G8 Education Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

G8 Education Bundle

G8 Education navigates a competitive landscape shaped by the bargaining power of parents and the constant threat of new childcare providers entering the market. Understanding these forces is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping G8 Education’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The scarcity of qualified early childhood educators in Australia is a significant factor that amplifies their bargaining power. This shortage means that G8 Education, like other providers, faces increased pressure to offer competitive wages and benefits to attract and retain staff, directly impacting recruitment costs.

This persistent shortage directly influences staffing levels, potentially compromising the quality of care and education offered. For G8 Education, this translates into challenges in maintaining consistent operational efficiency and can negatively affect overall profitability as labor costs rise and service delivery is potentially strained.

As of early 2024, reports indicated a national shortage of approximately 37,000 early childhood education and care professionals. This deficit underscores the critical leverage educators hold in the current labor market, driving up wage demands and making talent acquisition a key strategic hurdle for companies like G8 Education.

The bargaining power of suppliers for G8 Education is significantly influenced by the availability of suitable properties. Prime locations for childcare centers, especially in bustling urban areas, are often scarce. This limited supply means landlords in these desirable areas hold considerable sway, potentially driving up rental costs for G8 Education.

This scarcity can directly impact G8 Education's ability to expand its network. Securing new, well-situated sites becomes a challenge, and the increased overheads from higher rents can squeeze profit margins. For instance, in 2024, the Australian childcare sector continued to see strong demand for quality facilities, putting upward pressure on lease agreements in key growth corridors.

While the educational supply market is broad, G8 Education might face some supplier leverage from providers of highly specialized or proprietary early learning curricula. These unique offerings are crucial for G8's educational quality. For instance, in 2024, G8 Education's investment in curriculum development and resources is a significant operational cost. Suppliers with exclusive, high-demand content can command higher prices, directly influencing G8's program expenses.

Food and Catering Services

For G8 Education, the bargaining power of suppliers in the food and catering services sector is typically low. This is largely due to the high number of available catering providers and the relatively standardized nature of the services offered. In 2024, the Australian food service industry saw continued growth, with numerous small to medium-sized enterprises (SMEs) competing for contracts, which naturally suppresses individual supplier leverage.

G8 Education's substantial operational scale allows it to capitalize on this competitive landscape. By consolidating purchasing power across its numerous childcare centers, the company can negotiate more favorable terms and pricing from catering suppliers. This strategy directly mitigates the impact of input costs associated with providing meals and snacks to children.

- Numerous Providers: The Australian catering market is fragmented, offering G8 Education a wide selection of potential suppliers.

- Standardized Offerings: Core catering services are largely similar across providers, reducing the uniqueness of any single supplier.

- Scale Advantage: G8 Education's size enables bulk purchasing, strengthening its negotiating position.

- Cost Mitigation: Favorable supplier terms help control a significant operational expense for the company.

Maintenance and Utilities

The bargaining power of suppliers for maintenance and utilities for G8 Education is generally considered moderate to low. This is primarily due to the presence of numerous service providers for maintenance, offering G8 Education choices and limiting any single supplier's ability to dictate terms.

For essential utilities like electricity and water, the bargaining power of suppliers is further constrained by regulatory frameworks. These regulations often cap price increases, preventing suppliers from imposing significant cost hikes on G8 Education. In Australia, for instance, energy prices are subject to various market mechanisms and government oversight, which helps to moderate supplier leverage.

- Supplier Concentration: The market for maintenance services is typically fragmented, with many small to medium-sized businesses competing for contracts, reducing individual supplier influence.

- Availability of Substitutes: While utilities are essential, the ability to switch providers or the regulated nature of pricing for these services limits supplier power.

- Cost of Switching: For maintenance, switching providers might involve some administrative effort, but it generally does not represent a prohibitive cost for G8 Education.

- Industry Importance: The importance of G8 Education as a customer can also influence supplier willingness to negotiate, especially for larger contracts.

The bargaining power of suppliers for G8 Education is notably influenced by the scarcity of qualified early childhood educators, a situation exacerbated by a national shortage. As of early 2024, Australia faced a deficit of approximately 37,000 early childhood education and care professionals, empowering these educators to demand higher wages and better benefits, directly increasing G8 Education's labor costs and impacting profitability.

