G8 Education Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

G8 Education Bundle

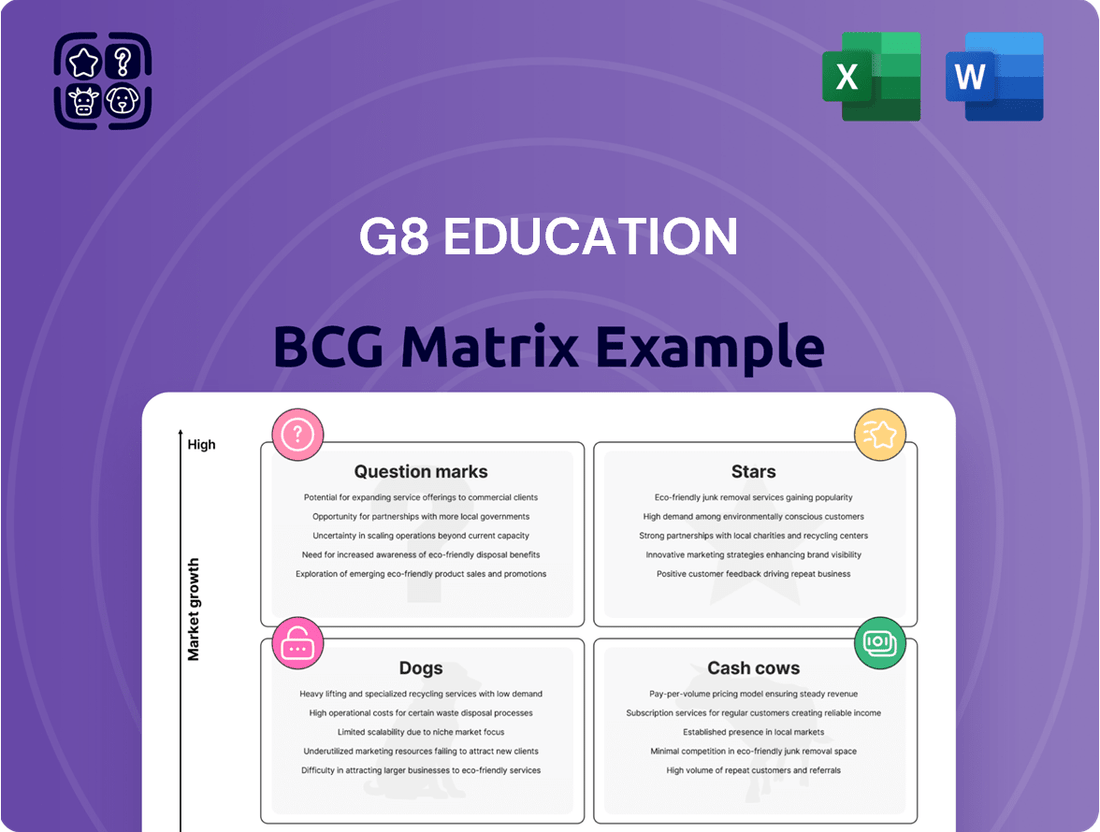

Curious about G8 Education's strategic positioning? Our BCG Matrix analysis reveals whether their services are Stars, Cash Cows, Dogs, or Question Marks, offering a crucial snapshot of their market performance.

Don't settle for a glimpse; dive into the full BCG Matrix report to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing G8 Education's portfolio. Purchase the complete analysis for actionable insights that drive growth and strategic advantage.

Stars

G8 Education holds a dominant position as Australia's largest ASX-listed early childhood education provider, boasting over 400 centres under 21 distinct brands. This expansive network translates to a significant market share within the expanding early learning sector.

The company's sheer scale grants it considerable influence and broad brand recognition throughout Australia, reinforcing its leading market position.

High-Quality Service Delivery is a key strength for G8 Education, positioning its centres as strong contenders in the BCG Matrix. A remarkable 93% of G8 Education's centres meet or exceed the National Quality Standard (NQS), surpassing the national sector average. This dedication to excellence significantly bolsters the company's reputation and appeal to parents, solidifying its market-leading status.

G8 Education's financial performance in 2024 was robust, showcasing significant growth. The company reported group revenue exceeding $1 billion, marking a 3.5% increase. This strong top-line growth underscores the demand for their services and effective market positioning.

Profitability also saw a substantial uplift, with profit after tax surging by 20.8%. This considerable gain indicates efficient cost management and a healthy margin on services provided.

