Geely Automobile Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geely Automobile Holdings Bundle

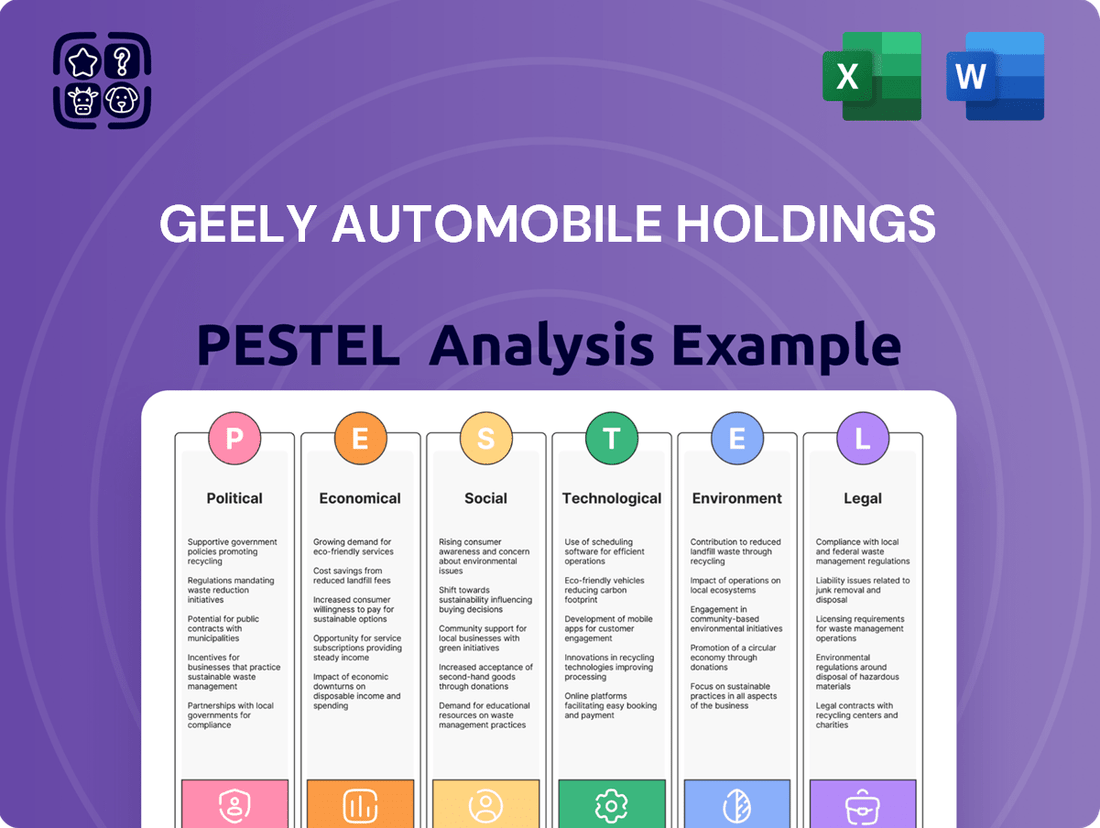

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Geely Automobile Holdings's trajectory. Our expertly crafted PESTEL analysis provides the deep-dive insights you need to anticipate market shifts and make informed strategic decisions. Download the full version now and gain a significant competitive advantage.

Political factors

Geely Automobile Holdings benefits significantly from the Chinese government's robust support for New Energy Vehicles (NEVs). This backing includes substantial subsidies, preferential tax policies, and significant investment in charging infrastructure, all of which directly stimulate consumer demand for electric and hybrid vehicles. For instance, by the end of 2024, China had built over 8 million charging piles, a critical enabler for NEV adoption.

These government initiatives align perfectly with Geely's strategic pivot towards NEV production and sales, creating a favorable market environment. The Chinese government's target to have NEVs account for at least 50% of new car sales by 2030 underscores the long-term commitment to this sector, providing Geely with a stable and encouraging foundation for sustained growth within its domestic market.

Geely's expanding global footprint, particularly in Europe and Southeast Asia, directly confronts evolving international trade relations. Tariffs imposed by various nations on imported vehicles, especially those originating from China, can significantly affect Geely's export competitiveness and profit margins. For instance, ongoing trade discussions between China and the European Union in 2024 and into 2025 will be critical in shaping these dynamics.

These trade policies can directly influence Geely's sales volumes in key markets. A sudden increase in tariffs, such as those being considered by some European countries on Chinese electric vehicles in late 2024, could make Geely's offerings less attractive compared to local or other international competitors. This necessitates proactive strategies to navigate these potential headwinds.

