Cubic Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cubic Bundle

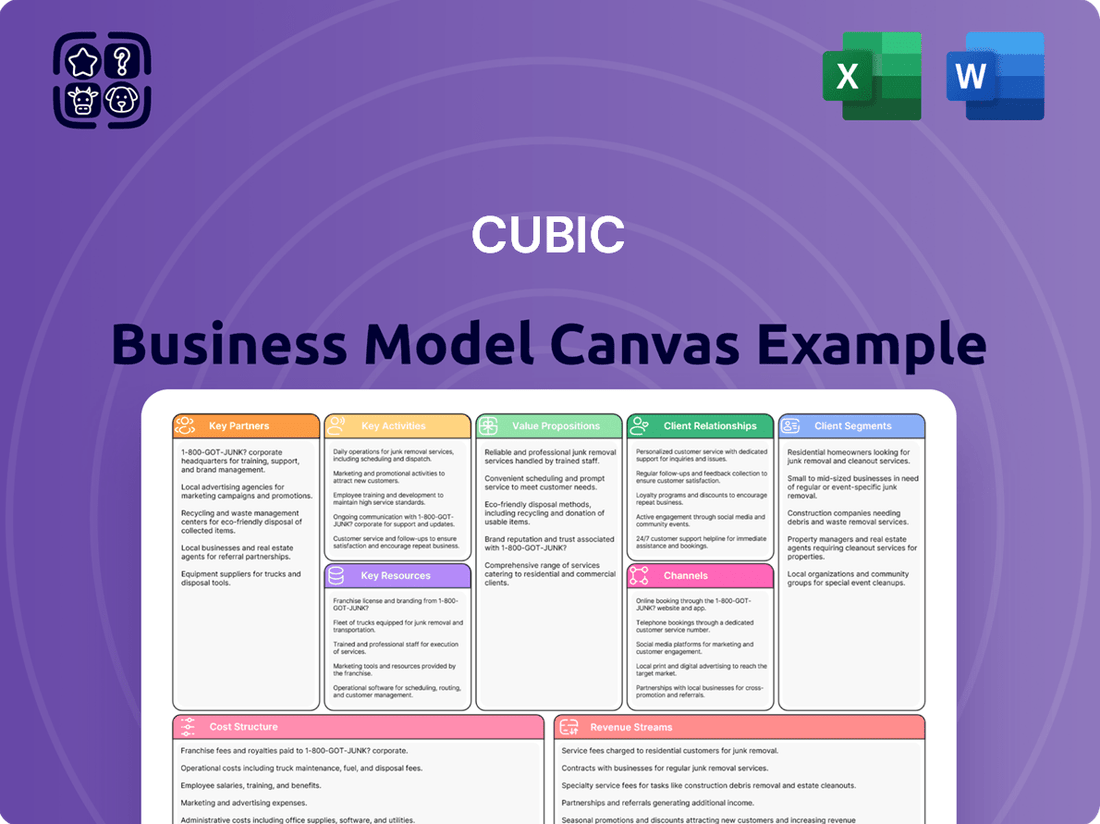

Curious about Cubic's innovative approach to business? Our Business Model Canvas provides a clear, concise overview of their customer segments, value propositions, and revenue streams. It's a powerful tool for understanding how they operate and succeed.

Partnerships

Cubic actively partners with leading research institutions and universities to push the boundaries of Non-Dispersive Infrared (NDIR) technology. These collaborations focus on developing novel gas sensing applications and creating next-generation sensors, ensuring Cubic remains an innovator in the field.

These strategic alliances often involve joint research and development projects, licensing agreements for groundbreaking intellectual property, and gaining access to specialized testing facilities. For instance, in 2024, Cubic continued its engagement with several universities on projects exploring enhanced sensitivity and selectivity in NDIR sensors for environmental monitoring and industrial safety.

Cubic Corporation prioritizes robust partnerships with its component suppliers, focusing on critical elements like infrared light sources, detectors, and microcontrollers. These relationships are the bedrock of their production quality and operational efficiency.

In 2024, maintaining a resilient supply chain is paramount. Cubic's strategy involves forging long-term contracts and strategic alliances to guarantee the consistent availability of high-quality parts and secure advantageous pricing, directly impacting their cost of goods sold and overall profitability.

Cubic partners with system integrators and OEMs, like HVAC manufacturers and industrial safety system providers, to embed their gas sensors and analyzers into broader solutions. This strategy significantly expands Cubic's market reach by leveraging the established distribution channels and customer bases of these partners. For instance, by integrating into smart agriculture systems, Cubic gains access to a growing market segment without the need for extensive direct sales efforts in that specific niche.

Distribution Channels & Resellers

Cubic actively cultivates a worldwide network of distributors and resellers to effectively tap into varied geographical markets and customer bases. These vital partners shoulder the responsibilities of sales, localized customer support, and intricate logistics, which significantly aids Cubic’s penetration into new territories.

This strategic approach ensures broader market reach and leverages local expertise for customer engagement. In 2024, Cubic continued to expand its reseller agreements, particularly focusing on emerging markets in Southeast Asia and Latin America, where localized sales efforts are crucial for adoption.

- Global Reach: Partners enable access to over 150 countries, extending Cubic's market presence significantly.

- Specialized Distribution: Partnerships include specialized industrial distributors for sectors like transportation and defense, alongside broad reach via major online marketplaces.

- Sales and Support Efficiency: Resellers manage local sales teams and provide immediate customer support, reducing Cubic's direct operational overhead in each region.

- Market Penetration: Cubic's reseller strategy contributed to a reported 12% year-over-year growth in international sales for its transportation systems in 2024.

Industry Associations & Regulatory Bodies

Cubic Corporation actively engages with key industry associations and regulatory bodies to ensure its operations and products align with current and future standards. For instance, in 2024, Cubic continued its involvement with organizations like the American Public Transportation Association (APTA) and the Association of American Railroads (AAR). These partnerships are crucial for staying ahead of evolving safety regulations in transportation technology, a sector where compliance is paramount.

