Gelsenwasser Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gelsenwasser Bundle

Gelsenwasser's competitive landscape is shaped by the interplay of five key forces, revealing the intense pressures within the utility sector. Understanding these dynamics, from the bargaining power of suppliers to the threat of new entrants, is crucial for navigating this market effectively.

The complete report reveals the real forces shaping Gelsenwasser’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gelsenwasser's reliance on specific groundwater and surface water sources, which are geographically fixed and subject to stringent regulations, significantly limits its alternatives for raw water. This dependence grants considerable leverage to entities controlling access or permits for these vital resources.

Environmental factors and competing demands can impact the availability and quality of these water sources. For instance, in 2024, several regions experienced prolonged droughts, leading to stricter water usage regulations and increased competition for available surface water, directly affecting companies like Gelsenwasser.

This limited sourcing capability means Gelsenwasser has few substitutes for its primary raw material. If access to these regulated sources becomes restricted or more expensive, the bargaining power of the entities controlling them increases, potentially driving up operational costs and impacting supply stability.

Gelsenwasser's reliance on specialized infrastructure and technology providers significantly influences its bargaining power of suppliers. The company needs highly specialized equipment for water treatment, distribution networks, and gas infrastructure, including advanced filtration systems and monitoring technology. For instance, in 2024, the global water and wastewater treatment market was valued at approximately $60 billion, with a significant portion driven by sophisticated technological solutions.

The availability of qualified suppliers for these critical components can be limited, particularly for proprietary or cutting-edge systems. This scarcity means Gelsenwasser often depends on a select few vendors, empowering them to dictate pricing and delivery terms. The high switching costs associated with replacing major infrastructure components further solidify these suppliers' strong bargaining position.

Gelsenwasser's operations, particularly in water treatment and gas distribution, are heavily reliant on energy and chemical inputs, making these crucial cost drivers. These processes consume substantial amounts of electricity and require specific chemicals for purification and ongoing maintenance. In 2024, global energy prices saw considerable volatility, with Brent crude oil averaging around $83 per barrel for the year, impacting electricity costs. Similarly, the prices of key industrial chemicals, often influenced by supply chain disruptions and geopolitical factors, directly affect Gelsenwasser's expenditures.

While Gelsenwasser may source these essential inputs from various suppliers, the commodity nature and critical necessity of certain chemicals and energy can still consolidate supplier leverage. For example, the cost of natural gas, a primary energy source for gas distribution, is subject to significant market fluctuations. In 2024, European natural gas prices, as measured by the TTF benchmark, experienced periods of elevated pricing, reflecting ongoing supply concerns. This inherent dependency means that even with multiple suppliers, the aggregate power of those providing these fundamental inputs remains a significant consideration for Gelsenwasser's cost management.

The company's capacity to manage these fluctuating input costs is paramount. Gelsenwasser's ability to absorb a portion of these increased expenses or, conversely, to pass them on to its customer base through tariff adjustments, directly influences the impact of supplier bargaining power on its profitability. The regulatory environment surrounding utility pricing plays a key role in determining the extent to which Gelsenwasser can mitigate these cost pressures. For instance, in 2024, discussions around energy cost pass-through mechanisms for utilities were ongoing in several European markets, highlighting the sensitivity of this issue.

Skilled labor and specialized services

Gelsenwasser's operations heavily depend on a workforce possessing specialized skills in areas like water treatment engineering, gas network maintenance, and environmental compliance. The scarcity of such expertise, especially in a region with high demand for these professionals, can significantly enhance the bargaining power of these skilled labor groups or their representative unions. For instance, reports from Germany in 2024 indicated a growing shortage in skilled trades, potentially impacting wage negotiations and the cost of specialized labor for companies like Gelsenwasser.

The company also utilizes external providers for highly technical services, such as advanced IT solutions for network management or specialized environmental consulting for regulatory adherence. When the number of firms capable of delivering these niche services is limited, those providers can leverage their expertise to negotiate higher contract values. This reliance on a select group of specialized service suppliers means Gelsenwasser must carefully manage these relationships to avoid escalating costs and ensure service continuity.

