Global Indemnity (GBLI) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Indemnity (GBLI) Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Global Indemnity (GBLI)'s trajectory. Our expert analysis breaks down how these external forces create both opportunities and challenges for the company. Equip yourself with this essential market intelligence to inform your investment decisions and strategic planning. Download the full PESTLE analysis now to gain a decisive competitive advantage.

Political factors

The insurance sector, especially in the United States, operates within a dynamic landscape of state and federal regulations. These rules are constantly being updated to address emerging risks and market practices.

The National Association of Insurance Commissioners (NAIC) is a key player in shaping these regulations. They are actively developing new frameworks that will impact Global Indemnity, particularly in areas like climate risk assessment, financial solvency monitoring, data privacy and reporting standards, and how insurance products are marketed to consumers. These evolving guidelines will necessitate adjustments to Global Indemnity's operational strategies and the design of its product portfolio.

The commercial auto insurance sector, a significant market for Global Indemnity (GBLI), continues to grapple with the persistent issue of 'nuclear verdicts' and social inflation. These trends have driven up litigation costs and jury awards considerably. For instance, the average jury award in U.S. commercial auto liability cases reached an estimated $1.7 million in 2023, a notable increase from previous years, directly impacting insurer profitability.

Potential tort reforms being considered at the state level offer a glimmer of hope for insurers like Global Indemnity. Proposals such as implementing caps on non-economic damages could help mitigate the financial impact of excessive jury awards. Some states have already seen legislative action; for example, Texas passed a bill in 2023 that limits the admissibility of certain expert testimony, potentially curbing some of the more extreme litigation tactics.

Changes in global trade policies and the implementation of tariffs directly impact the cost of claims for insurers like Global Indemnity (GBLI). For instance, tariffs on construction materials can significantly increase repair costs for property insurance claims. Similarly, tariffs on vehicle parts can escalate expenses for commercial auto insurance, potentially leading to higher premiums for policyholders.

The U.S. imposed tariffs on steel and aluminum in 2018, which, while subject to some adjustments, continued to influence material costs for construction and manufacturing sectors through 2024. These tariffs can translate into higher replacement costs for damaged buildings or components, directly affecting GBLI's claims payouts in property and casualty lines.

Agricultural Policy and Subsidies

Government support through agricultural policy and subsidies directly impacts the farm and ranch insurance sector, a key area for Global Indemnity (GBLI). These programs incentivize farmers to purchase more comprehensive insurance, thereby shaping market demand and the product offerings insurers can provide. For instance, the USDA's Risk Management Agency (RMA) oversees crop insurance programs, which saw a total of $10.8 billion in premium subsidies in 2023, encouraging widespread adoption of insurance products.

Changes in subsidy levels or program structures can significantly alter the competitive landscape and profitability for insurers like GBLI. A reduction in subsidies might lead to decreased demand for certain insurance products, while an expansion could create new opportunities. The Farm Bill, reauthorized periodically, often includes provisions that affect agricultural insurance availability and cost, making it a critical factor for GBLI's strategic planning.

- RMA Premium Subsidies: In 2023, the USDA's RMA provided approximately $10.8 billion in premium subsidies for crop insurance, a substantial incentive for farmers.

- Farm Bill Influence: The ongoing reauthorization and implementation of the Farm Bill directly shape the regulatory environment and financial incentives within agricultural insurance.

- Market Responsiveness: Insurers must remain agile to adapt product offerings and pricing strategies in response to evolving government support mechanisms and farmer demand.

Regulatory Scrutiny on Technology and Data

As Global Indemnity (GBLI) integrates advanced technologies such as artificial intelligence and sophisticated data analytics, it encounters intensifying regulatory oversight. This scrutiny centers on crucial areas like data governance, user privacy, and the potential for bias within AI algorithms. For instance, in 2024, the European Union's AI Act moved closer to full implementation, setting new standards for high-risk AI systems, which could impact GBLI's technology deployment.

Governments worldwide are enacting stricter regulations concerning how companies collect, secure, and utilize data. This includes mandates for enhanced data security protocols and greater transparency in the workings of algorithmic models. Such developments mean GBLI must ensure its data handling practices are not only compliant but also demonstrably ethical and secure to avoid penalties and maintain customer trust.

- Increased Compliance Costs: Adhering to evolving data privacy laws like GDPR and CCPA (with potential updates in 2024-2025) necessitates investment in robust compliance frameworks and technologies.

