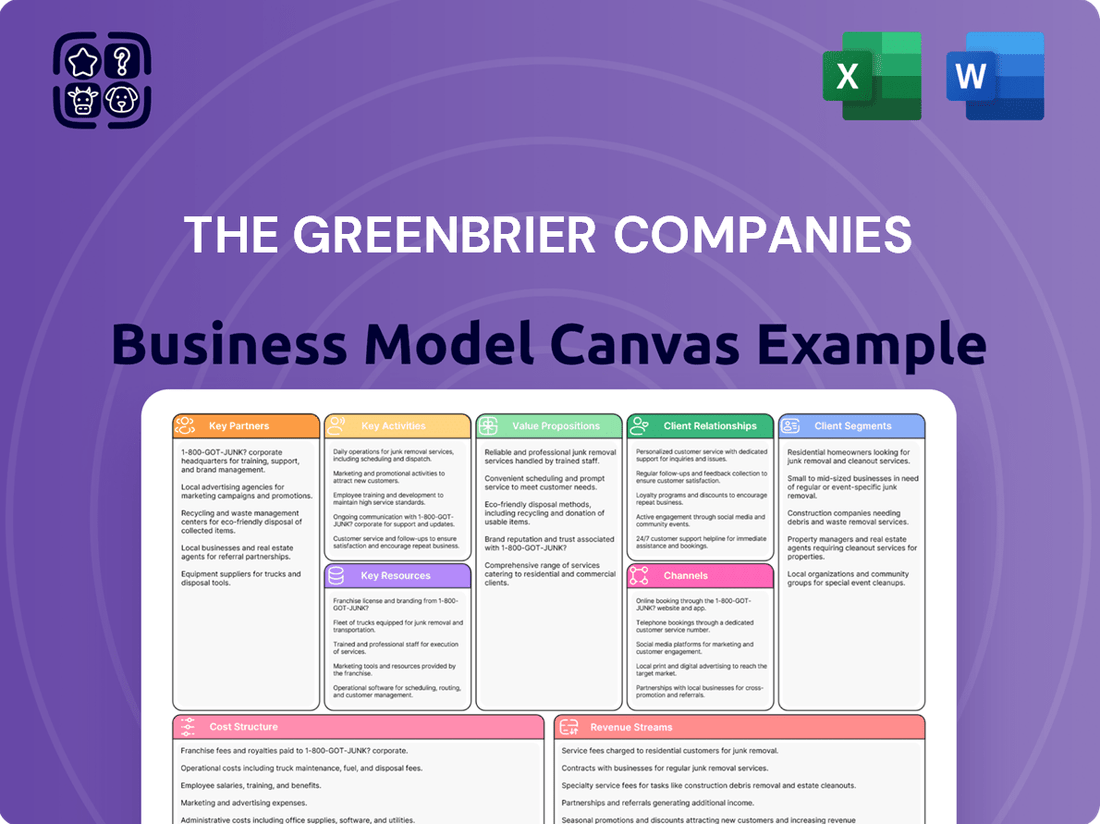

The Greenbrier Companies Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The Greenbrier Companies Bundle

Unlock the full strategic blueprint behind The Greenbrier Companies's business model. This in-depth Business Model Canvas reveals how the company drives value through its diversified railcar manufacturing and leasing services. It meticulously outlines their key partners, such as suppliers and logistics providers, and their customer segments, including railroads and leasing companies.

Discover how Greenbrier's value propositions, focused on quality, reliability, and innovation in railcar solutions, resonate with their target market. This canvas details their revenue streams, from new car sales to aftermarket services and leasing income, showcasing their multi-faceted approach to profitability.

Delve into the core activities that power Greenbrier's operations, from design and engineering to production and maintenance. Understand their cost structure, encompassing manufacturing expenses, R&D, and administrative overhead, which are critical to their financial performance.

See how The Greenbrier Companies leverages its key resources, including its manufacturing facilities and intellectual property, to maintain its competitive edge. This comprehensive view is essential for anyone seeking to understand their market position and operational efficiency.

Ready to go beyond a preview? Get the full Business Model Canvas for The Greenbrier Companies and access all nine building blocks with company-specific insights, strategic analysis, and financial implications—all designed to inspire and inform.

Partnerships

Strategic suppliers are crucial for The Greenbrier Companies, encompassing partnerships with providers of critical raw materials like steel and specialty components such as braking systems. Securing long-term contracts with these key partners is vital for managing input costs, especially given the volatility seen in steel prices, which have fluctuated significantly in 2024. These agreements ensure supply chain stability, allowing for consistent manufacturing quality in a cyclical industry where demand can shift. For instance, maintaining strong relationships helps Greenbrier navigate market dynamics and uphold its production schedule for new railcar builds and repairs.

