Gambling.com Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gambling.com Group Bundle

Gambling.com Group operates in a dynamic market shaped by intense rivalry and significant buyer power, as customers easily compare offerings. The threat of new entrants is moderate, but the bargaining power of suppliers, particularly for technology and data, presents a notable challenge.

The complete report reveals the real forces shaping Gambling.com Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Gambling.com Group's reliance on search engines like Google and advertising platforms for traffic generation means these entities wield considerable influence. In 2024, Google's continued dominance in search means any algorithm shifts directly affect Gambling.com's organic visibility, a crucial driver of its user acquisition. Similarly, changes in advertising platform costs or policies can drastically alter the economics of paid traffic, a significant portion of their marketing spend.

Gambling.com Group relies on specialized software for analytics and content management. While some software is readily available, unique AI-driven or real-time data solutions, such as those offered by OddsJam, can be sourced from a limited number of providers. This scarcity of highly specialized technology can grant these suppliers considerable bargaining power.

Gambling.com Group's reliance on skilled content creators and SEO experts significantly influences supplier power. These professionals are crucial for developing and optimizing the company's web portals, which are its primary assets.

The demand for talent with proven iGaming expertise means these individuals can command higher compensation and more favorable contractual terms. For instance, in 2024, the average salary for a senior SEO specialist in the digital marketing sector saw a notable increase, reflecting the competitive landscape for such skills.

Data Providers for Sports Betting and iGaming

The bargaining power of suppliers for Gambling.com Group, particularly data providers for sports betting and iGaming, is significant. This is driven by the critical need for accurate, real-time data feeds, as demonstrated by the group's acquisition of Odds Holdings, Inc. to bolster its sports data services.

Suppliers who offer comprehensive coverage across a wide array of sportsbooks and events hold considerable sway. The specialized nature and essential role of this data in powering betting operations mean that providers can command favorable terms.

- High Switching Costs: For Gambling.com Group, integrating and verifying new data feeds can be complex and time-consuming, increasing reliance on existing providers.

- Data Uniqueness: Some data providers may possess exclusive rights or unique analytical capabilities that are difficult for competitors to replicate.

- Industry Consolidation: As the data provider market consolidates, fewer suppliers may emerge, concentrating their bargaining power.

- Critical Input: Without timely and accurate data, the core business of sports betting and iGaming cannot function, giving suppliers leverage.

Affiliate Network Infrastructure Providers

The bargaining power of affiliate network infrastructure providers for Gambling.com Group is generally moderate. While Gambling.com Group manages its own affiliate marketing, it may still depend on specialized software or platforms for tracking, reporting, and managing affiliate relationships. If these providers offer proprietary or highly integrated solutions that are not easily replicable, they could hold some leverage.

However, the availability of alternative tracking technologies and the group's ability to develop some in-house capabilities can mitigate this power. For instance, the broader tech landscape offers various solutions for affiliate management, preventing any single provider from dominating. In 2024, the affiliate marketing technology sector saw continued innovation, with companies offering more flexible and scalable solutions, which generally increases choice for operators like Gambling.com Group.

The group's scale and established presence in the iGaming market also provide a degree of negotiation strength. Large operators often secure more favorable terms due to the volume of business they represent. This is particularly true as the digital advertising and affiliate marketing tech space continues to consolidate, with larger players often acquiring smaller, specialized firms, potentially leading to more integrated but also more concentrated service offerings.

- Moderate Leverage: Infrastructure providers have some power if their solutions are unique and hard to replace.

- Mitigating Factors: Availability of alternative technologies and potential for in-house development reduce supplier influence.

- Industry Trends: Innovation in affiliate tech in 2024 offered more choices, limiting any single provider's dominance.

- Operator Strength: Gambling.com Group's market position can be used to negotiate better terms with suppliers.

