Garanti Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Garanti Bundle

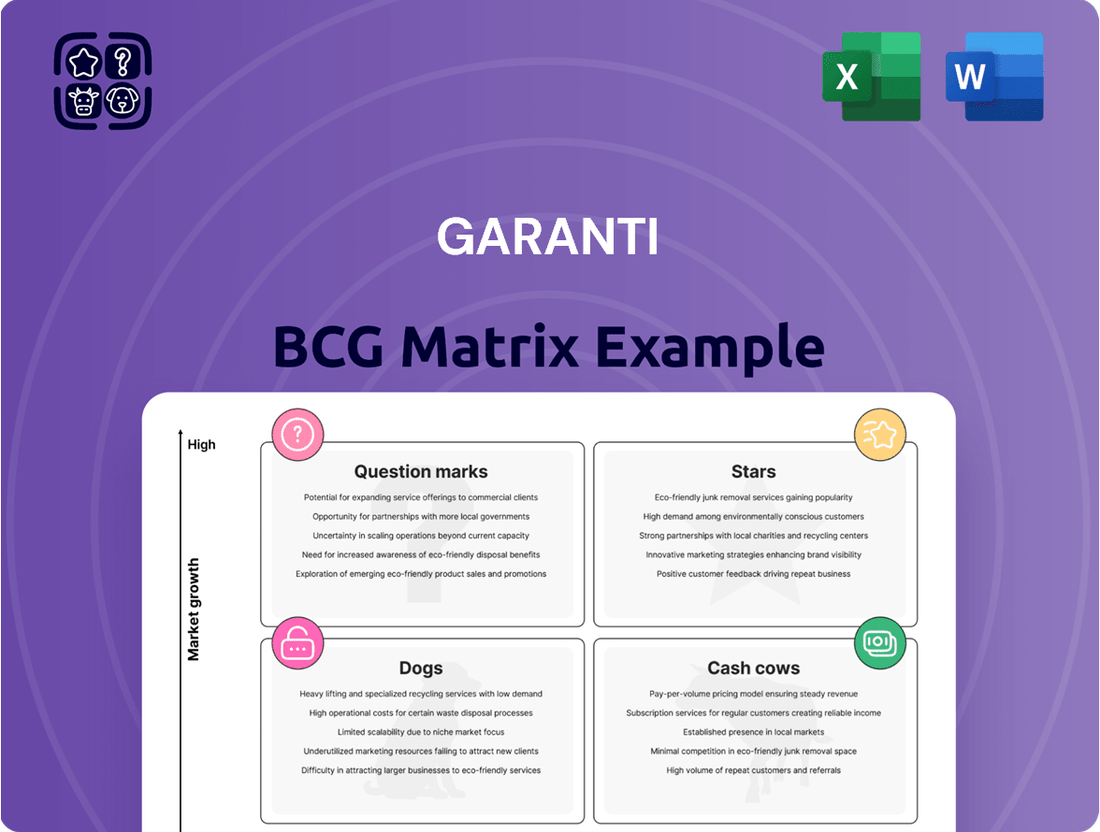

Uncover the strategic positioning of this company's product portfolio with our insightful Garanti BCG Matrix preview. See where its offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and begin to understand the dynamics at play.

Ready to transform this understanding into actionable strategy? Purchase the full Garanti BCG Matrix for a comprehensive breakdown of each quadrant, data-driven recommendations, and a clear roadmap for optimizing your investments and product development.

Don't just glimpse the potential; seize it. Get the complete report today and equip yourself with the insights needed to make confident, impactful business decisions.

Stars

Digital Banking and Mobile Platforms represent a Stars segment for Garanti BBVA. With nearly 17 million active mobile customers and 98% of transactions occurring outside branches by Q1 2025, the bank dominates this high-growth market. The sheer volume of 2.7 billion logins in the first half of 2024 underscores the platform's immense popularity and engagement.

Garanti BBVA's sustainable finance initiatives are a prime example of a "Star" in the BCG matrix. By May 2025, they had already surpassed their TL 400 billion target for 2018-2025, demonstrating robust growth and market leadership in this burgeoning sector. This success is fueled by increasing global demand for environmentally and socially responsible investments, with the bank setting an even more ambitious TL 3.5 trillion target for 2029.

