Global Indemnity (GBLI) Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Indemnity (GBLI) Bundle

Global Indemnity (GBLI) faces moderate bargaining power from buyers and suppliers within the insurance sector. The threat of new entrants is somewhat limited by regulatory hurdles and capital requirements, while substitute products pose a manageable risk. However, the intensity of rivalry among existing insurers is a significant force shaping GBLI's operations.

Ready to move beyond the basics? Get a full strategic breakdown of Global Indemnity (GBLI)’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

The global reinsurance market's stability through 2025, driven by strong capital and profits, means reinsurers have ample capacity to offer. This abundance, coupled with favorable pricing in many short-tailed lines, suggests their bargaining power over Global Indemnity is moderate.

While reinsurers as suppliers hold some sway, the observed pricing pressures in specialty and short-tail reinsurance lines could actually benefit Global Indemnity by providing more favorable terms for their reinsurance purchases.

Global Indemnity (GBLI) relies heavily on independent agents and brokers in the United States for distributing its specialty insurance products. This distribution model is crucial, as these agents and brokers represented a substantial segment of the U.S. property and casualty insurance market in 2024, holding a consistent market share.

The bargaining power of these independent agents and brokers stems from their direct access to customers and their freedom to select from various insurance providers. GBLI's dependence on these intermediaries to connect with clients seeking specialized risk coverage means these agents hold significant sway.

The insurance sector's digital evolution, marked by AI and cloud adoption, elevates specialized technology providers. Global Indemnity's investment in these advanced systems, crucial for underwriting complex risks, directly translates to increased leverage for these tech suppliers.

Data and Analytics Service Providers

For Global Indemnity (GBLI), the bargaining power of data and analytics service providers is a significant consideration, particularly for its focus on specialized risks. Access to high-quality, niche data and sophisticated analytical tools is paramount for accurate risk assessment and pricing. While GBLI has its own InsurTech capabilities, external providers offering granular data, predictive modeling, and actuarial expertise for unique markets can exert considerable influence. Their specialized knowledge and proprietary datasets often make them indispensable partners.

These suppliers' ability to provide unique insights into emerging or complex risk segments can give them leverage. For instance, a provider specializing in cyber risk analytics might command higher prices if their data is essential for GBLI to underwrite cyber policies effectively. The cost of switching such a specialized provider, especially if significant integration has occurred, can also be substantial, further bolstering their bargaining power.

- Data Specialization: Providers with unique datasets for niche underwriting (e.g., specific industrial risks, emerging technologies) hold strong bargaining power.

- Analytical Sophistication: Firms offering advanced predictive modeling and AI-driven actuarial insights can command premium pricing.

- Switching Costs: The investment in integrating a provider's analytics platform can create high switching costs for GBLI.

- Market Concentration: If only a few providers offer the required specialized data or analytics, their bargaining power increases.

Claims Adjustment and Third-Party Service Providers

While Global Indemnity (GBLI) maintains an in-house claims adjustment capability, the reliance on external claims adjusters and specialized third-party service providers for complex or catastrophic events introduces a degree of supplier bargaining power. This power intensifies when their niche expertise is in high demand, particularly after widespread disasters. For instance, following a major hurricane season in 2023, the demand for experienced catastrophe adjusters surged, potentially increasing their rates.

The efficiency and cost of these outsourced services directly influence GBLI's operational expenses and, consequently, its profitability and customer retention. A 2024 industry report indicated that third-party claims administration can represent a significant portion of an insurer's operating budget, making supplier negotiations crucial.

However, the insurance sector's growing adoption of artificial intelligence (AI) in claims processing is a counteracting force. By automating routine tasks and enhancing data analysis, AI aims to reduce the industry's overall dependence on manual, and thus external, claims adjustment services, potentially mitigating supplier leverage in the long run.

- Supplier Leverage: External claims adjusters and specialized service providers can exert bargaining power, especially for catastrophic losses or when their expertise is scarce.

- Cost Impact: The efficiency and cost of these third-party services directly affect Global Indemnity's profitability and customer satisfaction metrics.

- Industry Trends: The increasing integration of AI in claims management is a strategic move by insurers like GBLI to reduce reliance on manual, external resources.

- Market Dynamics: In 2023, periods of high disaster frequency led to increased demand and potentially higher costs for specialized claims adjusters.