The bargaining power of suppliers for Gambling.com Group is notably high, particularly concerning specialized data providers crucial for its sports betting and iGaming operations. The critical need for accurate, real-time data feeds, as exemplified by their acquisition of Odds Holdings, Inc., grants these suppliers significant leverage. Furthermore, the scarcity of providers offering comprehensive coverage across numerous sportsbooks and events, coupled with the high switching costs associated with integrating new data feeds, solidifies their influential position.

| Supplier Type | Bargaining Power | Key Factors |

| Specialized Data Providers (Sports Betting/iGaming) | High | Critical need for real-time data, limited providers with comprehensive coverage, high switching costs. |

| Key Technology Providers (Analytics, AI) | High | Scarcity of unique, AI-driven solutions, difficulty in replication. |

| Skilled Content Creators/SEO Experts | High | Essential for core business assets, high demand for iGaming expertise, increasing salaries in 2024. |

| Affiliate Network Infrastructure Providers | Moderate | Availability of alternatives, potential for in-house development, innovation in 2024 increased choice. |

What is included in the product

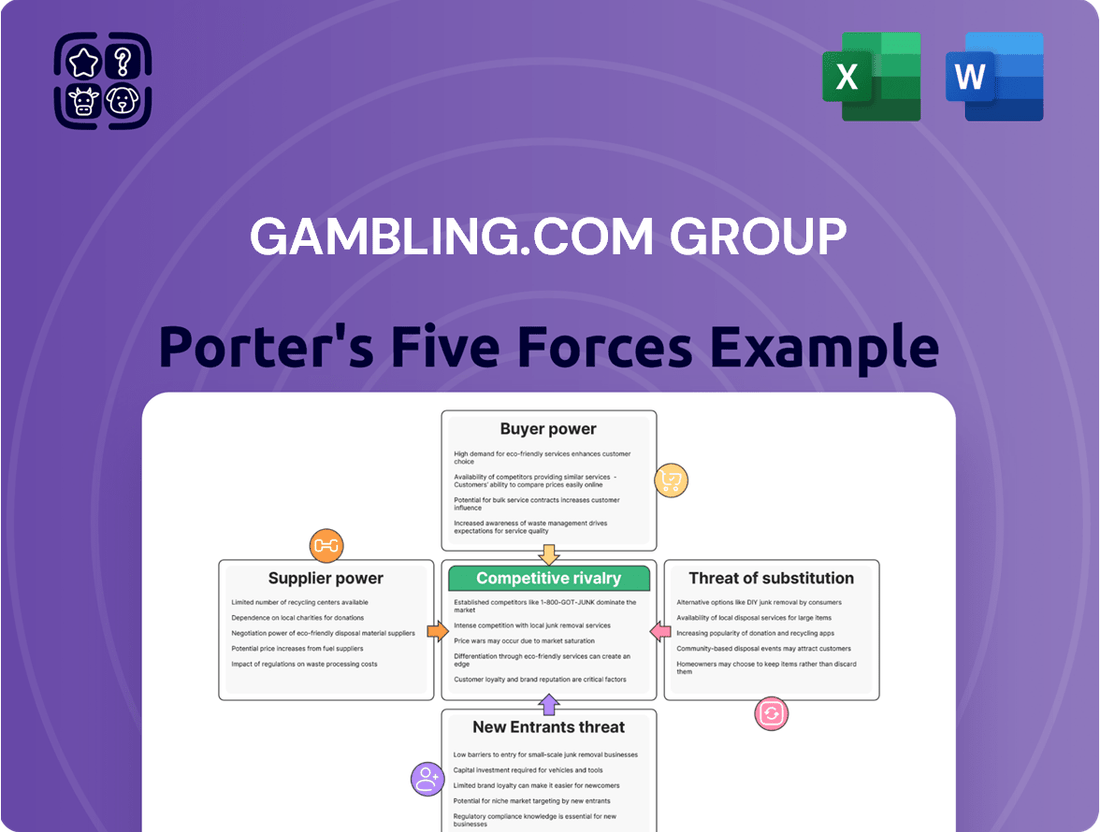

Gambling.com Group's Porter's Five Forces analysis reveals intense industry rivalry and significant buyer power, while also highlighting moderate threats from new entrants and substitutes, and low supplier power.

