G8 Education Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

G8 Education Bundle

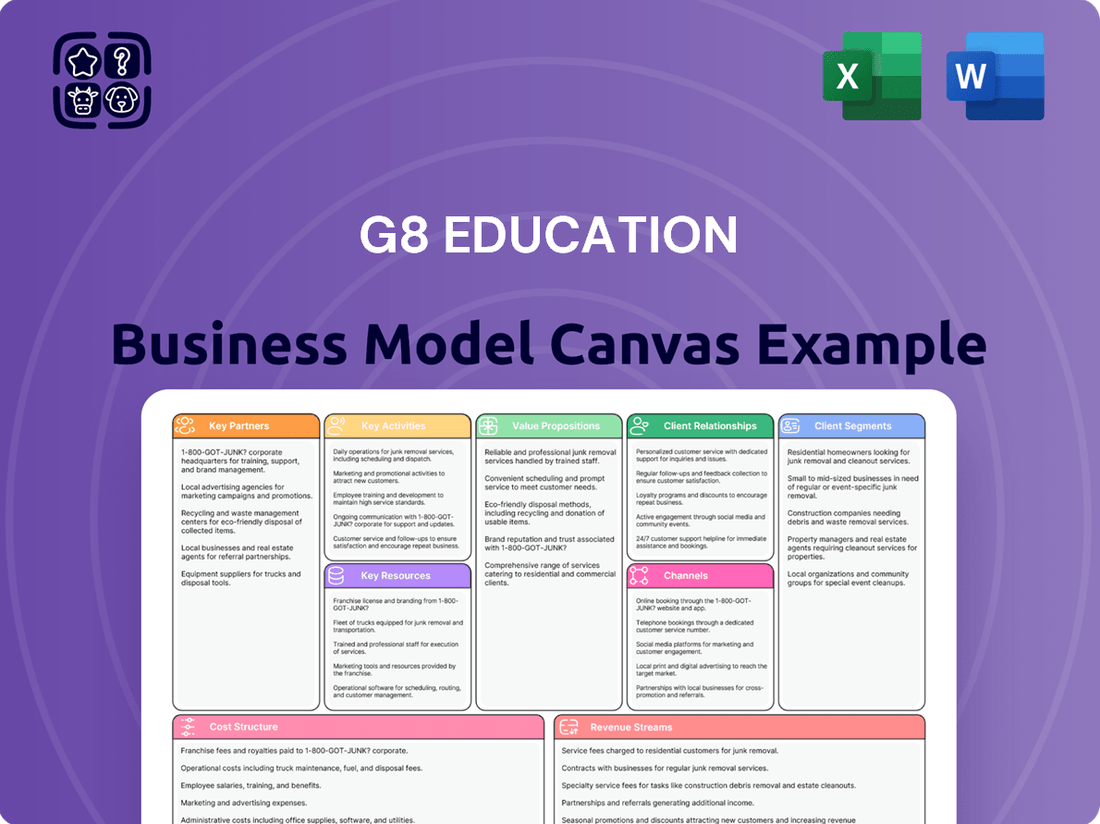

Discover the strategic framework behind G8 Education's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their approach to customer relationships, revenue streams, and key resources, offering invaluable insights for anyone looking to understand their operational blueprint.

Unlock the full strategic blueprint behind G8 Education's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

G8 Education collaborates extensively with Australian government bodies and regulatory authorities, most notably ACECQA. These partnerships are fundamental for maintaining compliance with the National Quality Framework, a critical aspect of their operations, and for securing vital government funding streams such as the Child Care Subsidy.

Through these collaborations, G8 Education stays abreast of evolving child safety regulations and educational standards, ensuring their practices meet or exceed national requirements. This proactive engagement is essential for retaining operating licenses and facilitating access to subsidies that benefit families utilizing their services.

G8 Education actively partners with universities, TAFE colleges, and vocational training providers to secure a steady flow of skilled early childhood educators. These collaborations are crucial for maintaining the quality of their workforce and ensuring high standards of education.

Through these educational alliances, G8 Education facilitates vital internship programs and continuous professional development opportunities for its existing staff. This focus on upskilling directly supports G8's strategic goal of enhancing workforce capabilities and delivering superior learning experiences to children.

In 2024, G8 Education continued to strengthen these academic ties, with a significant portion of its new educator intake originating from these partnerships. For instance, data from late 2023 indicated that over 60% of G8's new graduate placements were filled through collaborations with key tertiary institutions, demonstrating the practical impact of these relationships.

G8 Education prioritizes building strong ties with local communities, including Aboriginal and Torres Strait Islander groups. This commitment involves acknowledging and respecting traditional land ownership, a crucial element in fostering genuine partnerships.

Integrating Indigenous perspectives into educational curricula is a core aspect of these collaborations. For instance, in 2024, G8 Education continued to develop culturally responsive learning materials, aiming to enrich the educational experience for all children.

These partnerships are vital for cultivating authentic community relationships and enhancing cultural understanding. By supporting inclusive practices, G8 Education centers aim to create welcoming environments that reflect the diversity of the communities they serve.

Suppliers and Service Providers

G8 Education relies heavily on its suppliers and service providers to maintain the quality and efficiency of its operations. These partnerships are crucial for sourcing everything from educational materials and catering services to essential property maintenance and the technology that underpins its learning environments. Strategic procurement is a key focus, aiming to balance cost-effectiveness with the high standards expected across its many centers.

