Geely Automobile Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Geely Automobile Holdings Bundle

Geely Automobile Holdings navigates an automotive landscape shaped by intense rivalry and the rising threat of new entrants, particularly from electric vehicle startups. Understanding the bargaining power of both suppliers and buyers is crucial for Geely's sustained success in this dynamic market.

The complete report reveals the real forces shaping Geely Automobile Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The automotive sector, including companies like Geely, faces significant supplier bargaining power due to the concentration of key component providers. For example, in the electric vehicle (EV) battery market, CATL and BYD are dominant players, controlling a substantial portion of global supply. This reliance on a few major suppliers for critical parts like batteries and semiconductors can drive up costs for automakers and create vulnerabilities in their supply chains.

Suppliers of highly specialized components, like advanced semiconductors crucial for electric vehicles and intelligent driving systems, wield significant bargaining power. This is driven by robust demand and a scarcity of alternative suppliers capable of meeting these demanding specifications. For instance, the automotive industry's push towards autonomous driving and connected car features means companies like Geely are heavily reliant on these niche technology providers.

The increasing demand for sophisticated parts such as high-performance computing chips, advanced image processing units, and lidar sensors for Advanced Driver-Assistance Systems (ADAS) and the Internet of Vehicles (IoV) directly translates to greater leverage for their suppliers. Geely's strategic focus on developing smart vehicles, which are packed with these cutting-edge technologies, makes it particularly susceptible to the pricing and terms dictated by these specialized component manufacturers. In 2024, the global automotive semiconductor market alone was projected to reach over $60 billion, highlighting the immense value and demand for these critical inputs.

Switching suppliers for critical automotive components like advanced battery systems or specialized semiconductor architectures presents substantial hurdles for Geely Automobile Holdings. These hurdles include significant re-tooling expenses, extensive research and development investments, and complex integration processes, all of which elevate switching costs.

These elevated switching costs inherently diminish Geely's operational flexibility and, consequently, amplify the bargaining power held by its current suppliers. For instance, the automotive industry's intricate and highly specialized supply chains mean that transitioning between suppliers is not only time-consuming but also financially burdensome, often requiring extensive validation and testing phases.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers is a significant concern for automakers like Geely. Major players in critical component sectors, such as battery manufacturers, are increasingly entering the vehicle manufacturing space themselves. For instance, BYD, a leading battery supplier, is also a prominent electric vehicle (EV) producer. This dual role allows these suppliers to capture value further down the supply chain, potentially impacting Geely through restricted supply or inflated component prices.

This strategic move by suppliers strengthens their overall bargaining power. By becoming direct competitors, they can dictate terms more effectively, leveraging their control over essential inputs like batteries to gain a competitive edge. This dynamic is particularly relevant in the rapidly growing EV market, where battery technology and supply are paramount.

Consider the implications for Geely:

- Increased Input Costs: Suppliers who also manufacture vehicles may prioritize their own production lines, leading to higher costs for external buyers like Geely.

- Supply Chain Vulnerability: Reliance on suppliers who are also competitors can create vulnerabilities in Geely's production schedule and capacity.

- Competitive Disadvantage: If integrated suppliers offer more competitive pricing or exclusive access to advanced technologies for their own vehicle brands, Geely could face a disadvantage.

Geely's Vertical Integration and Strategic Partnerships

Geely Automobile Holdings significantly reduces the bargaining power of suppliers through extensive vertical integration. By developing its own battery technologies, electric drives, and vehicle-specific chips, Geely creates internal supply chains, lessening reliance on external component providers. This strategy, exemplified by their 2024 investments in advanced battery research, directly counters the leverage suppliers might otherwise wield.

Furthermore, Geely leverages strategic alliances and internal synergies across its diverse automotive brands. This collaborative approach aims to consolidate purchasing power and optimize production costs, thereby diminishing the bargaining strength of individual suppliers. For instance, shared platform development across brands like Volvo and Lynk & Co allows for bulk component orders, securing more favorable terms.

