Gaming Realms Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gaming Realms Bundle

Gaming Realms faces moderate competitive rivalry, with established players and emerging studios vying for market share in the dynamic online gaming sector. The threat of new entrants is present but somewhat mitigated by high development costs and regulatory hurdles. Understanding these forces is crucial for strategic planning.

The full Porter's Five Forces Analysis reveals the real forces shaping Gaming Realms’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gaming Realms' reliance on online casino operators as distribution platforms grants these partners considerable bargaining power. If a platform boasts a substantial player base or exclusive access to certain markets, it can dictate terms more effectively. For instance, in 2023, the global online gambling market was valued at approximately $86.7 billion, highlighting the scale of these platforms and their importance to content providers like Gaming Realms.

Gaming Realms' proprietary Remote Gaming Server (RGS) and its unique Slingo intellectual property significantly enhance its bargaining power with suppliers. This specialized technology and IP mean the company is less reliant on generic external development tools or core game mechanic providers, as its core offerings are distinct and difficult for competitors to replicate.

The development of specialized gaming content, such as Slingo, hinges on a unique talent pool encompassing game design, mathematics, and software engineering. While this talent isn't as widely available as for more common goods, the scarcity of highly skilled professionals in this niche can significantly impact development expenses and project schedules. Gaming Realms' demonstrated internal expertise in these specialized areas serves as a key strength, mitigating some of this supplier power.

Licensing of Third-Party Content

Gaming Realms actively licenses content from third-party studios to broaden its game portfolio and access markets with significant entry barriers. This approach positions Gaming Realms as a buyer in the content market, where its supplier bargaining power is influenced by the exclusivity and market desirability of the licensed games. For instance, in 2024, the online gambling market saw continued demand for diverse and engaging content, potentially increasing the leverage of popular third-party content providers.

- Content Uniqueness: The more unique and sought-after a third-party game is, the stronger the supplier's bargaining position.

- Market Demand: High player demand for specific third-party titles can empower those content creators.

- Supplier Concentration: If only a few studios offer highly popular content, their bargaining power increases.

- Licensing Costs: Increased demand can lead to higher licensing fees for Gaming Realms, impacting profitability.

Regulatory Compliance Services

The bargaining power of suppliers in regulatory compliance services is significant for Gaming Realms. Operating in diverse, regulated markets necessitates specialized legal and licensing expertise, making suppliers in this niche highly influential. Gaming Realms' ongoing efforts to secure iGaming Supplier Licenses in new territories, such as those granted in 2024, underscore this dependence.

Key factors contributing to supplier power include:

- Specialized Knowledge: Suppliers possess intricate knowledge of varying international and local gaming regulations, which is essential for market entry and continued operation.

- Licensing Complexity: The process of obtaining and maintaining gaming licenses is often complex and time-consuming, creating a high barrier to entry for new compliance service providers and consolidating power among existing ones.

- Risk Mitigation: Non-compliance can lead to severe penalties, fines, and operational shutdowns, compelling companies like Gaming Realms to rely on reputable and experienced compliance service providers to mitigate these risks.

Gaming Realms' reliance on third-party content creators for certain game titles means these suppliers can wield considerable influence. The uniqueness and popularity of their offerings, coupled with market demand, directly impact licensing costs and availability. For instance, in 2024, the online casino market continued to see robust demand for fresh and engaging content, potentially strengthening the hand of sought-after game developers.

| Supplier Type | Factors Influencing Bargaining Power | Impact on Gaming Realms |

|---|---|---|

| Third-Party Game Developers | Content uniqueness, market popularity, exclusivity | Higher licensing fees, potential delays in content acquisition |

| Regulatory Compliance Services | Specialized knowledge of gaming laws, licensing complexity | Increased operational costs, dependence on expert providers |

