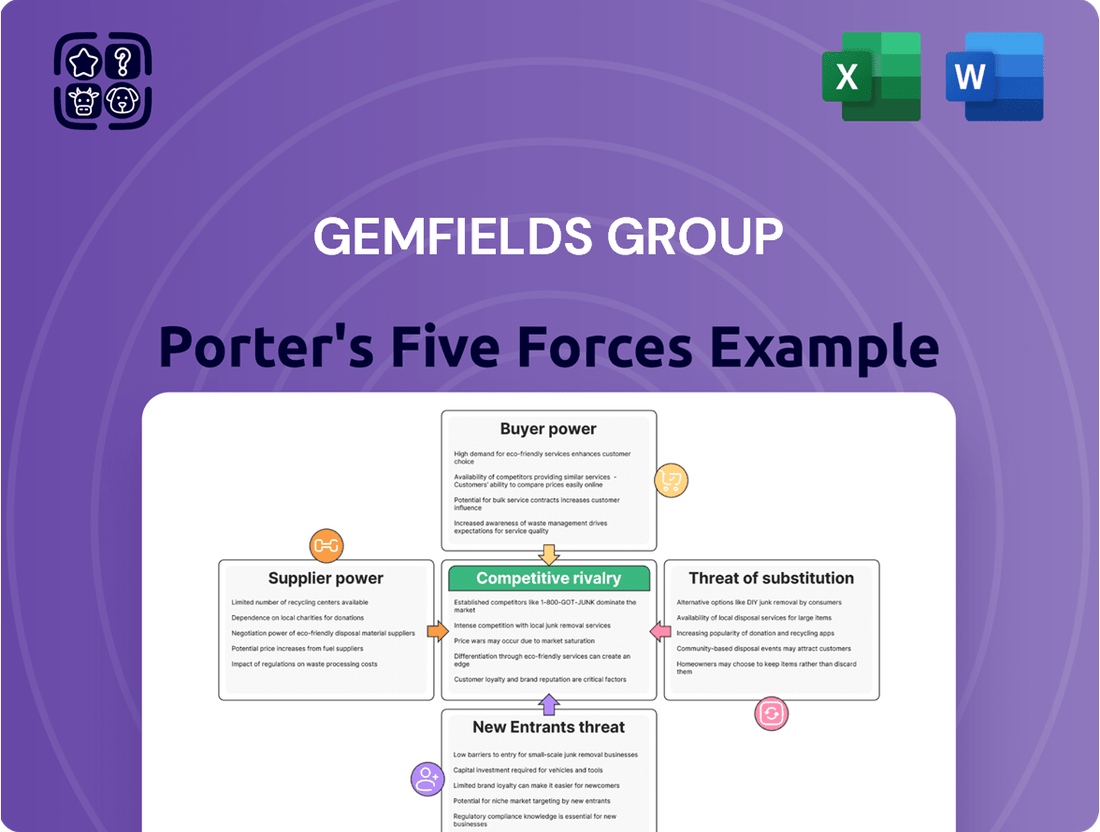

This analysis thoroughly examines the competitive forces impacting Gemfields Group, detailing the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the colored gemstone market.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Gemfields Group, enabling proactive strategic adjustments.

Customers Bargaining Power

Gemfields' customer base, particularly at the auction level, is highly fragmented. This means that the buyers of their rough gemstones are numerous and varied, including manufacturers, jewelers, and established brands from around the world.

This dispersion of buyers significantly limits the bargaining power of any single customer. For instance, in 2024, no individual third-party customer represented more than 10% of Gemfields' total sales. This lack of concentration means that customers cannot easily exert pressure on Gemfields to lower prices or dictate terms without risking losing access to the supply.

Customers, especially those in the luxury sector like Fabergé, a Gemfields brand, are prioritizing gemstones that are not only high-quality but also ethically sourced and traceable. This growing demand for provenance shifts the focus away from price alone.

Gemfields' dedication to responsible mining practices and its unique grading system builds significant customer trust. This trust can lessen customers' leverage to demand lower prices, as the added value of quality and ethical sourcing becomes a key purchasing driver.