Gambling.com Group's Porter's Five Forces analysis provides a clear, one-sheet summary of all competitive pressures—perfect for quick strategic decision-making.

Customers Bargaining Power

Gambling.com Group's core customers are online gambling operators, and these operators enjoy significant bargaining power due to low switching costs. Operators can readily shift their marketing spend from one affiliate partner to another, or even explore direct marketing efforts, with minimal disruption or expense. This ease of transition means they can actively shop for the best deals and performance, putting pressure on Gambling.com Group to continuously demonstrate value and competitive pricing. For instance, in 2023, the online gambling market saw intense competition, with operators constantly optimizing their acquisition costs, further highlighting the sensitivity to affiliate fees.

Gambling.com Group's reliance on performance-based compensation, such as Cost Per Acquisition (CPA) or revenue share, directly impacts customer bargaining power. Operators are incentivized to negotiate favorable terms because their payments are tied to tangible results, not upfront marketing costs.

This model inherently strengthens the position of operators, as they face minimal financial risk if customer acquisition campaigns don't yield desired outcomes. In 2023, Gambling.com Group reported revenue of $93.8 million, with a significant portion tied to these performance metrics, highlighting the direct correlation between operator acquisition success and the group's revenue.

Larger, consolidated gambling operators wield considerable market influence. This allows them to negotiate more advantageous terms with affiliate partners like Gambling.com Group. For instance, in 2024, major European sports betting operators reported significant revenue growth, giving them leverage in discussions.

Their substantial scale means these operators can demand higher quality traffic and better commission rates. They also seek more customized marketing solutions, directly impacting the profitability of companies such as Gambling.com Group by squeezing margins.

In-House Marketing Capabilities of Operators

Many online gambling operators possess substantial in-house marketing departments and allocate considerable funds towards direct advertising, brand development, and customer acquisition efforts. This internal strength lessens their dependence on external partners like Gambling.com Group, giving them more flexibility and bargaining power.

For instance, BetMGM, a prominent operator, reported significant marketing spend in 2023 as it continued its expansion across North America, aiming to capture market share through aggressive promotional campaigns. This capability allows operators to negotiate more favorable terms with affiliate marketing companies, potentially reducing the commission rates or demanding specific performance metrics.

- Reduced Reliance: Operators can manage a significant portion of their customer acquisition internally, diminishing the necessity of relying solely on third-party affiliates.

- Negotiating Leverage: Strong in-house marketing teams empower operators to negotiate better terms and pricing with affiliate networks.

- Cost Control: Direct marketing efforts can sometimes offer more predictable cost-per-acquisition models compared to performance-based affiliate commissions.

- Brand Control: In-house marketing ensures consistent brand messaging and direct control over customer interactions from the initial touchpoint.

Demand for Specific Market Access and Quality Traffic

Customers, particularly large gambling operators, possess significant bargaining power when they demand specific market access and high-quality traffic. Operators often have precise targets for customer demographics, geographic regions, or even specific gambling verticals like casino games versus sports betting. Gambling.com Group's strength lies in its capacity to consistently deliver this targeted, high-converting traffic, which inherently creates value.

However, operators can leverage these precise demands to negotiate better terms. For instance, an operator seeking to penetrate a newly regulated market with a specific player profile might use their ability to award significant marketing spend to a provider that guarantees access to that exact demographic. This can put pressure on commission rates or other contractual agreements.

- Targeted Traffic Demands: Operators require specific customer segments, geographic focus, and gambling product alignment.

- Value Creation: Gambling.com Group's ability to deliver on these niche traffic needs provides them leverage.

- Negotiation Leverage: Operators can use their specific demands to negotiate favorable terms, impacting revenue share or service costs.