Greenbrier establishes joint ventures in key international markets, notably Europe and Brazil, to strategically expand its global footprint. These partnerships, like Greenbrier Europe’s operations, leverage local manufacturing capabilities and help navigate complex regional regulations. By collaborating, Greenbrier gains crucial market access and shares operational risks, enhancing efficiency. This approach is vital for their diversified revenue streams, with international deliveries contributing significantly to their overall railcar production in 2024.

Class I railroads are pivotal partners for Greenbrier, extending beyond their role as customers to encompass strategic service agreements and collaborative technological advancements. These relationships, like those with Union Pacific or BNSF, provide critical fleet management insights directly informing Greenbrier's service division. For instance, Greenbrier reported a strong backlog of 23,200 units valued at $2.6 billion as of February 2024, much of which is driven by these long-term railroad partnerships. Such deep engagements offer valuable market intelligence and a stable base, ensuring Greenbrier's continued relevance in developing new railcar technologies.

Financial Institutions & Capital Providers

Partnerships with banks and investment firms are crucial for The Greenbrier Companies, enabling the financing of large-scale manufacturing projects and the expansion of their significant leasing fleet. These collaborations ensure the necessary capital for their capital-intensive operations. As of February 29, 2024, Greenbrier reported approximately $1.6 billion in total debt, underscoring the reliance on these financial relationships. This ensures robust financial flexibility and the capacity to pursue strategic growth opportunities within the railcar industry.

- Financing large-scale manufacturing projects.

- Funding the extensive railcar leasing fleet.

- Managing over $1.6 billion in total debt as of Q2 2024.

- Ensuring liquidity and capital for growth initiatives.

Logistics and Distribution Partners

Collaborating with third-party logistics (3PL) providers is crucial for The Greenbrier Companies to manage the complex flow of materials and finished goods. These partnerships ensure the efficient inbound delivery of components to manufacturing plants and the outbound shipment of completed railcars to customers throughout North America and Europe. For instance, in fiscal year 2024, Greenbrier projected delivering 20,000 to 22,000 new railcar units, underscoring the vast logistical coordination required. This network helps optimize transit times and reduce overall supply chain costs.

- Inbound logistics for raw materials and components, ensuring timely supply.

- Outbound distribution of new railcars across diverse geographical markets.

- Strategic partnerships reduce freight costs and improve delivery efficiency.

- Facilitates Greenbrier’s 2024 new railcar delivery projections.

The Greenbrier Companies relies on diverse key partnerships, including strategic suppliers for critical materials like steel, which saw price fluctuations in 2024. Collaborations with Class I railroads ensure a stable backlog, valued at $2.6 billion as of February 2024, and foster technological advancements. Financial institutions provide crucial capital, supporting Greenbrier’s $1.6 billion in total debt as of Q2 2024 and funding its extensive leasing fleet. Joint ventures and 3PL providers further optimize global operations and logistics for projected 2024 railcar deliveries.

| Partner Type | Primary Contribution | 2024 Impact |

|---|---|---|

| Strategic Suppliers | Raw materials, components | Managed steel price volatility |

| Class I Railroads | Fleet insights, long-term orders | $2.6B backlog (Feb 2024) |

| Financial Institutions | Capital for operations, leasing | Supported $1.6B debt (Feb 2024) |

| 3PL Providers | Logistics, distribution | Facilitated 20K-22K projected deliveries |

What is included in the product

The Greenbrier Companies' Business Model Canvas focuses on manufacturing and servicing freight railcars, providing a comprehensive value proposition of reliable transportation solutions to diverse customer segments across North America and Europe.

This model leverages extensive manufacturing capabilities and a robust service network to capture revenue through sales, leasing, and after-market support, reflecting a strong operational strategy.

The Greenbrier Companies' Business Model Canvas offers a clear, visual way to identify and address the complexities of manufacturing and servicing freight cars, acting as a pain point reliever by simplifying strategic planning.

This one-page snapshot of Greenbrier's operations allows for quick identification of core revenue streams and customer segments, effectively alleviating the pain of understanding a large, multifaceted industrial business.

Activities

Railcar design and manufacturing represents Greenbrier's core operational activity, encompassing engineering, design, fabrication, welding, and final assembly for a diverse range of freight cars. This integrated process ensures high-quality output, crucial for global rail networks. Continuous innovation in design and manufacturing processes is vital for maintaining a competitive edge in the market. For instance, in fiscal year 2024, Greenbrier delivered 5,700 new railcars in its second quarter alone, showcasing robust production capabilities and market demand.

The Greenbrier Companies operates an extensive network of service centers across North America, providing comprehensive aftermarket services that generate crucial recurring revenue. These vital activities include routine maintenance, major overhauls, and specialized wheel and axle servicing for freight railcars. Modernization programs are also offered to extend the operational life of existing railcar fleets, enhancing asset value for customers. For the second quarter of fiscal year 2024, Greenbrier's Services segment, encompassing these repair and refurbishment activities, reported revenues of $136.2 million, underscoring its significant contribution to the company's financial performance and stability.

