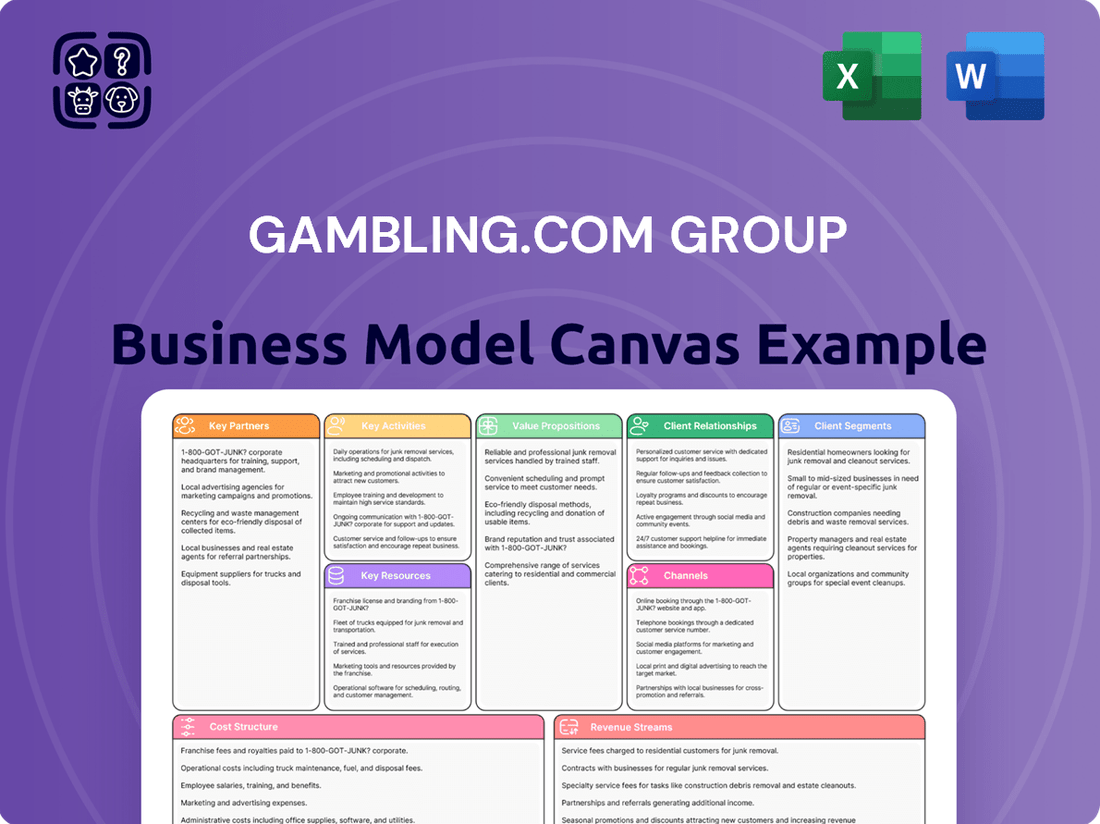

Gambling.com Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Gambling.com Group Bundle

Unlock the full strategic blueprint behind Gambling.com Group's business model. This in-depth Business Model Canvas reveals how the company drives value through affiliate marketing and content creation, captures market share by targeting specific player demographics, and stays ahead in a competitive landscape with strategic partnerships. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a leading iGaming affiliate.

Partnerships

Gambling.com Group's core strategy relies heavily on its key partnerships with major online gambling operators like DraftKings, FanDuel, BetMGM, and Caesars Sportsbook. These collaborations are the engine of their performance marketing approach, driving new, depositing customers to these platforms.

The group's revenue generation is directly linked to the success and market expansion of these operator partners. For instance, in 2023, Gambling.com Group reported a significant increase in revenue, partly fueled by the growth of these operator relationships in newly regulated US states.

Gambling.com Group strategically integrates acquired entities like Odds Holdings, which includes OddsJam and OpticOdds, as key partners. This move significantly broadens their product portfolio and diversifies revenue streams.

The acquisition of Freebets.com and RotoWire further strengthens the Group's market position by introducing new technological capabilities and expanding their customer reach. These integrations are crucial for enhancing their overall value proposition.

Gambling.com Group actively cultivates strategic alliances with media companies and publishers. These partnerships are crucial for embedding sports betting and iGaming content and advertisements directly onto established media platforms, significantly extending their audience reach beyond Gambling.com Group's proprietary websites. For instance, a key collaboration exists with the prominent UK media publisher, The Independent, showcasing the group's strategy to leverage established media brands.

These integrations serve a dual purpose: they effectively drive qualified traffic to Gambling.com Group's offerings and simultaneously amplify brand visibility across a much wider digital ecosystem. This approach allows the company to tap into existing reader bases and capitalize on the trust and authority these media outlets already command, a strategy that proved particularly effective in 2023, contributing to the group's robust revenue growth.

Technology and Data Providers

Gambling.com Group's strategic alliances with technology and data providers are foundational to its operational excellence. These partnerships are critical for accessing and integrating advanced technological platforms, particularly those offering real-time odds data and sophisticated analytics. This ensures Gambling.com Group can deliver highly accurate and timely information to its diverse user base, from casual bettors to professional analysts.

A prime example of this strategic focus is the acquisition of Odds Holdings, which brought the OddsJam platform into the group's portfolio. OddsJam's state-of-the-art technology is adept at processing and analyzing massive datasets, a capability that directly enhances Gambling.com Group's service offerings. This technological integration solidifies the group's position in providing cutting-edge tools and insights.

- Data Feeds: Partnerships with leading sports data providers ensure the constant flow of accurate, real-time odds and statistics from numerous global sporting events.