- Vertical Integration: Geely's in-house development of critical EV components like batteries and electric drives directly reduces dependence on external suppliers.

- Strategic Alliances: Partnerships and shared platforms across Geely's brands enhance purchasing power, enabling better negotiation with suppliers.

- Cost Reduction: Internal synergies and consolidated procurement strategies aim to lower overall production costs and improve profit margins, further weakening supplier leverage.

The bargaining power of suppliers remains a significant factor for Geely Automobile Holdings, particularly for specialized components like semiconductors and EV batteries where a few dominant players exist. The automotive industry's reliance on these critical inputs, especially with the surge in demand for smart and electric vehicles, grants suppliers considerable leverage. For example, the global automotive semiconductor market was valued at over $60 billion in 2024, underscoring the immense value and concentrated supply of these essential parts.

Switching costs for critical components are substantial for Geely, involving re-tooling, R&D, and complex integration, which strengthens supplier positions. Furthermore, the threat of forward integration by suppliers, such as battery manufacturers entering vehicle production, adds another layer of complexity, potentially leading to increased costs and supply chain vulnerabilities for Geely.

Geely actively mitigates supplier bargaining power through vertical integration, developing its own batteries and chips, as seen in its 2024 investments in advanced battery research. Strategic alliances and shared platforms across its brands, like Volvo and Lynk & Co, also consolidate purchasing power, securing more favorable terms and reducing reliance on external providers.

| Component Area | Key Suppliers/Market Dynamics | Impact on Geely's Bargaining Power | 2024 Market Context |

|---|---|---|---|

| EV Batteries | CATL, BYD (concentrated market) | High supplier power due to critical demand and limited alternatives | Global EV battery market projected significant growth |

| Semiconductors | Specialized chip manufacturers (niche technology) | High supplier power due to demand for advanced features (ADAS, IoV) | Automotive semiconductor market over $60 billion |

| Vertical Integration | Geely's internal development (batteries, chips) | Lowers supplier power by reducing external reliance | Increased investment in R&D for proprietary technologies |

| Strategic Alliances | Shared platforms (Volvo, Lynk & Co) | Enhances purchasing power through bulk orders, reducing supplier leverage | Synergies across brands for cost optimization |