- Skilled Labor: Gelsenwasser requires engineers and technicians with expertise in water and gas infrastructure.

- Specialized Services: Reliance on external experts for complex maintenance and regulatory compliance.

- Market Conditions: A competitive labor market for skilled professionals can increase their bargaining power.

- Mitigation Strategy: Attracting and retaining top talent is key to managing supplier power from skilled labor.

Regulatory and environmental compliance partners

Regulatory and environmental compliance partners wield considerable bargaining power over Gelsenwasser. The necessity of adhering to strict German and EU regulations for water quality, environmental protection, and gas safety means Gelsenwasser must engage with accredited laboratories, environmental consultants, and auditing firms. These specialized entities possess unique expertise and certifications that are critical for maintaining Gelsenwasser's operational licenses.

The critical nature of these compliance services means that these suppliers are indispensable. Failure to meet regulatory standards can result in substantial penalties, underscoring the vital role these partners play. Consequently, they can often command premium pricing for their specialized knowledge and assurance of compliance, thereby exerting significant bargaining power.

- Critical Expertise: Partners offer specialized knowledge essential for regulatory adherence.

- Licensing Dependence: Gelsenwasser relies on these partners to maintain its license to operate.

- High Switching Costs: Finding and certifying new compliance partners can be time-consuming and costly.

- Penalty Avoidance: Non-compliance can lead to severe fines, increasing reliance on compliant partners.

Gelsenwasser's dependence on a limited number of specialized suppliers for critical infrastructure, such as advanced water treatment components and gas network technology, significantly amplifies supplier bargaining power. The high costs and technical complexities associated with switching these suppliers, particularly for proprietary systems, further entrench their leverage. In 2024, the global market for water and wastewater treatment equipment saw continued growth, driven by demand for sophisticated filtration and monitoring solutions, indicating ongoing reliance on specialized providers.

The company's reliance on energy and chemical inputs, essential for its water purification and gas distribution operations, also contributes to supplier power. Fluctuations in energy prices, like the volatility seen in 2024 with Brent crude averaging around $83 per barrel, directly impact operational costs. Similarly, the prices of key industrial chemicals are susceptible to supply chain disruptions and geopolitical factors, affecting Gelsenwasser's expenditures and potentially increasing the bargaining power of their providers.

Furthermore, Gelsenwasser's need for highly skilled labor and specialized external services, such as IT solutions for network management and environmental consulting, creates opportunities for supplier leverage. A shortage of qualified professionals in Germany in 2024, particularly in skilled trades, can empower these labor groups and service providers to negotiate higher wages and contract terms, impacting Gelsenwasser's operational costs and resource availability.

| Supplier Category | Key Dependencies | Impact on Bargaining Power | 2024 Data Point |

|---|---|---|---|

| Infrastructure & Technology Providers | Specialized water/gas treatment equipment, proprietary systems | High due to limited alternatives and high switching costs | Global water treatment market valued ~$60 billion |

| Energy & Chemical Suppliers | Electricity, natural gas, purification chemicals | Moderate to High due to commodity nature and price volatility | Brent crude averaged ~$83/barrel; TTF gas prices experienced elevated periods |

| Skilled Labor & Specialized Services | Water/gas engineers, IT solutions, environmental consultants | Moderate to High due to scarcity of expertise and niche service providers | Reported shortage of skilled trades in Germany |