Consumers are increasingly seeking unique and personalized jewelry, driving a notable shift towards colored gemstones as alternatives to traditional diamonds. This trend is particularly strong in the bridal sector, where colored stones offer a distinct expression of individuality.

The global colored gemstone market is anticipated to experience robust growth, with projections indicating a significant expansion in the coming years. For instance, the market was valued at approximately $25 billion in 2023 and is expected to reach over $40 billion by 2030, showcasing a compound annual growth rate of around 7%.

This rising consumer demand for colored gemstones, including emeralds, rubies, and sapphires, directly benefits producers like Gemfields. It expands the overall market for their offerings, thereby diminishing the bargaining power of individual customers who have more choices and less leverage over pricing.

Influence of Downstream Brands and Retailers

Gemfields' bargaining power of customers is significantly influenced by the downstream luxury brands and retailers who purchase their rough gemstones. These entities, like Tiffany & Co. or Cartier, are the ultimate arbiters of consumer taste and demand for finished jewelry. Their ability to shape trends and perceptions grants them considerable leverage, as they can prioritize specific gemstone qualities or ethical sourcing requirements, directly impacting Gemfields' sales and operational focus.

For instance, major luxury jewelry houses often dictate the specifications for the rough stones they procure, influencing everything from color saturation to cut feasibility. This downstream demand, driven by sophisticated marketing and brand loyalty, allows these buyers to exert indirect pressure on Gemfields. In 2023, the global luxury jewelry market was valued at approximately $280 billion, highlighting the immense financial clout of these downstream players.

- Downstream Brand Influence: Luxury brands dictate consumer preferences and gemstone trends.

- Retailer Power: Retailers translate consumer demand into specific gemstone requirements.

- Sourcing Standards: Buyers can demand specific ethical and traceability standards, impacting Gemfields' operations.

- Market Value Impact: The substantial value of the luxury jewelry market ($280 billion in 2023) underscores the bargaining power of these downstream customers.

Market Transparency and Information Asymmetry

Gemfields' innovative auction platform and proprietary grading system are designed to significantly reduce information asymmetry in the colored gemstone market. This transparency empowers buyers by providing clear, consistent quality assessments, thereby limiting their ability to leverage uncertainty for price concessions.

By establishing a reliable benchmark for quality and supply, Gemfields diminishes the bargaining power derived from a lack of information. This approach ensures that buyers are well-informed, making price negotiations more about value than about exploiting knowledge gaps.

- Reduced Information Asymmetry: Gemfields' grading system offers buyers objective quality data, minimizing the advantage previously held by those with superior market knowledge.

- Empowered Buyers: Consistent supply and transparent quality assessments allow customers to make more informed purchasing decisions, leveling the playing field.

- Impact on Pricing: This transparency can lead to more stable and predictable pricing, as buyers are less reliant on guesswork or insider information to determine fair value.

The bargaining power of Gemfields' customers is relatively low, primarily due to the fragmented nature of its buyer base and the increasing demand for ethically sourced gemstones. While large luxury brands hold some sway due to their market influence, Gemfields' transparency and quality grading systems mitigate the power of individual buyers to negotiate significantly lower prices.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Observation |

|---|---|---|

| Customer Concentration | Low | No single third-party customer represented over 10% of Gemfields' total sales in 2024. |

| Demand for Ethical Sourcing | Low | Consumers and brands prioritize provenance, shifting focus from price alone. |

| Downstream Brand Influence | Moderate | Luxury brands dictate trends, but Gemfields' transparency counters some leverage. |

| Information Asymmetry | Low | Gemfields' grading system provides clear quality data, reducing buyer advantage. |

Preview the Actual Deliverable

Gemfields Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Gemfields Group, offering a detailed examination of competitive rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. The document you see here is the exact, fully formatted analysis you will receive immediately after purchase, providing actionable insights for strategic decision-making without any hidden content or placeholders.

