Gaming Realms Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gaming Realms Bundle

Gaming Realms' strategic positioning is laid bare in its BCG Matrix. Understand which of their products are driving growth, which are generating steady revenue, and which may require a closer look.

This preview offers a glimpse into their portfolio's health. To truly unlock Gaming Realms' future potential and make informed decisions about resource allocation, you need the complete BCG Matrix.

Purchase the full report for a comprehensive breakdown of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights to guide your investment strategy.

Stars

Gaming Realms' proprietary Slingo game format remains a standout performer, holding a significant market share in the hybrid casino game sector. This enduring popularity is a testament to its unique gameplay and broad appeal.

The release of new Slingo titles in 2024 proved exceptionally successful, with these new cohorts achieving the highest gross revenue in their debut year. This trend highlights the continued innovation and player enthusiasm for the Slingo brand.

This robust performance underscores Slingo's status as a star product, driving consistent player engagement and substantial revenue generation. Its strength is particularly notable within the expanding mobile gaming market, where it continues to capture a loyal player base.

North America is a clear star for Gaming Realms, driven by its rapid expansion and strong revenue growth. In 2024, licensing revenue in this region surged by 59% to £12.9 million, now representing a substantial 54% of the company's total content licensing income.

The company's strategic entry into five regulated US states, including West Virginia, highlights its commitment to capturing market share. Gaming Realms is actively broadening its partnerships with major operators, solidifying its position in this high-potential market.

Gaming Realms' content licensing business is a shining star, driving significant growth. In 2024, this segment saw a robust 23% revenue increase, reaching £24.5 million. This success stems from a high-margin, scalable model that allows for widespread global distribution of their popular gaming content through a vast network of operator partnerships.

The consistent and strong demand for Gaming Realms' iGaming content across diverse international markets underscores its star status. This indicates a dominant position within the expanding iGaming industry, a testament to their strategic focus on licensing their intellectual property.

Strategic Operator Partnerships

Gaming Realms demonstrates significant strength in strategic operator partnerships, a key indicator for its position within the BCG matrix. The company's ability to forge and expand these relationships is crucial for its growth.

In 2024, Gaming Realms successfully launched with an impressive 44 new partners. This momentum continued into the first quarter of 2025, with an additional 9 new partners joining their network. These collaborations are vital for market penetration and expanding the reach of their gaming content.

Key partnerships with major global operators such as FanDuel, Fanatics, BetMGM, and Superbet highlight Gaming Realms' strategic approach. These alliances facilitate rapid entry into both new and existing high-growth markets, significantly amplifying the distribution and market share of their innovative gaming products.

- 2024 Partner Growth: 44 new operator partnerships established.

- Q1 2025 Partner Growth: 9 new operator partnerships secured.

- Key Strategic Partners: FanDuel, Fanatics, BetMGM, Superbet.

- Market Impact: Accelerated penetration into high-growth markets.

Proprietary Remote Gaming Server (RGS)

Gaming Realms' proprietary Remote Gaming Server (RGS) is a clear star in its Business Growth-Share Matrix. This critical technology platform processed over £6 billion in gaming transactions during 2024, showcasing its immense scale and importance to the company's operations.

The RGS is the engine driving the distribution of Gaming Realms' diverse content portfolio. Its robust architecture supports a high-margin licensing model, allowing the company to efficiently reach players across multiple jurisdictions.

With a global presence spanning seven territories, the RGS's scalability is a key differentiator. This technological advantage helps Gaming Realms maintain a strong market position in the dynamic and competitive digital gaming landscape.

- Proprietary RGS: Processed over £6 billion in gaming transactions in 2024.

- High-Margin Licensing: Enables efficient content distribution and revenue generation.

- Global Reach: Operates across seven territories, ensuring broad market access.

- Scalability: Supports growth in a rapidly evolving digital gaming environment.

Gaming Realms' Slingo brand is a clear star, demonstrating sustained popularity and revenue generation. The introduction of new Slingo titles in 2024 achieved the highest gross revenue in their debut year, underscoring the brand's enduring appeal and the company's ability to innovate within this format.