Global Indemnity's bargaining power with suppliers is influenced by the concentration of specialized data and analytics providers. Companies offering unique datasets for niche underwriting, like specific industrial risks, hold significant leverage. For example, providers of advanced predictive modeling for emerging technologies can command higher prices due to their indispensable insights.

The cost and integration of these specialized services create high switching costs for GBLI, further strengthening supplier influence. If only a few firms can deliver the required granular data or sophisticated AI-driven actuarial insights, their market concentration amplifies their bargaining power.

| Supplier Type | Key Leverage Factor | Impact on GBLI |

|---|---|---|

| Data & Analytics Providers | Unique datasets for niche underwriting | Increased costs for essential risk assessment tools |

| Data & Analytics Providers | Advanced predictive modeling & AI insights | Premium pricing for specialized analytical capabilities |

| Data & Analytics Providers | High integration & switching costs | Reduced flexibility in supplier selection |

| Data & Analytics Providers | Market concentration in specialized areas | Amplified supplier pricing power |

What is included in the product

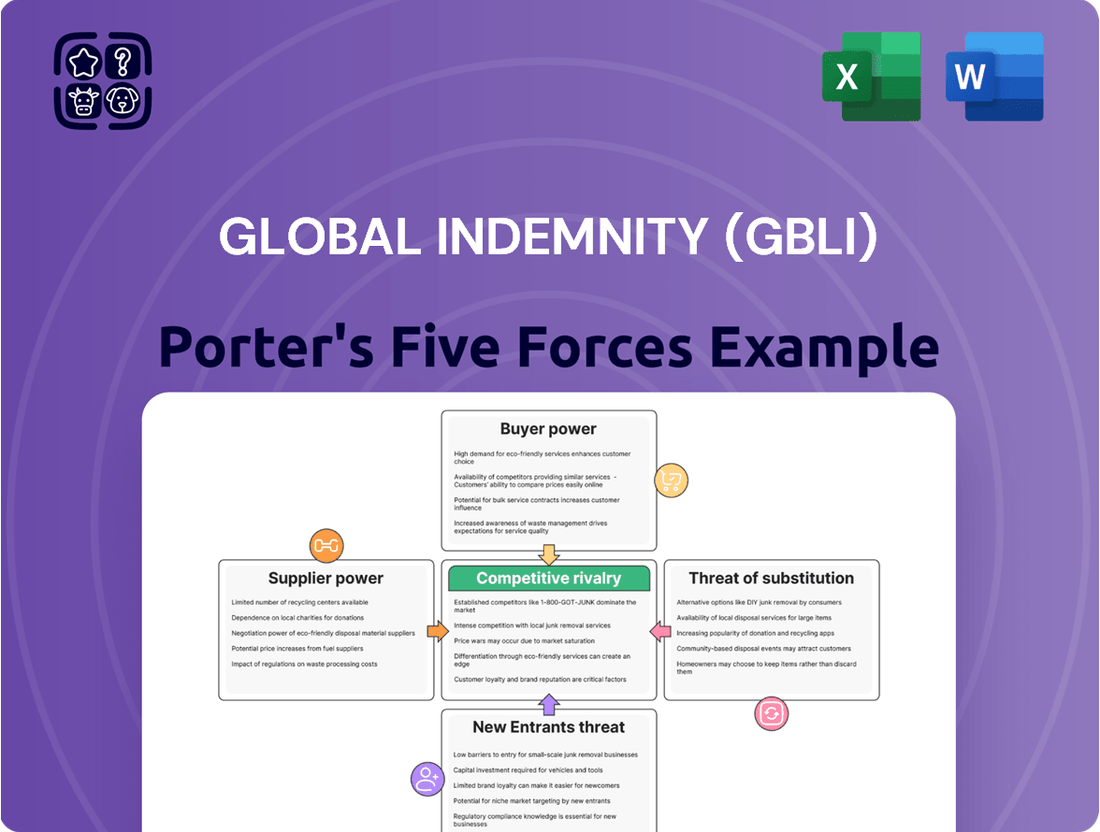

This analysis of Global Indemnity (GBLI) dissects the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, providing strategic insights into its competitive environment.

A dynamic, interactive model that allows for real-time adjustments to Porter's Five Forces for Global Indemnity (GBLI), enabling swift identification and mitigation of emerging competitive threats.

