Garanti PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Garanti Bundle

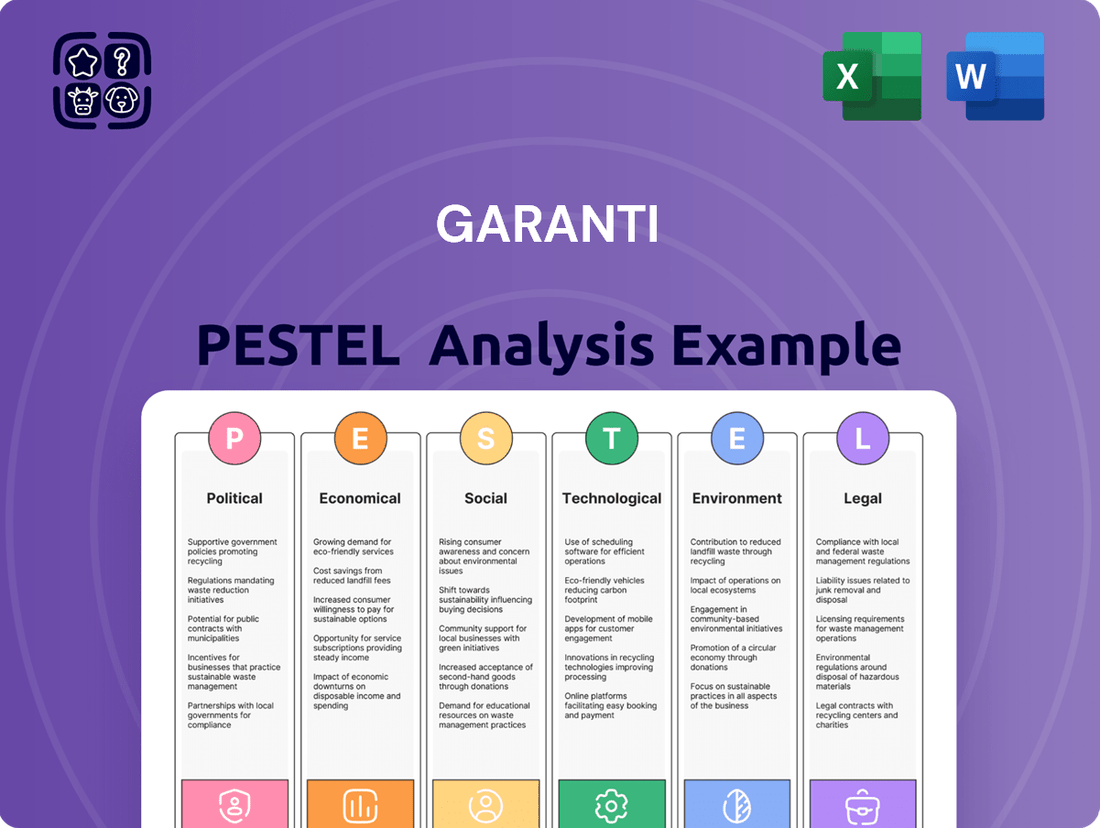

Unlock the strategic landscape surrounding Garanti with our comprehensive PESTLE analysis. Understand the intricate interplay of political, economic, social, technological, legal, and environmental factors shaping its future. Equip yourself with the foresight needed to navigate market complexities and capitalize on emerging opportunities. Download the full analysis now to gain actionable intelligence that drives informed decision-making.

Political factors

The stability of the Turkish government and the predictability of its economic policies are paramount for investor confidence, especially within the banking sector. Recent policy adjustments, such as a move towards tighter monetary policy, have garnered favorable attention from credit rating agencies, signaling a potential for improved economic management.

Maintaining this more conventional policy stance is critical for sustained financial stability and attracting foreign investment. For instance, the Turkish Lira showed some resilience in early 2024 following the central bank's commitment to tighter monetary policy, a trend investors will closely monitor for consistency throughout 2024 and into 2025.

The regulatory environment in Turkey, primarily shaped by the Banking Regulation and Supervision Agency (BRSA) and the Central Bank of the Republic of Turkey (CBRT), directly influences Garanti BBVA's operational scope and strategic decisions. These bodies set the rules for everything from capital adequacy to consumer protection, impacting how banks conduct business.

Recent regulatory shifts are particularly noteworthy for Garanti BBVA. For instance, the BRSA's ongoing focus on digital banking and fintech innovation, alongside evolving regulations for crypto assets, presents both opportunities and compliance challenges. Furthermore, Turkey's commitment to strengthening Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) standards, aligning with international best practices, adds another layer of operational complexity and scrutiny for financial institutions like Garanti BBVA.

