Garanti Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Garanti Bundle

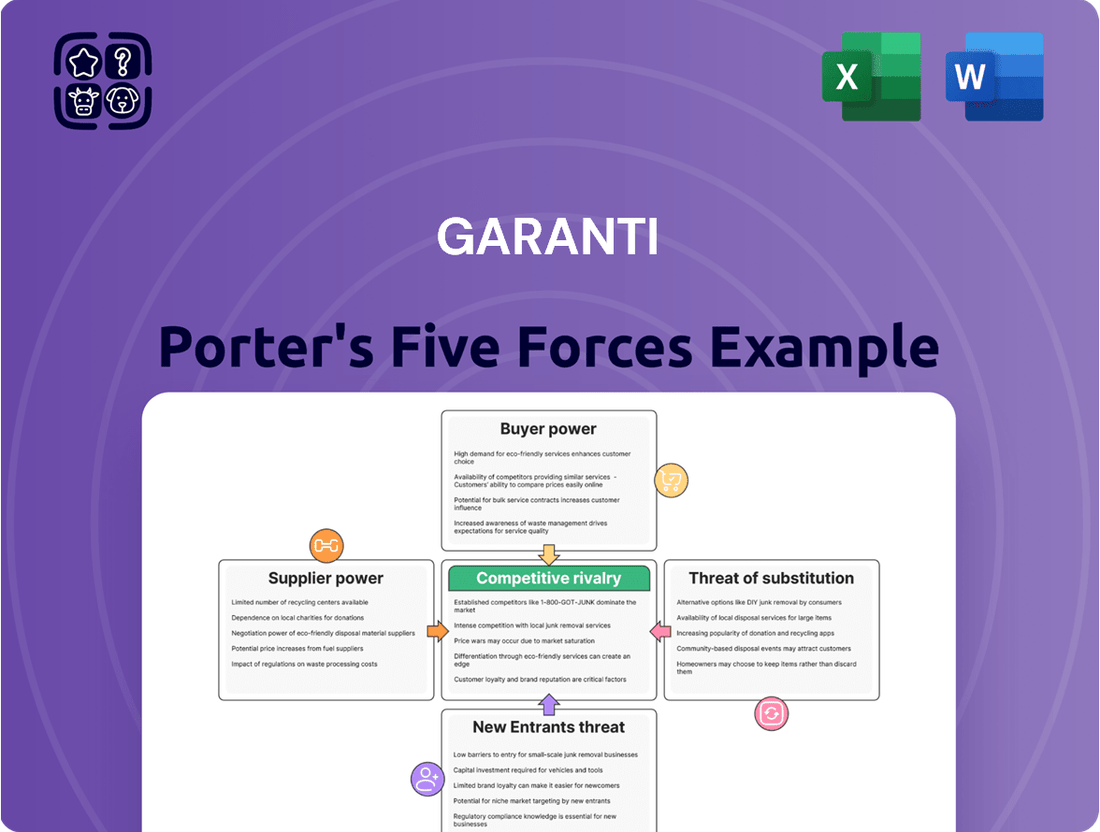

Garanti's competitive landscape is shaped by the interplay of five key forces, revealing the intensity of rivalry, the power of buyers and suppliers, and the threats from new entrants and substitutes.

Understanding these dynamics is crucial for navigating the banking sector. The complete report unlocks a detailed force-by-force assessment, providing actionable insights into Garanti's strategic positioning.

Ready to move beyond the basics? Get a full strategic breakdown of Garanti’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Regulatory bodies like the Central Bank of the Republic of Türkiye (CBRT) and the Banking Regulation and Supervision Agency (BRSA) significantly impact the bargaining power of suppliers in the Turkish banking sector. These institutions dictate crucial operational parameters, including monetary policy and capital requirements.

For example, Turkish banks are mandated to maintain a minimum capital adequacy ratio of 12%, a stipulation that directly affects their funding needs and operational flexibility. Changes in regulations, such as those concerning foreign exchange sale requirements or the introduction of FX-protected deposit accounts, can profoundly alter a bank's cost structure and revenue streams, thereby enhancing the regulatory bodies' influence as suppliers of the overall business environment.

Technology and infrastructure providers wield significant leverage over Garanti BBVA. This is largely due to the substantial costs associated with switching core banking software, digital platforms, and payment system infrastructure. These systems are fundamental to Garanti BBVA's multi-channel strategy, making their reliability and innovation paramount.

