Gelsenwasser Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gelsenwasser Bundle

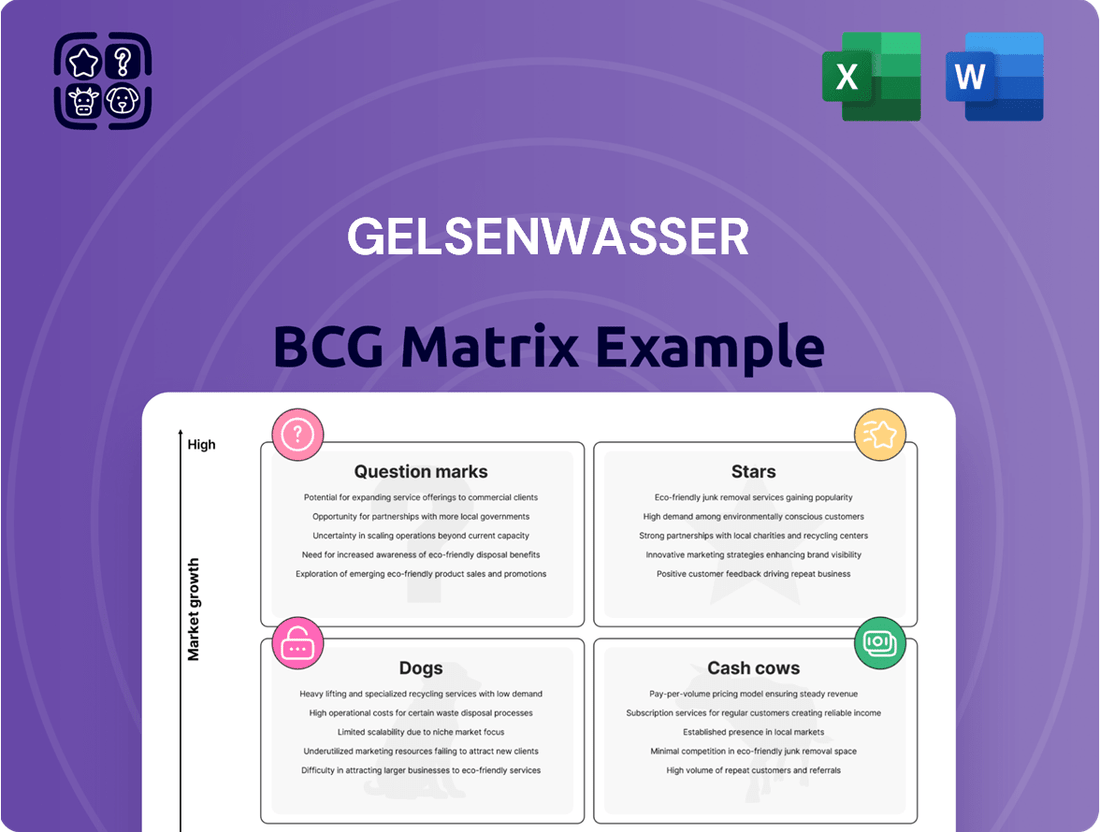

Curious about Gelsenwasser's strategic positioning? Our BCG Matrix analysis offers a glimpse into their product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Understand the current landscape and identify growth opportunities.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Gelsenwasser.

Purchase the full BCG Matrix to receive a detailed Word report + a high-level Excel summary. It’s everything you need to evaluate, present, and strategize with confidence regarding Gelsenwasser's business.

Stars

Gelsenwasser's AI-Controlled Waterworks Assistance System (AsWa) is a prime example of a potential star in the BCG matrix. This award-winning system optimizes electricity usage and ensures a steady supply of drinking water, showcasing Gelsenwasser's innovation.

AsWa is not just an internal tool; it's a market-ready product being offered to other water utilities. This strategic move into a high-growth niche for smart infrastructure highlights a strong leadership position.

The system's capability to intelligently manage energy generation and consumption within waterworks is a significant growth driver. Its potential to attract new customers and generate substantial revenue makes it a compelling candidate for a star.

Germany's ambitious energy transition fuels Gelsenwasser's strategic push into renewable energy infrastructure, particularly solar and wind power. This focus directly supports self-sufficiency in their water production, a critical component of their operations.