Turkey's strategic location creates both opportunities and challenges, directly impacting Garanti BBVA. Its relationships with the EU, the US, and regional powers influence trade agreements and foreign direct investment flows. For instance, ongoing geopolitical tensions in Eastern Europe and the Middle East can create volatility in global markets, indirectly affecting investor confidence in emerging economies like Turkey.

While direct impacts of global tariffs on Turkish banks are often minimal, shifts in international trade policies can alter the economic landscape. The Turkish banking sector, including Garanti BBVA, is sensitive to changes in global economic sentiment driven by geopolitical events. For example, the World Bank's projected global growth rate for 2024, while revised upwards, still faces headwinds from ongoing conflicts and trade disputes.

Monetary Policy and Central Bank Autonomy

The Central Bank of the Republic of Turkey's (CBRT) monetary policy is a critical political factor impacting Garanti BBVA. Decisions on interest rates and reserve requirements directly affect the bank's funding costs, lending margins, and overall profitability. For instance, a higher policy rate generally increases the cost of borrowing for Garanti, potentially squeezing net interest margins if lending rates do not adjust proportionally.

The CBRT's stated commitment to disinflation and its ongoing efforts to bolster foreign exchange reserves are significant political considerations. As of early 2024, Turkey's inflation rate remained elevated, prompting the CBRT to maintain a tight monetary stance. For example, the policy rate was held at 45% in early 2024, reflecting the central bank's focus on price stability. This stance influences the broader economic environment in which Garanti operates, affecting loan demand and asset quality.

- Policy Rate Impact: The CBRT's policy rate, which stood at 45% in Q1 2024, directly influences Garanti BBVA's cost of funds and its ability to price loans competitively.

- Disinflationary Goals: The central bank's success in controlling inflation is crucial for economic stability, impacting consumer confidence and borrowing appetite for Garanti's customers.

- FX Reserve Management: Efforts to rebuild foreign exchange reserves can affect currency stability, which is vital for banks engaged in foreign currency transactions and managing international exposures.

Fiscal Policy and Public Spending

Government fiscal policies, particularly public spending and tax reforms, are instrumental in shaping domestic demand and controlling inflation. For instance, Turkey's government has focused on fiscal discipline to support its disinflationary goals.

Tightening fiscal policy, when aligned with monetary policy, is considered essential for reducing inflation and fostering a more stable economic climate, which directly impacts the banking sector. In 2024, the Turkish government aimed to maintain a prudent fiscal stance, with the budget deficit projected to be around 6.4% of GDP, a reduction from previous years, signaling a commitment to fiscal consolidation.

Key fiscal measures include:

- Public Spending Controls: Efforts to manage and potentially reduce non-essential government expenditures to curb aggregate demand.

- Tax Reforms: Adjustments to tax policies, such as potential increases in certain tax revenues or efficiency improvements in tax collection, to bolster government finances.

- Fiscal Deficit Management: A focus on reducing the budget deficit to alleviate inflationary pressures and improve macroeconomic stability.

- Coordination with Monetary Policy: Ensuring that fiscal actions complement the central bank's efforts to bring down inflation, creating a unified front against price instability.

Political stability and predictable economic policies are crucial for investor confidence in Turkey's banking sector. The government's commitment to tighter monetary policy, evidenced by the Central Bank of the Republic of Turkey's (CBRT) policy rate remaining at 45% in Q1 2024, signals a focus on disinflation and economic stability.

The regulatory framework, overseen by bodies like the Banking Regulation and Supervision Agency (BRSA), directly shapes Garanti BBVA's operations, with recent emphasis on digital banking and robust AML/CTF standards. Geopolitical positioning and international relations also influence foreign investment flows and market sentiment, with global economic growth forecasts for 2024 still subject to geopolitical headwinds.

Fiscal discipline is a key government objective, with efforts to manage public spending and reduce the budget deficit, projected at 6.4% of GDP for 2024, to support disinflationary goals and enhance macroeconomic stability.

| Factor | Description | Impact on Garanti BBVA | 2024/2025 Data/Outlook |

|---|---|---|---|

| Political Stability | Government stability and policy predictability. | Influences investor confidence and economic outlook. | Government focused on economic reforms and stability. |

| Monetary Policy | CBRT's interest rate and inflation control measures. | Affects funding costs, lending margins, and profitability. | Policy rate at 45% (Q1 2024) to combat inflation. |

| Regulatory Environment | BRSA and CBRT regulations on banking operations. | Dictates operational scope, compliance, and innovation. | Focus on digital banking, fintech, and AML/CTF. |

| Fiscal Policy | Government spending, taxation, and deficit management. | Impacts domestic demand, inflation, and economic climate. | Targeting a 6.4% budget deficit for 2024; fiscal consolidation. |

| Geopolitics | Turkey's international relations and regional stability. | Affects trade, FDI, and global market sentiment. | Navigating regional tensions while seeking international partnerships. |

What is included in the product

This Garanti PESTLE analysis dissects the external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—that influence the bank's operations and strategic landscape.

