Geely Automobile Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geely Automobile Holdings Bundle

Geely Automobile Holdings navigates a dynamic automotive landscape, and understanding its position within the BCG Matrix is crucial for strategic decision-making. This preview offers a glimpse into how Geely's diverse portfolio might be categorized, hinting at areas of strong growth and established market dominance.

Unlock the full potential of this analysis by purchasing the complete Geely Automobile Holdings BCG Matrix report. Gain a comprehensive understanding of its Stars, Cash Cows, Dogs, and Question Marks, along with actionable insights to optimize resource allocation and drive future success.

Stars

Zeekr, Geely's premium electric vehicle brand, is a strong contender in the luxury EV market. In 2024, Zeekr saw a remarkable 87% year-on-year surge in deliveries, reaching 222,123 vehicles, solidifying its position as the top-selling Chinese luxury pure electric vehicle brand domestically. This impressive growth is further evidenced by a 100% year-on-year increase in Q2 2024 deliveries, totaling 54,811 units, alongside a 58.4% revenue jump to RMB 20.04 billion ($2.76 billion).

The Geely Galaxy series, a key player in Geely's expansion into high-end intelligent electrified vehicles, demonstrated remarkable growth in 2024. Sales for the series surged to 494,440 units, marking an impressive 80% increase compared to the previous year. This performance underscores the series' rapid ascent since its 2023 debut, encompassing both electric and plug-in hybrid models.

In October 2024, the Galaxy series emerged as the primary driver of Geely's new energy vehicle (NEV) sales, highlighting its significant market traction. Geely Auto has set an ambitious target for its Galaxy NEV range, aiming to achieve annual sales of 1 million vehicles by 2025. This goal is supported by ongoing advancements in vehicle architecture technology, the integration of full-domain AI for smart vehicle capabilities, and sophisticated intelligent driving systems.

Geely's New Energy Vehicle (NEV) segment is a clear star performer. In 2024, unit sales for their BEVs, PHEVs, and HEVs surged to 888,235, a remarkable 92% jump year-on-year. This impressive growth means NEVs now account for 45% of Geely Holding's total sales, showcasing a decisive pivot to electric mobility.

Looking ahead, Geely is doubling down on its electrification strategy. The company has ambitious plans to introduce 10 new NEV models in 2025, further solidifying its position as a technology-focused automotive leader and driving continued expansion in this high-growth category.

International Market Expansion

Geely Automobile Holdings is aggressively pursuing international market expansion, positioning its electric vehicle segment as a significant growth driver. The company's export performance in 2024 was exceptionally strong, with overseas sales climbing by a substantial 53% year-on-year to reach 403,923 units. This robust growth underscores Geely's increasing global competitiveness.

Looking ahead to 2025, Geely is further accelerating its global reach, particularly in the pure electric vehicle (EV) sector. Exports of EVs to overseas markets surged dramatically in the first half of 2025, hitting 184,000 units, which represents an impressive 307% increase compared to the same period in the previous year. This indicates a strategic focus on electrifying its international product offerings.

To support this ambitious global strategy, Geely is significantly expanding its customer-facing infrastructure. The company intends to establish over 300 new overseas sales and service outlets throughout 2025. This expansion will bolster its global network, bringing the total number of locations to over 1,100 by the end of the year, thereby enhancing customer accessibility and support worldwide.

- 2024 Exports: 403,923 units, a 53% year-on-year increase.

- H1 2025 EV Exports: 184,000 units, a 307% year-on-year surge.

- 2025 Network Expansion: Plan to add over 300 new overseas sales and service outlets.

- End-of-2025 Global Network: Projected to exceed 1,100 locations.

Technological Advancements (AI & Platforms)

Geely Automobile Holdings is heavily investing in cutting-edge technology, positioning itself for future growth. Their GEA global intelligent new energy architecture, touted as the world's first four-in-one AI intelligent architecture, integrates hardware, system, ecology, and AI. This foundational technology is key to their competitive edge.

The company's proprietary AI digital chassis is a prime example of this technological push. It seamlessly blends chassis technology with intelligence, electrification, and advanced AI models. This integration is crucial for developing industry-leading autonomous driving features and enhancing active safety systems.

Further demonstrating their commitment to innovation, Geely unveiled its NordThor EM-i super hybrid technology in October 2024. This new system aims to redefine energy efficiency and intelligent driving experiences, underscoring Geely's focus on next-generation powertrain solutions.

- GEA Architecture: World's first four-in-one AI intelligent architecture.

- AI Digital Chassis: Integrates proprietary chassis, intelligence, electrification, and AI for advanced autonomous driving and safety.

