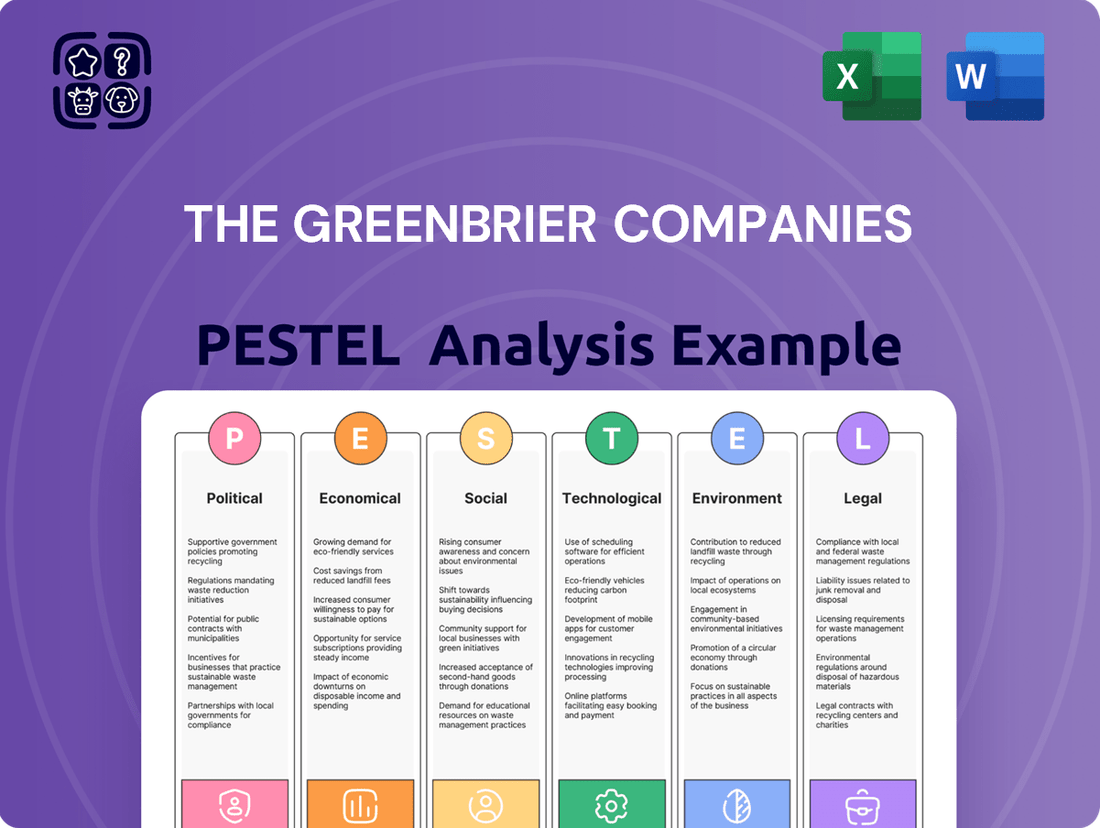

The Greenbrier Companies PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Greenbrier Companies Bundle

Understand how political, economic, and technological forces impact The Greenbrier Companies's performance. This ready-made PESTEL Analysis delivers expert-level insights—perfect for investors, consultants, and business planners. Buy the full version to get the complete breakdown instantly.

Political factors

Uncertainty around international trade agreements and tariffs significantly impacts Greenbrier's operations. The ongoing 25% Section 232 steel tariffs, for instance, continue to inflate raw material costs, directly affecting production efficiency and profitability in 2024 and 2025. Shifts in trade relationships between the U.S., Mexico, Europe, and Brazil could disrupt critical supply chains, potentially delaying new railcar orders and influencing customer demand for Greenbrier's products. Given Greenbrier's global manufacturing footprint, with facilities in Poland and Brazil, the company faces diverse political risks from potential changes in free trade agreements and import duties, impacting its competitive pricing strategy.

