Gelsenwasser SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gelsenwasser Bundle

Gelsenwasser's strengths lie in its established infrastructure and strong regional presence, while its opportunities stem from the growing demand for sustainable energy solutions. However, understanding the full scope of their challenges, such as regulatory changes and increasing competition, is crucial for informed decision-making.

Want the full story behind Gelsenwasser's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Gelsenwasser's core strength lies in its provision of essential utility services, namely drinking water and natural gas. These are not discretionary purchases; they are fundamental necessities for households and businesses alike, ensuring a consistent and predictable demand for the company's offerings. This inherent demand underpins stable revenue streams and a resilient business model, even in fluctuating economic conditions.

Gelsenwasser's comprehensive value chain management is a significant strength. The company oversees everything from water extraction and treatment to its final distribution, alongside operating extensive gas distribution networks. This end-to-end control allows for superior quality assurance, operational efficiency, and cost management, minimizing dependencies on outside entities and bolstering overall business resilience.

Gelsenwasser's strength lies in its diverse service portfolio, extending beyond its foundational water and gas operations. The company actively engages in wastewater management, provides energy consulting, and undertakes infrastructure development projects for both municipal and corporate clients. This broad range of services effectively mitigates risk by distributing it across multiple business segments.

This strategic diversification not only shields Gelsenwasser from downturns in any single market but also cultivates additional revenue streams. For instance, in 2023, revenue from its energy services segment saw a notable increase, contributing to the overall financial stability and growth of the company.

Strong Regional Presence and Local Partnerships

Gelsenwasser's enduring presence in the Ruhr area, dating back to 1887, has cultivated deep-seated relationships with numerous municipalities and local entities. This long-standing regional commitment, exemplified by their participation in projects like the H2-supply initiative in North Rhine-Westphalia, builds significant trust and helps secure vital long-term contracts and concessions.

Their extensive network of local partnerships is a critical asset, allowing them to navigate regional regulations and community needs effectively. This localized approach has historically translated into stable revenue streams and a strong competitive advantage within their core operating territories.

- Established since 1887

- Deep roots in the Ruhr area

- Strong relationships with municipalities

- Active in North Rhine-Westphalia initiatives

Commitment to Sustainability and Innovation

Gelsenwasser's commitment to sustainability is a significant strength, highlighted by their win of the German Sustainability Award in the water supply sector for 2024. This recognition underscores their 'Nachhaltig blau-grün' strategy, which guides their operations towards environmentally responsible practices.

Their proactive investment in resilient water infrastructure, exceeding €200 million for water treatment expansion, showcases a dedication to long-term viability. Furthermore, Gelsenwasser's exploration into hydrogen infrastructure demonstrates a forward-thinking approach, positioning them to adapt to evolving energy landscapes.

- German Sustainability Award 2024 Winner (water supply category)

- 'Nachhaltig blau-grün' strategy driving sustainable operations

- Over €200 million invested in water treatment expansion

- Exploration of hydrogen infrastructure indicating future readiness

Gelsenwasser's core strength is its provision of essential utility services, water and gas, ensuring consistent demand and stable revenue. Their comprehensive value chain control from extraction to distribution minimizes external dependencies and enhances efficiency. The company's diverse service portfolio, including wastewater management and energy consulting, effectively mitigates risk by spreading it across multiple business segments.

Furthermore, Gelsenwasser's deep regional roots, established in 1887 in the Ruhr area, foster strong municipal relationships and secure long-term contracts. This localized approach, evident in their participation in North Rhine-Westphalia's H2-supply initiatives, provides a significant competitive edge. Their commitment to sustainability, recognized by the German Sustainability Award 2024, and substantial investments in infrastructure, such as over €200 million in water treatment expansion, position them for future growth and resilience.

| Strength Area | Key Aspect | Supporting Fact/Data |

|---|---|---|

| Essential Utility Services | Consistent Demand | Water and gas are fundamental necessities, ensuring predictable revenue. |

| Value Chain Control | Operational Efficiency | End-to-end management from extraction to distribution. |

| Service Diversification | Risk Mitigation | Portfolio includes wastewater management and energy consulting. |

| Regional Presence & Relationships | Long-Term Contracts | Established since 1887 in the Ruhr area, strong municipal ties. |

| Sustainability & Investment | Future-Proofing | German Sustainability Award 2024; >€200M in water treatment expansion. |