To counter these risks, Geely has been actively pursuing localized manufacturing and strategic alliances. Establishing production facilities in regions like Europe, as seen with Volvo Cars' operations, helps circumvent certain tariff barriers and better aligns with local market demands. These moves are crucial for maintaining market access and profitability amidst fluctuating global trade landscapes.

The global regulatory landscape for autonomous driving is a critical factor shaping Geely Automobile Holdings' strategy. As of early 2025, countries are actively developing and refining rules for testing and deploying self-driving vehicles, with varying approaches. For instance, while some regions are pushing for rapid adoption with pilot programs, others maintain stricter oversight, requiring extensive validation before wider rollout.

Geely's significant investments in AI digital chassis and advanced self-driving systems, such as those powering its Zeekr and Lynk & Co brands, necessitate navigating these diverse legal frameworks. Clear guidelines on data privacy, cybersecurity, and accident liability are paramount for the safe and widespread commercialization of these technologies. The company is closely monitoring developments in key markets like China, Europe, and North America, where regulatory clarity is crucial for its global expansion plans.

The pace at which these regulations are established and harmonized will directly impact Geely's go-to-market timelines for its autonomous driving features. For example, China's ongoing efforts to create a comprehensive regulatory system for intelligent connected vehicles, including autonomous driving, are vital for Geely's domestic market penetration. Similarly, the European Union's framework for automated driving systems will influence Geely's strategies for the European market.

Geopolitical Tensions and Supply Chain Stability

Geopolitical tensions significantly impact global supply chains, directly affecting the availability and cost of critical automotive components for manufacturers like Geely. For instance, the ongoing trade friction between major economies in 2024 continues to create uncertainty around tariffs and import restrictions, potentially increasing Geely's raw material expenses. This vulnerability could lead to production delays and reduced profitability for a company with extensive international operations and a complex supplier network.

Geely's exposure to these geopolitical risks necessitates proactive strategies to mitigate potential disruptions. The company is actively working to bolster its supply chain resilience.

- Diversification of Sourcing: Geely is expanding its supplier base beyond single regions to reduce reliance on any one area, particularly in light of potential trade disputes.

- Regional Supply Chain Strengthening: The company is investing in developing more robust regional supply chains to serve key markets, aiming to shorten lead times and buffer against global shipping disruptions.

- Inventory Management: Enhanced inventory management practices are being implemented to hold strategic levels of critical components, providing a buffer against short-term supply shocks.

Government Environmental Regulations and Targets

Governments worldwide, including China and major international markets, are tightening environmental regulations. These focus heavily on vehicle emissions standards and ambitious carbon neutrality goals. For example, China aims for carbon emissions to peak before 2030 and achieve carbon neutrality before 2060, directly impacting the automotive sector.

Geely Automobile Holdings is actively aligning its strategy with these political mandates. The company is investing in reducing the lifecycle carbon emissions of its vehicles and implementing green manufacturing processes. This proactive approach ensures continued operational viability and market acceptance in an increasingly environmentally conscious landscape.

Compliance with these evolving regulations is not just a necessity but a strategic advantage. Geely's commitment to sustainability, including its investment in electric vehicle (EV) technology and battery development, positions it favorably. For instance, by 2025, Geely plans to electrify over 50% of its new vehicle sales, a move directly responsive to regulatory pressures and market demand.

- Stricter Emissions Standards: Many countries are adopting Euro 7 or equivalent standards, demanding significant reductions in pollutants like nitrogen oxides and particulate matter.

- Carbon Neutrality Targets: National and regional commitments to net-zero emissions by mid-century necessitate a rapid shift away from internal combustion engines.

- Government Incentives and Subsidies: Political support often includes tax credits and subsidies for EV purchases and charging infrastructure, influencing consumer choices and manufacturer strategies.

- Supply Chain Scrutiny: Regulations are increasingly extending to the environmental impact of vehicle production, including battery sourcing and manufacturing processes.

Government support for New Energy Vehicles (NEVs) in China, including subsidies and charging infrastructure development, directly benefits Geely. China's goal for NEVs to reach 50% of new car sales by 2030 provides a strong foundation for Geely's domestic growth.

Geely navigates varying international trade relations and potential tariffs on Chinese imports, particularly concerning electric vehicles. For example, in late 2024, discussions around EU tariffs on Chinese EVs highlighted these challenges, prompting Geely to focus on localized production and alliances to maintain market access.

The evolving global regulatory landscape for autonomous driving, with differing approaches to testing and deployment, significantly impacts Geely's strategy. Clarity on data privacy, cybersecurity, and liability is crucial for the commercialization of its advanced self-driving systems, with China's comprehensive regulatory system for intelligent connected vehicles being a key factor.