What is included in the product

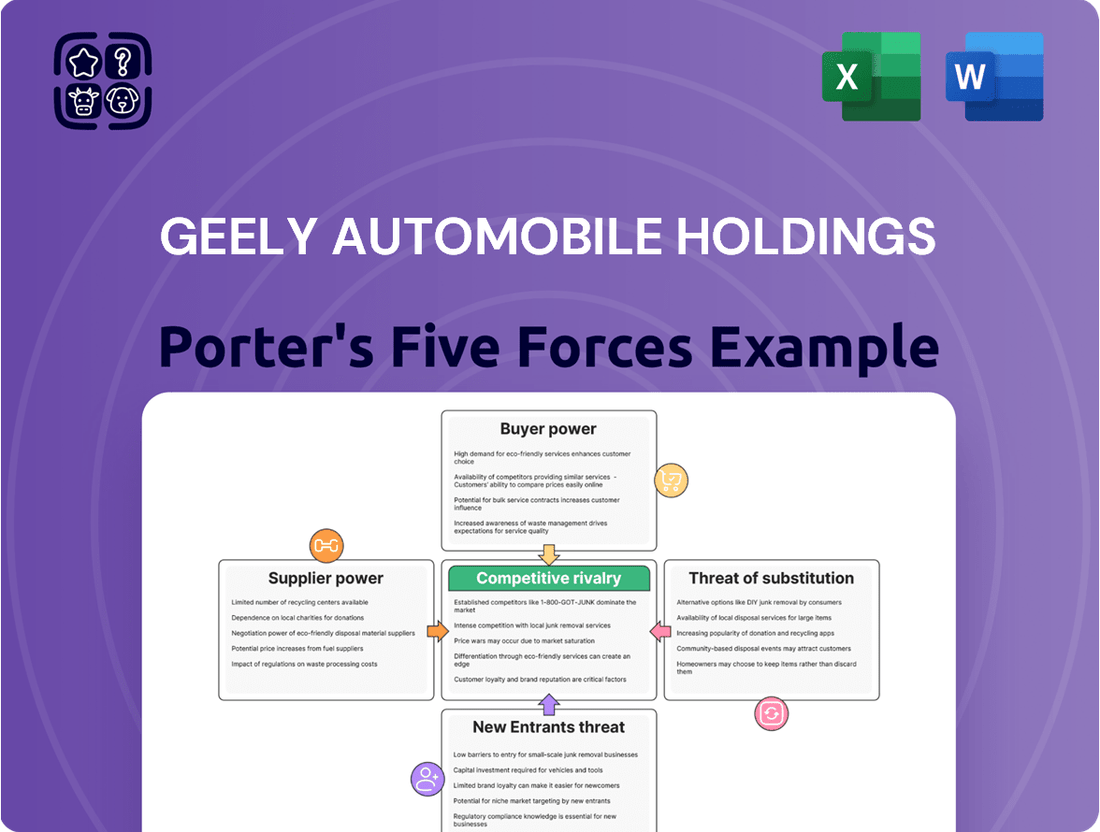

A Porter's Five Forces analysis for Geely Automobile Holdings reveals the intense competitive rivalry within the automotive sector, the significant bargaining power of both suppliers and buyers, and the moderate threat of new entrants, all of which shape Geely's strategic positioning and profitability.

Instantly identify and address competitive threats by visualizing Geely's Porter's Five Forces with a dynamic, interactive dashboard.

Gain actionable insights into Geely's competitive landscape, enabling swift strategic adjustments to mitigate risks and capitalize on opportunities.

Customers Bargaining Power

The Chinese automotive market, especially for New Energy Vehicles (NEVs), is a battleground of pricing. Customers are highly sensitive to cost, making price wars a common occurrence. For instance, in 2023, the NEV market saw aggressive price cuts from numerous manufacturers, with some models experiencing reductions of over 15% to capture market share.

While price remains a key factor, competition is evolving. Geely, like its rivals, must navigate this landscape by offering competitive pricing while also exploring non-monetary incentives. This shift means balancing the need to attract price-conscious buyers with maintaining healthy profit margins, a delicate act in a market where discounts can quickly erode earnings.

Chinese consumers are incredibly savvy about automotive technology, with a keen interest in low-carbon options. This awareness translates directly into their purchasing power, as they actively compare brands and features, pushing Geely to deliver more for their money.

The rapid shift in consumer tastes towards electric vehicles and advanced smart features means Geely needs to stay ahead of the curve. For instance, in 2024, the EV market in China saw significant growth, with sales increasing substantially year-over-year, highlighting the urgency for Geely to innovate and cater to these evolving preferences.

The increasing prevalence of trade-in programs and replacement purchases, particularly in China, significantly amplifies customer bargaining power. Government incentives and nationwide trade-in initiatives are driving a substantial portion of vehicle sales, with reports indicating a large percentage of buyers leveraging these schemes. This trend means customers are often looking to upgrade existing vehicles, giving them more leverage to negotiate better deals on new models from manufacturers like Geely.

Diverse Product Offerings and Brand Loyalty

Geely Automobile Holdings boasts a diverse product lineup, encompassing sedans, SUVs, and New Energy Vehicles (NEVs) across its brands like Geely Auto, Lynk & Co, and Zeekr. This broad offering appeals to various customer preferences and price points, potentially fragmenting customer demand.

While Chinese domestic brands, including Geely, are experiencing a rise in brand loyalty, the automotive market remains highly competitive. Customers have a plethora of choices from both domestic and international manufacturers, which can empower them to demand lower prices or higher quality.