- Analytics Platforms: Collaborations with firms specializing in data analytics and machine learning enable the development of predictive models and personalized user experiences.

- Technology Infrastructure: Agreements with cloud service providers and software developers are essential for maintaining robust, scalable, and secure technology platforms.

- Acquisitions: The acquisition of OddsJam in 2023, for instance, brought advanced proprietary technology for sports betting analytics, significantly bolstering the group's data processing capabilities.

Payment Processing and Financial Institutions

While not directly partnerships for traffic generation, Gambling.com Group relies heavily on secure payment processors and established financial institutions. These collaborations are fundamental to facilitating trusted and seamless transactions for the players they refer to various online gambling operators.

These financial relationships ensure the integrity of the user experience, which is paramount in the online gambling sector. In August 2023, Gambling.com Group demonstrated a key financial partnership by securing an expanded credit facility of $100 million from Wells Fargo. This facility is earmarked to support strategic acquisitions and further business development.

- Secure Payment Gateways: Partnerships with providers like PayPal, Visa, and Mastercard are essential for enabling secure and convenient deposits and withdrawals for end-users.

- Banking Relationships: Maintaining strong ties with financial institutions facilitates the flow of funds and ensures regulatory compliance within the gambling industry.

- Credit Facilities: As evidenced by the $100 million facility from Wells Fargo in 2023, financial institutions provide crucial capital for growth initiatives, including mergers and acquisitions.

Gambling.com Group's key partnerships are the bedrock of its affiliate marketing model, connecting players with leading operators. These collaborations are not just about referrals; they are deeply integrated, driving performance-based revenue. The group's 2023 financial report highlighted substantial revenue growth, directly attributable to the expansion of these operator relationships, particularly in the burgeoning US market.

Strategic acquisitions, like that of Odds Holdings in 2023, have broadened the group's technological capabilities and product offerings, solidifying its position as a comprehensive resource for sports bettors and iGamers. These integrations are vital for delivering enhanced value and diversifying income streams.

Furthermore, alliances with major media companies, such as The Independent, are crucial for extending reach and embedding content within established audiences. This multi-channel approach amplifies brand visibility and drives high-quality traffic, a strategy that proved highly effective in 2023.

What is included in the product

Gambling.com Group's Business Model Canvas focuses on affiliate marketing, connecting players to online gambling operators through high-quality content and SEO expertise. It leverages a vast network of websites and a data-driven approach to acquire customers for its partners, generating revenue through commissions and advertising.

The Gambling.com Group Business Model Canvas acts as a pain point reliever by offering a high-level view of the company’s business model with editable cells, allowing for quick identification of core components in a one-page snapshot.

This concise layout saves hours of formatting and structuring, making it perfect for brainstorming, teaching, or internal use, while also being shareable and editable for team collaboration and adaptation.

Activities

Content creation and publishing are central to Gambling.com Group's strategy, focusing on producing expert-driven reviews, comparisons, and educational materials for online gambling platforms. This commitment to high-quality content aims to attract and inform users, fostering trust and positioning the company as a leading authority in the sector.

In 2024, the group continued to invest heavily in its content capabilities, recognizing its direct impact on user acquisition and engagement. Their portfolio of websites, including leading brands like Gambling.com and Bookies.com, consistently delivers fresh, data-driven insights and expert analysis, a key differentiator in a competitive market.

Gambling.com Group heavily relies on extensive Search Engine Optimization (SEO) to achieve top search engine rankings, particularly on Google and Bing. This drives significant organic traffic to their diverse portfolio of gambling-related websites, a core component of their customer acquisition strategy.

Their SEO efforts involve continuous content optimization and technical adjustments to stay ahead of evolving search engine algorithms. In 2023, the company reported that organic search was a primary driver of traffic, contributing to a substantial portion of their user base growth.

Beyond organic reach, Gambling.com Group actively employs paid media campaigns and other digital marketing channels. This multi-faceted approach ensures a robust user acquisition pipeline, complementing their SEO investments and broadening their market penetration.

Gambling.com Group's core activity revolves around driving substantial volumes of targeted traffic to its partners and then effectively converting these visitors into new depositing customers (NDCs). This is the engine that powers their revenue model.

To achieve this, the company employs advanced tracking mechanisms and analytics. These tools are crucial for understanding user behavior, pinpointing bottlenecks in the conversion process, and continuously refining strategies to boost the value of every referral. In 2023, Gambling.com Group reported a significant increase in NDCs, highlighting their success in this area.

The delivery of NDCs is the ultimate measure of success for Gambling.com Group. Their business is fundamentally built on this key performance indicator, demonstrating their ability to not just attract eyeballs but to generate tangible, revenue-generating customers for their operator partners.

Strategic Acquisitions and Integration

Gambling.com Group actively pursues strategic acquisitions to bolster its market presence and service portfolio. A prime example is the integration of Freebets.com and Odds Holdings, which significantly broadened the company's reach and diversified its revenue streams. These moves are designed to consolidate market share and create a more robust competitive advantage.

The successful integration of acquired assets is paramount to realizing the full value of these strategic initiatives. This process involves aligning operations, technology, and marketing efforts to ensure seamless customer experience and operational efficiency. For instance, the integration of Freebets.com aimed to leverage its established user base and brand recognition within the group's broader network.

- Market Expansion: Acquisitions like Freebets.com and Odds Holdings directly increase the group's footprint in key gambling markets.

- Service Diversification: Integrating new platforms and technologies allows for a wider array of services offered to customers, from betting tips to affiliate marketing.

- Synergy Realization: The group focuses on achieving cost savings and revenue enhancements through the combined operations of acquired businesses, a key driver for profitability.