Garanti BBVA's heavy reliance on digital channels underscores the critical role of these tech suppliers. In 2024, a remarkable 98% of Garanti BBVA's transactions were conducted through non-branch channels, highlighting the indispensable nature of robust and cutting-edge technology solutions from these providers.

Key payment systems such as FAST, EFT, EMKT, and PÖS are crucial for managing Garanti BBVA's transaction volumes. The growing demand for electronic payment systems further amplifies the bargaining power of the companies that provide and maintain these essential financial conduits.

Garanti BBVA, like many Turkish banks, depends on international markets for funding via syndicated loans and bond sales. Türkiye's credit ratings and investor sentiment directly affect this access and the cost of borrowing. For instance, Fitch Ratings improved its outlook for the Turkish banking sector to 'improving' in June 2024, citing decreased financial risks and better access to external funding, which should lead to lower borrowing costs.

Skilled Labor and Talent Pool

The availability of a skilled workforce, especially in cutting-edge fields like digital banking, cybersecurity, and artificial intelligence, represents a critical input for Garanti BBVA. As the bank pushes for technological leadership and develops AI-powered solutions, securing and keeping top talent is paramount.

A scarcity of specialized skills or intense competition for these professionals can drive up labor expenses. This situation directly enhances the bargaining power of employees as a significant supplier group. For instance, in 2024, the demand for AI specialists in the financial sector saw a notable increase, with some roles experiencing salary hikes of up to 20% compared to the previous year, according to industry reports.

- High Demand for AI and Cybersecurity Talent: Banks like Garanti BBVA are actively seeking professionals with expertise in AI, machine learning, and robust cybersecurity measures to enhance digital offerings and protect customer data.

- Impact of Talent Shortages on Labor Costs: Limited supply of these specialized skills in the market can lead to increased recruitment costs and higher salary expectations, directly impacting operational expenses.

- Employee Bargaining Power: When specialized skills are in short supply, employees in these fields gain leverage, potentially influencing terms of employment and compensation, thereby acting as powerful suppliers.

Depositor Base as a Funding Source

While depositors are also customers, from a funding perspective, they act as suppliers of capital. Garanti BBVA's customer deposits are a crucial funding source, representing a substantial part of its balance sheet. By September 2024, these deposits reached TL 2.02 trillion, and by June 2025, they grew to TL 2.66 trillion, making up roughly 70% of the bank's total assets.

This significant reliance on deposits means depositors hold considerable bargaining power. Factors like prevailing interest rates, overall trust in the banking sector, and the attractiveness of Garanti BBVA's product offerings directly influence its ability to attract and retain these funds. Consequently, depositors can exert influence over the bank's cost of funding.

- Depositor Power: Depositors supply essential capital, acting as suppliers of funds for Garanti BBVA.

- Funding Dominance: Customer deposits constituted approximately 70% of Garanti BBVA's assets by June 2025, totaling TL 2.66 trillion.

- Influencing Factors: Interest rates, system-wide trust, and competitive deposit products empower depositors.

- Cost of Capital: Depositor influence directly impacts the bank's cost of acquiring and maintaining its funding base.

The bargaining power of suppliers is a key element in understanding Garanti BBVA's competitive landscape. Suppliers in this context include technology providers, skilled labor, and depositors, all of whom can influence the bank's costs and operational efficiency.

Technology providers, for instance, have significant leverage due to the high switching costs associated with core banking systems and digital platforms. Garanti BBVA's heavy reliance on digital channels, with 98% of transactions in 2024 occurring outside branches, underscores the critical role and power of these tech suppliers.

The availability of specialized talent, particularly in areas like AI and cybersecurity, also grants employees considerable bargaining power. Reports from 2024 indicated salary increases of up to 20% for AI specialists in the financial sector, reflecting a tight labor market for these in-demand skills.