Provides a clear, actionable overview of external factors impacting Garanti, simplifying complex market dynamics for strategic decision-making.

Economic factors

Turkey has grappled with elevated inflation, a persistent issue that erodes purchasing power and the real worth of investments. For instance, Turkey's annual inflation rate stood at 64.77% in April 2024, a slight decrease from 68.50% in March 2024, but still significantly high.

In response, the Central Bank of the Republic of Turkey (CBRT) has implemented substantial interest rate hikes. The policy rate was raised to 50% in March 2024, a move aimed at curbing inflation. These monetary policy decisions directly influence Garanti BBVA's financial performance by affecting its net interest margins, the cost of acquiring funds, and the overall demand for loans.

Turkey's economic growth rate, a key driver for Garanti BBVA, has experienced some moderation. For instance, the Turkish economy grew by 4.5% in 2023, a slowdown from the 5.6% in 2022. This moderation in overall growth directly impacts domestic demand, influencing factors like loan demand and overall business activity for the bank.

Despite this moderation, the outlook suggests a smooth adjustment is anticipated, largely dependent on the effectiveness of policy mixes. A stable economic environment fostered by prudent fiscal and monetary policies would likely support a rebound in domestic demand, thereby benefiting Garanti BBVA's lending and operational performance.

Currency volatility, particularly the Turkish Lira's fluctuations against major currencies like the US Dollar and Euro, significantly impacts Garanti BBVA's financial health. For instance, in early 2024, the Lira experienced notable depreciation, increasing the cost of foreign currency-denominated liabilities and affecting the valuation of foreign currency assets.

These exchange rate movements directly influence Garanti's balance sheet by altering the Lira equivalent of its foreign currency deposits and loans. The bank's strategy to manage this involves hedging instruments and encouraging Lira deposits to mitigate the risks associated with dollarization, a key concern for financial stability in Turkey.

Credit Market Conditions and Asset Quality

The health of Turkey's credit market is a critical determinant of Garanti BBVA's performance. As of early 2024, loan growth has shown resilience, but concerns about rising interest rates and potential economic slowdowns could impact future expansion. Non-performing loan (NPL) ratios, a key indicator of asset quality, have remained relatively stable, benefiting from prudent risk management. However, ongoing monitoring is essential as economic headwinds could test this stability.

Regulatory interventions, such as potential loan growth caps, can directly influence Garanti BBVA's ability to expand its loan portfolio and generate interest income. Furthermore, the cost of risk, which reflects the expected losses on loans, is influenced by macroeconomic factors and borrower creditworthiness. For instance, if the Turkish economy experiences higher inflation or currency depreciation, the cost of risk could increase, impacting profitability.

- Loan Growth: Turkish banks, including Garanti BBVA, have navigated varying loan growth environments, with cautious optimism for 2024, though subject to monetary policy shifts.

- NPL Ratios: The NPL ratio for the Turkish banking sector remained around 1.5% to 2% in late 2023 and early 2024, indicating generally sound asset quality, though sector-specific variations exist.

- Capital Buffers: Garanti BBVA maintains strong capital adequacy ratios, generally exceeding regulatory requirements, providing a buffer against potential asset quality deterioration.

- Cost of Risk: The cost of risk for Turkish banks is influenced by inflation and interest rate volatility, with projections for 2024 suggesting a need for continued vigilance in risk assessment.

External Financing and Investor Confidence

Access to external financing is vital for Turkish banks, and recent trends show a positive trajectory in regaining investor confidence. The issuance of foreign currency debt has seen an uptick, signaling renewed investor interest and improved risk perception for the Turkish banking sector. For instance, in the first half of 2024, Turkish banks successfully issued approximately $5 billion in Eurobonds, a notable increase from the same period in 2023, reflecting a more favorable international financial environment.

Improved risk premiums are a direct consequence of this growing investor confidence. The average cost of funding for Turkish banks through international markets has decreased, with credit default swap (CDS) spreads narrowing significantly. By mid-2024, Turkey's 5-year CDS spread had fallen below 300 basis points, a substantial improvement from over 500 basis points seen in late 2023, indicating a reduced perception of country risk.