What is included in the product

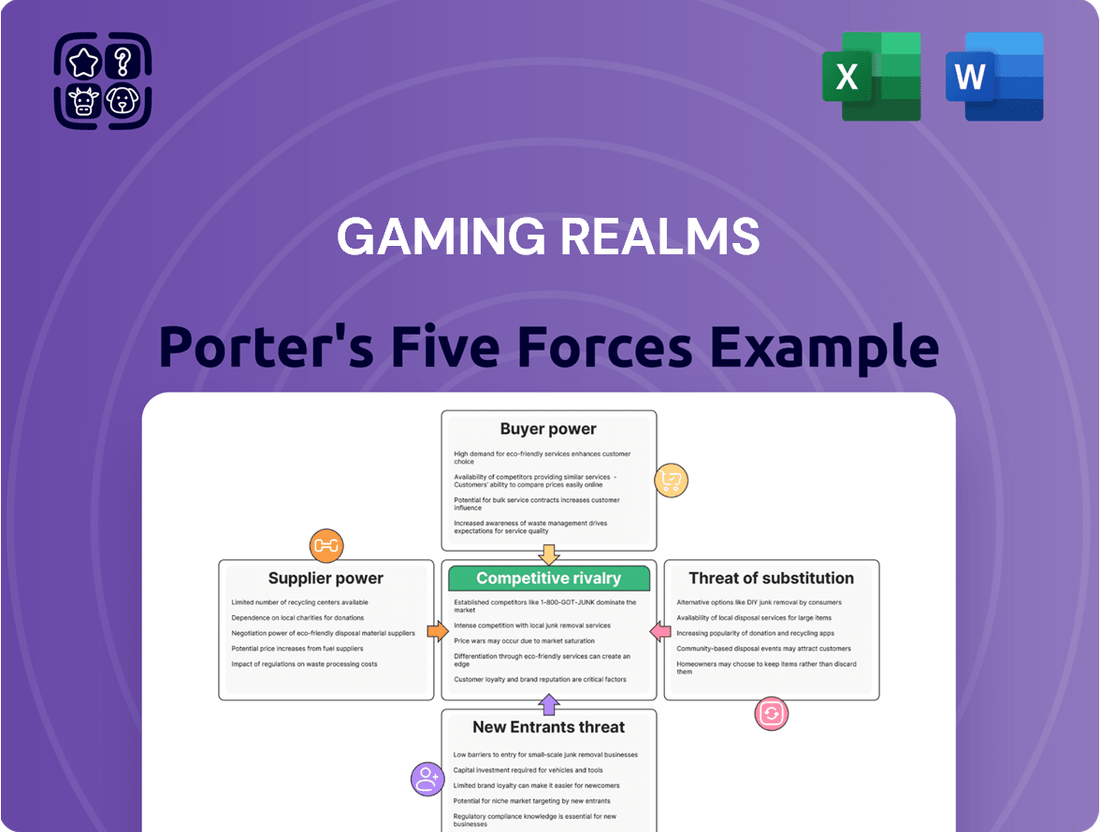

Gaming Realms' Porter's Five Forces analysis reveals the intense competition, buyer power, and threat of substitutes within the online gaming sector, highlighting strategic challenges and opportunities.

Instantly identify and address competitive pressures with a dynamic Gaming Realms Porter's Five Forces Analysis, simplifying complex market dynamics for strategic clarity.

Customers Bargaining Power

The bargaining power of customers for consolidated online casino operators is a significant factor for Gaming Realms. These large operators, by their very nature, represent substantial clients, meaning their business is highly valuable. For instance, in 2024, major European online casino groups like Flutter Entertainment and Entain continued to consolidate their market positions, increasing their purchasing power.

These major players can leverage their scale to negotiate more favorable terms with game developers like Gaming Realms. Their ability to demand exclusive content or better revenue-sharing agreements stems from the sheer volume of players and wagers they handle, making them attractive partners but also powerful negotiators.

Operators, while having significant bargaining power, are drawn to Gaming Realms' distinctive Slingo format. This unique offering, coupled with a consistent pipeline of successful new Slingo titles, strengthens Gaming Realms' appeal. In 2023, Gaming Realms reported a 20% year-on-year revenue increase, partly driven by the popularity of its proprietary content, demonstrating operators' demand for such engaging products.

Once an operator integrates Gaming Realms' content via its Remote Gaming Server (RGS) platform, significant switching costs arise. These include the technical effort and expense required to disconnect and replace the RGS, re-engineer marketing efforts to highlight new content, and retrain staff. For instance, a typical integration can take several months and involve substantial IT resources.