This commitment to green energy integration is not just a niche strategy; it mirrors a significant global trend toward energy autonomy and renewable adoption. Gelsenwasser's investment in this burgeoning sector is projected to see substantial expansion over the next four years, indicating strong growth potential.

Gelsenwasser is strategically positioning itself for the future by planning a substantial 50MW hydrogen project slated for completion by 2028. This initiative underscores the company's commitment to a burgeoning sector within the energy landscape, reflecting a forward-thinking approach to market evolution.

Hydrogen is a critical element in Germany's ambitious energy transition plans, and Gelsenwasser's proactive engagement in this area represents a significant high-growth opportunity. By investing early in hydrogen infrastructure, the company is poised to capitalize on the expanding hydrogen economy.

This early mover advantage could allow Gelsenwasser to secure a considerable market share as demand for clean hydrogen solutions escalates. The company's involvement in this key energy segment highlights its potential for substantial future returns and market leadership.

Digitalization of Energy Solutions

The digitalization of energy solutions presents a significant opportunity for Gelsenwasser, particularly as Germany pushes for wider smart meter adoption and the overall modernization of its energy infrastructure. This trend is creating a high-growth market where Gelsenwasser can leverage its expertise.

These digital initiatives are crucial for enhancing demand forecasting accuracy and bolstering the stability of the energy grid. This translates into new avenues for business development within the dynamic energy sector. The ongoing transition to smart grids is identified as a key driver for future growth in the utility industry.

- Smart Meter Rollout: Germany aims for universal smart meter installation by 2032, with over 11.5 million smart meters already installed by the end of 2023, according to the Federal Network Agency (Bundesnetzagentur).

- Grid Stability: Digitalization improves real-time data analysis, enabling utilities to better manage load balancing and reduce transmission losses, which can be as high as 5% in conventional grids.

- New Business Models: Gelsenwasser can explore services like predictive maintenance for energy infrastructure and data analytics for energy efficiency, tapping into a market projected to reach billions of euros annually in Germany.

- Demand Forecasting: Advanced analytics powered by digitalization can improve forecasting accuracy by up to 15%, leading to more efficient energy generation and distribution.

Strategic Investments in Growing Utility Segments

Gelsenwasser's acquisition of a 25.1% stake in Gelsen-Net Kommunikationsges. Mbh, alongside other strategic investments, signals a deliberate expansion into high-growth communication and related infrastructure sectors. This move is particularly significant if Gelsen-Net is positioned within the rapidly expanding digital or telecommunications infrastructure market. Such a strategic stake could elevate Gelsenwasser to a star performer in this burgeoning new sector.

These strategic acquisitions are designed to diversify Gelsenwasser's portfolio and capitalize on emerging market opportunities. For instance, the digital infrastructure market, which includes fiber optic networks and data centers, experienced substantial growth. In 2024, global spending on digital infrastructure was projected to exceed $2 trillion, driven by increasing demand for cloud services, 5G deployment, and the Internet of Things (IoT). Gelsenwasser's investment in Gelsen-Net could tap into this lucrative growth trajectory.

- Strategic Diversification: Gelsenwasser's investment in Gelsen-Net indicates a strategic shift towards diversifying its revenue streams beyond traditional utility services.

- High-Growth Potential: By acquiring a significant stake in a communications infrastructure company, Gelsenwasser aims to leverage the rapid expansion of the digital economy.

- Market Positioning: This move positions Gelsenwasser to capture new market opportunities and potentially achieve star status within the communications sector, mirroring its success in established utility segments.

- Future Revenue Streams: The investment is a forward-looking strategy to secure future revenue streams by participating in sectors with strong, sustained growth projections.