What is included in the product

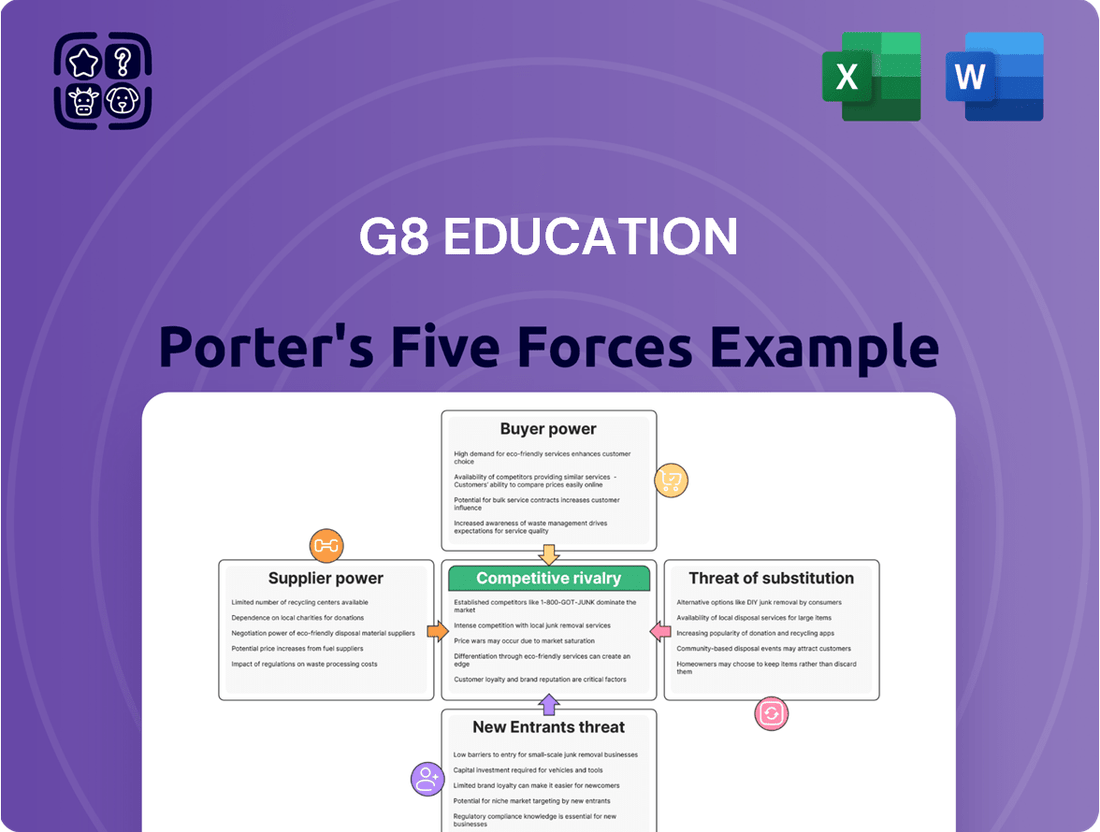

This analysis dissects the competitive forces impacting G8 Education, examining the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the early childhood education sector.

Instantly visualize the competitive landscape for G8 Education, helping to identify and mitigate threats from rivals and new market entrants.

Customers Bargaining Power

The Australian government's Child Care Subsidy (CCS) is a major factor in how affordable childcare is for parents. This directly influences how sensitive parents are to price and which childcare provider they choose. For instance, in the 2023-24 financial year, the Australian government committed to spending over $11.5 billion on childcare subsidies, a figure that underscores its significant impact on household budgets and provider revenue.

Any adjustments to these subsidies can shift demand for childcare services and affect G8 Education's capacity to set its own fees. This, in turn, alters the bargaining power of parents, making them more or less inclined to switch providers based on out-of-pocket costs.

The availability of alternative providers significantly impacts G8 Education's bargaining power with customers. In regions where numerous childcare options exist, parents gain leverage. For instance, in 2024, Australia's childcare sector experienced continued growth in the number of approved providers, offering parents a wider selection.

This abundance of choice means parents can more easily switch providers if they are dissatisfied or find better value elsewhere. Consequently, G8 Education faces pressure to maintain high service standards and competitive pricing to retain families.

To counter this, G8 Education must actively differentiate its offerings. Focusing on unique educational programs, staff qualifications, and a strong community reputation becomes crucial. This strategy helps build loyalty and reduces the likelihood of customers being swayed by competitors solely on price.

Parents are becoming more selective about early childhood education, heavily influenced by National Quality Framework (NQF) ratings and peer recommendations. G8 Education's standing for quality service is paramount; a dip in perceived quality can easily push parents towards competitors, thereby amplifying their bargaining power.

