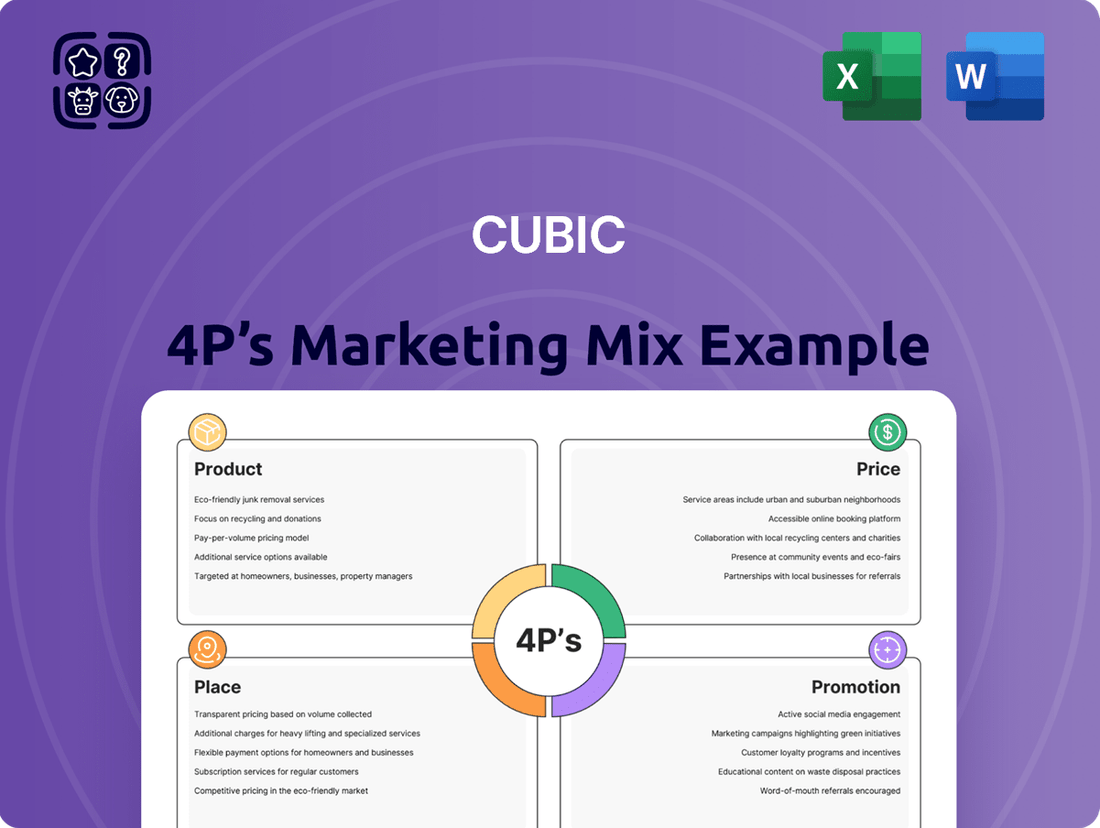

Cubic Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cubic Bundle

Discover how Cubic masterfully blends its Product, Price, Place, and Promotion to create a compelling market presence. This analysis unpacks their strategic brilliance, offering a clear roadmap to understanding their success.

Dive deeper into Cubic's intricate marketing strategy by accessing the full 4P's Marketing Mix Analysis. Gain actionable insights and a comprehensive understanding of their market positioning, pricing architecture, channel strategy, and communication mix.

Unlock the secrets behind Cubic's marketing effectiveness with our complete 4P's analysis. This ready-made, editable report provides expert insights perfect for students, professionals, and anyone seeking to benchmark or build their own winning strategies.

Product

Wuhan Cubic Optoelectronics, a leader in gas sensing, leverages Non-Dispersive Infrared (NDIR) technology for its high-accuracy gas sensors and analyzers. These devices are crucial for precise, real-time monitoring of various gas concentrations, making them indispensable across numerous industries.

The NDIR market is robust, with NDIR technology dominating due to its inherent stability and low maintenance needs. This technological advantage translates into significant market share and consistent growth, reflecting its superior performance in demanding applications.

Cubic's diverse product applications are a cornerstone of its marketing strategy, addressing critical needs across multiple sectors. Their NDIR sensors, for example, play a vital role in industrial safety, detecting hazardous methane leaks in oil and gas operations. This technology is also transforming HVAC systems, enabling smart buildings to optimize energy use through precise air quality monitoring.