What is included in the product

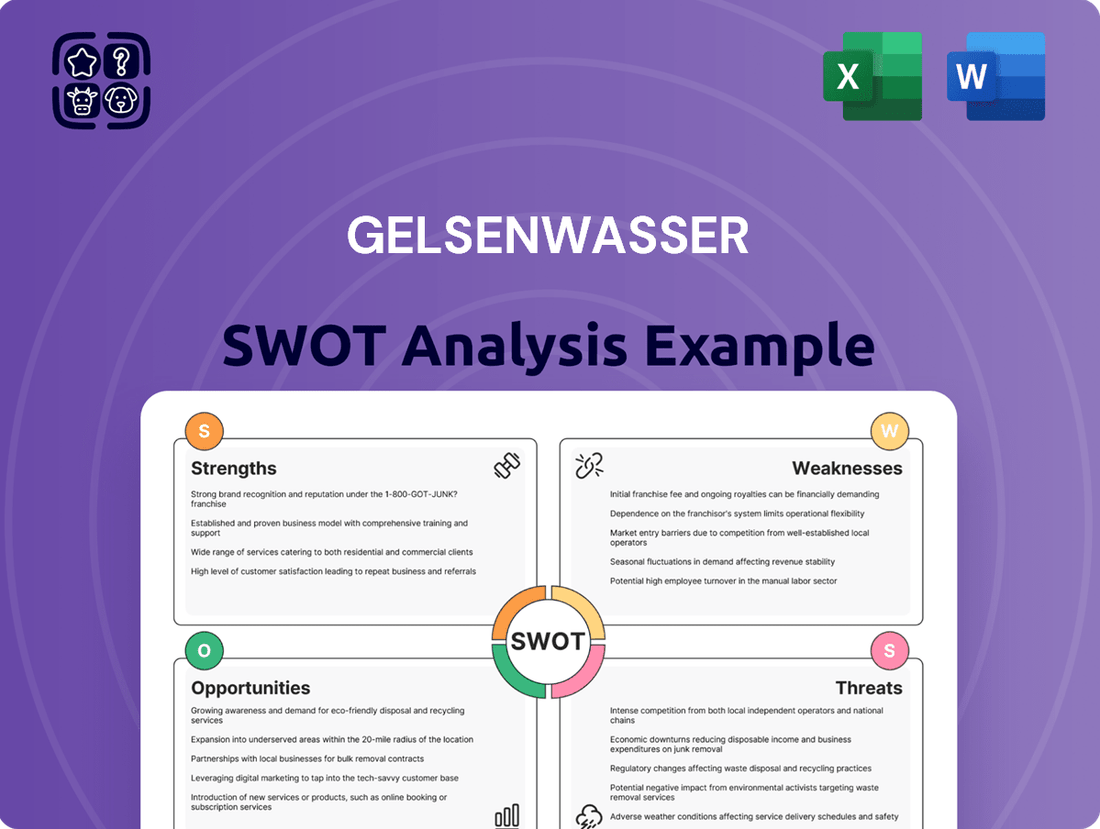

Delivers a strategic overview of Gelsenwasser’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Gives a clear, actionable SWOT analysis that simplifies complex strategic challenges for Gelsenwasser.

Weaknesses

Gelsenwasser's reliance on stringent regulatory frameworks for water and gas services presents a significant weakness. For instance, the German Federal Network Agency's (BNetzA) decisions on network access charges and investment frameworks directly influence revenue streams. Any adverse shifts in these regulations, potentially seen in upcoming regulatory reviews for 2025, could compress profit margins and necessitate costly strategic adjustments, thereby hampering Gelsenwasser's ability to pursue agile growth strategies.

Gelsenwasser's operations are inherently capital-intensive, demanding substantial and continuous investment in maintaining and upgrading its vast network of water and gas infrastructure, including treatment plants and distribution systems. This constant need for upkeep and modernization represents a significant financial commitment.

For instance, major projects such as the €200 million expansion of a water treatment facility, while crucial for long-term capacity, directly divert considerable financial resources, potentially affecting the company's short-term profitability and financial flexibility.

Gelsenwasser's profitability is quite sensitive to swings in natural gas prices. For instance, in 2024, natural gas prices saw considerable volatility, impacting operational costs for energy-intensive processes like water extraction and treatment. While Gelsenwasser actively participates in energy procurement and trading, significant and rapid price hikes in these essential commodities can still squeeze profit margins if these increased costs cannot be fully passed on to customers or effectively hedged.