Price Sensitivity of Parents

Parents' high sensitivity to childcare costs significantly impacts G8 Education's pricing power. With childcare fees representing a substantial part of family budgets, particularly when facing economic headwinds, parents are likely to scrutinize and resist price hikes. This financial pressure means G8 Education must often adopt competitive pricing to ensure its centers remain full, limiting its ability to pass on increased operational costs directly.

For instance, in 2024, the average weekly childcare fee in Australia remained a considerable expense for many families. This persistent cost burden reinforces the bargaining power of parents.

- Significant Budgetary Impact: Childcare fees are a major household expenditure, making parents acutely aware of costs.

- Resistance to Price Increases: Economic conditions in 2024 continued to make parents hesitant to accept higher fees.

- Competitive Pricing Necessity: G8 Education must maintain competitive pricing to attract and retain families, affecting profit margins.

- Occupancy Rate Influence: Fee levels directly influence occupancy rates, a key performance indicator for childcare providers.

Access to Information and Reviews

The rise of online platforms and government transparency initiatives, such as the National Quality Framework (NQF) ratings in Australia, significantly boosts the bargaining power of parents seeking childcare services from providers like G8 Education. This increased access to information allows parents to easily compare different centers based on quality, fees, and available services.

This enhanced transparency directly fuels competition among childcare providers. For instance, in 2023, Australia saw approximately 1.3 million children enrolled in early childhood education and care services, highlighting a large and competitive market where informed parents can readily switch providers if expectations are not met.

- Increased Information Access: Online reviews, comparison websites, and government quality assessments empower parents with detailed insights into childcare quality and value.

- Informed Decision-Making: Parents can now easily research and compare G8 Education centers against competitors, leading to more discerning choices.

- Heightened Competition: The availability of information intensifies competition, pressuring providers to offer competitive pricing and superior service to attract and retain families.

- Focus on Transparency: Providers are incentivized to be transparent about their operations and outcomes to meet parental expectations and maintain a strong market position.

Parents wield significant bargaining power due to the substantial cost of childcare, which forms a large portion of household budgets. In 2024, this sensitivity to price means G8 Education must offer competitive fees to maintain high occupancy rates, directly impacting its ability to pass on operational cost increases.

The availability of numerous alternative childcare providers, a trend continuing in 2024 with ongoing sector growth, further empowers parents. This abundance of choice allows families to readily switch to competitors if dissatisfied with G8 Education's pricing or service quality, necessitating a focus on differentiation and value.

Government subsidies, such as the Australian Child Care Subsidy, play a crucial role by influencing parental out-of-pocket expenses and thus their price sensitivity. For instance, the government's commitment of over $11.5 billion to childcare subsidies in the 2023-24 financial year highlights the direct impact of these policies on parental choice and provider leverage.

| Factor | Impact on G8 Education | Parental Leverage |

| Cost Sensitivity | Limits pricing power; necessitates competitive fees. | High due to childcare being a major household expense. |

| Availability of Alternatives | Pressures G8 to maintain quality and competitive pricing. | High due to a growing number of childcare options. |

| Government Subsidies | Influences parental out-of-pocket costs, affecting demand. | Moderate to high, depending on subsidy levels and eligibility. |

Preview the Actual Deliverable

G8 Education Porter's Five Forces Analysis

This preview showcases the complete G8 Education Porter's Five Forces Analysis, offering an in-depth examination of the competitive landscape. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase. This ensures transparency and guarantees you get the full, ready-to-use content without any alterations or missing sections.

Rivalry Among Competitors

The Australian early childhood education market is highly fragmented, featuring a blend of large publicly traded companies like G8 Education, numerous not-for-profit entities, smaller regional chains, and many independent childcare centers. This diverse landscape intensifies rivalry for securing student enrollments.

This intense competition necessitates that G8 Education continuously focuses on differentiating its service offerings and strategically optimizing its network of centers to maintain market share and attract families. For instance, in 2023, G8 Education operated approximately 430 centers across Australia, highlighting its significant but not dominant presence within this fragmented sector.

Competition within the early childhood education sector, particularly for G8 Education, is intense and frequently centers on both pricing and the perceived quality of care and educational programs. This dual focus means G8 Education must carefully manage its fee structures to remain attractive to parents while simultaneously investing in resources, staff development, and curriculum to ensure high-quality learning environments. For instance, in 2024, the average weekly fee for childcare in Australia varied significantly by state, but providers like G8 Education need to position their pricing competitively within these ranges while demonstrating superior educational outcomes to stand out.