- Algorithmic Transparency Demands: Regulators are pushing for explainability in AI, requiring GBLI to document and justify the decision-making processes of its AI systems.

- Data Security Mandates: Stricter data breach notification requirements and cybersecurity standards are being enforced, impacting GBLI's operational protocols and potential liabilities.

Government regulations significantly shape the insurance landscape, influencing everything from product development to operational compliance. For Global Indemnity (GBLI), staying abreast of evolving state and federal rules, particularly those from bodies like the NAIC, is crucial for maintaining market position and profitability.

The current regulatory focus on climate risk, data privacy, and AI governance presents both challenges and opportunities for GBLI, requiring strategic adaptation in its business practices and technological integration.

What is included in the product

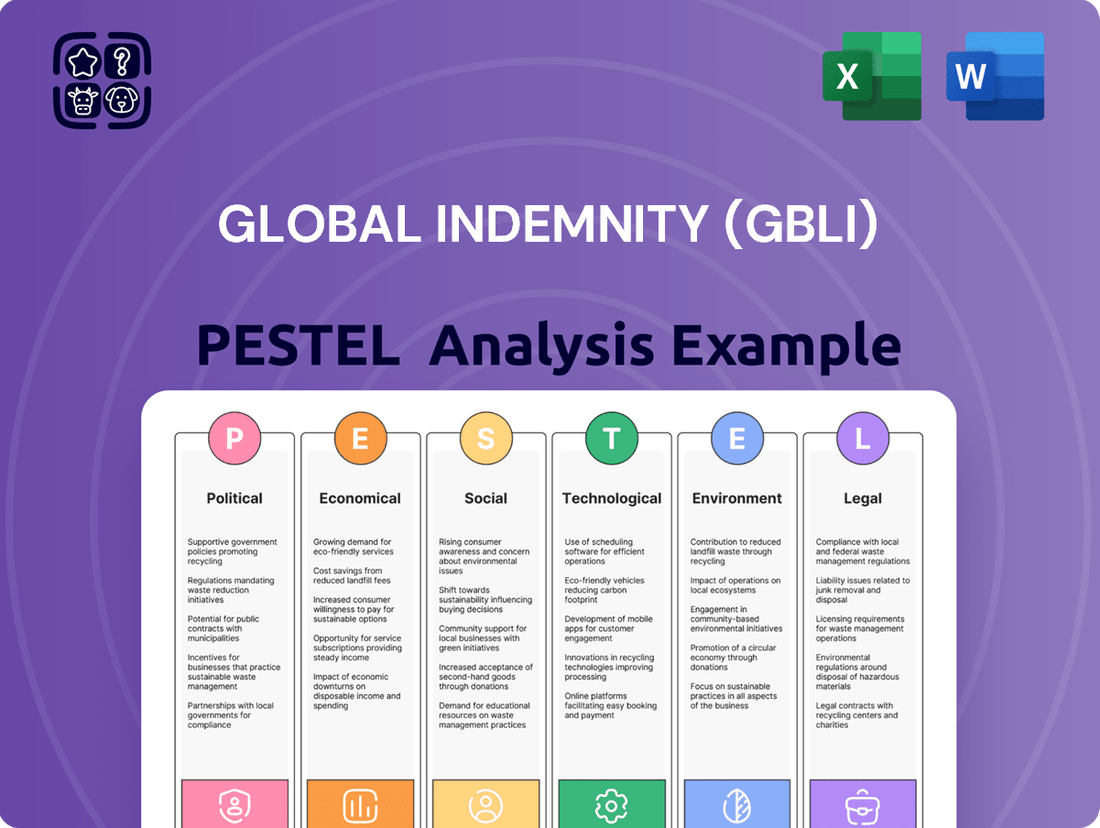

This PESTLE analysis dissects the external macro-environmental forces impacting Global Indemnity (GBLI) across Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights into how these dynamics create both risks and opportunities for GBLI's strategic planning.

A PESTLE analysis for Global Indemnity (GBLI) offers a structured framework to proactively identify and mitigate external threats, thereby relieving the pain point of unforeseen market disruptions and fostering strategic resilience.