North America has emerged as a star market for Gaming Realms, with licensing revenue in the region experiencing a significant 59% surge in 2024, reaching £12.9 million. This growth now accounts for 54% of the company's total content licensing income, highlighting its strategic success in key regulated US states.

The company's content licensing business, bolstered by a high-margin, scalable model, is a star performer. In 2024, this segment grew by a robust 23% to £24.5 million, driven by widespread global distribution through extensive operator partnerships.

Gaming Realms' proprietary Remote Gaming Server (RGS) is a critical star asset, processing over £6 billion in gaming transactions during 2024. This scalable technology platform efficiently distributes the company's content across seven territories, supporting its high-margin licensing strategy.

| Product/Market | BCG Category | Key Performance Indicators (2024/Q1 2025) | Strategic Importance |

|---|---|---|---|

| Slingo Brand | Star | Highest gross revenue for new titles in debut year. Enduring player engagement. | Core intellectual property, driving consistent revenue and player loyalty. |

| North America Market | Star | 59% licensing revenue growth (£12.9M), 54% of total content licensing income. Entry into 5 regulated US states. | High-growth territory with significant expansion potential and strategic operator partnerships. |

| Content Licensing | Star | 23% revenue increase (£24.5M). High-margin, scalable model. | Primary revenue driver with global reach and strong operator network. |

| Proprietary RGS | Star | Processed over £6 billion in gaming transactions. Operates across 7 territories. | Enabling technology for content distribution and high-margin licensing. |

What is included in the product

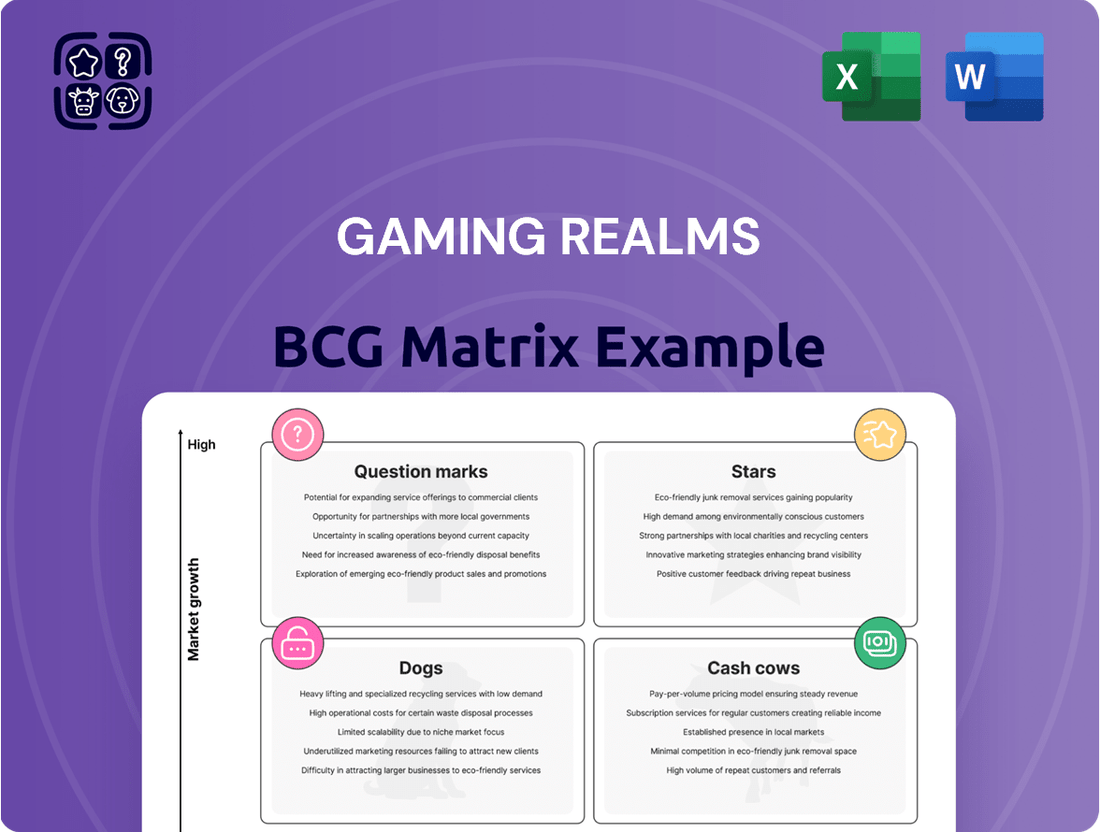

Gaming Realms' BCG Matrix offers a strategic overview of its product portfolio, categorizing games as Stars, Cash Cows, Question Marks, or Dogs.