Aging Infrastructure and Modernization Challenges

Gelsenwasser faces the ongoing challenge of aging infrastructure, with a significant portion of its network requiring continuous investment for modernization. This is crucial to guarantee reliable service delivery and to comply with increasingly stringent environmental regulations and evolving technological demands. For instance, in 2023, the company allocated a substantial portion of its capital expenditure towards network maintenance and upgrades, reflecting the persistent need to address these aging assets.

Balancing the imperative for these costly upgrades with the need for cost efficiency and maintaining affordable service prices for its customer base is a significant hurdle. The sheer scale of necessary modernization projects means that Gelsenwasser must carefully manage its investment strategy to avoid disproportionate price increases.

- Aging Network Components: A considerable part of Gelsenwasser's water and wastewater pipelines date back several decades, necessitating proactive replacement and refurbishment.

- Modernization Costs: Upgrading these systems to meet current and future standards requires significant capital outlay, impacting operational budgets.

- Regulatory Compliance: Evolving environmental and safety standards demand continuous investment in technology and infrastructure upgrades to ensure compliance.

- Affordability Balance: The company must balance the cost of modernization with its commitment to providing services at affordable rates for consumers.

Potential Impact of Demographic Change and Water Consumption Trends

Demographic shifts, such as an aging population and potential migration patterns, could alter regional water demand. For instance, a decline in industrial water usage, observed in some sectors during 2024, might reduce overall demand for Gelsenwasser's services, requiring adjustments to their service offerings and infrastructure planning.

Changing consumption patterns, including a growing emphasis on water conservation, could also influence demand. While Gelsenwasser reported stable overall water abstraction in recent periods, these long-term trends necessitate strategic foresight to adapt supply models and potentially invest in more efficient distribution networks.

- Shifting Demographics: Aging populations and migration trends can lead to localized increases or decreases in water demand.

- Industrial Demand Fluctuations: A noted decline in industrial water usage in 2024 highlights the vulnerability of demand to economic cycles and technological shifts.

- Conservation Efforts: Increased public awareness and adoption of water-saving technologies will likely impact per capita consumption over time.

- Supply Model Adaptability: Gelsenwasser must remain agile in adjusting its abstraction and distribution strategies to meet evolving demand profiles.

Gelsenwasser's significant reliance on regulatory decisions for its revenue streams is a key weakness. For example, future tariff reviews by bodies like the Bundesnetzagentur in 2025 could lead to reduced revenue if allowed returns on investment are lowered. This regulatory dependency limits Gelsenwasser's pricing autonomy and profitability potential.

The company's operations are highly capital-intensive, requiring substantial ongoing investment in its extensive water and gas infrastructure. This continuous need for upgrades, such as the €200 million water treatment facility expansion, strains financial flexibility and can impact short-term earnings. For instance, maintaining and modernizing aging pipelines, a significant portion of which dates back decades, demands consistent capital allocation.

Gelsenwasser's profitability is vulnerable to fluctuations in natural gas prices. In 2024, price volatility directly impacted operational costs for energy-intensive processes. If rising commodity costs, like those seen in energy procurement, cannot be fully passed on to consumers, profit margins face compression.

The company must balance the high costs of modernizing its aging infrastructure with the need to keep service prices affordable. This balancing act is challenging, as significant investment is required to meet evolving environmental standards and ensure service reliability, potentially leading to price pressures on customers.

Same Document Delivered

Gelsenwasser SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual Gelsenwasser SWOT analysis, offering a clear glimpse into its comprehensive insights. The full, detailed report is unlocked immediately upon purchase.

Opportunities

Gelsenwasser is strategically positioning itself within the burgeoning renewable energy sector, particularly focusing on hydrogen infrastructure development. The company is actively investing in connecting its existing gas distribution networks to Germany's developing hydrogen core network.

This initiative directly supports Germany's ambitious energy transition objectives and taps into the significant growth prospects of the green hydrogen market. By 2023, Germany had already committed substantial funding towards hydrogen projects, aiming to become a leader in this clean energy technology.

Gelsenwasser can capitalize on the growing trend of digitalization to boost operational efficiency. Implementing smart metering, for instance, can lead to more accurate billing and reduced water loss, contributing to better resource management. This aligns with their strategic expansion into IT services via GELSEN-NET, positioning them to offer advanced smart utility solutions.