The bargaining power of customers for Gambling.com Group is substantial, driven by low switching costs and the operators' ability to negotiate performance-based terms. Larger, consolidated operators, in particular, leverage their scale and in-house marketing capabilities to demand better rates and customized solutions, directly impacting Gambling.com Group's profitability. The group's revenue, with $93.8 million reported in 2023, is heavily influenced by these negotiations, as operators seek to optimize their customer acquisition costs.

| Factor | Impact on Gambling.com Group | Example Data (2023/2024) |

|---|---|---|

| Switching Costs | Low for operators, increasing leverage | Operators can shift marketing spend between affiliates easily. |

| Performance-Based Compensation | Operators negotiate favorable terms tied to results | CPA and revenue share models directly link operator success to affiliate fees. |

| Operator Scale & Consolidation | Larger operators have significant negotiating power | Major European sports betting operators saw revenue growth in 2024, enhancing their leverage. |

| In-house Marketing Capabilities | Reduces operator dependence on affiliates | BetMGM's significant marketing spend in 2023 for North American expansion demonstrates this. |

Full Version Awaits

Gambling.com Group Porter's Five Forces Analysis

This preview showcases the comprehensive Gambling.com Group Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning within the online gambling affiliate sector. The document you see here is precisely what you will receive immediately after purchase, offering an in-depth examination of industry rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the potential of substitute products. Rest assured, no placeholders or sample content are presented; you are viewing the actual, fully formatted analysis ready for your immediate use.

Rivalry Among Competitors

The online gambling affiliate sector is quite crowded, featuring big names like Better Collective alongside many smaller, specialized affiliates. This means Gambling.com Group faces stiff competition for new players and partnerships with gambling operators.

The iGaming market itself is expanding, which further fuels this intense rivalry. For instance, the global online gambling market was valued at approximately $64.1 billion in 2023 and is projected to reach over $114 billion by 2028, showcasing the significant growth and the resulting competitive pressures.

Gambling.com Group faces intense rivalry from competitors aggressively pursuing top search engine rankings and user attention. This involves substantial investment in sophisticated Search Engine Optimization (SEO) strategies and a high volume of content creation. For instance, in 2024, the digital advertising spend in the online gambling sector is projected to reach billions globally, with a significant portion allocated to SEO and content marketing to capture organic traffic.

This constant battle for organic visibility necessitates continuous investment in content quality, technical SEO, and optimizing user experience. Companies like Flutter Entertainment and Entain are known for their robust digital marketing capabilities, pushing the boundaries of what it takes to stand out in a crowded online space. The need for perpetual content updates and SEO refinements means operational costs remain elevated.

The online gambling sector is in a constant technological arms race, with companies like Gambling.com Group facing intense pressure to innovate. Key advancements include AI for personalized player experiences and sophisticated data analytics, crucial for optimizing marketing and player engagement. For instance, in 2024, the global online gambling market was projected to reach over $110 billion, underscoring the significant investment in technology to capture market share.

Competitors are aggressively integrating cutting-edge technologies, such as advanced mobile optimization and real-time betting platforms, to attract and retain users. This forces all players, including Gambling.com Group, to maintain a high pace of innovation. Failure to keep up means risking obsolescence in a rapidly evolving digital landscape.

Mergers and Acquisitions Activity

The gambling affiliate market is experiencing a surge in mergers and acquisitions. Larger players are actively acquiring smaller, specialized firms or key technological assets. This consolidation aims to expand market share and bolster operational capabilities. Gambling.com Group, for instance, has participated in these strategic acquisitions, underscoring the industry's drive for scale and diversification.

In 2024, the trend of consolidation continued. For example, in March 2024, Catena Media, another significant player, announced the divestment of its Italian business, highlighting a strategic refocusing that can lead to acquisition opportunities for competitors. This activity indicates a market where companies are seeking to gain a competitive edge through strategic combinations.

- Market Consolidation: Larger affiliates are buying smaller ones to gain market share.

- Technology Acquisition: Firms are acquiring specialized technology to improve services.

- Gambling.com Group's Role: The company's own M&A activity reflects the competitive nature of the sector.