Customers Bargaining Power

Global Indemnity's (GBLI) reliance on independent agents and brokers significantly amplifies customer bargaining power. These intermediaries offer customers a gateway to numerous insurance carriers, enabling easy comparison of policies and pricing from a single point of contact.

Customers, through these agents, can readily obtain multiple quotes and explore diverse insurance options. This ease of comparison and the potential to switch insurers based on better terms or coverage directly enhances their leverage when negotiating with GBLI or its competitors.

Even though Global Indemnity focuses on specialized insurance, the overall U.S. property and casualty insurance market is quite competitive. This competition means customers, even those needing niche policies, often have choices and are mindful of pricing. For instance, in 2024, the U.S. property and casualty insurance market saw continued competition, with some lines experiencing rate moderation due to increased capacity and moderating loss trends in certain areas.

Customers are generally sensitive to higher insurance premiums, particularly when economic factors or the cost of claims change. This means that if Global Indemnity were to significantly increase prices for its niche products, customers might explore alternatives or push back, giving them a degree of bargaining power.

The insurance industry's digital evolution, fueled by AI and analytics, is making information more accessible and leading to customized insurance products. This means customers can more easily understand policy terms and compare offerings, directly impacting their ability to negotiate better deals.

As of early 2024, consumer demand for transparency in financial services, including insurance, continues to surge. This heightened awareness, coupled with readily available online tools and comparison sites, significantly amplifies the bargaining power of customers, forcing insurers like Global Indemnity (GBLI) to offer more competitive pricing and clearer value propositions.

Option of Self-Insurance or Alternative Risk Transfer

For substantial commercial clients, especially those with predictable risk patterns, the choice to self-insure or engage in captive insurance arrangements presents a strong alternative to conventional policies. This capability directly enhances their leverage when negotiating with insurers like Global Indemnity.

The captive insurance sector saw robust growth in 2024, with industry experts estimating the market size to be in the tens of billions of dollars globally, providing adaptable risk management strategies. This trend empowers sophisticated clients to manage their own risks or seek alternative transfer methods, thereby increasing their bargaining power.

- Self-Insurance: Clients retain their own risk, avoiding premium payments and potentially benefiting from un-incurred losses.

- Captive Insurance: Formation of a subsidiary insurance company, offering tailored coverage and profit retention.

- Alternative Risk Transfer (ART): Includes options like finite risk insurance and catastrophe bonds.

- Market Impact: The availability of these alternatives limits the pricing power of traditional insurers, including Global Indemnity, particularly for large, stable accounts.

Evolving Customer Expectations and Digital Demands

Modern customers, particularly those engaging with insurance providers like Global Indemnity (GBLI), now demand frictionless digital interactions across all touchpoints. This includes everything from initial policy research and quoting to the submission and resolution of claims. Insurers that can effectively deliver these seamless digital experiences, coupled with personalized service offerings and rapid claim settlements, will naturally attract and retain a larger customer base.

The ability of Global Indemnity to embrace and integrate InsurTech solutions is a critical factor in meeting these evolving expectations. For instance, by the end of 2024, a significant portion of insurance consumers are expected to prefer digital channels for policy management and claims, based on industry trend reports. Failure to adapt to these digital demands empowers customers, increasing their willingness to switch to competitors who offer superior online platforms and more responsive service, thereby amplifying their bargaining power.

- Digital Channel Preference: By late 2024, surveys indicate over 60% of insurance customers prefer digital channels for policy inquiries and claims.

- InsurTech Adoption: Companies investing in InsurTech for streamlined digital experiences see higher customer retention rates, estimated to be up to 15% higher.

- Personalization Impact: Personalized digital interactions can increase customer loyalty by an estimated 20%, reducing churn.

- Unmet Expectations: If GBLI's digital offerings lag behind industry standards, customers are likely to seek alternatives, increasing their bargaining leverage.

The bargaining power of customers for Global Indemnity (GBLI) is influenced by market competition and the availability of alternatives. In 2024, the U.S. property and casualty insurance market continued to be competitive, with some segments experiencing rate moderation, which generally favors customers. This environment means that even for specialized insurance, customers have choices and are price-sensitive.