What is included in the product

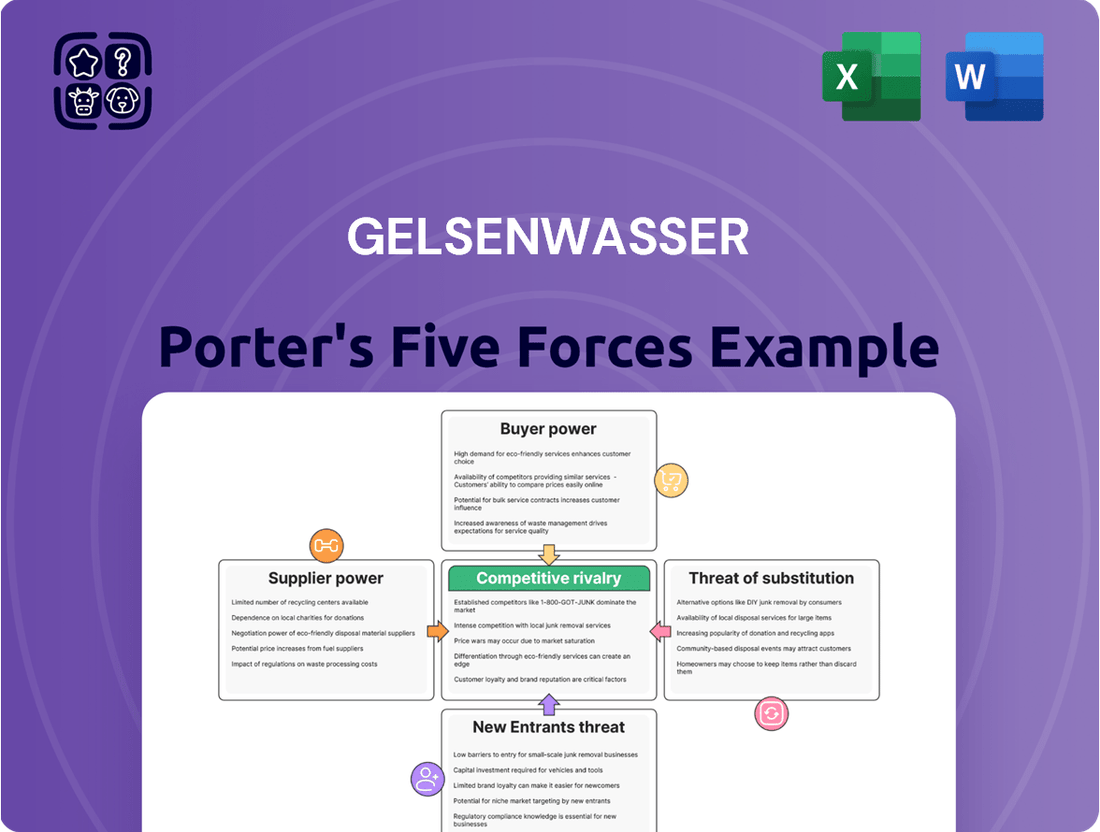

This Porter's Five Forces analysis for Gelsenwasser dissects the competitive intensity within the German water and energy sector, examining threats from new entrants, the bargaining power of buyers and suppliers, and the impact of substitute products and rivalry.

Gelsenwasser Porter's Five Forces Analysis provides a visual, easy-to-understand overview of competitive pressures, simplifying complex market dynamics for strategic planning.

Quickly identify and address key threats and opportunities within the water utility sector with this streamlined analysis.

Customers Bargaining Power

For Gelsenwasser's household customers, pricing is largely dictated by regulatory bodies, significantly dampening the company's pricing flexibility. This oversight means that price adjustments are not solely market-driven but must align with public interest and established tariffs, effectively empowering customers through collective regulatory influence.

For most residential customers, the bargaining power is significantly limited by extremely high switching costs. The extensive underground infrastructure connecting homes to Gelsenwasser's water and natural gas networks makes it practically impossible for an individual household to switch providers easily, unlike more flexible utility services.

This inherent infrastructure lock-in means customers cannot simply choose a different supplier without substantial, often prohibitive, new installation costs. For instance, the German Federal Network Agency reported in 2024 that the average cost for a new gas connection can range from €1,000 to €3,000, a significant deterrent for residential switching.

While this infrastructure barrier effectively curbs individual residential customer power, larger industrial or commercial clients might possess some leverage. These entities could potentially explore on-site generation or negotiation of bulk supply agreements, which could offer a degree of bargaining power not available to the average homeowner.