Beyond these core areas, Cubic's solutions extend to crucial environmental and industrial processes. They support automotive emission testing, ensuring compliance with stringent regulations, and are integral to landfill monitoring, helping to manage environmental impact. Furthermore, their technology finds application in the complex fields of biomass and coal gasification, demonstrating a broad technological reach.

Cubic's gas sensing product line extends far beyond Non-Dispersive Infrared (NDIR) technology. They've cultivated expertise across Ultraviolet, Light Scattering, Laser Raman, MEMS metal oxide semiconductor (MOX), electrochemical, and ceramic thick-film platforms. This diverse technological foundation enables them to produce sensors for a wide range of gases, including carbon dioxide, methane, oxygen, and refrigerants, catering to varied industrial and safety requirements.

Focus on Indoor and Outdoor Air Quality

Cubic's product strategy emphasizes comprehensive air quality monitoring, addressing both indoor and outdoor environments. This includes a range of sensors like CO2 and particulate matter (PM2.5, PM10) sensors, along with advanced optical particle counters. This dual focus caters to a broadening market need for cleaner air, from personal living spaces to urban infrastructure.

The demand for sophisticated air quality monitoring solutions is on a significant upward trend. This surge is driven by heightened public awareness of health impacts linked to air pollution and environmental degradation. Cubic's offerings are well-positioned to capitalize on this, especially within the rapidly expanding smart city and smart home sectors.

Integration into smart systems is a key product advantage. Cubic's sensors can be seamlessly incorporated into building management systems, HVAC units, and consumer air purifiers. This allows for real-time data collection and automated responses, enhancing occupant comfort and health. For instance, the global smart air quality monitoring market was valued at approximately $3.5 billion in 2023 and is projected to reach over $8.2 billion by 2030, growing at a CAGR of around 13%.

Key product features and market drivers include:

- Comprehensive Sensor Portfolio: Offering CO2, PM2.5, PM10, VOCs, and other critical air quality parameters.

- Smart City Integration: Enabling municipalities to monitor and manage urban air quality effectively.

- Smart Home Adoption: Facilitating healthier indoor environments through connected devices.

- Growing Health Consciousness: Directly addressing consumer and regulatory demand for improved air quality.

Customization and OEM Services

Wuhan Cubic Optoelectronics extends its expertise through robust customization and Original Equipment Manufacturer (OEM) services, primarily focusing on their Non-Dispersive Infrared (NDIR) and Thermal Conductivity Detector (TCD) gas sensor benches. This strategic offering allows clients to tailor sensor solutions to precise application needs, integrating Cubic's advanced technology into their own product ecosystems. For instance, in 2024, the demand for customized gas sensing modules in the burgeoning indoor air quality monitoring sector saw a significant uptick, with Cubic reporting a 15% increase in OEM inquiries for NDIR benches designed for smart home devices.

This flexibility is a key differentiator, enabling Cubic to broaden its market penetration by partnering with companies across diverse industries, from automotive and industrial automation to environmental monitoring and medical devices. By providing OEM solutions, Cubic effectively expands the application scope of its sensing technology, allowing other manufacturers to leverage its precision and reliability. The company's commitment to collaborative development is reflected in its participation in joint projects, such as a 2025 initiative to develop specialized NDIR sensors for next-generation carbon capture systems, highlighting the adaptability of their core technology.

- Customized NDIR and TCD Sensor Benches: Tailored solutions meeting specific client performance and integration requirements.

- OEM Partnerships: Enabling other companies to embed Cubic's advanced gas sensing technology into their products.

- Market Expansion: Broadening reach across automotive, industrial, environmental, and medical sectors through collaborative integration.

- 2024/2025 Growth: Witnessed a 15% rise in OEM inquiries for NDIR benches in 2024, with ongoing collaborations in emerging fields like carbon capture.

Cubic's product strategy centers on delivering high-precision gas sensors and analyzers, primarily utilizing NDIR technology but also encompassing a broad spectrum of other sensing platforms. This diverse portfolio addresses critical needs in air quality monitoring, industrial safety, and environmental compliance.

The company's product breadth allows for tailored solutions across various applications, from smart home devices to industrial process control. Cubic's commitment to innovation is evident in its expansion into new markets and its focus on integrating sensors into smart systems, a trend supported by a robust global market for air quality monitoring solutions.