However, the reliance on external funding sources remains a key consideration. While the ability to access international capital markets is a positive sign, the Turkish banking sector's ongoing need for foreign currency liquidity means it is still susceptible to shifts in global investor sentiment and changes in international monetary policy. The sustainability of this access will depend on continued economic stability and structural reforms within Turkey.

- Increased Foreign Currency Debt Issuance: Turkish banks raised around $5 billion in Eurobonds in H1 2024, up from H1 2023.

- Narrowing Risk Premiums: Turkey's 5-year CDS spread declined to below 300 bps by mid-2024, down from over 500 bps in late 2023.

- Investor Confidence Rebound: The positive trend in debt issuance and reduced risk premiums reflect a strengthening of investor confidence in the Turkish banking sector.

- Continued Reliance on External Funding: The sector's need for foreign currency liquidity makes it sensitive to global market shifts and investor appetite.

Turkey's economy continues to navigate a challenging landscape marked by high inflation and the Central Bank's aggressive monetary tightening. While annual inflation saw a slight dip to 64.77% in April 2024 from 68.50% in March, it remains elevated. The policy rate stands at 50% as of March 2024, impacting loan demand and bank margins.

Economic growth moderated to 4.5% in 2023, down from 5.6% in 2022, affecting domestic consumption. Currency volatility, particularly the Lira's depreciation in early 2024, increases foreign currency liabilities for banks like Garanti BBVA. The credit market shows resilience with NPL ratios around 1.5%-2% in late 2023/early 2024, but regulatory actions could influence loan expansion.

Investor confidence in Turkish banks is improving, evidenced by increased foreign currency debt issuance, with around $5 billion raised in H1 2024. Turkey's 5-year CDS spread narrowed to below 300 bps by mid-2024, indicating reduced country risk perception, though reliance on external funding persists.

Preview the Actual Deliverable

Garanti PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Garanti PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to a detailed breakdown of the external forces shaping Garanti's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights for understanding Garanti's operational environment and future opportunities.

Sociological factors

Turkey boasts a youthful population, with a significant portion under the age of 30. This demographic is highly comfortable with technology and rapidly adopting digital solutions. For instance, in 2024, smartphone penetration in Turkey was estimated to be over 80%, fueling the demand for mobile-first financial services.

This trend directly translates into increased demand for digital banking. Garanti BBVA, recognizing this, has been actively enhancing its digital offerings. By mid-2025, the bank aims to have over 90% of its customer transactions conducted through digital channels, reflecting the growing preference for online and mobile banking solutions.

Consumer preferences are shifting, with a notable increase in the adoption of digital and branchless banking services. In 2024, a significant portion of Turkish banking transactions, estimated to be over 70%, were conducted digitally, reflecting this trend and directly impacting how banks like Garanti BBVA design their offerings.

There's a growing demand for embedded financial services, meaning consumers expect banking functionalities to be integrated seamlessly into their everyday non-financial platforms and purchases. Garanti BBVA is responding by developing partnerships and APIs to facilitate these integrated experiences, aiming to capture a larger share of consumer financial activity.

Personalization is now a key expectation, with customers seeking tailored financial advice and product recommendations based on their individual needs and transaction history. Garanti BBVA's investment in data analytics and AI is crucial for delivering these personalized solutions, enhancing customer loyalty and satisfaction in a competitive market.

Garanti BBVA's commitment to financial inclusion is evident in its multi-channel strategy, aiming to reach a broader customer base. This includes a robust physical presence with numerous branches and ATMs, complemented by increasingly sophisticated digital platforms. For instance, as of Q1 2024, Garanti BBVA reported a significant portion of its customer transactions occurring through digital channels, highlighting the growing accessibility and adoption of its online and mobile banking services.

Trust and Reputation

Public trust is the bedrock of any financial institution, and Garanti BBVA is acutely aware of this. Maintaining a strong reputation hinges on consistent, ethical practices and open communication with customers and stakeholders. This trust directly impacts customer loyalty and the bank's ability to attract new business.

Garanti BBVA actively cultivates trust through its commitment to transparency in its operations and financial reporting. By adhering to international financial reporting standards, the bank ensures its financial health is presented clearly and accurately. This dedication to clarity is crucial for building and sustaining a positive reputation in the competitive banking landscape.

The bank's reputation is further bolstered by its proactive approach to corporate social responsibility and ethical conduct. For instance, in 2023, Garanti BBVA was recognized for its sustainability efforts, highlighting its commitment beyond just financial performance. Such initiatives are vital for fostering public confidence and reinforcing its image as a responsible corporate citizen.

