Gaming Realms PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gaming Realms Bundle

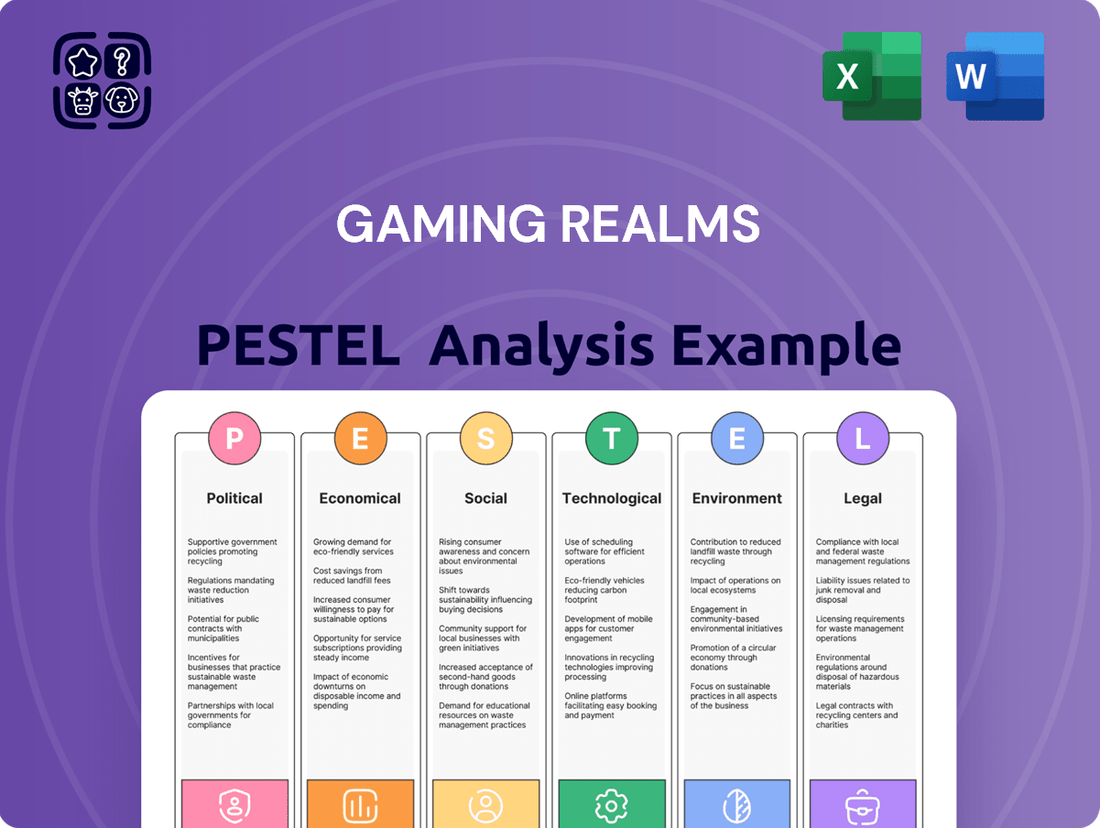

Gaming Realms operates in a dynamic landscape shaped by evolving regulations, economic fluctuations, and technological advancements. Our PESTLE analysis delves into these critical external factors, revealing opportunities and potential challenges. Gain a strategic advantage by understanding the forces influencing Gaming Realms's future. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The online gambling sector faces a dynamic regulatory environment, with significant shifts expected in 2024 and 2025. Brazil's market is slated for full regulation in early 2025, and British Columbia in Canada is anticipated to introduce regulated gaming. Gaming Realms has proactively entered these evolving markets, including West Virginia, its fifth U.S. presence, and Brazil, extending its reach to 21 global markets.

Navigating these diverse regulatory landscapes necessitates adaptation to varying requirements, such as enhanced age verification protocols and more stringent responsible gaming measures. These changes directly impact operational strategies and market entry approaches for companies like Gaming Realms.

Governments are tightening their grip on the iGaming sector to promote responsible gambling and ensure fair play. This regulatory push necessitates specific supplier licenses, which Gaming Realms has secured in key markets like West Virginia and British Columbia. For instance, as of early 2024, West Virginia's iGaming market continues to expand, with licenses being crucial for operators to participate.