These integration costs, coupled with the potential disruption to player experience and the need to build new player familiarity with alternative game offerings, effectively dampen an operator's immediate bargaining power. This inertia provides Gaming Realms with a degree of pricing leverage and stability in its partnerships, especially as operators are unlikely to switch providers frequently due to these embedded costs.

Market Competition Among Operators

The online casino market is incredibly competitive, with operators constantly seeking unique games to attract and retain players. This fierce rivalry often translates into a stronger bargaining position for content providers like Gaming Realms, as operators are eager to secure exclusive or high-performing titles. For instance, in 2024, the global online gambling market was projected to reach over $100 billion, highlighting the intense battle for market share among numerous players.

This competitive landscape directly influences the bargaining power of customers, which in this context are the online casino operators. They are incentivized to offer better terms to suppliers who can provide them with a competitive edge. Gaming Realms, by developing innovative and engaging content, can leverage this demand to negotiate favorable partnership agreements.

- Intense Market Rivalry: The online casino sector is crowded, pushing operators to seek differentiation through exclusive content.

- Demand for Novelty: Operators actively pursue new and engaging games to attract and retain their player base.

- Supplier Leverage: This demand empowers content providers like Gaming Realms, enhancing their negotiating position.

Geographic and Regulatory Expansion

Gaming Realms' strategic expansion into new regulated markets, including Brazil and various US states like West Virginia, significantly broadens its customer base. This geographical diversification inherently dilutes the bargaining power of any single customer or small group of customers.

By establishing partnerships with numerous new operators across the globe, Gaming Realms further reduces customer concentration. This wider network means that the loss or dissatisfaction of one operator has a less substantial impact on overall revenue, thereby strengthening the company's position.

For instance, in 2024, Gaming Realms announced its entry into British Columbia, Canada, and continued its expansion within the United States, demonstrating a clear strategy to tap into new revenue streams and customer segments. This ongoing global outreach is crucial for mitigating the bargaining power of its clientele.

- Geographic Diversification: Entry into markets like Brazil and West Virginia in 2024 spreads revenue across new customer bases.

- Operator Partnerships: Collaborations with numerous new global operators reduce reliance on any single client.

- Regulatory Compliance: Operating in regulated markets often involves standardized agreements, limiting individual customer negotiation leverage.

- Market Penetration: Successful launches in new territories in 2024 enhance market share and reduce customer dependency.

The bargaining power of customers, primarily online casino operators, is moderated by Gaming Realms' unique content and the high switching costs associated with its RGS platform. While large operators like Flutter Entertainment, a major player in 2024, possess significant leverage, they are also incentivized to secure Gaming Realms' popular Slingo titles to maintain a competitive edge in the crowded online gambling market, which was projected to exceed $100 billion globally in 2024.

Gaming Realms' strategy of expanding into new regulated markets, such as Brazil and various US states in 2024, effectively dilutes the influence of any single customer. This diversification, exemplified by their entry into British Columbia in 2024, reduces customer concentration and strengthens Gaming Realms' overall negotiating position.

| Factor | Impact on Gaming Realms | Supporting Data (2024 unless specified) |

| Customer Concentration | Lowers bargaining power | Expansion into new markets like Brazil and West Virginia. |

| Switching Costs | Reduces customer bargaining power | Integration of RGS platform involves significant IT resources and time. |

| Market Competition | Increases supplier leverage | Global online gambling market projected over $100 billion. |

| Product Differentiation | Strengthens Gaming Realms' position | Popularity of proprietary Slingo content; 20% revenue increase in 2023. |

Same Document Delivered

Gaming Realms Porter's Five Forces Analysis

This comprehensive Porter's Five Forces analysis of Gaming Realms provides an in-depth examination of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This detailed report offers actionable insights into the strategic positioning of Gaming Realms and the key factors influencing its profitability and market dynamics.

Rivalry Among Competitors

The iGaming content development landscape is intensely competitive, featuring a large number of companies creating games and providing services. This crowded market includes established giants like Playtech and Evolution Gaming, alongside numerous smaller, specialized studios all vying for operator attention and player engagement. For instance, in 2024, the global online gambling market was valued at approximately $70 billion, a figure driven by continuous innovation and content creation from these developers.