Geely's strategy to cultivate brand loyalty is crucial in mitigating customer bargaining power. For instance, in 2023, Geely Auto's sales reached 1,616,000 units, demonstrating significant market presence, but the sheer volume of available vehicles means customers can easily switch if offerings aren't compelling enough.

- Geely's extensive product portfolio: Includes sedans, SUVs, and NEVs under brands such as Geely Auto, Lynk & Co, and Zeekr, catering to diverse customer segments.

- Growing brand loyalty: Chinese domestic brands, including Geely, are seeing increased customer allegiance.

- Customer choice: Despite loyalty trends, customers still have numerous alternatives in the market, maintaining their bargaining power.

- Need for differentiation: Geely must continuously differentiate its products and strengthen its brand perception to counter customer leverage.

Impact of Online Sales and Direct-to-Consumer Models

The proliferation of online sales platforms and direct-to-consumer (DTC) strategies, particularly within the New Energy Vehicle (NEV) sector, significantly amplifies customer bargaining power. These channels offer unparalleled pricing transparency and foster direct interaction, effectively diminishing information asymmetry and facilitating straightforward comparisons between manufacturers. For instance, by mid-2024, many EV manufacturers were reporting increased online order volumes, with some DTC brands achieving substantial market share gains through this model.

This shift necessitates that Geely Automobile Holdings proactively refine its digital sales infrastructure and customer service approaches. By leveraging data analytics from online interactions, Geely can better understand customer preferences and tailor offerings, thereby mitigating some of the increased bargaining power. For example, in 2024, Geely's investment in its digital platform aimed to provide a more seamless online purchasing experience, including virtual showrooms and personalized financing options.

- Increased Transparency: Online platforms allow customers to easily compare prices, features, and reviews across different NEV models, reducing the advantage manufacturers once held.

- Direct Engagement: DTC models bypass traditional dealerships, enabling customers to negotiate directly with the manufacturer, often leading to better terms.

- Information Access: Customers can readily access technical specifications, performance data, and ownership costs online, empowering them with knowledge for negotiation.

- Reduced Switching Costs: The ease of online research and ordering lowers the effort for customers to switch between brands, increasing competitive pressure on Geely.

The bargaining power of customers for Geely Automobile Holdings is considerable, driven by a highly competitive Chinese automotive market, particularly in the New Energy Vehicle (NEV) segment. Customers are price-sensitive, and the availability of numerous domestic and international brands with comparable offerings means they can readily switch if Geely's value proposition isn't compelling enough. This is further amplified by the increasing transparency and direct engagement facilitated by online sales platforms and direct-to-consumer models.

Geely's broad product portfolio, spanning various segments and brands like Geely Auto, Lynk & Co, and Zeekr, caters to diverse needs. While this breadth can fragment demand, it also means customers have many options within Geely's own umbrella, and by extension, the wider market. The rise of trade-in programs and government incentives in China also empowers buyers, as they often leverage these schemes to negotiate better deals on new vehicles.

| Factor | Impact on Geely | Supporting Data (2023-2024) |

|---|---|---|

| Price Sensitivity | High | NEV market saw price cuts exceeding 15% in 2023; aggressive pricing is common. |

| Product Choice | High | Geely offers sedans, SUVs, NEVs; numerous domestic and international competitors. |

| Information Transparency | High | Online platforms and DTC models allow easy price/feature comparison; increased online orders reported mid-2024. |

| Brand Loyalty | Growing but not absolute | Geely Auto sold 1.616 million units in 2023, showing presence but not immunity to switching. |

Preview Before You Purchase

Geely Automobile Holdings Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual Geely Automobile Holdings Porter's Five Forces Analysis, detailing the competitive landscape, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the automotive industry.

Rivalry Among Competitors

Geely operates within a hyper-competitive Chinese automotive market, a landscape populated by formidable domestic rivals and established international manufacturers. This intense rivalry is particularly acute in the burgeoning New Energy Vehicle (NEV) sector, where companies like BYD are major forces.