Geopolitical tensions and trade friction in 2024 continue to create uncertainty regarding tariffs and import restrictions, potentially increasing Geely's raw material costs and impacting its global supply chain. Geely is actively diversifying its sourcing and strengthening regional supply chains to mitigate these risks.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Geely Automobile Holdings, covering political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights for strategic decision-making, highlighting how global trends and regional specifics create both challenges and avenues for growth for Geely.

This PESTLE analysis for Geely Automobile Holdings offers a concise overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

It provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations, thus alleviating the pain of information overload.

Economic factors

China's persistent economic expansion significantly bolsters consumer spending capacity, a critical element for Geely's sales within its home market. A healthy economy translates to increased disposable income, prompting consumers to invest in newer, more advanced vehicles, especially New Energy Vehicles (NEVs).

This trend is clearly reflected in Geely's financial results. For instance, in the first half of 2024, Geely reported a substantial increase in revenue, reaching approximately RMB 74.4 billion, up 32% year-on-year. This growth underscores the direct link between China's economic vitality and Geely's ability to sell more vehicles.

Geely Automobile Holdings' financial health is becoming more dependent on its performance in global markets. The company has been actively growing its export business, reaching new customers on multiple continents.

In 2023, Geely's vehicle exports surged by 37% year-on-year, reaching 215,000 units, demonstrating strong international demand. This expansion is vital for meeting their ambitious 2025 sales goals.

Sustained global demand for passenger cars, particularly New Energy Vehicles (NEVs), and Geely's capacity to enter and succeed in emerging markets are key drivers for future revenue growth.

The automotive sector, including Geely, is highly susceptible to shifts in the cost of essential materials like steel, aluminum, and key battery elements. For instance, the price of lithium carbonate, a vital battery component, saw significant volatility in 2023, impacting electric vehicle production costs globally. These price surges directly translate to higher production expenses for Geely, potentially squeezing profit margins.

Navigating these economic headwinds requires robust supply chain management and proactive strategic sourcing. Geely's ability to secure favorable long-term contracts for raw materials and explore alternative suppliers becomes crucial in mitigating the impact of price escalations. This strategic approach helps buffer the company against the unpredictable nature of commodity markets.

Exchange Rate Fluctuations

Geely Automobile Holdings, with its extensive global sales network and manufacturing presence, is significantly impacted by fluctuations in currency exchange rates. A strengthening Chinese Yuan (CNY) can make Geely's vehicles more expensive for international buyers, potentially dampening export demand.

Conversely, a weaker CNY can increase the cost of essential imported components and raw materials used in vehicle production, thereby squeezing profit margins. For instance, during periods of significant Yuan depreciation, the cost of sourcing advanced technology or specialized parts from overseas suppliers rises, directly affecting production expenses.

Managing these currency risks is paramount for Geely to maintain competitive pricing strategies in diverse international markets and ensure predictable profitability. The company actively employs hedging strategies to mitigate the impact of adverse currency movements.

- Impact on Exports: A stronger CNY makes Geely's cars pricier abroad, potentially reducing sales volume in key export markets.

- Cost of Imports: A weaker CNY inflates the cost of imported parts and technologies, impacting manufacturing expenses.

- Profitability Management: Effective currency risk management is crucial for maintaining stable profit margins and competitive pricing.

- Hedging Strategies: Geely utilizes financial instruments like forward contracts to lock in exchange rates and reduce uncertainty.

Competitive Landscape and Pricing Pressure

The automotive sector, especially the New Energy Vehicle (NEV) market, is incredibly crowded. Geely faces stiff competition from both established global automakers and a growing number of domestic Chinese brands. This intense rivalry often translates into significant pricing pressure, directly affecting Geely's average revenue per vehicle and its bottom line.

To navigate this, Geely is focusing on delivering products that offer strong value for money and consistently enhancing their competitiveness. This includes investing in technology and design to differentiate its offerings in a saturated market.

- Intensified Competition: The NEV market saw over 30 new models launched in China in 2023 alone, increasing the competitive intensity.

- Pricing Pressure Impact: Average selling prices for NEVs in China experienced a decline of approximately 15% in early 2024 compared to the previous year, driven by aggressive pricing strategies from competitors.

- Geely's Strategy: Geely aims to counter this by strengthening its brand portfolio, which includes Zeekr and Lynk & Co, focusing on premium features and advanced technology to justify pricing.

- Market Share Dynamics: While Geely maintained a strong position, its overall market share in the passenger vehicle segment faced slight erosion in late 2023 due to aggressive promotions by rivals.

China's economic growth remains a primary driver for Geely's domestic sales, with rising disposable incomes fueling demand for vehicles, particularly NEVs. Geely's revenue in the first half of 2024 reached approximately RMB 74.4 billion, a 32% increase year-on-year, directly reflecting this economic buoyancy.