Economic factors

Inflation remains a potent force, directly impacting Global Indemnity's (GBLI) claims. We're seeing this particularly in commercial auto and property insurance, where the cost of repairs and materials has surged. For instance, the Producer Price Index for auto repair and maintenance services saw a notable increase in early 2024, contributing to higher loss severity.

This escalation in claim costs translates into persistent underwriting losses for GBLI. The rising expenses for essential components like construction materials and skilled labor mean that individual claims are simply more expensive to settle. Consequently, the need for premium rate adjustments becomes unavoidable to maintain profitability and solvency.

Higher interest rates are a boon for insurance companies like Global Indemnity, as they directly boost investment income. This increased income acts as a valuable cushion, helping to absorb potential losses from the core insurance business.

In 2024, Global Indemnity saw its investment income climb by a notable 13%. This growth was primarily fueled by a higher yield on its substantial bond holdings, a key contributor to the company's financial strength.

The Excess and Surplus (E&S) lines market, a crucial area for Global Indemnity (GBLI), is still seeing robust growth. While the impressive double-digit premium increases seen in prior years have moderated slightly in 2024, the segment continues to expand. This market is essential for insuring risks that fall outside the scope of standard insurance offerings, indicating ongoing potential.

Commercial Auto Market Profitability

The commercial auto insurance sector continues to grapple with profitability challenges, marked by persistent underwriting losses. This environment has driven consistent rate increases across the industry as insurers seek to offset escalating costs and improve financial performance. For Global Indemnity (GBLI), navigating these conditions requires a keen focus on underwriting discipline and pricing accuracy.

Several key factors are contributing to the difficult market conditions. A significant driver is the ongoing shortage of qualified commercial drivers, which can lead to increased reliance on less experienced operators and potentially higher accident rates. Furthermore, the prevalence of "nuclear verdicts" – exceptionally large jury awards in liability cases – significantly inflates claim costs, putting immense pressure on insurer profitability. Rising claim frequencies, potentially linked to increased vehicle miles traveled and evolving accident dynamics, also exacerbate these challenges.

- Persistent Underwriting Losses: The commercial auto segment has experienced ongoing underwriting losses, making it difficult for insurers to achieve consistent profitability.

- Rate Increases: Insurers have implemented consistent rate increases to counteract rising claims costs and improve underwriting results.

- Driver Shortages: A lack of qualified commercial drivers contributes to market instability and potential increases in accident frequency.

- Nuclear Verdicts: Exceptionally large jury awards in liability cases are a major factor driving up claim severity and insurer expenses.

Farm and Ranch Market Dynamics

The farm and ranch insurance sector is showing robust expansion, fueled by appreciating agricultural asset values and a growing understanding of potential risks. For instance, the U.S. farm real estate value saw a significant 2.4% increase in the year ending February 1, 2024, reaching an average of $5,400 per acre, highlighting the rising asset base needing protection.

While fluctuations in commodity prices might lead to some adjustments, such as potential premium decreases in specific crop insurance segments, the broader market trend is upward. This growth is largely propelled by the increasing necessity to safeguard against climate-related events and the integration of advanced agricultural technologies that also introduce new risk profiles.

Key drivers for this market expansion include:

- Rising Agricultural Asset Values: Increased land and equipment values necessitate higher coverage limits.

- Climate Change Impact: Greater frequency and severity of weather events drive demand for protection.

- Technological Adoption: New farming technologies, while increasing efficiency, can also introduce new insurable risks.

- Increased Risk Awareness: Farmers and ranchers are more proactive in seeking insurance solutions.

Inflation continues to be a significant economic factor, driving up the cost of claims for Global Indemnity (GBLI), particularly in commercial auto and property lines. This is evident in rising repair costs and material expenses, directly impacting loss severity. Consequently, insurers like GBLI face pressure to adjust premiums to maintain profitability amid these escalating operational costs.

Higher interest rates, however, provide a beneficial tailwind for GBLI by boosting investment income. This increased income serves as a crucial buffer, helping to offset potential underwriting challenges. In 2024, GBLI experienced a substantial 13% increase in investment income, largely attributable to higher yields on its bond portfolio, reinforcing its financial stability.