Maintaining compliance with these evolving licensing frameworks and legal mandates is paramount. These requirements are not static; they are subject to change as governments refine their oversight strategies, directly impacting a company's ability to operate legally and access lucrative markets. For example, ongoing legislative reviews in various Canadian provinces in 2024 are shaping the future of iGaming licensing.

Governments worldwide are intensifying their focus on responsible gambling, leading to stricter regulations that directly affect online gaming operators like Gaming Realms. For instance, the UK's Gambling Act 2005 review, ongoing into 2024 and expected to yield further policy shifts, emphasizes enhanced player protection measures.

These evolving policies often mandate features such as robust affordability checks, tighter advertising restrictions, and the implementation of mandatory player tools like deposit limits and reality checks. These requirements necessitate significant operational adjustments and compliance investments for companies in the sector.

Gaming Realms must proactively adapt its business model and marketing strategies to align with this growing global momentum for player well-being, ensuring compliance with emerging and existing responsible gambling frameworks to maintain its license to operate and market.

International Market Access

Political relations and trade agreements significantly influence Gaming Realms' international market access. Favorable agreements can streamline entry into new territories, while geopolitical tensions or protectionist policies can create substantial barriers. For instance, the ongoing evolution of online gaming regulations in the United States, with states like Pennsylvania and New Jersey leading the charge, demonstrates how political decisions directly shape market opportunities for companies like Gaming Realms.

Gaming Realms' strategic expansion into diverse regions, including North America, Europe, and emerging markets such as Brazil and South Africa, is intrinsically linked to the political stability and regulatory frameworks of these areas. A stable political environment fosters investor confidence and facilitates the establishment of partnerships with local operators, crucial for successful market penetration. The company's 2024 projections for growth are contingent on navigating these varied political landscapes effectively.

- Regulatory Harmonization: Efforts towards regulatory harmonization across different jurisdictions can simplify market entry and reduce compliance costs for Gaming Realms.

- Trade Policies: International trade policies, including tariffs or digital service taxes, can impact the profitability of cross-border operations.

- Geopolitical Stability: Political stability in target markets is essential for long-term investment and operational planning.

- Licensing and Compliance: Political decisions on licensing requirements and data privacy regulations directly affect Gaming Realms' ability to operate legally and securely in new markets.

Taxation and Revenue Sharing Policies

Government taxation policies directly influence Gaming Realms' profitability. For instance, changes in corporate tax rates or specific levies on gaming revenue, such as the UK's 15% Point of Consumption Tax (POCT) on gross gaming revenue for remote operators, can alter net profit margins. Gaming Realms reported a pre-tax profit of £10.1 million for the year ended December 31, 2023, which is subject to these evolving fiscal regulations.

Shifts in tax structures, like potential increases in gaming duty or new revenue-sharing agreements with governments in key markets, require strategic financial adjustments. These changes can impact decisions about where Gaming Realms chooses to operate and invest, especially as they navigate diverse regulatory landscapes. For example, a more favorable tax environment in one region might encourage expansion, while a punitive one could lead to a reassessment of existing operations.

The company's robust financial performance, highlighted by its increasing profits, means it is increasingly exposed to these fiscal policies. As Gaming Realms continues to grow, understanding and adapting to varying national and regional tax frameworks becomes crucial for sustained financial health and strategic planning. The ability to manage tax liabilities effectively will be key to maximizing returns for shareholders.

Key considerations for Gaming Realms regarding taxation include:

- Impact of Corporate Tax Rates: Fluctuations in corporate tax rates directly affect the company's bottom line.

- Specific Gaming Levies: Taxes like the UK's POCT on gross gaming revenue can significantly reduce profitability.

- Market Entry and Expansion Costs: Tax implications are a major factor in deciding whether to enter or expand in new regulated markets.

- Revenue Sharing Agreements: Potential new demands for revenue sharing with governments could alter profit distribution.

Political factors significantly shape the iGaming landscape for Gaming Realms. Governments are increasingly focused on consumer protection, leading to stricter regulations and licensing requirements. For example, the ongoing review of the UK's Gambling Act 2005 into 2024 emphasizes enhanced player protection, impacting operational strategies.