Depositors, as suppliers of capital, hold substantial influence. By June 2025, customer deposits reached TL 2.66 trillion, representing about 70% of Garanti BBVA's total assets, making their ability to dictate terms through interest rates and product demand a significant factor.

| Supplier Type | Key Factors Influencing Bargaining Power | Impact on Garanti BBVA | Relevant Data/Examples (2024-2025) |

| Technology Providers | High switching costs for core systems, reliance on digital infrastructure | Increased costs for software, maintenance, and upgrades | 98% of transactions via non-branch channels in 2024 |

| Skilled Labor (e.g., AI Specialists) | Scarcity of specialized skills, high demand in digital banking | Higher salary expenses, increased recruitment costs | Up to 20% salary increase for AI specialists in 2024 |

| Depositors | Significant portion of funding, sensitivity to interest rates and trust | Influence on cost of funding, need for competitive deposit products | TL 2.66 trillion in deposits by June 2025 (approx. 70% of assets) |

What is included in the product

Garanti's Five Forces Analysis dissects the competitive intensity within its operating environment, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and rivalry among existing competitors.

Instantly identify and mitigate competitive threats with a visual breakdown of all five forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

Garanti BBVA serves a wide range of clients, from individuals to large corporations, all of whom are increasingly embracing digital channels. In Turkey, mobile banking is booming, with Garanti BBVA reporting over 17 million active mobile customers by the first quarter of 2025. This widespread digital adoption means customers have more power than ever.

With easy access to internet banking, mobile apps, ATMs, and a robust branch network, customers can effortlessly compare offerings from different financial institutions. This convenience empowers them to switch providers if they find better deals or services elsewhere, thereby increasing the bargaining power of customers for Garanti BBVA.

For many standard banking services, such as checking accounts and basic personal loans, customers face minimal hurdles when switching providers. The widespread adoption of digital onboarding processes in Turkey, for instance, has significantly streamlined account opening, making it quicker and more convenient than ever to move funds and services. This ease of transition empowers customers, giving them greater leverage to seek out better rates or superior service from competitors.

Customers, especially individuals and small to medium-sized enterprises (SMEs), demonstrate significant price sensitivity regarding loan and deposit rates. This is particularly evident in Turkey's fluctuating economic landscape. For instance, in Q1 2024, the average loan interest rate for commercial loans in Turkey hovered around 50%, while deposit rates also saw considerable variation, directly impacting customer choices.

Garanti BBVA's profitability is directly tied to its funding costs and any regulatory limits on lending. When interest rates rise, the cost of attracting deposits increases, potentially squeezing net interest margins. Conversely, if lending rates are capped, the bank's ability to pass on higher funding costs is limited, influencing customer decisions to seek more favorable terms elsewhere.

The increasing trend in non-performing loans (NPLs), particularly within retail segments like credit cards, underscores customer sensitivity to loan affordability. In 2023, Turkey's overall NPL ratio stood at approximately 1.55%, with retail loans contributing to this figure, indicating that customers are struggling with existing loan terms when economic conditions shift.

Availability of Alternative Financial Services

The burgeoning fintech sector in Turkey significantly bolsters customer bargaining power. With a proliferation of payment service providers and electronic money institutions, customers now have readily available alternatives to traditional banking. This increased choice, especially with AI-driven personalized services, empowers consumers to seek better terms and more tailored financial solutions.

For instance, by the end of 2023, Turkey's fintech market saw substantial growth, with over 600 licensed fintech companies operating. These firms offer a diverse range of services, from digital payments to peer-to-peer lending, directly challenging incumbent banks. The ease with which customers can switch between these providers, often with lower fees and more user-friendly interfaces, forces traditional institutions to compete more aggressively on price and service quality.

- Fintech Growth: Turkey's fintech landscape expanded rapidly, with more than 600 licensed companies active by the close of 2023.

- Customer Options: A wide array of payment service providers and electronic money institutions offer viable alternatives to traditional banking.

- Personalization: AI-driven services are enabling more personalized banking experiences, further increasing customer leverage.

- Competitive Pressure: The availability of substitutes compels traditional banks to improve their offerings and pricing to retain customers.

Information Transparency and Access

Customers today possess unprecedented access to information about banking products, fees, and interest rates. This is largely due to the proliferation of digital comparison platforms and readily available financial news. Such transparency empowers individuals to make more informed choices, actively seeking out and leveraging competitive offerings, thereby amplifying their bargaining power.

Garanti BBVA recognizes this shift and is actively working to enhance customer experience through advanced AI and personalized solutions. This strategic focus aims to cultivate deeper customer relationships and loyalty, serving as a key strategy to counterbalance the increasing bargaining power of informed customers.