This analysis helps Gaming Realms identify which game segments to invest in, maintain, or divest to optimize resource allocation.

A clear, visual Gaming Realms BCG Matrix instantly clarifies which business units need investment and which can be divested, easing strategic decision-making.

Cash Cows

Gaming Realms' mature Slingo titles are its cash cows, forming a substantial revenue base. These games, particularly in established markets like the UK, are reliable income generators. For instance, the UK market, while showing modest growth of 1% in 2024, continues to be a stronghold for these established titles, providing consistent cash flow with limited need for further investment.

The licensing segment stands out as a significant profit driver for Gaming Realms. In 2024, it achieved an impressive EBITDA of £14.2 million, underscoring its strong financial performance and ability to generate substantial cash flow.

This segment's dominance is further evident as it accounts for a substantial 86% of the company's total revenue. This financial backbone provides the essential capital required to fuel expansion into new markets and support investments in promising, high-growth opportunities.

A key factor in the segment's high profitability is its minimal promotional expenditure. This is largely due to its established presence in the market, which naturally leads to high profit margins and a consistent revenue stream.

Gaming Realms' robust financial health, marked by a debt-free status and a healthy cash reserve of £13.5 million at the close of 2024, directly reflects the strong cash generation capabilities of its core gaming operations.

This solid financial footing, achieved through effective cash management, empowers the company to pursue growth opportunities and strategic endeavors without the encumbrance of external debt, underscoring the profitability of its established business lines.

Renewed Slingo Brand Licensing Agreement

The five-year renewal of Gaming Realms' licensing agreement with Scientific Games for the Slingo brand solidifies its position as a Cash Cow. This ensures ongoing revenue from both retail and digital Slingo games across numerous global lottery markets. The agreement, spanning a mature segment of the market, guarantees a consistent and predictable high-margin income stream.

This demonstrates the lasting appeal and robust cash-generating capacity of the Slingo brand, extending beyond just direct content licensing. For instance, in 2023, Gaming Realms reported that its proprietary IP, including Slingo, contributed significantly to its revenue growth.

- Brand Longevity: The Slingo brand continues to be a reliable revenue generator, proving its enduring market appeal.

- Predictable Income: The long-term nature of the agreement in a mature market offers a stable and high-margin income.

- Diversified Revenue: Revenue is generated from both retail and digital channels across various global lottery markets.

- IP Value: The renewal highlights the significant value and cash-generating power of Gaming Realms' intellectual property.

Social Publishing Segment

The social publishing segment represents a stable revenue source for Gaming Realms. In 2024, this segment generated £4.0 million in revenue, marking a 14% increase.

This steady growth is primarily driven by its freemium game offerings, with a strong presence in the US market. The segment consistently delivers positive EBITDA, reaching £1.2 million in 2024, underscoring its role as a reliable cash generator within the mature social gaming landscape.

- Revenue Contribution: £4.0 million in 2024.

- Growth Rate: 14% year-over-year.

- Profitability: £1.2 million in positive EBITDA for 2024.

- Market Focus: Primarily the US market with freemium games.

Gaming Realms' established Slingo titles are definitive cash cows, consistently generating substantial revenue with minimal reinvestment. The licensing segment, in particular, is a profit powerhouse, contributing £14.2 million in EBITDA in 2024, representing 86% of total revenue. This strong performance is bolstered by low promotional costs due to market maturity.

The company's debt-free status and £13.5 million cash reserve at the end of 2024 directly reflect the robust cash flow from these mature operations. The five-year renewal of the Slingo brand licensing agreement with Scientific Games further solidifies this income stream, ensuring predictable, high-margin revenue from both digital and retail channels across global lottery markets.