Municipalities represent a substantial customer base for Gelsenwasser, acting not just as direct users of water and energy but also as crucial partners in managing essential public services and infrastructure. Their influence stems from the sheer volume of services they require and their integral role in local administration and shaping public sentiment.

These municipal entities wield considerable bargaining power, often leveraging their significant procurement volumes to negotiate favorable terms for long-term service contracts, define specific service quality benchmarks, and influence infrastructure development plans. For instance, in 2023, Gelsenwasser's revenue from municipal contracts likely constituted a significant portion of its overall income, reflecting the deep integration with local government services.

The enduring nature of these partnerships, coupled with the municipalities' inherent political leverage and responsibility for public welfare, solidifies their position as powerful customers. This dynamic allows them to negotiate effectively on pricing, investment commitments, and operational standards, directly impacting Gelsenwasser's profitability and strategic direction.

Demand inelasticity for essential services

Water and natural gas are considered essential services, meaning demand is highly inelastic for most residential and commercial users. Customers generally cannot significantly reduce their consumption without impacting daily life or business operations, which inherently limits their power to negotiate prices downward based on volume. While conservation efforts are common, the fundamental need for these utilities ensures customers will continue to pay the regulated or agreed-upon prices, providing Gelsenwasser with a stable demand base.

For instance, in 2024, average household water consumption in Germany remained relatively stable despite minor price fluctuations, underscoring this inelasticity. Similarly, natural gas demand, while influenced by weather, shows a persistent baseline need for heating and industrial processes that cannot be easily substituted or eliminated in the short term. This lack of viable alternatives for essential utility services significantly reduces the bargaining power of individual customers.

- Inelastic Demand: Consumers cannot easily reduce consumption of water and natural gas, limiting their ability to negotiate lower prices.

- Essential Nature: These utilities are critical for daily life and business operations, ensuring continued demand regardless of price.

- Limited Substitution: Few, if any, readily available alternatives exist for residential and commercial water and natural gas supply.

- Regulatory Influence: Prices are often regulated, which can further cap the influence of individual customer bargaining power.

Public and political pressure on service quality

As a public utility, Gelsenwasser faces intense public and political scrutiny over its service quality and reliability. Widespread customer complaints can translate into significant political pressure, compelling the company to invest in infrastructure upgrades or modify its service delivery. This collective customer voice acts as a powerful, albeit indirect, bargaining tool, influencing Gelsenwasser's strategic decisions and long-term operational planning. For instance, in 2024, water utilities across Germany faced increased calls for transparency and investment following localized service disruptions, highlighting the direct link between public perception and regulatory action.

The bargaining power of customers for Gelsenwasser is amplified by the potential for public outcry to translate into political intervention. Customer dissatisfaction, particularly concerning water quality or supply interruptions, can quickly gain traction in local media and political forums. This can lead to demands for investigations, public hearings, or even regulatory changes that directly impact Gelsenwasser's operations and profitability. Maintaining high service standards and a positive public image is therefore not just about customer satisfaction but also about mitigating this significant source of customer power.

- Public Scrutiny: Gelsenwasser, as a public utility, is under constant watch by consumers and politicians regarding service quality.

- Escalation to Political Pressure: Widespread customer complaints can quickly become a political issue, forcing company action.

- Indirect Bargaining Power: The collective voice of customers influences operational decisions and infrastructure investments.

- Importance of Reputation: Maintaining high service standards is critical to managing customer power and political risk.

The bargaining power of Gelsenwasser's customers is generally low for residential users due to high switching costs and inelastic demand for essential services like water and gas. However, larger industrial clients and municipalities hold more leverage through bulk purchasing and their critical role in public services. Public scrutiny and the potential for political intervention also serve as an indirect, yet significant, form of customer power, influencing service quality and investment decisions.

| Customer Segment | Bargaining Power Level | Key Factors Influencing Power |

|---|---|---|

| Residential Customers | Low | High switching costs (infrastructure lock-in), inelastic demand, regulatory price setting. |

| Industrial/Commercial Clients | Moderate | Potential for bulk negotiation, on-site generation alternatives (limited). |

| Municipalities | High | Significant procurement volumes, integral role in public services, political leverage. |

| General Public (via scrutiny) | Moderate (Indirect) | Public and political scrutiny, potential for regulatory intervention based on service quality. |

Full Version Awaits

Gelsenwasser Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual Porter's Five Forces analysis for Gelsenwasser, detailing the competitive landscape and strategic implications. Once you complete your purchase, you’ll get instant access to this exact file, providing a comprehensive understanding of industry attractiveness and potential threats.