Increased government investment in rail infrastructure, particularly in North America and Europe, presents a robust opportunity for Greenbrier. The U.S. Bipartisan Infrastructure Law continues to allocate billions, with over $100 billion specifically for rail. Furthermore, NATO's elevated defense spending targets, aiming for 2% of GDP, are indirectly stimulating European infrastructure, boosting demand for rail transport and railcars. Upcoming legislative actions, such as potential renewable fuels bills, could also drive future demand for specialized railcars for biomass and ethanol transport in 2024 and 2025.

The Greenbrier Companies operates globally, making it subject to diverse railroad safety and equipment design regulations. For instance, the Federal Railroad Administration (FRA) in the U.S. continually updates safety standards, impacting new railcar designs and manufacturing processes. Any changes to these regulations, or Greenbrier's failure to maintain necessary certifications like AAR M-1003 for quality assurance, could directly hinder its ability to market and sell its products. The evolving regulatory landscape, particularly potential reregulation efforts concerning railcar maintenance or operational requirements, could significantly reshape the competitive environment of the North American rail industry through 2025.

Geopolitical Instability

Global geopolitical events, such as the ongoing conflict in Ukraine, introduce significant market uncertainty for The Greenbrier Companies. This instability can disrupt critical supply chains, affecting the delivery of components like steel, which saw price volatility in early 2024. Furthermore, customer demand in key markets can fluctuate, impacting new railcar orders, with projections for North American railcar deliveries showing potential shifts based on economic sentiment. Greenbrier's substantial international footprint, including operations in Europe and South America, makes it particularly susceptible to a range of geopolitical risks that could adversely affect its global operations and business outlook.

- Global trade growth forecasts for 2024 remain modest at around 2.6%, influenced by geopolitical tensions.

- Railcar backlog figures, like Greenbrier's reported 23,200 units as of February 2024, can be sensitive to sustained economic uncertainty.

- Freight rail volumes, a key indicator, experienced fluctuations in early 2024, reflecting broader economic and geopolitical influences.

'Onshoring' and 'Nearshoring' Trends

The strategic shift of manufacturing from China to North American countries, particularly Mexico, is set to significantly boost rail freight volumes. This nearshoring trend reconfigures supply chains, increasing demand for rail transportation across the U.S. and Mexico. Greenbrier, a key player in railcar manufacturing and services, is poised to capitalize on this evolving logistics landscape as North American production expands, directly impacting railcar orders through 2025.

- Mexico's manufacturing exports to the U.S. are projected to grow by 6-8% in 2024, driving cross-border rail demand.

- U.S. rail intermodal volumes are forecast to increase by 3-5% by mid-2025 due to re-shored supply chains.

- New railcar orders linked to nearshoring could add 5,000-7,000 units annually to the North American market through 2025.

Ongoing political factors like the 25% Section 232 steel tariffs inflate Greenbrier's costs, while shifting trade policies globally introduce supply chain risks. Conversely, robust government investments, including the U.S. Bipartisan Infrastructure Law's $100 billion for rail, drive demand for new railcars through 2025. Evolving railroad safety regulations from bodies like the FRA directly impact design and manufacturing processes. Geopolitical events and the significant nearshoring trend, with Mexico's manufacturing exports to the U.S. projected for 6-8% growth in 2024, reshape rail freight volumes and new railcar orders.

| Factor | Impact | 2024/2025 Data |

|---|---|---|

| Steel Tariffs | Inflated raw material costs | 25% Section 232 tariffs persist |

| Infrastructure Spending | Increased railcar demand | U.S. Bipartisan Law: >$100B for rail |

| Nearshoring Trend | Boosted cross-border rail freight | Mexico exports to U.S.: 6-8% growth (2024) |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external forces impacting The Greenbrier Companies, covering political, economic, social, technological, environmental, and legal factors. It offers actionable insights for strategic decision-making and risk management.

A concise PESTLE analysis for The Greenbrier Companies, presented in a digestible format, serves as a powerful pain point reliever by offering a clear, actionable overview of external factors impacting the business.

This analysis provides a structured framework for understanding and navigating complex market dynamics, thereby reducing uncertainty and enabling more informed strategic decision-making.