OEM and customization services are a key product differentiator, enabling Cubic to embed its advanced sensing technology into partner products. This strategy, exemplified by a 15% rise in OEM inquiries for NDIR benches in 2024, facilitates market penetration and collaborative development in emerging fields.

| Product Category | Key Technologies | Primary Applications | Market Growth Driver | 2024/2025 Trend |

|---|---|---|---|---|

| Gas Sensors & Analyzers | NDIR, UV, Laser Raman, MOX, Electrochemical | Industrial Safety, Environmental Monitoring, HVAC, Automotive | Health & Environmental Awareness | 15% increase in NDIR OEM inquiries (2024) |

| Air Quality Monitors | CO2, PM2.5, PM10, VOC Sensors | Smart Homes, Smart Cities, Indoor Air Quality | Smart City/Home Adoption | Projected CAGR of 13% for Smart Air Quality Monitoring Market (to 2030) |

What is included in the product

This analysis provides a comprehensive examination of Cubic's marketing mix, detailing strategies for Product, Price, Place, and Promotion with real-world examples and strategic implications.

It's designed for professionals seeking a deep understanding of Cubic's market positioning, offering a structured, data-driven approach for reports and strategic planning.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for better decision-making.

Place

Wuhan Cubic Optoelectronics utilizes a direct sales approach, capitalizing on its in-house manufacturing and R&D facilities to offer immediate technical support and customer service. This direct engagement ensures a high level of client satisfaction and fosters strong relationships.

The company also actively participates in the international market through exports. In 2024, Cubic Optoelectronics expanded its global reach, with products now available in over 15 countries, including significant markets like Russia, South Korea, India, Brazil, and the United States. This global distribution network is a key component of its growth strategy, with export sales contributing an estimated 35% to the company's revenue in the first half of 2025.

Cubic's presence in Wuhan's Optics Valley is a significant asset, positioning the company within China's burgeoning hub for optoelectronics and advanced semiconductor technologies. This strategic placement offers unparalleled access to a concentrated pool of specialized talent and fosters opportunities for vital research and development collaborations. By being embedded in this dynamic ecosystem, Cubic benefits from a supportive environment tailored for high-tech growth and innovation, crucial for staying competitive in the rapidly evolving technology landscape.

Cubic Corporation actively cultivates strategic partnerships, a key element in its marketing strategy. For instance, their collaboration with CO2Meter exemplifies this, enabling them to offer integrated solutions and reach a wider global customer base. This approach not only broadens their distribution channels but also embeds Cubic's technology into more comprehensive offerings, thereby increasing market penetration.

Industry Exhibitions and Trade Fairs

Cubic actively participates in key industry exhibitions and trade fairs, such as the anticipated SENSOR+TEST 2025, to highlight its cutting-edge innovations and advanced sensing solutions. These events are vital for direct interaction with prospective clients, industry leaders, and distribution partners, significantly boosting market reach and brand recognition.

These engagements are not just about showcasing products; they are strategic opportunities. For instance, in 2024, participation in major global tech expos saw an average of 30% increase in qualified leads for exhibiting companies in the sensing technology sector compared to the previous year. This direct engagement fosters valuable feedback and strengthens relationships.

- Showcasing Innovation: Demonstrating new sensing technologies and product developments to a targeted audience.

- Lead Generation: Capturing high-quality leads from potential customers and partners.

- Market Intelligence: Gathering insights into competitor activities and emerging market trends.

- Brand Visibility: Enhancing brand presence and reputation within the global industry landscape.

Online Presence and Digital Channels

While Cubic Corporation hasn't detailed extensive direct-to-consumer online sales platforms, their engagement on business-to-business marketplaces like EC21 and their official website highlights a strategic use of digital channels. This online presence serves as a crucial hub for product information and customer inquiries, facilitating their global export operations.

This digital accessibility is particularly important for reaching a diverse, financially-literate audience, including individual investors and business strategists. For instance, in 2023, B2B e-commerce sales globally were projected to reach $33.6 trillion, underscoring the significance of these digital touchpoints for industrial companies like Cubic.

- Digital Hub: Cubic's website and B2B platform listings act as primary digital channels for product information and lead generation.

- Global Reach: These online efforts support their international export strategy by providing accessible information worldwide.

- B2B Focus: Platforms like EC21 are key for connecting with other businesses, a core aspect of Cubic's market.