Sophisticated clients, particularly large commercial entities, can leverage options like self-insurance or captive insurance arrangements. The captive insurance market's robust growth in 2024, estimated in the tens of billions of dollars globally, provides these clients with significant alternatives to traditional policies, thereby increasing their negotiation leverage.

Customers increasingly demand seamless digital experiences for policy management and claims processing. By late 2024, industry reports suggest over 60% of insurance consumers prefer digital channels. Insurers that fail to meet these expectations, including GBLI, risk losing customers to competitors offering superior online platforms, which amplifies customer bargaining power.

| Factor | Impact on GBLI Customer Bargaining Power | 2024 Relevance |

|---|---|---|

| Market Competition | High | Continued competition in P&C sector, some rate moderation observed. |

| Availability of Alternatives (Self-Insurance/Captives) | Moderate to High (for large clients) | Captive insurance market valued in tens of billions globally, offering strong alternatives. |

| Digital Channel Preference | High | Over 60% of customers prefer digital interactions by late 2024. |

| Price Sensitivity | Moderate | Customers are sensitive to premium increases, especially with economic shifts. |

Full Version Awaits

Global Indemnity (GBLI) Porter's Five Forces Analysis

This preview shows the exact, comprehensive Porter's Five Forces Analysis for Global Indemnity (GBLI) you'll receive immediately after purchase, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products within the insurance industry. You'll gain immediate access to this professionally formatted document, enabling you to thoroughly understand the strategic landscape GBLI operates within without any surprises or placeholders.

Rivalry Among Competitors

Global Indemnity operates within the specialty property and casualty insurance sector, a market characterized by its fragmented nature and significant growth. This dynamic environment means that while the expanding market size can absorb more participants, it also intensifies rivalry as numerous companies compete for dominance across various specialized niches.

The specialty insurance market is projected for substantial growth, with industry forecasts indicating continued expansion throughout 2024 and beyond. This robust growth, however, acts as a magnet for new entrants, further fragmenting the competitive landscape and increasing the number of players vying for market share.

Global Indemnity's strategic focus on underwriting specialized risks like commercial auto, farm and ranch, and excess and surplus lines inherently differentiates its products. This specialization allows GBLI to sidestep direct confrontation with insurers focused on more common insurance needs.

While this niche approach offers some protection, the competitive landscape is heating up. Other specialty insurers and Managing General Agents (MGAs) are increasingly adopting similar specialization strategies, often enhanced by technological advancements, to capture these same targeted markets. This means rivalry within these lucrative niche segments is intensifying.

The insurance industry's competitive landscape is increasingly shaped by technological adoption. Companies are pouring resources into artificial intelligence, machine learning, and sophisticated data analytics to refine underwriting, boost operational efficiency, and elevate customer experiences. This technological arms race is crucial for staying ahead.

Global Indemnity's strategic focus on its InsurTech segment underscores its commitment to leveraging technology. This emphasis is vital for competing effectively against both established insurers and agile, tech-forward newcomers. For instance, in 2024, the global InsurTech market was projected to reach over $10 billion, highlighting the significant investment and growth in this area.

Impact of Reinsurance Market Conditions

The global reinsurance market, showing ample capacity and stable pricing through 2024 and into 2025, directly impacts competitive rivalry among primary insurers like Global Indemnity (GBLI). When reinsurance terms are favorable, it can embolden insurers to accept greater risk or present more competitive pricing, thereby intensifying competition in specific insurance segments.

- Favorable reinsurance terms in 2024-2025 may lead to increased price competition among primary insurers.

- Global Indemnity's significant assumed reinsurance business means it is directly exposed to and influenced by these market conditions.

- The availability of abundant reinsurance capacity can lower barriers to entry for new primary insurers, potentially escalating rivalry.

Distribution Channel Competition and Agent Relationships

Global Indemnity's competitive rivalry within its distribution channels is significantly shaped by its reliance on independent agents and brokers. This necessitates a constant effort to secure and nurture these crucial relationships, as insurers vie for agents' loyalty by offering competitive commissions, user-friendly technology platforms, and robust underwriting support. In 2024, the property and casualty insurance market continued to see the independent agency channel as the primary avenue for reaching customers, underscoring the critical nature of these partnerships for market penetration and expansion.

- Agent Dependency: Global Indemnity's business model heavily depends on independent agents and brokers for sales, making the competition for their business a key factor.