Key aspects influencing trust and reputation include:

- Transparency: Clear communication of financial performance and business practices.

- Ethical Conduct: Upholding high standards in all dealings and operations.

- Customer Service: Providing reliable and responsive support to build customer loyalty.

- Corporate Social Responsibility: Engaging in initiatives that benefit society and the environment.

Labor Market Dynamics and Talent Acquisition

The availability of skilled talent, particularly in rapidly evolving fields like fintech, artificial intelligence, and digital transformation, is paramount for Garanti BBVA's ongoing innovation and competitiveness within the Turkish banking sector. The intense competition for these specialized professionals directly impacts operational expenses and the pace of strategic development, as evidenced by rising salary benchmarks for AI engineers and data scientists.

This scarcity of expertise can lead to increased recruitment costs and longer hiring cycles, potentially delaying critical technology implementations.

- Talent Competition: Banks are increasingly competing with tech companies for top AI and data science talent, driving up compensation packages.

- Skill Gaps: A noticeable gap exists between the skills required for digital banking and the current workforce's capabilities, necessitating significant investment in training and development.

- Digital Transformation Impact: The success of Garanti BBVA's digital transformation initiatives hinges on its ability to attract and retain individuals proficient in areas like cloud computing, cybersecurity, and advanced analytics.

- Operational Costs: Higher demand for specialized skills translates to increased personnel costs, affecting the bank's overall cost structure and profitability.

Sociological factors significantly shape Garanti BBVA's operational landscape, particularly concerning the youthful, tech-savvy Turkish population. This demographic's comfort with digital solutions, evidenced by over 80% smartphone penetration in 2024, drives demand for mobile-first financial services. Consequently, Garanti BBVA is prioritizing digital channels, aiming for over 90% of transactions to be digital by mid-2025, reflecting a broader societal shift towards online and branchless banking.

Technological factors

Turkey's financial sector is undergoing a significant digital transformation, bolstered by government initiatives and increasing consumer appetite for online services. This shift is a critical technological driver, reshaping how financial institutions operate and interact with customers.

Garanti BBVA is actively participating in this digital revolution, prioritizing its internet and mobile banking platforms. The bank is also investing in exploring and implementing novel digital solutions to maintain its competitive edge in this rapidly evolving landscape.

As of Q1 2024, Garanti BBVA reported that 94% of its transactions were conducted through digital channels, highlighting the profound impact of digital adoption on customer behavior and operational efficiency.

Turkey's fintech sector is booming, with over 500 active fintech companies as of early 2024, creating a dynamic landscape for established banks like Garanti BBVA. This vibrant ecosystem offers opportunities for strategic partnerships, particularly in areas like digital payments, where Turkish fintechs are innovating rapidly, and blockchain technology, which holds promise for transaction efficiency.

Garanti BBVA faces a dual challenge and opportunity in navigating this evolving fintech space. While collaboration with these agile companies, especially in the rapidly growing digital wallet and payment gateway segments, can enhance Garanti BBVA's service portfolio and customer reach, intense competition from these same players could also erode market share if not addressed proactively.

As Garanti BBVA increasingly offers digital services, the importance of strong cybersecurity and adherence to data protection regulations like GDPR and KVKK becomes critical. In 2024, the global cost of cybercrime is projected to reach $10.5 trillion annually, highlighting the significant financial and reputational risks involved. Proactive investment in advanced security protocols and ongoing compliance efforts are essential for safeguarding customer information and preserving the bank's reputation.

Artificial Intelligence (AI) and Automation

Artificial intelligence (AI) and automation are significantly reshaping the banking sector, with Garanti BBVA actively integrating these technologies. The bank is enhancing customer experience through personalized banking solutions and AI-powered customer support, aiming for greater efficiency and innovation in product development. For instance, in 2024, many leading banks reported increased customer satisfaction scores following the implementation of AI chatbots for handling routine queries, freeing up human agents for more complex issues. This trend is expected to continue, with projections indicating a substantial rise in AI adoption across financial services by 2025.

Garanti BBVA's strategic focus on AI allows it to:

- Enhance customer engagement through tailored product recommendations and proactive service.

- Streamline operations by automating repetitive tasks, leading to cost reductions and improved processing times.

- Develop innovative financial products that leverage data analytics and predictive modeling.

- Improve risk management by utilizing AI for fraud detection and credit scoring accuracy.