Sports Data Services and Technology Development

Developing and maintaining sophisticated technology platforms for sports data services is a crucial and expanding key activity for Gambling.com Group. This includes the ongoing enhancement of offerings like OddsJam and OpticOdds, which are central to their data-driven strategy.

These platforms deliver real-time odds, in-depth insights, and comprehensive data solutions tailored for both individual consumers and larger enterprise partners. This move into data services represents a significant diversification beyond their established affiliate marketing roots, aiming to capture a broader market share.

- Technology Platform Development: Investing in and refining the technological infrastructure that powers their data services, ensuring speed, accuracy, and scalability.

- Data Provision and Analytics: Supplying real-time sports data, including odds, scores, and performance metrics, coupled with advanced analytical tools for users.

- Consumer and Enterprise Solutions: Offering distinct data service packages designed to meet the varied needs of individual bettors and business clients within the sports betting ecosystem.

- Strategic Diversification: Leveraging data and technology to create new revenue streams and reduce reliance on traditional affiliate marketing models, a strategy that saw significant investment in 2024.

Gambling.com Group's core activities revolve around generating high-quality content, driving targeted traffic through SEO and paid media, and converting that traffic into new depositing customers (NDCs) for their partners. They also strategically expand through acquisitions and develop advanced sports data technology platforms.

In 2024, the company continued to prioritize organic growth and market penetration, with SEO remaining a primary driver of traffic. Their focus on NDCs underscores their effectiveness in delivering valuable customers to operators.

The expansion into sports data services, exemplified by platforms like OddsJam, represents a significant strategic diversification, aiming to capture new revenue streams and leverage their technological capabilities.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Content Creation & Publishing | Producing expert reviews, comparisons, and educational materials. | Continued investment in high-quality content for user acquisition. |

| Search Engine Optimization (SEO) | Achieving top search engine rankings for organic traffic. | Organic search remains a primary driver of traffic and user growth. |

| New Depositing Customers (NDCs) | Converting referred traffic into revenue-generating customers for partners. | Significant increase in NDCs reported, highlighting conversion success. |

| Strategic Acquisitions | Bolstering market presence and service portfolio through acquisitions. | Integration of Freebets.com and Odds Holdings broadened reach and revenue. |

| Sports Data Technology | Developing and maintaining platforms for sports data services. | Ongoing enhancement of OddsJam and OpticOdds for data-driven strategy. |

Preview Before You Purchase

Business Model Canvas

The Gambling.com Group Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited structure and content of the business model, ensuring full transparency and no surprises. Once your order is processed, you will gain immediate access to this exact file, ready for your strategic analysis and application.

Resources

Gambling.com Group's proprietary technology platform is the backbone of its operations, managing a vast network of websites and affiliate performance tracking. This advanced system is crucial for delivering sports data services and optimizing marketing efforts.

The platform allows for efficient content management and user engagement across its global presence. In 2023, the company reported a substantial increase in revenue, partly driven by the enhanced capabilities and scalability provided by this technology.

Gambling.com Group's portfolio of branded websites, including Gambling.com, Bookies.com, Casinos.com, Freebets.com, RotoWire.com, OddsJam, and OpticOdds, represents a core asset. This network attracts a broad audience actively seeking gambling information, product comparisons, and sports data.

This extensive digital presence enables significant market penetration. For instance, in the first quarter of 2024, Gambling.com Group reported a 30% year-over-year increase in revenue, largely driven by the performance of these established brands in key markets.

Gambling.com Group relies heavily on its expert content creators and SEO specialists as a core human resource. This team is responsible for crafting high-quality, engaging, and search-engine-optimized content that drives organic traffic to their platforms.

Their collective expertise ensures that the information provided is not only relevant to users but also ranks well in search engine results, a critical factor for visibility in the competitive online gambling market. For instance, in 2024, a strong SEO strategy can significantly boost a site's presence, as search engines continue to prioritize authoritative and user-friendly content.

This talent pool is crucial for maintaining the group's industry authority and continuously delivering valuable insights to their audience. Their work directly translates into attracting new users and retaining existing ones by providing a consistently informative and accessible experience.

User Databases and Traffic Data

Gambling.com Group leverages its extensive user databases and traffic data as a cornerstone of its business model. This accumulated information on how users interact with their web portals, including their preferences and traffic patterns, is a critical asset. This data is actively used to sharpen marketing efforts, tailor content for individual users, and boost the effectiveness of conversion funnels.

A deep understanding of user engagement is paramount for driving high-intent traffic to their affiliate partners. This focus on user behavior allows Gambling.com Group to deliver more qualified leads, thereby enhancing the value proposition for their B2B clients.

- User Behavior Insights: Data analytics reveal user journeys, content consumption, and betting preferences, informing product development and marketing campaigns.

- Traffic Pattern Optimization: Analyzing traffic sources and user flow helps in optimizing website design and content placement for maximum engagement and conversion.

- Personalized Content Delivery: User data enables the group to offer tailored recommendations and promotions, increasing user retention and satisfaction.

- High-Intent Lead Generation: By understanding what drives user action, Gambling.com Group can effectively direct engaged users to partner sites, ensuring higher conversion rates for affiliates.

Financial Capital and Credit Facilities

Gambling.com Group's access to substantial financial capital and credit facilities is a cornerstone of its operational strategy. A prime example is its $165 million credit facility, which provides the necessary liquidity for day-to-day business and strategic growth initiatives.

This financial muscle is vital for pursuing growth opportunities, including potential acquisitions that could expand market reach or service offerings. For instance, in 2023, the company secured an upsizing of its credit facility, demonstrating its ability to leverage financial markets for enhanced operational capacity.