Rivalry Among Competitors

The global market for high-quality, large-scale emerald and ruby mining exhibits significant concentration, with Gemfields standing as a dominant world-leading producer. This concentration directly impacts competitive rivalry by limiting the number of players capable of operating at such a scale and with comparable responsible mining practices. For instance, Gemfields' Kagem emerald mine is recognized as the world's largest single emerald producer, and its Montepuez ruby deposit is among the most substantial discoveries, creating a high barrier to entry for new, similarly positioned competitors.

Gemfields, despite its strong market position, contends with significant rivalry from other natural gemstone producers. This competition intensifies when rivals strategically time their auctions and adjust pricing, directly impacting market dynamics and Gemfields' revenue streams.

The emerald sector, in particular, demonstrated this sensitivity in the latter half of 2024. An oversupply of Zambian emeralds, offered at reduced prices by a competing producer, created considerable market disruption. This event underscores how crucial it is for Gemfields to closely monitor and react to the competitive landscape, especially concerning auction schedules and pricing strategies of its rivals.

Gemfields stands out in the competitive gemstone market by deeply embedding responsible sourcing and ethical practices into its brand identity. This commitment, coupled with its ownership of the luxury brand Fabergé, creates a powerful differentiator. This strategic integration appeals directly to a growing consumer base that prioritizes sustainability and provenance in their purchases.

The company's transparency in its mining operations and supply chain builds trust, a crucial factor in the often opaque world of colored gemstones. By owning Fabergé, Gemfields gains direct access to the luxury market, allowing for controlled brand messaging and a premium customer experience. This dual approach positions Gemfields as more than just a supplier; it's a purveyor of ethically sourced luxury.

Market Dynamics and Price Volatility

The colored gemstone market is inherently volatile, with demand often swinging based on global economic health and geopolitical stability. This fluctuation directly impacts pricing and creates a challenging environment for major players.

Gemfields, for instance, saw its revenues significantly impacted in 2024. This was a direct result of tougher market conditions and a reduced output of high-quality rubies. This situation highlights how sensitive the industry is to external factors and internal production capabilities.

- Market Sensitivity: Demand for colored gemstones is closely tied to discretionary spending, making it vulnerable to economic downturns.

- Geopolitical Impact: Instability in key regions can disrupt supply chains and affect consumer confidence, leading to price drops.

- Production Challenges: Lower yields of premium stones, as experienced by Gemfields, directly reduce revenue potential in a competitive landscape.

- Price Volatility: The market can see rapid price shifts, making forecasting and consistent revenue generation difficult for companies.

Product Quality and Consistency

Maintaining a consistent supply of high-quality gemstones is a crucial element of competition within the industry. Gemfields leverages its structured auction system, which provides buyers with predictable access to graded rough stones, thereby solidifying its market standing.

Gemfields' strategic investments in processing infrastructure are designed to bolster product quality and consistency. For instance, the company's expansion of its ruby processing capabilities in Montepuez, with a second plant anticipated to triple capacity by the first half of 2025, directly addresses this competitive factor.

- Consistent Supply: Gemfields' auction system ensures a regular flow of gemstones to the market.

- Quality Assurance: Investment in processing plants enhances the grading and quality of rough gemstones.

- Capacity Expansion: The Montepuez ruby processing plant's capacity increase by H1 2025 is a key indicator of commitment to consistent supply.

Gemfields faces a competitive landscape where rivals strategically time auctions and adjust pricing, impacting market dynamics. For example, in late 2024, an oversupply of Zambian emeralds at lower prices caused market disruption, highlighting the need for Gemfields to monitor competitor actions closely. The company's commitment to responsible sourcing and its ownership of Fabergé serve as key differentiators against competitors focused solely on extraction.

| Competitor Action | Impact on Gemfields | Example (H2 2024) |

|---|---|---|

| Strategic Auction Timing | Market Share Fluctuation | N/A |

| Pricing Adjustments | Revenue Pressure | Zambian emeralds offered at reduced prices |

| Ethical Sourcing Practices | Brand Differentiation | Gemfields' focus on responsible mining |

| Luxury Brand Integration | Market Access & Premium Pricing | Gemfields' ownership of Fabergé |

SSubstitutes Threaten

The most significant threat to Gemfields Group comes from synthetic and lab-grown gemstones. These alternatives offer consumers more affordable options, often with guaranteed consistency in quality and appealing ethical sourcing claims. This directly challenges the perceived value and exclusivity of natural stones.