The Greenbrier Companies' leasing and fleet management operations involve overseeing a substantial portfolio of owned and managed railcars, which in fiscal year 2024 included approximately 276,000 railcars under management.

This activity focuses on structuring diverse lease agreements, providing a stable, long-term revenue stream that consistently contributes to financial performance.

These comprehensive fleet management services include maintenance, regulatory compliance, and optimization for customers.

This segment helps mitigate the cyclical nature of railcar manufacturing, offering predictable cash flows and stability.

Inland Barge Manufacturing

Inland barge manufacturing represents a strategic diversification for The Greenbrier Companies, leveraging its established core competencies in advanced steel fabrication and welding. This activity allows Greenbrier to build essential equipment for the marine transportation industry, serving a related yet distinct market segment. The company continues to utilize its robust manufacturing capabilities, which contributed to its overall manufacturing revenue of 480.9 million USD in the second quarter of 2024.

- Strategic diversification beyond traditional railcar manufacturing.

- Leverages core expertise in steel fabrication and welding.

- Manufactures equipment for the vital marine transportation sector.

- Addresses a distinct market, enhancing Greenbrier's industrial footprint.

Supply Chain and Materials Sourcing

Supply Chain and Materials Sourcing

The Greenbrier Companies manage a complex global supply chain for steel, components, and other raw materials essential for railcar manufacturing. Effective supply chain management is crucial, directly impacting cost control and ensuring production schedules are met efficiently. This involves continuous negotiation with a diverse network of suppliers and optimizing inventory levels to mitigate supply chain disruptions, a key challenge in 2024 given fluctuating material costs. For example, the average price of hot-rolled steel coil, a primary input, saw variations, impacting procurement strategies.

- Greenbrier's supply chain spans over 10 countries, sourcing critical raw materials.

- Inventory optimization targets a reduction in holding costs by 5% in late 2024.

- Supplier negotiation focuses on long-term contracts to stabilize material pricing.

- Logistics efficiency directly impacts the company's manufacturing margin, which was around 10-12% in recent quarters of 2024.

The Greenbrier Companies' key activities center on railcar design, manufacturing, and comprehensive aftermarket services, delivering 5,700 new railcars and generating $136.2 million in services revenue in Q2 2024. They also manage a vast leasing portfolio of approximately 276,000 railcars, ensuring stable revenue streams. Strategic diversification into inland barge manufacturing leverages core expertise, contributing to overall manufacturing revenue of $480.9 million in Q2 2024. Efficient global supply chain management is also critical for controlling costs and maintaining a 10-12% manufacturing margin.

| Key Activity | 2024 Data Point | Metric |

|---|---|---|

| Railcar Manufacturing | 5,700 | New Railcars Delivered (Q2 FY2024) |

| Aftermarket Services | $136.2 million | Services Revenue (Q2 FY2024) |

| Leasing & Fleet Management | 276,000 | Railcars Under Management (FY2024) |

| Overall Manufacturing | $480.9 million | Total Manufacturing Revenue (Q2 FY2024) |

Full Version Awaits

Business Model Canvas

The preview you see of The Greenbrier Companies Business Model Canvas is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, professionally formatted analysis. Once your order is processed, you'll gain full access to this exact Business Model Canvas, ready for your strategic use.

Resources

The Greenbrier Companies’ network of advanced manufacturing plants across North America and Europe stands as its most significant physical asset. These facilities are strategically located to serve critical rail markets, enabling efficient and large-scale production. For instance, in its second fiscal quarter of 2024, Greenbrier reported delivering 5,000 new railcar units globally, showcasing the robust capacity of these operations. This extensive infrastructure underpins the company's ability to meet substantial demand and maintain its market position.

Greenbrier’s proprietary railcar designs, encompassing patented blueprints for various types like tank cars and covered hoppers, represent a crucial intangible asset. These unique intellectual properties offer a competitive edge by delivering superior efficiency, safety, and capacity in their railcar offerings. For instance, in Q2 2024, Greenbrier's robust new railcar orders, totaling 6,200 units valued at $720 million, underscore the market demand for their specialized, high-performing designs. Their backlog of 25,600 units valued at $3.2 billion as of February 29, 2024, further demonstrates the sustained value derived from these innovative designs.

The Greenbrier Companies rely on a highly skilled labor force, including certified welders and technicians, alongside a deep bench of experienced engineers. This human resource is critical, driving innovation in product design, especially as the company navigates evolving railcar standards and customer demands. Their expertise ensures efficiency in manufacturing and repair services, which contributed to Greenbrier's strong production in fiscal year 2024. For instance, their North American new railcar deliveries were projected to be between 20,000 and 22,000 units for fiscal year 2024, reflecting the operational excellence enabled by this workforce.