Garanti BBVA has solidified its position in consumer and micro-SME lending, capturing a larger slice of the market among private banks and reinforcing its dominance in Turkish lira lending. This growth is fueled by persistent demand for retail loans, especially consumer credit cards and general-purpose loans, highlighting a vibrant and expanding segment.

The bank's commitment to digital innovation for its SME clientele is a key driver, enhancing accessibility and service for this crucial customer base. For instance, in 2023, Garanti BBVA's loan portfolio saw significant expansion, with consumer loans growing by approximately 50% year-on-year, reflecting this strong market demand and strategic focus.

AI-driven Customer Experience Solutions

AI-driven Customer Experience Solutions, a key component of Garanti BBVA's strategic growth, represents a Stars category due to its high market growth and strong competitive position. The bank’s substantial investments in AI and digitalization are designed to elevate customer interactions, catering to its 16.7 million digital platform users with tailored offerings. This focus is crucial for maintaining a competitive edge in a rapidly evolving financial landscape.

Garanti BBVA is actively leveraging AI to deliver hyper-personalized and context-aware customer journeys. This strategic push aims to redefine banking services by offering real-time, relevant solutions that anticipate customer needs. By 2025, the bank intends to solidify its leadership in this area through continuous innovation and a deep understanding of customer behavior.

- High Growth Potential: AI in banking is a rapidly expanding sector, with projections indicating significant market growth driven by increased adoption of advanced technologies.

- Customer Centricity: Garanti BBVA's 16.7 million digital platform customers benefit from personalized solutions, enhancing engagement and loyalty.

- Innovation Focus: Investments in AI and digitalization are central to the bank's strategy for financial innovation and competitive differentiation.

- Strategic Priority: Hyper-personalization and real-time contextual interactions are key objectives for the bank's customer experience strategy through 2025.

International Operations (e.g., Garanti BBVA Romania)

Garanti BBVA's international operations, exemplified by Garanti BBVA Romania, are performing exceptionally well. In 2024, these subsidiaries achieved a notable 28.6% surge in net revenues, underscoring their robust financial health and market competitiveness.

The growth is further evidenced by significant increases in lending volumes across all segments. Consumer loans, in particular, saw a remarkable expansion of 33.9%, indicating strong demand and successful market penetration for Garanti BBVA's offerings in these regions.

- Strong Revenue Growth: Net revenues for international operations, including Garanti BBVA Romania, rose by 28.6% in 2024.

- Lending Volume Expansion: Significant growth was observed in lending, with consumer loans up by 33.9%.

- Market Penetration: These subsidiaries demonstrate high growth in their respective markets, contributing positively to the bank's global portfolio.

Stars in Garanti BBVA's BCG matrix represent high-growth, high-market-share segments. Digital banking, sustainable finance, and AI-driven customer experiences are key examples. These areas are characterized by substantial customer engagement, significant revenue growth, and strategic investments aimed at future leadership.

Garanti BBVA's digital platforms, with 16.7 million users, and its international operations, which saw a 28.6% net revenue surge in 2024, exemplify this Star category. The bank's commitment to AI innovation and sustainable finance, evidenced by surpassing its TL 400 billion target, further solidifies these segments as Stars with strong growth potential and market dominance.

| Segment | Market Growth | Market Share | Key Metrics |

|---|---|---|---|

| Digital Banking | High | High | 16.7M active mobile customers, 2.7B logins (H1 2024) |

| Sustainable Finance | High | High | Exceeded TL 400B target (2018-2025), new TL 3.5T target (2029) |

| AI-driven CX | High | High | Elevating customer interactions for 16.7M digital users |

| International Operations (e.g., Romania) | High | High | 28.6% net revenue growth (2024), 33.9% consumer loan growth |

What is included in the product

The Garanti BCG Matrix categorizes business units by market share and growth, guiding investment decisions.

Garanti BCG Matrix provides a clear visual of your portfolio, alleviating the pain of indecision on resource allocation.

Cash Cows

Garanti BBVA's Turkish Lira customer deposits are a prime example of a Cash Cow. The bank boasts the largest TL customer deposit portfolio among private banks, holding a significant 21.7% market share.

These deposits are the bedrock of Garanti's funding, making up a substantial 70% of its total assets. This dominance in a mature market segment ensures a steady and dependable funding source, capable of generating consistent returns without requiring substantial new investment.

The robust 37% year-over-year increase in TL time deposits further solidifies this position, highlighting the ongoing strength and attractiveness of this core business for Garanti BBVA.