- Increased Digital Comparison: In 2024, it's estimated that over 70% of banking customers utilize online tools to compare financial products before making a decision.

- Transparency Drives Choice: This readily available data allows customers to easily identify and switch to providers offering better rates or lower fees, putting pressure on banks to remain competitive.

- Garanti's Response: Garanti BBVA's investment in AI-driven personalization aims to create stickier customer relationships, potentially reducing churn and mitigating the impact of price-based competition.

The bargaining power of customers for Garanti BBVA is significant, driven by digital accessibility, a competitive fintech landscape, and increased transparency. Customers can easily compare offerings, switch providers, and are highly sensitive to pricing, especially in Turkey's dynamic economic environment. This forces banks to focus on service quality and competitive rates.

| Factor | Impact on Garanti BBVA | Supporting Data (Q1 2024/2023) |

|---|---|---|

| Digital Adoption & Ease of Switching | Increases customer leverage; easy to compare and move. | 17M+ active mobile customers (Q1 2025); streamlined digital onboarding. |

| Fintech Competition | Provides alternatives, driving need for better pricing/service. | 600+ licensed fintechs in Turkey (end of 2023); diverse digital payment options. |

| Price Sensitivity | Customers seek better loan/deposit rates. | Average commercial loan rates around 50% (Q1 2024); NPL ratio ~1.55% (2023) indicates affordability concerns. |

| Information Transparency | Empowers informed choices and comparison shopping. | Over 70% of banking customers use online tools for comparison (2024 estimate). |

Full Version Awaits

Garanti Porter's Five Forces Analysis

This preview showcases the comprehensive Garanti Porter's Five Forces Analysis you will receive immediately after purchase, offering a detailed examination of competitive forces within the banking sector. You're looking at the actual document, ensuring that what you see is precisely what you'll get, fully formatted and ready for your strategic planning needs. This means no surprises, just a complete, professionally written analysis ready for your immediate use and integration into your business strategy.

Rivalry Among Competitors

The Turkish banking sector is a battleground, dominated by a handful of major players. This intense rivalry isn't just about size; it's about grabbing every customer across all banking needs, from big corporate deals to everyday retail accounts. Garanti BBVA, as the second-largest private bank in Turkey by March 2025, finds itself in the thick of this competition, constantly vying for market share.

Turkish banks are navigating a challenging landscape marked by significant profitability pressures. High funding costs, driven by the country's economic conditions, directly impact their ability to generate profits. Compounding this, regulatory lending caps, which were a notable feature in 2024, continue to constrain loan expansion and squeeze net interest margins (NIMs).

While projections suggest an improvement in NIMs by the close of 2025, the persistence of regulatory growth caps remains a key factor shaping competitive dynamics. This regulatory environment compels banks to engage in intense competition, not just on pricing but also on the quality of their services, as they strive to preserve profitability in a capped market.

Competitive rivalry in the banking sector is significantly fueled by product differentiation, with digital innovation and customer experience at the forefront. Banks are constantly vying to offer unique, value-added services that set them apart.

Garanti BBVA exemplifies this trend by extensively utilizing artificial intelligence to elevate customer interactions. By Q1 2025, the bank boasted over 17 million active mobile customers, a testament to its digital reach and commitment to providing personalized financial advice and solutions in real-time.

This focus on cutting-edge digital services, from intuitive mobile apps to AI-powered assistance, has become a critical battleground. The banks that succeed in offering the most innovative and user-friendly digital experiences are gaining a distinct competitive advantage.

Market Share Dynamics and Loan Growth

Banks fiercely compete for both loan and deposit market share, a dynamic that directly impacts Garanti BBVA's strategic positioning. The bank’s ability to attract and retain customers is crucial in this environment.

Garanti BBVA has demonstrated its strength by acquiring over 2 million new customers annually, underscoring its competitive edge in customer acquisition. This influx of new clients contributes significantly to its market share growth across various banking segments.

Despite general margin compression within the banking sector, Garanti BBVA has maintained a robust performance. This resilience is attributed to effective collection strategies and solid loan expansion, allowing it to not just keep pace but actually gain market share.

- Market Share Gains: Garanti BBVA is actively increasing its share in key lending areas, including mortgage, consumer, and SME loans.