- Competitive Incentives: Insurers compete by offering attractive commission structures, efficient digital tools, and reliable underwriting support to win over agents.

- Market Dominance: The independent agency channel remains the dominant distribution method in the P&C sector, highlighting its importance for market access.

- Relationship Management: Maintaining strong, mutually beneficial relationships with agents is vital for Global Indemnity's sustained growth and market share.

The competitive rivalry within the specialty property and casualty insurance market is intense, driven by a growing market and increasing specialization among insurers. While Global Indemnity (GBLI) carves out niches, competitors are also adopting similar strategies, often leveraging technology to gain an edge. This dynamic means that even specialized segments are experiencing heightened competition as more players target profitable areas.

The InsurTech boom, with the global market projected to exceed $10 billion in 2024, fuels this rivalry. Companies like GBLI are investing heavily in technology to enhance underwriting and customer experience, aiming to outmaneuver both established rivals and nimble startups. This technological arms race is critical for maintaining market share and profitability.

Favorable reinsurance terms, prevalent through 2024 and into 2025, further intensify competition. With ample capacity and stable pricing, primary insurers can offer more aggressive pricing, potentially lowering barriers for new entrants and escalating rivalry across various insurance lines. Global Indemnity, with its significant assumed reinsurance business, is directly impacted by these market dynamics.

Global Indemnity's reliance on independent agents and brokers for distribution means competition for these partnerships is a key battleground. Insurers are vying for agent loyalty through competitive commissions, advanced technology platforms, and strong underwriting support. The independent agency channel remains dominant in the P&C sector, making these relationships crucial for market access and growth in 2024.

| Factor | Impact on Rivalry | GBLI's Position |

|---|---|---|

| Market Growth & Specialization | Intensifies competition as more players target profitable niches. | Niche focus offers differentiation, but rivals are adopting similar strategies. |

| InsurTech Adoption | Drives a technological arms race, crucial for competitive advantage. | Strategic investment in InsurTech is vital to compete with tech-forward players. |

| Reinsurance Market Conditions | Favorable terms can lead to price competition and lower entry barriers. | Directly influenced by reinsurance capacity, affecting pricing strategies. |

| Distribution Channels (Independent Agents) | Competition for agent loyalty is fierce, impacting market penetration. | Strong relationships with agents are critical for sales and growth. |

SSubstitutes Threaten

For large commercial clients, self-insurance and captive insurance programs are significant substitutes for traditional insurance. These alternatives allow businesses to retain and manage their own risks, potentially leading to cost savings and more customized coverage.

The captive insurance market saw robust growth in 2024, fueled by ongoing economic pressures and a strong demand for adaptable risk management strategies. This trend directly impacts traditional insurers like Global Indemnity by offering clients a way to bypass conventional policies and internalize risk.

Alternative Risk Transfer (ART) mechanisms, like catastrophe bonds and insurance-linked securities (ILS), present a growing challenge to traditional insurance models. These capital market solutions allow for the transfer of specific, large-scale risks away from insurers and reinsurers. For instance, the ILS market saw significant growth, with gross market capacity for ILS reaching approximately $90 billion in early 2024, indicating a substantial alternative capacity for risk transfer.

While Global Indemnity (GBLI) operates as a primary insurer, these ART instruments can act as substitutes for certain high-severity, low-frequency risks. This means that for specific perils, such as major natural disasters, cedents might opt for ILS coverage instead of traditional reinsurance. This can potentially lessen the demand for specialized reinsurance products that GBLI might otherwise provide or participate in, impacting its market share in those niche areas.

Businesses are significantly boosting their investments in advanced risk management and loss prevention. For example, in 2024, the global risk management software market was projected to reach over $60 billion, reflecting this trend. This focus on proactive mitigation, using tools like IoT sensors and sophisticated data analytics, directly challenges the traditional reliance on comprehensive insurance.

By effectively preventing or reducing potential losses, companies can reduce their overall need for insurance. This might mean opting for lower coverage levels or higher deductibles, essentially substituting robust internal controls for the full protection previously offered by insurers like Global Indemnity (GBLI).

Government-Backed Insurance Programs

Government-backed insurance programs, particularly for catastrophic events like floods and crop failures, represent a significant threat of substitutes for private insurers such as Global Indemnity. These programs, often managed by state or federal entities, provide coverage that can be more affordable or even mandated, directly competing with private offerings.