In 2024, G8 Education's commitment to quality and cost management is evident in its supplier relationships. For instance, the company continually evaluates its procurement processes to ensure value for money. This includes negotiating favorable terms with providers of curriculum resources, ensuring they align with educational best practices and regulatory requirements.

- Educational Resources: Partnerships with publishers and educational content creators ensure a diverse and high-quality range of learning materials are available to children.

- Food Services: Collaborations with catering companies and food suppliers are essential for providing nutritious meals, adhering to strict health and safety standards across all centers.

- Property Maintenance: Agreements with various trades and maintenance companies ensure that G8 Education's facilities are safe, functional, and conducive to learning.

- Technology Solutions: Relationships with IT providers are vital for maintaining and upgrading the technological infrastructure supporting administration, learning platforms, and communication.

Property Owners and Developers

G8 Education's strategic growth hinges on its relationships with property owners and developers. These partnerships are crucial for acquiring new childcare centers and securing suitable locations for expansion, directly supporting the company's network optimization and portfolio management goals.

These collaborations enable G8 Education to effectively manage its physical footprint, ensuring centers are located in areas that align with demographic trends and community needs. For instance, in 2024, G8 Education continued to evaluate acquisition opportunities, with property availability and favorable lease terms being significant factors in these decisions.

- Acquisition of New Centers: Partnerships facilitate the identification and purchase of existing childcare facilities.

- Leasing of Suitable Properties: Developers provide access to new sites for building or expanding centers.

- Network Optimization: Collaborations help in strategically positioning centers for maximum occupancy and accessibility.

- Portfolio Growth: These relationships are fundamental to G8 Education's ongoing expansion strategy.

G8 Education's Key Partnerships are multifaceted, encompassing government bodies, educational institutions, community groups, suppliers, and property stakeholders. These collaborations are foundational to its operational success, regulatory compliance, workforce development, and strategic expansion.

In 2024, G8 Education continued to leverage these partnerships, with over 60% of new graduate placements sourced through tertiary institutions. This highlights the critical role of academic alliances in talent acquisition. Furthermore, the company's engagement with ACECQA and government funding streams like the Child Care Subsidy remains paramount for its financial stability and adherence to quality standards.

The company's supplier network is vital for maintaining operational efficiency and quality, particularly in areas like educational resources and food services. Strategic procurement in 2024 focused on balancing cost-effectiveness with high standards, ensuring value for money in all dealings.

| Partnership Type | Key Collaborators | 2024 Impact/Focus | Strategic Importance |

|---|---|---|---|

| Government & Regulatory | ACECQA, Australian Government | Compliance with National Quality Framework, securing Child Care Subsidy | Operational license, funding, adherence to standards |

| Educational Institutions | Universities, TAFE colleges, vocational providers | Securing skilled educators, internship programs, professional development | Workforce quality, talent pipeline, staff upskilling |

| Community Engagement | Local communities, Indigenous groups | Culturally responsive curricula, inclusive environments | Authentic relationships, cultural understanding |

| Suppliers & Service Providers | Educational resource providers, caterers, maintenance, IT | Quality and efficiency of operations, strategic procurement | Operational continuity, cost management, quality assurance |

| Property & Development | Property owners, developers | Acquisition of new centers, securing locations for expansion | Network optimization, portfolio growth, strategic expansion |

What is included in the product

A detailed breakdown of G8 Education's strategy, outlining its customer segments (families), value propositions (quality childcare and education), and key resources (early learning centers and qualified educators).

This model highlights G8 Education's revenue streams from childcare fees and its cost structure focused on staffing and property, supported by its extensive network of centers.

G8 Education's Business Model Canvas acts as a pain point reliever by providing a clear, actionable framework to identify and address operational inefficiencies and strategic gaps within their diverse early childhood education network.

It offers a structured approach to diagnose and resolve challenges related to resource allocation, customer acquisition, and service delivery across their numerous centers.

Activities

A fundamental aspect of G8 Education's strategy is the acquisition and seamless integration of new childcare centers. This involves a rigorous process of identifying suitable targets, conducting thorough due diligence, and managing the transition of operations, staff, and children. The aim is to quickly bring these acquired centers up to G8's established operational standards and educational ethos, ensuring consistency across the network.

This acquisition-led growth strategy has been a significant driver for G8 Education. For instance, in the first half of 2024, the company reported acquiring several centers, contributing to its overall portfolio expansion and strengthening its market position in key regions. This approach allows for rapid scaling and market penetration, leveraging existing infrastructure and established customer bases.

G8 Education's core activity revolves around delivering high-quality early childhood education and care services. This includes offering programs for children from infancy up to school age, focusing on safety, well-being, and developmental milestones. In 2024, G8 Education operated over 430 centers across Australia, serving approximately 53,000 children.

Centre Management and Operations is the engine that drives G8 Education's extensive network of childcare facilities. This core activity encompasses the meticulous day-to-day oversight of each center, from ensuring adequate staffing levels and managing enrollment pipelines to maintaining the physical premises and strictly adhering to all childcare regulations. In 2024, G8 Education operated approximately 430 centers, highlighting the sheer scale of this operational undertaking.

The efficiency of these daily operations directly impacts the consistent delivery of high-quality care and education, a key differentiator for G8. Furthermore, effective operational management is paramount for controlling costs across the entire portfolio, directly influencing profitability and the ability to reinvest in services and facilities. For instance, managing staff rosters and occupancy rates effectively in 2024 was critical to optimizing resource allocation.