Geely's increasing reliance on global markets is evident in its export performance, which surged by 37% in 2023 to 215,000 units, signaling strong international demand and contributing to its 2025 sales targets.

Fluctuations in raw material costs, such as the volatile lithium carbonate prices in 2023, directly impact Geely's production expenses and profit margins, necessitating robust supply chain management and strategic sourcing.

Currency exchange rate shifts, particularly for the Chinese Yuan, significantly affect Geely's international competitiveness and the cost of imported components, making hedging strategies crucial for profitability.

Intense competition within the crowded NEV market, with over 30 new models launched in China in 2023, leads to pricing pressures, prompting Geely to focus on value and technological differentiation through brands like Zeekr and Lynk & Co.

| Economic Factor | Impact on Geely | Data Point/Example (2023/2024) |

|---|---|---|

| China's GDP Growth | Increased consumer spending on vehicles | China's GDP grew by 5.2% in 2023. |

| Global Economic Stability | Demand for exports and international sales | Geely's exports grew 37% in 2023. |

| Commodity Prices (e.g., Lithium) | Production costs and profit margins | Lithium carbonate prices saw significant volatility in 2023. |

| Currency Exchange Rates (CNY) | Export pricing and import costs | CNY depreciation can increase imported component costs. |

| Inflation Rates | Consumer purchasing power and operational costs | Inflation impacts disposable income and manufacturing expenses. |

What You See Is What You Get

Geely Automobile Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Geely Automobile Holdings.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE analysis for Geely.

The content and structure shown in the preview is the same document you’ll download after payment, offering deep insights into the external forces shaping Geely's strategic landscape.

Sociological factors

Chinese consumers are increasingly drawn to New Energy Vehicles (NEVs) and smart vehicle features, fueled by growing environmental consciousness and a strong appetite for cutting-edge technology. This evolving preference is a significant driver behind the rapid expansion of the electric vehicle market and smart mobility solutions.

Geely's strategic emphasis on creating a broad range of NEV models and advancing its intelligent vehicle technologies is a direct response to this burgeoning consumer demand. For instance, in 2023, Geely Auto Group's sales of NEVs surged by 37% year-on-year, reaching over 470,000 units, demonstrating their alignment with market trends.

Rapid urbanization across China continues to reshape how people move, driving a demand for vehicles that are not only smaller and fuel-efficient but also highly connected. Geely Automobile Holdings, with its broad range of offerings from compact sedans to versatile SUVs, is well-positioned to meet these evolving urban and suburban consumer preferences.

The burgeoning popularity of ride-hailing platforms, exemplified by Geely's own CaoCao Mobility, underscores a significant shift in urban transportation habits. As of early 2024, ride-hailing services account for a substantial portion of urban travel in major Chinese cities, reflecting a growing preference for shared mobility solutions over private vehicle ownership in dense urban environments.

Consumer trust and brand perception are paramount for Geely Automobile Holdings, particularly as it navigates global markets. Building a strong reputation for quality and reliability is key to attracting and keeping customers in today's competitive automotive landscape. For instance, in 2024, Geely's continued investment in advanced safety features, aiming to achieve top safety ratings across its brands, directly impacts how consumers view its commitment to well-being.

Demographic Shifts and Generational Buying Habits

Demographic shifts significantly influence Geely Automobile Holdings' market approach. Younger consumers, particularly in key markets like China, are increasingly valuing advanced technology. For instance, a 2024 survey indicated that over 60% of Gen Z car buyers in China consider a sophisticated digital cockpit and seamless smartphone integration as crucial factors in their purchasing decisions. This highlights a clear need for Geely to integrate cutting-edge infotainment systems and connectivity features to capture this growing demographic.

Generational differences also shape vehicle preferences. While older generations might prioritize reliability and traditional comfort, younger buyers are often more drawn to electric vehicles (EVs) and sustainable mobility solutions. Geely's 2025 product roadmap, as outlined in their investor relations updates, shows a strong commitment to expanding their EV portfolio, with a target of 30% of new vehicle sales being fully electric by 2025. This strategic pivot directly addresses the evolving eco-consciousness and technological appetite of younger generations.

- Digital Cockpit Demand: Over 60% of Chinese Gen Z car buyers in 2024 prioritize advanced digital cockpits and connectivity.

- EV Adoption: Geely aims for 30% of its new vehicle sales to be fully electric by 2025, aligning with younger generations' sustainability focus.

- Marketing Tailoring: Geely must adapt marketing messages and product features to resonate with diverse age groups and their distinct preferences.