The company's expansion into new markets like Brazil, expected to fully regulate in early 2025, and British Columbia, Canada, highlights the direct influence of political decisions on market access. Securing necessary supplier licenses, such as those in West Virginia as of early 2024, is a critical political and operational hurdle.

Geopolitical stability and favorable trade policies are also crucial. Political decisions on licensing, data privacy, and taxation, like the UK's 15% Point of Consumption Tax on gross gaming revenue, directly affect Gaming Realms' profitability and strategic planning for international operations.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Gaming Realms, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions to identify strategic opportunities and threats.

A concise PESTLE analysis for Gaming Realms, presented in a clear, summarized format, acts as a pain point reliever by offering easy referencing during meetings and quick interpretation of external factors.

This PESTLE analysis for Gaming Realms, segmented by category, alleviates pain points by enabling rapid understanding of market dynamics, thereby streamlining strategic planning and decision-making.

Economic factors

The online gambling market is on a significant upward trajectory. It's expected to grow from $106.22 billion in 2024 to $117.5 billion in 2025, and further expand to $186.58 billion by 2029.

This rapid expansion, fueled by wider internet access and increased smartphone usage, creates a favorable environment for Gaming Realms' licensing operations. The company saw its revenue climb by 22% in 2024, reaching £28.5 million, with licensing playing a key role in this growth.

Consumer disposable income is a critical driver for the online gaming sector, directly impacting how much players can spend on entertainment. As of late 2024, many developed economies are showing resilience, with real disposable income growth projected to continue, albeit at a moderate pace. For Gaming Realms, this translates to a generally positive outlook for player spending on their real-money gaming content.

The online gaming sector is intensely competitive, with many companies fighting for players. Gaming Realms has shown strong performance, with licensing revenue growing by 23% in 2024, demonstrating their ability to stand out. This success is largely due to their well-loved Slingo games and their efforts to enter new geographical areas.

Gaming Realms has proven resilient, maintaining its market position even when major UK clients experienced revenue drops. This resilience points to the underlying strength and appeal of their product offerings and their strategic approach to client relationships within a crowded market.

Operational Costs and Profitability

Rising operational costs, such as inflation, energy prices, and labor expenses, can directly impact Gaming Realms' profitability. These factors can squeeze margins if not managed effectively.

However, Gaming Realms has shown robust financial resilience. In 2024, the company reported a significant 30% increase in adjusted EBITDA, reaching £13.1 million.

Furthermore, profit before tax saw a substantial 61% jump to £8.3 million. This performance indicates strong cost control and operational leverage capabilities, allowing the company to navigate potential cost pressures effectively.

- Inflationary pressures: Increased costs for goods and services can impact input expenses.

- Energy costs: Fluctuations in energy prices affect operational expenditure for data centers and offices.

- Labor expenses: Wage inflation and the need for skilled personnel contribute to rising employment costs.

- Profitability resilience: Gaming Realms achieved a 30% increase in adjusted EBITDA (£13.1m) and a 61% rise in profit before tax (£8.3m) in 2024, demonstrating effective cost management.

Investment and Capital Allocation

The prevailing economic climate significantly shapes investment opportunities and how capital is allocated. For Gaming Realms, this was evident in their decision to initiate a £6 million share buyback program in 2024. This move suggests management's belief in the company's intrinsic value and a commitment to returning capital to shareholders.

A robust cash position is crucial for enabling strategic growth initiatives. Gaming Realms' cash balance grew to £13.5 million by the end of 2024, providing the financial flexibility needed to invest in key areas. This includes funding new game development, expanding into new markets, and integrating with potential partners, all of which are vital for long-term success.

- Share Buyback: Gaming Realms launched a £6 million share buyback program in 2024.

- Cash Position: The company's cash balance reached £13.5 million by year-end 2024.

- Strategic Investments: Funds are allocated to game development, market expansion, and partner integrations.

- Confidence Signal: The capital allocation strategy signals strong confidence in the business model's future.