Blockchain and Digital Currencies

The Turkish government is actively exploring the development of a Central Bank Digital Currency, often referred to as the Digital Turkish Lira. This initiative, alongside evolving regulations for crypto assets, signals a growing integration of blockchain technology into the country's financial infrastructure. Garanti BBVA must remain attuned to these shifts, as they have the potential to fundamentally alter payment systems and transaction processing.

As of early 2024, preliminary studies and pilot programs for the Digital Turkish Lira are underway, with the Central Bank of the Republic of Turkey (CBRT) indicating a phased approach to its potential implementation. This strategic move positions Turkey to leverage the efficiencies and security offered by distributed ledger technology. For Garanti BBVA, this translates to a need for proactive adaptation, focusing on how these digital currencies and updated regulatory frameworks will impact customer transactions, operational costs, and competitive landscape. The bank's ability to integrate with or offer services related to these emerging digital assets will be crucial for maintaining its market position.

- Digital Turkish Lira Pilot Programs: The CBRT has been conducting research and pilot tests, indicating a serious commitment to exploring a CBDC.

- Evolving Crypto Regulations: Turkey is working on comprehensive regulations for crypto assets, aiming to provide clarity and security for investors and financial institutions.

- Blockchain Integration: The broader adoption of blockchain technology could streamline financial operations and introduce new service offerings for Garanti BBVA.

Technological advancements are profoundly reshaping Garanti BBVA's operational landscape, with digital transactions dominating customer interactions. The bank's commitment to digital channels is evident, with 94% of transactions occurring digitally as of Q1 2024. This digital-first approach is further amplified by Turkey's burgeoning fintech sector, which presents both partnership opportunities and competitive pressures for Garanti BBVA.

The integration of artificial intelligence (AI) and automation is a key strategic focus for Garanti BBVA, enhancing customer experience through personalized services and improving operational efficiency. Furthermore, the potential introduction of a Digital Turkish Lira and evolving crypto regulations signal a significant shift towards blockchain technology, necessitating proactive adaptation from the bank to maintain its competitive edge.

| Technology Area | Garanti BBVA's Focus/Impact | Key Data/Trend (2024/2025) |

|---|---|---|

| Digital Channels | Dominant transaction method, customer engagement | 94% of transactions via digital channels (Q1 2024) |

| Fintech Ecosystem | Partnership opportunities, competitive landscape | Over 500 active fintech companies in Turkey (early 2024) |

| AI & Automation | Customer experience, operational efficiency, product innovation | Increased customer satisfaction with AI chatbots; rising AI adoption projected by 2025 |

| Blockchain & Digital Currency | Future of payments, regulatory evolution | Ongoing pilot programs for Digital Turkish Lira; evolving crypto asset regulations |

Legal factors

Garanti BBVA navigates a complex legal landscape, primarily governed by the Banking Regulation and Supervision Agency (BRSA) and the Central Bank of the Republic of Turkey (CBRT). These bodies enforce stringent laws covering everything from capital adequacy ratios to financial reporting standards, ensuring the stability and integrity of the banking sector. For instance, as of late 2024, Turkish banks are expected to maintain a capital adequacy ratio well above the Basel III minimums, with specific requirements often exceeding 12% to bolster resilience against economic shocks.

Recent shifts in capital markets law, notably the evolving regulations around crypto assets, present both challenges and opportunities for Garanti BBVA. As the regulatory framework for digital currencies continues to solidify in 2025, the bank must adapt its compliance strategies and potentially explore new service offerings within these defined boundaries. This includes adhering to new Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols specifically designed for digital asset transactions.

Consumer protection laws, like Turkey's Law on the Protection of Consumers, are fundamental for Garanti BBVA. These regulations ensure that the bank operates with transparency and fairness across all its banking services and product offerings, from loans to digital banking. For instance, the Turkish Consumer Protection Law No. 6502 mandates clear disclosure of terms and conditions for financial products, directly impacting Garanti's customer agreements and marketing practices.

Garanti BBVA must adhere to stringent regulations designed to prevent predatory lending and misleading advertising. In 2023, the Banking Regulation and Supervision Agency (BDDK) in Turkey continued to emphasize consumer rights, with a focus on digital financial services. This means Garanti's online platforms and mobile app must meet high standards for data security and transparent fee structures, directly influencing customer trust and potential legal challenges.

Garanti BBVA, like all financial institutions, must adhere to stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations. These rules are constantly evolving, with a particular focus in 2024 and 2025 on the digital asset space. New regulations targeting Virtual Asset Service Providers (VASPs) are a key area, requiring enhanced due diligence and reporting.

A significant aspect of these updated regulations mandates robust user identification for all cryptocurrency transactions. This means Garanti BBVA and similar entities need sophisticated systems to verify customer identities, adding a layer of compliance complexity and operational cost. Failure to comply can result in substantial fines and reputational damage.