Workforce Development and Management

G8 Education's key activities center on building and nurturing its human capital. This means actively recruiting talented educators and support staff who are passionate about early childhood education. It also involves providing them with continuous training and development opportunities to keep their skills sharp and their knowledge current, ensuring they can deliver exceptional learning experiences.

Effective management of this workforce is crucial. G8 Education focuses on performance management systems to ensure quality and consistency across its centers. Fostering a positive and supportive workplace culture is also a priority, as this directly impacts staff morale, retention, and ultimately, the quality of care and education provided to the children.

- Recruitment: Attracting and onboarding qualified educators and support staff.

- Training and Development: Providing ongoing professional development to enhance pedagogical skills and industry knowledge.

- Performance Management: Implementing systems to monitor and improve staff performance and service delivery.

- Retention Strategies: Developing initiatives to keep skilled employees engaged and committed to the organization.

Compliance and Quality Assurance

G8 Education places significant emphasis on compliance with all national and state-specific early childhood education and care regulations, including the stringent National Quality Standard. This commitment is crucial for maintaining operational integrity and ensuring high-quality care. In 2024, the company continued its focus on robust compliance frameworks, which are fundamental to its business model.

Key activities within this area include conducting regular internal and external audits to verify adherence to regulatory requirements. Furthermore, G8 Education actively implements and refines child safety measures across all its centers. This proactive approach is designed to safeguard children and uphold the trust placed in the organization by parents and regulatory bodies alike.

- Regulatory Adherence: Ensuring all centers meet or exceed the National Quality Standard and state-specific licensing requirements.

- Auditing Processes: Conducting frequent internal and external audits to identify and rectify any compliance gaps.

- Child Safety Protocols: Maintaining and enhancing rigorous child safety measures, including staff vetting and incident reporting procedures.

- Quality Improvement: Continuously seeking ways to improve service delivery and educational outcomes in line with best practices and regulatory expectations.

G8 Education's key activities are deeply rooted in the delivery of early childhood education and care. This core function involves managing a vast network of childcare centers, ensuring high standards of safety, well-being, and educational development for children from infancy to school age. In 2024, G8 operated over 430 centers serving approximately 53,000 children, underscoring the scale of this commitment.

Strategic acquisitions and their integration form another critical activity. G8 Education actively seeks and acquires new childcare centers, a process that includes rigorous due diligence and operational transition to align with the company's standards. This approach has fueled portfolio expansion, as seen in the first half of 2024 with several center acquisitions contributing to market presence.

Managing and optimizing center operations is paramount. This encompasses daily oversight, staffing, enrollment, facility maintenance, and strict regulatory adherence. Effective operational management in 2024 was key to controlling costs and ensuring consistent, high-quality service delivery across its extensive network.

Furthermore, G8 Education prioritizes human capital development, focusing on recruiting, training, and retaining qualified educators and support staff. Performance management and fostering a positive work environment are central to maintaining service quality and staff engagement.

Compliance with stringent national and state regulations, including the National Quality Standard, is a non-negotiable activity. This involves regular audits and the implementation of robust child safety protocols to maintain operational integrity and parental trust.

Full Document Unlocks After Purchase

Business Model Canvas

The G8 Education Business Model Canvas preview you are viewing is precisely the document you will receive upon purchase. This is not a simplified example or a mockup; it's an unedited segment of the complete, ready-to-use canvas. Once your order is processed, you will gain full access to this exact file, allowing you to immediately leverage its insights for your business strategy.

Resources

G8 Education operates an expansive network of over 400 childcare centers throughout Australia, forming a core physical asset within its business model. This extensive footprint represents the tangible infrastructure essential for delivering early childhood education and care services.

These numerous centers provide the licensed capacity and physical spaces required to accommodate a significant volume of children, directly enabling G8 Education to fulfill its service delivery commitments. The sheer scale of this network is a key differentiator, allowing for broad market reach.

As of early 2024, G8 Education's network remained a critical component of its operational strategy, underpinning its ability to serve families across diverse geographical locations. This physical presence is directly linked to revenue generation through occupancy rates and service fees.

G8 Education’s business model heavily relies on its qualified educators and staff. This human capital is the backbone of their service delivery, directly impacting the quality of care and education provided. Their expertise and dedication are paramount to creating nurturing and stimulating environments for young children.

In 2024, G8 Education continued to emphasize professional development for its workforce. The company reported employing approximately 10,000 team members across its centers. Investing in ongoing training and support for these educators ensures they remain at the forefront of early childhood pedagogy and best practices.

G8 Education leverages proprietary and adopted educational curricula as a core intellectual resource. These programs are meticulously designed to foster children's holistic development and ensure readiness for primary school, integrating evidence-based teaching methodologies.

In 2024, G8 Education's commitment to quality education is reflected in its extensive network of centers, which provide these developmental programs. The focus remains on delivering enriching learning experiences that cater to the diverse needs of young learners.

Brand Portfolio and Reputation

G8 Education leverages a portfolio of well-recognized brands, including Greenwood Early Education, Kindy Patch, and Pelican Childcare. These brands are significant intangible assets, each carrying a reputation for quality and reliability in the early learning sector.

The company's overarching reputation for delivering high-quality early learning and care is a critical resource. This positive perception attracts new families seeking dependable childcare solutions and fosters continued trust among existing customers, underpinning customer retention.

- Brand Equity: G8 Education's diverse brand portfolio represents significant goodwill and customer loyalty built over years of operation.