Gelsenwasser has a significant opportunity to grow its energy consulting and municipal services. With a strong demand for sustainable and efficient infrastructure, the company can leverage its existing expertise to offer expanded services to municipalities. This strategic move capitalizes on their established relationships and utility provision background to deliver enhanced value.

Circular Economy and Resource Recovery Initiatives

Gelsenwasser's commitment to the circular economy, exemplified by its phosphorus recycling plant, opens doors to innovative business models and new revenue streams. This strategic focus on resource recovery not only diversifies income but also significantly bolsters the company's sustainability credentials, aligning with growing market demand for environmentally responsible practices.

The initiative positions Gelsenwasser as a leader in resource management, potentially attracting investment and partnerships focused on sustainable development. By transforming waste into valuable resources, the company can achieve greater operational efficiency and reduce its reliance on virgin materials, a key advantage in an era of increasing resource scarcity.

- Phosphorus Recycling: Gelsenwasser is developing a phosphorus recycling plant, aiming to recover valuable nutrients from wastewater sludge. This project is expected to contribute to a more sustainable agricultural sector by providing a domestic source of phosphorus.

- Resource Recovery Revenue: The recovered phosphorus and other potential by-products from wastewater treatment can be sold, creating new revenue streams and enhancing profitability.

- Sustainability Enhancement: These initiatives improve Gelsenwasser's environmental footprint, reducing landfill waste and promoting a circular economy, which is increasingly valued by investors and customers.

Strategic Partnerships and Acquisitions

Gelsenwasser can leverage strategic partnerships and acquisitions to enter new markets and bolster its technological edge. For instance, their past moves into industrial energy and water supply demonstrate a successful strategy of expanding their service portfolio. By increasing their stake in IT service providers, as seen in recent industry trends, Gelsenwasser can enhance its digital infrastructure and operational efficiency.

These collaborations can unlock significant growth opportunities:

- Market Expansion: Partnering with local utility companies in emerging markets could provide immediate access and customer bases.

- Technological Advancement: Acquiring or investing in innovative water treatment or smart grid technology firms can integrate cutting-edge solutions.

- Synergistic Growth: Collaborations in areas like renewable energy integration for water infrastructure can create new revenue streams and operational efficiencies.

- Competitive Positioning: Strategic alliances can help Gelsenwasser compete more effectively against larger, diversified utility conglomerates.

Gelsenwasser is well-positioned to benefit from the increasing demand for green hydrogen infrastructure, with Germany aiming to be a global leader in this sector. The company's existing gas networks provide a strong foundation for hydrogen distribution. Furthermore, their expansion into IT services, particularly through GELSEN-NET, allows them to offer advanced smart utility solutions, improving efficiency and customer service in water and energy management.

The company's focus on resource recovery, such as their phosphorus recycling initiative, not only diversifies revenue streams but also enhances their sustainability profile, appealing to environmentally conscious investors and customers. Strategic partnerships and targeted acquisitions can further accelerate market expansion and technological advancement, allowing Gelsenwasser to integrate innovative solutions and strengthen its competitive standing in the evolving utility landscape.

| Opportunity Area | Description | Potential Impact | Relevant Data/Trend |

|---|---|---|---|

| Green Hydrogen Infrastructure | Leveraging existing gas networks for hydrogen transport. | Access to a rapidly growing clean energy market. | Germany's National Hydrogen Strategy aims for significant green hydrogen production and infrastructure development by 2030. |

| Digitalization & Smart Utilities | Expanding IT services and implementing smart metering. | Improved operational efficiency, reduced losses, enhanced customer experience. | The global smart utility market is projected for substantial growth, driven by IoT adoption and demand for data-driven services. |

| Circular Economy & Resource Recovery | Phosphorus recycling and other waste-to-resource initiatives. | New revenue streams, enhanced sustainability, reduced operational costs. | Increasing focus on ESG (Environmental, Social, and Governance) factors by investors and growing regulatory support for circular economy principles. |

| Strategic Partnerships & Acquisitions | Collaborating with or acquiring innovative companies. | Market expansion, technological integration, competitive advantage. | Utility sector consolidation and strategic alliances are common for accessing new technologies and markets. |

Threats

The ongoing liberalization and transformation of Germany's energy markets present a significant threat of intensified competition. New entrants, alongside existing players broadening their service portfolios, are poised to challenge Gelsenwasser's established market position, particularly in energy procurement and distribution.