Data Protection and Privacy Laws (KVKK)

Garanti BBVA must strictly adhere to Turkey's Law on the Protection of Personal Data (KVKK) to ensure the secure handling and privacy of customer information. This involves robust data management practices for all digital interactions and financial services offered.

Compliance with KVKK is not merely a legal obligation but a critical factor in maintaining customer trust and safeguarding the bank's reputation. For instance, in 2023, financial institutions in Turkey faced increased scrutiny regarding data breaches, highlighting the importance of proactive security measures.

- KVKK Compliance: Ensuring all data processing activities align with the Personal Data Protection Law.

- Customer Data Security: Implementing advanced measures to protect sensitive customer information across all platforms.

- Digital Service Integrity: Maintaining high standards of data privacy for online banking and mobile applications.

- Regulatory Adherence: Staying updated with evolving data protection regulations and enforcement actions in Turkey.

Foreign Exchange Regulations and Payment Systems

Changes in foreign exchange regulations, such as the recent lifting of restrictions on foreign currency payments for movable sales in Turkey, can significantly influence international transactions and the operational flexibility for banks like Garanti BBVA. These shifts directly impact how cross-border payments are processed and the associated risks and opportunities.

Regulations governing payment systems are equally critical, affecting Garanti BBVA's ability to facilitate seamless domestic and international transactions for its customers. For instance, the Central Bank of the Republic of Turkey (CBRT) continuously updates regulations concerning payment infrastructure and digital payment services, aiming for greater efficiency and security. In 2024, the CBRT continued its focus on modernizing payment systems, including advancements in instant payment capabilities and the ongoing development of a central bank digital currency (CBDC) framework, which could reshape transaction landscapes.

Key considerations for Garanti BBVA include:

- Adaptation to evolving FX rules: The bank must navigate and capitalize on regulatory changes impacting foreign currency flows and hedging strategies.

- Compliance with payment system mandates: Adherence to CBRT directives on payment system operations, data security, and consumer protection is paramount.

- Innovation in digital payments: Staying abreast of and integrating new payment technologies and regulatory frameworks for digital transactions is crucial for competitive positioning.

- Cross-border payment facilitation: Understanding and complying with international payment regulations, such as those related to SWIFT and emerging digital payment networks, is essential for global business.

Garanti BBVA operates under a strict legal framework enforced by Turkish regulatory bodies like the BRSA and CBRT. These regulations dictate capital adequacy, with Turkish banks aiming for ratios exceeding 12% as of late 2024, well above Basel III minimums. Evolving laws around digital assets require adaptation in compliance, particularly for KYC and AML protocols in 2025.

Consumer protection laws, such as Law No. 6502, mandate transparency in financial products and services, impacting Garanti's customer agreements and marketing. The bank must also comply with robust AML/CTF regulations, with increased focus on digital assets and VASP identification requirements in 2024-2025.

Adherence to the Personal Data Protection Law (KVKK) is crucial for safeguarding customer information and maintaining trust, especially following increased scrutiny on data breaches in 2023. Changes in foreign exchange and payment system regulations, including the CBRT's focus on instant payments and CBDC in 2024, also significantly influence Garanti's operations.

Environmental factors

Turkey faces significant physical risks from climate change, including an increased frequency of extreme weather events like floods and droughts. These events can directly damage infrastructure, impacting supply chains and business operations, which in turn could affect loan repayment capabilities for sectors heavily reliant on stable conditions, such as agriculture.

For a financial institution like Garanti BBVA, these physical risks translate into potential impacts on its loan portfolio. For instance, a severe drought in 2024 could significantly reduce agricultural yields, increasing the likelihood of defaults in the farming sector. Similarly, extreme heat waves can disrupt energy supply and increase operational costs for businesses, indirectly affecting their financial health.

The global shift towards a low-carbon economy presents significant transition risks for industries heavily reliant on fossil fuels, impacting the financial institutions that support them. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully operational in 2026, will impose costs on carbon-intensive imports, potentially affecting Turkish exports and the banks financing these sectors. This necessitates a proactive approach to evaluating financed emissions and adapting lending portfolios.

Consequently, there's a growing focus on green finance and sustainable banking. By 2024, many financial institutions are expected to integrate climate-related financial disclosures, aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). Garanti BBVA, as a major player, is likely enhancing its strategies to support green projects and manage the environmental impact of its financing activities, reflecting a broader industry trend towards sustainability.

