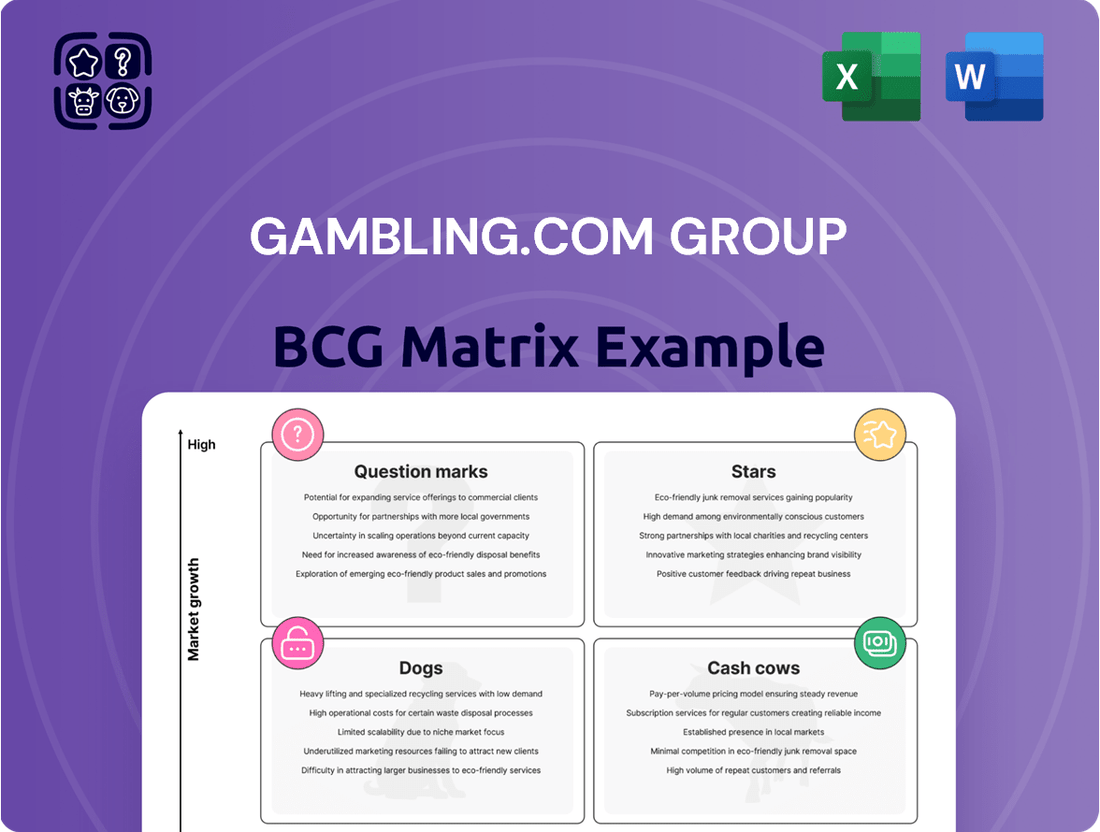

Gambling.com Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gambling.com Group Bundle

Gambling.com Group's BCG Matrix offers a strategic snapshot of its diverse portfolio, highlighting which ventures are driving growth and which require careful consideration.

Uncover the hidden potential and strategic imperatives within Gambling.com Group's product lines. This preview hints at the powerful insights contained within the full report.

Purchase the complete BCG Matrix to gain a comprehensive understanding of each product's market share and growth rate, enabling you to make informed investment decisions and optimize your capital allocation.

Stars

North America stands out as a significant growth engine for Gambling.com Group. In the first quarter of 2025, revenue from this region surged by 42% year-over-year, reaching $21 million. This robust performance, coupled with expectations for further market share expansion throughout 2025, clearly places North America in the Stars category of the BCG Matrix.

The continued legalization of online sports betting in new US states, like the anticipated launch in Missouri, represents considerable untapped potential. While these future opportunities are not yet reflected in current financial projections, they underscore the dynamic and expanding nature of the North American market for Gambling.com Group.

The acquisition of OddsJam and OpticOdds in January 2025 propelled Gambling.com Group's sports data services into a high-growth category. This segment saw its revenue skyrocket by 405% to $9.9 million in the first quarter of 2025.

This surge means the sports data services now represent a significant portion of the group's overall revenue, projected to exceed 20% for the entirety of 2025. The business model, built on recurring subscription revenue and high margins, is a key driver of this expansion.

Leveraging advanced real-time odds data and covering almost 300 sportsbooks, the platform positions Gambling.com Group as a dominant player in a rapidly growing niche market.