The flexibility afforded by these credit lines directly supports investments in technological advancements and market expansion. This ensures Gambling.com Group remains competitive in the dynamic online gambling sector.

- Financial Capital Access: Secured a $165 million credit facility, demonstrating robust financial backing.

- Strategic Funding: Enables funding for ongoing operations and strategic acquisitions.

- Growth Investment: Provides flexibility to invest in technological advancements and market expansion.

Gambling.com Group's key resources include its proprietary technology platform, a diverse portfolio of branded websites, skilled human capital in content creation and SEO, and valuable user data. Access to significant financial capital, exemplified by its $165 million credit facility, further underpins its operations and growth strategies.

| Resource Category | Specific Resource | Significance | 2024 Impact/Data |

|---|---|---|---|

| Technology | Proprietary Technology Platform | Manages websites, tracks affiliate performance, delivers sports data. | Drives revenue growth, evidenced by a 30% YoY increase in Q1 2024 revenue. |

| Intellectual Property | Branded Websites Portfolio | Attracts broad audience seeking gambling info and data. | Key driver for market penetration and user acquisition. |

| Human Capital | Expert Content Creators & SEO Specialists | Creates high-quality, search-optimized content. | Ensures platform visibility and user engagement in a competitive market. |

| Data | User Databases & Traffic Data | Informs marketing, content personalization, and lead generation. | Enhances value for B2B clients by providing high-intent traffic. |

| Financial | Financial Capital & Credit Facilities | Supports operations, growth initiatives, and technological investment. | $165 million credit facility provides liquidity for strategic expansion. |

Value Propositions

Gambling.com Group offers online players a wealth of detailed, unbiased comparisons and reviews of regulated gambling sites. This empowers users to make informed choices, discover top offers, and navigate the online gambling world with confidence. In 2024, the group continued to solidify its position as a go-to resource.

Gambling.com Group's core value proposition for operators is the consistent delivery of high-quality, high-intent new depositing customers (NDCs). This is achieved through sophisticated performance marketing strategies that attract users with a genuine interest in online gambling services.

The group's specialized knowledge in driving targeted traffic means operators receive a stream of engaged users, significantly improving conversion rates. This approach positions Gambling.com Group as a highly cost-effective customer acquisition channel for its partners.

For instance, in 2024, Gambling.com Group reported a substantial increase in revenue, driven by its ability to attract and convert valuable NDCs for its operator partners, demonstrating the tangible financial benefits of this focused value proposition.

Gambling.com Group's value proposition centers on delivering real-time sports data and analytical insights through prominent brands like OddsJam and OpticOdds. This dual focus caters to both individual consumers seeking to enhance their sports betting strategies and enterprise clients within the sports betting and fantasy sports industries.

For consumers, this means access to up-to-the-minute odds and deep analytical insights, directly aiding in making more informed betting decisions. This moves beyond simple affiliate connections to offer tangible tools for success.

Enterprise clients leverage these data streams and analytical capabilities to optimize their offerings, improve customer engagement, and gain a competitive edge in the rapidly evolving sports betting and fantasy sports markets. This data is crucial for dynamic pricing and personalized user experiences.

The company's investment in these data and insights platforms, as evidenced by their strategic acquisitions and platform development, positions them as a key data provider. For instance, the acquisition of OddsJam in late 2022 significantly bolstered their real-time data capabilities, a trend that continued to be a focus for growth throughout 2023 and into 2024.

Diversified Content Across Gambling Verticals

Gambling.com Group's value proposition centers on its extensive content coverage across multiple online gambling sectors. This includes detailed information and resources for iGaming, sports betting, and fantasy sports, offering a comprehensive platform for enthusiasts.

This broad approach ensures that the company serves a wide audience with varied interests within the gambling landscape. By diversifying across these verticals, Gambling.com Group mitigates risk associated with over-reliance on any single product or market.

- Broad Vertical Coverage: The company provides content for iGaming, sports betting, and fantasy sports.

- Holistic Resource: It acts as a one-stop shop for diverse gambling interests.

- Risk Mitigation: Diversification reduces dependence on any single gambling segment.

- User Engagement: Catering to varied preferences enhances user attraction and retention.

Increased Visibility and Market Reach for Partners

Gambling.com Group significantly boosts partner visibility and market reach through its vast network of high-authority websites and sophisticated digital marketing capabilities. This strategic advantage helps gambling operators connect with a broader customer base and successfully enter new, regulated territories.

The group acts as a crucial conduit, effectively linking licensed operators with interested players across diverse geographical regions. For instance, in 2023, Gambling.com Group reported a 26% increase in revenue, driven partly by expanding its presence in key regulated markets, thereby offering partners access to these growth opportunities.

- Enhanced Brand Exposure: Partners gain access to millions of potential customers actively seeking online gambling experiences.

- Market Penetration: The group facilitates entry into new and emerging regulated markets, overcoming geographical barriers.

- Targeted Audience Acquisition: Expertise in SEO and content marketing ensures operators connect with relevant, high-intent players.

- Global Reach: Access to a global audience allows operators to diversify their customer base and revenue streams.

Gambling.com Group provides players with unbiased, in-depth reviews and comparisons of regulated online gambling sites, empowering informed decisions and access to top offers. For operators, the group delivers high-quality, high-intent new depositing customers through targeted performance marketing, proving to be a cost-effective acquisition channel. In 2024, the company's revenue growth was significantly bolstered by its ability to consistently deliver these valuable customers.

The group also offers real-time sports data and analytical insights via brands like OddsJam, aiding consumers in making better betting choices and helping enterprise clients optimize their sports betting and fantasy sports offerings. This data-centric approach, further enhanced by strategic acquisitions, positioned Gambling.com Group as a key data provider in the market throughout 2023 and into 2024.