The online gambling market's projected growth from $106.22 billion in 2024 to $186.58 billion by 2029 highlights a strong economic tailwind for Gaming Realms. Despite inflationary pressures impacting operational costs, the company demonstrated robust financial health in 2024, with adjusted EBITDA increasing by 30% to £13.1 million and profit before tax jumping 61% to £8.3 million. This profitability resilience, coupled with a healthy cash balance of £13.5 million by the end of 2024, positions Gaming Realms to navigate economic uncertainties and pursue strategic growth opportunities, including a £6 million share buyback program initiated in 2024.

| Metric | 2024 Value | Growth/Change |

|---|---|---|

| Online Gambling Market Size (Est.) | $106.22 Billion | Projected to reach $186.58 Billion by 2029 |

| Gaming Realms Revenue | £28.5 Million | 22% Increase |

| Gaming Realms Adjusted EBITDA | £13.1 Million | 30% Increase |

| Gaming Realms Profit Before Tax | £8.3 Million | 61% Increase |

| Gaming Realms Cash Balance | £13.5 Million | Increase |

| Share Buyback Program | £6 Million | Initiated in 2024 |

Full Version Awaits

Gaming Realms PESTLE Analysis

The Gaming Realms PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Gaming Realms, providing valuable strategic insights. You'll gain a deep understanding of the external forces shaping the company's future, enabling informed decision-making.

Sociological factors

Consumer preferences are increasingly leaning towards mobile-first gaming experiences that offer dynamic and engaging gameplay. Gaming Realms, with its specialization in mobile-focused content and the unique Slingo format, which cleverly merges slots and bingo, is well-positioned to meet these evolving player demands.

The company's strategic focus on its Slingo portfolio has proven successful, particularly in international iGaming markets. For instance, in 2023, Gaming Realms reported a significant uplift in revenue, driven by the strong performance of its existing Slingo titles and the successful launch of new ones, demonstrating a direct correlation between their offerings and shifting consumer tastes.

Societal concerns about problem gambling are on the rise, pushing the gaming industry towards a stronger focus on responsible gaming (RG) practices. This growing awareness means companies like Gaming Realms need to actively incorporate and highlight tools that help players manage their activity, such as setting deposit limits or using self-exclusion features. Meeting these expectations is becoming crucial for maintaining public trust and regulatory compliance.

The online gambling sector is increasingly drawing in a younger, more technologically adept audience. Mobile gaming, in particular, has become dominant, holding an estimated 90-95% of the online casino market share by 2024, underscoring its critical importance.

Gaming Realms' strategic emphasis on mobile-first content and its popular game formats, such as Slingo, directly targets this expanding and evolving demographic. This approach is key to fostering user engagement and driving continued growth within the competitive online gaming landscape.

Influence of Social Media and Streaming

Social media and streaming platforms like Twitch and YouTube are profoundly shaping how games are discovered, played, and discussed, creating powerful communities around them. This trend is a significant sociological force that content developers, including those in the iGaming sector, can harness for marketing and player engagement. For instance, Twitch viewership for gaming content consistently breaks records, with millions of concurrent viewers regularly tuning in to watch their favorite streamers play. This presents a direct avenue for building brand loyalty and promoting new game releases by partnering with influential streamers.

The continued growth of influencer marketing within the gaming sphere is a testament to this shift. In 2024, the global influencer marketing market was projected to reach over $21 billion, with gaming being a substantial contributor. This indicates a clear societal preference for content delivered through trusted personalities on these platforms, offering a direct channel for Gaming Realms to connect with its target audience and foster a sense of community around its offerings.

- Platform Dominance: Twitch and YouTube remain the primary hubs for gaming content consumption, with billions of hours watched annually.

- Influencer Impact: Streamers and content creators directly influence purchasing decisions and game adoption rates among their followers.

- Community Building: These platforms facilitate the creation and maintenance of strong player communities, crucial for long-term engagement.

- Marketing Leverage: Social media and streaming provide cost-effective channels for targeted advertising and brand promotion within the gaming demographic.

Public Perception and Trust

Public perception of the online gambling industry significantly impacts player trust and brand reputation, with concerns often centering on fairness, transparency, and social consequences. Gaming Realms, like other operators, must navigate these perceptions carefully.

Companies prioritizing environmental, social, and governance (ESG) principles, alongside robust responsible gambling protocols and clear governance, can build stronger public trust. This proactive approach is crucial for long-term success and community acceptance.

- Player Trust: A 2024 survey indicated that 65% of online gamblers consider transparency in game fairness a top priority when choosing a platform.

- Brand Reputation: Gaming Realms' commitment to responsible gambling, as highlighted in their 2024 sustainability report, aims to bolster its image.