The Excess and Surplus (E&S) lines market, a vital segment for GBLI, continues its growth trajectory, albeit at a moderated pace compared to prior years. This sustained expansion in the E&S market underscores its importance in providing coverage for non-standard risks, indicating ongoing opportunities for the company.

| Economic Factor | Impact on GBLI | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Inflation | Increased claims costs, pressure on underwriting profitability | Producer Price Index for auto repair services saw notable increases in early 2024. |

| Interest Rates | Boosted investment income, improved financial stability | GBLI's investment income climbed 13% in 2024 due to higher bond yields. |

| E&S Market Growth | Continued expansion, opportunity for specialized coverage | E&S market premium increases moderated but remained positive in 2024. |

Preview Before You Purchase

Global Indemnity (GBLI) PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Global Indemnity (GBLI) delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping GBLI's strategic landscape.

Sociological factors

Modern insurance consumers, especially millennials and Gen Z, expect digital-first interactions. They want quick access to policy information, online claims processing, and round-the-clock support. For instance, a 2024 survey indicated that 70% of consumers prefer managing their insurance digitally.

Global Indemnity, relying on independent agents, must equip its distribution partners with advanced digital tools. This includes user-friendly portals for policy management and customer service to align with evolving consumer demands and stay competitive in the digital age.

Social inflation, characterized by growing public skepticism towards corporations and a surge in exceptionally large jury awards, commonly known as nuclear verdicts, is profoundly affecting liability insurance. This phenomenon is particularly pronounced in sectors like commercial auto and umbrella coverage, where the potential for high payouts is significant.

These escalating claims costs directly translate into upward pressure on insurance premiums. For instance, the Insurance Information Institute reported that the average cost of a liability claim in the U.S. has been steadily increasing, with social inflation being a key contributor. This makes insurance less affordable and potentially less available for many businesses, forcing them to reassess their risk management strategies.

The insurance sector, including companies like Global Indemnity, grapples with an aging workforce, with a significant portion of experienced professionals nearing retirement. This demographic shift creates a talent gap, impacting institutional knowledge and operational capacity. For instance, the U.S. Bureau of Labor Statistics projected that by 2024, the median age in the insurance sector would continue to rise, highlighting the urgency of succession planning.

Independent agencies, vital for Global Indemnity's distribution network, must evolve to attract and retain younger talent. These emerging professionals prioritize flexible work arrangements, clear pathways for career advancement, and robust technological tools. Failure to meet these expectations could hinder the agencies' ability to maintain a skilled and motivated workforce, directly affecting Global Indemnity's market reach and service delivery.

Risk Perception and Demand for Niche Coverage

The increasing complexity of global risks fuels a growing demand for specialized insurance. As threats like sophisticated cyber-attacks and unique environmental exposures emerge, standard insurance policies often fall short. This creates a significant opportunity for companies like Global Indemnity (GBLI) that focus on underwriting these niche and often overlooked risks.

Businesses and individuals are actively seeking tailored coverage to address these evolving challenges. For instance, the global cyber insurance market is projected to reach $20.5 billion by 2025, up from an estimated $10.2 billion in 2022, highlighting the urgent need for specialized protection. Global Indemnity’s strategic alignment with this trend positions them to capture a share of this expanding market by offering solutions for these specific vulnerabilities.

- Rising Demand for Niche Coverage: The complexity of modern risks necessitates specialized insurance solutions beyond standard offerings.

- Emerging Threats: Businesses and individuals are increasingly seeking coverage for new threats like cyber risks and specific environmental exposures.

- Market Growth: The global cyber insurance market, for example, is expected to double between 2022 and 2025, underscoring the demand for specialized protection.

- Global Indemnity's Position: The company's focus on underwriting unique risks aligns with this growing market need, offering tailored solutions for emerging threats.

Role and Value of Independent Agents

Independent insurance agents remain crucial for Global Indemnity, offering a personalized touch that digital platforms often lack. Their expertise in risk management and ability to explain intricate policy details fosters stronger client relationships, leading to reduced policy churn. For instance, studies in 2024 indicate that clients working with independent agents are up to 15% less likely to cancel their policies compared to those who purchase directly online.

The enduring value of these agents is evident in their ability to navigate complex insurance needs and provide tailored advice. This human element is particularly important in specialized insurance sectors where Global Indemnity operates. In 2025, the independent agent channel is projected to account for over 60% of new business for many specialty insurers, underscoring their vital role in distribution strategy.

- Human Touch: Agents provide personalized service and build trust.

- Expertise: They offer specialized knowledge in risk assessment and policy explanation.

- Local Knowledge: Agents understand regional market nuances and client needs.