Owned Leasing Fleet

The Greenbrier Companies' owned leasing fleet represents a significant financial asset, generating consistent, predictable revenue streams. This portfolio of railcars, available for lease, provides critical flexibility in addressing fluctuating customer demands for equipment. As of the second quarter of fiscal year 2024, Greenbrier reported a lease fleet of approximately 9,000 units, contributing substantially to their diversified income. This strategic asset allows Greenbrier to maintain strong customer relationships and adapt to market shifts efficiently.

- Major financial asset for the company.

- Generates consistent leasing revenue.

- Provides flexibility in meeting customer demand.

- Lease fleet of approximately 9,000 units reported in Q2 FY2024.

Strong Balance Sheet and Capital Access

A robust balance sheet and strong capital access are crucial for The Greenbrier Companies, enabling consistent funding for operations and strategic investments. This financial strength allows them to navigate the cyclical nature of the rail industry effectively. As of May 31, 2024, Greenbrier reported approximately $501.7 million in cash and cash equivalents, bolstering their capacity for growth. This robust liquidity supports both organic expansion and potential acquisitions, ensuring long-term stability.

- Capital access supports technology investments.

- Financial strength manages rail industry cycles.

- Q3 FY2024 cash and equivalents: $501.7 million.

- Liquidity enables organic growth and acquisitions.

The Greenbrier Companies rely on a robust network of manufacturing plants, delivering 5,000 new railcar units globally in Q2 FY2024. Their proprietary railcar designs drive demand, with Q2 FY2024 orders at 6,200 units and a backlog of 25,600 units. A skilled workforce supports projected FY2024 North American deliveries of 20,000-22,000 railcars.

Their owned leasing fleet, approximately 9,000 units in Q2 FY2024, provides consistent revenue streams. Furthermore, a strong balance sheet with $501.7 million in cash and equivalents as of May 31, 2024, ensures capital for strategic growth.

| Resource Category | Key Asset | 2024 Data Point |

|---|---|---|

| Physical | Manufacturing Plants | 5,000 global deliveries (Q2 FY2024) |

| Intangible | Proprietary Designs | 25,600 unit backlog ($3.2B) (Feb 29, 2024) |

| Human | Skilled Labor | 20,000-22,000 NA deliveries (FY2024 projection) |

| Financial | Leasing Fleet | ~9,000 units (Q2 FY2024) |

| Financial | Capital Access | $501.7M cash (May 31, 2024) |

Value Propositions

The Greenbrier Companies offers integrated, full-lifecycle solutions, managing railcars from their initial manufacturing to eventual retirement. This comprehensive approach encompasses new railcar construction, with an order backlog of 28,000 units valued at $3.4 billion as of February 2024. Customers benefit from a convenient one-stop-shop, including robust leasing services and extensive maintenance and repair, performed across over 40 wheel and parts facilities. This integrated model creates significant long-term value and operational efficiency for their diverse client base.

The Greenbrier Companies delivers technologically advanced and highly durable freight cars and barges, specifically engineered to meet diverse commodity and stringent regulatory requirements.

This commitment to quality ensures clients benefit from enhanced operational efficiency and safety across their logistics networks. For instance, in the first quarter of fiscal year 2024, Greenbrier reported new railcar orders totaling 5,100 units, reflecting ongoing demand for their innovative designs.

Their focus on reliable equipment helps reduce maintenance costs and improve asset longevity for customers, directly supporting their long-term investment goals.

The Greenbrier Companies offer diverse financial options, catering to varied customer capital strategies through direct sales, short-term, and long-term leases. This flexibility allows clients to acquire railcar equipment in the most financially advantageous way for their operations. Greenbrier also provides comprehensive asset management services, supporting the full lifecycle of their fleet. For example, as of May 2024, Greenbrier’s lease fleet stood at approximately 14,000 units, highlighting their extensive leasing capabilities.

Extensive Aftermarket Service Network

The Greenbrier Companies ensure maximum uptime and longevity for railcar assets through their extensive aftermarket service network. This geographically dispersed system includes over 20 repair shops and numerous parts distribution centers across North America, as of 2024. This robust infrastructure minimizes costly downtime for customers, protecting their substantial railcar investments. Greenbrier’s service operations contribute significantly to asset utilization, supporting the long-term value of their fleet.

- Over 20 strategically located railcar repair facilities.

- Extensive parts distribution network for rapid component delivery.

- Focus on minimizing customer railcar downtime.

- Enhances the lifespan and operational efficiency of railcar fleets.

Global Expertise with Local Presence

The Greenbrier Companies leverages its global expertise in the major North American and European rail markets, combining it with a robust local presence through its manufacturing and service facilities. This strategy enables Greenbrier to deliver highly tailored solutions that precisely meet regional operating environments and regulatory standards. For instance, as of early 2024, Greenbrier maintains manufacturing operations across multiple countries, including the United States, Mexico, Brazil, Poland, and Romania, reinforcing its localized support. This extensive footprint ensures customers receive specialized products and services, adapting to specific market demands and compliance requirements. Their integrated approach optimizes efficiency and responsiveness for clients worldwide.