Gelsenwasser's AI-Controlled Waterworks Assistance System (AsWa) represents a significant star opportunity, optimizing operations and offering a market-ready solution to other utilities. The company's strategic investments in renewable energy, including a substantial 50MW hydrogen project by 2028, align with Germany's energy transition and position Gelsenwasser for high growth in clean energy infrastructure. Furthermore, the digitalization of energy solutions, coupled with smart meter adoption and grid modernization, creates new avenues for business development and revenue generation.

| Business Unit | Market Growth | Relative Market Share | BCG Classification | Strategic Rationale |

|---|---|---|---|---|

| AI-Controlled Waterworks Assistance System (AsWa) | High | High | Star | Innovation, market-ready solution, optimization |

| Renewable Energy Infrastructure (Hydrogen Project) | High | High | Star | Alignment with national energy transition, early mover advantage |

| Digitalization of Energy Solutions & Smart Grids | High | High | Star | Leveraging smart meter rollout, grid stability, new business models |

| Communications Infrastructure (Gelsen-Net Stake) | High | High | Star | Diversification, capitalizing on digital economy growth |

What is included in the product

The Gelsenwasser BCG Matrix offers a strategic framework to categorize business units based on market share and growth, guiding investment decisions.

Gelsenwasser's BCG Matrix offers a clear, visual roadmap, eliminating the pain of strategic uncertainty by pinpointing which business units need investment and which to divest.

Cash Cows

Gelsenwasser's core business of supplying drinking water is a classic Cash Cow. This essential service enjoys consistent, non-cyclical demand, ensuring a stable revenue stream. In 2024, the company's extensive network likely serves a significant portion of its established German regions, reflecting its strong market position.

The regulated nature of the German water market, while limiting rapid expansion, also provides a predictable operating environment. This stability allows Gelsenwasser to generate substantial and reliable cash flow from its water supply operations, even with modest growth expectations. These profits are crucial for funding other ventures within the company's portfolio.

Despite the ongoing energy transition, Gelsenwasser's natural gas distribution remains a robust revenue generator, underpinning its financial stability. The company's extensive infrastructure and substantial customer base ensure consistent income, solidifying this segment's position as a core business. In 2024, the energy sector saw continued demand for natural gas, with distribution networks playing a vital role in meeting energy needs. Gelsenwasser's established presence in this market allows it to capitalize on this steady demand.

Wastewater management services represent a stable, mature business for Gelsenwasser, fitting the Cash Cow quadrant of the BCG Matrix. The demand is consistently high due to ongoing urbanization and strict environmental laws, ensuring predictable revenue streams.

Gelsenwasser's strong presence in this established market allows for reliable cash generation. For instance, in 2023, German municipalities spent approximately €10.5 billion on wastewater treatment, highlighting the significant and steady market size.

Strategic investments in upgrading wastewater infrastructure, such as advanced treatment technologies, can optimize operational efficiency and bolster already strong cash flows from this segment.

Established Infrastructure Management for Municipalities

Gelsenwasser's established infrastructure management for municipalities operates as a Cash Cow. They expertly manage existing utility infrastructure, securing predictable income through long-term public utility contracts. This stability is a direct result of the essential and continuous need for maintaining vital services like water and energy.

The company's deep expertise and established trust with municipal clients are key differentiators. These long-standing relationships ensure a steady revenue stream, characteristic of a mature and reliable business segment. For example, in 2024, Gelsenwasser continued to secure and renew contracts for water supply and wastewater management in several German municipalities, underscoring the ongoing demand for their services.

- Stable Revenue: Predictable income from long-term municipal utility contracts.

- Low Growth, High Share: Mature market segment with established operations.

- Trust and Reliability: Deeply embedded relationships with public sector clients.

- Essential Services: Continuous demand for water, wastewater, and energy infrastructure management.

Traditional Heating Supply Services

Gelsenwasser's traditional heating supply services represent a classic Cash Cow within the BCG Matrix. This segment serves a mature market with a well-established customer base, consistently generating stable revenue without demanding significant capital infusions.

The heating services sector, while not experiencing rapid expansion, provides a reliable income stream for Gelsenwasser. In 2024, the demand for reliable heating solutions remained robust, particularly in established residential and commercial areas.

- Steady Revenue Generation: The mature nature of the heating market ensures a predictable and consistent cash flow for Gelsenwasser.

- Low Investment Needs: Maintaining market share in this segment typically requires minimal new investment, allowing for high cash generation.

- Established Customer Base: Gelsenwasser benefits from a loyal and long-standing customer base for its heating services.

- Market Stability: The sector is characterized by its stability, offering a dependable component to Gelsenwasser's overall portfolio.