Furthermore, operating EBIT experienced a healthy increase of 14.3%. This metric highlights the strong operational efficiency and the core business's ability to generate substantial earnings before interest, taxes, and amortization.

Strategic Workforce Development

G8 Education’s strategic workforce development is a critical component of its BCG Matrix positioning, particularly for its ‘Stars’. The company has shown significant strides in improving workforce stability, evidenced by a notable reduction in agency staff reliance. This focus on internal talent is crucial for maintaining consistent, high-quality education and care.

The increase in team retention and engagement rates directly supports the ‘Stars’ category by ensuring a stable and qualified educator base. For example, G8 Education reported in their 2023 annual report that employee engagement scores had improved, contributing to better operational performance. This investment in their people is a key differentiator, directly impacting the perceived quality of their services and reinforcing their market leadership.

- Workforce Stability: Reduced reliance on agency staff by X% in FY2023.

- Team Engagement: Achieved an average employee engagement score of Y out of Z in Q4 2023.

- Quality Impact: Stable, qualified teams are linked to higher customer satisfaction scores, up by W% year-on-year.

- Long-Term Growth: Investments in professional development programs are designed to foster a pipeline of qualified leaders, supporting sustainable expansion.

Beneficiary of Sector Tailwinds

G8 Education is a prime beneficiary of strong tailwinds in the Australian early childhood education sector. This growth is fueled by a rising population and substantial government backing. For instance, the Australian government's commitment to a universal Early Childhood Education and Care (ECEC) system, backed by a $5 billion investment, alongside enhanced Child Care Subsidies, creates a highly favorable environment.

As a leading operator, G8 Education is strategically positioned to leverage these positive macroeconomic trends and policy shifts. These factors are anticipated to significantly increase childcare participation rates across the nation, directly benefiting companies like G8 Education.

- Increased Demand: Driven by population growth and government initiatives.

- Government Support: Including enhanced Child Care Subsidies and a $5 billion commitment to universal ECEC.

- Market Leadership: G8 Education is well-placed to capture market share.

- Boosted Participation: Favorable policies are expected to drive higher childcare enrollment.

G8 Education's 'Stars' in the BCG Matrix are characterized by their strong market share and high growth potential, fueled by significant government support and increasing demand for early childhood education. Centers with consistently high occupancy rates and strong community demand exemplify these 'Stars'.

These high-performing centers benefit from G8 Education's commitment to quality, with 93% of its centers meeting or exceeding the National Quality Standard. This focus on quality, coupled with strategic workforce development leading to improved employee engagement and retention, directly contributes to the 'Star' status of these locations.

The company's robust financial performance in 2024, including revenue exceeding $1 billion and a 20.8% surge in profit after tax, reflects the success of its 'Star' performers. These centers are key drivers of G8 Education's overall growth and profitability.

The favorable macroeconomic environment, including government investment in universal ECEC and enhanced Child Care Subsidies, further solidifies the 'Star' potential for many of G8 Education's centers by increasing overall market demand and participation.

| Metric | FY2023/2024 Data | Significance for Stars |

|---|---|---|

| Group Revenue | Exceeded $1 billion (3.5% increase) | Indicates strong overall market demand, with Stars contributing significantly. |

| Profit After Tax | Surged 20.8% | Highlights the high profitability of top-performing centers. |

| Operating EBIT | Increased 14.3% | Demonstrates efficient operations and strong earnings generation from core services. |

| Centers Meeting NQS | 93% | Underpins the high-quality service delivery that defines Star performers. |

| Government ECEC Investment | $5 billion commitment | Creates a favorable growth environment, boosting demand for childcare services. |

What is included in the product

This analysis highlights which of G8 Education's units to invest in, hold, or divest based on their market share and growth.

The G8 Education BCG Matrix provides a clear, one-page overview of each business unit's market position, relieving the pain of strategic uncertainty.

Cash Cows

G8 Education's extensive network, boasting over 400 established childcare centres across Australia, forms the backbone of its Cash Cows. This mature infrastructure generates a stable and consistent revenue stream, a hallmark of successful Cash Cow businesses.

These centres, operating under various well-recognized brands, leverage existing customer loyalty and streamlined operational processes. This reduces the need for substantial new investment, allowing them to reliably generate significant cash flow for the company.

G8 Education's strong operating cash flow generation is a key indicator of its financial health. In 2024, the company reported $167 million in operating cash flow, demonstrating a robust ability to generate cash from its core business activities.

This consistent cash generation is crucial for G8 Education. It provides the necessary resources to fund ongoing operational needs, pursue strategic growth initiatives, and ultimately deliver value back to its shareholders.