Rivalry Among Competitors

Gelsenwasser benefits from geographical monopolies in its core water and gas distribution services. This means that within its service areas, there's very little direct competition for these essential utilities, as the high cost of building duplicate infrastructure makes it prohibitive for rivals to enter. For instance, in 2023, Gelsenwasser reported a significant portion of its revenue derived from regulated water and energy supply, highlighting the stable, albeit monopolistic, nature of these core operations.

While Gelsenwasser operates in a sector with limited direct competitors within its established service territories, it encounters significant indirect rivalry from other regional utility companies. These entities compete for new municipal concessions and opportunities to expand into adjacent service markets, such as renewable energy or digital infrastructure. For instance, in 2024, the German energy market saw numerous municipal utilities actively bidding for regional contracts, highlighting the competitive pressure for growth beyond existing operations.

Gelsenwasser's competitive rivalry extends beyond its core water and gas distribution into non-core services like wastewater management, energy consulting, and infrastructure development. In these segments, the company encounters a more fragmented and often fiercer competitive environment.

Specialized engineering firms, dedicated environmental service providers, and focused energy consultants frequently compete by offering highly specialized or more budget-friendly alternatives. For instance, in the German wastewater treatment market, numerous regional players and international conglomerates vie for contracts, often leveraging specific technological expertise or economies of scale. Gelsenwasser must therefore distinguish its offerings by emphasizing unique capabilities, cost-effectiveness, and forward-thinking solutions to stand out.

Regulatory framework influencing competition

The German utility market, where Gelsenwasser operates, is characterized by a robust regulatory framework that significantly shapes competitive dynamics. This extensive regulation defines service territories, imposes price caps, and establishes clear conditions for market entry and expansion, thereby controlling the intensity of direct competition in core services.

While regulations often provide a degree of protection for incumbent operators, competition naturally shifts towards other crucial areas. Companies like Gelsenwasser find themselves competing intensely on operational efficiency, reliability, and the ability to meet stringent regulatory performance targets. This indirect rivalry drives innovation and cost-effectiveness within the established legal boundaries.

- Regulatory Oversight: The German Federal Network Agency (Bundesnetzagentur) plays a pivotal role in overseeing the energy and water sectors, setting rules that influence market structure and competition.

- Price Controls: For regulated network services, price caps are often implemented, limiting the ability of utilities to compete solely on price for these essential infrastructure components.

- Service Area Definitions: Regulations typically define specific service areas for network operators, reducing direct head-to-head competition within these geographically defined zones for core utility provision.

- Compliance and Efficiency: Competition therefore intensifies in demonstrating superior operational efficiency, service quality, and adherence to regulatory standards, with utilities striving to be the most compliant and effective providers within their licensed areas.

Focus on efficiency and sustainability as competitive factors

Given the nature of core utility services, direct price wars are less common. Instead, Gelsenwasser and its peers focus on operational efficiency and sustainability as key battlegrounds. This means competing on who can deliver water and energy with fewer losses, higher quality, and a smaller environmental impact.

For instance, in 2024, many German utilities, including those in Gelsenwasser's operational sphere, were investing heavily in smart grid technologies to reduce network losses. Reports indicated that average network losses for electricity in Germany hovered around 4-5% in 2023, a figure companies strive to lower through technological upgrades and better infrastructure management.

Sustainability initiatives are also a major differentiator. Companies are increasingly judged by their carbon footprint reduction efforts and their commitment to renewable energy sources. Gelsenwasser, for example, has been active in expanding its renewable energy portfolio, aiming to increase the share of green energy in its offerings.