- Social Impact: Public discourse around problem gambling remains a sensitive area, influencing regulatory scrutiny and consumer choices.

Societal attitudes towards online gambling continue to evolve, with a growing emphasis on player welfare and responsible gaming practices. Gaming Realms must actively demonstrate its commitment to these principles to maintain consumer trust and regulatory approval.

The increasing influence of social media and streaming platforms on gaming culture is undeniable, creating new avenues for player engagement and brand building. Companies that effectively leverage these channels, often through influencer partnerships, can foster strong communities and drive game adoption.

Public perception of the iGaming industry is heavily shaped by concerns about fairness and transparency, making robust responsible gambling measures and clear communication essential for brand reputation. A proactive approach to social responsibility can significantly bolster player trust and long-term acceptance.

Technological factors

The increasing prevalence of smartphones, coupled with the ongoing expansion of 5G networks, significantly fuels the online gambling sector by enabling richer mobile gaming experiences. Gaming Realms, with its focus on mobile-first content, is well-positioned to capitalize on this, ensuring its offerings are optimized for smooth play on any device.

By 2024, mobile games are projected to command an impressive 90-95% of the entire online casino market share, highlighting the critical importance of mobile optimization for companies like Gaming Realms.

AI and machine learning are revolutionizing the iGaming sector, offering Gaming Realms opportunities for hyper-personalized player experiences and sophisticated fraud detection. These technologies allow for real-time analysis of player data, leading to dynamic odds adjustments and deeper market insights.

By implementing AI, Gaming Realms can offer tailored game suggestions, proactively identify at-risk player behaviors, and ultimately improve player loyalty and support responsible gaming initiatives. For instance, in 2024, iGaming companies are increasingly investing in AI for customer service chatbots and predictive analytics, with some reporting a 15% increase in player engagement through personalized content.

Technological advancements are a major driver in the gaming industry, enabling the development of entirely new game genres and significantly enhancing player immersion through technologies like virtual reality (VR) and augmented reality (AR). This continuous innovation allows companies to offer fresh and engaging content.

Gaming Realms is actively leveraging these technological shifts by consistently updating its proprietary Slingo portfolio. In 2024, they released 12 new Slingo games, with an additional 3 new titles launched in the first quarter of 2025. This strategy also includes integrating content from third-party studios, ensuring a dynamic and appealing game library for players.

Cybersecurity and Data Protection

Cybersecurity and data protection are paramount for Gaming Realms, given its reliance on digital platforms for online gaming. Robust measures are essential to shield player information and uphold consumer trust. The sector's shift towards advanced payment systems and biometric authentication highlights the growing importance of secure transactions, a critical aspect for Gaming Realms as both a content licensor and developer.

The escalating threat landscape necessitates continuous investment in cybersecurity. For instance, the global cybersecurity market was projected to reach over $270 billion in 2024, underscoring the significant resources dedicated to this area. Gaming Realms must stay ahead of evolving threats to protect its intellectual property and player data.

- Data Breach Costs: The average cost of a data breach in the technology sector reached $4.45 million in 2023, emphasizing the financial imperative for strong security.

- Biometric Adoption: Biometric authentication use in payments is expected to grow significantly, offering enhanced security for online transactions.

- Regulatory Compliance: Stricter data protection regulations, like GDPR and CCPA, require substantial compliance efforts and investment in secure data handling practices.

Blockchain and Cryptocurrency Potential

Blockchain and cryptocurrency are increasingly relevant in the iGaming sector, offering enhanced transparency and security. While Gaming Realms has not detailed specific implementations, the industry is exploring these technologies for smoother, cross-border payments. This trend could influence future platform development and regulatory compliance.

The potential for blockchain to underpin provably fair gaming systems is a significant technological factor. Such systems allow players to independently verify the fairness of game outcomes, building trust. This could become a key differentiator or even a requirement for licensing in certain jurisdictions, impacting how platforms like Gaming Realms operate.

- Industry Growth: The global online gambling market was valued at approximately $64.1 billion in 2023 and is projected to reach $158.3 billion by 2030, according to Statista.

- Crypto Adoption: While specific iGaming adoption rates for crypto are nascent, broader financial sector trends show increasing interest, with cryptocurrencies like Bitcoin seeing significant transaction volumes.