- Customer Acquisition: The bank’s success in onboarding over 2 million new customers each year highlights its appeal and competitive offering.

- Performance Resilience: Despite industry-wide pressure on net interest margins, Garanti BBVA's strong collections and loan growth have enabled it to outperform.

- Competitive Landscape: The ongoing rivalry for market share means continuous innovation and customer-centric strategies are essential for sustained success.

Credit Card Programs and Payment Systems Competition

Competition in the credit card and payment systems arena is intense, with major global players like Mastercard and Visa holding significant sway in Turkey's market. The Turkish Competition Board has actively investigated their practices, highlighting the scrutiny these dominant schemes face.

Garanti BBVA's Bonus Credit Card Program stands as a key competitor within this dynamic landscape, underscoring the strategic importance of robust credit card offerings. In 2024, the Turkish credit card market continued to see substantial transaction volumes, with Garanti BBVA consistently ranking among the top issuers.

- Market Dominance: Mastercard and Visa are the primary global networks facilitating credit card transactions in Turkey, influencing market dynamics.

- Regulatory Oversight: The Turkish Competition Board's investigations into card scheme practices indicate a focus on fair competition and consumer protection.

- Key Player: Garanti BBVA's Bonus Credit Card Program is a significant competitor, reflecting the importance of loyalty programs and cardholder benefits in attracting and retaining customers.

- Market Activity: In 2024, the total transaction volume for credit cards in Turkey reached trillions of Turkish Lira, demonstrating the scale of this competitive segment.

The Turkish banking sector is characterized by fierce competition among a few large private banks, including Garanti BBVA, which is the second-largest private bank as of March 2025. This rivalry is intensified by profitability pressures stemming from high funding costs and regulatory lending caps, which were prominent in 2024 and continue to influence market dynamics through 2025.

Banks are actively differentiating themselves through digital innovation and customer experience, with Garanti BBVA leading in AI-driven customer interactions, boasting over 17 million active mobile customers by Q1 2025. This focus on digital services is a key battleground, as banks strive to attract and retain customers in a market where Garanti BBVA alone acquires over 2 million new customers annually.

The credit card market also sees intense competition, with global players like Mastercard and Visa dominating. Garanti BBVA's Bonus Credit Card Program is a significant competitor, especially given the trillions of Turkish Lira in credit card transactions in 2024, highlighting the critical role of loyalty and benefits in this segment.

| Metric | Garanti BBVA | Industry Average (Approx.) | Notes |

| Active Mobile Customers (Q1 2025) | 17+ million | Varies by bank | Indicates strong digital engagement |

| New Customer Acquisition (Annual) | 2+ million | Varies by bank | Demonstrates competitive appeal |

| Market Share Growth | Positive in key lending areas | Mixed across sector | Driven by strong collections and loan expansion |

| Credit Card Transactions (2024) | Significant volume | Trillions of TRY total market | Highlights importance of card segment |

SSubstitutes Threaten

Fintech payment solutions present a substantial threat by offering innovative alternatives like digital wallets and electronic money, gaining significant traction in Turkey. QR code payments, a prime example, saw a remarkable 271% surge in transaction volume during 2024, highlighting rapid consumer adoption.

These agile, user-friendly, and often cost-effective fintech platforms directly challenge traditional bank-operated payment systems. Their ability to rapidly adapt to market demands and evolving consumer preferences makes them a formidable competitive force.

The increasing adoption of cryptocurrencies and blockchain technology poses a significant threat of substitution for traditional financial services. These digital assets offer alternative avenues for transactions and investments, effectively bypassing established banking and payment systems. For instance, Turkey's high global ranking in cryptocurrency ownership underscores the public's willingness to explore these alternatives, with the Central Bank itself investigating a Digital Turkish Lira, signaling a potential shift in the financial landscape.

Large corporations are increasingly bypassing traditional banks for direct financing. In 2024, for instance, global corporate bond issuance reached significant levels, offering companies an alternative to bank loans. This trend is fueled by improved access to capital markets, allowing firms to raise funds directly from investors through mechanisms like bond sales or private equity placements.

This shift directly impacts the bargaining power of banks. As more corporations tap into capital markets, their reliance on bank financing diminishes. This can lead to reduced lending margins for banks and a need to innovate their service offerings to remain competitive in the corporate financing landscape.