Economic factors

The demand for freight rail equipment and services for companies like Greenbrier is inherently cyclical, closely tied to broader economic performance. Economic downturns and heightened uncertainty, such as the anticipated global growth deceleration to around 2.9% in 2025, directly suppress new orders and service needs for railcars and marine barges. This reduction in demand can significantly impact Greenbrier's revenue, potentially affecting its operating margins. For instance, a slowdown in manufacturing or commodity shipments globally reduces the need for new railcar capacity, directly challenging Greenbrier's order book and financial outlook.

High inflation, with the US Consumer Price Index still elevated around 3.5% in early 2024, directly increases Greenbrier's operating costs for materials, energy, and wages, impacting profit margins. Rising interest rates, like the Federal Funds Rate holding above 5% through mid-2024, increase borrowing costs for Greenbrier's capital expenditures and for customers seeking financing for new railcar purchases. This reduces available capital for equipment acquisition across the industry. Such macroeconomic factors create a challenging business climate, potentially slowing order volumes and increasing financial leverage costs for The Greenbrier Companies through 2025.

The global freight market faces a complex environment in 2024, balancing robust demand in some sectors with geopolitical uncertainties and persistent capacity constraints. While U.S. rail carloads showed modest growth, with total carloads up 0.5% through May 2024 year-over-year, intermodal traffic experienced a notable decline of 3.9% in the same period, reflecting mixed economic signals. Fluctuations in consumer spending, which typically accounts for over 68% of U.S. GDP, directly influence freight demand and rail volumes. Economic forecasts for 2025 suggest continued volatility, impacting Greenbrier’s new railcar orders and utilization rates.

Leasing Market Strength

Greenbrier's leasing segment offers stable, recurring revenue, effectively hedging against the cyclical nature of its manufacturing operations. This strategic shift towards more predictable cash flows is evident in the segment's robust performance. The company reported a lease fleet of 28,100 units with a high utilization rate of 97.4% as of Q2 2024, demonstrating disciplined growth and favorable market conditions.

- Lease fleet reached 28,100 units in Q2 2024, providing consistent revenue streams.

- Utilization rate stood at a strong 97.4% as of Q2 2024, indicating high demand.

- Leasing acts as a crucial hedge against the inherent cyclicality of railcar manufacturing.

Global Supply Chain and Trade

Global supply chain disruptions continue to influence the freight industry, affecting both intermodal and carload traffic for companies like Greenbrier. Trade policy uncertainty, including potential tariffs expected to shift global trade flows through late 2024, can lead to front-loading of railcar orders followed by subsequent demand slowdowns, creating volatility. The reordering of global trade routes, especially with increased nearshoring trends, could benefit certain regions such as Brazil, where Greenbrier has significant manufacturing operations. This shift may increase demand for new railcars in strategic markets.

- North American rail traffic (carloads and intermodal) saw a 1.2% year-over-year decrease through early 2024, reflecting ongoing supply chain adjustments.

- Brazilian exports, a key driver for Greenbrier Maxion, are projected to grow by 3.5% in 2025, potentially boosting railcar demand in the region.

- New US tariff discussions on specific imports in mid-2024 could influence future rail freight patterns and order book stability.

Economic deceleration, with global growth projected at 2.9% in 2025, coupled with elevated US CPI around 3.5% and Federal Funds Rate above 5% through mid-2024, directly constrains Greenbrier’s new orders and elevates operating costs. Despite mixed U.S. rail traffic, the company’s leasing segment offers stability, boasting 28,100 units at 97.4% utilization in Q2 2024. Future demand is influenced by global trade shifts and projected 3.5% growth in Brazilian exports for 2025.

| Metric | 2024 Data | 2025 Projection |

|---|---|---|

| Global Growth | 2.9% | |

| US CPI | ~3.5% (early 2024) | |

| Fed Funds Rate | >5% (mid-2024) | |

| GBX Lease Fleet Util. | 97.4% (Q2 2024) | |

| Brazilian Export Growth | 3.5% |

Preview Before You Purchase

The Greenbrier Companies PESTLE Analysis

The preview you see here is the exact PESTLE analysis document for The Greenbrier Companies that you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Greenbrier’s operations and strategic positioning.