The increasing emphasis on Environmental, Social, and Governance (ESG) criteria significantly shapes investment choices and business planning. Investors and regulators are prioritizing companies that demonstrate strong ESG performance, leading to a greater focus on sustainability and ethical practices across industries.

Garanti BBVA is actively embedding ESG principles into its core operations, financial reporting, and lending strategies, mirroring a broader trend among Turkish financial institutions. This includes developing green financing products and enhancing transparency in its sustainability disclosures, aligning with global best practices.

In 2023, Garanti BBVA reported a significant portion of its loan portfolio, specifically 10.7% or TRY 69.9 billion, was directed towards sustainable projects, highlighting a tangible commitment to ESG integration. This focus is crucial for attracting capital and maintaining stakeholder trust in an evolving market landscape.

Regulatory Requirements for Green Assets and Climate Risk Reporting

New regulations are emerging in Turkey that mandate financial institutions, including banks, to actively measure and disclose their green asset ratios. This signifies a significant regulatory push towards environmental accountability within the banking sector.

Furthermore, these regulations require Turkish banks to conduct thorough assessments of their exposure to climate-related financial risks. This proactive approach aims to integrate climate considerations into the core risk management frameworks of financial institutions.

For instance, as of early 2024, the Banking Regulation and Supervision Agency (BDDK) has been actively developing guidelines for climate risk management, with implementation expected to ramp up throughout 2024 and 2025. This includes expectations for scenario analysis and stress testing related to climate events.

- Green Asset Ratio Reporting: Banks will need to quantify the proportion of their assets that are environmentally sustainable.

- Climate Risk Assessment: A mandate to evaluate potential financial impacts arising from climate change, both physical and transitional.

- Regulatory Oversight: Increased scrutiny from bodies like the BDDK on environmental, social, and governance (ESG) performance.

- Data Disclosure: Growing pressure for transparency in reporting climate-related financial disclosures, aligning with international standards.

Resource Scarcity and Sustainable Operations

Resource scarcity, particularly concerning water and energy, presents a significant environmental factor for banks like Garanti. These issues impact not only the bank's direct operational footprint but also the long-term sustainability of the businesses it chooses to finance. For instance, increased energy costs due to scarcity can affect the profitability of commercial clients, influencing loan performance.

Garanti, like other financial institutions, is increasingly focused on reducing its own environmental impact. This involves adopting more sustainable operational practices, such as investing in energy-efficient technologies and exploring renewable energy sources for its branches and data centers. This proactive approach aligns with growing investor and regulatory expectations for corporate environmental responsibility.

The bank's lending portfolio is also under scrutiny regarding resource intensity. Financing sectors heavily reliant on scarce resources, such as water-intensive agriculture or fossil fuel extraction, carries inherent risks. Garanti's strategy likely involves assessing and managing these risks, potentially by favoring or incentivizing clients who demonstrate strong resource management and a transition towards more sustainable models.

- Water Scarcity: Regions where Garanti operates may face increasing water stress, impacting sectors like textiles and agriculture, which are significant borrowers.

- Energy Consumption: Banks' large physical infrastructure and data processing demands contribute to energy consumption, making efficiency and renewable sourcing crucial.

- Renewable Energy Adoption: Garanti may be exploring or implementing the use of solar or wind power for its facilities to reduce its carbon footprint and operational costs.

- Sustainable Financing: The bank's lending policies are likely evolving to incorporate environmental risk assessments, potentially offering better terms for businesses with strong sustainability credentials.

Turkey's vulnerability to climate change, including extreme weather events, poses direct risks to Garanti BBVA's loan portfolio, particularly impacting sectors like agriculture. The global push towards a low-carbon economy, exemplified by the EU's CBAM, also introduces transition risks for financed industries, necessitating adaptation in lending strategies.

Garanti BBVA is actively integrating ESG principles, evidenced by directing 10.7% of its loan portfolio, or TRY 69.9 billion, towards sustainable projects in 2023. New regulations are mandating green asset ratio reporting and climate risk assessments for Turkish banks, with the BDDK developing guidelines throughout 2024-2025.

Resource scarcity, especially water and energy, affects both Garanti's operations and its clients' financial health, driving the bank towards sustainable practices and potentially favoring clients with strong resource management. This aligns with increasing investor and regulatory demands for corporate environmental responsibility.

PESTLE Analysis Data Sources

Our Garanti PESTLE Analysis is built on a robust foundation of data from reputable financial institutions like the World Bank and IMF, alongside government economic reports and industry-specific market research. This comprehensive approach ensures that our insights into political, economic, social, technological, legal, and environmental factors are accurate and actionable.