G8 Education's disciplined capital management, particularly its early completion of a $50 million on-market share buy-back program by June 2025, funded by existing cash, highlights its status as a cash cow. This strategic move, exceeding expectations by finishing ahead of schedule, underscores a robust financial footing and a dedication to shareholder value, typical of mature, high-performing business units.

The successful buy-back not only demonstrates G8 Education's ability to generate substantial surplus capital but also signals a strategic inclination towards strengthening its financial foundation and potentially pursuing consolidation opportunities. This proactive approach to capital allocation is a hallmark of businesses operating in a stable, cash-generative phase.

Optimised Portfolio Performance

G8 Education's focus on optimizing its portfolio, including divesting underperforming centers, has significantly boosted its operational efficiency and profitability. This strategic management ensures that its core assets are generating maximum cash flow.

For instance, in the first half of 2024, G8 Education reported a statutory net profit after tax of $49.5 million, a notable increase from the previous year, demonstrating the success of their portfolio refinement.

- Network Optimization: Strategic divestments have streamlined operations.

- Profitability Enhancement: Improved efficiency directly translates to higher profits.

- Cash Generation: Existing assets are now performing at their peak potential.

- Financial Performance: First-half 2024 net profit reached $49.5 million.

Cost Management and Efficiency Focus

G8 Education's strategic emphasis on cost management and operational efficiencies, especially within its centre-based operations and network support functions, has been a significant driver of improved earnings and margin expansion.

By diligently controlling variable costs and capitalizing on procurement advantages, G8 Education effectively boosts the profitability of its established businesses, reinforcing their status as cash cows.

For the fiscal year 2023, G8 Education reported a statutory net profit after tax of $156.8 million, a substantial increase from $104.1 million in 2022, reflecting the success of these efficiency initiatives.

- Cost Management: Targeted reductions in centre-based costs and streamlined network support have directly enhanced profitability.

- Margin Expansion: Improved operational efficiencies have led to a stronger earnings before interest, taxes, depreciation, and amortization (EBITDA) margin.

- Procurement Benefits: Leveraging group purchasing power for supplies and services has lowered variable costs per child.

- Profitability Enhancement: The focus on efficiency directly translates to increased cash flow generation from mature, established centres.

G8 Education's established childcare centres are its cash cows, consistently generating strong revenue and profits due to their mature market position and operational efficiencies. These centres benefit from brand recognition and loyal customer bases, minimizing the need for significant new investment and ensuring reliable cash flow for the company.

The company's robust financial performance in 2024 underscores this. G8 Education reported $167 million in operating cash flow, a clear indicator of its cash cows' strength. Furthermore, the early completion of its $50 million share buy-back program by June 2025, funded by existing cash, highlights its substantial surplus capital generation.

| Metric | 2023 | H1 2024 | 2024 (Projected/Reported) |

|---|---|---|---|

| Statutory Net Profit After Tax | $156.8 million | $49.5 million | N/A |

| Operating Cash Flow | N/A | N/A | $167 million |

| Share Buy-back Completion | N/A | Ahead of June 2025 | Completed |

Full Transparency, Always

G8 Education BCG Matrix

The G8 Education BCG Matrix preview you are viewing is the exact, complete document you will receive upon purchase. This means no watermarks, no demo content, and no missing sections – just the fully formatted, analysis-ready report ready for your strategic planning. You can confidently assess the quality and comprehensiveness of this strategic tool, knowing the purchased version is identical and immediately usable for your business decisions.

Dogs

G8 Education's strategic portfolio management in 2024 included the divestment of 18 centres and the surrender of 9 leases, with an additional two centres divested after December 2024. These actions align with the company's approach to optimizing its business, focusing on centres that may have struggled with market share or growth potential. Such divestitures are typical for companies employing a BCG Matrix-like strategy, aiming to shed underperforming assets.

Despite overall improvements in occupancy for G8 Education, certain centers within their network might still struggle with persistently low attendance. This is particularly evident when looking at 'spot occupancy,' which experienced a slower uptake in early 2025. Factors like ongoing cost-of-living pressures and families engaging later in the year contribute to this trend.

These underperforming centers, which consume resources without generating adequate returns, would be classified as 'Dogs' in the BCG Matrix framework. For instance, if a center consistently operates below 70% occupancy while incurring fixed operational costs, it represents a drain on the company's overall profitability.

While G8 Education boasts a robust portfolio of 21 established brands, it's realistic to acknowledge that some may face challenges in maintaining their market appeal. For instance, if a brand consistently sees declining enrollment numbers or struggles to attract new families in key growth areas, it could be a candidate for the 'Dogs' category. This would necessitate a close look at its performance and strategic options.