Gambling.com Group demonstrated impressive financial performance in Q1 2025, achieving record revenue of $40.6 million, a substantial 39% increase compared to the previous year. This strong revenue growth was complemented by a 56% year-over-year surge in adjusted EBITDA, reaching $15.9 million, underscoring the company's expanding profitability and operational efficiency.

The company's outlook for the full year 2025 remains exceptionally positive, with reaffirmed guidance projecting revenue between $170 million and $174 million. This represents a healthy 35% year-over-year growth. Furthermore, adjusted EBITDA is expected to be between $67 million and $69 million, signaling a robust 40% increase year-over-year. This consistent financial uplift points to the company's solid market position and effective strategic execution.

New Depositing Customers (NDCs) Growth

The consistent delivery of a high volume of new depositing customers (NDCs) to its partners highlights Gambling.com Group's robust market standing and effective performance marketing strategies. This ability is a cornerstone of their business model, directly impacting affiliate revenue and overall growth.

In the first quarter of 2025, the company achieved a significant milestone, delivering over 138,000 NDCs. This represents a substantial 29% increase when compared to the same period in 2024, underscoring their success in attracting new users within the expanding online gambling market.

- Q1 2025 NDCs: Over 138,000

- Year-over-Year NDC Growth: 29% increase (Q1 2025 vs. Q1 2024)

- Impact: Drives increased affiliate revenue and strengthens the core business

Strategic Acquisitions and Diversification

Gambling.com Group's strategic acquisitions are a key driver of its growth, positioning it favorably within the BCG matrix. The company has actively pursued mergers and acquisitions to broaden its reach and offerings.

Notable examples include the acquisition of Odds Holdings for $160 million, a move that significantly expanded its product portfolio and introduced recurring subscription revenue streams. This acquisition, along with the purchase of XLMedia's European and Canadian assets, diversifies the group's revenue base and strengthens its market presence.

These accretive acquisitions are designed to enhance the company's overall value proposition and contribute positively to future adjusted EBITDA. The focus is on integrating these new assets to drive synergistic growth and solidify the group's competitive standing.

- Acquisition of Odds Holdings: $160 million deal, adding subscription revenue and expanding product offerings.

- Acquisition of XLMedia Assets: Strengthened presence in European and Canadian markets, further diversifying revenue.

- Strategic M&A Focus: Proactive approach to expanding market share and enhancing service capabilities.

- Accretive Growth: Acquisitions are structured to contribute positively to future adjusted EBITDA.

Gambling.com Group's North American operations and its sports data services are prime examples of Stars within the BCG Matrix. North America's revenue jumped 42% year-over-year in Q1 2025 to $21 million, driven by ongoing state-level legalization of online sports betting.

The sports data segment, bolstered by recent acquisitions, experienced an incredible 405% revenue surge to $9.9 million in Q1 2025, now representing over 20% of total revenue for 2025. This rapid growth, coupled with strong recurring subscription models and high margins, solidifies these segments as Stars.

The company's overall financial health, with Q1 2025 revenue at $40.6 million (up 39% year-over-year) and reaffirmed 2025 revenue guidance of $170-$174 million, supports this classification. The consistent delivery of over 138,000 new depositing customers in Q1 2025, a 29% increase from the prior year, further validates the high-growth potential of these key business areas.

| Segment | BCG Category | Q1 2025 Revenue | YoY Growth | Key Drivers |

|---|---|---|---|---|

| North America | Stars | $21 million | 42% | Online sports betting expansion, market share gains |

| Sports Data Services | Stars | $9.9 million | 405% | Acquisitions (OddsJam, OpticOdds), subscription model, high margins |

| Overall Group | N/A | $40.6 million | 39% | Strong performance marketing, strategic M&A, growing NDC volume |

What is included in the product

The Gambling.com Group BCG Matrix offers a tailored analysis of its product portfolio, highlighting which units to invest in, hold, or divest.

The Gambling.com Group BCG Matrix offers a clear, one-page overview of business unit performance, relieving the pain of strategic uncertainty.

Its export-ready design allows for quick drag-and-drop into PowerPoint, simplifying the communication of strategic direction.

Cash Cows

Gambling.com Group's core performance marketing business, a cornerstone of its operations, continues to be a reliable cash generator. This segment, which expertly links online gamblers with various operators, demonstrated its enduring strength by generating $30.7 million in revenue in Q1 2025, marking a solid 13% increase compared to the previous year.

This mature business boasts a commanding market share within the affiliate marketing landscape for online gambling. Its stability and consistent revenue streams are crucial, providing a dependable financial foundation for the group's broader strategic initiatives and investments.