For instance, the National Flood Insurance Program (NFIP) in the United States offers flood coverage, a market where private insurers might otherwise operate. Similarly, crop insurance is heavily subsidized and administered by the USDA, impacting the potential market share for private crop insurers. This competition from government-sponsored entities can limit pricing power and market penetration for private companies like Global Indemnity.

- Government programs like the NFIP offer flood insurance, a direct substitute for private market offerings.

- Subsidized crop insurance programs administered by government bodies reduce the addressable market for private crop insurers.

- These government-backed alternatives can limit the ability of private insurers to compete on price and coverage for specific perils.

Embedded Insurance Solutions

The increasing prevalence of embedded insurance presents a significant threat of substitutes for Global Indemnity (GBLI). This model integrates insurance directly into the purchase of other products or services, offering a frictionless experience that bypasses traditional insurance channels. For instance, travel insurance bundled with flight bookings or extended warranties added at electronics checkout are prime examples.

This trend is not just a niche offering; it's a fundamental shift in distribution. Projections indicate substantial growth, with some estimates suggesting the embedded insurance market could reach hundreds of billions of dollars globally by the late 2020s. For specific, often lower-value or niche risks, these embedded solutions are becoming a more convenient and accessible substitute than GBLI's standalone policies.

- Embedded Insurance Growth: The market is anticipated to expand rapidly, potentially reaching over $3 trillion in premiums globally by 2030, according to some industry analyses.

- Convenience Factor: Consumers increasingly value seamless integration, making bundled insurance a more attractive option than separate policy purchases.

- Distribution Channel Disruption: Embedded insurance fundamentally alters how insurance is sold, potentially disintermediating traditional agents and brokers.

- Niche Risk Substitution: For certain risks, such as product protection or travel inconvenience, embedded options may entirely replace the need for traditional insurance products.

The threat of substitutes for Global Indemnity (GBLI) is multifaceted, encompassing self-insurance, alternative risk transfer, and government programs. Businesses are increasingly opting for self-insurance and captive programs, a trend bolstered by economic pressures in 2024, offering tailored risk management and potential cost savings. This directly challenges traditional insurance models by allowing companies to retain and manage their own risks internally.

Alternative Risk Transfer (ART) mechanisms, such as catastrophe bonds and insurance-linked securities (ILS), provide substantial alternative capacity for risk transfer, with the ILS market reaching approximately $90 billion in early 2024. These capital market solutions can substitute for traditional reinsurance for specific high-severity risks, potentially impacting GBLI's market share in specialized areas.

Furthermore, government-backed programs like the National Flood Insurance Program (NFIP) and subsidized crop insurance directly compete with private insurers. These offerings can limit private insurers' ability to compete on price and coverage for specific perils, thereby reducing the addressable market for companies like Global Indemnity.

| Substitute Type | Description | 2024/2025 Relevance | Impact on GBLI |

|---|---|---|---|

| Self-Insurance/Captives | Businesses retaining and managing their own risks. | Growing due to economic pressures and demand for adaptable strategies. | Reduces demand for traditional policies. |

| Alternative Risk Transfer (ART) / ILS | Capital market solutions for risk transfer. | ILS market capacity ~$90 billion (early 2024). | Substitutes for specific high-severity risks, impacting reinsurance demand. |

| Government Programs | Federally or state-administered insurance for specific perils. | NFIP for flood, USDA for crop insurance. | Limits private market pricing power and penetration. |

Entrants Threaten

The insurance sector, including companies like Global Indemnity (GBLI), faces substantial hurdles for newcomers due to rigorous regulations. These include mandated capital reserves, intricate licensing processes, and the need to comply with diverse state-specific regulations within the U.S. For instance, in 2024, many states require insurers to maintain solvency margins that can run into millions of dollars, making it difficult for less capitalized entities to enter the market.

These high regulatory and capital requirements effectively deter potential new entrants, creating a more stable competitive landscape for established players. Global Indemnity, with its existing network of state-regulated insurance carriers and a robust capital base, is well-positioned to leverage these entry barriers, benefiting from the reduced threat of new competition.

In the insurance industry, trust and brand recognition are critical. Customers need to feel confident that an insurer can pay future claims, making an established reputation a significant barrier to entry. Global Indemnity, for instance, benefits from its 'A (Excellent)' rating from AM Best, a testament to its financial strength and reliability.