Gaming Realms distinguishes itself significantly through its proprietary Slingo game, a unique fusion of slots and bingo. This innovative blend, protected by intellectual property, carves out a distinct market segment. For instance, in 2023, Slingo games contributed a substantial portion of Gaming Realms' revenue, showcasing its effectiveness in reducing direct competition from operators focused solely on traditional casino offerings.

Gaming Realms is aggressively pursuing geographic market penetration, with North America representing a substantial portion of its licensing income. This expansion into emerging, regulated markets heightens competition but simultaneously unlocks new growth opportunities, forcing it to contend with deeply entrenched competitors.

Licensing and Partnership Strategies

Gaming Realms faces intense competition within the iGaming sector, partly due to its dual strategy of licensing its proprietary content and distributing third-party games. This means it's vying for operator attention not only with its own popular titles but also against other content providers seeking similar distribution deals. The landscape is crowded, with numerous game developers and aggregators all aiming to capture market share.

Securing and maintaining strong partnerships with major online casino operators, such as FanDuel and Fanatics, is a cornerstone of Gaming Realms' competitive strategy. These alliances provide significant reach and visibility for its games. For instance, in 2023, Gaming Realms expanded its US presence through multiple new operator agreements, demonstrating the ongoing importance of these relationships in a rapidly growing market.

- Content Licensing: Gaming Realms licenses its Slingo Originals and other branded content to numerous online casino operators globally, creating a revenue stream while also increasing brand exposure.

- Third-Party Distribution: The company also acts as a distributor for other game studios, broadening its content portfolio and offering a one-stop shop for operators seeking diverse game libraries.

- Key Partnerships: Agreements with major operators like FanDuel and BetMGM are critical, providing access to large player bases and driving significant revenue. For example, its expansion with BetMGM in Pennsylvania in late 2023 highlights the strategic value of these partnerships.

- Competitive Landscape: The iGaming content market is highly competitive, with many studios vying for operator attention and player engagement, making differentiation through unique content and strong distribution networks essential.

Pace of New Game Releases

The pace of new game releases is a significant factor in competitive rivalry within the gaming industry. Gaming Realms, for instance, demonstrates a commitment to this by consistently updating its Slingo portfolio.

- Gaming Realms released 12 new Slingo titles in 2024.

- The company launched three new Slingo games in the first quarter of 2025.

- This continuous release cycle is crucial for maintaining player interest and staying ahead of competitors.

Competitive rivalry in the iGaming content space is fierce, with numerous developers constantly innovating to capture operator and player attention. Gaming Realms navigates this by leveraging its unique Slingo brand, a key differentiator in a crowded market. For example, in 2024, the global online gambling market reached approximately $70 billion, underscoring the significant revenue potential that fuels this intense competition.

| Competitor Type | Key Characteristics | Gaming Realms' Response |

|---|---|---|

| Established Giants | Large portfolios, extensive operator networks (e.g., Playtech, Evolution Gaming) | Focus on proprietary content (Slingo), strategic partnerships with major operators |

| Specialized Studios | Niche game types, agile development | Continuous new game releases, licensing agreements for broader reach |

| Aggregators | Wide variety of third-party content | Acts as a distributor for other studios, offering a diverse library |

SSubstitutes Threaten

The primary threat of substitutes for Gaming Realms stems from a wide array of digital entertainment options vying for consumers' leisure time and disposable income. This includes established giants like console and PC video games, the ever-present mobile gaming market, and the massive subscription-based streaming services such as Netflix and Disney+. Social media platforms also capture significant user engagement, presenting a constant challenge for attention.

The global video game market is a formidable competitor, projected to reach over $200 billion in 2024. This vast and continuously expanding industry offers diverse experiences that can easily divert players from real-money gaming, highlighting the intense competition for entertainment spending.

While Gaming Realms primarily operates in the online gaming space, traditional land-based casinos and other forms of in-person gambling represent a substitute threat. These venues offer a different, often more social, experience. However, the growing preference for convenience and accessibility, especially through mobile devices, significantly dilutes this threat for companies like Gaming Realms. For instance, the global online gambling market was projected to reach over $100 billion in 2024, highlighting the shift towards digital platforms.