The iGaming/Casino vertical stands as a robust Cash Cow for Gambling.com Group. In the first quarter of 2025, this segment saw a significant 24% year-over-year revenue increase, bringing in $24.5 million. This strong performance highlights the company's established competitive edge within the iGaming landscape.

This mature market segment consistently delivers substantial cash flow, underscoring the profitability of Gambling.com Group's casino-focused assets. The division's reliable revenue generation plays a crucial role in the company's overall financial health and ability to fund other growth initiatives.

The UK & Ireland market stands as a robust cash cow for Gambling.com Group. In the first quarter of 2025, this segment saw a significant revenue increase of $11.1 million, marking a 24% growth. This strong performance underscores the market's maturity and the company's established position.

Within this developed online gambling landscape, Gambling.com Group benefits from a substantial market share. This allows for healthy profit margins and a consistent generation of cash flow. Crucially, the need for extensive promotional spending or aggressive placement strategies is reduced, further enhancing profitability.

Established Web Portal Portfolio

Gambling.com Group's established web portal portfolio, featuring over 50 informational sites like Gambling.com and Bookies.com, operates in a mature segment of the online gambling industry. These portals are present in 19 national markets and available in more than 10 languages, demonstrating significant market penetration.

These established platforms are considered cash cows because they consistently generate traffic and conversions. Their high market share in a mature industry means they require minimal additional investment to maintain their strong performance, thus producing substantial cash flow for the company.

- Portfolio Size: Over 50 informational web portals.

- Geographic Reach: 19 national markets.

- Language Availability: Over 10 languages.

- Market Position: High market share in a mature segment.

Strong Free Cash Flow Generation

Gambling.com Group's position as a cash cow is clearly demonstrated by its robust free cash flow generation. This financial strength is a key indicator of a mature and profitable business segment. The company's ability to consistently convert earnings into readily available cash underpins its strategic flexibility.

The latest figures highlight this impressive performance. In the first quarter of 2025, free cash flow saw a significant increase of 25%, reaching $10.3 million. Looking back at the full year 2024, the company achieved an even more substantial 81% year-over-year growth in free cash flow. This substantial cash generation capability is a hallmark of a cash cow business.

- Consistent Free Cash Flow Growth: Gambling.com Group demonstrated a 25% increase in free cash flow to $10.3 million in Q1 2025.

- Strong Full-Year Performance: The company experienced an 81% year-over-year growth in free cash flow for the entirety of 2024.

- Financial Flexibility: This strong cash generation allows the company to self-fund acquisitions and operational expenditures.

- Shareholder Value Potential: The ability to generate significant free cash flow also creates opportunities for returning value to shareholders.

Gambling.com Group's core performance marketing operations, particularly within the iGaming/Casino vertical and the UK & Ireland market, represent strong Cash Cows. These segments consistently generate substantial revenue and profit, as evidenced by Q1 2025 revenue increases of 24% in iGaming/Casino to $24.5 million and 24% in UK & Ireland to $11.1 million.

The established web portal portfolio, comprising over 50 sites across 19 countries, also functions as a Cash Cow. These mature assets require minimal investment for maintenance, allowing them to produce significant and stable cash flow, contributing to the company's overall financial health.

The company's robust free cash flow generation further solidifies its Cash Cow status. A 25% increase in free cash flow to $10.3 million in Q1 2025, following an impressive 81% year-over-year growth in 2024, highlights the mature and profitable nature of these business segments.

| Segment | Q1 2025 Revenue | YoY Growth | Status |

| iGaming/Casino | $24.5 million | 24% | Cash Cow |

| UK & Ireland | $11.1 million | 24% | Cash Cow |

| Web Portals | N/A | N/A | Cash Cow |

Full Transparency, Always

Gambling.com Group BCG Matrix

The Gambling.com Group BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This ensures you see the exact strategic insights and analysis that will be delivered, with no alterations or watermarks. You can confidently assess the value of this comprehensive market analysis, knowing the final document is ready for immediate download and application in your business planning.

Dogs

Underperforming legacy assets within Gambling.com Group's portfolio, such as older web portals or content properties, would fall into the 'Dogs' category of the BCG Matrix. These are typically found in niche or declining markets, experiencing low traffic and conversion rates. For instance, if a portal focused on a now-outdated betting method saw its user base shrink by 15% year-over-year in 2024, it would exemplify such an asset.