The social publishing segment also acts as a steady cash generator, with 2024 revenues reaching £4.0 million, a 14% increase, and delivering £1.2 million in positive EBITDA. This segment's reliance on freemium games, primarily in the US, contributes to its reliable cash generation within the mature social gaming sector.

| Segment | 2024 Revenue | 2024 EBITDA | Key Driver |

|---|---|---|---|

| Licensing (Slingo) | £16.5m (86% of total) | £14.2m | Established IP, low promotion |

| Social Publishing | £4.0m | £1.2m | Freemium games, US market |

What You See Is What You Get

Gaming Realms BCG Matrix

The Gaming Realms BCG Matrix preview you are currently viewing is the precise, unedited document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just the fully formatted, analysis-ready report designed for strategic decision-making.

Dogs

Within Gaming Realms' portfolio, underperforming legacy game titles would likely fall into the "Dogs" category of the BCG Matrix. These are older games that, while perhaps once successful, now struggle to attract significant player engagement or generate substantial revenue. Think of them as digital relics that might still require some upkeep, like server costs, but aren't contributing much to the company's bottom line.

Gaming Realms might have certain content pieces that are only popular in a few specific regions and aren't growing much. If these games need ongoing support but can't break into new, growing markets, they could be using up resources without helping the company expand. For example, if a game launched in 2023 in a single European country and only saw a 2% year-over-year user increase by mid-2024, it might be a candidate for this category.

Marketing spend on Gaming Realms' underperforming titles, those failing to attract or retain players despite investment, are classified as dogs. This inefficient allocation of resources diverts capital that could be strategically reinvested into promising star or question mark products, hindering overall portfolio growth.

In 2024, companies across the gaming sector are increasingly scrutinizing marketing ROI. For instance, a significant portion of marketing budgets in the mobile gaming space, often upwards of 30-40%, can be tied up in campaigns for titles that do not yield a positive return on ad spend (ROAS), effectively marking them as dogs.

The strategic imperative for Gaming Realms, as with many in the industry, is to pivot towards high-grossing new cohorts. This means a deliberate shift away from supporting legacy or low-performing titles, ensuring that marketing efforts are concentrated on products with the highest potential for future revenue and player acquisition.

Outdated Technology or Game Engines

Older games, particularly those built on legacy technology or game engines, can fall into the Dogs category within the BCG Matrix. If the cost of maintaining these titles outweighs the revenue they bring in, they become problematic cash drains. This is especially true if there's little to no prospect of updating them for better performance or adding new features.

For instance, a game released in the early 2010s on an engine that is no longer supported by its developer might require significant custom patching for compatibility with modern operating systems. This effort, coupled with declining player numbers, makes it a prime candidate for the Dogs quadrant. Gaming Realms' commitment to its Remote Gaming Server (RGS) platform, which is updated regularly, indicates a strategic move away from such outdated assets.

- High Maintenance Costs: Games on outdated platforms can incur substantial costs for bug fixes and compatibility updates, diverting resources from more promising titles.

- Low Revenue Potential: As technology advances, older games often struggle to attract new players or retain existing ones, leading to stagnant or declining revenue streams.

- Scalability Issues: Legacy technology may limit the ability to scale operations, implement new features, or integrate with emerging platforms, hindering future growth.

- Strategic Focus: Companies like Gaming Realms prioritize investment in modern infrastructure, such as their RGS, to ensure future competitiveness and avoid the pitfalls of outdated technology.

Any Divested or Phased-Out Products

Products or minor business ventures that Gaming Realms might decide to discontinue or divest, because they no longer align with its core strategy of mobile-focused content licensing, would be classified as 'dogs' in the BCG Matrix. While specific divestitures haven't been publicly detailed, companies like Gaming Realms dynamically manage their product portfolios to ensure resources are optimally allocated. These are typically identified as underperforming assets that warrant minimal future investment to avoid draining valuable capital and management attention.

For instance, if Gaming Realms were to phase out older, non-mobile optimized gaming titles or a particular subsidiary that isn't contributing to its strategic goals, these would represent the 'dogs'. Such a move would free up capital and focus for its more promising mobile ventures. As of the latest available data, Gaming Realms has been actively investing in its real-money gaming (RMG) segment, suggesting a strategic pruning of less profitable or non-core areas to bolster growth in its primary market.