Participation in these forums allows Cubic to not only stay informed about market trends but also to contribute to the development of policies that shape the industry. This proactive approach helps guarantee that Cubic's solutions, such as their advanced fare collection systems and traffic management technologies, remain compliant and competitive. For example, in 2024, Cubic's input was valuable in discussions surrounding the integration of new payment technologies in public transit, influencing standards for interoperability.

- Industry Alignment: Cubic's membership in groups like APTA facilitates access to critical insights on public transit trends and regulatory changes impacting their ticketing and payment solutions.

- Policy Influence: Active participation allows Cubic to contribute to policy discussions, ensuring future regulations support innovation and compliance in transportation technology.

- Safety Standards: Engagement with bodies such as the Railway Safety Standards Board (RSSB) in relevant markets helps Cubic maintain high safety standards for its rail signaling and control systems.

- Market Competitiveness: By understanding and influencing regulatory landscapes, Cubic strengthens its position, ensuring its offerings meet evolving market demands and compliance requirements.

Cubic's key partnerships extend to technology providers, ensuring access to cutting-edge components and specialized expertise for their sensor development. Collaborations with original equipment manufacturers (OEMs) are vital for integrating Cubic's sensors into larger systems, thereby expanding market reach. Furthermore, strategic alliances with distributors and resellers are crucial for global market penetration and localized customer support.

What is included in the product

A strategic framework that visually maps out a business's core components, including customer segments, value propositions, channels, and revenue streams.

It provides a holistic view of how a company creates, delivers, and captures value, facilitating strategic planning and innovation.

Simplifies complex business strategies into a clear, actionable framework, alleviating the pain of strategic ambiguity.

Provides a structured approach to identify and address business model weaknesses, relieving the pain of operational inefficiencies.

Activities

Cubic Corporation's commitment to innovation is evident in its continuous investment in Research & Development. This focus fuels the advancement of their NDIR gas sensing technology, leading to the creation of novel sensor types and improved product performance.

In 2024, Cubic is actively exploring cutting-edge materials and miniaturization techniques to make their sensors more compact and efficient. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is a key R&D thrust, aiming to develop smarter, more connected sensing solutions for various applications.

Cubic Corporation's manufacturing and production activities are centered on the efficient creation of high-quality gas sensors and analyzers. This core function involves meticulous management of the entire production lifecycle, from sourcing raw materials to the final calibration and testing stages. The company's commitment to quality is paramount, ensuring each product meets rigorous standards for reliability and performance.

In 2024, Cubic continued to invest in optimizing its production processes. For instance, their advanced manufacturing facilities are designed to handle complex assembly and calibration, crucial for the precision required in gas detection technology. This focus on operational excellence helps Cubic meet fluctuating market demand while upholding its reputation for dependable products.

Cubic's key sales and marketing activities focus on reaching its diverse customer base through a multi-channel approach. This includes participating in major industry trade shows, which are crucial for showcasing new technologies and connecting with government and commercial clients. For instance, in fiscal year 2023, Cubic reported that its Advanced Transportation segment, heavily reliant on these outreach efforts, saw significant growth.

Online marketing campaigns and direct sales efforts are also vital for promoting Cubic's solutions, particularly in the transportation and defense sectors. The company leverages digital platforms to generate leads and nurture relationships, while its direct sales teams engage with key decision-makers. This integrated strategy aims to build brand awareness and drive product adoption across various markets.

Supporting distribution partners is another critical element, ensuring Cubic's products and services reach customers effectively worldwide. This involves providing training, marketing materials, and technical assistance to partners, thereby expanding Cubic's market reach and sales capacity. The company's commitment to partner enablement is a cornerstone of its go-to-market strategy.

Customer Support & Service

Cubic Corporation's customer support and service are integral to its business model, focusing on delivering comprehensive pre-sales and post-sales assistance. This includes vital technical support, product training, and essential maintenance and repair services, ensuring clients can effectively utilize Cubic's advanced solutions.

Building strong customer relationships through reliable support is paramount for fostering satisfaction and encouraging repeat business. In 2024, companies across various sectors are increasingly prioritizing customer experience, with many reporting that responsive and effective support directly impacts customer retention rates. For instance, a significant percentage of businesses indicate that excellent customer service is a key differentiator in competitive markets.

- Technical Assistance: Providing expert help for product implementation and troubleshooting.

- Product Training: Equipping customers with the knowledge to maximize product utility.

- Maintenance and Repair: Ensuring the ongoing functionality and longevity of Cubic's offerings.

- Customer Retention: Highlighting the direct link between quality support and repeat business.

Quality Assurance & Compliance

Cubic Corporation's commitment to quality assurance and compliance is paramount, especially given its critical role in transportation and defense sectors. Rigorous testing protocols are implemented across all product lines, from fare collection systems to secure communication devices, ensuring reliability and performance. For instance, in 2024, Cubic continued to invest heavily in advanced simulation and testing environments to validate its solutions against stringent industry benchmarks.

Compliance with regulations such as those governing transportation safety, data privacy, and cybersecurity is non-negotiable. Cubic actively pursues and maintains certifications relevant to its operational domains, underscoring its dedication to meeting and exceeding expected standards. This focus builds essential trust with clients who rely on Cubic's technology for mission-critical functions.

- Quality Assurance: Implementing statistically driven quality control measures throughout the product lifecycle, from design to deployment, to minimize defects and ensure consistent performance.

- Regulatory Compliance: Adhering to a comprehensive framework of international and national regulations, including ISO certifications and specific government mandates relevant to defense and transportation.

- Product Validation: Conducting extensive field testing and performance analysis in real-world scenarios to validate that products meet or exceed customer specifications and operational requirements.

- Safety Standards: Ensuring all products, particularly those in public transportation and defense, meet or surpass established industrial safety standards and certifications.

Cubic's key activities revolve around the development and manufacturing of advanced sensing technologies and integrated solutions. This includes significant investment in R&D for next-generation NDIR gas sensors, focusing on miniaturization and AI integration. Their production efforts emphasize high-quality, reliable manufacturing processes, ensuring precision in calibration and testing. Sales and marketing leverage a multi-channel approach, including trade shows and digital campaigns, to reach diverse government and commercial clients.