Gelsenwasser's core water supply operations are a prime example of Cash Cows. These services benefit from consistent, non-negotiable demand, generating predictable revenue streams. In 2024, the company's vast network likely serves a substantial portion of its established German operating regions, reflecting its dominant market position.

The regulated nature of the German water market, while limiting aggressive expansion, fosters a stable operating environment. This predictability allows Gelsenwasser to generate significant and reliable cash flow from its water supply activities, even with modest growth projections. These profits are vital for funding other company initiatives.

Gelsenwasser's natural gas distribution remains a strong revenue generator, bolstering its financial stability. The company's extensive infrastructure and large customer base ensure consistent income, solidifying this segment as a core business. In 2024, the energy sector continued to see strong demand for natural gas, with distribution networks playing a crucial role in meeting energy needs. Gelsenwasser's established presence allows it to leverage this steady demand.

Wastewater management is a stable, mature business for Gelsenwasser, fitting the Cash Cow profile. Demand is consistently high due to ongoing urbanization and stringent environmental regulations, ensuring predictable revenue. In 2023, German municipalities allocated approximately €10.5 billion to wastewater treatment, underscoring the market's significant and steady size.

| Segment | BCG Classification | Key Characteristics | 2024 Relevance |

| Water Supply | Cash Cow | Essential service, stable demand, regulated market, high market share | Continued provision of vital utility in established regions |

| Natural Gas Distribution | Cash Cow | Extensive infrastructure, large customer base, consistent income | Meeting ongoing energy needs in the German market |

| Wastewater Management | Cash Cow | High demand from urbanization and regulations, predictable revenue | Supporting municipal environmental compliance and infrastructure needs |

What You’re Viewing Is Included

Gelsenwasser BCG Matrix

The Gelsenwasser BCG Matrix you see here is the complete, unwatermarked document you will receive immediately after your purchase. This preview accurately represents the final, professionally formatted report, ready for immediate integration into your strategic planning processes. You'll gain access to the full analysis, allowing you to leverage Gelsenwasser's market position for informed decision-making without any additional steps or hidden content.

Dogs

Gelsenwasser’s strategic divestitures, including the sale of Kge - Kommunale Gasspeichergesellschaft Epe Mbh & Co. Kg and La Nantaise des Eaux Services, align with a classic BCG Matrix approach to shedding non-core or underperforming assets. These moves are designed to streamline operations and reallocate resources.

The divestment of these specific entities, which likely represented units with limited market share or growth potential, allows Gelsenwasser to concentrate on areas with higher strategic value. This is a common tactic for companies looking to improve overall portfolio performance and financial flexibility.

While the agreement to acquire Gelsenwasser Beteiligungen SE indicates a focus on strengthening core or growth areas, the sale of other assets demonstrates a commitment to optimizing the business portfolio. This strategic pruning is essential for maintaining competitiveness and driving future growth.

Aging, non-optimized gas infrastructure within Gelsenwasser's portfolio represents assets that are increasingly difficult and costly to adapt for future energy needs, such as hydrogen transport. These segments are characterized by high maintenance expenses that do not yield commensurate returns, potentially becoming financial burdens as the energy sector transitions. For instance, in 2024, the European Union continued to emphasize decarbonization, with investments shifting towards more flexible and future-proof energy grids, making older, rigid gas networks less attractive.

Energy consulting services that haven't kept pace with the market's pivot to renewables and digital solutions are essentially outdated. These offerings, lacking innovation, often face dwindling demand and low market share, making them a significant drain on a company's resources.

For instance, a consulting firm still heavily focused on traditional fossil fuel analysis without integrating strategies for carbon capture or renewable energy integration would fall into this category. In 2024, the global renewable energy market was valued at over $1.5 trillion, a stark contrast to the declining investments in purely fossil-fuel-centric consulting.

Small, Non-Strategic Investments with Poor Returns

Small, non-strategic investments with poor returns in Gelsenwasser's portfolio would represent ventures that are not contributing significantly to financial performance or strategic goals. These could be minor equity stakes or experimental projects that have not materialized as expected, essentially tying up capital without generating substantial benefits.

For instance, if Gelsenwasser held a 2% stake in a small regional renewable energy startup that has struggled to scale and is currently valued at only €500,000, this would fit the description. Such an investment, while perhaps initiated with good intentions, now represents a drain on resources and offers minimal strategic leverage or financial upside.