Competitive rivalry is fierce as companies like G8 Education pursue aggressive expansion, both by opening new childcare centers and acquiring existing ones. This constant push for growth intensifies the battle for market share, directly impacting G8's strategic maneuvering.

This strategic expansion and acquisition activity can significantly inflate the costs associated with acquiring new businesses or securing prime locations. For instance, in 2024, the Australian childcare sector continued to see consolidation, with some smaller operators being acquired by larger entities, driving up valuations and making organic growth in desirable areas more challenging.

Staffing and Talent Acquisition

The competition for qualified early childhood educators is intense, directly impacting G8 Education. This shortage means providers are constantly vying for the same limited pool of talent, driving up recruitment costs and making retention a significant challenge. For instance, in 2024, industry reports indicated a national shortage of over 20,000 early childhood educators, a figure that has persisted and even worsened in some regions.

This fierce rivalry for staff can translate into higher wage demands and increased training expenses for G8 Education. Consequently, maintaining consistent quality of care across its numerous centers becomes more difficult when staff turnover is high or when new, less experienced educators are brought in to fill gaps. This talent war is a critical factor influencing operational efficiency and profitability.

- Talent Shortage: The Australian early childhood education sector faces a persistent deficit of qualified educators, creating a highly competitive hiring environment.

- Increased Costs: Competition for staff often leads to higher wages and benefits, directly impacting G8 Education's operational expenses.

- Service Quality Impact: High staff turnover and reliance on less experienced educators can compromise the consistency and quality of educational services provided by G8 Education.

- Retention Challenges: Providers like G8 Education must invest in attractive employment packages and professional development to retain their valuable educators amidst this competitive landscape.

Location-Based Competition

Childcare choices are very much tied to where people live, making competition fierce among centers in the same neighborhoods. G8 Education's performance in any given locale hinges on how visible, easy to reach, and well-regarded its centers are compared to nearby competitors.

For instance, in 2024, G8 Education operated a significant number of centers across Australia, with many concentrated in populated suburban areas where local demand is high. This geographical concentration means that a substantial portion of their competitive set consists of small, independent centers or other larger chains with a strong local presence.

- Geographic Concentration: G8 Education's strategy often involves establishing centers in areas with high population density and a strong family demographic, intensifying direct competition with other providers in those specific catchments.

- Local Reputation Matters: The perceived quality and community standing of a G8 center relative to its immediate local rivals are critical drivers of enrollment and market share within that particular geographic area.

- Accessibility as a Differentiator: Proximity to homes and workplaces, along with convenient operating hours, becomes a key competitive factor, directly influencing parental decisions when multiple childcare options exist locally.

Competitive rivalry within Australia's early childhood education sector is intense, driven by a fragmented market and a constant pursuit of enrollments. G8 Education faces direct competition from a mix of large, small, and independent providers, all vying for parental attention through pricing and quality of service. This dynamic necessitates continuous strategic adjustments to maintain market position.

The battle for qualified educators further fuels this rivalry, leading to increased recruitment costs and retention challenges for G8 Education. This talent war directly impacts operational efficiency and the consistent delivery of high-quality care across its network. For instance, the national shortage of early childhood educators in 2024 exceeded 20,000, a critical factor in this competitive landscape.

Geographic concentration of centers means G8 Education often competes directly with numerous local providers in high-demand areas. Factors like accessibility, community reputation, and convenient operating hours become crucial differentiators in securing enrollments against these immediate rivals.

SSubstitutes Threaten

Informal care arrangements, like relying on grandparents or friends, present a significant threat to G8 Education. These alternatives are often free or low-cost, directly competing with the fees charged by formal childcare providers. For instance, in 2024, the rising cost of living may push more families towards these informal solutions, especially if they perceive less immediate educational value in early years care.

The choice for a parent to take extended parental leave or stay home with their child represents a significant substitute for G8 Education's childcare services. This decision is often influenced by a combination of financial prudence, deeply held family values, and a personal desire to be directly involved in a child's formative years. For instance, in 2024, many families are re-evaluating household budgets, and the cost of early childhood education can be a substantial factor. This directly impacts the demand for G8 Education's offerings, as fewer children are enrolled when a parent opts for home-based care.