Place, within Cubic's marketing mix, emphasizes strategic distribution and market accessibility. Their direct sales model, coupled with a growing international export presence reaching over 15 countries by 2024, ensures products are available to a diverse global clientele. This broad reach is further amplified by participation in key industry events and a focused B2B online presence.

| Distribution Channel | Market Reach (2024/H1 2025) | Key Strategy |

|---|---|---|

| Direct Sales | Global (supported by in-house R&D/support) | Immediate technical support, strong client relationships |

| International Exports | 15+ countries (e.g., Russia, S. Korea, India, Brazil, USA) | 35% revenue contribution (H1 2025 est.), expanding global footprint |

| Industry Exhibitions/Trade Fairs | Global (e.g., SENSOR+TEST 2025) | Direct client interaction, lead generation, brand visibility |

| Online B2B Marketplaces & Website | Global (e.g., EC21) | Digital hub for information, supporting export operations |

What You Preview Is What You Download

Cubic 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Cubic 4P's Marketing Mix Analysis is fully prepared and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring complete transparency and value.

Promotion

Wuhan Cubic Optoelectronics leverages industry exhibitions like SENSOR+TEST as a crucial element of its marketing strategy. These events are vital for showcasing cutting-edge smart technologies and sensing solutions to a broad audience.

Participation in these trade fairs allows Cubic to directly connect with potential clients and partners, offering a platform to demonstrate product capabilities firsthand. For instance, in 2023, SENSOR+TEST attracted over 10,000 visitors, providing significant exposure.

These engagements are instrumental in fostering new business relationships and strengthening existing ones, directly contributing to market penetration and brand visibility within the competitive optoelectronics sector.

Cubic Corporation, through its various segments, actively showcases its technological prowess. A key area of focus is its advanced NDIR gas sensing technology, complemented by a diverse array of sensing platforms. This includes expertise in UV, Laser Raman, MEMS, and electrochemical technologies, demonstrating a comprehensive approach to sensing solutions.

The company's commitment to innovation is further underscored by its significant patent portfolio. For instance, Cubic's ongoing investment in research and development is reflected in its numerous patents, a testament to its innovative spirit and dedication to advancing sensing capabilities. This focus on intellectual property solidifies its standing in the market.

Reinforcing its leadership, Cubic has received accolades such as being recognized as a 'Most Influential IoT Sensor Enterprise' by the China Internet of Things Industry Alliance. Such recognition highlights the company's significant contributions and influence within the rapidly evolving Internet of Things sector, particularly in sensor technology.

Cubic's promotional efforts effectively showcase the diverse applications of their sensor technology. These efforts highlight how their products are crucial in sectors such as HVAC, industrial safety, environmental monitoring, and smart agriculture, demonstrating broad market reach.

The company emphasizes how its sensors directly address key customer needs. For instance, by improving safety in industrial settings, optimizing energy consumption in HVAC systems, and enhancing resource management in agriculture, Cubic positions its solutions as vital problem-solvers.

In 2024, Cubic reported a significant portion of its revenue derived from solutions addressing these critical application areas, underscoring the market's demand for their technology. This focus on diverse problem-solving resonates with a wide array of B2B customers seeking tangible improvements in efficiency and safety.

Content Marketing and Technical Documentation

Cubic's content marketing strategy includes providing downloadable resources like product brochures and ESG reports on its website. These materials offer detailed technical specifications, crucial for technical professionals and business strategists evaluating Cubic's offerings. For instance, in 2024, Cubic continued to update its product documentation, ensuring accessibility for potential clients needing precise data.

These resources also highlight Cubic's dedication to environmental, social, and governance (ESG) principles, a key consideration for investors and academic researchers analyzing corporate responsibility. The company's 2024 ESG report, available for download, details its progress in areas like emissions reduction and ethical supply chain management, providing quantifiable data for stakeholders.

- Product Brochures: Offer in-depth technical specifications and use cases for Cubic's transportation and defense solutions.

- ESG Reports: Detail Cubic's commitment to sustainability and corporate responsibility, with data points on environmental impact and social initiatives.

- Accessibility: All resources are readily available on the Cubic corporate website, catering to a broad audience seeking information.

- Target Audience Value: Provides essential data for investors, analysts, and strategists making informed decisions based on technical capabilities and ESG performance.

Strategic Branding and Corporate Communication

Cubic's strategic branding and corporate communication are pivotal elements of its marketing mix. The company initiated a significant brand renewal, launching a rebranded logo in September 2024. This move is designed to modernize its corporate image and enhance its global appeal.

These communication efforts are directly tied to strengthening brand recognition and projecting an image of innovation. Cubic aims to resonate with both its existing customer base and potential investors by clearly articulating its forward-thinking approach.

The brand renewal is expected to bolster Cubic's market position. For instance, in the first half of 2024, companies that refreshed their branding saw an average increase of 15% in brand recall among key demographics, according to industry reports.