- Connectivity Expectations: Seamless smartphone integration and in-car digital services are becoming non-negotiable for younger vehicle purchasers.

Cultural Acceptance of Chinese Brands in International Markets

Geely's global expansion hinges on overcoming lingering perceptions of Chinese manufacturing. While progress has been made, building trust in markets where Chinese brands are less established remains a key challenge. For instance, a 2024 survey indicated that while consumer interest in Chinese automotive brands is growing, particularly in emerging economies, a significant portion of consumers in Western markets still express reservations regarding long-term reliability and after-sales support compared to established European or Japanese manufacturers.

To navigate this, Geely is actively pursuing strategies that foster cultural acceptance. This includes investing heavily in localized research and development, appointing local leadership, and forming strategic alliances with established players in target regions. For example, Geely's acquisition of Volvo has provided a significant boost to its brand perception in Western markets, leveraging Volvo's long-standing reputation for safety and quality. This approach aims to demonstrate a commitment to understanding and meeting the specific needs and preferences of diverse consumer bases.

- Brand Perception Shift: Geely aims to transition from a perception of cost-effectiveness to one of quality and innovation.

- Localization Efforts: Significant investment in R&D and manufacturing facilities in key international markets like Europe and Southeast Asia.

- Strategic Acquisitions: The integration of brands like Volvo and Lotus serves to enhance global brand equity and market penetration.

- Consumer Trust Building: Focus on transparent communication regarding product quality, safety standards, and after-sales service.

Societal trends significantly impact Geely's market position, with a growing emphasis on sustainability and technological integration. Chinese consumers, particularly younger demographics, are increasingly prioritizing New Energy Vehicles (NEVs) and advanced digital features. This shift is evident in Geely Auto Group's 2023 NEV sales, which saw a 37% year-on-year increase, reaching over 470,000 units.

Urbanization fuels demand for connected, efficient vehicles, a trend Geely addresses with its diverse model range. Furthermore, the rise of ride-hailing services, like Geely's CaoCao Mobility, highlights changing urban mobility preferences, moving towards shared solutions. Consumer trust remains critical, with Geely investing in safety features to bolster its brand image globally.

Demographic shifts, especially among Gen Z in China, underscore the importance of digital cockpits and connectivity, with over 60% of these buyers citing these as crucial purchasing factors in 2024. Geely's 2025 goal of 30% of new vehicle sales being fully electric directly caters to the eco-consciousness of younger generations.

Geely faces the sociological challenge of overcoming lingering perceptions of Chinese manufacturing quality in global markets. Strategies like localized R&D and leveraging acquisitions such as Volvo are key to building brand equity and consumer trust abroad.

| Sociological Factor | Impact on Geely | Supporting Data/Trend (2023-2025) |

| Environmental Consciousness & NEV Demand | Drives sales of electric and hybrid vehicles. | Geely Auto Group NEV sales up 37% YoY in 2023 (470,000+ units). |

| Urbanization & Connectivity Needs | Increases demand for smart, efficient, and connected urban mobility solutions. | Growth of ride-hailing platforms like CaoCao Mobility. |

| Demographic Preferences (Gen Z) | Prioritization of digital cockpits, connectivity, and sustainability. | >60% of Chinese Gen Z buyers in 2024 consider digital cockpits crucial. |

| Brand Perception & Trust (Global) | Requires overcoming stereotypes and building reputation for quality and reliability. | Strategic acquisitions (Volvo) and localization efforts to enhance global brand equity. |

Technological factors

Geely is making significant strides in new energy vehicle (NEV) technology, pouring resources into advanced battery systems, electric motors, and hybrid powertrains. This commitment is evident in their GEA global intelligent new energy architecture and the innovative NordThor hybrid system, designed to boost performance and efficiency.

The company's proprietary Short Blade Battery technology is a prime example of their focus on enhancing vehicle range and charging speed, crucial for meeting growing consumer demand. These technological advancements are directly supporting Geely's ambitious NEV sales targets, with the company aiming for substantial growth in this sector.

Geely Automobile Holdings is aggressively pursuing advancements in autonomous driving, positioning itself as a frontrunner in this transformative sector. The company’s strategic focus on AI digital chassis and intelligent driving systems underpins its commitment to future mobility solutions.

Demonstrating its technological prowess, Geely has showcased sophisticated capabilities such as driverless drifting, signaling a significant leap in autonomous vehicle control. The company is actively working towards the commercial deployment of Level 4 (L4) autonomous driving technologies, with a target for 2025, which will allow vehicles to handle most driving scenarios without human intervention.

Central to Geely's 'Smart Geely 2025' strategy is the deep integration of artificial intelligence models. This integration aims to bolster vehicle safety through enhanced active avoidance systems and to create more personalized user experiences, setting new benchmarks for the automotive industry.