Garanti BBVA's established corporate and commercial lending portfolios are true cash cows. With a total loan portfolio exceeding TL 2 trillion and a commanding 19.9% market share in Turkish Lira commercial loans among private banks, these segments are the bedrock of the bank's consistent cash generation in a mature market.

Garanti BBVA's payment systems, encompassing both issuing and acquiring, are robust cash cows. The bank secured the top spot in both these segments in 2024, demonstrating a commanding presence in a core banking function.

This leadership translates into consistent and significant fee income, a testament to the maturity and profitability of these services. The established infrastructure requires minimal further investment to maintain market dominance and revenue generation.

Further strengthening this position, Garanti BBVA has forged strategic alliances, like its collaboration with Worldline for instant payment solutions, reinforcing its competitive edge in this vital area.

Mortgage and General Purpose Loan (GPL) Portfolios

Garanti BBVA's mortgage and General Purpose Loan (GPL) portfolios represent significant cash cows within its lending operations. As of March 2025, GPLs constituted 18% of the bank's total loan book, while credit cards, a closely related product, made up a substantial 36%.

These established lending products are crucial for generating consistent interest income. Their mature market status and ongoing consumer demand contribute to a stable cash flow for Garanti BBVA.

- GPLs represent 18% of the loan portfolio as of March 2025.

- Credit cards account for 36% of the loan portfolio as of March 2025.

- These products provide a stable source of interest income.

- They hold a high market share due to consistent demand.

Extensive Branch Network and ATM Services

Garanti BBVA maintains a significant presence through its extensive physical branch network and ATM services, catering to over 28 million customers. This robust traditional infrastructure signifies a substantial market share in a mature banking channel, ensuring fundamental accessibility for a broad customer base.

This established network generates stable, recurring income from long-standing customer relationships. Despite the ongoing digital transformation, these physical touchpoints remain a cornerstone of Garanti BBVA's operations, contributing to its position as a cash cow.

- Over 28 million customers served

- High market share in mature service channels

- Stable, recurring income generation

- Fundamental banking accessibility

Cash Cows are business units or products that have a high market share in a mature industry, generating more cash than they consume. Garanti BBVA's Turkish Lira customer deposits, with a 21.7% market share among private banks, exemplify this. These deposits form a substantial 70% of its total assets, providing a stable funding source with consistent returns, further bolstered by a 37% year-over-year increase in TL time deposits.

| Business Segment | Market Share (Private Banks) | Key Metric | Cash Cow Indicator |

|---|---|---|---|

| TL Customer Deposits | 21.7% | 70% of Total Assets | Stable funding, consistent returns |

| Corporate & Commercial Loans | 19.9% (TL Commercial Loans) | > TL 2 Trillion Portfolio | Consistent cash generation |

| Payment Systems (Issuing & Acquiring) | Top Spot (2024) | Significant Fee Income | Minimal new investment needed |

| GPLs & Credit Cards | 18% (GPLs), 36% (Credit Cards) of Loan Book (Mar 2025) | Stable Interest Income | Ongoing consumer demand |

| Branch Network & ATMs | High Share (Mature Channel) | > 28 Million Customers | Recurring income from relationships |

Full Transparency, Always

Garanti BCG Matrix

The Garanti BCG Matrix you are currently previewing is the exact, fully completed document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered without any watermarks or demo content, ready for immediate application in your business planning.

Dogs

Declining Niche Traditional Services represent areas where a bank has a low market share in a market that is not growing, or is even shrinking. Think of services like manual check processing or in-person wire transfers for a very specific, older demographic. These are often costly to maintain due to their manual nature and lack of scalability.

For instance, while specific figures for such niche services are often proprietary, the broader trend shows a significant shift. In 2023, digital transaction volumes continued to surge, with many banks reporting over 80% of customer interactions occurring through digital channels. This leaves these traditional, manual services with a diminishing customer base and minimal revenue potential, making them prime candidates for divestment or phasing out.

Certain physical bank branches, especially those in areas experiencing a downturn in customer visits or a strong move towards online services, can be classified as Dogs. These locations often show low activity and a small slice of the local banking market, consuming resources without generating significant returns. For instance, a report from late 2023 indicated that a notable percentage of traditional bank branches saw a decline in in-person transactions by over 15% year-over-year.