- Reduced Churn: Personalized guidance leads to higher client retention rates.

Societal shifts, like the growing preference for digital interactions, are reshaping how insurance is bought and sold. A 2024 survey found that 70% of consumers prefer digital insurance management, pushing companies like Global Indemnity to enhance their digital offerings and support for independent agents.

The rise of social inflation, marked by increased skepticism towards corporations and larger jury awards, significantly impacts liability insurance costs. This trend, contributing to rising claim expenses as noted by the Insurance Information Institute, forces businesses to re-evaluate their risk management, potentially increasing demand for specialized coverage.

An aging workforce within the insurance sector presents a talent gap, with the U.S. Bureau of Labor Statistics projecting a rising median age by 2024. This necessitates that independent agencies, crucial for Global Indemnity's distribution, attract younger talent by offering flexible work and technological tools to maintain operational capacity.

The increasing demand for niche insurance, driven by complex risks like cyber threats and environmental exposures, presents a significant opportunity. The global cyber insurance market, projected to reach $20.5 billion by 2025, highlights this trend, aligning with Global Indemnity's focus on underwriting specialized risks.

Technological factors

Global Indemnity's operations are significantly impacted by advancements in artificial intelligence and machine learning. These technologies are being woven into the fabric of insurance, from more precise risk assessment to automating the underwriting process and making claims management smoother.

Generative AI, a specific area of AI, is particularly promising for claims departments. It's expected to deliver a faster return on investment by simplifying intricate tasks and boosting the efficiency of fraud detection, which is crucial for profitability in the insurance sector.

The InsurTech industry is booming, and Global Indemnity's own InsurTech division is a prime example, demonstrating substantial growth. This sector's expansion highlights the critical need for insurers to adopt digital platforms for smoother customer experiences, more efficient policy sales, and improved operational performance.

The increasing adoption of Internet of Things (IoT) devices and telematics is a significant technological factor impacting Global Indemnity (GBLI). These technologies are fueling the growth of usage-based insurance (UBI) models, particularly in commercial auto sectors.

This shift allows for more precise insurance pricing, directly tied to how vehicles are actually used and the driving behaviors observed. For instance, by mid-2024, a substantial portion of commercial auto insurers were actively exploring or implementing UBI programs, leveraging telematics data to assess risk more accurately.

The benefit for GBLI and its clients lies in the potential for rewarding safer drivers with reduced premiums. This data-driven approach encourages better risk management practices, ultimately leading to a more equitable and efficient insurance market.

Blockchain and Smart Contracts for Efficiency

Blockchain and smart contracts are increasingly impacting the insurance industry, offering significant improvements in efficiency and transparency for companies like Global Indemnity (GBLI). These technologies are maturing, allowing for the automation of many insurance processes. For instance, smart contracts can automatically trigger claim payouts once predefined conditions are met, significantly speeding up a historically slow process. This automation not only reduces administrative overhead but also minimizes the potential for human error. The inherent transparency of blockchain also aids in reducing fraudulent activities by creating an immutable record of transactions and policy details. By mid-2024, the global blockchain in insurance market was projected to reach approximately $3.5 billion, with continued growth expected as adoption increases.

The implementation of these technologies can lead to tangible benefits for insurers and policyholders alike. For Global Indemnity, this could translate into lower operational costs, as manual data entry and verification are reduced. Furthermore, enhanced data security and integrity through blockchain can improve trust among partners and customers. The ability to securely and efficiently share data between insurers, reinsurers, and other parties involved in the insurance lifecycle is a key advantage.

- Streamlined Operations: Smart contracts automate claims processing, reducing manual intervention and processing times.

- Enhanced Transparency: Blockchain provides an immutable ledger, increasing visibility and trust in transactions.

- Cost Reduction: Automation and reduced fraud contribute to lower administrative and operational expenses.

- Improved Data Security: Secure and efficient data sharing capabilities benefit all stakeholders in the insurance ecosystem.

Automation through RPA and Low-Code/No-Code Platforms

Robotic Process Automation (RPA) is significantly boosting operational efficiency for companies like Global Indemnity (GBLI) by automating repetitive tasks. This automation translates directly into reduced costs and quicker processing times, crucial for a sector that relies on speed and accuracy. For instance, in 2024, the global RPA market was projected to reach approximately $3.9 billion, indicating widespread adoption and its tangible benefits.