Consumers increasingly desire vehicles that offer intuitive digital cockpits and robust connectivity, transforming the car into a connected hub. Geely is actively responding to this trend by developing sophisticated infotainment systems and advanced connectivity solutions, such as its Flyme Auto cockpit, designed to elevate the passenger experience.

These technological advancements are vital for Geely to capture the attention of digitally native consumers and maintain a competitive edge in the rapidly evolving automotive market. For instance, Geely's investment in AI and software development for its intelligent cockpits is a key differentiator, aiming to provide a seamless user interface and personalized in-car services.

Sustainable Manufacturing and Production Technologies

Geely Automobile Holdings is actively integrating advanced manufacturing technologies to boost efficiency and minimize its environmental impact. This commitment is evident in their operation of green, zero-waste factories and their strategic use of renewable energy sources. For instance, in 2023, Geely announced plans to increase renewable energy usage across its manufacturing facilities, aiming for a significant reduction in carbon emissions by 2030.

The company is also pioneering closed-loop recycling systems, particularly for high-volume materials like steel and aluminum. These systems not only reduce waste but also lower the reliance on virgin materials, contributing to cost savings and a more circular economy. Geely's investment in these technologies underscores a dual focus on operational excellence and achieving ambitious sustainability targets, aligning with global trends towards greener industrial practices.

- Green Factory Initiatives Geely operates multiple facilities designed with zero-waste principles, reducing landfill contributions.

- Renewable Energy Adoption The company is increasing its reliance on solar and wind power for manufacturing operations, with specific targets for 2025 and beyond.

- Closed-Loop Recycling Implementation of advanced systems for recycling steel and aluminum, aiming to recover over 90% of these materials from production waste.

- Efficiency Gains These technological upgrades are projected to improve production line efficiency by up to 15% by the end of 2024.

Data-Driven Development and Over-The-Air (OTA) Updates

Geely Automobile Holdings is increasingly using data to enhance user experience and drive product development. This approach is evident in their focus on Firmware Over-The-Air (FOTA) updates, aiming for frequent deployments to refine vehicle performance and introduce new features. This strategy marks a significant shift, moving development from a purely manufacturer-driven model to one that incorporates user software and even user co-creation.

This data-centric development allows Geely to adapt quickly to evolving consumer demands and roll out new functionalities at an accelerated pace. For instance, by the end of 2024, Geely plans to have over 50% of its new vehicle models equipped with advanced connectivity features, enabling seamless FOTA updates for enhanced user satisfaction and vehicle longevity.

- Data Integration: Geely utilizes vast amounts of user data to inform software development and feature prioritization.

- Agile Updates: Frequent FOTA updates allow for rapid iteration and improvement of vehicle systems and user interfaces.

- User-Centricity: The development model emphasizes user feedback and co-creation to shape future product offerings.

- Competitive Edge: This technological focus aims to provide a more dynamic and evolving ownership experience compared to traditional automotive development cycles.

Geely is heavily investing in new energy vehicle (NEV) technology, focusing on advanced battery systems, electric motors, and hybrid powertrains. Their GEA architecture and NordThor hybrid system highlight this commitment, aiming for improved performance and efficiency.

The company is also pushing forward with autonomous driving, targeting Level 4 (L4) deployment by 2025. This includes developing AI digital chassis and intelligent driving systems, with demonstrations like driverless drifting showcasing their progress in advanced vehicle control.

Geely's 'Smart Geely 2025' strategy integrates AI models to enhance vehicle safety and personalize user experiences, while their Flyme Auto cockpit and advanced connectivity solutions cater to the demand for connected vehicles.

The company is also adopting advanced manufacturing technologies, including green factory principles and closed-loop recycling for materials like steel and aluminum. Geely aims to increase renewable energy usage across its facilities, targeting significant carbon emission reductions by 2030.

| Technological Focus | Key Developments | Target/Status |

| New Energy Vehicles | GEA architecture, NordThor hybrid system, Short Blade Battery | Enhanced range and charging speed |

| Autonomous Driving | AI digital chassis, intelligent driving systems, L4 capability | Commercial deployment by 2025 |

| Connectivity & Infotainment | Flyme Auto cockpit, FOTA updates | Over 50% of new models equipped by end of 2024 |

| Manufacturing Efficiency | Green factories, closed-loop recycling, renewable energy | Improved production efficiency by up to 15% by end of 2024 |

Legal factors

Geely Automobile Holdings must navigate a complex web of vehicle safety standards and regulations across its global operations. This necessitates meeting stringent requirements set by bodies such as China's C-NCAP, Europe's Euro NCAP, and Australia's ANCAP.