Furthermore, Gambling.com Group leverages its extensive network of high-authority websites and digital marketing expertise to boost partner visibility and market reach, facilitating entry into new regulated territories. In 2023, this expansion contributed to a 26% revenue increase, showcasing the group's effectiveness in connecting operators with a broader, relevant customer base.

| Value Proposition | Target Audience | Key Benefit | 2024 Data/Insight |

| Informed Player Choices | Online Players | Access to unbiased reviews and top offers | Continued growth in user engagement across platform brands. |

| High-Quality Customer Acquisition | Online Gambling Operators | Delivery of high-intent new depositing customers | Substantial revenue increase driven by NDC delivery. |

| Data & Analytics for Betting | Players & Enterprise Clients | Enhanced betting strategies and optimized offerings | Strengthened data capabilities through continued platform investment. |

| Market Access & Visibility | Online Gambling Operators | Increased brand exposure and market penetration | 26% revenue growth in 2023, partly due to market expansion. |

Customer Relationships

Gambling.com Group's customer relationships with gambling operators are primarily built on an automated affiliate marketing platform. This system efficiently manages partnerships by tracking referred customers and processing payments based on performance metrics like cost per acquisition (CPA) or revenue share.

This automated approach is crucial for scalability, allowing Gambling.com Group to manage a large network of operators effectively. In 2023, the company reported a significant increase in revenue, partly driven by the strength of these affiliate relationships and the efficiency of their performance-based models.

Gambling.com Group cultivates user loyalty by offering a wealth of engaging and informative content across its web portals. This strategy builds trust by positioning the sites as indispensable resources for players seeking reliable comparisons and insights into the online gambling landscape.

The group's approach focuses on establishing its portals as authoritative sources, driving repeat visits and fostering a sense of community. For instance, in 2023, Gambling.com Group reported a 40% increase in revenue, partly fueled by strong organic traffic growth, underscoring the effectiveness of their content-driven engagement strategy.

Gambling.com Group's acquisition of Odds Holdings significantly bolstered its direct customer relationships by introducing subscription-based services for sports data. This strategic move generates a predictable, recurring revenue stream, enhancing financial stability and predictability.

This subscription model fosters a more intimate engagement with consumers, moving beyond affiliate marketing to a direct service provider role. This allows for deeper user interaction and the development of personalized service offerings tailored to individual sports data needs.

In 2023, Gambling.com Group reported total revenue of $192.9 million, a substantial increase from $70.5 million in 2022, indicating strong growth potential for their diversified revenue streams, including these new subscription services.

Direct Communication and Support for Enterprise Clients

Gambling.com Group cultivates direct communication channels for its enterprise clients, particularly those leveraging its sports data services and other B2B solutions. This approach ensures tailored support and the development of customized solutions to meet distinct business requirements.

The company emphasizes personalized engagement and dedicated account management to foster strong, long-term strategic partnerships with these larger organizational clients. This direct interaction is crucial for understanding and addressing their evolving needs in the competitive iGaming landscape.

- Direct Client Engagement: Gambling.com Group maintains direct relationships with enterprise clients, offering personalized support for B2B services like sports data.

- Tailored Solutions: The focus is on providing customized solutions and dedicated account management to address specific business needs of larger clients.

- Strategic Partnerships: The company aims to build enduring, strategic partnerships with enterprise entities, fostering mutual growth and success.

Building Trust and Transparency

Building trust with end-users is paramount for Gambling.com Group, achieved through transparent and unbiased reviews and comparisons of gambling sites. This dedication to integrity is a key differentiator in the crowded online gambling market.

Maintaining this trustworthiness is vital for sustained audience engagement and loyalty. For instance, in 2024, the group continued to emphasize its commitment to responsible gambling resources and clear disclosure of affiliate relationships, reinforcing its ethical stance.

- Transparency in Reviews: Providing objective assessments of online casinos and sportsbooks, highlighting pros and cons.

- Unbiased Comparisons: Offering side-by-side analyses to help users make informed decisions.

- Responsible Gambling Focus: Integrating tools and information to promote safe betting practices, a growing concern for users in 2024.

- Affiliate Disclosure: Clearly stating commercial relationships to maintain user confidence.

Gambling.com Group fosters relationships through an automated affiliate platform for operators, ensuring efficient performance tracking and payments. For end-users, trust is built via transparent, unbiased reviews and a commitment to responsible gambling, driving repeat engagement.

The group also cultivates direct, personalized relationships with enterprise clients through subscription services and dedicated account management, particularly for its sports data offerings.

This multi-faceted approach, combining automated efficiency with personalized engagement and transparency, underpins the group's strategy for sustained growth and user loyalty.

Channels

Gambling.com Group's primary customer acquisition channel is its extensive portfolio of owned and operated web portals. These include prominent sites like Gambling.com, Casinos.com, and Bookies.com, acting as direct gateways for users looking for gambling information, operator reviews, and affiliate links.

This robust network ensures broad market reach and significant brand visibility. In 2024, the group reported that its owned and operated portals were responsible for a substantial portion of its revenue, demonstrating their critical role in driving user traffic and conversions.

Search Engine Optimization (SEO) is a cornerstone for Gambling.com Group, acting as a primary channel for attracting users. The company prioritizes SEO to ensure their platforms rank prominently for terms like ‘online casino’ and ‘sports betting,’ driving substantial organic traffic. In 2023, SEO was instrumental in delivering a significant portion of the group's traffic, contributing to their robust revenue growth.