Beyond traditional casino games, the online gambling landscape offers a wide array of substitutes that compete for consumer discretionary spending. These include robust markets for sports betting, online poker, and digital lottery games. For instance, the global sports betting market was valued at approximately $76.7 billion in 2023 and is projected to grow, presenting a significant alternative for entertainment budgets.

Gaming Realms strategically positions itself by focusing on its unique hybrid format, Slingo, which blends elements of slots and bingo. This distinctive offering aims to capture a specific segment of the market that may not be fully satisfied by other online gambling formats, thereby mitigating the threat of direct substitution.

Free-to-Play Social Casino Games

The free-to-play social casino market presents a significant threat of substitutes for Gaming Realms' real money gaming operations. These games, which rely on in-app purchases rather than actual gambling, offer a similar entertainment experience without the financial risk associated with real money play. This segment is substantial and continues to expand, attracting a broad user base.

The global social casino market was valued at approximately $6.5 billion in 2023 and is projected to reach over $10 billion by 2028, demonstrating robust growth. This indicates a large and accessible alternative for players seeking casino-style entertainment. Gaming Realms' social publishing segment competes directly within this space, but the broader market's appeal means players may opt for these free-to-play options instead of engaging with real money games.

- Market Size: The social casino market is a multi-billion dollar industry, offering a vast alternative entertainment channel.

- Revenue Model: Primarily driven by in-app purchases, making it accessible to a wider audience than real money gambling.

- Player Behavior: Players may choose social casino games for entertainment without the financial commitment or risk of real money gambling.

- Growth Trajectory: Continued expansion of the social casino market signifies an increasing competitive pressure from substitutes.

User-Generated Content and Casual Games

The proliferation of user-generated content platforms and a vast ecosystem of casual mobile games, frequently available at no cost or a minimal price, poses a significant substitute threat to traditional casino gaming. These accessible entertainment options provide immediate gratification without the inherent financial risk associated with real money wagering.

For instance, the global mobile gaming market was valued at approximately $180 billion in 2023, demonstrating a massive addressable market that competes for consumer leisure time and disposable income. Many of these casual games are free-to-play, monetizing through in-app purchases or advertising, making them an extremely low-barrier alternative to the financial commitment required by casino games.

- User-Generated Content: Platforms like Roblox and Minecraft allow users to create their own gaming experiences, diverting attention from traditional entertainment.

- Casual Mobile Games: The sheer volume and accessibility of free-to-play mobile games offer a constant stream of entertainment alternatives.

- Low Financial Risk: These substitutes eliminate the direct financial outlay and potential losses associated with casino gambling.

- Time Competition: Casual games and UGC platforms compete directly for the discretionary time consumers might otherwise spend on casino-style entertainment.

The threat of substitutes for Gaming Realms is substantial, encompassing a broad spectrum of digital entertainment. This includes the massive global video game market, projected to exceed $200 billion in 2024, and the highly accessible mobile gaming sector, valued at around $180 billion in 2023. Additionally, subscription streaming services and social media platforms compete fiercely for consumer attention and discretionary spending.

The free-to-play social casino market, valued at approximately $6.5 billion in 2023, presents a direct substitute by offering similar entertainment without the financial risk of real money gambling. Furthermore, the online sports betting market, worth an estimated $76.7 billion in 2023, and other forms of online gambling like poker and lotteries, also divert potential customers.

| Substitute Category | Estimated Market Value (2023/2024) | Key Characteristics |

|---|---|---|

| Global Video Games | >$200 billion (2024) | Diverse genres, high engagement, broad appeal |

| Mobile Gaming | ~$180 billion (2023) | Ubiquitous access, casual play, free-to-play options |

| Social Casino Games | ~$6.5 billion (2023) | No financial risk, in-app purchases, similar mechanics |

| Online Sports Betting | ~$76.7 billion (2023) | Event-driven, competitive odds, growing legality |

Entrants Threaten

The iGaming industry, particularly in well-established and regulated markets like the United States, presents substantial hurdles for new companies looking to enter. These barriers are largely driven by the intricate and expensive licensing processes that are mandatory for operating legally. For instance, obtaining a license in a state like New Jersey can cost hundreds of thousands of dollars and involves extensive background checks and compliance audits, making it a significant financial commitment before any revenue is generated.