The threat of substitutes for G8 Education's core services, particularly in the nanny and in-home childcare sector, is a significant consideration. Families seeking highly personalized care, especially those with complex scheduling needs or multiple children, may opt for private nannies or in-home childcare services. These alternatives offer flexibility that center-based care often cannot match, though they typically come at a higher price point. For instance, in 2024, the average cost of a full-time nanny in major Australian cities could range from $800 to $1,200 per week, significantly exceeding the fees for a child at a G8 Education center.

Family Day Care Schemes

Family day care schemes represent a significant threat of substitutes for G8 Education's larger, center-based childcare services. These home-based settings offer a more intimate, personalized care environment, which appeals to parents seeking an alternative to the often larger group sizes and more structured settings of traditional childcare centers. In 2023, the Australian government continued to support and regulate these schemes, ensuring a competitive and accessible alternative for families across the nation.

The appeal of family day care lies in its flexibility and home-like atmosphere, which can be particularly attractive to parents of very young children or those who prefer a smaller, more familial setting. This can draw demand away from larger providers like G8 Education, especially in areas where family day care is well-established and accessible. The Australian government's commitment to diverse childcare options, including regulated family day care, underscores its role as a viable substitute.

- Home-like environment: Family day care offers a more intimate setting compared to larger centers.

- Flexibility: These schemes often provide more adaptable care arrangements.

- Government support: Continued regulation and funding for family day care maintain its viability as an alternative.

- Parental preference: A segment of parents actively seeks out smaller, home-based care options.

Reduced Working Hours or Part-Time Employment

The threat of substitutes for G8 Education's services, particularly in the form of reduced working hours or part-time employment, is a significant factor. Parents facing economic shifts or seeking better work-life balance might adjust their own schedules, leading to a decreased reliance on full-time childcare. This trend directly impacts the demand for G8 Education's core offerings.

For instance, in 2024, reports indicated a growing interest in flexible work arrangements across various sectors. If a substantial portion of parents opt for fewer working days or shorter hours, their need for five-day-a-week, full-day childcare diminishes. This could translate into reduced occupancy rates for G8 Education's centers.

- Reduced Demand: Parents seeking part-time employment or flexible schedules may reduce their children's attendance from full-time to part-time.

- Shift in Service Needs: This shift necessitates G8 Education adapting its service model to accommodate more flexible, potentially lower-revenue, part-time care options.

- Economic Sensitivity: The prevalence of this substitute is often tied to broader economic conditions and parental employment trends, which can fluctuate.

The availability of informal care, such as relying on family members or friends, presents a significant substitute for G8 Education's services. These arrangements are often cost-free, directly competing with the fees charged by formal childcare providers. In 2024, the increasing cost of living may lead more families to utilize these informal options, particularly if they perceive less immediate educational value in early childhood care.

Parents choosing to extend their parental leave or remain at home with their children also acts as a substitute for G8 Education's childcare. This decision is driven by financial considerations and a desire for direct involvement in a child's early development. For instance, in 2024, many households are re-evaluating budgets, making the cost of early childhood education a key factor in enrollment decisions, thus impacting demand for G8 Education.

Nannies and in-home childcare services represent a notable threat of substitutes, especially for families needing highly personalized care or facing complex scheduling. While typically more expensive, these options offer greater flexibility than center-based care. In 2024, the weekly cost of a full-time nanny in major Australian cities could range from $800 to $1,200, significantly higher than G8 Education's center fees.

Family day care schemes offer a more intimate and flexible alternative to G8 Education's larger centers, appealing to parents seeking a home-like environment. The Australian government's continued support for these regulated schemes in 2023 ensures their viability as a competitive substitute. This preference for smaller, familial settings can divert demand from larger providers.

| Substitute Type | Key Appeal | Estimated Cost (Weekly, 2024) | Impact on G8 Education |

|---|---|---|---|

| Informal Care (Family/Friends) | Cost-free | $0 | Direct competition, reduced fee revenue |

| Parental Leave/Stay-at-Home Care | Cost savings, personal involvement | Opportunity cost of lost wages | Reduced enrollment, lower occupancy |

| Nannies/In-Home Care | Personalized, flexible | $800 - $1,200 (Major Cities) | Loss of higher-margin customers |

| Family Day Care | Intimate, flexible, home-like | Varies, generally lower than centers | Competition for market share, especially with young children |

Entrants Threaten

Establishing new childcare centers demands significant upfront capital, often running into millions of dollars for property acquisition, building, and initial staffing. For instance, in 2024, the average cost to build a new childcare facility can range from $1.5 million to $5 million, depending on size and location. This substantial financial hurdle acts as a powerful deterrent for many aspiring entrepreneurs, thereby limiting the threat of new entrants and providing a degree of protection for established operators like G8 Education.