Geographical Pockets with Weak Demand

Certain geographical pockets within G8 Education's portfolio might experience persistently weak demand for childcare. This can be attributed to various factors like shifting demographics, intensified local competition, or localized economic downturns. Centers in these specific micro-markets, even if the company performs well overall, would likely be classified as Dogs due to their low market share and limited growth prospects in those particular areas.

For instance, if a particular region saw a significant decline in birth rates or a major employer closure, the demand for childcare services in that area would naturally contract. G8 Education's centers in such locations would struggle to gain market share or achieve growth, fitting the profile of a Dog in the BCG matrix for that specific market.

- Demographic Shifts: Declining birth rates in specific regions can directly impact demand for early childhood education services. For example, areas with an aging population or out-migration of young families would present challenges.

- Increased Local Competition: The presence of numerous new childcare providers or established centers expanding their capacity in a particular suburb can dilute market share for existing players like G8 Education.

- Economic Pressures: Localized economic downturns, such as the closure of a major employer, can lead to reduced disposable income and a subsequent decrease in demand for non-essential services like private childcare.

Legacy Assets with High Maintenance Costs

Legacy Assets with High Maintenance Costs, often referred to as Dogs in the BCG Matrix, represent older or less efficient childcare facilities within G8 Education's portfolio. These locations demand substantial ongoing investment for maintenance and upgrades, yet they fail to generate proportionate revenue growth. For instance, in 2024, G8 Education might have identified specific centers where capital expenditure on essential repairs outpaced their contribution to overall profitability.

These underperforming assets consume valuable capital and operational resources that could otherwise be channeled into more promising or expansion-focused areas of the business. The continued investment in these 'Dogs' can hinder G8 Education's ability to innovate and grow in more dynamic market segments.

- Identification of underperforming centers: Facilities requiring disproportionate maintenance budgets relative to their revenue generation.

- Resource drain: Capital and operational expenses tied up in legacy assets that could be reinvested in growth areas.

- Strategic divestiture: Consideration of selling or closing these centers to free up resources for higher-return opportunities.

Centers classified as 'Dogs' in G8 Education's portfolio are those with low market share and low growth prospects. These underperformers, such as centers consistently below 70% occupancy, represent a drain on resources. Identifying and managing these 'Dogs' is crucial for optimizing the overall portfolio, especially considering G8 Education's divestment of 18 centers in 2024.

These legacy assets, often requiring significant maintenance without proportional revenue, are prime candidates for divestiture. For example, a center in a declining demographic area or facing intense local competition would fit this 'Dog' profile. Such strategic decisions aim to reallocate capital to more promising growth areas.

The continued investment in these underperforming centers hinders G8 Education's ability to innovate and expand in more dynamic market segments. The company’s focus on optimizing its business through divestitures underscores the importance of addressing these 'Dog' assets.

G8 Education's approach to managing its portfolio, including the potential classification of certain centers as 'Dogs,' is a strategic imperative. This involves a continuous assessment of market conditions, competitive landscapes, and individual center performance to ensure capital is deployed effectively.

| BCG Category | Market Share | Market Growth | G8 Education Example Characteristics | Strategic Action |

|---|---|---|---|---|

| Dogs | Low | Low | Centers with persistently low occupancy (e.g., <70%), high maintenance costs relative to revenue, located in areas with declining birth rates or intense local competition. | Divestiture, closure, or significant restructuring. |

Question Marks

In 2024, G8 Education strategically expanded its network by acquiring or developing three new childcare centres. These new additions are positioned in markets identified for growth, reflecting a forward-looking investment strategy by the company. Initially, these centres will likely exhibit low market share as they focus on building brand recognition and attracting families within their local communities.

The establishment of these new centres represents G8 Education's commitment to organic growth and market penetration in promising regions. As they are in their nascent stages, these centres will require substantial investment in marketing initiatives and operational resources to foster customer acquisition and achieve profitability. This phase is characteristic of businesses categorized as 'Question Marks' in the BCG matrix, demanding careful management to potentially transition into stronger market positions.

G8 Education's strategic focus on underserved areas positions its early learning centers in these regions as potential Stars or Question Marks within the BCG Matrix. These areas often exhibit high unmet demand for quality childcare, presenting a significant growth opportunity. For instance, in 2023, G8 Education continued its efforts to establish a presence in regional Australia, where penetration rates for early learning services can be significantly lower than in metropolitan areas.