Legacy IT infrastructure, particularly core systems that are difficult to integrate with modern technologies, often fall into the Dogs category of the BCG Matrix. These systems typically have substantial maintenance costs and offer little to no competitive advantage. For instance, many financial institutions in 2024 still grapple with mainframe systems that are costly to update and hinder the adoption of agile cloud-based solutions, impacting their ability to innovate quickly.

Such outdated systems represent a low-growth potential area that drains valuable resources. Companies might spend upwards of 70-80% of their IT budget on maintaining existing infrastructure, leaving less for digital transformation initiatives. This resource drain prevents investment in high-growth areas like AI, data analytics, or customer experience platforms, which are crucial for future competitiveness.

Specific FX-Protected Deposit Schemes (e.g., KKM)

Specific FX-protected deposit schemes, such as KKM, are now categorized as a 'Dog' within the Garanti BCG Matrix. This classification stems from their rapidly declining strategic importance and market share.

- Declining Market Share: The amount held in these schemes has fallen dramatically, from $82 billion in January 2024 to just $28 billion by the end of January 2025.

- Low Growth Prospects: The segment is experiencing significant contraction and is not expected to recover or grow.

- Limited Strategic Value: With its diminishing presence and anticipated discontinuation, the scheme no longer holds strategic importance for the bank's future.

Non-Strategic, Low-Volume Investment Products

Non-strategic, low-volume investment products are those that haven't attracted substantial client interest or market presence and don't fit with a bank's future investment plans. These products often demand marketing and upkeep resources that exceed their meager returns and limited potential for growth.

For example, a niche bond fund launched in 2022 that garnered only $5 million in assets under management by mid-2024, despite a dedicated marketing campaign, would likely fall into this category. Its low adoption rate suggests it's not resonating with the target client base.

Such products can become a drain on resources, diverting attention and capital from more promising ventures. Banks must regularly assess their product portfolios to identify and divest from these underperforming offerings.

- Low Adoption: Products failing to reach critical mass in client adoption, indicating a lack of market demand.

- Strategic Misalignment: Offerings that do not support the bank's long-term strategic vision or growth objectives.

- Resource Drain: Investments in marketing and maintenance that yield disproportionately low returns compared to their cost.

Dogs in the Garanti BCG Matrix represent offerings with low market share in slow-growing or declining markets. These are typically resource drains that offer little future potential. Examples include legacy systems, underperforming niche products, and certain declining traditional services.

For instance, KKM, a specific FX-protected deposit scheme, saw its holdings plummet from $82 billion in January 2024 to $28 billion by January 2025, highlighting its status as a Dog due to declining market share and limited strategic value.

Similarly, many banks in 2024 still rely on costly legacy IT infrastructure, with maintenance consuming a significant portion of IT budgets, hindering innovation. Certain physical bank branches also fall into this category, with some reporting over a 15% year-over-year decline in in-person transactions in late 2023.

Non-strategic, low-volume investment products, such as a niche bond fund with only $5 million in assets under management by mid-2024, also exemplify Dogs due to low adoption and strategic misalignment.

Question Marks

New fintech-driven payment solutions, such as real-time payment networks and embedded finance options, represent a burgeoning area for Garanti BBVA. While the bank is actively enhancing its digital wallet offerings and optimizing credit card sales through strategic partnerships, these truly disruptive payment innovations are currently in their infancy for Garanti, operating in high-growth fintech markets but with a low existing market share.

These emerging payment technologies, including peer-to-peer (P2P) transfers via blockchain or advanced QR code systems, are experiencing rapid adoption globally. For instance, the global digital payments market was valued at over $7.7 trillion in 2023 and is projected to grow significantly. Garanti BBVA's engagement in these nascent solutions, though currently representing a small portion of its overall payment volume, signals a strategic move into a future where card-centric payments may be complemented or even superseded by these newer, more agile methods.

Emerging digital asset and cryptocurrency services, exemplified by Garanti BBVA Kripto, represent a classic 'Question Mark' in the BCG Matrix. The cryptocurrency market is experiencing rapid expansion, with the global digital asset market capitalization reaching approximately $2.5 trillion in early 2024, highlighting significant growth potential.

However, for traditional banks like Garanti BBVA, the market share for these specific services remains relatively low due to the nascent stage of adoption and evolving regulatory landscapes. This positions them as high-risk, high-reward ventures.

Significant investment is required to capture market share and potentially transform these offerings into 'Stars'. Failure to navigate regulatory hurdles or achieve widespread customer adoption could see these services decline into 'Dogs', representing a poor return on investment.