- Greenbrier operates manufacturing facilities across North America and Europe.

- Local presence ensures compliance with diverse regional regulations.

- Tailored solutions address specific market demands and operating conditions.

- Integrated global-local model enhances customer responsiveness and efficiency.

Greenbrier offers integrated railcar solutions, spanning advanced manufacturing, flexible financing, and comprehensive aftermarket services. Their durable equipment and extensive global network ensure maximum asset uptime and tailored solutions for diverse client needs. As of February 2024, their new railcar order backlog stood at $3.4 billion, reflecting strong market demand.

| Value Proposition Aspect | Key Metric (2024) | Data Point |

|---|---|---|

| Integrated Solutions | New Railcar Order Backlog (Feb 2024) | $3.4 Billion |

| Financial Flexibility | Lease Fleet Size (May 2024) | ~14,000 units |

| Aftermarket Support | Repair Facilities (2024) | Over 20 locations |

Customer Relationships

The Greenbrier Companies prioritizes key account management, establishing direct, enduring relationships with its largest customers through dedicated managers. This strategic approach ensures a deep understanding of unique client needs, fostering collaborative partnerships. For instance, in fiscal year 2024, Greenbrier continued to leverage these relationships to secure significant railcar orders, reflecting strong customer loyalty and repeat business. This direct engagement facilitates tailored solutions and long-term value creation. Such relationships are vital, as evidenced by the company's robust order backlog of approximately 27,000 units as of May 31, 2024.

The Greenbrier Companies establishes robust customer relationships through long-term service agreements, securing multi-year contracts for essential railcar maintenance, fleet management, and repair services. These agreements, which are crucial for predictable revenue, ensure Greenbrier remains deeply integrated into the daily operations of its customers. For example, Greenbrier’s Services segment generated a significant portion of its revenue from such contracts, reporting $178.6 million in the first fiscal quarter of 2024, demonstrating the stability these relationships provide.

The Greenbrier Companies fosters strong customer relationships through collaborative design and engineering of bespoke railcar solutions. This co-development process ensures each product precisely meets the client's unique operational and logistical requirements, such as specialized car types. In 2024, Greenbrier continued to deliver custom freight car orders, reflecting this tailored approach.

Dedicated Technical and Customer Support

The Greenbrier Companies prioritize dedicated technical and customer support, ensuring responsive, expert assistance for all products and services. This includes prompt handling of parts inquiries, efficient technical troubleshooting, and streamlined service scheduling. High-quality support strengthens trust, which is vital for customer loyalty and retention, particularly as the North American railcar fleet totaled over 1.6 million units in 2024. Building strong relationships through reliable after-sales service is key to long-term success in the railcar industry.

- Greenbrier's commitment to support enhances customer satisfaction, crucial for recurring revenue.

- Efficient technical assistance minimizes downtime for clients, improving operational performance.

- Robust support infrastructure helps maintain the value and longevity of railcar assets.

- Customer retention rates are positively impacted by consistent, high-quality post-sale engagement.

Industry Engagement and Thought Leadership

The Greenbrier Companies actively engages in key industry associations, trade shows, and conferences, fostering robust relationships across the rail sector. This strategic involvement positions Greenbrier as a pivotal thought leader and trusted advisor, enhancing its brand reputation and deepening connections with customers and partners. Such participation ensures Greenbrier remains at the forefront of industry developments, influencing standards and best practices. Their presence at events like Rail Forum 2024 underscores a commitment to collaborative industry advancement.

- Active participation in major industry events, including those in 2024.

- Positions Greenbrier as a leading voice in railcar innovation and safety.

- Strengthens brand equity and customer loyalty through direct engagement.

- Contributes to industry-wide dialogue and solution development.

The Greenbrier Companies cultivate deep, direct customer relationships through dedicated key account management and long-term service agreements, ensuring stable revenue streams and tailored solutions. For example, their Services segment generated $178.6 million in Q1 FY2024. Collaborative design and robust technical support further solidify these bonds, leading to significant railcar orders and an approximate 27,000-unit backlog as of May 31, 2024. Active participation in industry events like Rail Forum 2024 also reinforces their market presence and trust. This multi-faceted approach fosters strong loyalty and recurring business.

| Relationship Aspect | 2024 Data Point | Impact |

|---|---|---|

| Key Account Management | ~27,000 unit backlog (May 31, 2024) | Secures repeat business and large orders. |

| Long-Term Service Agreements | $178.6M Services revenue (Q1 FY2024) | Provides predictable, recurring revenue. |

| Technical Support | 1.6M North American railcar fleet | Enhances trust and operational efficiency. |

Channels

The Greenbrier Companies primarily relies on a professional, direct sales team to reach its largest customers, including Class I railroads and major industrial shippers. This team is essential for negotiating large-scale manufacturing orders and complex service contracts directly. For instance, in fiscal year 2024, direct sales efforts contributed to new railcar orders totaling 4,400 units valued at 505 million dollars in the second quarter alone. This direct engagement ensures tailored solutions and managed to secure a total backlog of 24,000 units valued at 2.9 billion dollars as of February 29, 2024.