- Strategic Alignment: Products or ventures divested due to a lack of fit with the mobile-first content licensing strategy.

- Underperformance: These would be characterized by low market share and low growth potential within their respective segments.

- Resource Optimization: Discontinuing such offerings allows for reallocation of capital and management focus to core, high-potential areas.

- Portfolio Pruning: A common practice for dynamic companies to enhance overall efficiency and profitability.

Within Gaming Realms' portfolio, underperforming legacy game titles that struggle to attract significant player engagement or generate substantial revenue would fall into the Dogs category of the BCG Matrix. These older games might require upkeep but aren't contributing much to the company's bottom line. For example, a game released in the early 2010s on an unsupported engine might need costly custom patching for modern systems, making it a prime candidate for the Dogs quadrant. Gaming Realms' focus on its updated RGS platform signals a move away from such outdated assets.

Products or ventures that no longer align with Gaming Realms' mobile-first content licensing strategy, characterized by low market share and growth potential, would also be classified as dogs. Discontinuing these offerings allows for capital and management focus to be reallocated to core, high-potential areas. This portfolio pruning enhances overall efficiency and profitability, a common practice for dynamic companies.

In 2024, the gaming industry is seeing a trend where companies scrutinize marketing ROI. A significant portion of marketing budgets, sometimes 30-40% in mobile gaming, can be tied to titles that don't yield a positive return on ad spend (ROAS), effectively marking them as dogs. The strategic imperative is to pivot towards high-grossing new cohorts, concentrating efforts on products with the highest potential for future revenue and player acquisition.

Gaming Realms' commitment to its Remote Gaming Server (RGS) platform, which is regularly updated, demonstrates a strategic shift away from outdated assets that incur high maintenance costs and offer low revenue potential. These legacy games, particularly those on unsupported platforms, can become cash drains, hindering scalability and future growth. By avoiding these pitfalls, Gaming Realms aims to ensure future competitiveness.

Question Marks

Gaming Realms' strategic expansion into Brazil, South Africa, and British Columbia in 2025 positions these new markets as question marks within its BCG Matrix. The Brazilian iGaming market, for instance, is experiencing rapid growth, with projections indicating a substantial increase in revenue by 2027, driven by regulatory advancements and increasing player adoption.

While these regions represent high-growth opportunities, Gaming Realms' initial market share is expected to be minimal, necessitating significant investment to build brand awareness and acquire customers. The substantial upfront capital required for market penetration and the inherent uncertainty surrounding immediate revenue generation solidify their classification as question marks, balancing high potential with considerable risk.

Gaming Realms' strategy to expand third-party content distribution, exemplified by partnerships with studios like ReelPlay and the forthcoming S Gaming, marks a significant new growth avenue. This initiative aims to diversify the company's portfolio and tap into lucrative markets, including the United States, a key objective for 2024 and beyond.

While this venture is still in its nascent stages, its market share and profitability are actively being cultivated. The company invested approximately £1.5 million in marketing and new content acquisition in the first half of 2024, reflecting the resource allocation towards this developing business line.

This expansion, though resource-intensive for integration and distribution, holds considerable potential to evolve into a substantial revenue stream for Gaming Realms. The company anticipates this segment to contribute significantly to its overall growth trajectory by the end of 2025.

Gaming Realms is strategically prioritizing the development of new game formats beyond its established Slingo intellectual property for 2025. This initiative targets the burgeoning mobile gaming market, a sector experiencing significant growth.

While Slingo's brand recognition provides a solid foundation, these new formats are currently in their nascent stages with unproven market adoption and share. Significant investment in research, development, and marketing will be crucial to establish their presence and foster growth.

These ventures represent potential stars within Gaming Realms' portfolio, requiring substantial capital and effort to transition from question marks to market leaders. The company's commitment to innovation in this high-growth area underscores its forward-looking strategy.

Early-Stage Branded Slingo Collaborations

Gaming Realms' early-stage branded Slingo collaborations, like Slingo Space Invaders and Slingo Tetris launched in 2024, represent a strategic move into the 'Question Marks' category of the BCG matrix. These ventures leverage the strong recognition of established brands to attract players, a strategy that saw the company's revenue grow by 12% in the first half of 2024 compared to the same period in 2023.