- Regulatory Landscape: Emerging regulations around digital assets could shape how iGaming companies integrate blockchain and crypto, potentially affecting operational costs and market access.

The increasing dominance of mobile gaming, with projections showing it will account for 90-95% of the online casino market by 2024, underscores Gaming Realms' strategic focus on mobile-first content. AI and machine learning are also transforming the sector, enabling hyper-personalization and improved player engagement, with companies investing heavily in these areas to boost customer interaction by up to 15% in 2024.

Technological advancements continue to drive innovation, allowing for new game genres and enhanced immersion through VR/AR, prompting companies like Gaming Realms to consistently update their portfolios. In 2024, they released 12 new Slingo games, with 3 more in early 2025, demonstrating a commitment to fresh content. Furthermore, the growing importance of cybersecurity, with the global market projected to exceed $270 billion in 2024, necessitates robust data protection measures for platforms handling sensitive player information.

| Technological Factor | Impact on Gaming Realms | Key Data/Trend (2024/2025) |

| Mobile Dominance | High relevance for mobile-first strategy | 90-95% online casino market share projected for mobile by 2024 |

| AI & Machine Learning | Enhanced personalization, player engagement, fraud detection | 15% increase in player engagement reported by some firms via personalized content |

| VR/AR & New Genres | Opportunity for immersive experiences, portfolio expansion | Gaming Realms released 12 new Slingo games in 2024, 3 in Q1 2025 |

| Cybersecurity | Essential for data protection, trust, and IP | Global cybersecurity market projected >$270 billion in 2024 |

Legal factors

The iGaming sector demands rigorous adherence to jurisdictional licensing, a key legal hurdle for Gaming Realms' market access and ongoing operations. Navigating these varied regulatory landscapes is paramount for sustained growth and player trust.

Demonstrating a proactive approach to compliance, Gaming Realms secured full iGaming Supplier Licenses in West Virginia and British Columbia in 2024. This strategic move allows them to offer their gaming content legally in these key North American markets. Furthermore, the company has successfully launched its offerings in Brazil, a significant market that recently formalized its iGaming regulations, underscoring their commitment to operating within established legal frameworks across diverse global territories.

Legal frameworks are increasingly mandating responsible gambling measures, impacting companies like Gaming Realms. This includes stricter age verification, with Brazil, for instance, implementing facial recognition for account authentication starting January 2025. Such regulations extend to deposit limits and self-exclusion programs, requiring Gaming Realms to ensure its operations and partnerships adhere to these evolving and often tightening legal obligations across diverse regulated markets.

Gaming Realms' intellectual property, particularly its proprietary Slingo format, is a cornerstone of its legal strategy. Protecting this unique IP is vital as the company licenses it to other developers, generating revenue and expanding its market reach. Robust legal frameworks are essential to prevent unauthorized use and maintain the exclusivity that drives its licensing agreements.

Data Privacy and Consumer Protection Laws

Gaming Realms must navigate a complex web of data privacy and consumer protection laws. Compliance with regulations like the EU's General Data Protection Regulation (GDPR) and similar global frameworks is crucial, given the company's handling of sensitive player information. Failure to adhere to these rules can result in substantial fines and damage to reputation. For instance, in 2023, the Irish Data Protection Commission fined a major tech company over €1 billion for GDPR violations, highlighting the significant financial risks involved.

These laws govern every stage of player data management, from collection and storage to usage and retention. Gaming Realms needs robust legal oversight and transparent data handling practices to build and maintain player trust. This includes obtaining explicit consent for data processing and providing clear privacy policies. The company's commitment to these standards directly impacts its ability to operate legally and ethically in the global online gaming market.

- GDPR Fines: Penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher.

- Player Trust: Strong data protection practices are essential for customer retention and brand loyalty in the competitive gaming sector.

- Global Variations: Gaming Realms must monitor and adapt to evolving data privacy laws in all its operating jurisdictions, such as the California Consumer Privacy Act (CCPA) in the United States.

- Data Security: Implementing stringent security measures to protect player data from breaches is a legal and ethical imperative.