The pressure from both homegrown brands and global giants like Volkswagen and Toyota forces Geely to constantly innovate and manage pricing strategies to maintain its market position. In 2023, China's automotive sales reached 30.09 million units, highlighting the sheer volume and competitive intensity.

The automotive industry is characterized by a fierce competitive rivalry fueled by the relentless pace of technological innovation. Companies like Geely are under immense pressure to constantly introduce new models equipped with cutting-edge features, particularly in areas like electrification, advanced driver-assistance systems (ADAS), and sophisticated smart cockpit functionalities. This rapid cycle of development means that staying ahead requires continuous investment in research and development, as seen with Geely's focus on its 'Year of Smart Driving' initiative planned for 2025, underscoring the intense technological arms race.

Competitive rivalry is intense, especially in the burgeoning New Energy Vehicle (NEV) sector. Chinese domestic brands have made significant inroads, with BYD, for instance, achieving remarkable sales dominance, capturing a substantial portion of the market. This escalating competition necessitates that Geely, a major player in the Chinese automotive industry, consistently enhances its brand appeal and deepens its market penetration to maintain and grow its sales volume.

Pricing Strategies and Profitability Pressures

While direct price wars might be less frequent, Geely Automobile Holdings still faces significant competitive pressure through strategic pricing and value-added incentives. Automakers are increasingly using non-monetary benefits, such as extended warranties or bundled services, to draw in customers without directly slashing vehicle prices, a tactic that still impacts overall profitability. For instance, in the first half of 2024, Geely reported a net profit attributable to equity holders of RMB 4.8 billion, highlighting the ongoing need to balance sales volume with margin health.

This environment necessitates that Geely continually refines its cost management and product portfolio to ensure sustained profitability. The company’s ability to offer compelling features and differentiated models at competitive price points is paramount. Geely's focus on expanding its electric vehicle (EV) offerings, such as the Zeekr brand, also plays a role in its pricing strategy, as it aims to capture market share in a rapidly growing segment.

- Strategic pricing remains critical for Geely, even as overt price wars subside.

- Non-monetary incentives are being used to attract buyers, indirectly pressuring profit margins.

- Geely's net profit for H1 2024 was RMB 4.8 billion, underscoring the need for cost optimization.

- Product mix and cost structure management are essential for maintaining healthy profitability in a competitive market.

Globalization and Export Market Competition

Geely Automobile Holdings faces intensified competitive rivalry as Chinese automakers, including itself, aggressively pursue global markets via exports. This export-driven strategy means Geely is not only competing with established international players but also with other rapidly growing Chinese manufacturers vying for the same overseas market share. In 2023, Geely's export sales reached a significant milestone, demonstrating its expanding global presence and the increasing competition it encounters.

Geely's commitment to expanding its international footprint and sales networks directly translates to facing a broader array of rivals and the necessity of adapting to diverse consumer demands across different regions. This global expansion necessitates a keen understanding of varied regulatory environments and consumer preferences, adding layers of complexity to its competitive landscape.

- Record Export Growth: Geely reported substantial growth in its export volumes in 2023, indicating a stronger global market presence.

- Expanding International Footprint: The company is actively establishing and strengthening its sales and service networks in key international markets.

- Increased Global Competition: Geely's global push means direct competition with both established global automotive giants and other emerging Chinese brands in export territories.

- Market Diversification Challenges: Adapting product offerings and marketing strategies to meet the unique demands of diverse international consumer bases presents a significant competitive challenge.

Geely operates in a highly competitive automotive market, both domestically and internationally. This rivalry is intensified by rapid technological advancements, particularly in the New Energy Vehicle (NEV) sector, where companies like BYD are major players.

The pressure to innovate and manage pricing is significant, with China's automotive sales reaching 30.09 million units in 2023 underscoring market volume.

Geely's net profit for the first half of 2024 was RMB 4.8 billion, indicating the ongoing need to balance sales with profitability amidst these competitive pressures.