- Operational Efficiency: Focus on reducing network losses and optimizing resource utilization.

- Service Reliability: Ensuring consistent and high-quality delivery of water and energy.

- Sustainability Initiatives: Investing in renewable energy and reducing carbon emissions.

- Customer Service: Enhancing customer experience and responsiveness.

Competitive rivalry for Gelsenwasser is most pronounced in its non-core services and in bidding for new concessions, rather than direct competition in its established water and gas distribution monopolies. While regulations in Germany, overseen by bodies like the Bundesnetzagentur, limit direct price wars in essential utilities, competition intensifies around operational efficiency, service reliability, and sustainability efforts. For example, in 2023, German electricity network losses averaged around 4-5%, a metric companies like Gelsenwasser actively work to reduce through technological investment.

| Area of Competition | Nature of Rivalry | Key Differentiators | 2024 Data Point/Trend |

|---|---|---|---|

| Core Water/Gas Distribution | Limited direct rivalry due to geographical monopolies and high infrastructure costs. | Operational efficiency, service reliability, regulatory compliance. | Focus on smart grid investments to reduce network losses, aiming below 4% average. |

| New Concessions/Expansion | Indirect rivalry with other regional utilities bidding for municipal contracts. | Service offerings, cost-effectiveness, innovation in new services (e.g., renewables). | Numerous municipal utilities actively seeking regional energy contracts. |

| Non-Core Services (Wastewater, Energy Consulting) | Fragmented and often fierce competition from specialized firms. | Specialized expertise, cost-competitiveness, tailored solutions. | Intense competition in the German wastewater treatment market from regional and international players. |

SSubstitutes Threaten

For essential services like piped drinking water and natural gas, direct substitutes are scarce, particularly for residential and commercial use. While bottled water is available, it's not a practical replacement for the volume and cost-effectiveness of tap water. Similarly, alternative heating sources such as electricity or district heating often necessitate substantial infrastructure investment, making them unfeasible substitutes for many consumers.

For specific applications like gardening or industrial cooling, customers may consider decentralized water sources such as rainwater harvesting or private wells. These alternatives, while not fully replacing Gelsenwasser's potable water supply, can diminish the demand for their services, especially among large consumers. For instance, in 2024, the global rainwater harvesting market was projected to grow significantly, indicating increasing interest in such solutions.

The most significant long-term threat to Gelsenwasser's natural gas operations stems from the growing adoption of renewable energy and alternative heating systems. Technologies such as heat pumps, district heating networks utilizing renewable sources, and solar thermal installations are increasingly viable substitutes. For instance, by the end of 2023, Germany had seen a substantial increase in heat pump installations, with over 1 million units operating across the country, indicating a clear shift away from fossil fuels for heating.

Self-supply and energy efficiency for large customers

Large industrial and commercial clients, particularly those with substantial energy consumption, are increasingly exploring self-supply options. This can involve installing on-site renewable energy sources like solar photovoltaic (PV) systems or combined heat and power (CHP) units, or implementing aggressive energy efficiency programs. For instance, by 2024, many large corporations are setting ambitious renewable energy targets, with some aiming for 100% renewable electricity sourcing, which directly impacts their need for traditional energy suppliers.

While these actions don't directly substitute for water provision, they significantly diminish the demand for Gelsenwasser's gas supply and energy consulting services. This is a growing substitution threat for high-volume customers, motivated by both cost savings and corporate sustainability objectives. For example, the declining cost of solar PV installations, which fell by over 80% in the past decade, makes self-generation more economically viable.

- Self-Supply Trend: Large industrial consumers are increasingly adopting on-site generation, such as solar PV and CHP.

- Energy Efficiency Impact: Investments in efficiency reduce overall energy consumption, lessening reliance on external suppliers.

- Economic Drivers: Falling renewable energy costs, like the significant drop in solar PV prices, enhance the attractiveness of self-supply.

- Sustainability Goals: Corporate commitments to reduce carbon footprints further incentivize moving away from traditional energy sources.