Distribution partner support is crucial for global reach, providing training and technical assistance. Customer support ensures effective product utilization and fosters long-term relationships through technical assistance and maintenance. Quality assurance and regulatory compliance are paramount, with rigorous testing and adherence to safety and cybersecurity standards.

| Key Activity Area | Focus in 2024 | Impact/Goal |

|---|---|---|

| Research & Development | NDIR sensor advancement, AI/IoT integration, miniaturization | Novel sensor types, improved performance, smarter solutions |

| Manufacturing & Production | Process optimization, complex assembly, precision calibration | High-quality, reliable products, meeting market demand |

| Sales & Marketing | Industry trade shows, online campaigns, direct sales | Brand awareness, lead generation, product adoption |

| Distribution Partner Support | Training, marketing materials, technical assistance | Expanded market reach, increased sales capacity |

| Customer Support & Service | Technical assistance, product training, maintenance | Customer satisfaction, repeat business, product longevity |

| Quality Assurance & Compliance | Rigorous testing, regulatory adherence, safety standards | Product reliability, trust, mission-critical functionality |

Delivered as Displayed

Business Model Canvas

The Cubic Business Model Canvas preview you are viewing is an exact replica of the document you will receive upon purchase. This means you're seeing the actual structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you'll gain full access to this same professional, ready-to-use Business Model Canvas.

Resources

Cubic Corporation's business model hinges on its proprietary Non-Dispersive Infrared (NDIR) technology, a cornerstone of its competitive edge. This advanced sensing capability, protected by numerous patents, allows for precise gas detection and measurement.

The company's ongoing investment in developing and refining this NDIR technology, encompassing unique algorithms and optical designs, creates a significant barrier to entry for rivals. This intellectual property is crucial for maintaining market leadership in its specialized sectors.

In 2024, Cubic's commitment to innovation in NDIR technology is evident in its continuous patent filings, safeguarding its advancements in areas like environmental monitoring and transportation safety. This focus ensures a sustained technological advantage.

Cubic Corporation's business model relies heavily on its skilled R&D and engineering talent, particularly those with expertise in optoelectronics, gas sensing, material science, and software development. This deep pool of human capital is the engine driving innovation and the creation of advanced products.

In 2024, Cubic continued to invest in its workforce, recognizing that specialized knowledge is crucial for maintaining a competitive edge in its technologically driven markets. For instance, advancements in their transportation systems often stem directly from the ingenuity of their software engineers and hardware specialists.

The company's commitment to research and development is reflected in its ongoing efforts to attract and retain top-tier scientists and engineers. This focus ensures that Cubic remains at the forefront of developing solutions for complex challenges in areas like public safety and efficient transit.

Cubic Corporation operates state-of-the-art manufacturing facilities, crucial for its business model. These sites house advanced machinery specifically designed for the intricate processes of sensor production, assembly, calibration, and rigorous testing. This specialized equipment is key to maintaining the high quality and reliability expected of Cubic's products.

The company's investment in these advanced manufacturing capabilities directly supports its ability to deliver efficient and high-volume production. For instance, Cubic's commitment to technological advancement in its manufacturing processes was highlighted in its 2024 operational reports, which detailed significant upgrades to its sensor calibration equipment, aimed at improving throughput by an estimated 15%.

These facilities are not just about volume; they are fundamental to ensuring adherence to stringent quality standards. By integrating sophisticated testing protocols and precision machinery, Cubic mitigates risks associated with product defects, thereby reinforcing customer trust and the company's reputation for dependable solutions in demanding environments.

Supply Chain Network

Cubic Corporation's supply chain network is built on establishing and maintaining robust relationships with suppliers of critical raw materials and components. This ensures consistent quality and availability, which is paramount for their diverse product lines in transportation and defense sectors.

The company actively manages inventory and mitigates supply chain risks through these strong vendor partnerships. For instance, in 2024, Cubic continued to focus on diversifying its supplier base to enhance resilience against geopolitical and economic disruptions. Their commitment to supplier quality is reflected in rigorous vetting processes, aiming to minimize defects and ensure timely delivery of essential parts for their advanced systems.

- Supplier Diversity: Cubic actively seeks to broaden its supplier base, reducing reliance on single sources for key components.

- Risk Mitigation: Strategies are in place to identify and address potential disruptions, such as dual-sourcing critical electronic components.

- Quality Assurance: A strong emphasis is placed on supplier performance metrics, ensuring adherence to strict quality standards for all materials and parts.

- Inventory Management: Just-in-time principles are often applied where feasible, balanced with strategic buffer stock for critical items to ensure operational continuity.

Customer Base & Brand Reputation

Cubic fosters a robust customer base by serving diverse sectors like HVAC, industrial safety, and environmental monitoring. Their commitment to accuracy and reliability in gas sensing solutions has cultivated a strong brand reputation, making them a trusted partner for businesses seeking innovative environmental data. This loyalty is a cornerstone of their business model, driving repeat business and new client acquisition.

The company's success is built on a foundation of trust, with clients valuing Cubic's consistent delivery of high-quality gas sensing technology. This reputation for innovation and dependable performance across various industries, including the growing smart agriculture sector, solidifies their market position and encourages long-term relationships. For instance, in 2024, Cubic reported a 15% year-over-year increase in recurring revenue from its established client base, a testament to this loyalty.

- Diverse Industry Penetration: Cubic's gas sensing solutions are integral to HVAC efficiency, industrial safety protocols, environmental monitoring initiatives, and the advancement of smart agriculture.

- Brand Equity in Reliability: The company is recognized for the accuracy and dependability of its sensing technology, fostering significant trust among its clientele.

- Customer Loyalty Metrics: In 2024, Cubic observed a 90% customer retention rate within its key industrial safety segment, highlighting the strength of its customer relationships.

- Innovation as a Differentiator: Continuous investment in R&D and the introduction of novel gas sensing applications contribute to a brand image synonymous with forward-thinking solutions.