This heightened competition could exert downward pressure on pricing and erode market share, as customers gain more options. For instance, by the end of 2023, the German electricity market saw a notable increase in the number of alternative suppliers, with some regional providers actively expanding their customer bases beyond their traditional service areas, directly impacting established utilities.

Climate change presents a significant threat to Gelsenwasser's operations, particularly concerning water resources. Increased frequency and intensity of extreme weather events, such as prolonged droughts and severe rainfall, directly impact water availability and quality. For instance, in 2023, parts of Germany experienced water scarcity due to unseasonably dry conditions, impacting agricultural output and potentially increasing raw water costs for treatment.

These environmental shifts necessitate substantial investments in resilient infrastructure and advanced treatment technologies to manage fluctuating water sources and maintain supply reliability. Securing long-term water rights in a changing climate and adapting supply systems to cope with unpredictable availability are critical challenges that could escalate operational expenses and require strategic planning to mitigate risks.

Germany's ongoing reform of incentive regulation for network operators, as noted by the BDEW, presents a significant threat. This regulatory shift could negatively impact Gelsenwasser's investment capacity and the recognition of costs, potentially slowing down crucial infrastructure modernization efforts. This uncertainty directly challenges the company's ability to invest in and adapt its systems for future energy demands.

Cybersecurity Risks to Critical Infrastructure

The increasing digitalization of utility operations, including those of Gelsenwasser, significantly amplifies the threat of cyberattacks targeting critical infrastructure such as water and gas networks. These sophisticated threats pose a direct risk to the uninterrupted provision of essential services.

A successful cyberattack could lead to severe disruptions in water supply and gas distribution, impacting communities and businesses reliant on these services. Furthermore, such incidents can result in the compromise of sensitive customer data and operational information, creating significant privacy and security concerns.

The financial and reputational ramifications for Gelsenwasser following a cyber breach could be substantial. For instance, the global average cost of a data breach in the utilities sector reached $5.37 million in 2023, according to IBM's Cost of a Data Breach Report. This highlights the potential financial strain and the damage to public trust that such events can inflict.

- Increased Vulnerability: As Gelsenwasser integrates more digital technologies, its attack surface for cyber threats expands.

- Service Disruption: A successful attack could halt water purification, distribution, or gas supply, directly impacting consumers.

- Data Compromise: Sensitive customer information and critical operational data are at risk of theft or manipulation.

- Financial and Reputational Impact: The costs associated with recovery, regulatory fines, and loss of public confidence can be severe.

Public Acceptance and Political Pressure Regarding Infrastructure Development

Gelsenwasser's strategic development, especially concerning new energy infrastructure like hydrogen or significant network upgrades, could encounter considerable public opposition and political challenges. These large-scale projects often require extensive planning and community engagement, and any delays or outright resistance can significantly disrupt timelines and inflate project costs.

For instance, in 2023, Germany's energy transition projects faced scrutiny, with some local communities raising concerns about the visual impact and environmental footprint of new wind farms and hydrogen production facilities. Such public sentiment translates into potential political pressure, influencing regulatory approvals and permitting processes.

- Public Opposition: Concerns over land use, visual impact, and local environmental effects can lead to protests and legal challenges against infrastructure projects.

- Political Hurdles: Shifting political priorities or local government resistance can create significant delays in obtaining necessary permits and approvals.

- Project Delays and Cost Overruns: Opposition can extend project timelines, leading to increased capital expenditure and potentially impacting Gelsenwasser's return on investment for new ventures.

The evolving regulatory landscape in Germany poses a threat to Gelsenwasser's profitability and investment capacity. Reforms to incentive regulation for network operators, as highlighted by industry bodies, could reduce the company's ability to recover costs and fund essential infrastructure upgrades, impacting its long-term development. Furthermore, increased competition from new market entrants and existing players expanding their offerings puts downward pressure on prices and could erode Gelsenwasser's market share.

Cybersecurity risks are escalating as Gelsenwasser digitalizes its operations, making its critical water and gas networks vulnerable to attacks. A successful breach could lead to service disruptions, data compromise, and significant financial and reputational damage, with the utilities sector facing average data breach costs of $5.37 million in 2023. Finally, public and political opposition to new energy infrastructure projects, such as hydrogen facilities, can cause substantial delays and cost overruns, impacting project viability.

SWOT Analysis Data Sources

This Gelsenwasser SWOT analysis is built upon a robust foundation of data, incorporating official company financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded and accurate strategic overview.