Simultaneously, the rise of low-code/no-code platforms is accelerating digital transformation initiatives. These platforms democratize software development, allowing business users to create and deploy digital solutions with minimal traditional coding. This empowers faster innovation and reduces the burden on IT departments, enabling quicker responses to market changes and customer needs.

- RPA Efficiency Gains: Automation of routine tasks by RPA is projected to save businesses an average of 20-30% on operational costs by 2025.

- Low-Code Adoption: Gartner predicted that by the end of 2024, low-code application development will account for over 70% of new application development.

- Digital Transformation Acceleration: Companies leveraging low-code/no-code platforms can reduce application development time by up to 70%.

Technological advancements are reshaping the insurance landscape for Global Indemnity (GBLI). The increasing integration of AI and machine learning is enhancing risk assessment and claims processing, while InsurTech continues its rapid expansion, driving the need for digital platforms. Furthermore, the adoption of IoT and telematics is fueling usage-based insurance models, particularly in commercial auto, allowing for more precise risk-based pricing.

Blockchain and smart contracts are streamlining operations by automating claims payouts and improving transparency, with the global blockchain in insurance market projected to reach approximately $3.5 billion by mid-2024. Robotic Process Automation (RPA) is also a key driver of efficiency, with the global RPA market expected to reach around $3.9 billion in 2024, while low-code/no-code platforms are accelerating digital transformation, with Gartner predicting they will account for over 70% of new application development by the end of 2024.

| Technology | Impact on GBLI | Key Data/Projections (2024-2025) |

|---|---|---|

| Artificial Intelligence (AI) & Machine Learning (ML) | Improved risk assessment, underwriting automation, claims management efficiency, fraud detection. | Generative AI expected to deliver faster ROI in claims. |

| InsurTech | Growth in digital platforms for customer experience, policy sales, and operational performance. | Substantial growth in the InsurTech sector. |

| Internet of Things (IoT) & Telematics | Growth of Usage-Based Insurance (UBI), precise risk pricing, rewarding safer drivers. | Mid-2024: Commercial auto insurers exploring/implementing UBI programs. |

| Blockchain & Smart Contracts | Enhanced efficiency, transparency, automation of processes (e.g., claims payouts), reduced administrative overhead, fraud reduction. | Global blockchain in insurance market projected at ~$3.5 billion (mid-2024); potential for lower operational costs and improved data security. |

| Robotic Process Automation (RPA) | Automation of repetitive tasks, reduced costs, quicker processing times. | Global RPA market projected at ~$3.9 billion (2024); projected savings of 20-30% on operational costs by 2025. |

| Low-Code/No-Code Platforms | Accelerated digital transformation, democratized software development, faster innovation, reduced IT burden. | Over 70% of new application development by end of 2024 (Gartner); application development time reduction up to 70%. |

Legal factors

The U.S. insurance regulatory landscape is constantly shifting, with states enacting a multitude of changes each year. These updates frequently address mandated benefits, data privacy protocols, and specific stipulations for cyber insurance and climate risk disclosures. For a company like Global Indemnity (GBLI), staying abreast of these evolving state-level regulations is crucial for maintaining compliance and mitigating potential risks.

State regulators are tightening requirements for insurers providing cyber coverage due to rising cyber losses. These new rules often mandate specific minimum security standards and clear processes for reporting security incidents, impacting how Global Indemnity (GBLI) operates its cyber insurance lines.

The National Association of Insurance Commissioners (NAIC) data security model law is gaining traction, influencing state-level regulations. This model law emphasizes transparency in data collection, the implementation of strong security measures, and granting consumers more control over their personal information, which directly affects data handling practices for GBLI.

Insurance regulators are intensifying their oversight of consumer protection, especially regarding rate adjustments and transparency in coverage details for commercial auto policies. This heightened focus means companies like Global Indemnity must ensure their pricing and communication strategies proactively address fair value and identify policyholders who might be particularly susceptible to adverse impacts from rate changes.

In 2024, several states, including California and New York, have seen increased enforcement actions related to inadequate disclosure of policy terms and unfair pricing practices, signaling a trend that will likely continue into 2025. This regulatory environment necessitates robust internal controls and clear, accessible customer communications to mitigate compliance risks and maintain market trust.