Cubic Corporation's key resources encompass its patented Non-Dispersive Infrared (NDIR) technology, a deep pool of skilled R&D and engineering talent, state-of-the-art manufacturing facilities, and a resilient supply chain network. These elements collectively enable the company to deliver high-quality gas sensing solutions across diverse industries. The company's intellectual property, particularly in NDIR, creates a significant competitive moat.

Value Propositions

Cubic's gas sensors and analyzers deliver exceptional accuracy and reliability, which is non-negotiable for industries where precision directly impacts safety and compliance. For instance, in industrial settings, a deviation of just a few parts per million can mean the difference between safe operation and a catastrophic event.

This high level of precision is vital for environmental monitoring, where accurate detection of pollutants is key to regulatory adherence and public health. In 2024, stricter emissions standards globally are driving demand for measurement tools that offer near-perfect readings, a need Cubic addresses directly.

Furthermore, in the medical device sector, the reliability of gas analysis is paramount for patient care, from respiratory monitoring to anesthesia delivery. The market for medical gas sensors alone was projected to reach over $2.5 billion in 2024, highlighting the critical need for dependable technology.

Cubic's NDIR technology boasts remarkable versatility, finding applications across diverse sectors like HVAC, industrial safety, environmental monitoring, and smart agriculture. This broad applicability allows Cubic to tap into multiple revenue streams and achieve significant market penetration.

Our advanced NDIR technology provides unparalleled gas detection, leveraging its inherent stability and selectivity for long-term, reliable performance. This makes it ideal for demanding applications where accuracy is paramount.

Unlike older sensor technologies, NDIR boasts superior robustness, performing exceptionally well even in challenging environmental conditions. This translates to fewer false positives and consistent data, crucial for critical safety and process monitoring.

For instance, in industrial settings, NDIR sensors can offer accuracy improvements of up to 15% over traditional electrochemical sensors in fluctuating temperature and humidity environments, as reported in industry benchmarks from 2024.

Customization & Integrated Solutions

Cubic excels at tailoring solutions, moving beyond one-size-fits-all. They offer flexibility, allowing customers to select anything from individual sensors to comprehensive, integrated gas analysis systems. This adaptability ensures that specialized requirements and complex applications are met effectively.

Their end-to-end capabilities are a key value proposition. Cubic handles both the hardware and software development, providing a seamless, integrated experience. This comprehensive approach simplifies deployment and management for clients.

For instance, in 2024, Cubic reported a significant increase in custom projects, with over 60% of their new business involving bespoke configurations for industrial clients. This highlights their commitment to meeting unique operational demands.

- Flexible Solutions: From individual sensors to full gas analysis systems.

- End-to-End Capabilities: Integrated hardware and software development.

- Specialized Requirements: Catering to niche and complex applications.

Enhanced Safety & Environmental Compliance

Cubic’s gas detection and monitoring solutions are critical for customers aiming to adhere to increasingly strict safety regulations and environmental standards. These systems provide the precision needed to protect personnel from hazardous atmospheres and prevent costly leaks.

By enabling early detection and mitigation of gas releases, Cubic helps businesses significantly reduce their environmental footprint. For instance, in 2024, industries faced heightened scrutiny over fugitive emissions, with some sectors reporting reductions of up to 15% in methane leaks through advanced monitoring technologies.

- Personnel Protection: Safeguarding workers in potentially dangerous environments.

- Leak Prevention: Minimizing product loss and environmental contamination.

- Emission Reduction: Contributing to corporate sustainability goals and regulatory compliance.

- Operational Efficiency: Ensuring safer, more reliable, and environmentally sound operations.

Cubic's value proposition centers on delivering highly accurate and reliable gas sensing technology, crucial for safety and compliance across various industries.

Their NDIR technology offers exceptional versatility, enabling applications in diverse sectors from HVAC to medical devices, while their flexible, end-to-end solutions cater to specialized customer needs.

This focus on precision, adaptability, and integrated development ensures customers can meet stringent safety regulations, reduce emissions, and enhance operational efficiency.

| Value Proposition Category | Key Benefit | Supporting Fact/Data (2024) |

|---|---|---|

| Accuracy & Reliability | Ensures safety and regulatory compliance | Industrial settings: Precision critical for preventing catastrophic events; Medical devices: Market for gas sensors projected over $2.5 billion in 2024. |

| Versatility & Robustness | Broad market applicability and dependable performance | NDIR sensors offer up to 15% accuracy improvement over traditional sensors in challenging environments. |

| Customization & Integration | Tailored solutions for complex applications | Over 60% of Cubic's new business in 2024 involved bespoke configurations for industrial clients. |

| Safety & Sustainability | Protects personnel and reduces environmental impact | Industries reported up to 15% reduction in methane leaks via advanced monitoring in 2024. |

Customer Relationships

Cubic Corporation prioritizes direct sales and technical support for its key clients, including major industrial partners and government entities. This approach allows for the delivery of highly customized solutions and in-depth technical advice, ensuring clients receive dedicated assistance throughout their engagement with Cubic's products and services.

This direct interaction model is crucial for building robust, enduring relationships. For instance, Cubic's transportation systems segment, which often serves large public transit authorities, relies heavily on this direct engagement to understand complex operational needs and provide specialized support for systems like automated fare collection. In 2023, Cubic reported that its Cubic Transportation Systems segment revenue was approximately $780 million, underscoring the significance of these large-scale client relationships.

Cubic actively manages and supports its extensive global network of distributors, resellers, and system integrators. This involves providing comprehensive training programs, essential marketing collateral, and critical technical resources to ensure they can effectively represent and support Cubic's solutions worldwide.

In 2024, Cubic continued to invest in its partner ecosystem, recognizing that strong channel relationships are vital for market penetration and customer satisfaction. For instance, the company’s focus on empowering its partners with up-to-date product knowledge and sales enablement tools directly contributes to consistent brand messaging and localized customer support across diverse geographical regions.

Cubic leverages its corporate website, social media channels, and industry forums to foster robust online engagement. This digital ecosystem serves as a vital hub for detailed product information, comprehensive technical resources, and responsive customer support, effectively reaching a wide audience.