What you’re previewing here is the actual file, offering a detailed examination of external forces shaping the company's future, delivered professionally structured.

No placeholders, no teasers—this is the real, ready-to-use document you’ll get upon purchase, providing actionable insights into the industry landscape.

Sociological factors

Shortages of skilled labor and rising labor costs present a notable risk to Greenbrier's manufacturing operations. The U.S. manufacturing sector continues to face challenges in sourcing qualified applicants, with millions of job openings projected through 2025. For instance, the manufacturing job opening rate remains elevated, indicating persistent demand. A resilient labor market, characterized by low unemployment and wage growth, indirectly fuels economic activity and, consequently, demand for rail transportation services.

The Greenbrier Companies prioritizes its workforce, evident in a high global response rate to its 2024 employee survey, signaling strong internal communication and engagement. This commitment extends to fostering continuous learning and development opportunities for staff across all levels. Furthermore, the company has expanded leadership roles within its Employee Resource Groups, demonstrating a dedication to diversity and inclusion. This strategic emphasis on employee well-being and engagement is integral to Greenbrier's long-term business strategy and operational stability.

The Greenbrier Companies prioritizes community investment as a key sociological factor, actively engaging through charitable giving and extensive volunteerism. In 2024, Greenbrier significantly contributed nearly $800,000 to local communities, reinforcing its commitment. Employees further amplified these efforts by dedicating thousands of volunteer hours to various initiatives. These contributions include establishing a scholarship fund, specifically designed to support individuals pursuing careers within the vital rail industry.

Shifting Consumer Behavior

Shifting consumer behavior directly influences freight volumes, especially for intermodal transport, which relies heavily on retail and e-commerce activity. A recent moderation in consumer spending growth, with real personal consumption expenditures (PCE) growth slowing to around 2.5% in early 2025, raises questions about future rail freight demand for companies like Greenbrier. However, the sustained expansion of e-commerce, projected to reach over $1.7 trillion in US sales by 2025, continues to drive demand in air and sea freight, indirectly affecting the broader logistics network and potentially influencing intermodal rail needs for final mile delivery.

- Real PCE growth moderates to approximately 2.5% in early 2025, impacting freight demand.

- US e-commerce sales are projected to exceed $1.7 trillion by 2025, supporting logistics.

Demographic Shifts and Housing

Broader societal trends like elevated interest rates, which saw the federal funds rate at 5.25-5.50% in early 2024, and persistent inflation, with the CPI at approximately 3.1% year-over-year as of January 2024, are making homeownership less accessible. This impacts overall economic stability, potentially dampening consumer confidence and spending. An aging U.S. population, with over 17% of the population aged 65 or older by 2023, coupled with declining labor force participation rates, especially post-pandemic, presents long-term challenges for the manufacturing workforce. These demographic shifts could directly affect labor availability and increase costs for Greenbrier.

- US labor force participation rate was approximately 62.5% in early 2024.

- The median existing home price in the US reached $379,100 by January 2024.

Societal shifts, including an aging workforce and persistent labor shortages, impact Greenbrier's operational costs and talent acquisition, with the US labor force participation at 62.5% in early 2024. Consumer behavior, like e-commerce growth projected to exceed $1.7 trillion by 2025, influences freight demand. Greenbrier actively addresses these by investing in communities and fostering employee engagement, contributing nearly $800,000 in 2024.

| Sociological Factor | Trend/Data Point | Implication for Greenbrier |

|---|---|---|

| Labor Force Participation | 62.5% (Early 2024) | Potential for ongoing labor shortages and wage pressure. |

| US E-commerce Sales | >$1.7 Trillion (Projected 2025) | Drives intermodal freight demand, especially for last-mile. |

| Greenbrier Community Investment | ~$800,000 (2024) | Enhances brand reputation and local workforce development. |

Technological factors

The rail industry, including Greenbrier, is rapidly integrating AI, digital twins, and advanced robotics to boost manufacturing efficiency. For instance, by early 2025, smart factories are projected to reduce production costs by up to 15% through process optimization. Additive manufacturing, or 3D printing, is increasingly used for custom spare parts and lightweight components, cutting lead times and material waste by an estimated 20-30%. These technologies enable precise process simulation, minimizing costly trial-and-error and improving product quality, critical for meeting rising demand for specialized railcars. Greenbrier's adoption of these innovations enhances its competitive edge and operational resilience.