Litigation Environment and Class Action Risks

The increasing prevalence of social inflation and 'nuclear verdicts' significantly complicates the litigation landscape for insurers like Global Indemnity, especially within commercial auto and liability segments. This trend escalates the likelihood of substantial jury awards and class-action suits, directly impacting underwriting profitability. For instance, the average jury award in U.S. tort cases has seen a notable uptick, with some reports indicating double-digit percentage increases year-over-year in certain jurisdictions leading up to 2024.

These elevated risks can compel insurers to reassess their market participation. Consequently, Global Indemnity may face decisions to reduce capacity or even withdraw from specific high-risk lines of business to protect its financial stability. This strategic recalibration is a direct response to the heightened potential for adverse legal outcomes and their financial repercussions.

- Social Inflation Impact: Continued upward pressure on jury awards and settlement costs, particularly in liability claims.

- Class Action Exposure: Increased vulnerability to large-scale class-action lawsuits, amplifying potential financial liabilities.

- Underwriting Profitability: Direct negative correlation between litigation environment severity and the profitability of affected insurance lines.

- Capacity and Market Exits: Potential for insurers to reduce coverage limits or exit markets deemed too exposed to litigation risk.

Regulatory Response to Climate-Related Risks

US regulators, particularly at the state level, are intensifying their focus on how insurers evaluate, report, and manage climate-related risks. This heightened scrutiny aims to ensure the financial stability of the insurance sector in the face of evolving environmental challenges.

Property and casualty (P&C) insurers are now encountering new mandates. These include detailed reporting on the potential financial consequences of climate change, the incorporation of climate-related factors into their underwriting processes, and the demonstration of sufficient capital reserves to cover the increasing frequency and severity of natural catastrophes. For instance, in 2024, several states have introduced or enhanced climate disclosure requirements for insurers, reflecting a growing trend towards greater transparency and risk management.

- State-level scrutiny: Regulators are pushing for more robust climate risk assessments.

- New reporting requirements: Insurers must detail potential financial impacts from climate events.

- Underwriting integration: Climate considerations are becoming integral to risk selection.

- Capital adequacy: Demonstrating reserves for escalating natural disasters is crucial.

The legal landscape for insurers like Global Indemnity (GBLI) is increasingly shaped by evolving state regulations, particularly concerning data privacy and cyber insurance. For example, the NAIC's data security model law influences state-specific mandates on transparency and consumer data control, directly impacting GBLI's operational procedures.

Heightened regulatory scrutiny on consumer protection, especially in commercial auto policies, requires GBLI to ensure fair pricing and clear communication regarding rate adjustments. Increased enforcement actions in states like California and New York in 2024 for inadequate disclosure and unfair pricing underscore the need for robust compliance measures heading into 2025.

The growing impact of social inflation, evidenced by rising jury awards in tort cases, presents significant litigation risk for GBLI, especially in liability segments. This trend can lead to reduced underwriting profitability and may prompt strategic decisions regarding capacity or market exits in high-risk areas.

Environmental factors

Global Indemnity (GBLI) faces significant challenges from the escalating frequency and intensity of extreme weather. Climate change is fueling more frequent and severe events like wildfires, hurricanes, and floods. These occurrences directly translate to higher insured losses, particularly impacting GBLI's property and casualty lines.

The financial ramifications are substantial, forcing insurers to re-evaluate underwriting strategies and adjust pricing models to account for this heightened risk. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported 28 separate billion-dollar weather and climate disasters in the U.S. during 2023, the second-highest annual total on record, underscoring the growing impact on the insurance industry.

The escalating financial burden of natural disasters directly impacts the underwriting profitability of property and casualty (P&C) insurers like Global Indemnity. For instance, insured losses from natural catastrophes in 2023 were estimated to be around $110 billion globally, according to Swiss Re, a significant figure that eats into insurer profits.

Insurers are reacting to these increased costs by adjusting their strategies. This often translates to reduced coverage limits, higher premium rates, or complete withdrawal from regions deemed too high-risk. This retrenchment can create significant availability and affordability issues for policyholders, potentially driving more risk towards the excess and surplus (E&S) lines market.

Regulators and stakeholders are intensifying their calls for insurers like Global Indemnity to transparently disclose their climate risk exposure and outline robust mitigation strategies. This pressure extends to detailing how climate considerations are woven into underwriting and investment portfolios. For instance, the Task Force on Climate-related Financial Disclosures (TCFD) framework, widely adopted by financial institutions, guides companies in reporting on governance, strategy, risk management, and metrics and targets related to climate change.