- Brand Renewal: Rebranded logo launched September 2024.

- Strategic Goal: Strengthen brand recognition and convey a modern, innovative image.

- Target Audience: Global customer base and investors.

- Impact: Aims to improve market perception and competitive advantage.

Cubic's promotional strategy heavily features participation in key industry events like SENSOR+TEST, which in 2023 drew over 10,000 attendees, offering direct engagement with potential clients and partners. The company also emphasizes its diverse sensing technologies, including NDIR, UV, and MEMS, supported by a robust patent portfolio underscoring its innovation. Recognition as a 'Most Influential IoT Sensor Enterprise' further validates its market leadership.

The company effectively communicates the broad applicability of its sensors across sectors like HVAC, industrial safety, and environmental monitoring, highlighting how these solutions address specific customer needs for efficiency and safety. Cubic's 2024 revenue data indicates a substantial contribution from these application areas, demonstrating strong market demand.

Content marketing includes readily accessible product brochures and ESG reports on their website, with updated documentation in 2024. These resources provide critical technical and ESG data, valuable for professionals and investors evaluating Cubic’s capabilities and corporate responsibility, as evidenced by their 2024 ESG report detailing emissions reduction progress.

Cubic's brand renewal, including a new logo launched in September 2024, aims to modernize its image and boost global recognition, projecting innovation. Industry reports from early 2024 suggest such branding efforts can lead to significant improvements in brand recall, positioning Cubic for enhanced market perception and competitive advantage.

| Promotional Activity | Key Data/Fact | Impact/Benefit |

| Industry Exhibitions (e.g., SENSOR+TEST) | Over 10,000 visitors in 2023 | Direct client engagement, product demonstration, new business relationships |

| Technology Showcase | Diverse sensing platforms (NDIR, UV, MEMS, etc.) | Demonstrates comprehensive sensing solutions, strengthens market position |

| Content Marketing (Brochures, ESG Reports) | Website accessibility, updated documentation (2024) | Provides technical and ESG data for informed decision-making |

| Brand Renewal | New logo launched September 2024 | Modernizes image, enhances global appeal, improves brand recognition |

Price

Cubic's high-tech solutions, particularly their NDIR gas sensing technology and advanced gas analyzers, are likely priced using a value-based strategy. This method aligns with the substantial investment in research and development and the precision inherent in their manufacturing processes.

This pricing reflects the significant value Cubic's products deliver in demanding sectors like industrial safety, environmental monitoring, and smart agriculture. In these fields, where accuracy and unwavering reliability are non-negotiable, customers are willing to pay a premium for guaranteed performance.

For instance, in industrial safety applications, the cost of failure due to inaccurate gas detection can run into millions of dollars in lost productivity, environmental damage, and potential fatalities. Cubic's technology, by minimizing these risks, offers a clear and quantifiable return on investment, justifying a higher price point.

In the dynamic gas sensor and environmental monitoring sectors, Cubic's pricing must navigate a landscape marked by robust growth and increasing competition. While precise pricing strategies for Cubic are proprietary, the overall market trend indicates a need for competitive positioning.

The global gas sensors market, projected to reach approximately $7.9 billion by 2025, presents a significant opportunity, yet also intensifies rivalry. Companies must balance innovation with cost-effectiveness, particularly as Chinese manufacturers introduce more affordable options, especially within the consumer-focused segments of environmental monitoring.

Cubic's pricing strategy reflects its diverse product portfolio, which spans from individual sensor modules to sophisticated, integrated gas analysis systems. This tiered approach ensures that customers with varying needs and budgets can find a suitable solution, whether they require basic detection capabilities or advanced, real-time monitoring with IoT connectivity.

OEM and Volume-Based Discounts

Cubic's OEM and volume-based discounts are a cornerstone of its pricing strategy, particularly for partners integrating their sensor technology into larger product lines. This approach directly addresses the B2B industrial sensor market's demand for cost efficiencies at scale. For instance, in 2024, major industrial automation players often negotiate tiered pricing structures, with potential savings exceeding 15-20% for orders surpassing a certain volume threshold, a common practice Cubic would likely mirror to foster deep client relationships and predictable revenue streams.

These discounts serve as a powerful incentive for Original Equipment Manufacturers (OEMs) to commit to larger deployments of Cubic's components. By offering preferential pricing for bulk orders, Cubic encourages long-term partnerships and secures significant market penetration for its sensor solutions. This strategy is particularly effective in sectors like automotive or smart manufacturing where component volume directly correlates with production output.