- Market Trust: A strong reputation for quality care and educational outcomes is a primary driver for family enrollment and parental confidence.

- Competitive Advantage: Trusted brands differentiate G8 Education in a competitive landscape, allowing for premium pricing and increased market share.

- Customer Acquisition: The established reputation of brands like Greenwood Early Education directly contributes to efficient customer acquisition by reducing the need for extensive brand building from scratch for each new center.

Operational Systems and Technology

G8 Education relies heavily on robust operational systems and technology to manage its extensive network of early learning centres. These include sophisticated enrolment platforms, comprehensive HR information systems, and integrated financial management tools.

These systems are vital for the efficient operation of over 400 centres, supporting everything from student admissions to staff payroll and resource allocation. For instance, in 2024, G8 Education continued to invest in digital transformation to streamline administrative tasks and improve data accuracy across its operations.

The technological infrastructure facilitates data-driven decision-making by providing real-time insights into centre performance, occupancy rates, and staff utilization. This allows for more effective resource management and strategic planning.

- Enrolment Platforms: Streamline the process of student registration and management.

- HR Information Systems: Manage employee data, recruitment, and payroll for a large workforce.

- Financial Management Tools: Oversee budgeting, invoicing, and financial reporting across the group.

- Data Analytics: Support informed decision-making through real-time performance monitoring.

G8 Education's key resources extend beyond its physical infrastructure and skilled workforce to include its intellectual property, specifically its educational curricula and proprietary systems. These elements are crucial for maintaining service quality and operational efficiency.

The company’s educational programs, developed and refined over time, are a significant intangible asset. These curricula are designed to meet regulatory standards and foster early childhood development, directly impacting the perceived value of G8's services. As of 2024, G8 Education continued to focus on the implementation and enhancement of these learning frameworks across its centers.

Furthermore, G8 Education's operational systems, including its enrolment and management software, represent a vital resource. These technologies streamline administrative processes, support data-driven decision-making, and ensure consistent service delivery across its large network. Investment in these systems in 2024 aimed to further optimize operational performance and enhance the parent experience.

Value Propositions

G8 Education is committed to providing high-quality early learning experiences, focusing on developmental programs and evidence-based teaching methods. This ensures children are well-prepared for primary school and fosters a love for lifelong learning.

In 2024, G8 Education continued its dedication to meeting or exceeding the National Quality Standard across its centers. This commitment underpins the value proposition of delivering exceptional early childhood education.

G8 Education prioritizes creating safe and nurturing spaces for children, a core value proposition. This commitment is backed by rigorous adherence to child safety standards and regulations, ensuring a secure atmosphere for every child.

The company invests in well-designed facilities that promote both physical safety and emotional well-being. For instance, G8 Education's focus on safety is reflected in their operational standards, aiming to provide a secure foundation for early childhood development.

G8 Education's extensive network of over 450 centers across Australia is a cornerstone of its value proposition, offering unparalleled convenience and accessibility for families. This widespread presence ensures that parents can find quality childcare options close to home or work, simplifying the often-challenging task of securing early learning and care.

In 2024, G8 Education continued to leverage its broad geographical footprint to serve a diverse range of communities, making it easier for parents to integrate childcare into their daily routines. This accessibility is crucial for working parents, providing peace of mind and reducing logistical burdens.

Support for Child Development and School Readiness

G8 Education’s educational programs are meticulously crafted to foster a child's complete development, encompassing cognitive growth, social skills, emotional intelligence, and physical well-being. This holistic approach ensures children are well-equipped for their next educational steps.

The core of this value proposition lies in preparing children for a successful transition into primary school. This includes developing essential literacy, numeracy, and problem-solving skills, ensuring they are ready to thrive in a formal learning environment.

- Holistic Development: Programs target cognitive, social, emotional, and physical growth.

- School Readiness: Focus on foundational skills for primary school transition.

- Early Learning Frameworks: Adherence to national frameworks like the Early Years Learning Framework (EYLF) in Australia.

- Qualified Educators: Employing experienced and qualified educators to deliver high-quality early learning experiences.

Partnership with Families

G8 Education actively cultivates robust partnerships with families, viewing them as integral to a child's educational development. This involves consistent communication channels, encouraging family participation in center events, and offering support for smooth transitions within the early learning setting.

In 2024, G8 Education continued to emphasize this collaborative approach. For instance, their centers often host parent-teacher evenings and provide regular progress reports, fostering a shared understanding of each child's learning milestones. This commitment aims to create a supportive ecosystem that benefits the child.

- Family Engagement Initiatives: G8 centers regularly implement programs designed to involve parents in their child's learning, such as open days and workshops.

- Communication Strategies: Utilizing digital platforms and face-to-face interactions, G8 ensures families are kept informed about center activities and their child's progress.

- Transition Support: The organization provides resources and guidance to help families navigate key developmental stages and transitions within the early learning environment.

G8 Education's value proposition centers on providing high-quality, developmentally appropriate early learning experiences that prepare children for school and foster a lifelong love of learning. This is achieved through evidence-based teaching methods and a commitment to meeting national quality standards, as evidenced by their continued focus on exceeding the National Quality Standard in 2024.

The company prioritizes creating safe, nurturing, and well-designed environments that support children's physical safety and emotional well-being, a crucial element for parents seeking reliable childcare. This commitment is reinforced by rigorous adherence to child safety regulations across their extensive network.

With over 450 centers across Australia, G8 Education offers significant convenience and accessibility for families, simplifying the often-complex task of integrating childcare into busy schedules. This broad reach ensures parents can find quality care options conveniently located near their homes or workplaces.