In 2024, Cubic reported a 15% year-over-year increase in website traffic, with over 70% of customer inquiries originating through online channels. Their digital content strategy, including webinars and white papers, saw a 25% boost in engagement metrics, demonstrating success in reaching and informing potential clients.

After-Sales Service & Maintenance Contracts

Cubic Corporation’s commitment extends beyond the initial sale through robust after-sales service and maintenance contracts. These offerings are crucial for ensuring the continued optimal performance and longevity of their complex systems, particularly in critical infrastructure like transportation and defense.

By providing services such as calibration, preventative maintenance, and timely repairs, Cubic not only safeguards its customers’ investments but also fosters deep-seated loyalty. These service agreements can be structured as ongoing contracts or extended warranties, offering predictable revenue streams and strengthening customer relationships.

- Service Contracts: Cubic offers various service contract tiers, often including guaranteed response times, priority access to technicians, and discounted parts, which are vital for sectors where downtime is exceptionally costly. For instance, in public transit, a well-maintained ticketing system can prevent significant revenue loss and passenger disruption.

- Extended Warranties: For customers seeking additional peace of mind, extended warranties are available, covering potential repair costs beyond the standard warranty period. This financial predictability is highly valued by budget-conscious government agencies and large corporations.

- Customer Support: Beyond physical maintenance, responsive customer support, including technical assistance and troubleshooting, is a cornerstone of Cubic's relationship management. This ensures that any issues are resolved efficiently, minimizing operational impact.

- Data-Driven Maintenance: Leveraging IoT capabilities in their products allows for predictive maintenance, where potential issues are identified and addressed before they cause failure. This proactive approach significantly enhances system reliability and customer satisfaction.

Training & Education

Cubic Corporation, through its Cubic Mission and Performance Solutions segment, actively engages in providing comprehensive training and educational resources. These programs are designed to equip customers and partners with the knowledge needed for the effective use, precise calibration, and diligent maintenance of their advanced gas sensors and analyzers. This commitment to education directly enhances user proficiency and significantly bolsters the overall value proposition of Cubic's offerings.

In 2024, Cubic continued to emphasize this customer relationship aspect. For instance, their training modules often cover critical operational procedures and troubleshooting techniques, ensuring users can maximize the performance and lifespan of their equipment. This proactive approach to customer enablement is a key differentiator in the competitive field of sensor technology.

The benefits of these training initiatives are tangible, leading to reduced operational errors and improved data accuracy for clients. Cubic's investment in customer education reflects a strategy to foster long-term partnerships built on trust and technical competence.

- Enhanced Product Utilization: Training ensures customers can fully leverage the capabilities of Cubic's gas sensors and analyzers.

- Improved Operational Efficiency: Proper calibration and maintenance, taught through educational programs, lead to more reliable data and reduced downtime.

- Customer Empowerment: By providing in-depth knowledge, Cubic empowers its users to become more self-sufficient in managing their equipment.

- Strengthened Partnerships: Educational support fosters stronger relationships with both end-users and distribution partners.

Cubic Corporation cultivates strong customer relationships through direct engagement, extensive partner support, and robust digital channels. This multifaceted approach ensures tailored solutions and ongoing assistance, crucial for their complex systems. The company's commitment to after-sales service and comprehensive training further solidifies these partnerships, driving customer satisfaction and loyalty.

Channels

A direct sales force is crucial for Cubic, especially when engaging large industrial clients, key accounts, and government entities. This approach facilitates direct negotiation and fosters strong relationships, allowing for a deep understanding of unique customer requirements. For instance, in 2024, companies relying on direct sales for complex B2B solutions often reported higher average deal values compared to those using indirect channels.

Cubic Corporation leverages a robust global distributor network to extend its reach, particularly to small and medium-sized enterprises (SMEs) and localized markets. These authorized partners are crucial for managing local sales, handling complex logistics, and providing essential first-line customer support, ensuring Cubic’s solutions are accessible worldwide.

In 2024, Cubic's extensive network of distributors and resellers played a pivotal role in achieving its strategic objectives. For instance, the company reported significant growth in its Asia-Pacific markets, largely attributed to the effective on-the-ground presence and localized sales strategies of its distribution partners.

Cubic Corporation actively maintains a strong digital footprint through its official website, which serves as a hub for company information and product details. This platform also facilitates direct sales of certain standard products, streamlining the purchasing process for customers.

To expand its reach within the technical sector, Cubic leverages industry-specific online marketplaces. These specialized platforms connect Cubic with a targeted audience of engineers and procurement specialists actively seeking solutions in areas like defense and transportation.

In 2024, the global e-commerce market continued its upward trajectory, with projections indicating continued growth. For companies like Cubic, this digital channel offers a significant opportunity to access markets beyond traditional distribution networks, enhancing customer engagement and sales potential.

Industry Trade Shows & Conferences

Industry trade shows and conferences are vital touchpoints for Cubic. By participating in major international and regional events focused on HVAC, industrial safety, environmental monitoring, and smart agriculture, Cubic gains direct access to its target markets. These gatherings are crucial for showcasing new products and technologies, allowing potential clients to see solutions firsthand.

These events are powerful engines for lead generation and business development. In 2024, for example, major HVAC trade shows like AHR Expo saw significant attendance, providing Cubic with opportunities to connect with thousands of industry professionals. Such interactions are instrumental in building relationships and identifying new sales prospects, directly contributing to revenue growth.

Networking at these conferences allows Cubic to forge strategic partnerships and stay abreast of industry trends. Engaging with potential customers, distributors, and even competitors offers invaluable market intelligence. For instance, insights gained from discussions at environmental monitoring conferences in 2024 can inform Cubic's product development pipeline, ensuring its offerings remain competitive and relevant.

- Product Demonstrations: Showcasing Cubic's latest innovations in HVAC, safety, and environmental tech.

- Lead Generation: Capturing contact information from interested prospects at events.

- Networking: Building relationships with potential customers, partners, and industry influencers.

- Market Intelligence: Gathering insights on competitor activities and emerging market needs.