- NordThor EM-i: Launched in October 2024, setting new standards for super hybrid technology in energy efficiency and intelligent driving.

Geely's New Energy Vehicle (NEV) segment is a clear star performer, showing exceptional growth and market penetration. In 2024, unit sales for their BEVs, PHEVs, and HEVs surged to 888,235, a remarkable 92% jump year-on-year. This impressive growth means NEVs now account for 45% of Geely Holding's total sales, showcasing a decisive pivot to electric mobility. Looking ahead, Geely is doubling down on its electrification strategy, planning to introduce 10 new NEV models in 2025 to further solidify its position as a technology-focused automotive leader.

| Category | 2024 Sales (Units) | Year-on-Year Growth | Percentage of Total Sales |

|---|---|---|---|

| NEV (BEV, PHEV, HEV) | 888,235 | 92% | 45% |

| Zeekr Deliveries | 222,123 | 87% | N/A |

| Galaxy Series Sales | 494,440 | 80% | N/A |

What is included in the product

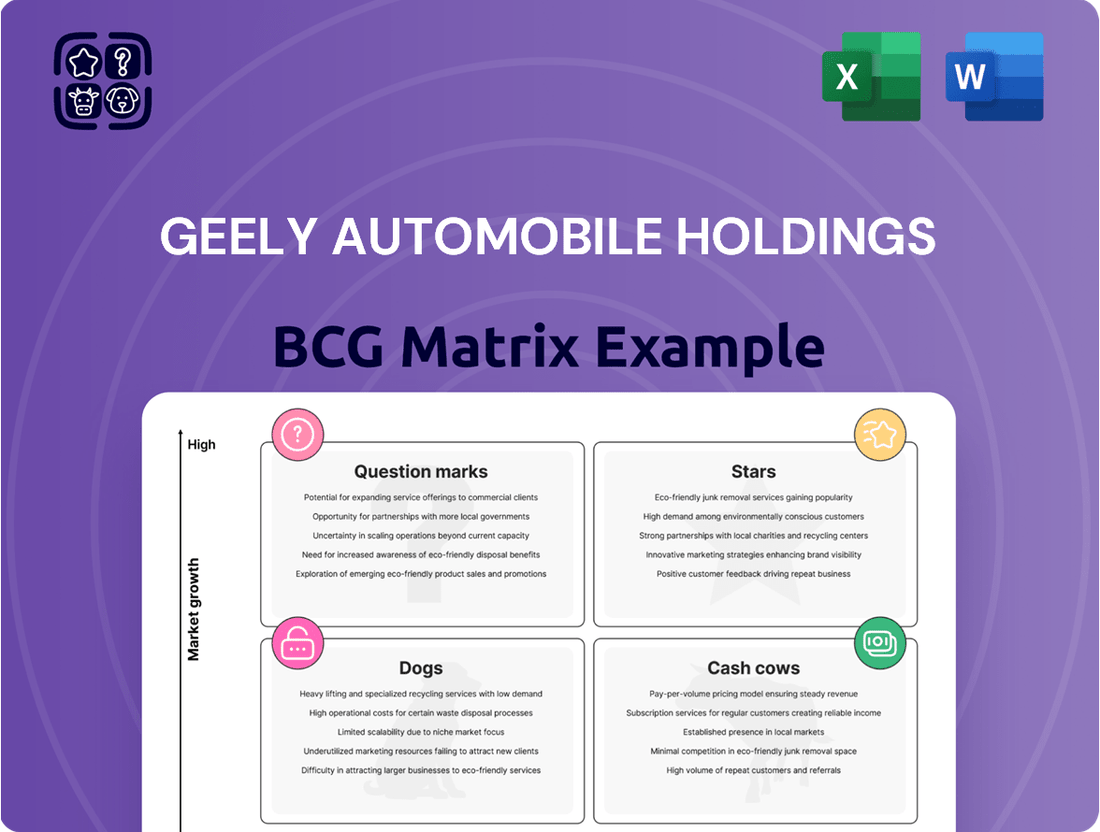

Geely Automobile Holdings' BCG Matrix reveals a portfolio with strong Stars and Cash Cows, indicating successful market positions and cash generation.

The Geely Automobile Holdings BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex portfolio strategies.

Cash Cows

The Geely Emgrand series stands as a strong Cash Cow for Geely Automobile Holdings. By June 2025, it had surpassed an impressive 4 million global sales, solidifying its position as a dominant force in the sedan segment.

Since its debut in 2009, the Emgrand has consistently broken sales records, notably becoming the fastest Chinese car model to reach 1, 2, and 3 million sales milestones. This sustained performance highlights its enduring market appeal and robust demand.