The market for synthetic gemstones is not just growing; it’s experiencing robust expansion. This growth is fueled by increasing consumer acceptance and rapid technological advancements in production methods. For instance, the lab-grown diamond market alone saw significant growth, with sales projected to reach billions globally by 2024, putting pressure on traditional mining operations.

Treated natural gemstones present a significant threat of substitution for Gemfields Group. These treated stones, enhanced for color or clarity, provide a more budget-friendly alternative to untreated, premium natural gems. For instance, amethyst is often heat-treated to achieve deeper purples, making it far more accessible than naturally vibrant amethyst.

Consumers' discretionary spending can be directed towards a vast range of luxury items, presenting a significant threat of substitution for Gemfields Group. Beyond precious stones and jewelry, affluent individuals have numerous other avenues to express their wealth and seek status, such as designer fashion, high-end automobiles, fine art, and exclusive travel experiences. This broad competitive landscape means that demand for Gemfields' core products is not guaranteed and can easily be siphoned off by competing luxury categories.

For high-net-worth individuals, colored gemstones often compete with other investment vehicles for capital allocation. While gemstones can be seen as an alternative asset, the market for them is less liquid and transparent compared to traditional investments like equities or real estate. In 2024, global real estate markets continued to show resilience in certain sectors, and stock markets, particularly in developed economies, offered substantial returns, potentially drawing investment away from the gemstone sector.

Alternative Materials in Jewelry

While not direct competitors to emeralds, other luxury materials like precious metals, pearls, and diamonds, including both natural and lab-grown varieties, represent substitutes in the wider jewelry market. The perceived value and desirability of these alternatives can influence consumer spending on colored gemstones.

Consumer preferences are evolving, with a notable shift observed in 2025 towards colored gemstones, potentially drawing demand away from traditional diamonds. This trend highlights the substitutability within the luxury goods sector. For instance, reports from late 2024 indicated a growing interest in alternative gemstones for engagement rings, suggesting a direct impact on the diamond market and, by extension, other colored gemstones.

- Precious Metals: Gold, platinum, and silver are fundamental components of jewelry, often complementing or replacing gemstones in certain designs.

- Pearls: Offering a distinct aesthetic, pearls compete for consumer attention and disposable income within the luxury jewelry segment.

- Diamonds: Both natural and lab-grown diamonds remain significant substitutes, particularly as consumers re-evaluate traditional choices, as seen with the increasing acceptance of lab-grown diamonds in 2024-2025.

- Colored Gemstones: Within the colored gemstone category itself, a shift in preference from one type to another, such as from sapphires to emeralds, signifies internal substitution dynamics.

Consumer Education and Transparency

The threat of substitutes for natural gemstones like those offered by Gemfields is significantly reduced when consumers are well-informed and the industry operates with transparency. Gemfields' commitment to educating consumers about the unique characteristics, ethical sourcing, and inherent value of natural emeralds, rubies, and sapphires plays a crucial role here. By highlighting the rarity and artisanal craftsmanship involved, Gemfields helps differentiate its products from synthetic alternatives or other luxury materials.

Consumer education empowers buyers to understand the intrinsic value proposition of natural gemstones, making it harder for substitutes to compete solely on price or appearance. For example, the market for lab-grown diamonds has seen significant growth, with some reports indicating a substantial increase in their market share in recent years. However, with increasing awareness of the environmental and ethical considerations tied to mining, alongside the unique provenance stories that natural gemstones can offer, consumers are increasingly looking beyond mere material composition.

Gemfields’ proactive approach to transparency, including detailed information about mine operations and supply chain integrity, builds trust and reinforces the perceived value of their natural stones. This transparency allows consumers to make informed choices, appreciating the provenance and rarity of natural gemstones over mass-produced or synthetically created alternatives. This focus on education and transparency directly addresses the threat of substitutes by solidifying the unique selling propositions of natural gemstones.

- Consumer Education: Initiatives that highlight the rarity, unique geological formation, and artisanal processes behind natural gemstones versus synthetics.