While these collaborations offer significant potential, their future market share and revenue generation capacity are still under evaluation, mirroring the characteristics of Question Marks. Upcoming releases such as Fishing Bob and Cash Eruption in 2025 are expected to further bolster this segment.

- Brand Leverage: Collaborations with iconic brands like Space Invaders and Tetris aim to capitalize on existing player bases, potentially reducing initial customer acquisition costs.

- Market Potential: The success of these new titles is crucial for Gaming Realms to capture market share in increasingly competitive online gaming segments.

- Revenue Uncertainty: Despite initial interest, the long-term revenue consistency of these early-stage products is yet to be proven, requiring ongoing marketing investment.

- Strategic Investment: These 'Question Marks' require focused investment to transition into 'Stars' or at least 'Cash Cows' within the company's portfolio.

Untapped Opportunities in Existing Regulated Markets

Gaming Realms can explore underpenetrated niches within its established regulated markets, focusing on operators where its current market share is minimal. This strategic approach involves dedicated investment and focused efforts to elevate these underperforming segments into more profitable ventures.

The company's stated objective of sustained growth within its current operational territories and with existing partners underscores the importance of identifying and capitalizing on these latent opportunities. For instance, in the UK, a key market for Gaming Realms, while the overall online gambling market is mature, there remain opportunities to deepen penetration with specific, smaller operators or to introduce new game variants tailored to distinct player demographics.

- Untapped Sub-segments: Identifying specific player groups or game types within regulated markets that are currently underserved by Gaming Realms' offerings.

- Operator Penetration: Targeting existing partners with whom the company has a low market share, aiming to increase the proportion of their gaming revenue derived from Gaming Realms' products.

- Strategic Investment: Allocating resources towards marketing, content development, and operational support to unlock the potential of these identified areas.

- Growth Focus: Prioritizing efforts on existing markets and partnerships as a core strategy for continued expansion and revenue enhancement.

Gaming Realms' strategic expansion into new territories like Brazil and South Africa, alongside new product development in mobile gaming, firmly places these initiatives in the Question Marks category of the BCG Matrix. These ventures represent high-growth potential but currently hold low market share, demanding significant investment to establish a foothold and prove their commercial viability.

For example, the Brazilian iGaming market is projected for substantial growth, yet Gaming Realms' presence there is nascent. Similarly, new game formats, while innovative, require substantial R&D and marketing spend to gain traction against established products. The company's investment in marketing and content acquisition, such as the £1.5 million in H1 2024, directly supports these high-potential, high-risk Question Marks.

Gaming Realms' early-stage branded Slingo collaborations, like Slingo Space Invaders launched in 2024, exemplify this category. While leveraging established IP to attract players, their long-term market share and revenue contribution are still being assessed. The company's overall revenue growth of 12% in H1 2024 highlights the potential, but these specific ventures require continued investment to mature.

Gaming Realms is actively working to convert these Question Marks into Stars by strategically investing in marketing and content development for these emerging opportunities. The success of these initiatives is critical for the company's future growth trajectory, aiming to transform potential into market leadership.

| Initiative | Market Potential | Current Market Share | Investment Required | Strategic Focus |

|---|---|---|---|---|

| Brazil Expansion | High (Rapidly growing iGaming market) | Low (Nascent presence) | Significant (Market entry costs, brand building) | Market penetration, customer acquisition |

| South Africa Expansion | High (Emerging iGaming market) | Low (Nascent presence) | Significant (Market entry costs, brand building) | Market penetration, customer acquisition |

| New Game Formats (Mobile) | High (Growing mobile gaming sector) | Low (Unproven market adoption) | Substantial (R&D, marketing) | Innovation, player engagement |

| Branded Slingo Collaborations (e.g., Space Invaders) | Moderate to High (Leverages existing IP) | Low to Moderate (Early stage) | Moderate (Marketing, content integration) | Brand leverage, market testing |

| Third-Party Content Distribution | High (Diversification, new markets) | Low (Developing segment) | Significant (Partnerships, platform integration) | Portfolio diversification, revenue stream growth |

BCG Matrix Data Sources

Our Gaming Realms BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.