Built on Geely's proprietary BMA platform, the Emgrand is a leading A-class sedan in key international markets such as Saudi Arabia, the UAE, Kazakhstan, and the Philippines, demonstrating its widespread global success and profitability.

The Geely Coolray, or Binyue, stands out as a significant Cash Cow for Geely Automobile Holdings. This 'High-Power SUV' has achieved remarkable success, surpassing one million cumulative sales globally. Its strong performance is evident in its top-three sales ranking in crucial markets like Nigeria, Kazakhstan, and the UAE.

Domestically, the Coolray has redefined expectations for 'hot hatch' models, and internationally, it has cemented its status as a leading choice in the B-segment SUV category. This sustained popularity and robust market standing ensure a consistent and reliable contribution to Geely's overall cash flow.

Geely Auto's core brand, encompassing both internal combustion engine (ICE) and hybrid vehicles, functions as a Cash Cow within the BCG Matrix. In 2024, Geely Auto reported sales of 2.17 million units, a significant 32% year-on-year jump, demonstrating robust demand for its diverse product portfolio. This growth underscores the continued strength and profitability of these established technologies.

Despite a strategic push into New Energy Vehicles (NEVs), Geely Holding Group Chairman Li Shufu has emphasized a dual-track approach. This means substantial investment continues in refining ICE and hybrid powertrains, ensuring these segments remain highly competitive and profitable. This strategy capitalizes on existing market share and brand loyalty, generating consistent cash flow to fund future innovations.

Lynk & Co Brand

Lynk & Co, a premium brand under Geely Auto Group, demonstrated robust performance in 2024, delivering 285,441 vehicles worldwide. This represents a significant 30% increase compared to the previous year, highlighting its growing market presence. The brand's success is largely attributed to its new generation of ultra-long-range EM-P plug-in hybrid models.

Models such as the Lynk & Co 07 and 08 EM-P have been particularly strong performers, each exceeding 10,000 monthly sales for seven consecutive months in 2024. This sustained demand underscores the market's positive reception to Lynk & Co's innovative hybrid technology. Despite ongoing plans to integrate Lynk & Co into a new energy vehicle manufacturing group alongside Zeekr, its current sales momentum and strong position in the premium automotive segment firmly establish it as a cash cow for Geely.

- 2024 Global Vehicle Deliveries: 285,441 units

- Year-on-Year Growth: 30% increase

- Key Performing Models: Lynk & Co 07 EM-P and 08 EM-P

- Monthly Sales Milestone: Over 10,000 units/month for 7 consecutive months for key EM-P models

Strategic Partnerships and Global Manufacturing

Geely's strategic alliances and expanding global manufacturing capabilities are key drivers of its steady cash flow generation. The company's presence now spans five continents, with plans for over 1,100 global sales and service locations by the close of 2025. This global reach is bolstered by localized production, such as facilities in Egypt and Indonesia, which effectively lowers operational expenses and deepens market penetration.

These well-established operations and strategic partnerships create a robust foundation for consistent cash generation. For instance, Geely's collaboration with Volvo Cars has led to shared platforms and technology, optimizing production efficiency and contributing to profitability. By the end of 2024, Geely reported significant growth in its international sales network, underscoring the success of its global expansion strategy in generating reliable revenue streams.

- Global Footprint: Presence across five continents with over 1,100 planned sales and service outlets by end of 2025.

- Localized Production: Facilities in Egypt and Indonesia reduce costs and enhance market access.

- Strategic Partnerships: Collaborations, like with Volvo Cars, drive efficiency and profitability.

- Stable Cash Generation: Established operations provide a reliable base for consistent cash flow.

The Geely Emgrand and Coolray models are prime examples of Geely's established Cash Cows. The Emgrand's consistent sales, exceeding 4 million globally by mid-2025, and the Coolray's milestone of over one million global sales, demonstrate their enduring market appeal and profitability. These vehicles, built on robust platforms and popular in key international markets, provide a stable and significant cash flow for Geely Automobile Holdings.

| Product | BCG Category | Key Performance Indicators (2024/2025 Data) | Contribution to Cash Flow |

| Geely Emgrand | Cash Cow | Over 4 million global sales (by mid-2025); Fastest Chinese model to reach 1, 2, 3 million sales. | High, consistent revenue from established market dominance. |

| Geely Coolray (Binyue) | Cash Cow | Over 1 million cumulative global sales; Top-three sales in Nigeria, Kazakhstan, UAE. | Reliable and substantial cash generation from strong B-segment SUV positioning. |

Delivered as Shown

Geely Automobile Holdings BCG Matrix

The Geely Automobile Holdings BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no altered content, and no hidden surprises – just the comprehensive strategic analysis ready for your immediate use. You can be confident that the insights and visual representation of Geely's product portfolio will be precisely as presented here, enabling you to effectively strategize and make informed business decisions. This preview serves as a direct guarantee of the quality and completeness of the final report you will download.