- Low Return on Investment: These investments typically exhibit a negative or negligible return on investment, failing to meet even basic capital cost benchmarks.

- Lack of Strategic Alignment: They do not align with Gelsenwasser's core business objectives or future growth strategies, offering no synergistic benefits.

- Capital Impairment: The capital invested is effectively impaired, as there is little prospect of recovery or significant future value creation.

- Opportunity Cost: Holding these assets means foregoing opportunities to invest in more promising or strategically vital areas of the business.

Inefficient Legacy Wastewater Treatment Processes

Inefficient legacy wastewater treatment processes often fall into the Dogs category of the BCG Matrix. These are typically older facilities that struggle to meet current environmental regulations, requiring significant capital investment for upgrades. For example, many municipal wastewater treatment plants built in the mid-20th century may not have the advanced filtration or nutrient removal capabilities needed today.

These operations can become cash traps because the necessary investments are often for compliance rather than for competitive advantage or growth. In 2024, the cost of upgrading such facilities can run into tens or even hundreds of millions of dollars, depending on the scale and specific deficiencies. Without a clear path to revenue generation from these upgrades, they drain resources.

- High Compliance Costs: Older plants may require upgrades to meet stricter discharge limits for pollutants like phosphorus and nitrogen, which are increasingly regulated globally.

- Lack of Scalability: These legacy systems are often not designed for population growth or increased industrial output, limiting their future potential.

- Operational Inefficiencies: Outdated technology can lead to higher energy consumption and chemical usage compared to modern, more efficient treatment methods.

Gelsenwasser's aging gas infrastructure, particularly segments not easily adaptable for hydrogen transport, represents classic 'Dogs' in the BCG Matrix. These assets demand high maintenance costs without commensurate returns, becoming financial burdens as the energy sector transitions. For instance, in 2024, the EU's continued emphasis on decarbonization means investments are shifting to more flexible grids, making older, rigid gas networks less attractive.

Outdated energy consulting services that haven't integrated renewable and digital solutions also fit this category. These offerings, lacking innovation, face dwindling demand and low market share, draining company resources. In 2024, the global renewable energy market exceeded $1.5 trillion, highlighting the declining relevance of purely fossil-fuel-centric consulting.

Small, non-strategic investments with poor returns, such as a minor stake in a struggling regional startup, tie up capital without significant benefits. For example, a 2% stake in a startup valued at only €500,000 in 2024, if it has failed to scale, represents a drain and offers minimal strategic leverage.

Inefficient legacy wastewater treatment processes are also Dogs. These older facilities require significant, often compliance-driven, capital investment for upgrades. In 2024, upgrading such plants could cost tens to hundreds of millions of dollars, draining resources without generating competitive advantage.

| Category | Characteristics | Gelsenwasser Examples | Financial Implication | Market Context (2024) |

| Dogs | Low market share, low growth potential, negative or low ROI, high costs | Aging gas infrastructure, outdated consulting services, underperforming investments, inefficient wastewater plants | Cash drain, capital impairment, opportunity cost | Shift to renewables, stricter environmental regulations, declining fossil fuel relevance |

Question Marks

Gelsenwasser's pilot project for phosphorus recovery from incinerated sewage sludge positions it within a burgeoning market driven by stringent German environmental regulations mandating such recovery. This initiative is classified as a Question Mark in the BCG matrix due to its high growth potential, fueled by these new legal requirements, but Gelsenwasser's nascent position in this specialized technological niche suggests a currently low market share.

Significant investment will be crucial for Gelsenwasser to scale this innovative technology and capture a leading market position. The global phosphorus recovery market is projected to reach over $2.5 billion by 2028, indicating substantial growth opportunities for early movers who can overcome technological and market entry hurdles.

Gelsenwasser’s expansion into new municipal utility markets via acquisitions, such as its stakes in Stadtwerken Eilenburg and Stadtwerke Oranienburg GmbH, positions these ventures as potential Stars within the BCG Matrix. While the utility sector itself is generally stable, Gelsenwasser’s initial market share in these specific new geographic areas is relatively low, suggesting a need for significant growth to capitalize on these opportunities. For instance, in 2024, the German municipal utility market saw continued consolidation, with companies actively seeking to expand their service territories through strategic acquisitions to achieve economies of scale and enhance service offerings.