Peer-to-Peer (P2P) Lending Platforms

Peer-to-peer (P2P) lending platforms represent a potential threat of substitutes for traditional banking services, particularly for consumer and small to medium-sized enterprise (SME) loans. While their presence in Turkey is still developing compared to global markets, these platforms directly link borrowers with lenders, bypassing traditional financial institutions.

These P2P platforms can offer attractive alternatives by potentially providing more competitive interest rates, faster loan processing times, and greater flexibility in loan terms. For instance, by the end of 2023, the global P2P lending market was valued at over $100 billion, indicating a significant and growing alternative to traditional finance.

- Growing P2P Market: Global P2P lending market size exceeded $100 billion by the end of 2023, showcasing a substantial alternative to traditional loans.

- Potential for Flexibility: P2P platforms can offer borrowers more adaptable loan terms and quicker access to capital.

- Disintermediation: These platforms directly connect borrowers and lenders, reducing reliance on conventional banking intermediaries.

Non-Bank Financial Institutions and Specialized Lenders

Non-bank financial institutions, such as factoring, leasing, and asset management firms, along with specialized lenders, present a significant threat by offering tailored financial services that can directly substitute for traditional banking products. These entities often focus on specific market niches, providing more agile and customized solutions that traditional banks might find harder to match.

For instance, in 2023, the global alternative lending market, which includes many of these non-bank players, saw substantial growth, indicating a strong demand for services outside the conventional banking system. Specialized lenders might offer quicker approval times or more flexible terms for certain types of financing, directly competing with Garanti BBVA's offerings in those segments.

- Factoring and Receivables Financing: Companies specializing in factoring can provide immediate liquidity against accounts receivable, a service that might be more efficiently delivered than through a bank's standard credit lines.

- Leasing and Equipment Finance: Dedicated leasing companies offer flexible asset financing solutions, often with attractive residual value options that can be more appealing than outright purchase or traditional bank loans for capital equipment.

- Asset Management and Wealth Services: Independent asset managers can compete for investment mandates and wealth management clients by offering specialized strategies or lower fee structures compared to a large bank's broad service model.

- Specialized Lending: Niche lenders focusing on sectors like technology, real estate development, or small business loans can provide expertise and tailored risk assessment that outcompete generalist banking approaches.

The threat of substitutes for traditional banking services is multifaceted, encompassing fintech innovations, digital assets, direct corporate financing, and specialized non-bank financial institutions. These alternatives often offer greater agility, lower costs, and more tailored solutions, directly challenging established players like Garanti BBVA.

Fintech payment solutions, for example, saw a significant surge in Turkey, with QR code payments alone increasing by 271% in transaction volume during 2024. Cryptocurrencies also represent a growing alternative, with Turkey ranking highly in ownership, indicating a public openness to these digital assets.

Furthermore, the global P2P lending market, exceeding $100 billion by the end of 2023, and the substantial growth in the alternative lending market in 2023 highlight the increasing demand for financial services outside traditional banking channels.

| Substitute Type | Key Characteristics | Impact on Traditional Banks | Example Data (2024/2023) |

|---|---|---|---|

| Fintech Payment Solutions | Digital wallets, QR codes, user-friendly interfaces | Reduced transaction fees, increased competition for payment services | QR code payment volume up 271% (2024) |

| Cryptocurrencies & Blockchain | Decentralized transactions, alternative investments | Potential disintermediation of banking services, regulatory challenges | High global crypto ownership in Turkey |

| Direct Corporate Financing | Corporate bonds, private equity | Reduced demand for bank loans, pressure on lending margins | Significant global corporate bond issuance (2024) |

| P2P Lending Platforms | Direct borrower-lender connection, potentially better rates | Competition for consumer and SME loans | Global P2P market > $100 billion (end of 2023) |

| Non-Bank Financial Institutions | Factoring, leasing, specialized lending | Niche competition, need for service customization | Substantial growth in global alternative lending market (2023) |

Entrants Threaten

The Turkish banking sector presents a formidable challenge for new entrants due to substantial capital requirements. Banks must adhere to a minimum capital adequacy ratio of 12%, a significant financial commitment that acts as a primary deterrent.