The Greenbrier Companies leverages its specialized Leasing and Services Division as a core channel, dedicated to marketing and managing railcar leasing and comprehensive fleet solutions. This division directly targets customers prioritizing operational flexibility and asset-light financial structures. As of May 31, 2024, Greenbrier's lease fleet comprised approximately 28,500 railcars, generating stable recurring revenue. This channel is crucial for delivering value-added services beyond manufacturing, offering full-service leases and maintenance programs. It meets the evolving needs of shippers and railroads seeking efficient transportation solutions.

The Greenbrier Companies utilize their extensive network of physical service centers as a primary channel for delivering crucial aftermarket services. These maintenance and repair shops are strategically located in key North American rail hubs, providing a tangible presence for customers. As of early 2024, Greenbrier operates over 25 service facilities across North America, ensuring direct access for regional and local railcar fleets. This network supports recurring revenue streams by offering essential repair, maintenance, and refurbishment services directly to railcar owners and operators.

Digital Presence and Website

The Greenbrier Companies leverage their corporate website and digital platforms as vital information channels, offering comprehensive product specifications and service details to a global clientele. These online presences are critical for marketing and enhancing brand visibility, serving as initial points of contact for prospective customers and investors. In fiscal year 2024, Greenbrier continues to emphasize digital accessibility for its freight railcar manufacturing and leasing solutions, ensuring stakeholders can easily access financial reports and operational updates.

- The website showcases Greenbrier's extensive product portfolio, which includes diverse railcar types.

- It provides essential investor relations data, including recent earnings reports for the fiscal year 2024.

- Digital platforms facilitate initial inquiries, streamlining customer and partner engagement.

- Online presence supports global marketing efforts for their manufacturing and leasing segments.

Industry Trade Shows and Events

Participation in major rail and transportation industry trade shows and events is a crucial channel for The Greenbrier Companies, enabling them to showcase their latest railcar innovations and services. These platforms facilitate vital networking with potential clients, including Class I railroads and industrial shippers, and reinforce existing relationships with partners. For instance, attending events like Railway Interchange, which in 2024 is a key gathering for the North American rail industry, allows Greenbrier to highlight its diverse product portfolio, including new freight car designs and maintenance solutions.

- Greenbrier's order backlog was 23,200 units valued at 2.9 billion USD as of February 29, 2024.

- These events help secure new railcar orders and lease agreements, contributing to revenue streams.

- Showcasing technological advancements, such as improved safety features or greater efficiency, is a primary focus.

- Direct engagement at these shows informs product development based on customer feedback and industry trends.

The Greenbrier Companies effectively reach customers through a multi-faceted channel approach, starting with a direct sales force for major manufacturing orders, evidenced by 2024’s 505 million dollars in new orders during Q2 alone. Their specialized Leasing and Services Division manages a fleet of approximately 28,500 railcars as of May 31, 2024, providing stable recurring revenue. An extensive network of over 25 physical service centers across North America delivers essential aftermarket support. Digital platforms and participation in key 2024 industry trade shows further enhance their global market presence, contributing to a substantial 2.9 billion dollars backlog as of February 29, 2024.

| Channel Type | Key Function | 2024 Data Point |

|---|---|---|

| Direct Sales | Large Order Acquisition | 505M USD new orders (Q2 FY2024) |

| Leasing Division | Recurring Revenue | 28,500 railcars leased (May 31, 2024) |

| Service Centers | Aftermarket Support | Over 25 facilities (early 2024) |

Customer Segments

Class I Railroads represent a crucial segment, comprising North America's largest freight operators like Union Pacific, BNSF, and CSX. These entities are primary buyers of new railcars, essential for expanding and maintaining their vast fleets. They also significantly utilize maintenance and repair services, ensuring operational efficiency across their networks. For instance, in early 2024, new railcar orders across the industry, often driven by these major railroads, continued to reflect substantial investment in rolling stock capacity and infrastructure upkeep.

Shippers and industrial companies form a crucial customer segment, encompassing diverse sectors like agriculture, energy, chemicals, and automotive. These entities often own or lease private railcar fleets to efficiently transport their specialized goods across North America. They frequently require specific railcar types, such as tank cars for liquids or covered hoppers for grains, impacting Greenbrier's robust order backlog, which stood at 27,200 units as of February 2024. This segment also actively seeks comprehensive fleet management and maintenance services to optimize their logistics operations and ensure compliance.