Gelsenwasser's public EV charging stations operate within a burgeoning market, a sector projected to reach $150 billion globally by 2030, according to recent industry forecasts. While this represents a significant growth opportunity, the company's current market share in this highly competitive space is likely modest when juxtaposed with established, specialized charging network operators.

The high growth potential of the EV charging infrastructure necessitates substantial investment and a well-defined strategy to elevate Gelsenwasser's position from a potential 'Question Mark' to a 'Star' in the BCG matrix. This transition hinges on capturing a larger slice of the expanding market and achieving significant operational scale.

New Digital Services Beyond AsWa

Gelsenwasser is exploring new digital avenues beyond its established AsWa system, focusing on smart energy and water management. These emerging services, while holding significant growth potential in the utility sector's digital shift, currently represent a smaller market share as they work towards wider adoption and scaling.

The company is likely investigating areas such as advanced data analytics for predictive maintenance of water infrastructure, smart metering solutions that offer real-time consumption data to customers, and potentially platforms for distributed energy resource management. These initiatives align with the broader industry trend of utilities leveraging digital technologies to enhance efficiency, customer engagement, and sustainability.

- Smart Metering Rollouts: By the end of 2023, Germany had achieved a smart meter penetration rate of approximately 15%, with projections indicating a significant increase in the coming years as regulatory frameworks evolve.

- IoT in Water Management: The global Internet of Things (IoT) in water management market was valued at an estimated USD 5.8 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 12% through 2030.

- Digital Utility Services Growth: Investments in digital transformation within the European utility sector are projected to reach tens of billions of euros annually by the mid-2020s, driven by the need for operational efficiency and new service offerings.

Emerging Carbon Capture and Storage (CCS) Ventures

Emerging Carbon Capture and Storage (CCS) ventures for Gelsenwasser would likely be classified as Stars. The global CCS market is experiencing significant growth, projected to reach USD 25.6 billion by 2030, driven by ambitious climate targets. Germany's own decarbonization strategy necessitates substantial investment in CCS technologies, creating a high-growth environment.

Gelsenwasser's initial involvement would represent a low market share within this rapidly expanding sector. Significant capital expenditure would be required to develop the necessary infrastructure and expertise to compete effectively. However, the potential for future market leadership and substantial returns makes these ventures strategic priorities.

- High Growth Potential: Driven by global climate targets and national decarbonization strategies.

- Substantial Investment Required: To build infrastructure and gain market share.

- Strategic Importance: Aligns with Germany's long-term energy and climate goals.

- Emerging Market Dynamics: Early-stage involvement offers opportunities for leadership.

Gelsenwasser's ventures into new digital utility services, such as smart metering and IoT water management, are prime examples of Question Marks. These areas boast high growth potential, with the IoT in water management market alone expected to exceed USD 5.8 billion in 2023 and grow at over 12% annually through 2030. However, Gelsenwasser's current market share in these nascent digital fields is likely modest, requiring significant investment and strategic focus to ascend the BCG matrix.

The company's investment in emerging carbon capture and storage (CCS) technologies also places it in the Question Mark category. While the global CCS market is set for substantial growth, projected to reach USD 25.6 billion by 2030, Gelsenwasser's initial involvement means it holds a low market share. Substantial capital is needed to develop the necessary infrastructure and expertise, but the potential for future leadership in this strategically important sector is considerable, aligning with Germany's climate goals.

Gelsenwasser's public EV charging stations represent another Question Mark. The EV charging market is expanding rapidly, with global projections reaching $150 billion by 2030. Despite this high growth, Gelsenwasser's market share is likely small compared to established players, necessitating strategic investment to convert this potential into a leading position.

The company's pilot project for phosphorus recovery from incinerated sewage sludge is a classic Question Mark. This market is driven by strict German environmental regulations and has high growth potential, but Gelsenwasser's position is new and its market share is currently low. Significant investment is vital to scale this technology and capture a leading market share in a sector projected to exceed $2.5 billion by 2028.

BCG Matrix Data Sources

Our Gelsenwasser BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.