Advertising and Marketing Regulations

Advertising and marketing regulations within the gaming sector are tightening, with a strong emphasis on consumer protection and the elimination of deceptive advertising. Gaming Realms must navigate these evolving legal landscapes to ensure its marketing efforts for Slingo and its various partnerships are compliant. These regulations are not uniform; they differ considerably by jurisdiction, directly influencing how and where Gaming Realms can promote its offerings.

For instance, the UK's Advertising Standards Authority (ASA) has been particularly active. In 2024, the ASA continued to enforce stricter guidelines on gambling advertising, focusing on preventing appeals to children and ensuring responsible messaging. Gaming Realms' campaigns must adhere to these rules, which could involve limitations on imagery, language, and the placement of advertisements. The company's global reach means it must also track and comply with regulations in markets like the United States, where state-specific advertising rules for online gaming are still developing and can be quite stringent.

- Stricter Oversight: Regulatory bodies globally are increasing scrutiny on gambling advertising, demanding greater transparency and responsible messaging.

- Consumer Protection Focus: Regulations aim to shield consumers, particularly vulnerable groups, from misleading or aggressive marketing tactics.

- Jurisdictional Variability: Compliance challenges arise from diverse advertising laws across different countries and even within regions of the same country.

- Impact on Strategy: Gaming Realms must adapt its marketing strategies to meet these varied and often evolving legal requirements, potentially limiting promotional channels or content.

Gaming Realms' legal landscape is defined by stringent licensing requirements across various jurisdictions, with recent successes including full iGaming Supplier Licenses in West Virginia and British Columbia in 2024. The company's expansion into Brazil, a market that formalized its iGaming regulations, further highlights the necessity of operating within established legal frameworks. These licenses are critical for market access and ensuring continued operations in key territories.

The company must also navigate evolving responsible gambling legislation, such as Brazil's mandate for facial recognition for account authentication starting January 2025, impacting player verification and data handling. Furthermore, robust protection of intellectual property, like the proprietary Slingo format, is a legal imperative for its licensing revenue streams. Compliance with data privacy laws, including GDPR and CCPA, is paramount, with significant penalties for breaches, as evidenced by a €1 billion fine levied against a tech company in 2023 for GDPR violations.

Advertising regulations are also tightening globally, with bodies like the UK's ASA enforcing stricter guidelines in 2024 to prevent appeals to children and ensure responsible messaging. Gaming Realms must adapt its marketing strategies to comply with these diverse and evolving legal requirements across its operating markets, impacting promotional channels and content.

Environmental factors

The energy demands of digital infrastructure, including data centers powering online gaming, are substantial and contribute to the industry's environmental impact. For instance, global data center energy consumption was estimated to be around 1% of worldwide electricity usage in 2023, a figure expected to rise with increased digital activity.

The iGaming sector, and by extension companies like Gaming Realms, faces growing pressure to implement energy-saving measures. This includes optimizing code for efficiency, utilizing more power-conscious server architectures, and investing in sustainable hardware solutions to mitigate their carbon footprint.

There's a rising demand for businesses, including those in the gaming sector, to adopt Environmental, Social, and Governance (ESG) strategies. This push is driven by investors, consumers, and regulators alike, all seeking more responsible corporate behavior.

While Gaming Realms hasn't publicly detailed its specific ESG initiatives, the broader gaming industry is moving towards greater transparency. For instance, companies like GAMING1 have released their 2024 ESG reports, showcasing a commitment to environmental performance and sustainable operations. This trend suggests an increasing need for companies like Gaming Realms to demonstrate their own ESG credentials to maintain a competitive edge and meet evolving stakeholder expectations.

The lifecycle of gaming devices, from their creation to eventual disposal, generates significant electronic waste. This e-waste contains hazardous materials that can harm the environment if not managed properly.

While Gaming Realms focuses on software, its indirect influence on the gaming ecosystem means it should consider the environmental footprint of the hardware its products run on. Awareness of sustainable hardware production and robust recycling programs within the gaming industry is crucial.

Globally, e-waste is a growing concern, with estimates suggesting over 50 million metric tons were generated in 2023 alone. The gaming industry, with its rapid hardware upgrade cycles, contributes to this trend, highlighting the need for industry-wide environmental responsibility.