These 'dog' assets often demand significant investment for promotion or updates, yet offer minimal returns. Imagine a legacy affiliate site that historically generated $50,000 annually but in 2024 only brought in $10,000 due to declining search interest and increased competition. Such properties are prime candidates for divestiture or require a drastic reduction in resource allocation to cut losses.

Content or tools that don't capture much user interest or lead to conversions, and operate in slow-growing market areas, might be categorized as 'dogs' within the BCG matrix. These could include older informational pieces, reviews that are no longer current, or specialized subjects that have lost their broad appeal, contributing very little to overall revenue.

For Gambling.com Group, this could manifest as underperforming content sections. For instance, if a particular casino game's strategy guide from 2022 saw only a few hundred pageviews in the first half of 2024 and generated no affiliate clicks, it would likely be a 'dog.' Such assets represent an inefficient use of resources, as they require maintenance but offer minimal return.

Operating in highly saturated affiliate niches within the gambling sector, characterized by intense competition and slim profit margins, positions these activities as potential 'dogs' for Gambling.com Group. Without a distinct competitive edge, these ventures likely drain marketing budgets and staff focus, yielding little in terms of new revenue or market share growth.

For instance, in 2024, the global online gambling affiliate market is projected to reach $12.6 billion, but many sub-niches are already overcrowded. Companies must strategically prune these low-return areas to optimize resource allocation and improve overall profitability.

Geographical Markets with Stagnant Regulation or Growth

Geographical markets where online gambling regulation has stalled or growth has significantly slowed, and where Gambling.com Group holds a low market share, are categorized as 'dogs' in the BCG matrix. These areas present limited opportunities for expansion, suggesting that further investment might not generate adequate returns.

For instance, consider a hypothetical European market where regulatory frameworks for online sports betting have remained unchanged for several years, and the overall market growth rate has flattened to around 2% annually. If Gambling.com Group's market share in this specific region is below 5%, it would fit the 'dog' profile.

- Stagnant Regulatory Environments: Markets with no new licensing opportunities or evolving consumer protection laws hinder expansion.

- Decelerated Market Growth: Regions experiencing low single-digit or negative growth rates in online gambling revenue.

- Low Market Share: Companies with a minimal presence in these markets are unlikely to benefit from any residual growth.

- Strategic Review: Such markets typically warrant a reassessment of resource allocation, potentially leading to divestment.

Inefficient Traffic Acquisition Channels

Inefficient traffic acquisition channels for Gambling.com Group, often categorized as 'dogs' in a BCG Matrix context, are those that yield a persistently low return on investment (ROI). These channels fail to attract customers with a strong intent to wager, doing so at an unsustainable cost. For instance, certain digital advertising campaigns that have become saturated or are targeting the wrong audience might fall into this category, consuming budget without proportional revenue generation.

These underperforming channels tie up valuable capital that could be reinvested in more promising areas of the business. In 2024, for example, a hypothetical paid search campaign with a cost per acquisition (CPA) of $150 and an average customer lifetime value (CLV) of $120 would represent a 'dog,' as it loses money on every acquired customer.

- Low ROI Channels: Paid social media campaigns with high CPMs and low conversion rates.

- Ineffective Partnerships: Affiliate marketing agreements with partners who deliver low-quality traffic.

- Outdated SEO Strategies: Content or link-building efforts that no longer rank effectively in search engine results.

- Underperforming Display Ads: Banner advertising on websites with low engagement from the target demographic.

Assets categorized as 'Dogs' for Gambling.com Group represent underperforming elements within their business. These are typically found in niche markets with low growth potential and where the company holds a minimal market share. For instance, a specific geographical region experiencing stagnant online gambling growth, perhaps only 2% annually, with Gambling.com Group's presence below 5%, would fit this profile.

These 'dog' assets often consume resources without generating substantial returns, making them candidates for divestment or significant resource reduction. An example could be an older affiliate website focused on an outdated betting niche that saw its revenue drop by 80% in 2024, from $50,000 to $10,000.

Inefficient traffic acquisition channels, such as paid advertising campaigns with a high cost per acquisition ($150) that exceeds the customer lifetime value ($120) in 2024, also fall into the 'dog' category. These channels tie up capital that could be better utilized elsewhere.

Ultimately, 'dogs' within Gambling.com Group's portfolio are those ventures or assets that operate in low-growth, competitive environments, possess a low market share, and deliver minimal financial returns, necessitating a strategic re-evaluation of their place in the company's overall structure.

Question Marks

Emerging regulated US states like Missouri are significant question marks for Gambling.com Group's BCG Matrix. These markets, on the verge of legalizing online sports betting or iGaming, present high growth potential but also uncertainty. Gambling.com Group's market share in these nascent territories is currently minimal, necessitating considerable investment to build brand awareness and secure a foothold.