Dogs

Geely's older internal combustion engine (ICE) models in saturated markets, despite the company's dual focus on ICE and new energy vehicles (NEVs), are likely positioned as Dogs in the BCG Matrix. These vehicles, often facing declining market share due to intense competition, may struggle to generate significant profits. For instance, in 2024, the global automotive market continued to see a strong push towards electrification, with ICE sales in many developed markets showing stagnation or decline, making it challenging for older models to compete effectively.

Some Geely models have struggled to gain significant traction in international markets, despite the company's overall export growth. These models might face challenges with brand recognition, adapting to local market preferences, or competitive pricing outside of Geely's primary markets. For instance, while Geely's global sales reached 2.79 million vehicles in 2023, a portion of these sales are concentrated in China, with specific models not yet achieving widespread international appeal.

These underperforming international models could be classified as 'Dogs' in a BCG matrix analysis. Investing heavily in promoting these specific models globally might result in low returns on investment. Therefore, Geely may consider divesting from these particular models in certain international markets or undertaking a significant re-evaluation of their global marketing and product development strategies for them.

Geely Automobile Holdings' diverse lineup likely includes niche models that, despite their innovative nature, haven't gained significant traction. These could be experimental vehicles or those aimed at very specialized market segments, potentially limiting their sales volume and ability to achieve cost efficiencies through scale. For instance, if a particular electric vehicle variant targeted a very narrow demographic and saw sales of only a few thousand units globally in 2024, it would fit this category.

Models Facing Intense Domestic Competition

In China's fiercely competitive automotive landscape, certain Geely models find themselves in a challenging position due to intense domestic rivalry. These vehicles often operate in market segments crowded with both established international brands and rapidly innovating local manufacturers.

This saturation can lead to price pressures and make it difficult for these Geely models to stand out, potentially hindering market share growth. For instance, in 2023, the Chinese passenger vehicle market saw a significant increase in competition, with domestic brands collectively capturing a larger share, putting pressure on all players.

- Market Saturation: Geely models in high-volume segments like compact SUVs and sedans face numerous competitors, impacting their ability to command premium pricing or rapid sales growth.

- Technological Advancement: Rivals are frequently introducing new technologies and features, potentially making older or less differentiated Geely models appear less appealing.

- Profitability Concerns: The need to compete on price in these saturated markets can erode profit margins for these specific Geely offerings.

- Slowed Growth Trajectory: Consequently, these models may exhibit a slower growth rate compared to other vehicles in Geely's portfolio that operate in less crowded or more niche segments.

Discontinued or Phased-Out Models

Models that Geely has decided to discontinue or is phasing out would naturally fall into the 'Dogs' category of the BCG Matrix. These vehicles are no longer central to the company's long-term growth strategy and are either being divested or are simply allowed to cease production as their market relevance wanes.

The strategic realignment of some specialized ventures, such as the Radar brand being merged into Geely Auto Group, indicates a move to consolidate resources and focus on more promising areas. This often happens with models that have not met sales expectations or are in declining market segments.

While specific discontinued models for 2024 are not publicly detailed by Geely in a way that aligns with BCG matrix categorization, the company has previously managed its portfolio by phasing out older generations or less popular variants to streamline production and investment. For example, in previous years, Geely has adjusted its offerings in response to evolving consumer preferences and regulatory changes.

- Portfolio Rationalization: Geely's approach to phasing out models is a standard practice for optimizing its product lineup and resource allocation.

- Market Responsiveness: Discontinuations often reflect shifts in market demand or the introduction of newer, more competitive models.

- Strategic Realignment: Merging brands like Radar into the main Geely Auto Group highlights a focus on core competencies and market opportunities.

Geely's older internal combustion engine (ICE) models in saturated markets, despite the company's dual focus on ICE and new energy vehicles (NEVs), are likely positioned as Dogs in the BCG Matrix. These vehicles, often facing declining market share due to intense competition, may struggle to generate significant profits. For instance, in 2024, the global automotive market continued to see a strong push towards electrification, with ICE sales in many developed markets showing stagnation or decline, making it challenging for older models to compete effectively.