The Internet of Trains, leveraging IoT sensors and real-time data, significantly enhances railway infrastructure reliability and safety, a key factor for Greenbrier's customers. Predictive maintenance, powered by big data analytics and AI, is projected to reduce railcar downtime by up to 20% by mid-2025, optimizing schedules and improving asset management for operators. This digitalization provides greater operational visibility and efficiency across the rail network, aligning with industry trends towards smarter logistics. Greenbrier's offerings benefit from these advancements by integrating with or supporting advanced fleet management systems, ensuring competitive advantage. These technologies are crucial as the rail sector aims for higher capacity and reduced operational costs.

Technological advancements are crucial for enhancing rail safety and reliability for companies like Greenbrier. Non-destructive testing (NDT) methods, such as advanced ultrasonic inspections, are becoming more sophisticated, improving railcar component integrity. By late 2024, AI integration is further optimizing NDT for predictive maintenance and streamlining rail yard operations, reducing hazardous movements. Furthermore, technologies akin to automatic kill switches, part of Positive Train Control (PTC) systems, continue to prevent accidents, with PTC systems active on over 90% of Class I freight routes as of 2025, significantly boosting safety metrics across the industry.

Sustainable Technologies and Decarbonization

The rail industry is significantly advancing decarbonization, integrating innovations like hydrogen fuel cells for zero-emission trains and regenerative braking systems to improve efficiency. Greenbrier contributes through its Sustainable Conversions program, which actively restores and reclaims materials from older railcars, reducing waste. This initiative, alongside the use of lightweight materials and more efficient designs, helps cut energy consumption and aligns with projected 2025 targets for reduced freight emissions. The company's 2024 sustainability report highlights continued investment in these areas.

- Rail freight emissions reduction targets aim for significant cuts by 2025, driven by technological adoption.

- Greenbrier's Sustainable Conversions program recycled approximately 27,000 tons of steel in 2023, contributing to circular economy principles.

- The global market for hydrogen fuel cell trains is projected to grow substantially, indicating future industry shifts.

- Regenerative braking systems can recover up to 30% of energy during deceleration, enhancing overall train efficiency.

Enhanced Traceability and Quality Control

Digital technologies like advanced barcoding and RFID tags are transforming traceability in rail component manufacturing for companies like Greenbrier. These systems build a robust digital history for each component, tracking it from production through its operational lifespan. This enhanced traceability is vital for stringent quality control, ensuring the long-term performance and safety of critical rail equipment. For instance, such systems can reduce warranty claims by improving component lifecycle management.

- By 2025, over 60% of new railcar components are projected to utilize digital traceability.

- Enhanced traceability can cut maintenance costs by up to 15% through predictive analytics on component health.

Greenbrier integrates advanced technologies like AI, IoT, and additive manufacturing to optimize railcar production and maintenance, targeting up to 15% cost reduction by 2025. Digital traceability and predictive analytics enhance operational efficiency and safety, reducing railcar downtime by an estimated 20%. The company also invests in decarbonization, utilizing lightweight materials and its Sustainable Conversions program, which recycled 27,000 tons of steel in 2023.

| Technology | Impact | 2025 Projection |

|---|---|---|

| Smart Factories | Production Cost Reduction | Up to 15% |

| Predictive Maintenance | Railcar Downtime Reduction | Up to 20% |

| Digital Traceability | New Component Adoption | Over 60% |

Legal factors

Greenbrier's extensive global operations are deeply influenced by international trade laws, including various free trade agreements, tariffs, quotas, and embargoes across continents. For instance, shifts in global trade policies, like the imposition of new tariffs on steel or critical rail components, directly impact the company's material costs and profitability, as seen with steel price volatility affecting 2024 margins. To manage this intricate landscape and ensure compliance, Greenbrier employs a sophisticated third-party automated risk management system, continuously monitoring international regulations. This proactive approach helps mitigate financial risks from dynamic trade policies, which could otherwise significantly alter revenue projections.