New companies entering the market must invest heavily in marketing and building a track record to gain customer confidence. This process is lengthy and expensive, creating a substantial hurdle for potential competitors aiming to challenge established players like Global Indemnity.

Global Indemnity's reliance on a robust network of independent agents and brokers presents a significant hurdle for potential new entrants. Establishing a comparable distribution system in the U.S. insurance market is not only costly but also demands considerable time to cultivate the necessary relationships and infrastructure.

For instance, building trust and securing agreements with a substantial number of agents can take years, a timeline many new companies may not be able to sustain. This established network acts as a formidable barrier, making it difficult for newcomers to achieve the market penetration that Global Indemnity already enjoys.

Technological Investment and Expertise

The threat of new entrants into the insurance sector, particularly for a company like Global Indemnity (GBLI), is significantly shaped by the substantial technological investment and expertise required. While InsurTech platforms can lower some barriers, the core need for advanced technology, including sophisticated AI for underwriting, robust data analytics capabilities, and efficient policy administration systems, represents a considerable hurdle.

New players must either develop or acquire these advanced technological capabilities to compete effectively. This is especially true when underwriting specialized risks or aiming to streamline operations, tasks that demand significant capital outlay and specialized knowledge. For instance, the global InsurTech market was valued at over $10 billion in 2023 and is projected to grow substantially, indicating a high level of investment, but also highlighting the capital intensity involved.

- High Capital Requirements: Building or acquiring cutting-edge AI, data analytics, and policy administration systems demands millions in investment.

- Specialized Expertise Needed: Operating these advanced systems and leveraging them for underwriting requires highly skilled data scientists and technologists.

- Competitive Necessity: Without these technological advancements, new entrants struggle to match the efficiency and risk assessment accuracy of established players like GBLI.

Niche Market Saturation and Specialization Challenges

Global Indemnity's strategy of underwriting specialized risks creates a barrier for generalist insurers, but it also invites new entrants focused on even more granular niches. The rise of Managing General Agents (MGAs) in specialty lines, such as those in the cyber or parametric insurance space, demonstrates how agile, smaller players can effectively target specific, profitable gaps. For instance, in 2024, the specialty insurance market continued to see significant growth, with some segments experiencing double-digit increases, attracting new capital and innovative business models.

- Niche Specialization: Global Indemnity's focus on unique risks deters broad market entry but attracts highly specialized competitors.

- MGA Growth: New MGAs are emerging, leveraging technology and agility to capture underserved segments within specialty insurance.

- Technological Disruption: Technology enables new entrants to efficiently underwrite and serve niche markets previously inaccessible to larger incumbents.

- Market Attractiveness: The continued growth in specialty insurance segments in 2024 signals ongoing attractiveness for new, specialized players.

The threat of new entrants for Global Indemnity (GBLI) is relatively low due to significant barriers. These include substantial capital requirements, stringent regulatory compliance, and the need for established trust and brand recognition, which are difficult and costly for newcomers to replicate.

New companies face immense challenges in building the necessary infrastructure, including extensive agent networks and advanced technological capabilities for underwriting and data analysis. For example, the cost of implementing sophisticated AI and data analytics systems in 2024 can easily run into millions of dollars, creating a steep financial hurdle.

While InsurTech has lowered some barriers, the core operational complexities and the need for deep expertise in specialized underwriting, like that of Global Indemnity, still deter broad market entry. The specialty insurance market, which experienced robust growth in 2024, attracts niche players, but these often require specialized knowledge and capital themselves.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Regulatory & Capital | High solvency margins, licensing complexity, mandated reserves. | Significant financial and administrative burden. |

| Brand & Trust | Customer confidence in future claims payment, established reputation. | Requires lengthy and costly marketing and track record building. |

| Distribution Networks | Cultivating relationships with agents and brokers. | Time-consuming and expensive to replicate established networks. |

| Technological Investment | AI, data analytics, policy administration systems. | Demands substantial capital outlay and specialized expertise. |

Porter's Five Forces Analysis Data Sources

Our Global Indemnity (GBLI) Porter's Five Forces analysis is built upon a robust foundation of data, including financial statements from GBLI and its competitors, industry-specific market research reports, and regulatory filings from insurance bodies.