- Industry Transparency: Detailed reporting on sourcing practices, environmental impact, and community engagement to build consumer trust.

- Value Proposition: Emphasizing provenance, historical significance, and the enduring investment value of natural gemstones.

- Market Differentiation: Creating a clear distinction between the unique attributes of natural stones and the characteristics of lab-grown or imitation alternatives.

The threat of substitutes for Gemfields Group is significant, primarily from synthetic and treated gemstones, which offer lower price points and perceived consistency. Beyond these direct alternatives, a broad array of luxury goods and investments, including precious metals, diamonds (both natural and lab-grown), fine art, and real estate, vie for consumer discretionary spending and capital allocation, especially in 2024 when traditional investments showed strong returns.

The growing acceptance and technological advancements in lab-grown gemstones, particularly diamonds, directly challenge the market for natural stones. For instance, the lab-grown diamond market was projected for substantial global sales in 2024. Furthermore, treated natural gemstones provide a more affordable entry into owning colored stones, impacting demand for higher-quality, untreated alternatives.

Consumer education and industry transparency are key mitigators for Gemfields. By emphasizing the rarity, provenance, and ethical sourcing of natural gemstones, the company can differentiate its offerings from synthetics and other luxury categories. This strategy aims to solidify the unique value proposition of natural stones against substitutes that may compete on price or convenience.

| Substitute Category | Key Characteristics | Impact on Gemfields | 2024/2025 Trends |

| Synthetic Gemstones | Lower price, consistent quality, ethical marketing | Direct competition, eroding perceived value of natural stones | Rapid market growth, increasing consumer acceptance |

| Treated Natural Gemstones | Enhanced appearance, more affordable than untreated | Offers a budget alternative, impacting demand for premium natural stones | Established market, continues to provide accessible options |

| Other Luxury Goods | Fashion, art, automobiles, travel | Diversion of discretionary spending and investment capital | Resilient luxury market, strong performance in real estate and equities |

| Precious Metals & Diamonds | Established luxury appeal, investment vehicles | Direct competition within jewelry market, diamonds are a major substitute | Continued strong demand for gold and platinum; lab-grown diamonds gaining market share |

Entrants Threaten

The colored gemstone mining industry, particularly for large-scale operations like those Gemfields engages in, demands immense upfront capital. Think millions, even billions, for exploration, specialized equipment, and processing facilities. For instance, establishing a new emerald mine can easily run into the hundreds of millions of dollars, a sum that deters many potential newcomers.

Beyond the financial hurdle, the inherent geological risk is a major deterrent. Discovering commercially viable gemstone deposits is akin to finding a needle in a haystack, with a high probability of exploration efforts yielding nothing. This uncertainty means new entrants face the prospect of substantial investment with no guarantee of return, a significant barrier that protects established players like Gemfields.

Governments in gemstone-rich nations, such as Zambia and Mozambique where Gemfields operates, wield significant control through mining licenses and rigorous regulations. These often encompass detailed environmental and social impact assessments, alongside substantial taxes and royalties. For instance, Zambia's Mines and Minerals Development Act requires extensive documentation and fees for exploration and mining licenses, creating a substantial upfront investment and compliance burden. This intricate web of legal and administrative requirements acts as a formidable barrier, deterring many potential new entrants who may lack the capital, expertise, or connections to navigate these complexities successfully.

Entering the gemstone mining sector, particularly at a scale comparable to established players like Gemfields Group, demands significant upfront investment in highly specialized expertise. This includes deep knowledge in geology for resource identification, sophisticated engineering for mine design and operation, and advanced processing techniques. For instance, the development of advanced laser sorting technology, crucial for efficiently separating valuable gemstones from waste rock, represents a considerable technological barrier.

The sheer capital outlay required for acquiring or developing this specialized technology and cultivating the necessary human capital is a substantial deterrent. New entrants must contend with the costs associated with cutting-edge exploration equipment, advanced extraction machinery, and state-of-the-art sorting and grading systems. This financial hurdle, coupled with the long lead times for realizing returns, makes the threat of new entrants moderate.