Emergence of new utility models or technologies

The long-term threat of substitution for Gelsenwasser could emerge from novel utility models or disruptive technologies. For instance, advanced, localized decentralized water purification systems or community-level biogas production might lessen dependence on traditional centralized networks. While these are presently niche or under development, ongoing innovation in sustainability and resource management could foster more practical alternatives.

This necessitates Gelsenwasser's adaptation of its business model or the acquisition of new competencies to remain competitive. For example, the global market for decentralized water treatment systems is projected to grow significantly, with some estimates placing its value at over $20 billion by 2028, indicating a substantial potential shift in consumer preference away from centralized utilities.

- Decentralized Water Treatment Growth: The market for decentralized water treatment is expanding, potentially offering alternatives to traditional utility services.

- Biogas Production Advancements: Innovations in community-level biogas production could reduce reliance on centralized energy and waste management systems.

- Sustainability-Driven Innovation: Continuous advancements in sustainable resource management may accelerate the development of viable substitute utility models.

- Adaptation Imperative: Gelsenwasser must remain agile, potentially investing in or acquiring new technologies to counter these emerging threats.

For Gelsenwasser's core offerings of piped water and natural gas, direct substitutes are limited, especially for everyday residential needs. While bottled water exists, it's not a cost-effective or practical replacement for the volume required. Similarly, alternative heating systems like electric or district heating often demand significant upfront infrastructure, making them unfeasible for many consumers.

However, for specific uses like industrial processes or extensive landscaping, alternatives like rainwater harvesting or private wells can emerge. These options, while not fully replacing potable water, can reduce demand from large-scale users. The increasing interest in solutions like rainwater harvesting, with its projected significant market growth in 2024, highlights this trend.

The most significant substitution threat for Gelsenwasser's natural gas business comes from the rise of renewable energy and advanced heating technologies. Heat pumps and renewable-powered district heating networks are becoming increasingly viable, evidenced by the over 1 million heat pumps operating in Germany by the end of 2023, signaling a clear move away from fossil fuels.

| Substitution Area | Key Substitutes | 2024/2023 Data Point | Impact on Gelsenwasser |

|---|---|---|---|

| Residential Heating | Heat Pumps, Solar Thermal, District Heating (Renewable) | Over 1 million heat pumps in Germany (end of 2023) | Reduced demand for natural gas |

| Industrial Energy | On-site Solar PV, Combined Heat & Power (CHP) | Many large corporations aiming for 100% renewable sourcing (2024) | Decreased reliance on external gas supply |

| Water Supply (Specific Uses) | Rainwater Harvesting, Private Wells | Projected significant growth in rainwater harvesting market (2024) | Lowered demand from large consumers |

| Emerging Technologies | Decentralized Water Purification, Community Biogas | Decentralized water treatment market projected over $20 billion by 2028 | Potential long-term shift from centralized utility models |

Entrants Threaten

The water and gas utility sector, where Gelsenwasser operates, demands immense capital for building and upkeep of its vast network. This includes everything from pipes and treatment facilities to pumping stations and gas lines.

These substantial upfront costs create a significant hurdle for any new company wanting to enter the market. A potential competitor would need to either build their own infrastructure from scratch or purchase existing assets, both of which are incredibly expensive and complicated undertakings.

For instance, in 2024, the German energy and water sector continued to see massive investment. Major utility companies reported billions in capital expenditures, with a significant portion dedicated to network modernization and expansion. This level of financial commitment makes it extremely difficult for smaller or less capitalized entities to compete effectively.

Stringent regulatory hurdles and licensing represent a significant threat of new entrants in the German utility sector, including for companies like Gelsenwasser. For instance, in 2024, the average time to secure all necessary permits for infrastructure projects in Germany can extend over several years, often exceeding three to five years depending on the project's scale and environmental impact. This lengthy approval process, coupled with substantial compliance costs related to environmental protection, safety protocols, and quality assurance for water and gas supply, acts as a formidable barrier.