Gaming Realms itself demonstrates the impact of these high regulatory barriers by actively pursuing and securing licenses in various new states and Canadian provinces. This strategic move not only expands their operational footprint but also underscores the considerable effort and investment required to navigate these entry requirements, effectively deterring smaller or less capitalized potential competitors.

New entrants find it difficult to get distribution deals with established online casino operators. These operators often stick with content providers who have a history of successful games and dependable platforms, like Gaming Realms' Remote Gaming Server (RGS). For instance, in 2024, major operators continued to prioritize partners with proven integration capabilities and a robust portfolio, making it harder for newcomers to break in without significant prior success or unique offerings.

Developing a strong brand identity and unique intellectual property, such as the highly successful Slingo game, requires substantial time and financial commitment. New competitors would find it challenging to quickly match the established brand equity and deep player familiarity that Gaming Realms has meticulously built over the years.

Technological Sophistication and Development Costs

The gaming industry, particularly for mobile-focused content and sophisticated Remote Gaming Server (RGS) platforms, demands significant technological prowess and substantial upfront investment. This high barrier to entry deters many potential new competitors.

- Technological Expertise: Developing cutting-edge games and robust RGS infrastructure requires specialized skills in areas like game design, software engineering, cybersecurity, and data analytics.

- Capital Investment: The creation of high-quality, engaging mobile games and the underlying server technology can involve millions of dollars in development costs, licensing fees, and ongoing maintenance.

- R&D Intensity: Continuous innovation is crucial in the gaming sector, necessitating significant and sustained investment in research and development to stay competitive.

Intense Competition from Existing Players

The iGaming market is already quite crowded. Established companies with significant resources and brand recognition present a formidable barrier. For instance, in 2024, the global online gambling market was valued at over $70 billion, indicating the scale of existing operations.

Newcomers would struggle to carve out a niche against these well-entrenched players. These incumbents often benefit from:

- Economies of scale in marketing and operations.

- Established customer bases and loyalty programs.

- Significant capital for product development and acquisition.

Therefore, the threat of new entrants is somewhat mitigated by the sheer difficulty of competing effectively in such a mature and competitive landscape.

The threat of new entrants into the iGaming sector, particularly concerning companies like Gaming Realms, is significantly low. This is primarily due to the substantial financial and regulatory hurdles involved in obtaining necessary operating licenses. For example, in 2024, licensing costs in key US states continued to range from hundreds of thousands to over a million dollars, alongside rigorous compliance requirements.

Furthermore, the need for established distribution channels and strong brand recognition, built through years of operation and investment in intellectual property like Slingo, acts as a powerful deterrent. New entrants also face high capital demands for developing sophisticated RGS platforms and engaging mobile games, with development costs often running into millions.

The market's maturity, evidenced by a global online gambling market valued at over $70 billion in 2024, means established players benefit from economies of scale and loyal customer bases, making it exceedingly difficult for newcomers to gain traction without considerable resources and a unique value proposition.

| Barrier Type | Description | Example Impact (2024 Data) |

|---|---|---|

| Regulatory & Licensing | Extensive and costly licensing processes required by jurisdictions. | License fees in US states can exceed $1 million; lengthy approval times. |

| Distribution Agreements | Securing partnerships with established online casino operators. | Operators prioritize proven content providers, limiting access for new entrants. |

| Brand & IP Development | Building brand loyalty and unique game content. | Significant investment required to match established brands like Slingo. |

| Capital Investment & Technology | High costs for game development, RGS infrastructure, and ongoing R&D. | Millions required for quality game creation and robust server technology. |

| Market Saturation | Competition from well-capitalized incumbents with large customer bases. | Global online gambling market over $70 billion, dominated by established players. |

Porter's Five Forces Analysis Data Sources

Our Gaming Realms Porter's Five Forces analysis utilizes a robust blend of data, including company annual reports, investor presentations, and industry-specific market research from firms like Newzoo and Statista. This ensures a comprehensive understanding of competitive dynamics.