Achieving top safety ratings, like a 5-star C-NCAP score, is paramount for market entry and consumer confidence. For instance, in 2024, Geely's Xingyue L achieved a high score in C-NCAP, demonstrating its commitment to safety. Failure to comply can lead to significant legal penalties and reputational damage.

Geely Automobile Holdings, like all automakers, must navigate a complex web of evolving emissions standards. For instance, China's ambitious targets for new energy vehicles (NEVs) and tightening fuel economy standards for traditional internal combustion engine (ICE) vehicles directly influence Geely's R&D investment and production mix. Failure to meet these mandates, such as the stringent Euro 7 standards being phased in across Europe, could result in significant fines and limit market access for their vehicles.

As Geely's vehicles increasingly incorporate advanced connectivity and autonomous driving features, the sheer volume of data collected necessitates robust data privacy and cybersecurity measures. Compliance with global regulations like the EU's General Data Protection Regulation (GDPR) is paramount, impacting how Geely handles sensitive customer information and secures its intelligent vehicle platforms.

In 2024, the automotive industry faced heightened scrutiny over data handling, with reports indicating a significant rise in cyber threats targeting connected car systems. Geely's adherence to stringent data protection laws, which can involve substantial fines for breaches, directly influences its operational costs and brand reputation.

Intellectual Property Rights and Patents

Intellectual property rights are paramount for Geely, especially concerning its advancements in new energy vehicles (NEVs), autonomous driving systems, and smart cockpit technologies. The company has actively secured a substantial patent portfolio, with a notable concentration in its pioneering methanol engine technology. As of recent reports, Geely has filed thousands of patents globally, underscoring its commitment to innovation and protection.

Safeguarding these intellectual assets is critical for maintaining Geely's competitive advantage in the rapidly evolving automotive sector. Navigating the intricate and often challenging international intellectual property landscape requires constant vigilance to prevent infringement and ensure the exclusivity of its technological breakthroughs. This proactive approach is essential for sustained growth and market leadership.

- Geely's patent filings demonstrate a strong focus on NEV and autonomous driving technologies.

- The company holds significant patents related to methanol engine technology, a key differentiator.

- Protecting its IP globally is vital to prevent competitors from leveraging Geely's innovations.

- Maintaining a robust patent portfolio is crucial for Geely's long-term competitive edge and market position.

International Trade Laws and Anti-Dumping Measures

Geely Automobile Holdings' global operations are significantly influenced by international trade laws and the ever-present threat of anti-dumping measures. As Geely expands its reach and exports vehicles worldwide, it must meticulously adhere to regulations governing cross-border commerce. For instance, in 2023, the European Union initiated investigations into Chinese electric vehicle (EV) subsidies, a move that could lead to tariffs impacting Geely's European sales strategy.

Trade disputes and the rise of protectionist policies in major automotive markets present a direct challenge to Geely's competitive pricing strategies. A surge in tariffs or stringent import quotas could hinder its ability to offer vehicles at attractive price points, potentially affecting sales volumes and profitability. For example, ongoing trade tensions between major economic blocs could introduce unpredictable cost increases for imported components or finished vehicles.

Navigating these intricate legal frameworks is not merely a compliance exercise but a strategic imperative for Geely's sustained global growth. The company must remain agile, adapting to evolving trade landscapes and proactively managing potential legal challenges. This includes thorough due diligence on market-specific trade regulations and robust engagement with international trade bodies to mitigate risks associated with protectionist measures.

- Trade Regulation Compliance: Geely must ensure adherence to World Trade Organization (WTO) agreements and specific trade pacts in its key export markets.

- Anti-Dumping Risk: The company faces potential anti-dumping duties if its vehicles are deemed to be sold below fair market value in certain regions, as evidenced by past investigations into automotive imports from China.

- Impact of Protectionism: Tariffs and non-tariff barriers implemented by countries like the United States or those within the EU could increase the landed cost of Geely vehicles, affecting price competitiveness.

- Geopolitical Trade Tensions: Escalating trade disputes, such as those impacting the automotive sector in 2024, necessitate continuous monitoring and strategic adjustments to supply chains and market entry plans.

Geely must adhere to a complex web of international trade laws and customs regulations, especially concerning vehicle imports and exports. The company's global strategy is directly impacted by trade agreements, tariffs, and potential anti-dumping investigations, as seen in the EU's 2023 scrutiny of Chinese EV subsidies which could impose tariffs on Geely vehicles in Europe.

Environmental factors

Climate change is a major force pushing the auto sector towards cleaner operations. Geely Holding Group is actively responding by aiming for operational carbon neutrality by 2030 and full value chain neutrality by 2045.