Some Geely models have struggled to gain significant traction in international markets, despite the company's overall export growth. These models might face challenges with brand recognition, adapting to local market preferences, or competitive pricing outside of Geely's primary markets. For instance, while Geely's global sales reached 2.79 million vehicles in 2023, a portion of these sales are concentrated in China, with specific models not yet achieving widespread international appeal.

Models that Geely has decided to discontinue or is phasing out would naturally fall into the 'Dogs' category of the BCG Matrix. These vehicles are no longer central to the company's long-term growth strategy and are either being divested or are simply allowed to cease production as their market relevance wanes.

The strategic realignment of some specialized ventures, such as the Radar brand being merged into Geely Auto Group, indicates a move to consolidate resources and focus on more promising areas. This often happens with models that have not met sales expectations or are in declining market segments.

Question Marks

Geometry, Geely's electric vehicle brand, has been integrated into the Geely Galaxy lineup. This move signals a strategic consolidation within Geely's new energy vehicle (NEV) portfolio, aiming for greater synergy and market impact rather than independent expansion. The success of this integration, particularly how Geometry's established models and brand identity will fare under the Galaxy umbrella, presents a significant 'Question Mark' for Geely's NEV strategy.

Geely is making a significant push into the electric vehicle (EV) market, with plans to introduce several new models. Notably, they aim to launch five new vehicles under their Geely Galaxy series in 2025. This expansion targets the high-growth New Energy Vehicle (NEV) sector.

However, the success of these new NEV models, particularly in already crowded and fiercely competitive EV segments, places them in the 'Question Mark' category of the BCG matrix. Their ability to capture market share against established automotive giants and emerging EV startups will be a critical determinant of their future trajectory.

Geely is actively pursuing early-stage international market entries in regions like Australia, New Zealand, Indonesia, Vietnam, Greece, Brazil, Poland, and the United Kingdom. These markets represent significant growth opportunities, but Geely's current market share and brand awareness are minimal, characteristic of a Question Mark in the BCG matrix.

Significant investment is crucial to build brand presence and distribution networks in these emerging territories. For instance, Geely's investment in establishing local assembly plants or partnerships, as seen in some Southeast Asian markets, will be key to adapting to local consumer preferences and regulatory environments.

Methanol-Electric Hybrid Vehicles for Individual Consumers

Geely's commitment to methanol technology, including its upcoming fifth-generation methanol-electric hybrid vehicles slated for individual consumers in late 2025, positions it as an innovator. However, the market's response to this novel powertrain for everyday drivers is uncertain, classifying these vehicles as a Question Mark in Geely's BCG matrix.

The success of methanol-electric hybrids hinges on overcoming consumer education gaps and the need for robust refueling infrastructure. Geely's 2024 sales data, showing a significant increase in new energy vehicle (NEV) sales, indicates a growing market for cleaner alternatives, but the specific adoption rate for methanol hybrids is yet to be determined.

- Market Uncertainty: Consumer acceptance of methanol-electric hybrids for personal use is unproven.

- Infrastructure Dependence: Widespread adoption requires significant investment in methanol refueling stations.

- Educational Hurdle: Consumers need to be educated on the benefits and safety of methanol-powered vehicles.

- Geely's NEV Growth: Geely's overall NEV sales growth in 2024 provides a positive backdrop, but specific methanol hybrid traction is unknown.

Advanced Autonomous Driving and AI Features

Geely is making significant strides in advanced autonomous driving and AI features, investing heavily in multimodal AIGC, AI digital chassis, and AI smart driving within its new vehicle architectures. This strategic focus aims to create highly differentiated products in a competitive and rapidly advancing technological landscape.

The commercial viability of these sophisticated AI and autonomous driving technologies is still being established, with widespread consumer adoption being a key factor in determining their success. Geely's substantial research and development expenditures in these areas are directly tied to market acceptance and the evolving regulatory frameworks governing autonomous systems.

- AI Integration: Geely's new architectures incorporate multimodal AIGC, AI digital chassis, and AI smart driving, showcasing a commitment to cutting-edge technology.

- Market Differentiation: These advanced features are intended to significantly differentiate Geely's vehicles in a fast-paced technological market.

- Investment Returns: The success of these R&D investments depends critically on consumer adoption rates and favorable regulatory developments for autonomous driving.

Geely's integration of Geometry into the Galaxy lineup and its ambitious 2025 NEV model launches represent significant strategic moves. However, the success of these ventures, particularly in capturing market share against established players and navigating nascent markets, places them firmly in the Question Mark category. The company's innovative approach with methanol-electric hybrids and advanced AI features also carries inherent market uncertainties, making their future performance a key area to watch.

BCG Matrix Data Sources

Our Geely Automobile Holdings BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on market share, and official sales figures to ensure reliable insights.