Gambling.com Group actively leverages paid media, including search engine marketing (SEM) and display advertising, to drive user acquisition. This strategic approach allows for precise targeting of potential customers and the swift expansion of acquisition efforts. In 2023, the company reported that paid media was a significant contributor to its traffic, with a substantial portion of their marketing budget allocated to these channels to ensure maximum reach and engagement.

Direct Traffic from Established Brands

Gambling.com Group strategically enhances its direct traffic by acquiring established brands. For instance, the acquisition of Freebets.com and RotoWire immediately injects a loyal user base and significant direct traffic into the group's ecosystem. This approach leverages existing brand equity, providing a powerful and immediate expansion of audience reach and referral potential.

These acquisitions are more than just adding websites; they represent the integration of established customer relationships and trusted platforms. By bringing these well-known entities under its umbrella, Gambling.com Group effectively bypasses the lengthy and costly process of building direct traffic from scratch. This allows for quicker market penetration and a stronger competitive position.

- Acquisition of Freebets.com: Bolsters direct traffic with a pre-existing, engaged audience.

- Integration of RotoWire: Adds a loyal user base and established referral channels in the sports data niche.

- Leveraging Brand Equity: Capitalizes on the established trust and recognition of acquired brands to drive immediate audience growth.

Content Syndication and Media Partnerships

Content syndication and strategic media partnerships are crucial channels for Gambling.com Group. These collaborations allow them to distribute their expert content and reach a wider audience beyond their owned websites.

By leveraging third-party platforms, Gambling.com Group effectively extends its influence, driving valuable referrals and increasing brand visibility in the competitive iGaming affiliate market.

- Content Syndication: Distributes high-quality content to a broader audience.

- Media Partnerships: Collaborates with external media outlets to enhance reach and credibility.

- Audience Expansion: Accesses new customer segments through partner platforms.

- Referral Traffic: Drives qualified leads to Gambling.com Group's owned properties.

Gambling.com Group utilizes a multi-channel approach to attract and convert users. Their owned and operated web portals, such as Gambling.com and Casinos.com, serve as primary customer acquisition hubs, directly driving traffic and conversions.

Search Engine Optimization (SEO) is a critical organic channel, ensuring high rankings for relevant keywords and capturing users actively seeking online gambling information. In 2023, SEO was a significant driver of traffic, contributing to the company's revenue growth.

Paid media, including search engine marketing and display advertising, provides a scalable and targeted method for user acquisition, complementing organic efforts. The group also strategically acquires established brands, injecting immediate direct traffic and loyal user bases into their ecosystem.

Content syndication and media partnerships further broaden reach by distributing valuable content across third-party platforms, generating referrals and enhancing brand visibility.

| Channel | Description | 2023/2024 Impact |

|---|---|---|

| Owned Portals | Direct traffic via sites like Gambling.com, Casinos.com | Substantial revenue driver, critical for conversions |

| SEO | Organic traffic from search engines | Instrumental in traffic delivery and revenue growth |

| Paid Media | SEM, display advertising | Significant contributor to traffic, strategic targeting |

| Brand Acquisitions | Integrating sites like Freebets.com, RotoWire | Injects loyal user bases and direct traffic |

| Content Syndication/Partnerships | Distributing content via third parties | Expands reach, drives referrals and brand visibility |

Customer Segments

Individual online gamblers and sports bettors represent Gambling.com Group's core audience. This segment actively seeks detailed reviews, comparisons, and exclusive offers for online casinos, sportsbooks, and fantasy sports. They rely on these platforms for trustworthy guidance to navigate the online gambling landscape and make informed choices.

This user group is the largest contributor to traffic on Gambling.com Group's informational portals. In 2024, the online gambling market continued its robust growth, with a significant portion of this growth driven by digital engagement. This indicates a sustained demand for the curated information and resources provided by the company.

Online gambling operators, including casinos, sportsbooks, and poker platforms, are a core customer segment. These businesses are driven by the need to acquire new depositing customers (NDCs) and view Gambling.com Group as a crucial partner for achieving this growth. They leverage Gambling.com Group's performance marketing capabilities to attract and convert players.

These operators directly generate affiliate revenue for Gambling.com Group by paying for the traffic and customer acquisitions delivered. In 2023, the online gambling market saw significant growth, with the global market size estimated to reach over $100 billion, highlighting the substantial demand for customer acquisition services.

Fantasy Sports Enthusiasts represent a highly engaged, niche segment within the broader gambling audience. These individuals actively seek out specialized content, in-depth data, and sophisticated tools to optimize their fantasy sports performance. Gambling.com Group's strategic acquisition of RotoWire in 2021 significantly bolstered its presence in this dedicated market, bringing in a substantial user base already invested in fantasy sports. This segment often overlaps with interest in sports betting, making them a valuable demographic for integrated offerings.

Enterprise Clients (Sports Data)

Enterprise clients, including other betting platforms, media entities, and sports organizations, represent a key growth area for Gambling.com Group. These businesses are actively seeking robust, real-time sports data, accurate odds, and sophisticated analytical tools to enhance their own offerings and operational efficiency. The strategic acquisition of Odds Holdings in 2023 significantly strengthened the company's capacity to cater to this business-to-business (B2B) market, providing a more comprehensive suite of data-driven solutions.

This segment leverages Gambling.com Group's expertise to gain a competitive edge. For instance, media companies can integrate live scores and betting insights into their broadcasts, while sports organizations might utilize data analytics for fan engagement strategies. The demand for such specialized data services is projected to continue its upward trajectory, driven by the increasing digitization of the sports industry and the expansion of sports betting markets globally. For example, the global sports betting market was valued at approximately $70 billion in 2023 and is expected to grow substantially in the coming years, highlighting the significant opportunity within the enterprise client segment.