Gambling.com Group's expansion into untapped global markets represents a significant question mark within its BCG matrix. These are regions where the company currently has minimal or no operational footprint, but which exhibit strong growth potential, often due to emerging economies or evolving regulatory landscapes.

For instance, exploring opportunities in parts of Southeast Asia or certain African nations could offer substantial upside. However, these ventures are inherently risky, demanding considerable investment in adapting services to local languages and cultural nuances, as well as navigating complex and often uncertain regulatory frameworks. The success hinges on effective market entry strategies and the ability to build brand recognition from the ground up.

Exploring affiliate opportunities in cutting-edge technologies like Virtual Reality (VR) or Augmented Reality (AR) in iGaming places Gambling.com Group within the question mark quadrant of the BCG matrix. The market for VR/AR gaming is still nascent, but it holds considerable future growth potential.

While these areas could evolve into future stars, current market adoption remains low. Significant investment in content development and specialized expertise would be necessary for Gambling.com Group to establish a leading position in this emerging sector.

Niche or Specialized Sports Betting Markets

Developing dedicated affiliate strategies for niche sports betting markets, though currently small, presents a significant question mark for Gambling.com Group. These segments, such as esports or specific regional sports, often boast high growth potential but require highly targeted content and marketing to attract a dedicated audience. Success hinges on rapidly capturing substantial market share to validate the investment.

The challenge lies in the resource allocation for these specialized areas. While the potential for high returns exists, the initial investment in tailored content creation and specialized SEO can be substantial. For instance, a niche market like competitive cycling betting might require in-depth analysis of rider form and race dynamics, a departure from mainstream football coverage.

- High Growth Potential: Niche markets can offer exponential growth if early adoption is achieved.

- Targeted Audience: Requires specialized content and marketing expertise to engage specific demographics.

- Market Share Acquisition: Rapidly gaining traction is crucial to justify investment and outpace competitors.

- Resource Allocation: Balancing investment between established markets and emerging niche segments is a key strategic consideration.

Advanced AI-Driven Personalization & Hyper-Targeting Initiatives

Gambling.com Group's investment in advanced AI and machine learning for hyper-personalization is a question mark within its BCG matrix. While the affiliate marketing sector is projected for significant growth, with the global online gambling market expected to reach $157.50 billion by 2029, the specific return on investment for deep AI integration in this niche remains to be fully demonstrated.

The company is exploring new applications for AI to deliver highly tailored content and marketing messages, aiming to capture a larger market share. However, the effectiveness of these sophisticated AI initiatives in driving user acquisition and retention in the competitive online gambling landscape needs to be validated to transition from a question mark to a star.

- AI Investment: Heavy investment in AI/ML for hyper-personalization.

- Market Trend: Personalization is a key high-growth trend for 2025.

- Uncertainty: Effectiveness and ROI of deep AI for affiliate marketing need proof.

- Risk: Failure to prove ROI could lead to becoming a dog in the BCG matrix.

Emerging regulated US states represent significant question marks for Gambling.com Group. These markets, like Missouri, are poised for online sports betting legalization, offering substantial growth potential but also inherent uncertainty. Gambling.com Group's current market share in these nascent territories is minimal, requiring dedicated investment to build brand presence and establish a strong foothold.

The company's strategic exploration of untapped global markets also falls into the question mark category. These regions, often characterized by developing economies or shifting regulatory landscapes, present high growth prospects but come with considerable risks. Adapting services to local languages and navigating complex regulations demand significant upfront investment, with success contingent on effective market entry and brand building.

Investment in advanced AI and machine learning for hyper-personalization within affiliate marketing is another key question mark. While the global online gambling market is projected to reach $157.50 billion by 2029, the precise return on investment for deep AI integration in this niche is still being determined. The effectiveness of these sophisticated AI initiatives in driving user acquisition and retention needs validation to transition from a question mark to a star performer.

| Area of Uncertainty | Market Potential | Current Status | Investment Need | Key Success Factor |

|---|---|---|---|---|

| Emerging US States | High (Legalization imminent) | Minimal Market Share | Brand Building, Market Entry | Regulatory Navigation, User Acquisition |

| Untapped Global Markets | High (Developing economies) | No Operational Footprint | Localization, Regulatory Compliance | Market Entry Strategy, Brand Recognition |

| AI for Hyper-Personalization | High (Personalization trend) | ROI Not Fully Proven | AI/ML Development, Validation | Demonstrated ROI, User Retention |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.