Geely's expanding global presence, with substantial export growth in 2023, means it faces increased competition from both established international brands and other rising Chinese manufacturers in overseas markets.

| Aspect | Geely's Position | Key Competitors |

|---|---|---|

| Domestic Market Intensity | Strong presence, faces intense competition | BYD, SAIC, GAC |

| NEV Sector Competition | Aggressively expanding NEV offerings | BYD, Tesla, Nio |

| Global Expansion Competition | Increasing export volumes | Volkswagen, Toyota, Hyundai, other Chinese brands |

| Innovation & Technology | Focus on electrification and smart driving | All major global and domestic OEMs |

SSubstitutes Threaten

The rise of ride-hailing and car-sharing services, like Didi Chuxing and Meituan Dianping’s ride service, offers a compelling alternative to owning a personal vehicle, especially in densely populated Chinese cities.

In 2024, these services continue to capture market share, impacting Geely's traditional sales model. For instance, a significant portion of urban commuters may opt for ride-sharing over purchasing a new car, directly affecting Geely's unit sales targets.

Furthermore, Chinese government initiatives aimed at reducing urban congestion and emissions, such as restrictions on gasoline-powered vehicles used for ride-hailing, are indirectly boosting demand for electric vehicles within these service fleets. This trend could further divert potential individual car buyers towards shared mobility solutions, presenting a sustained threat to Geely's private vehicle sales.

Continuous improvements and expansion of public transportation networks in major cities can reduce the necessity of owning a private vehicle for daily commuting. For instance, in 2024, many cities are investing heavily in expanding metro lines and bus rapid transit (BRT) systems, aiming to make public transit more appealing and efficient. This directly impacts the demand for personal vehicles.

Efficient and accessible public transport systems offer a cost-effective and convenient alternative to car ownership, potentially impacting Geely's sales. In 2023, the average cost of car ownership in major urban centers, including insurance, fuel, and maintenance, significantly exceeded the cost of monthly public transport passes in many regions. This cost differential makes public transit an increasingly attractive substitute.

This trend might influence car sales, especially in urban areas where congestion and parking challenges are prevalent. By 2024, cities like London and Paris are further implementing low-emission zones and congestion charges, adding to the overall cost and inconvenience of private car usage, thereby strengthening the threat of public transportation substitutes for automakers like Geely.

The increasing consumer preference for Plug-in Hybrid Electric Vehicles (PHEVs) and Extended-Range Electric Vehicles (EREVs) presents a significant threat of substitution for Geely's pure Battery Electric Vehicle (BEV) models within the New Energy Vehicle (NEV) market. This trend suggests that a portion of the market, seeking greater flexibility and range assurance, may opt for hybrid solutions rather than fully electric ones. For instance, in 2024, PHEVs and EREVs have captured a substantial share of the NEV market, potentially impacting the sales volume of Geely's BEV lineup.

Changing Consumer Lifestyles and Urbanization

Evolving urban lifestyles, particularly among younger demographics in China, are increasingly favoring convenience, sustainability, and flexible mobility solutions over the traditional model of private car ownership. This shift presents a significant threat of substitutes for traditional automakers like Geely.

The rapid urbanization across China, with a growing percentage of the population residing in cities, is fostering a greater acceptance and demand for multi-modal transportation networks. This includes ride-sharing services, public transit, and micro-mobility options like electric scooters, which can serve as direct substitutes for personal vehicle use.

For instance, by the end of 2023, China's ride-hailing market was estimated to be worth over $50 billion, with millions of daily active users, indicating a strong preference for on-demand mobility services. Geely needs to actively monitor these demographic and urban trends to adapt its product development and service strategies, potentially exploring integrated mobility platforms or services that complement rather than solely compete with car ownership.

- Urbanization Trends: China's urbanization rate reached approximately 65.2% by the end of 2023, a figure projected to continue rising, increasing the potential for multi-modal transport adoption.

- Ride-Sharing Growth: The number of ride-hailing trips in China surged significantly in 2023, demonstrating a strong consumer preference for convenient, alternative transportation.