Corporate Social Responsibility (CSR) Initiatives

Gaming Realms, like many companies, is increasingly focused on Corporate Social Responsibility (CSR) initiatives. This includes environmental protection, with a goal to reduce its carbon footprint. While not a heavy industry in terms of direct emissions, demonstrating environmental stewardship is becoming crucial for brand image and meeting stakeholder expectations.

For Gaming Realms, this could translate into sustainable operational practices and supporting environmental causes. For instance, many UK companies are setting ambitious net-zero targets. In 2023, the UK government reported that 40% of large businesses had set a net-zero target, a figure expected to rise significantly by 2025.

- Brand Enhancement: Proactive CSR can boost Gaming Realms' reputation among players and investors.

- Stakeholder Alignment: Meeting growing demands for environmental responsibility from customers and shareholders.

- Operational Efficiency: Exploring energy-saving measures in offices and data centers.

- Community Engagement: Supporting environmental projects or charities can foster goodwill.

Climate Change and Operational Resilience

While Gaming Realms operates primarily in the digital space, climate change can still present indirect operational challenges. Extreme weather events, which are projected to increase in frequency and intensity, could disrupt the physical infrastructure supporting online gaming, such as data centers or the broader energy supply chain. For instance, a significant heatwave in 2024 caused power grid strain in several regions, highlighting the vulnerability of digital services to climate-related energy disruptions. Companies like Gaming Realms must factor these potential impacts into their operational resilience strategies to ensure service continuity.

The iGaming sector's reliance on stable digital infrastructure means that events like severe storms or floods could impact server uptime and player access. The World Meteorological Organization reported that 2023 was the warmest year on record, with numerous extreme weather events impacting global infrastructure. This underscores the growing need for robust disaster recovery and business continuity plans that account for climate-related risks, ensuring that Gaming Realms can maintain its services even when facing external environmental pressures.

Gaming Realms, like other digital service providers, needs to consider the resilience of its data center partners and the broader internet backbone against climate-related threats.

- Data Center Vulnerability: Increased risk of power outages or cooling system failures due to extreme temperatures.

- Supply Chain Disruptions: Potential impact on hardware procurement or maintenance if climate events affect manufacturing or logistics.

- Energy Price Volatility: Climate policies and scarcity could lead to fluctuating energy costs, impacting operational expenses.

- Regulatory Scrutiny: Growing pressure on businesses to demonstrate climate risk mitigation in their operational planning.

The environmental impact of digital operations, particularly energy consumption by data centers, presents a key consideration for Gaming Realms. With global data center energy usage around 1% of worldwide electricity in 2023, efficiency measures are paramount.

The industry faces increasing pressure to adopt Environmental, Social, and Governance (ESG) strategies, driven by investors and consumers seeking responsible practices. While Gaming Realms' specific ESG initiatives are not detailed, the trend towards transparency is evident, with companies like GAMING1 releasing ESG reports.

Climate change also poses indirect risks, such as disruptions to infrastructure from extreme weather events. The WMO reported 2023 as the warmest year on record, highlighting the need for robust business continuity plans to ensure service availability.

Gaming Realms, like its peers, must consider the environmental footprint of hardware and promote sustainable practices within its operations and supply chain. The growing concern over e-waste, exceeding 50 million metric tons globally in 2023, underscores this need.

| Environmental Factor | Impact on Gaming Realms | Mitigation Strategies | Industry Trend/Data (2023-2025) |

|---|---|---|---|

| Energy Consumption | High operational costs, carbon footprint | Optimizing code, efficient server architecture, sustainable hardware | Data center energy use ~1% of global electricity; UK large businesses with net-zero targets rising (40% in 2023) |

| E-waste | Indirect impact on hardware lifecycle | Promoting hardware recycling, considering sustainable sourcing | Over 50 million metric tons of e-waste globally in 2023 |

| Climate Change & Extreme Weather | Disruption to data centers and supply chains | Robust disaster recovery, resilient infrastructure partnerships | 2023 warmest year on record; increased frequency of extreme weather events |

| ESG & CSR Demands | Reputational risk/opportunity, stakeholder expectations | Developing and communicating ESG/CSR initiatives, transparency | Growing investor and consumer demand for responsible corporate behavior |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Gaming Realms is built on a robust foundation of data from leading market research firms, financial reports, and regulatory bodies. We incorporate insights from industry-specific publications and government economic indicators to ensure comprehensive coverage of all relevant factors.