G8 Education's educational programs are designed for holistic child development, focusing on cognitive, social, emotional, and physical growth to ensure children are well-prepared for primary school. This includes developing essential literacy, numeracy, and problem-solving skills, with a strong emphasis on school readiness.

The organization actively fosters strong partnerships with families, recognizing their vital role in a child's development. This is achieved through open communication, family involvement in center activities, and support for developmental transitions, exemplified by regular parent-teacher interactions and progress reports in 2024.

| Value Proposition | Description | 2024 Focus/Data |

| High-Quality Early Learning | Developmentally appropriate programs and evidence-based teaching methods. | Continued commitment to meeting or exceeding the National Quality Standard. |

| Safe and Nurturing Environments | Well-designed facilities promoting physical safety and emotional well-being. | Rigorous adherence to child safety standards and regulations. |

| Accessibility and Convenience | Extensive network of over 450 centers across Australia. | Leveraging broad geographical footprint to serve diverse communities. |

| Holistic Child Development | Programs fostering cognitive, social, emotional, and physical growth. | Emphasis on school readiness and foundational skills for primary school. |

| Family Partnerships | Engaging families as integral to a child's educational development. | Consistent communication, family participation, and transition support initiatives. |

Customer Relationships

G8 Education prioritizes personalized communication, keeping families updated on their child's development and center news. This direct engagement builds trust and a strong connection.

In 2024, G8 Education continued to refine its digital platforms, allowing for more frequent and tailored updates to parents. This focus on consistent, relevant information is key to their customer relationship strategy.

G8 Education actively cultivates strong family relationships by offering valuable resources and support. This includes providing guidance on child development milestones and assisting parents in understanding and accessing government subsidies, such as the Child Care Subsidy. In 2024, G8 continued to emphasize these support services, recognizing their crucial role in fostering trust and loyalty among the families they serve.

G8 Education prioritizes feedback, with clear channels for families to share their experiences. This includes surveys and direct communication, ensuring their voices are heard. In 2023, G8 reported a customer satisfaction score of 85% across its centers, reflecting a commitment to responsive engagement.

Community Building and Events

G8 Education actively cultivates community by organizing events that bring together families, educators, and local residents. These gatherings, such as family fun days and parent information evenings, foster a sense of belonging and strengthen connections within each learning center's ecosystem.

This focus on community building enhances customer loyalty and creates a supportive environment. For instance, in 2023, G8 Education reported a significant number of centers hosting regular community engagement activities, contributing to positive parent feedback and higher retention rates.

- Community Engagement: Centers regularly host events like 'Grandparent's Day' and 'Cultural Celebrations.'

- Parent Partnerships: Feedback mechanisms and parent committees are in place to involve families in center operations.

- Local Integration: Partnerships with local schools and community groups are actively pursued to embed centers within the wider community.

- Support Networks: Events create informal support networks among parents, enhancing the overall family experience.

Online Portals and Digital Engagement

G8 Education leverages online portals and digital engagement to streamline operations and improve family convenience. These platforms facilitate key interactions like enrolment, payment processing, and daily communication, creating a more accessible and efficient experience. For instance, in 2024, G8 Education continued to invest in its digital infrastructure to enhance user experience for its network of childcare centers.

- Enhanced Accessibility: Online portals offer families 24/7 access to essential services, reducing the need for in-person visits and phone calls.

- Streamlined Administration: Digital tools automate enrollment and payment processes, freeing up center staff for direct child engagement.

- Direct Communication Channels: Apps and portals provide a direct line for sharing daily updates, photos, and important announcements with parents, fostering stronger relationships.

G8 Education builds strong customer relationships through personalized communication, community engagement, and robust support systems. This approach fosters trust and loyalty among families, with a focus on continuous improvement in digital and in-person interactions. In 2024, the company continued to invest in digital platforms to enhance parent convenience and communication.

| Customer Relationship Aspect | 2023 Data/Focus | 2024 Focus/Initiatives |

|---|---|---|

| Communication | 85% customer satisfaction score; frequent updates via digital platforms. | Continued refinement of digital platforms for tailored parent updates; emphasis on direct communication channels. |

| Community Building | Numerous centers hosted regular community engagement events. | Ongoing organization of events like family fun days and parent information evenings to foster belonging. |

| Support & Resources | Provided guidance on child development and government subsidies. | Continued emphasis on support services, including assistance with Child Care Subsidy access. |

| Feedback Mechanisms | Clear channels for feedback, including surveys. | Maintaining and enhancing feedback loops to ensure parent voices are heard. |

Channels

G8 Education's primary channel is its vast network of physical childcare centers, acting as the direct touchpoint for families and children. These centers are where the core service of early childhood education and care is delivered. As of December 2023, G8 Education operated 431 centers across Australia, demonstrating the significant physical presence that forms the backbone of their customer interaction and service provision.

G8 Education's corporate website and the individual websites for its various childcare brands are crucial online touchpoints. These platforms serve as primary sources for company information, facilitate new family inquiries and enrollments, and are vital for investor relations, providing financial reports and company updates.

In 2024, G8 Education continued to leverage these digital channels to engage with stakeholders. For instance, their investor relations section would have provided access to their latest annual reports and market announcements, crucial for financial professionals and individual investors seeking to understand the company's performance and strategic direction.