- Sustainability Focus: Younger urban consumers are showing a heightened interest in eco-friendly options, making electric bikes, scooters, and efficient public transport more attractive substitutes.

Durability and Longevity of Existing Vehicles

The increasing durability and longevity of vehicles present a significant threat of substitutes for Geely Automobile Holdings. Consumers are holding onto their cars for longer durations, often exceeding 10 years, due to advancements in automotive engineering and manufacturing quality. This trend directly impacts new vehicle sales, as fewer replacement purchases are needed when existing vehicles remain functional and reliable. For instance, the average age of vehicles on U.S. roads reached a record 12.5 years in 2023, a clear indicator of this extended lifespan.

This extended vehicle life cycle poses a challenge for Geely in stimulating demand for new models. The company must focus on innovation and compelling value propositions to encourage consumers to upgrade from their still-operational vehicles.

- Extended Vehicle Lifespans: Average vehicle age on roads globally is increasing, delaying replacement cycles.

- Reduced Demand for New Cars: Consumers are less compelled to purchase new vehicles if their current ones are durable and perform well.

- Geely's Challenge: The need to offer strong incentives and technological advancements to drive upgrades.

The rise of ride-hailing and car-sharing services, coupled with expanding public transportation networks, presents a significant threat of substitutes for Geely. In 2024, these alternatives are increasingly favored in urban centers due to cost-effectiveness and convenience, directly impacting demand for new vehicle purchases. For example, the average cost of owning a car in major Chinese cities in 2023 far exceeded monthly public transport pass costs, making transit a more attractive option.

Furthermore, evolving urban lifestyles and a growing preference for flexible mobility solutions among younger demographics in China are shifting consumer priorities away from traditional car ownership. This trend is amplified by China's urbanization rate, which reached approximately 65.2% by the end of 2023, fostering greater adoption of multi-modal transport like ride-sharing and electric scooters.

The increasing durability of vehicles also contributes to this threat, as consumers are holding onto cars longer. With the average vehicle age on U.S. roads reaching a record 12.5 years in 2023, fewer replacement purchases are necessary, challenging Geely's ability to stimulate new model sales without compelling innovation and value propositions.

| Substitute | Impact on Geely | 2023/2024 Data Point |

| Ride-Hailing/Car-Sharing | Reduces demand for personal vehicle ownership | China's ride-hailing market valued over $50 billion by end of 2023 |

| Public Transportation | Offers cost-effective alternative to car ownership | Monthly public transport passes significantly cheaper than car ownership costs in urban centers |

| Vehicle Longevity | Delays new car purchase cycles | Average vehicle age on U.S. roads reached 12.5 years in 2023 |

Entrants Threaten

The automotive sector, including car manufacturing, requires substantial capital for research, development, and establishing production lines and intricate supply chains. This significant financial hurdle makes it challenging for newcomers to enter and effectively compete with established companies like Geely. For instance, the average cost to develop a new vehicle model can range from hundreds of millions to over a billion dollars, a clear deterrent for potential new entrants.

Established brand loyalty and extensive distribution networks present a significant barrier to new entrants in the automotive market, a challenge Geely Automobile Holdings leverages effectively. Incumbent players like Geely have spent years building trust and a physical presence, making it difficult for newcomers to gain traction. Geely's commitment to expanding its global outlets, aiming for further reach in 2024, reinforces this advantage.

The automotive industry, particularly with the rise of electric and autonomous vehicles, demands substantial technological expertise and ongoing research and development. New players must either commit significant capital to R&D or acquire advanced technologies, creating a high barrier to entry. Geely's substantial investments in areas like intelligent driving systems and advanced battery technology, exemplified by their 2023 R&D expenditure of approximately RMB 20 billion (around $2.8 billion USD), highlight the scale of this challenge.