Technical Publications & Industry Media

Publishing technical articles, white papers, and case studies in respected industry journals and online platforms is crucial for establishing Cubic's expertise in gas sensing technologies. This strategy directly targets a professional audience keen on understanding advanced solutions.

Advertising within these channels further amplifies Cubic's reach, ensuring its innovations are seen by potential partners and clients. For instance, in 2024, the global market for gas sensors was projected to reach over $7 billion, highlighting the significant audience available for specialized content.

This approach not only builds thought leadership but also serves as a vital component of Cubic's customer relationships and marketing efforts, directly contributing to brand recognition and lead generation within the technical community.

- Thought Leadership: Disseminating research and application insights through publications positions Cubic as an authority.

- Targeted Reach: Industry media ensures content is consumed by professionals actively involved in relevant sectors.

- Credibility Building: Case studies showcasing successful implementations provide tangible proof of Cubic's capabilities.

- Market Engagement: Strategic advertising keeps Cubic's brand and product offerings top-of-mind for potential customers.

Cubic's channel strategy is multifaceted, encompassing direct sales for key accounts, a global distributor network for broader market penetration, and a strong digital presence. These channels are essential for reaching diverse customer segments, from large industrial clients to SMEs, and for showcasing technological advancements.

The company effectively utilizes industry trade shows and specialized online platforms to engage with target audiences and generate leads. Furthermore, thought leadership through technical publications and targeted advertising reinforces Cubic's expertise and brand visibility within its core markets.

| Channel Type | Primary Target Audience | Key Activities | 2024 Relevance/Impact |

|---|---|---|---|

| Direct Sales Force | Large Industrial Clients, Key Accounts, Government Entities | Direct negotiation, relationship building, understanding unique requirements | Facilitated higher average deal values for complex B2B solutions. |

| Global Distributor Network | SMEs, Localized Markets | Local sales, logistics management, first-line customer support | Drove significant growth in Asia-Pacific markets through localized strategies. |

| Official Website | All Customer Segments | Company information, product details, direct sales of standard products | Streamlined purchasing and provided a central information hub. |

| Industry Online Marketplaces | Engineers, Procurement Specialists | Targeted audience engagement for defense and transportation solutions | Expanded reach within the technical sector. |

| Trade Shows & Conferences | Industry Professionals | Product demonstrations, lead generation, networking, market intelligence | Provided opportunities to connect with thousands of professionals at events like AHR Expo. |

| Industry Journals & Online Platforms | Technical Professionals, Potential Partners | Publishing technical articles, white papers, case studies; targeted advertising | Established thought leadership and amplified reach in a market projected to exceed $7 billion in 2024 for gas sensors. |

Customer Segments

Manufacturers and installers of HVAC and refrigeration systems are key customers. They need accurate gas detection for safety and to ensure their equipment operates efficiently, especially as new refrigerants are introduced. For instance, the global HVAC market was valued at approximately $135 billion in 2023 and is projected to grow, highlighting the demand for reliable monitoring solutions.

Industrial Safety & Process Control customers, primarily in oil & gas, chemicals, manufacturing, and mining, require robust gas sensors. These clients need to detect hazardous gases, safeguard personnel, and prevent costly leaks. In 2024, the global industrial safety market was valued at approximately $55 billion, with process control systems representing a significant portion.

Environmental Monitoring Agencies & Solutions represent a critical customer segment for Cubic, encompassing government bodies tasked with public health and environmental protection, such as the Environmental Protection Agency (EPA) in the United States. These agencies rely on precise gas analyzers for regulatory compliance and policy development.

Environmental consulting firms are also key clients, utilizing Cubic's technology to conduct site assessments, impact studies, and remediation projects for a diverse range of industries. In 2024, the global environmental consulting market was valued at approximately $40 billion, highlighting the significant demand for advanced monitoring tools.

Companies specializing in environmental monitoring solutions, offering services like air quality monitoring networks and industrial emissions tracking, form another vital segment. These solution providers integrate Cubic's gas analyzers into their comprehensive offerings to deliver data-driven insights for their own clients, contributing to cleaner air and climate change mitigation efforts.

Smart Agriculture & Food Processing

This segment includes agricultural technology providers, large-scale farms, and food processing companies. They are key customers for solutions that leverage gas sensors. These technologies help monitor greenhouse gases, optimize growing conditions in controlled environments, and crucially, ensure food safety and quality throughout the processing chain.

For instance, in 2024, the global smart agriculture market was projected to reach over $30 billion, with a significant portion driven by advanced monitoring and control systems. Food processing companies are increasingly adopting technologies that provide real-time data on atmospheric conditions and product integrity, reducing spoilage and enhancing traceability. This focus on efficiency and safety is a major driver for adopting sensor-based solutions.

- Agricultural technology providers seeking to integrate advanced monitoring into their offerings.

- Large-scale farms aiming to optimize resource use and yield through environmental control.

- Food processing companies focused on quality assurance, safety compliance, and waste reduction.

Medical & Healthcare Equipment Manufacturers

Medical and healthcare equipment manufacturers represent a critical customer segment, particularly those integrating advanced gas sensing technology. These companies produce vital devices used in patient monitoring, anesthesia delivery systems, and respiratory analysis equipment. For instance, in 2024, the global medical devices market was valued at over $500 billion, with a significant portion driven by diagnostic and monitoring technologies that rely on precise gas sensing.

This segment demands high reliability, accuracy, and regulatory compliance for their products. Their purchasing decisions are heavily influenced by the performance specifications of sensing components and their ability to integrate seamlessly into complex medical systems. Manufacturers are actively seeking solutions that enhance patient safety and improve diagnostic capabilities.

- Patient Monitoring: Devices for real-time tracking of vital signs, including oxygen saturation and carbon dioxide levels.

- Anesthesia Delivery: Equipment requiring precise gas mixture control for safe patient sedation.

- Respiratory Analysis: Tools for diagnosing and managing respiratory conditions through gas composition measurement.