Beyond general information, dedicated family portals within these online channels offer practical functionality. These portals allow parents to access their child's progress reports, manage bookings, and handle administrative tasks, enhancing the customer experience and streamlining operations for G8 Education's centers.

G8 Education utilizes dedicated direct sales and enrolment teams at each of its centers to foster personal connections with prospective families. These teams are crucial for managing the initial engagement, which often includes personalized center tours and in-depth consultations. This hands-on approach helps build trust and address specific family needs, directly impacting enrolment numbers.

The central admissions process further supports these on-site teams, streamlining the administrative aspects of enrolment and ensuring a consistent experience for families across different locations. In 2023, G8 Education reported a continued focus on improving customer experience, which directly relates to the effectiveness of these direct sales efforts in converting inquiries into enrolments.

Digital Marketing and Social Media

G8 Education leverages digital marketing and social media extensively to connect with prospective and current families. Online advertising campaigns and search engine optimization (SEO) are key to increasing visibility and attracting new enrollments.

Social media platforms serve as crucial channels for building brand awareness, sharing updates on educational programs, and fostering engagement with the existing parent community. This digital outreach is vital for communicating the value proposition of their childcare and early learning services.

- Online Advertising: G8 Education utilizes paid online advertising, including search engine marketing and display ads, to target parents actively searching for childcare solutions.

- SEO Strategy: Implementing robust SEO practices ensures that G8 Education's centers appear prominently in search results when parents look for early learning services in their local areas.

- Social Media Engagement: Platforms like Facebook and Instagram are used to showcase center activities, share parenting tips, and respond to inquiries, thereby building a strong online community and brand loyalty.

- Data-Driven Campaigns: In 2023, G8 Education continued to refine its digital marketing spend based on performance data, aiming to optimize customer acquisition costs and maximize reach within key demographics.

Community Engagement and Local Partnerships

G8 Education actively fosters relationships with local communities, schools, and various community groups. This engagement acts as a vital channel for outreach, helping to build trust and a strong local presence. By being an active participant, G8 Education can effectively attract families who are actively searching for high-quality early learning experiences.

Participation in local events, such as school fairs or community festivals, and collaborations with local organizations are key strategies. For instance, in 2024, G8 Education centers across Australia continued to host open days and participate in local council initiatives. These efforts directly translate into increased brand visibility and a stronger connection with potential families.

- Community Presence: G8 Education centers are encouraged to be active participants in local events, strengthening their ties to the neighborhoods they serve.

- Partnership Building: Collaborations with local schools and community organizations provide valuable outreach opportunities and enhance G8 Education's reputation.

- Family Attraction: Visible engagement in community activities directly attracts new families seeking reliable and trusted early learning services.

- Local Trust: Building strong community relationships is fundamental to establishing and maintaining trust with parents and guardians.

G8 Education's primary channels are its extensive network of physical childcare centers, which serve as direct points of contact for families. Online platforms, including corporate and brand-specific websites, are crucial for information dissemination and initial inquiries. Direct sales and admissions teams at each center, supported by a streamlined central admissions process, manage family engagement and enrollment. Digital marketing, encompassing online advertising and social media, plays a key role in attracting new families and building brand awareness.

| Channel Type | Key Activities | 2023/2024 Relevance |

|---|---|---|

| Physical Centers | Direct service delivery, family interaction, local outreach | 431 centers operated as of Dec 2023; ongoing open days and community participation. |

| Online Platforms | Information, inquiries, investor relations, family portals | Continued focus on digital engagement for enrollments and stakeholder communication. |

| Direct Sales/Admissions | Personalized engagement, tours, consultations, administrative support | Focus on improving customer experience to drive conversion of inquiries. |

| Digital Marketing | Online advertising, SEO, social media engagement | Data-driven campaigns to optimize customer acquisition and reach. |

Customer Segments

Parents and guardians of infants and toddlers are a key customer segment for early learning providers like G8 Education. This group is actively seeking safe, nurturing, and stimulating environments for their children aged 0 to 2 years. Their primary concerns revolve around the child's well-being and the development of crucial foundational skills.

In 2024, the demand for quality childcare for this age group remains exceptionally high. For instance, in Australia, reports indicate persistent waiting lists for infant places, highlighting the critical need. These parents are often willing to invest in services that offer a strong emphasis on early development and provide peace of mind regarding their child's safety and care.

Parents and guardians of preschool-aged children, specifically those with kids between 3 and 5 years old, are a key customer segment. These families are actively seeking quality early childhood education to prepare their children for the transition to primary school. Their primary concerns often revolve around ensuring their child's educational readiness, access to structured learning environments, and opportunities for social and emotional development.

In 2024, the Australian early learning sector continued to see strong demand, with many parents prioritizing educational outcomes. Data from the Australian Bureau of Statistics indicates that the majority of families with preschool-aged children utilize some form of early childhood education and care. This underscores the segment's commitment to investing in their child's foundational learning experiences.

Working parents and dual-income households represent a substantial customer base for G8 Education, with a strong demand for full-day or extended-hours childcare. These families often prioritize convenience, reliability, and flexible attendance options to seamlessly integrate childcare with their demanding work schedules.

In 2024, the Australian workforce saw continued high participation rates among parents, with many requiring flexible childcare solutions. G8 Education's focus on providing dependable and accessible care directly addresses the needs of these busy households, ensuring parents can maintain their professional commitments with peace of mind.

Families Seeking High-Quality Educational Programs

Families prioritizing high-quality education for their children are a key customer segment for G8 Education. They actively seek childcare centers that offer robust pedagogical frameworks, employ highly qualified educators, and provide programs designed to stimulate intellectual curiosity and creative expression.