Garanti BBVA's focus on AI for hyper-personalized lending and investment products places these offerings in the early stages of the Garanti BCG Matrix. While the AI technology itself is a Star, the actual tailored products are still developing, aiming for significant future growth. These innovative products are designed to cater to individual customer needs with precision, a key driver for market expansion.

The current market share for these hyper-personalized products is relatively low, necessitating substantial ongoing investment in refinement and customer acquisition. Garanti BBVA's commitment to this area reflects a strategic bet on future demand for highly customized financial solutions. For instance, in 2024, banks globally are increasing their AI investment, with estimates suggesting the AI in banking market could reach over $40 billion by 2025, underscoring the potential for these nascent products.

Venture Capital Investments in Startups

Venture capital investments in startups, like those supported by Garanti BBVA, align with the 'Question Marks' quadrant of the BCG matrix. These are typically early-stage companies with high growth potential in nascent markets, but currently hold a low market share.

Garanti BBVA's commitment to this area is evident through its support for entrepreneurs via acceleration programs and direct investments. For instance, in 2024, the bank invested TL 150 million in 56 startups, demonstrating a clear strategy of backing innovative ventures.

- High Growth Potential: Startups in emerging sectors offer significant upside, fitting the 'Question Mark' profile.

- Low Market Share: Garanti BBVA's direct involvement in these individual startups represents a small portion of its overall business.

- Strategic Investment: These are speculative bets that require substantial capital and nurturing to develop into potential market leaders or complementary services.

- Risk and Reward: The success of these ventures is uncertain, but a successful startup can become a future 'Star' in the portfolio.

Expansion into New Niche International Markets

Garanti BBVA could consider expansion into new niche international markets as a potential 'Question Mark' in the BCG matrix. These markets would typically offer high growth potential but currently represent a very small market share for the bank. For instance, exploring emerging economies in Southeast Asia or specific segments within the African continent could fit this profile.

Entering these markets would require significant initial investment in infrastructure, technology, and local talent acquisition. The success hinges on Garanti BBVA's ability to adapt its product offerings and operational strategies to local consumer needs and regulatory environments. Without a clear path to increasing market share and profitability, these ventures could become cash drains.

- High Growth Potential: Emerging markets often exhibit GDP growth rates exceeding those of developed economies, presenting opportunities for rapid customer acquisition and revenue expansion. For example, many Southeast Asian economies are projected to see robust economic growth in the coming years.

- Low Initial Market Share: Garanti BBVA would likely start with a negligible presence, meaning substantial marketing and operational efforts are needed to gain traction. This is characteristic of a Question Mark, where the future is uncertain.

- Substantial Investment Required: Establishing a banking presence, even in a niche, involves significant capital outlay for licensing, branch networks, digital platforms, and compliance.

- Strategic Importance: Successful entry and growth could transform these Question Marks into future Stars, diversifying Garanti BBVA's geographic footprint and revenue streams. Failure, however, necessitates a timely divestment to avoid further losses.

Garanti BBVA's exploration into new, niche international markets embodies the 'Question Mark' in the BCG matrix. These markets, while offering high potential for growth, currently represent a minimal market share for the bank, demanding significant upfront investment. Success hinges on adapting products and operations to local conditions, with the risk of becoming a drain if market share isn't gained.

These ventures are speculative bets, requiring substantial capital and nurturing to potentially evolve into market leaders. The uncertainty of success means they could either become future Stars or, if unmanaged, decline into Dogs, yielding poor returns. For example, many Southeast Asian economies are projected to see robust economic growth in the coming years, offering a prime example of such a market.

The bank's strategy involves significant capital outlay for licensing, digital platforms, and compliance in these new territories. This strategic importance means that successful entry could transform these Question Marks into future Stars, diversifying Garanti BBVA's revenue streams, while failure necessitates a timely divestment.

| Potential Market | Projected Growth Rate | Current Market Share (Garanti BBVA) | Investment Required | Risk Factor |

| Southeast Asia (Niche Segment) | 6-8% GDP Growth (2024-2025 est.) | Negligible | High (Infrastructure, Tech, Talent) | High (Regulatory, Competition) |

| Specific African Markets (Digital Banking) | 5-7% GDP Growth (2024-2025 est.) | Negligible | High (Localization, Compliance) | High (Market Volatility, Infrastructure) |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.