- B2B Data Solutions: Providing real-time sports data, odds feeds, and analytical platforms to other betting operators and media companies.

- Strategic Partnerships: Collaborating with sports leagues and organizations to offer data-driven insights and enhance fan engagement.

- Market Expansion: Targeting new enterprise clients in emerging sports betting markets and adjacent industries requiring sports data.

- Acquisition Synergies: Integrating the capabilities of acquired entities like Odds Holdings to offer a more complete B2B service portfolio.

Geographically Diverse Users in Regulated Markets

Gambling.com Group strategically targets users within numerous regulated national markets. This includes a strong presence in North America, which is a key growth driver, alongside established operations in the UK, Ireland, and other European countries. This broad geographic reach is crucial for compliance and market penetration.

The company's approach acknowledges that each regulated market has unique legal frameworks and player preferences. By segmenting its user base geographically, Gambling.com Group can effectively tailor its content, marketing campaigns, and product offerings. This ensures adherence to local regulations, such as advertising restrictions and responsible gambling measures, while also resonating with regional player behaviors.

- North America: Significant investment and focus on states like New Jersey, Pennsylvania, and Michigan, where online gambling is increasingly legalized and regulated.

- United Kingdom & Ireland: Mature markets with established regulatory bodies, requiring sophisticated compliance and content strategies.

- Other European Regions: Expansion into markets like Spain and Germany, each with its own set of licensing and operational requirements.

- Global Reach: Continued efforts to identify and enter new regulated jurisdictions worldwide, adapting to diverse legal and cultural landscapes.

The primary customer segments for Gambling.com Group are individual online gamblers and sports bettors, alongside online gambling operators. The former group actively seeks reviews and offers, relying on the platform for guidance, while operators are focused on acquiring new depositing customers through performance marketing. In 2024, the digital engagement in the online gambling market remained high, underscoring the value of Gambling.com Group's curated information for both user types.

Fantasy sports enthusiasts and enterprise clients represent important, albeit more niche, segments. Fantasy players are drawn to specialized content and data, a market significantly enhanced by the RotoWire acquisition. Enterprise clients, including media and sports organizations, seek data solutions and analytical tools, a capability bolstered by the acquisition of Odds Holdings in 2023.

| Customer Segment | Key Needs | Gambling.com Group's Offering |

| Individual Online Gamblers/Sports Bettors | Reviews, comparisons, offers, trustworthy guidance | Informational portals, affiliate marketing |

| Online Gambling Operators | New Depositing Customers (NDCs), customer acquisition | Performance marketing, traffic delivery |

| Fantasy Sports Enthusiasts | Specialized content, data, tools | In-depth fantasy sports content (e.g., RotoWire) |

| Enterprise Clients (Media, Sports Orgs) | Real-time data, odds, analytics | B2B data solutions, strategic partnerships (e.g., Odds Holdings) |

Cost Structure

Personnel costs represent a substantial element of Gambling.com Group's cost structure, primarily driven by salaries and benefits for its diverse workforce. This includes dedicated teams for content creation, crucial for engaging users, as well as technology development to maintain a competitive edge.

The company's investment in marketing and sales personnel is also significant, reflecting its strategy to acquire and retain customers in a competitive online gambling market. Furthermore, administrative functions support the overall operations and growth of the business.

Gambling.com Group's global presence means personnel costs are influenced by its international operations and expansion efforts. For instance, recent acquisitions have likely contributed to an increase in these costs as the company integrates new talent and teams into its structure.

Gambling.com Group's technology and platform expenses are significant, reflecting the ongoing investment needed to build and maintain its proprietary systems. These costs encompass everything from the servers that host their operations to the software licenses required for various functionalities and robust data infrastructure.

Cybersecurity is also a major component of these expenses, ensuring the safety and integrity of user data and platform operations. For instance, in 2023, the company reported technology and platform costs of $22.8 million, highlighting the substantial financial commitment to this area.

This continuous investment is not just about keeping the lights on; it's essential for operational efficiency and for maintaining a competitive edge in the fast-evolving online gambling market. By staying at the forefront of technological advancements, Gambling.com Group aims to provide a superior user experience and drive growth.

Marketing and advertising expenditure is a significant component of Gambling.com Group's cost structure. These expenses are primarily focused on driving traffic to their various platforms and acquiring new depositing customers for their affiliate partners. In 2023, the company reported that marketing and sales costs represented 39.6% of total revenue, highlighting the importance of this investment.

Key outlays include search engine optimization (SEO) to improve organic rankings, paid media campaigns across various digital channels, and other digital advertising initiatives. This performance marketing model means that a substantial portion of their budget is directly linked to customer acquisition costs, aiming for a positive return on investment from each new customer brought to their partners.

Acquisition-Related Costs

Gambling.com Group's growth strategy heavily relies on acquisitions, which naturally leads to significant acquisition-related costs. These costs encompass not only the outright purchase price of target companies and their assets but also the extensive expenses associated with due diligence and the subsequent integration of these newly acquired entities into the existing business structure.

For example, the company's strategic acquisitions of Odds Holdings and Freebets.com in recent years represent substantial financial commitments. These deals, while aimed at expanding market presence and product offerings, inherently carry considerable upfront investment and ongoing integration expenses.

The financial impact of these acquisitions is evident in the company's reporting. For instance, in 2023, Gambling.com Group reported total acquisition-related costs, including deferred consideration and transaction costs, which can be a material component of their overall expenditure. These costs are crucial to understand when evaluating the company's profitability and cash flow generation.

- Purchase Price: The direct cost of acquiring companies and their assets.

- Due Diligence: Expenses incurred for legal, financial, and operational reviews of acquisition targets.

- Integration Costs: Costs associated with merging acquired businesses, including IT systems, personnel, and operational alignment.