Established Supply Chains and Auction Platforms

Gemfields' established supply chains and auction platforms present a substantial barrier to new entrants. The company has invested heavily in creating a transparent and efficient system for sourcing and selling rough gemstones, which is crucial for building buyer confidence. For instance, Gemfields' auction revenues reached $713 million in 2023, demonstrating the scale and effectiveness of their existing channels.

New competitors would face immense challenges in replicating Gemfields' established infrastructure and relationships. Building trust with a global network of buyers and ensuring a consistent supply of ethically sourced, graded rough gemstones requires significant time and capital investment. This intricate network, honed over years, provides Gemfields with a distinct competitive advantage that is difficult for newcomers to overcome.

- Established Auction Platform: Gemfields operates a proprietary auction system that facilitates direct sales to a global customer base, ensuring price discovery and market access.

- Supply Chain Integrity: The group's commitment to ethical sourcing and traceability through its supply chain builds a reputation that new entrants would struggle to match quickly.

- Buyer Network Trust: Gemfields has cultivated long-standing relationships with key downstream partners, creating a loyal customer base that values the consistency and quality offered.

- Significant Capital Requirement: Establishing comparable supply chain logistics, grading expertise, and auction infrastructure would demand substantial upfront investment, deterring many potential entrants.

Brand Reputation and Ethical Sourcing Demands

The colored gemstone industry, especially for premium stones, is increasingly focused on ethical sourcing, transparency, and sustainability. New entrants would need to quickly establish robust responsible practices to compete, a challenging feat given Gemfields' long-standing commitment. For instance, in 2023, Gemfields reported that 99% of its rough emeralds and rubies were sold through its auction system, which emphasizes transparency and adherence to responsible sourcing principles.

Building a strong brand reputation for ethical practices takes significant time and investment. Newcomers would face the daunting task of demonstrating trustworthiness and commitment to these values, a hurdle Gemfields has already cleared through years of dedicated effort and transparent reporting. The market demands more than just beautiful stones; it demands provenance and ethical assurance, which are costly to verify and communicate effectively.

- Brand Reputation: New entrants must invest heavily to build trust and a positive image in an industry where reputation is paramount.

- Ethical Sourcing: Meeting the high bar for ethical sourcing and transparency, as established by industry leaders like Gemfields, requires significant upfront investment and ongoing commitment.

- Transparency Demands: Consumers and regulators are demanding greater transparency in the supply chain, making it difficult for new, less established players to gain credibility.

- Sustainability Focus: The growing emphasis on sustainability means new entrants must adopt environmentally and socially responsible practices from the outset, adding to their operational costs and complexity.

The threat of new entrants into the colored gemstone mining sector, especially for operations on the scale of Gemfields Group, remains moderate. High capital requirements for exploration, specialized equipment, and navigating complex government regulations in key mining nations like Zambia and Mozambique act as significant deterrents. For instance, a new emerald mine development can easily exceed hundreds of millions of dollars, creating a substantial financial barrier.

Furthermore, the inherent geological risks involved in discovering viable gemstone deposits, coupled with the need for specialized expertise in geology and engineering, deter many potential competitors. Gemfields' established auction platforms and robust, ethically sourced supply chains, evidenced by $713 million in auction revenues in 2023, create additional hurdles for newcomers seeking to replicate their market access and buyer trust.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for exploration, equipment, and facilities. | Significant deterrent due to scale of investment required. |

| Geological Risk | Uncertainty in discovering commercially viable deposits. | High risk discourages new players from investing heavily. |

| Government Regulations | Complex licensing, taxes, and compliance requirements. | Adds cost and complexity, favoring established players. |

| Specialized Expertise | Need for deep knowledge in geology, engineering, and processing. | Requires significant investment in human capital and technology. |

| Established Supply Chains & Brands | Existing infrastructure, buyer networks, and reputation. | Difficult and costly for new entrants to replicate. |

Porter's Five Forces Analysis Data Sources

Our Gemfields Group Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, annual reports, and investor presentations. We also leverage industry-specific market research reports and reputable trade publications to capture a comprehensive view of the competitive landscape.