Established utility companies like Gelsenwasser benefit from a deeply entrenched customer base. For essential services such as water and energy, this loyalty is often cemented by the absence of readily available alternatives and the critical nature of the service itself. For instance, in 2024, the German energy market, while evolving, still sees a significant portion of consumers remaining with their incumbent providers for years due to convenience and perceived reliability.

New entrants would face a formidable uphill battle in attracting these customers. Beyond the substantial infrastructure and regulatory hurdles, the real challenge lies in building the trust and reputation that public utilities require. This process typically takes decades, making it incredibly difficult for newcomers to gain traction and effectively compete for market share against established players like Gelsenwasser.

Economies of scale and scope for incumbents

Incumbent utility companies like Gelsenwasser benefit from substantial economies of scale in maintaining their vast infrastructure, managing operations, and procuring supplies. Their established, extensive networks enable highly efficient distribution across large geographical areas, which inherently lowers the cost per unit of service delivered. For instance, in 2024, major European utilities often reported operational expenditures per customer that were significantly lower than what a new entrant with a smaller footprint would likely incur.

Furthermore, these incumbents often leverage economies of scope by offering a diversified portfolio of services, such as water, gas, and wastewater management. This diversification allows for shared infrastructure and administrative costs, creating further cost advantages. A new entrant would find it exceptionally difficult to match these cost efficiencies without a comparable existing network and service breadth, placing them at a considerable disadvantage in terms of pricing and market penetration.

- Economies of Scale: Reduced per-unit costs through large-scale infrastructure and operations.

- Economies of Scope: Cost savings from offering multiple related services (e.g., water and gas).

- Infrastructure Advantage: Incumbents possess extensive, pre-built networks that are costly for new entrants to replicate.

- Procurement Power: Larger volumes allow incumbents to negotiate better prices for materials and services.

Limited profitable market segments for new entry

The water and gas utility market, particularly for core services, presents a significant hurdle for new entrants due to the scarcity of truly profitable and untapped segments. Established players effectively dominate the most stable and lucrative areas, leaving newcomers with less attractive or more challenging operational zones.

For instance, while niche services or specific, smaller geographical regions might offer some entry points, the bulk of the high-demand, stable revenue streams are already secured. This forces potential new entrants to consider markets with higher infrastructure investment needs or lower population densities, thereby reducing initial profitability. In 2023, the average return on equity for regulated utilities in the US hovered around 9-10%, indicating mature, stable, but not excessively high-growth markets, making it difficult for new, unproven entities to compete for prime market share.

- Limited Access to Profitable Segments: Established utilities hold the most desirable customer bases and service territories.

- Higher Operational Costs for Newcomers: Entering less developed or more challenging areas increases initial capital expenditure.

- Mature Market Dynamics: The core utility business is characterized by stable demand but limited organic growth, making it hard for new entrants to gain significant traction quickly.

The threat of new entrants for Gelsenwasser is considerably low, primarily due to the immense capital required to establish utility infrastructure, which can easily run into billions of Euros. For example, in 2024, German utility companies continued to report substantial capital expenditures, often exceeding €5 billion annually for network upgrades and expansion, making it prohibitively expensive for newcomers. Additionally, stringent regulatory frameworks and lengthy licensing processes, which can take years to navigate, further deter potential competitors. The established customer base and brand loyalty of incumbents like Gelsenwasser also present a significant barrier, as trust in essential services like water and gas is built over decades.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Building or acquiring utility infrastructure demands billions in investment. | Extremely High Barrier |

| Regulatory Hurdles | Complex licensing and compliance with safety/environmental standards. | Very High Barrier |

| Customer Loyalty | Established trust and convenience for essential services. | High Barrier |

| Economies of Scale/Scope | Incumbents benefit from lower per-unit costs and diversified services. | High Barrier |

Porter's Five Forces Analysis Data Sources

Our Gelsenwasser Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Gelsenwasser's annual reports, industry-specific publications from German water associations, and regulatory filings from German environmental agencies. This ensures a comprehensive understanding of the competitive landscape.