Furthermore, the regulatory landscape, overseen by the Banking Regulation and Supervision Agency (BRSA), is characterized by extensive oversight and complex licensing procedures. These stringent regulations and the need for considerable upfront capital effectively limit the threat of new, traditional full-service banks entering the market.

Established brand loyalty and trust represent a formidable barrier to entry for new banks. Incumbent institutions like Garanti BBVA have cultivated deep customer relationships over years, fostering significant trust. For instance, in 2024, Garanti BBVA maintained a strong market position, reflecting the enduring loyalty of its customer base, built through consistent service and reliable financial solutions. This established trust is not easily replicated by newcomers.

Garanti BBVA's vast network of branches and ATMs presents a significant hurdle for new entrants. While digital banking is on the rise, this physical infrastructure remains a powerful competitive asset, demanding considerable capital investment to replicate. For instance, as of the end of 2023, Garanti BBVA operated over 800 branches and more than 4,000 ATMs across Turkey, a footprint that new, purely online banks would struggle to match without substantial upfront funding.

Technological Investment and Digital Transformation

The threat of new entrants in the banking sector is significantly amplified by the substantial technological investment and digital transformation required. New players must deploy vast capital for advanced technology, secure digital platforms, and robust cybersecurity. For instance, as of 2024, global spending on digital transformation in the financial services sector is projected to reach hundreds of billions of dollars, underscoring the high entry barrier.

Beyond initial setup, continuous innovation is paramount. Entrants need to keep pace with evolving digital banking trends and escalating customer expectations, a challenge exemplified by institutions like Garanti BBVA, which is heavily investing in artificial intelligence to enhance customer experience and operational efficiency. Failing to innovate technologically can quickly render a new entrant obsolete in this fast-moving market.

- High Capital Outlay: Significant investment needed for cutting-edge technology and digital infrastructure.

- Cybersecurity Demands: Robust security measures are essential, adding to the cost and complexity of entry.

- Continuous Innovation: The need to constantly update and improve digital offerings to meet market demands.

- AI and Digital Transformation Focus: Leading banks are prioritizing AI, setting a high bar for new entrants.

Emergence of Digital Banks and Fintechs Lowering Barriers

The Turkish banking sector is experiencing a notable shift with the emergence of digital banks and fintech companies. These new players are effectively lowering traditional entry barriers, making the market more accessible. This trend is particularly evident with new digital banks commencing operations in Q4 2024, signaling a significant development in the competitive landscape.

Regulatory advancements in Turkey have played a crucial role in facilitating this change. Specifically, the introduction of regulations supporting remote identification methods and digital contract establishment has eased some of the hurdles for new entrants. This regulatory environment allows challenger banks to enter the market and focus on specific customer segments without the substantial overhead of maintaining a physical branch network.

- Digital Bank Entry: New digital banks began operations in Turkey in Q4 2024.

- Regulatory Support: Turkish regulations now favor remote identification and digital contracts, reducing entry barriers.

- Targeted Segments: Challenger banks can now effectively target specific customer groups by leveraging digital channels.

- Reduced Overhead: The need for physical branches is diminished, lowering initial capital requirements for new entrants.

While established banks like Garanti BBVA possess strong brand loyalty and extensive physical networks, the threat of new entrants is evolving. The rise of digital banks and fintech firms, supported by recent Turkish regulations enabling remote identification and digital contracts, is lowering traditional entry barriers. These new players can now more easily target specific customer segments, reducing the need for costly physical infrastructure.

| Factor | Impact on New Entrants | Example/Data (as of 2024/late 2023) |

|---|---|---|

| Capital Requirements | High, but shifting with digital models | Minimum Capital Adequacy Ratio: 12% (traditional banks) |

| Regulatory Hurdles | Significant, but easing for digital players | BRSA oversight, licensing; easing via remote ID regulations |

| Brand Loyalty & Trust | Major barrier for traditional entry | Garanti BBVA's established customer base |

| Physical Infrastructure | Costly to replicate | Garanti BBVA: >800 branches, >4,000 ATMs (end 2023) |

| Technology Investment | Essential and ongoing | Global fintech investment in digital transformation in the hundreds of billions |

| Emergence of Digital Challengers | Increasing threat | New digital banks commencing operations in Q4 2024 |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial statements, industry-specific market research reports, and expert analyst forecasts to provide a comprehensive view of competitive pressures.