The Greenbrier Companies' operations in the U.S. and Mexico are subject to rigorous workplace health and safety regulations, including those enforced by OSHA and STPS. Adherence to these standards is paramount for ensuring employee well-being and mitigating significant fines or legal repercussions. Greenbrier prioritizes safety as a core value, investing in comprehensive programs and training initiatives to minimize workplace risks for its workforce, which included over 10,000 employees globally as of early 2024. This commitment helps maintain operational continuity and a strong safety record, essential for long-term sustainability.

The Greenbrier Companies must strictly adhere to diverse local and national environmental regulations across all operational jurisdictions. These mandates cover critical areas such as industrial emissions, comprehensive waste management protocols, and biodiversity protection near their facilities. For instance, in the UK, the Office of Rail and Road requires licensed rail operators, including potential clients, to submit detailed environmental arrangements for approval by 2024. This regulatory landscape, increasingly focused on ESG performance, directly impacts Greenbrier's operational costs and strategic investments in sustainable manufacturing practices through 2025.

Railroad Economic and Safety Regulation

The rail industry, crucial for The Greenbrier Companies, faces robust economic regulation primarily from the Surface Transportation Board (STB) in the U.S., which oversees common-carrier obligations and service issues. Discussions intensified in late 2024 regarding potential reregulation, including proposals for competitive switching, aiming to address shipper concerns over service reliability and rates. Simultaneously, federal bodies like the Federal Railroad Administration (FRA) and international agencies continuously update technical and safety standards for rail equipment and operations. These evolving regulatory landscapes directly influence demand for new railcar builds and maintenance services, impacting Greenbrier's market strategy.

- STB oversight in 2024 continued to scrutinize Class I railroad service metrics and demurrage practices.

- FRA data for Q1 2024 indicated a slight decrease in overall rail accidents compared to 2023, emphasizing ongoing safety compliance.

- Legislative talks in early 2025 may revisit strengthening common carrier obligations, affecting rail freight competition.

- New EPA emission standards for rail equipment, anticipated by mid-2025, could influence future railcar designs.

Corporate Governance and Reporting Standards

As a publicly traded entity, The Greenbrier Companies must meticulously adhere to stringent securities laws and reporting requirements. This includes comprehensive disclosures on financial performance and evolving ESG matters, reflecting heightened regulatory scrutiny. The company is actively transitioning its sustainability reporting from the TCFD framework to the new IFRS S1 and S2 standards, effective for periods beginning January 1, 2024. This shift underscores a significant legal and investor-driven demand for standardized, transparent sustainability disclosures across global markets.

- Greenbrier complies with SEC regulations and Sarbanes-Oxley Act provisions.

- Transition to IFRS S1 and S2 for sustainability reporting began in 2024.

- Investor expectations for transparent ESG data are increasing globally.

- New EU Corporate Sustainability Reporting Directive (CSRD) impacts global operations.

The Greenbrier Companies navigate intricate legal landscapes, including international trade policies where 2024 tariff shifts on materials like steel directly affect profitability. Strict adherence to global health, safety, and environmental regulations, such as new EPA emission standards anticipated by mid-2025, significantly shapes operational costs and investments. Furthermore, robust economic oversight from bodies like the STB, which scrutinized Class I railroad service in 2024, influences demand for railcar builds. As a public entity, Greenbrier is also transitioning to IFRS S1 and S2 for sustainability reporting by January 2024, demonstrating compliance with evolving securities and ESG disclosure laws.

| Legal Area | Key Impact | 2024/2025 Data Point |

|---|---|---|

| International Trade | Material cost volatility | Steel price volatility impacted 2024 margins |

| Environmental Compliance | Operational costs, investments | New EPA emission standards anticipated by mid-2025 |

| Economic Regulation | Railcar demand & service | STB scrutinized Class I railroad service metrics in 2024 |

| Securities & ESG | Reporting standards, investor trust | Transition to IFRS S1/S2 for sustainability reporting started Jan 2024 |