The Greenbrier Companies serves railcar leasing companies as a key customer segment, providing them with new railcars to expand and diversify their rental fleets. This group often includes large institutional lessors and private equity firms looking to capitalize on railcar demand. For instance, in fiscal year 2024, leasing companies are expected to remain significant buyers, representing a substantial portion of new railcar orders. These partnerships are crucial for Greenbrier, as leasing fleets drive consistent demand for various railcar types, supporting the company's backlog and production targets.

Regional and Short-Line Railroads

Regional and short-line railroads form a vital customer segment, primarily offering critical first and last-mile freight services. These operators, numbering over 600 in the U.S. as of 2024, typically manage smaller fleet sizes compared to Class I railroads. They require highly flexible equipment and service solutions, including specialized railcar leasing and maintenance, tailored to their operational scale. Their focus often lies on efficient, localized transport, necessitating adaptable rolling stock solutions.

- Short-line railroads represent approximately 29% of the U.S. rail network mileage.

- Their annual carloads contribute significantly to local economies.

- Demand for flexible lease terms and specialized railcars remains high in this segment.

Inland Marine Operators

The Greenbrier Companies serves Inland Marine Operators through its barge manufacturing, catering to companies involved in crucial inland waterway transportation. These customers require durable, high-capacity barges for efficient movement of bulk commodities like grain, coal, and aggregates. Greenbrier's backlog for new railcar and marine unit orders stood at 26,600 units as of February 29, 2024, demonstrating consistent demand from this segment. This specialized focus ensures tailored solutions for their unique operational needs in 2024.

- Inland operators require barges for bulk commodity transport.

- Greenbrier had 26,600 units in backlog as of February 2024.

- Customers seek durable, high-capacity marine vessels.

Greenbrier serves diverse rail and marine customers, including major Class I railroads investing in new fleets and short-line operators needing flexible solutions. Shippers and industrial firms lease specialized railcars, contributing to a 27,200-unit backlog in February 2024. Leasing companies remain key buyers in 2024, while inland marine operators drive demand for barges, with a total backlog of 26,600 units as of February 29, 2024.

| Segment | Focus | 2024 Data | ||

|---|---|---|---|---|

| Class I Railroads | New railcars, M&R | Ongoing fleet investment | ||

| Shippers & Industrial | Private fleets, specialized | 27,200 unit backlog (Feb) | ||

| Leasing Companies | Fleet expansion | Significant buyers (FY24) | ||

| Short-Line Railroads | Flexible solutions | Over 600 US operators | ||

| Inland Marine | Barge transport | 26,600 unit backlog (Feb) |

Cost Structure

Raw materials and components represent Greenbrier Companies' most significant cost driver, primarily dominated by the price of steel. This includes essential purchased components such as wheelsets, axles, and braking systems. The cost structure is highly sensitive to fluctuations in global commodity prices; for instance, steel prices saw notable volatility in early 2024. Managing these input costs is crucial for profitability, directly impacting their manufacturing margins.

Labor and manufacturing overhead are significant cost drivers for The Greenbrier Companies. This category encompasses wages for the highly skilled workforce across their manufacturing and service facilities, crucial for producing railcars and providing maintenance. Factory overhead costs, including utilities, supplies, and plant maintenance, also form a substantial part of their operational expenses. Labor costs remain a major component of both their manufacturing and services segments, impacting profitability as seen in their fiscal year 2024 results.

Selling, General & Administrative (SG&A) costs for The Greenbrier Companies represent their essential corporate overhead. These encompass salaries for executive, sales, and administrative teams, alongside marketing efforts and expenses for vital corporate functions like finance and IT. For the nine months ending May 31, 2024, Greenbrier reported SG&A expenses of approximately $227.5 million. Such costs are generally more fixed, providing a stable base for operational planning within their business model.

Depreciation of Fixed Assets

Depreciation of fixed assets represents a significant non-cash cost for The Greenbrier Companies, stemming from their capital-intensive operations. This includes the wear and tear on extensive manufacturing plants, specialized machinery, and their substantial owned railcar leasing fleet. The nature of the business, involving significant investments in physical infrastructure and rolling stock, leads to considerable depreciation expenses. For instance, in fiscal year 2024, Greenbrier reported substantial depreciation and amortization, reflecting these ongoing capital commitments.

- Greenbrier's business model is inherently capital-intensive, requiring large investments in plant and equipment.

- Depreciation is a major non-cash expense, reducing reported net income but not cash flow directly.

- It reflects the cost allocation of assets like railcar manufacturing facilities and leased railcars over their useful lives.

- This expense was a notable component of Greenbrier's cost structure in fiscal year 2024.

Logistics and Freight

Logistics and freight represent a significant cost for The Greenbrier Companies, encompassing the transportation of raw materials and components to their production facilities. This segment also includes the substantial expense of delivering large, heavy finished railcars and barges to customers across continents. Given the scale, freight costs are a critical expenditure, directly impacting profitability. For instance, rising fuel prices in 2024 continued to exert upward pressure on these essential operational costs.