- Industry Dynamics: M&A signifies a push for scale, diversification, and enhanced competitive positioning.

Regulatory Compliance as a Differentiator

Gambling.com Group's commitment to operating in highly regulated markets, such as the US, where it generated 80% of its revenue in Q1 2024, highlights regulatory compliance as a key differentiator. Navigating these complex and often changing rules demands substantial investment, acting as a significant barrier for newer entrants.

Established players like Gambling.com Group, which have demonstrated expertise in adhering to these stringent requirements, cultivate trust and a competitive edge. This focus on compliance not only ensures legal operation but also builds credibility with both consumers and industry partners.

- Regulatory Investment: Gambling.com Group invests heavily in compliance infrastructure and personnel to operate legally in multiple jurisdictions.

- Market Access: Strong compliance records facilitate easier market entry and partnerships with licensed operators.

- Brand Trust: Adherence to regulations fosters consumer trust, a critical asset in the online gambling sector.

- Barrier to Entry: The high cost and complexity of regulatory compliance deter potential new competitors.

Competitive rivalry is intense in the online gambling affiliate space, with numerous players vying for user attention and operator partnerships. Gambling.com Group faces this head-on, investing heavily in SEO and content to stand out. The global online gambling market's projected growth, reaching over $114 billion by 2028, fuels this competition, attracting significant digital advertising spend in 2024, estimated in the billions globally, with a large portion dedicated to organic traffic acquisition.

The sector is also marked by a technological arms race, pushing companies like Gambling.com Group to innovate with AI and advanced analytics to enhance player experiences and marketing. This constant need for technological advancement, including mobile optimization and real-time betting, forces continuous investment to avoid obsolescence. The industry also sees significant consolidation through mergers and acquisitions, as seen with Catena Media's strategic divestments in early 2024, indicating a drive for scale and competitive positioning.

| Metric | Value | Year | Source/Note |

| Global Online Gambling Market Value | ~$64.1 billion | 2023 | Market research projections |

| Projected Global Online Gambling Market Value | >$114 billion | 2028 | Market research projections |

| Digital Advertising Spend (Online Gambling Sector) | Billions (Global) | 2024 | Industry estimates |

SSubstitutes Threaten

Online gambling operators are increasingly leveraging their own extensive marketing channels, such as brand advertising, social media, and paid search, to directly acquire customers. This direct approach by operators acts as a significant substitute for the customer acquisition services offered by platforms like Gambling.com Group. For instance, in 2023, major online gambling companies invested billions in marketing, with some reporting customer acquisition costs (CAC) that could rival or undercut what affiliate marketers charge.

Operators can turn to general digital marketing agencies, which are not exclusively focused on the iGaming affiliate model. These agencies often possess strong capabilities in performance marketing, search engine optimization (SEO), and pay-per-click (PPC) advertising, offering a viable alternative for traffic generation.

These generalist agencies can provide comparable services to specialized iGaming affiliates, potentially at a different cost structure or with a broader marketing approach. For instance, a large performance marketing agency might leverage its extensive network and data analytics to drive traffic, acting as a direct substitute for a dedicated iGaming affiliate.

The availability of these broader marketing solutions means that operators are not solely reliant on the iGaming affiliate channel. This competitive landscape pressures specialized affiliates to continually innovate and demonstrate unique value propositions to retain their market position.

Traditional advertising like TV, radio, and print still sway consumer decisions in gambling, even if their direct impact on online conversions is harder to track. These methods act as indirect substitutes for Gambling.com Group's performance marketing, as consumers might be drawn to gambling through these channels rather than affiliate links.

Furthermore, organic word-of-mouth, though unquantifiable for direct attribution, remains a powerful influencer in the gambling industry. Positive or negative experiences shared among friends and family can steer potential customers away from or towards specific platforms, bypassing the need for affiliate marketing altogether.

Social Media Influencers and Direct Content Creators

Individual social media influencers and content creators pose a threat by directly promoting gambling platforms, bypassing established affiliate networks like Gambling.com Group. These creators can leverage their substantial followings to drive user acquisition for operators, presenting a distinct alternative channel.