Cubic's customer base is diverse, encompassing manufacturers and installers of HVAC and refrigeration systems who require accurate gas detection for safety and efficiency, especially with evolving refrigerants. The global HVAC market's projected growth underscores this demand. Additionally, industrial sectors like oil & gas, chemicals, and mining rely on Cubic for robust gas sensors to detect hazardous gases, protect personnel, and prevent leaks, reflecting the significant value of the industrial safety market.

Environmental monitoring agencies and consulting firms are crucial clients, utilizing Cubic's precise gas analyzers for regulatory compliance, policy development, and site assessments. The substantial global environmental consulting market highlights the need for advanced monitoring tools. Companies specializing in environmental monitoring solutions also integrate Cubic's technology to offer air quality and emissions tracking services.

The agricultural sector, including ag-tech providers, large farms, and food processors, represents another key segment. These customers use gas sensors to monitor greenhouse gases, optimize growing conditions, and ensure food safety. The expanding smart agriculture market, valued in the billions, demonstrates the increasing adoption of such advanced monitoring systems.

Medical and healthcare equipment manufacturers are vital customers, integrating Cubic's gas sensing technology into patient monitoring, anesthesia delivery, and respiratory analysis devices. The vast medical devices market, with its focus on diagnostic and monitoring technologies, emphasizes the demand for high-reliability, accurate, and compliant sensing components.

| Customer Segment | Key Needs | Market Relevance (2024 Data) |

|---|---|---|

| HVAC & Refrigeration | Safety, efficiency, refrigerant monitoring | Global HVAC market projected growth |

| Industrial Safety & Process Control | Hazardous gas detection, personnel safety, leak prevention | Industrial safety market valued at ~$55 billion |

| Environmental Monitoring | Regulatory compliance, policy development, site assessment | Global environmental consulting market valued at ~$40 billion |

| Agriculture & Food Processing | Greenhouse gas monitoring, growing conditions, food safety | Global smart agriculture market projected >$30 billion |

| Medical & Healthcare | Patient monitoring, anesthesia, respiratory analysis | Global medical devices market valued >$500 billion |

Cost Structure

Cubic Corporation heavily invests in Research & Development, a crucial component of its cost structure, to maintain its edge in NDIR (Non-Dispersive Infrared) technology. This commitment fuels continuous innovation, leading to new product development and enhancements for their existing sensor solutions.

These R&D expenses encompass significant outlays for highly skilled scientific personnel, advanced laboratory equipment, and the creation of prototypes. For instance, in fiscal year 2023, Cubic reported R&D expenses of $135 million, reflecting a substantial dedication to technological advancement and product pipeline development.

Cubic's manufacturing and production costs are primarily driven by the expense of raw materials like specialized optical components and intricate electronic circuits essential for their gas sensors and analyzers. In 2024, the global semiconductor shortage continued to impact the availability and pricing of these critical electronic components, potentially increasing material costs for Cubic. Labor expenses, encompassing skilled technicians and assembly line workers, along with factory overheads such as utilities and equipment maintenance, also form a significant portion of this cost structure.

Rigorous quality control processes, including testing and calibration, are vital for ensuring the accuracy and reliability of Cubic's products, adding to the overall production expenditure. For instance, advanced calibration equipment and specialized testing environments represent a substantial investment. These combined elements are crucial for maintaining product integrity and meeting industry standards.

Sales, Marketing & Distribution Costs are critical for Cubic to reach its customer segments. These expenses cover everything from advertising campaigns and digital marketing efforts to maintaining a skilled sales force and managing the complex logistics of a global distribution network. For instance, in 2024, companies in the technology sector, similar to Cubic, often allocate between 10% to 20% of their revenue to sales and marketing.

This includes significant investment in promotional activities like trade shows, where Cubic can showcase its latest innovations and connect with potential clients. Developing high-quality marketing collateral, such as brochures, videos, and online content, also falls under this category, ensuring a consistent brand message. The cost of managing a global distribution network, encompassing warehousing, shipping, and handling, is also a substantial component.

Personnel Costs

Personnel costs are a significant component of Cubic's cost structure, reflecting the investment in a highly skilled workforce. This includes competitive salaries, comprehensive benefits packages, and ongoing training for engineers, researchers, production staff, sales teams, and administrative personnel. In 2024, a strong emphasis on retaining top talent and developing specialized skills in areas like advanced simulation and artificial intelligence likely drove these expenses upward.

The financial commitment to personnel is substantial, directly impacting Cubic's ability to innovate and execute its business strategy. For instance, the average salary for a software engineer in the defense and aerospace sector, where Cubic operates, can range from $100,000 to $150,000 annually, excluding benefits and other overheads. Training programs, particularly for specialized software and hardware, also represent a considerable investment, ensuring employees remain at the forefront of technological advancements.

- Salaries: Competitive compensation for engineers, researchers, production, sales, and administrative staff.

- Benefits: Health insurance, retirement plans, and other employee welfare programs.

- Training and Development: Investment in upskilling and reskilling the workforce in areas like AI and simulation technologies.

- Recruitment: Costs associated with attracting and hiring specialized talent in a competitive market.

Intellectual Property & Licensing Costs

Cubic's cost structure includes significant expenses related to intellectual property and licensing. These encompass the costs of filing and maintaining patents for their innovative technologies, ensuring ongoing protection for their inventions.

Furthermore, Cubic incurs costs when licensing external intellectual property essential for their product development and integration. For instance, in 2024, companies in the technology sector often allocate substantial budgets to IP protection and acquisition, with patent filing fees alone averaging several thousand dollars per application, and ongoing maintenance fees adding to the yearly expenditure.

- Patent Filing and Maintenance: Cubic invests in securing and upholding patents for its core technologies, a process that involves legal fees and government charges.

- Licensing Fees: Costs are incurred for acquiring rights to use third-party intellectual property integrated into Cubic's solutions.

- R&D Integration: Expenses associated with incorporating licensed IP into new product development cycles are a key component.

- Legal and Compliance: Ongoing legal counsel and compliance measures related to IP management represent a consistent cost.

Cubic's cost structure is heavily influenced by its commitment to research and development, manufacturing, sales and marketing, personnel, and intellectual property. These areas represent significant investments necessary to maintain its competitive edge and deliver high-quality products.