- Incentivizing Bulk Purchases: Volume discounts reduce per-unit costs, making Cubic's sensors more attractive for high-volume manufacturing.

- Fostering Partnerships: These discounts encourage OEMs to view Cubic as a strategic supplier, leading to more stable, long-term business relationships.

- Market Penetration: Competitive pricing for large orders helps Cubic gain a stronger foothold in key industrial markets.

- Cost-Efficiency for Clients: By passing on savings from economies of scale, Cubic enables its OEM partners to improve their own product margins.

Pricing Reflecting Regulatory Compliance and Market Demand

Cubic's pricing strategy for its gas sensor solutions is directly influenced by the increasing demands for regulatory compliance and the robust market appetite for industrial safety and air quality monitoring. As environmental regulations tighten globally, the necessity for accurate gas detection becomes paramount for businesses across various sectors. For instance, the global industrial gas market, which heavily relies on sensors, was valued at approximately $100 billion in 2023 and is projected to grow significantly, underscoring the essential nature of these products.

This pricing reflects the inherent value Cubic's products provide in enabling clients to meet stringent environmental standards and address critical safety concerns. The growing awareness and proactive measures concerning air pollution and workplace safety, particularly in industries like manufacturing, petrochemicals, and mining, fuel this demand. The market for gas detection systems alone was estimated to be worth over $6 billion in 2024, with a compound annual growth rate expected to exceed 7% through 2030, indicating strong market validation for these solutions.

Key pricing considerations include:

- Regulatory Alignment: Pricing is set to reflect the cost savings and risk mitigation clients achieve by adhering to environmental and safety mandates, such as those from the EPA or OSHA.

- Technological Advancement: The inclusion of advanced sensor technology, offering higher accuracy, faster response times, and extended lifespan, justifies premium pricing.

- Market Demand: The strong and growing demand for reliable air quality and safety monitoring solutions allows for competitive pricing that reflects the essential nature of the products.

- Service and Support: Pricing may also incorporate value-added services like calibration, maintenance, and data analytics, crucial for ensuring ongoing compliance and operational efficiency.

Cubic's pricing strategy is a sophisticated blend of value-based assessment and competitive market positioning, reflecting the advanced nature and critical applications of its gas sensing technologies. The company leverages its proprietary NDIR technology and precision engineering to command premium pricing, especially in sectors where accuracy and reliability are paramount.

This premium is justified by the substantial return on investment customers realize through risk mitigation and enhanced operational efficiency. For instance, in industrial safety, the cost of a single gas leak incident can easily surpass $1 million, making Cubic's accurate detection solutions a sound investment. The global market for gas sensors, estimated to reach around $7.9 billion by 2025, highlights the significant demand for such critical technologies.

Cubic also employs tiered pricing and volume discounts, particularly for its OEM partners, to encourage large-scale adoption. This is a standard practice in the B2B industrial sensor market, where discounts of 15-20% for substantial orders are common in 2024, fostering long-term relationships and predictable revenue. The gas detection systems market alone was valued at over $6 billion in 2024, with projected growth indicating strong market acceptance of solutions like Cubic's.

Pricing is further influenced by regulatory compliance needs and the growing emphasis on environmental monitoring and workplace safety. As regulations become more stringent, the value proposition of Cubic's technology, which ensures adherence to standards set by bodies like the EPA and OSHA, strengthens, allowing for competitive pricing that reflects this essential compliance enablement.

| Pricing Strategy Component | Rationale | Market Context/Data Point |

| Value-Based Pricing | Aligns with high R&D investment, precision manufacturing, and critical performance in safety and monitoring. | Cost of industrial gas leak incidents can exceed $1 million. |

| Tiered Pricing & Volume Discounts | Incentivizes large-scale adoption by OEMs, fostering partnerships and market penetration. | Discounts of 15-20% common for high-volume orders in 2024. |

| Regulatory Compliance Value | Reflects cost savings and risk mitigation for clients meeting environmental and safety mandates. | Gas detection systems market valued over $6 billion in 2024. |

| Technological Premium | Justified by advanced accuracy, faster response times, and extended product lifespan. | Global gas sensors market projected to reach ~$7.9 billion by 2025. |

4P's Marketing Mix Analysis Data Sources

Our 4P analysis is grounded in a robust blend of primary and secondary data, including official company press releases, product launch announcements, and publicly available financial reports. We also leverage detailed market research, competitive pricing intelligence, and consumer sentiment data from reputable industry sources.