This strong commitment directly shapes Geely's product strategy, accelerating the development of new energy vehicles (NEVs) and promoting sustainable manufacturing processes throughout its global operations.

The automotive sector, including Geely, faces challenges from the significant consumption of natural resources. Geely is actively pursuing circular economy principles to mitigate this, focusing on closed-loop recycling for materials like steel and aluminum. In 2023, the global automotive industry's demand for raw materials continued to be substantial, underscoring the importance of these resource management strategies.

Geely Automobile Holdings is making significant strides in minimizing pollution and enhancing waste management across its manufacturing operations. The company is actively establishing green and zero-waste factories, a testament to its commitment to environmental stewardship. These initiatives are crucial for reducing its overall environmental footprint and showcasing strong corporate responsibility.

In 2023, Geely reported a 15% reduction in industrial wastewater discharge compared to 2022, a direct result of upgraded treatment facilities and recycling programs. The company also achieved a 90% recycling rate for solid waste at its major production sites, diverting substantial amounts from landfills.

Energy Consumption and Renewable Energy Adoption

Reducing energy consumption and boosting renewable energy use are key environmental goals. Geely has actively pursued these, sourcing a significant amount of its factory electricity from renewable sources. By 2023, Geely Auto Group reported that several of its manufacturing facilities had achieved zero-carbon factory status, directly contributing to lower greenhouse gas emissions.

This strategic move towards green energy is not just about compliance; it's about operational efficiency and sustainability. Geely's commitment is demonstrated through tangible progress in its manufacturing processes.

- Renewable Energy Sourcing: Geely sources a substantial portion of its vehicle plant electricity from renewables.

- Zero-Carbon Factory Targets: Several Geely manufacturing sites have met their zero-carbon factory goals as of 2023.

- Emission Reduction: The shift to green energy directly lowers the company's greenhouse gas emissions.

Impact of Electric Vehicle Battery Production and Disposal

While new energy vehicles (NEVs) significantly cut down on tailpipe emissions, the environmental impact associated with producing and disposing of their batteries is a key consideration. Geely Automobile Holdings is actively addressing this by developing innovative battery technologies, such as its Short Blade Battery, and investing in robust battery recycling programs. These initiatives are vital for minimizing the ecological footprint across the entire lifecycle of their electric vehicle offerings.

The sourcing of raw materials like lithium and cobalt for EV batteries presents environmental challenges, including potential habitat disruption and water usage. Geely's commitment to sustainable sourcing and closed-loop recycling systems aims to mitigate these upstream impacts. For instance, by 2023, Geely's battery recycling efforts were designed to recover valuable materials, reducing the need for virgin resource extraction.

- Battery Production Environmental Concerns: Mining of lithium and cobalt can lead to habitat destruction and significant water consumption.

- Battery Disposal Challenges: Improper disposal can result in heavy metal contamination of soil and water.

- Geely's Mitigation Strategies: Development of advanced battery chemistries and investment in recycling infrastructure are key to reducing environmental impact.

- Recycling Efficiency: By 2024, Geely aims to increase the recovery rate of critical materials from spent EV batteries to over 95%.

Geely is actively addressing environmental concerns by pursuing operational carbon neutrality by 2030 and full value chain neutrality by 2045, influencing its product development towards new energy vehicles (NEVs).

The company champions circular economy principles, focusing on material recycling to combat the automotive sector's significant resource consumption, with a 2023 wastewater discharge reduction of 15% and a 90% solid waste recycling rate at major sites.

Geely's commitment to sustainability extends to its manufacturing, with several facilities achieving zero-carbon factory status by 2023, powered significantly by renewable energy sources to reduce greenhouse gas emissions.

Addressing the environmental impact of EV batteries, Geely invests in advanced battery technologies and recycling programs, aiming for over 95% recovery of critical materials from spent batteries by 2024.

| Environmental Initiative | Target/Status | Key Data Point (2023 unless noted) |

|---|---|---|

| Operational Carbon Neutrality | By 2030 | - |

| Full Value Chain Carbon Neutrality | By 2045 | - |

| Wastewater Discharge Reduction | 15% reduction vs. 2022 | - |

| Solid Waste Recycling Rate | 90% at major sites | - |

| Zero-Carbon Factory Status | Achieved at several sites | - |

| EV Battery Material Recovery | Target >95% by 2024 | - |

PESTLE Analysis Data Sources

Our Geely Automobile Holdings PESTLE Analysis is built on a comprehensive review of official government reports, international trade data, and leading automotive industry publications. We incorporate insights from economic forecasts, environmental regulations, and technological advancements to provide a robust understanding of the macro-environment.