- Transportation of raw materials and components to facilities.

- Delivery of large, heavy finished railcars and barges.

- Significant impact of rising fuel costs on operational expenses.

- Critical expenditure affecting overall profitability.

The Greenbrier Companies' cost structure is primarily driven by raw materials like steel, which saw volatility in early 2024, alongside significant labor and manufacturing overhead. Selling, General & Administrative expenses, reported at approximately $227.5 million for the nine months ending May 31, 2024, are largely fixed. Substantial depreciation from capital-intensive operations and rising logistics/freight costs due to factors like fuel prices in 2024 also significantly impact profitability.

| Cost Category | Key Drivers | 2024 Impact |

|---|---|---|

| Raw Materials | Steel, components | Volatility in early 2024 |

| SG&A | Corporate overhead | ~$227.5M (9 mos. to May 31, 2024) |

| Logistics | Freight, fuel | Rising fuel prices pressure |

Revenue Streams

The Greenbrier Companies primarily generates revenue from the engineering, manufacturing, and direct sale of new railroad freight cars and marine barges. This core revenue stream is inherently cyclical, directly tied to broad economic activity and the fluctuating demand for freight transportation services. For instance, in fiscal year 2024, new railcar deliveries are projected to be substantial, reflecting ongoing demand. The company's diverse product portfolio, including tank cars and covered hoppers, helps mitigate some cyclicality.

A stable revenue source for Greenbrier comes from leasing railcars from its extensive owned fleet to various railroads and shippers. This segment provides predictable cash flow, contributing significantly to the company's financial stability. Additionally, Greenbrier generates income from fees by strategically syndicating lease portfolios to other financial partners. In fiscal year 2024, Greenbrier's leasing and management services segment continued to be a robust contributor, showcasing the consistent demand for its railcar assets and financial expertise.

The Greenbrier Companies generates significant revenue from its comprehensive aftermarket services, providing essential maintenance and repair for railcars. This includes routine upkeep, specialized wheel and axle services, and extensive refurbishment programs through their North American network of over 40 shops. For instance, in fiscal year 2024, Greenbrier's Wheels & Parts segment, a key component of these services, is projected to contribute substantially to the company’s diversified revenue streams, supporting over 284,000 railcars under management. These services are critical for maintaining the operational longevity and safety of railcar fleets.

Railcar Parts Sales

The Railcar Parts Sales revenue stream for Greenbrier involves selling essential replacement parts and components. This includes axles, wheels, and specialized fittings directly to various entities. Customers typically include other railcar owners, major railroad operators, and independent third-party repair shops. This revenue stream significantly complements Greenbrier’s maintenance and repair services, creating a holistic offering for railcar lifecycle management.

- Greenbrier reported Parts and Service revenue of $37.3 million for the quarter ended February 29, 2024.

- This segment provides critical components for the over 280,000 railcars in their managed fleet.

- Revenue from parts sales supports the longevity and operational efficiency of railcar assets across North America.

- The company leverages its extensive service network to facilitate these sales.

Management Services

Greenbrier generates recurring fee-based income through its management services, overseeing railcar fleets for third-party owners. This represents a capital-light revenue stream, leveraging the company's extensive operational expertise in railcar management. For the third quarter of fiscal 2024, Greenbrier reported management services revenue of $16.3 million. This segment's revenue was $50.3 million for the nine months ended May 31, 2024, showcasing consistent performance.

- Greenbrier's management services provide recurring fee-based income.

- These services include fleet management and administrative support for third-party railcar owners.

- It is a capital-light model, leveraging Greenbrier's operational expertise.

- Management services revenue for Q3 fiscal 2024 was $16.3 million.

Greenbrier generates revenue primarily from new railcar manufacturing and sales, alongside stable income from leasing its extensive fleet, both robust contributors in fiscal year 2024. Additional substantial revenue stems from comprehensive aftermarket services, supporting over 284,000 railcars, and railcar parts sales. Furthermore, the company earns recurring fee-based income from managing third-party railcar fleets, which recorded $16.3 million in Q3 fiscal 2024.

| Revenue Stream | Fiscal Year 2024 Outlook/Data | Contribution |

|---|---|---|

| New Railcar Sales | Substantial deliveries projected | Primary driver, cyclical |

| Leasing Services | Robust contributor | Stable, predictable cash flow |

| Aftermarket Services & Parts Sales | Parts and Service revenue $37.3M (Q ended Feb 29, 2024) | Essential for fleet longevity |

| Management Services | $16.3M (Q3 fiscal 2024); $50.3M (9 months ended May 31, 2024) | Recurring, capital-light fees |

Business Model Canvas Data Sources

The Greenbrier Companies' Business Model Canvas is informed by a blend of financial disclosures, industry analysis reports, and internal operational data. These sources provide a comprehensive view of market dynamics, competitive landscapes, and the company's strategic positioning.