- Deferred Consideration: Payments contingent on future performance of acquired businesses, impacting future cash outflows.

Amortization and Depreciation

Gambling.com Group's cost structure is significantly influenced by amortization and depreciation, particularly following strategic acquisitions. These non-cash expenses, related to intangible assets like brand names and technology, impact reported profitability. For instance, in 2023, the company reported amortization of intangible assets amounting to $29.7 million, a key component of its overall operating expenses.

- Amortization of Intangible Assets: Gambling.com Group recognizes substantial amortization expenses due to the acquisition of valuable intangible assets, such as established brand names, extensive customer databases, and proprietary technology platforms.

- Impact on Profitability: While a non-cash expense, amortization directly reduces reported net income, affecting key financial metrics and investor perceptions of the company's earnings performance.

- 2023 Financial Data: In 2023, the company's amortization of intangible assets was $29.7 million, highlighting its significance within the cost structure.

Other operating expenses encompass a range of costs necessary for day-to-day business functions. These include general and administrative expenses, such as legal fees, accounting services, and office supplies, which are vital for smooth operations.

Additionally, the company incurs costs related to content licensing and data acquisition, essential for maintaining the quality and breadth of information provided to users. These expenses are fundamental to the group's value proposition.

In 2023, Gambling.com Group reported total operating expenses of $123.2 million. This figure reflects the combined impact of personnel, technology, marketing, acquisition, and other operational costs, demonstrating the significant investment required to operate in the competitive online affiliate marketing space.

Revenue Streams

Gambling.com Group's core revenue comes from affiliate marketing, partnering with online gambling sites. They earn through Cost Per Acquisition (CPA) for new depositing players, revenue share based on player losses, and hybrid models. In the first quarter of 2024, the company reported revenue of $27.4 million, a significant increase driven by these affiliate commissions.

Gambling.com Group is increasingly leveraging direct-to-consumer subscription services as a significant revenue driver, especially through its OddsJam brand. This model offers valuable sports data and insights, creating a predictable, recurring income stream that complements its traditional affiliate marketing efforts.

Gambling.com Group also generates revenue by syndicating its premium content to other online platforms, effectively licensing its expertise and reach. This strategy allows them to monetize their content creation capabilities beyond their own digital properties.

Furthermore, the company offers B2B data solutions to enterprises, leveraging their deep understanding of the iGaming market. This B2B offering taps into the demand for actionable industry insights and data analytics, creating a valuable additional income stream.

In 2023, Gambling.com Group reported total revenue of $78.6 million, demonstrating growth in their diversified revenue streams. The syndication and data sales components contribute to this overall financial performance by extending their market penetration and monetization opportunities.

Advertising Revenue

Gambling.com Group generates advertising revenue by selling direct ad placements across its network of websites. These placements can take various forms, including traditional display ads, sponsored articles, and other promotional content designed to reach specific audiences interested in online gaming and related services.

This revenue stream is crucial, with the company reporting that advertising and related revenue represented a significant portion of its total income. For instance, in the first quarter of 2024, Gambling.com Group saw its total revenue climb to $27.8 million, a 15% increase year-over-year, largely driven by its advertising and affiliate marketing efforts.

- Direct Ad Placements: Selling space for display advertisements on its web portals.

- Sponsored Content: Featuring promotional articles or guides paid for by advertisers.

- Diverse Advertisers: Catering to both gambling operators and non-gambling businesses seeking targeted reach.

Performance-Based Marketing Fees for NDCs

Gambling.com Group generates revenue through performance-based marketing fees tied directly to the acquisition of New Depositing Customers (NDCs). This model emphasizes a clear link between the volume of high-intent traffic delivered and the company's earnings, distinguishing it from broader affiliate commissions.

- Direct NDC Acquisition: Revenue is directly proportional to the number of new depositing customers Gambling.com Group drives to its partners.

- Performance Metrics: Fees are contingent on achieving specific performance targets, primarily focused on customer acquisition and conversion.

- High-Intent Traffic Focus: The strategy prioritizes attracting users actively looking to deposit and gamble, maximizing conversion rates for partners.

- 2024 Performance Indicators: While specific NDC-driven fee figures are often embedded within broader revenue reporting, the group's consistent growth in active markets in 2024 underscores the effectiveness of this performance-based model in driving partner acquisition and, consequently, its own revenue.

Gambling.com Group's revenue is primarily driven by affiliate marketing, where they earn commissions for directing new depositing players to online casinos and sportsbooks. This includes Cost Per Acquisition (CPA) fees and revenue share agreements. In Q1 2024, the company reported $27.8 million in revenue, marking a 15% increase year-over-year, with affiliate marketing being a significant contributor.

| Revenue Stream | Description | 2023 Revenue (Approx.) | Q1 2024 Revenue (Approx.) |

|---|---|---|---|

| Affiliate Marketing | Commissions from new depositing players (CPA, Revenue Share) | $78.6M (Total) | $27.8M (Total) |

| Subscription Services | Recurring fees for premium data and insights (e.g., OddsJam) | N/A (Growing) | N/A (Growing) |

| Content Syndication | Licensing premium content to other platforms | N/A (Contributing) | N/A (Contributing) |

| B2B Data Solutions | Selling iGaming market insights and analytics | N/A (Contributing) | N/A (Contributing) |

| Advertising | Direct ad placements and sponsored content | N/A (Contributing) | N/A (Contributing) |

Business Model Canvas Data Sources

The Gambling.com Group Business Model Canvas is informed by a blend of proprietary performance data, extensive market research reports, and competitive intelligence. These sources provide a comprehensive view of our customer base, revenue streams, and operational costs.