Regulatory Hurdles and Compliance Costs

The automotive sector faces significant regulatory burdens worldwide, encompassing safety, environmental, and emissions standards. New entrants must invest heavily to meet these complex requirements, a process that can be prohibitively expensive. For instance, meeting Euro 7 emission standards, which are progressively being implemented across Europe, requires substantial R&D and manufacturing adjustments, adding millions to development costs for new models.

These stringent regulations act as a considerable barrier to entry for aspiring automakers. Navigating the diverse and evolving compliance landscapes across different markets demands specialized expertise and financial resources. Companies lacking established relationships with regulatory bodies or prior experience in automotive manufacturing will find these hurdles particularly daunting.

- Global Regulatory Complexity: New entrants must comply with varying safety, emissions, and environmental standards in each target market.

- High Compliance Costs: Meeting these standards can cost millions in research, development, and manufacturing modifications.

- Experience Barrier: Companies without prior automotive industry experience face a steeper learning curve and higher initial investment.

Emergence of Tech-Backed New Entrants

Despite established high barriers to entry in the automotive sector, the emergence of technology-focused companies, such as Xiaomi's venture into electric vehicles (EVs), signals a significant threat. These new entrants, leveraging their deep expertise in software and digital platforms, are capable of disrupting traditional market dynamics and reshaping consumer expectations. For instance, Xiaomi's 2024 EV launch aims to integrate its extensive smart ecosystem, a strategy that could attract a new segment of tech-savvy buyers.

These tech-backed challengers pose a threat by introducing innovative business models and user experiences that traditional automakers may find difficult to replicate quickly. Their agility and focus on software integration allow them to rapidly adapt to evolving market demands. Geely Automobile Holdings must therefore maintain a proactive and agile approach to effectively counter these technologically driven competitors and preserve its market position.

- Xiaomi's Entry: Xiaomi announced its entry into the EV market in late 2023, with its first model, the SU7, launching in China in April 2024.

- Tech Integration Focus: These new players prioritize software, connectivity, and advanced driver-assistance systems (ADAS), differentiating themselves from traditional hardware-centric approaches.

- Redefining Expectations: The threat lies in their ability to set new benchmarks for in-car technology and user interface, potentially drawing customers away from established brands.

While established players like Geely benefit from high capital requirements, regulatory hurdles, and brand loyalty, the threat of new entrants is evolving. Technology companies, unburdened by legacy manufacturing, are entering the automotive space, particularly in EVs. Their expertise in software and digital ecosystems allows them to offer integrated user experiences that challenge traditional automakers.

Xiaomi's 2024 entry into the EV market with its SU7 model exemplifies this trend, aiming to leverage its extensive smart ecosystem. This move highlights how tech-focused companies can rapidly gain traction by redefining consumer expectations around connectivity and user interface.

The automotive industry's significant R&D costs, with new model development potentially exceeding a billion dollars, remain a deterrent. However, the agility of tech entrants, coupled with their focus on advanced driver-assistance systems and software integration, presents a dynamic challenge that established firms must actively address to maintain their competitive edge.

| Factor | Impact on New Entrants | Geely's Advantage |

|---|---|---|

| Capital Intensity | High (e.g., $1B+ for new model dev) | Established scale and financing capabilities |

| Brand Loyalty & Distribution | Difficult to build | Extensive global network, years of trust |

| Technological Expertise | Requires significant R&D investment (e.g., Geely's ~ $2.8B in 2023) | Ongoing investment in intelligent driving, battery tech |

| Regulatory Compliance | Costly and complex (e.g., Euro 7 standards) | Experience navigating global regulations |

| Tech-Focused Challengers | Agile, software-centric (e.g., Xiaomi's 2024 EV launch) | Need for rapid adaptation to new business models |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Geely Automobile Holdings is built upon a robust foundation of data, including Geely's annual reports and financial statements, alongside industry-specific market research from firms like IHS Markit and LMC Automotive.

We also incorporate data from regulatory filings, global economic indicators, and news from reputable automotive trade publications to provide a comprehensive understanding of the competitive landscape.