This direct approach can siphon potential customers and revenue away from traditional affiliate models. For instance, a popular streamer with millions of followers could directly partner with an online casino, offering exclusive bonuses that compete with affiliate-driven promotions. In 2023, the influencer marketing industry was valued at approximately $21.1 billion, indicating the significant reach and financial power of individual creators.

- Direct Promotion: Influencers bypass affiliate networks to promote gambling sites.

- Audience Reach: Creators leverage their followers for user acquisition.

- Competitive Channel: Offers an alternative to traditional affiliate marketing.

- Market Impact: The growing influencer market signifies a substantial threat.

Changes in User Behavior and Information Seeking

The threat of substitutes for Gambling.com Group is amplified by evolving user behavior. A significant shift could see users bypassing affiliate portals like Gambling.com Group and heading directly to operator websites for promotions or engaging with independent gambling forums and peer recommendations for reviews. This bypass diminishes the perceived value of affiliate sites as a primary research tool.

For instance, if a growing number of players in 2024 find trusted, up-to-the-minute information on new casino bonuses or sports betting odds directly from the source or through social media communities, the need for a third-party aggregator like Gambling.com Group could lessen. This behavioral change directly impacts the group's core business model, which relies on directing traffic to operators.

- Direct Operator Engagement: Players may increasingly visit online casino or sportsbook sites directly, bypassing affiliate referrals to access exclusive deals or loyalty programs.

- Peer-to-Peer Recommendations: The rise of online communities and social media means players might rely more on advice from fellow gamblers than on curated reviews from affiliate sites.

- Shifting Information Channels: If users find reliable, real-time information on gambling platforms through channels other than affiliate marketing, the competitive advantage of portals like Gambling.com Group could erode.

The threat of substitutes for Gambling.com Group is significant as online gambling operators increasingly utilize their own marketing channels for direct customer acquisition. This bypasses the need for affiliate services, with major operators in 2023 investing billions in marketing, often at competitive customer acquisition costs.

General digital marketing agencies also present a viable substitute, offering expertise in SEO and PPC to drive traffic, potentially at different cost structures than specialized affiliates. Furthermore, individual social media influencers are a growing threat, leveraging their substantial followings to directly promote gambling platforms, a trend supported by the influencer marketing industry's valuation of approximately $21.1 billion in 2023.

Evolving user behavior, where players might bypass affiliate portals for direct operator engagement or peer recommendations, further amplifies this threat. If users in 2024 increasingly find reliable information through social media communities or directly from operators, the value proposition of third-party aggregators like Gambling.com Group could diminish.

| Substitute Type | Description | Impact on Gambling.com Group | Supporting Data/Trend |

|---|---|---|---|

| Operator Direct Marketing | Online gambling companies using their own marketing channels (social media, paid search) | Reduces reliance on affiliate marketing | Billions invested in marketing by major operators in 2023; competitive CAC |

| General Digital Marketing Agencies | Agencies offering SEO, PPC, and performance marketing services | Provides alternative traffic generation channels | Broad marketing capabilities comparable to specialized affiliates |

| Social Media Influencers | Individual creators promoting gambling platforms to their followers | Siphons potential customers and revenue from affiliate networks | Influencer marketing industry valued at $21.1 billion in 2023 |

| Direct User Engagement & Peer Recommendations | Players going directly to operator sites or relying on community advice | Diminishes the perceived value of affiliate sites as primary research tools | Potential shift in user behavior observed in 2024 trends |

Entrants Threaten

While setting up a simple affiliate site is relatively inexpensive, establishing a sophisticated performance marketing operation akin to Gambling.com Group demands substantial capital. This includes outlays for robust infrastructure, advanced proprietary technology, in-depth data analytics capabilities, and a skilled workforce. For instance, in 2024, major players in the iGaming affiliate space often invest millions annually in platform development and marketing to maintain a competitive edge.