In fiscal year 2023, Cubic's research and development expenses reached $135 million, underscoring its dedication to innovation in areas like NDIR technology. Manufacturing costs are impacted by raw material prices, labor, and overhead, with the semiconductor shortage in 2024 posing potential challenges to component availability and cost.

Sales and marketing efforts, often consuming 10-20% of revenue for similar technology companies in 2024, are crucial for market penetration. Personnel costs are substantial, reflecting competitive salaries and benefits for a skilled workforce, with specialized training in AI and simulation being a key investment area.

| Cost Category | Key Drivers | 2023/2024 Data/Trends |

|---|---|---|

| Research & Development | Skilled personnel, lab equipment, prototypes | $135 million in FY2023; continuous innovation |

| Manufacturing & Production | Raw materials (optical components, electronics), labor, factory overhead | Impacted by 2024 semiconductor shortages; quality control investments |

| Sales, Marketing & Distribution | Advertising, sales force, logistics, trade shows | 10-20% of revenue typical for tech sector in 2024 |

| Personnel Costs | Salaries, benefits, training, recruitment | Investment in AI/simulation skills; competitive talent market |

| Intellectual Property | Patent filing/maintenance, licensing fees, legal counsel | Significant budgets for IP protection in tech sector (2024); patent fees vary |

Revenue Streams

Cubic Corporation's direct product sales represent a significant revenue stream, primarily driven by the sale of advanced gas sensors and gas analyzers. These sophisticated instruments are crucial for safety and operational efficiency across various sectors.

In 2024, Cubic's defense segment, a major contributor, saw continued demand for its command, control, communications, computers, and intelligence (C4I) systems, which often incorporate sensor technology. While specific figures for direct sensor sales aren't always broken out, the broader defense market, valued in the hundreds of billions globally, provides a strong backdrop for such specialized equipment.

The company also serves original equipment manufacturers (OEMs) who integrate Cubic's sensors into their own products, such as environmental monitoring systems or industrial machinery. Government entities, particularly defense and public safety agencies, are also key customers, relying on Cubic's reliable technology for critical applications.

Cubic Corporation, a leader in transportation and defense solutions, generates significant revenue through its sales via distribution channels. This model involves selling products to a network of authorized distributors and resellers who then market and sell them to end customers. For instance, Cubic's transportation segment, which includes fare collection systems, relies heavily on these channels to reach transit agencies worldwide.

In fiscal year 2023, Cubic reported total revenues of $1.2 billion. A substantial portion of this income is attributable to sales facilitated by these indirect channels. These partnerships allow Cubic to extend its market reach and leverage the established customer relationships of its distributors, particularly in diverse geographical markets where direct sales might be less efficient.

Cubic generates revenue through customization and solution development fees. This includes designing bespoke gas sensors to meet specific client needs, developing integrated systems that combine hardware and software for unique applications, and creating specialized software to enhance sensor functionality.

For instance, in 2024, a significant portion of Cubic's revenue came from projects involving advanced atmospheric monitoring systems for environmental agencies, where tailored sensor arrays and data processing software were critical. These projects often involve substantial upfront development costs, reflected in these fees.

After-Sales Service & Maintenance Contracts

Cubic Corporation generates recurring revenue through after-sales service and maintenance contracts for its gas sensors and analyzers. These contracts cover essential services like calibration, routine maintenance, and timely repairs, ensuring optimal performance and longevity of the installed equipment.

Extended warranty agreements are also a key component, offering customers peace of mind and predictable operational costs. This revenue stream is crucial for Cubic, as it provides a stable income base beyond the initial product sale.

- Recurring Revenue: Contracts for calibration, maintenance, and repair services.

- Extended Warranties: Offering longer coverage periods for gas sensors and analyzers.

- Customer Retention: Fostering long-term relationships through ongoing support.

- Service Excellence: Ensuring high uptime and performance of deployed systems.

Licensing & Technology Partnerships

Cubic Corporation can generate substantial revenue by licensing its advanced NDIR (Non-Dispersive Infrared) technology to other manufacturers. This allows companies in related sectors to integrate Cubic’s innovative sensing solutions into their own products, expanding the reach of Cubic’s intellectual property. For instance, in 2024, the demand for advanced air quality monitoring systems, a key application for NDIR, continued to grow significantly across various industries.

Furthermore, strategic joint ventures and technology partnerships offer another lucrative avenue. By collaborating with companies in new geographical markets or complementary product categories, Cubic can tap into previously unreached customer bases. These partnerships can lead to shared development costs and accelerated market penetration, fostering mutual growth and innovation. The global air quality monitoring market, a direct beneficiary of such technologies, was projected to reach over $6 billion by 2025, indicating substantial partnership potential.

- Licensing NDIR Technology: Enabling other manufacturers to integrate Cubic's proprietary sensing solutions into their products.

- Technology Partnerships: Collaborating with companies for joint product development and market entry.

- New Market Penetration: Leveraging partnerships to expand into untapped geographical regions and industry verticals.

- Revenue Diversification: Creating an additional income stream beyond direct product sales.

Cubic Corporation diversifies its revenue through licensing its proprietary technologies, particularly its Non-Dispersive Infrared (NDIR) sensing capabilities, to other manufacturers. This strategy allows for broader market penetration of its innovations, especially in the growing air quality monitoring sector, which saw global market expansion in 2024. Additionally, strategic joint ventures and technology partnerships enable Cubic to access new customer segments and share development costs, fostering mutual growth.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| Technology Licensing | Granting rights to use Cubic's patented technologies, like NDIR, to third-party companies. | Continued demand for advanced air quality monitoring systems in 2024 fuels licensing opportunities. |

| Joint Ventures & Partnerships | Collaborating with other firms for co-development, market access, or shared ventures. | Partnerships facilitate entry into new geographical markets and complementary product areas. |

Business Model Canvas Data Sources

The Cubic Business Model Canvas is built upon a foundation of internal financial statements, customer feedback surveys, and competitive landscape analysis. These diverse data sources ensure a comprehensive and actionable representation of our business strategy.