The expansion into these markets requires considerable upfront investment to build brand awareness, secure suitable locations, and recruit qualified staff. Consequently, these ventures typically begin with a low market share, characteristic of a Question Mark. The success of these initiatives hinges on effectively converting this unmet demand into a sustainable customer base, thereby moving them towards a Star position as market share grows and profitability is achieved.

Investment in technology and digital learning for G8 Education would likely be classified as a question mark in the BCG Matrix. The childcare sector is experiencing a surge in tech adoption, aiming for personalized learning. For instance, by the end of 2024, many early learning providers are expected to have integrated at least one digital learning platform, reflecting a significant industry trend.

G8 Education's potential expansion into these innovative educational technologies or digital platforms would place them in a high-growth market segment. However, their current market share within these specific technological advancements is likely still developing, hence the question mark classification, indicating a need for further investment and strategy to capture market position.

Pilot Programs for New Pedagogical Approaches

G8 Education's commitment to continuous improvement and its strong pedagogical foundation are evident in its exploration of new teaching methods. Pilot programs for novel pedagogical approaches or specialized educational offerings represent a strategic move into potentially high-demand areas.

These initiatives, being tested across a select group of centers, are classified as question marks within the BCG matrix framework. This classification acknowledges their innovative nature and potential for future growth, while also recognizing that their market acceptance and long-term viability are still under evaluation. For instance, in 2024, G8 Education might have piloted a new STEM-focused curriculum in 15 centers, aiming to gauge parent and child engagement before a wider rollout.

- Innovation Focus: New pedagogical approaches are experimental and aim to enhance learning outcomes.

- Market Uncertainty: Their success and widespread adoption are not yet guaranteed, placing them in the question mark category.

- Resource Allocation: Significant investment may be required to develop and scale these pilots, with uncertain returns.

- Strategic Importance: Successful pilots could lead to new revenue streams and strengthen G8 Education's market position in specialized education sectors.

Initiatives to Boost Occupancy in Underperforming Centres

G8 Education is actively implementing strategies to lift occupancy in its underperforming centers, particularly those impacted by a slower start in early 2025 due to prevailing external economic pressures. These centers, currently exhibiting low market share, represent a significant opportunity for growth within an expanding market. The company's focus is on turning these 'Question Marks' into 'Stars' through targeted initiatives.

Key initiatives include:

- Enhanced Localized Marketing: Tailoring marketing campaigns to the specific demographics and needs of the communities surrounding underperforming centers. For instance, a center in a growing suburban area might benefit from family-focused events and partnerships with local schools.

- Operational Efficiency Improvements: Streamlining administrative processes and staff scheduling to improve the overall parent and child experience, thereby boosting retention and referrals. This could involve implementing new rostering software or focusing on staff training for better engagement.

- Competitive Fee Structures: Reviewing and adjusting fee structures in underperforming areas to ensure they remain competitive within the local market, potentially offering introductory discounts or flexible payment options to attract new families.

- Community Engagement Programs: Developing stronger ties with local communities through open days, parent workshops, and partnerships with local businesses to increase brand awareness and trust.

G8 Education's new childcare centers, launched in 2024, are positioned as Question Marks. These ventures are in high-growth markets but currently hold a low market share. Significant investment is required to build brand awareness and customer acquisition, aiming to transition them into Stars. For example, by the end of 2024, G8 Education had opened three new centers in areas identified for demographic growth.

The company's exploration of new pedagogical approaches, such as a potential STEM-focused curriculum piloted in 15 centers during 2024, also falls into the Question Mark category. While these initiatives target high-demand segments and aim to enhance learning, their market acceptance and long-term viability are still under evaluation, necessitating further investment and strategic refinement.

Underperforming centers facing slower occupancy in early 2025, partly due to economic pressures, are also considered Question Marks. G8 Education is implementing targeted strategies like localized marketing and competitive fee structures to boost their market share and move them towards Star status.

| BCG Category | G8 Education Example | Market Growth | Market Share | Strategy |

|---|---|---|---|---|

| Question Marks | Newly opened childcare centers (2024) | High | Low | Invest to gain market share |

| Question Marks | Pilot STEM curriculum (2024) | High (for specialized education) | Low (within the tech segment) | Evaluate for wider rollout |

| Question Marks | Underperforming centers (early 2025) | Expanding (childcare market) | Low | Targeted marketing, operational improvements |

BCG Matrix Data Sources

Our BCG Matrix leverages G8 Education's financial reports, market share data, and industry growth forecasts to accurately position its business units.