The online gambling sector is a minefield of regulations, with rules differing significantly from one country or even state to another. New companies entering this space must navigate a labyrinth of licensing, advertising restrictions, and data privacy laws, which are also subject to frequent updates. For instance, in the United States, the legality of online gambling varies by state, with some states like New Jersey having a mature market while others, such as California, have yet to legalize it broadly. This patchwork of laws creates substantial barriers to entry, requiring significant legal and compliance investment before any operations can begin.

Newcomers to the online gambling affiliate space face a significant hurdle in building brand authority and trust, a critical factor for attracting both operators and players. Established companies like Gambling.com Group have invested heavily over many years to cultivate strong brand recognition and a reputation for reliability.

For instance, Gambling.com Group reported a 13% year-over-year increase in revenue to $303.2 million for the full year 2023, demonstrating the fruits of their long-term brand building efforts. New entrants find it challenging to quickly gain credibility and compete with the vast, authoritative content libraries and established domain authority that market leaders possess.

Challenges in Securing Premium Operator Partnerships

The threat of new entrants for Gambling.com Group, specifically concerning securing premium operator partnerships, is moderated by the high barriers to entry. Top-tier gambling operators, the most desirable partners, typically seek established affiliates with a proven history of delivering substantial volumes of high-quality, converting traffic. This preference makes it difficult for newcomers to gain access to these lucrative relationships without demonstrating a solid track record.

Newcomers often struggle to secure partnerships with major operators because they lack the established reputation and performance metrics that these operators value. This initial hurdle can significantly limit a new entrant's revenue-generating potential. For instance, in 2024, the average cost per acquisition (CPA) for a new customer in the online gambling sector remained robust, often exceeding $200 for premium markets, making it challenging for unproven affiliates to command competitive rates.

- Established Operator Preference: Major online gambling operators prioritize affiliates with a demonstrated ability to drive significant, high-converting traffic, making it hard for new entrants to secure premium deals.

- Track Record Requirement: A proven history of performance is crucial for attracting top-tier operator partnerships, creating a barrier for new affiliates lacking this credential.

- Revenue Limitation: The inability to secure partnerships with leading operators directly impacts the initial revenue streams available to new entrants in the affiliate marketing space.

- Market Dynamics: The competitive landscape in 2024 saw continued demand for proven affiliate performance, with CPA rates reflecting the value placed on reliable traffic generation.

Need for Specialized Talent and Expertise

The iGaming affiliate marketing landscape requires deep expertise in areas like sophisticated search engine optimization (SEO), data-driven content strategies, and a nuanced understanding of evolving regulatory frameworks. Newcomers face considerable hurdles in acquiring and keeping personnel with these specialized skills.

For instance, the demand for skilled SEO professionals in the digital marketing sector saw a significant increase, with job postings for SEO specialists rising by an estimated 25% year-over-year leading into 2024. This intense competition for talent translates into higher recruitment costs and longer onboarding periods for new entrants, acting as a substantial barrier to entry.

- Advanced SEO Skills: Crucial for driving organic traffic in a competitive online space.

- Content Strategy Expertise: Essential for creating engaging and conversion-focused content.

- Data Analysis Capabilities: Necessary for optimizing campaigns and understanding player behavior.

- Regulatory Knowledge: Vital for navigating complex and varying legal requirements across jurisdictions.

The threat of new entrants for Gambling.com Group is considerably low due to significant capital requirements for sophisticated operations, extensive regulatory navigation, and the challenge of building brand trust. Established players benefit from years of investment in technology, data analytics, and skilled personnel, creating a high barrier for newcomers. For example, in 2024, the cost of building a competitive iGaming affiliate platform often runs into millions of dollars, encompassing infrastructure and proprietary software development.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Gambling.com Group is built upon a foundation of reliable data, including the company's annual reports, investor presentations, and industry-specific market research from firms like H2 Gambling Capital. We also leverage public filings and regulatory data to assess the competitive landscape.