Environmental factors

The Greenbrier Companies deeply commits to sustainable products, leveraging rail's inherent efficiency as a low-carbon freight transport mode. Their innovative Sustainable Conversions program significantly enhances this, focusing on a circular economy within railcar manufacturing. This initiative effectively reuses, reclaims, and recycles substantial materials from existing railcars, drastically reducing waste. For instance, in fiscal year 2023, Greenbrier's efforts diverted significant tonnage of materials from landfills, minimizing the environmental footprint of new production and contributing to a greener supply chain.

Greenbrier is actively working to reduce its environmental footprint by increasing renewable energy use and recycled materials. In 2024, 35% of its U.S.-based electricity came from renewable sources, and the share of recycled steel in new railcar manufacturing rose to 56%. The company maintains an Environmental Management System to ensure adherence to regulations and drive continuous performance improvements. These initiatives reflect a strong commitment to sustainable operations and resource efficiency.

The Greenbrier Companies actively assesses climate change risks, having completed a 2-degree Celsius scenario planning event to gauge its preparedness for potential climate-related situations. Through its Enterprise Risk Management program for 2024-2025, the company evaluates physical risks like extreme heat and floods, alongside transition risks such as carbon taxes. Greenbrier believes its business strategy demonstrates resilience to these challenges, anticipating that rail transport will become more competitive under conditions of higher fuel prices or increased carbon levies, reflecting a robust strategic outlook.

Waste and Materials Management

The Greenbrier Companies prioritizes robust waste and materials management, emphasizing comprehensive tracking and recycling initiatives. Through its railcar restoration operations, Greenbrier successfully reused, reclaimed, or recycled approximately 25,000 tons of materials in 2024. This systematic approach significantly curtails the demand for virgin materials and effectively minimizes landfill waste, aligning with sustainable operational goals.

- 2024 Material Recycling: 25,000 tons of materials reused, reclaimed, or recycled.

- Operational Focus: Comprehensive tracking and recycling within railcar restoration.

- Environmental Impact: Reduced virgin material consumption and landfill waste.

Decarbonization and Emissions Reduction

The rail industry is crucial for a low-carbon economy, as rail freight emits significantly less CO2 than road freight. The Greenbrier Companies actively supports this transition by manufacturing fuel-efficient railcars, contributing to the broader industry's decarbonization efforts. The company is held accountable for achieving environmental success measures, including reductions in its Scope 1 and 2 carbon emissions.

- Rail freight emits approximately 75% less CO2 per ton-mile compared to trucks, underscoring its environmental efficiency.

- Greenbrier's 2024 sustainability update details ongoing progress in reducing operational emissions.

- The company aims for continued reductions in Scope 1 and 2 emissions through fiscal year 2025.

The Greenbrier Companies emphasizes environmental stewardship by leveraging rail's inherent low-carbon efficiency and actively promoting a circular economy through its Sustainable Conversions program, which reused 25,000 tons of materials in 2024. The company increased renewable electricity use to 35% in its U.S. operations and recycled steel in new railcars to 56% in 2024, significantly reducing its footprint. Greenbrier also assesses climate risks via 2024-2025 ERM, anticipating rail's competitiveness under future carbon policies and aiming for continued Scope 1 and 2 emission reductions.

| Metric | 2024 Data | Goal/Context |

|---|---|---|

| Renewable Electricity Use (U.S.) | 35% | Increased from prior years |

| Recycled Steel in New Railcars | 56% | Supports circular economy |

| Materials Reused/Recycled | 25,000 tons | From railcar restoration |

| Rail Freight CO2 vs. Trucks | ~75% less per ton-mile | Industry efficiency metric |

PESTLE Analysis Data Sources

Our PESTLE analysis for The Greenbrier Companies is informed by a robust blend of publicly available data. We draw upon official government publications, financial reports from industry leaders, and reputable market research firms to ensure comprehensive coverage.