The Australian early childhood education sector is a complex landscape, governed by stringent regulations like the National Quality Framework. This framework mandates rigorous licensing, accreditation, and quality standards that new businesses must meet. Successfully navigating these requirements demands significant investment in time and resources, acting as a substantial barrier for potential new entrants seeking to establish a presence in the market.

The persistent shortage of qualified early childhood educators presents a significant hurdle for any new entity looking to enter the education sector, particularly in early learning. This scarcity means new entrants struggle to find experienced staff, impacting their ability to open or expand operations effectively. For instance, in 2023, Australia faced a critical shortage of early childhood teachers, with many centers operating below capacity due to staffing issues, a dynamic that benefits established providers like G8 Education who have existing recruitment pipelines and brand recognition.

Brand Recognition and Trust

Established operators like G8 Education leverage significant brand recognition and trust built over years, making it difficult for newcomers to gain parental confidence. In 2024, the early learning sector continues to see parents prioritize established, reputable providers. New entrants must invest heavily in marketing and demonstrating quality to overcome this hurdle.

G8 Education's established network and reputation act as a substantial barrier. For instance, in the 2023 financial year, G8 Education reported a strong occupancy rate across its centers, indicating existing demand and trust in its brand. Newcomers struggle to replicate this level of ingrained trust and market presence, requiring substantial time and resources to build.

- Brand Loyalty: Parents often stick with providers they trust, creating a barrier for new entrants.

- Reputation Management: New entrants must build a positive reputation from scratch, a time-consuming process.

- Marketing Investment: Significant capital is needed for new brands to achieve visibility and credibility.

- Trust Deficit: Overcoming parental skepticism towards unproven services is a major challenge for new operators.

Economies of Scale and Network Effects

Large operators such as G8 Education leverage significant economies of scale. This translates to cost advantages in areas like bulk purchasing for supplies, centralized administrative services, and more efficient marketing campaigns. For instance, in 2023, G8 Education reported revenue of AUD $1.1 billion, indicating a substantial operational footprint that underpins these scale benefits.

The existing extensive network of G8 Education provides crucial operational efficiencies. These include streamlined logistics and the ability to cross-promote services across its numerous centers. New, smaller competitors face a considerable challenge in matching these established network advantages and the associated cost efficiencies, making market entry more difficult.

- Economies of Scale: G8 Education's large operational size allows for cost reductions in procurement, administration, and marketing.

- Network Effects: An established network offers operational efficiencies and cross-promotional advantages that are hard for new entrants to replicate.

- Barriers to Entry: These combined factors create substantial barriers to entry for new, smaller childcare providers aiming to compete with established players like G8 Education.

The threat of new entrants for G8 Education is generally considered moderate to low. Significant capital investment, stringent regulatory compliance, and a shortage of qualified staff create substantial barriers. Established brand recognition and existing networks further solidify G8's position.

New childcare centers require substantial upfront capital, often millions of dollars for property and setup. For example, building a new facility in 2024 can cost between $1.5 million and $5 million. This financial barrier deters many potential new operators.

Navigating Australia's National Quality Framework, which mandates rigorous licensing and quality standards, demands considerable time and resources. This regulatory complexity acts as a significant hurdle for new businesses entering the sector.

The ongoing shortage of qualified early childhood educators in 2023 and 2024 makes it difficult for new entrants to staff their centers adequately. G8 Education, with its established recruitment channels, is better positioned to manage this challenge.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High upfront costs for property, construction, and initial operations. | Significant deterrent due to substantial financial outlay. |

| Regulatory Compliance | Meeting stringent licensing and quality standards (e.g., National Quality Framework). | Requires significant investment in time, resources, and expertise. |

| Staffing Shortages | Difficulty in recruiting and retaining qualified early childhood educators. | Impairs ability to open or operate at full capacity. |

| Brand Recognition & Trust | Established providers like G8 have built parental confidence over time. | New entrants need extensive marketing to build credibility. |

Porter's Five Forces Analysis Data Sources

Our G8 Education Porter's Five Forces analysis is built upon a foundation of robust data, including G8 Education's annual reports, ASX filings, and industry-specific market research from firms like IBISWorld.

We also incorporate data from government education statistics, competitor disclosures, and economic indicators to provide a comprehensive view of the competitive landscape.