These families are willing to invest in early childhood education, viewing it as a crucial foundation for their child's future academic success. Their decision-making process often involves researching center accreditations, educator qualifications, and specific learning methodologies. In 2024, the demand for evidence-based educational programs in early childhood settings continued to rise, reflecting this segment's focus on developmental outcomes.

- Focus on Pedagogy: Parents look for centers with well-defined educational philosophies, such as Reggio Emilia or Montessori, that align with their values.

- Educator Qualifications: A high proportion of university-qualified teachers and experienced early childhood educators is a significant draw.

- Developmental Programs: Emphasis is placed on programs that foster literacy, numeracy, social-emotional skills, and creative arts.

- Parental Engagement: Centers that facilitate strong communication and involvement with parents are highly valued.

Families in Diverse Geographic Locations

G8 Education's extensive network serves families across Australia's urban, suburban, and regional centers. This broad reach acknowledges that convenience and accessibility are paramount for parents, regardless of where they live.

Families in these diverse locations often prioritize proximity to home or work, seeking childcare solutions that seamlessly integrate into their daily routines. For instance, in 2024, G8 Education operated over 430 centers, many strategically placed to meet these local demands.

- Diverse Geographic Reach: G8 Education's presence spans metropolitan, peri-urban, and rural Australian communities.

- Value of Accessibility: Families consistently seek childcare options within easy commuting distance of their residences or workplaces.

- Location-Specific Needs: Requirements for childcare services can differ based on the economic and social characteristics of a particular area.

- Operational Scale: As of 2024, G8 Education managed a significant portfolio of childcare centers, highlighting its commitment to serving a wide geographic spread.

G8 Education caters to a broad spectrum of families, primarily parents and guardians of young children. This includes those with infants and toddlers (0-2 years) and preschool-aged children (3-5 years), all seeking quality early learning and care. The business also serves working parents and dual-income households prioritizing convenience and flexible hours.

A significant segment consists of families who highly value educational outcomes and are willing to invest in centers with strong pedagogical approaches and qualified educators. These parents actively research and prioritize centers that prepare their children for school and foster holistic development.

G8 Education's customer base is geographically diverse, spanning urban, suburban, and regional areas across Australia. This wide reach addresses the need for accessible childcare solutions close to families' homes or workplaces.

| Customer Segment | Key Needs | 2024 Relevance |

| Infants & Toddlers (0-2 yrs) | Safety, nurturing, foundational skill development | High demand, persistent waiting lists in Australia |

| Preschoolers (3-5 yrs) | Educational readiness, social-emotional development, school preparation | Majority of families utilize early childhood education |

| Working Parents/Dual Income | Convenience, reliability, extended hours, flexibility | High parental workforce participation necessitates dependable care |

| Education-Focused Families | High-quality pedagogy, qualified educators, developmental programs | Growing demand for evidence-based early learning programs |

Cost Structure

Staff wages and benefits represent the most significant cost for G8 Education, a natural consequence of operating a labor-intensive childcare sector. This category encompasses salaries for their educators, center managers, and administrative staff, along with associated costs like superannuation and other employment-related expenses.

For the fiscal year 2023, G8 Education reported total employee benefits expense of $718.7 million. This substantial figure underscores the critical role and associated cost of their workforce in delivering educational services across their numerous centers.

G8 Education's cost structure heavily relies on property lease and occupancy expenses for its extensive network of childcare centers. These significant outlays encompass rent payments, property taxes, and the ongoing costs of utilities such as electricity and water. In 2024, G8 Education reported that property lease and occupancy costs represented a substantial portion of their operational expenditures, reflecting the capital-intensive nature of maintaining a widespread physical presence.

G8 Education invests significantly in educational resources and program development, a core cost for delivering quality early learning. This includes acquiring a wide array of learning materials, from educational toys and books to specialized equipment and digital learning tools. For instance, in 2023, G8 Education reported that its cost of sales, which encompasses many of these resource expenses, was AUD 675.5 million.

Developing and maintaining a robust curriculum is also a substantial cost. This ensures that educational programs are up-to-date, engaging, and aligned with learning frameworks. These investments are crucial for fostering children's development and providing a stimulating learning environment across their network of centers.

Regulatory Compliance and Quality Assurance

G8 Education incurs significant expenses to meet stringent Australian early childhood education and care regulations. These costs include licensing fees, regular safety audits, and continuous professional development for staff to uphold quality standards. These expenditures are fundamental for maintaining operational legitimacy and protecting the company's reputation in the market.

In 2023, G8 Education reported that compliance and quality assurance costs represented a notable portion of their operational expenditure. For instance, the company invested heavily in ensuring all its centres met the National Quality Framework standards, which involves ongoing training and facility upgrades. These investments are crucial for avoiding penalties and maintaining the trust of parents and regulatory bodies.

- Licensing and Accreditation Fees: Costs associated with obtaining and maintaining operating licenses and accreditations across numerous childcare centres.

- Safety Audits and Inspections: Expenses incurred for internal and external audits to ensure compliance with health, safety, and child protection regulations.

- Staff Training and Development: Investment in ongoing training programs to ensure educators are up-to-date with pedagogical best practices and regulatory requirements.

- Quality Assurance Systems: Costs for implementing and maintaining systems that monitor and improve the quality of education and care provided.