Influence on Specialty Niche Markets

Environmental factors significantly shape Global Indemnity's specialized niche markets, particularly farm and ranch insurance. For instance, the increasing frequency and intensity of extreme weather events, a direct consequence of climate change, directly impact agricultural yields and the value of rural properties. This trend is projected to continue, with the NOAA reporting that the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, a record high.

This heightened risk landscape fuels demand for highly specialized insurance products. We're seeing a growing interest in solutions like parametric insurance, which pays out based on predefined triggers, such as rainfall levels or temperature deviations, offering faster claims processing for agricultural producers. Furthermore, there's an emerging need for coverage that supports and encourages sustainable farming practices, reflecting a broader societal shift towards environmental responsibility.

- Climate Change Impact: Extreme weather events directly affect agricultural yields and property values in niche markets.

- Demand for Specialization: Increased climate-related risks drive the need for tailored insurance products.

- Emerging Solutions: Parametric insurance and coverage for sustainable farming practices are gaining traction.

- Record Disasters: The US saw a record 28 billion-dollar weather and climate disasters in 2023, highlighting the growing environmental volatility.

Emerging Environmental Liabilities

Insurers like Global Indemnity are increasingly confronting environmental liabilities that extend beyond traditional property damage. These emerging risks include the financial fallout from pollution incidents, the growing number of climate change-related lawsuits, and the compliance costs associated with new environmental protection regulations. For instance, the U.S. Environmental Protection Agency (EPA) continues to enforce strict regulations, with Superfund site cleanups costing billions annually, a cost that can indirectly impact insurers through liability claims.

As a specialty insurer, Global Indemnity must proactively develop or refine its insurance products and underwriting strategies to effectively manage these complex and evolving environmental exposures. The market for environmental insurance is expanding, with projections indicating continued growth driven by increased regulatory scrutiny and corporate awareness of environmental risks. For example, the global environmental insurance market was valued at approximately $10 billion in 2023 and is expected to grow at a compound annual growth rate of over 5% through 2030, reflecting the increasing demand for specialized coverage.

- Pollution Liability: Covering costs associated with cleanup and third-party damages from accidental releases.

- Climate Litigation: Addressing potential claims arising from failure to mitigate or adapt to climate change impacts.

- Regulatory Compliance: Insuring against fines and penalties for non-compliance with evolving environmental laws.

- New Product Development: Creating innovative policies for renewable energy projects and carbon capture technologies.

Environmental factors significantly influence Global Indemnity's operations, particularly through the increasing frequency and severity of extreme weather events. These events, amplified by climate change, lead to higher insured losses, impacting profitability and necessitating adjustments in underwriting and pricing. For example, the U.S. experienced 28 billion-dollar weather and climate disasters in 2023, according to NOAA, underscoring the growing environmental volatility.

The company must also navigate evolving environmental liabilities, including pollution incidents and climate change-related litigation, alongside compliance costs for new regulations. This necessitates proactive product development, such as coverage for renewable energy projects, to address these expanding risks. The global environmental insurance market, valued at around $10 billion in 2023, reflects this growing demand for specialized protection.

| Environmental Factor | Impact on GBLI | Supporting Data/Trend |

|---|---|---|

| Extreme Weather Events | Increased insured losses, higher claims costs, underwriting challenges | 28 billion-dollar weather/climate disasters in the U.S. in 2023 (NOAA) |

| Climate Change Litigation | Potential for new liability claims, need for specialized coverage | Growing trend of lawsuits against companies for climate impact mitigation failures |

| Environmental Regulations | Increased compliance costs, demand for pollution liability insurance | Ongoing enforcement of EPA regulations, Superfund site cleanup costs in billions |

| Shift to Sustainable Practices | Demand for insurance supporting green initiatives, renewable energy projects | Growth in environmental insurance market (approx. $10 billion in 2023) |

PESTLE Analysis Data Sources

Our Global Indemnity (GBLI) PESTLE Analysis is built on a robust foundation of data from leading international financial institutions, government statistical agencies, and reputable industry research firms. This ensures comprehensive coverage of political stability, economic trends, regulatory changes, technological advancements, environmental policies, and social shifts impacting the global insurance landscape.