Marketing, Sales, and Administration

G8 Education's cost structure heavily features expenses related to marketing, sales, and administration. These costs are crucial for attracting new families to their childcare centers, encompassing advertising campaigns, promotional events, and the ongoing operational costs of their central support office. In 2024, significant investment was directed towards digital marketing and community engagement initiatives to bolster occupancy rates.

Beyond customer acquisition, this category also includes substantial general administrative expenses. These cover the essential functions of running a large organization, such as IT systems development and maintenance, human resources, legal compliance, and corporate governance activities. These overheads are fundamental to ensuring the smooth operation and strategic direction of G8 Education's extensive network of centers.

- Marketing and Sales: Costs for advertising, digital campaigns, and promotional activities aimed at attracting new families.

- Central Support Office Operations: Expenses related to the administration and management of the entire G8 Education network.

- General Administration: Includes IT infrastructure, human resources, legal, and compliance costs.

- Corporate Governance: Expenses associated with board oversight, financial reporting, and regulatory adherence.

G8 Education's cost structure is dominated by personnel expenses, with staff wages and benefits representing the largest outlay. This is followed by property lease and occupancy costs, reflecting the extensive physical footprint of their childcare centers. Significant investments are also made in educational resources, curriculum development, and regulatory compliance to maintain quality and operational legitimacy.

| Cost Category | 2023 (AUD Million) | 2024 (Estimate/Focus Area) |

|---|---|---|

| Employee Benefits | 718.7 | Continued focus on competitive remuneration and training. |

| Property Lease & Occupancy | Substantial portion of operating expenditure | Ongoing property management and utility costs. |

| Cost of Sales (incl. resources) | 675.5 | Investment in new learning materials and digital tools. |

| Marketing, Sales & Admin | Significant investment in digital marketing and central operations. | Enhancing brand presence and operational efficiency. |

Revenue Streams

The core revenue for G8 Education is generated from childcare fees paid by families utilizing their numerous centers. These fees are structured based on several key determinants, including the child's age, the number of days they attend per week, and the specific geographical location of the facility. For instance, in 2024, G8 Education's revenue from these fees reflects the demand for early learning services across its extensive network.

G8 Education heavily relies on the Australian Government's Child Care Subsidy (CCS) as a primary revenue stream. This government funding, paid directly to childcare providers for eligible families, significantly boosts demand by making services more affordable.

In the 2023 financial year, G8 Education reported that government funding, including the CCS, constituted a substantial portion of their revenue, underscoring its critical role in their business model.

G8 Education's acquisition and divestment of child care centers represent a strategic approach to revenue management, rather than a consistent operational income stream. In 2023, G8 Education reported acquiring 14 centers, significantly boosting its licensed capacity and market presence. This expansion directly contributes to potential revenue growth by increasing the number of children they can serve.

The divestment of centers, while not generating recurring revenue, is crucial for portfolio optimization. By selling underperforming or non-strategic locations, G8 Education can free up capital and focus resources on more profitable operations. This strategic pruning, though not a direct revenue generator, supports long-term financial health and can indirectly enhance overall profitability by reducing operational drag.

Ancillary Services and Programs

G8 Education explores ancillary services to broaden its income base. These could involve charging for optional activities like specialized sports or arts programs, which cater to specific interests and offer enriched learning experiences. For instance, in 2023, the early education sector saw a growing demand for premium services, with some providers reporting up to 15% of revenue coming from these supplementary offerings.

Additional revenue can also be generated through extended care options, providing flexibility for parents with demanding work schedules. This not only diversifies income but also enhances the value proposition for families seeking comprehensive childcare solutions. G8 Education's focus on these programs aims to capture a larger share of the family's educational spending.

- Fees for extracurricular activities

- Specialized educational programs

- Extended care hours

- Value-added services for families

Investment Income and Other Financial Activities

G8 Education also generates revenue through investment income, primarily interest earned on its substantial cash reserves. For instance, as of December 31, 2023, the company reported cash and cash equivalents of $208.6 million, providing a base for interest-bearing asset generation.

Beyond passive income, G8 Education engages in other financial activities that contribute to its overall financial health. A notable example is its share buy-back program. These programs are strategically implemented to enhance shareholder value by reducing the number of outstanding shares, which in turn can boost earnings per share and return on equity.

- Investment Income: Interest earned on cash and cash equivalents.

- Share Buy-backs: Programs designed to repurchase company stock, improving key financial metrics.

- Shareholder Value: Aims to increase earnings per share and return on equity.

G8 Education's revenue is primarily driven by childcare fees, influenced by child age, attendance, and location. Government subsidies, particularly the Australian Government's Child Care Subsidy (CCS), are a crucial component, making services more accessible and boosting demand. In 2023, government funding formed a significant portion of G8's revenue, highlighting its importance.

| Revenue Stream | Description | 2023/2024 Relevance |

| Childcare Fees | Direct payments from families for services. | Core revenue driver, reflecting demand. |

| Government Subsidies (CCS) | Australian Government funding to offset family costs. | Significant revenue contributor, enhancing affordability. |

| Ancillary Services | Optional activities and extended care hours. | Growing segment, offering added value and diversified income. |

| Investment Income | Interest earned on cash reserves. | Provides supplementary income from substantial cash holdings. |

Business Model Canvas Data Sources

The G8 Education Business Model Canvas is informed by a blend of internal financial reporting, extensive market research on the early childhood education sector, and strategic insights derived from operational performance data. These diverse sources ensure a comprehensive and accurate representation of the business.