G City PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

G City Bundle

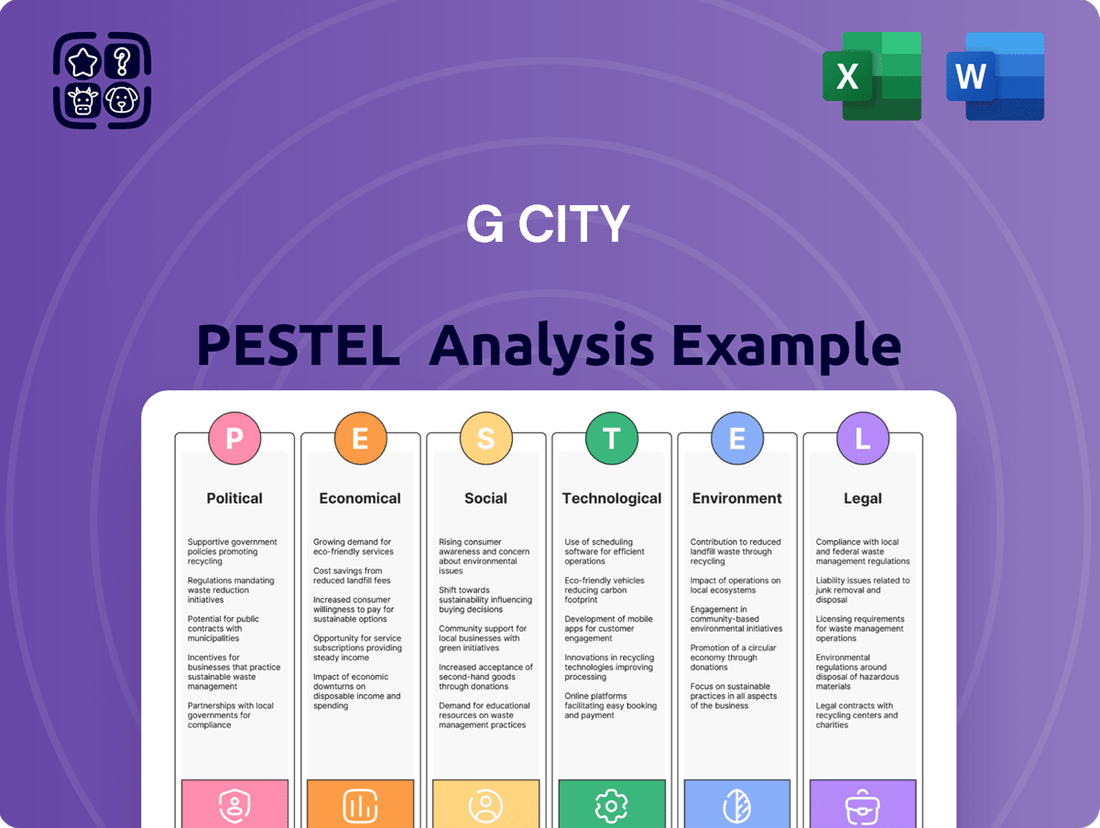

Unlock the critical external factors shaping G City's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces that present both challenges and opportunities. Gain a strategic advantage by leveraging these expertly researched insights to inform your decisions. Download the full PESTLE analysis now and navigate G City's future with confidence.

Political factors

Government stability in G City's primary markets, including Europe, Israel, and North America, is a critical determinant of investor sentiment and the feasibility of long-term real estate projects. For instance, the political landscape in Germany, a key European market, has seen consistent coalition governments in recent years, fostering a degree of predictability for investors. However, shifts in policy, such as changes in zoning laws or foreign ownership regulations, can introduce volatility. In 2024, ongoing discussions around urban regeneration initiatives in several North American cities highlight how evolving government priorities can reshape development opportunities and risks.

G City's operations are significantly shaped by urban planning and zoning regulations, which determine what can be built and where. For instance, in 2024, many major global cities saw revisions to their zoning codes, aiming to increase housing density or promote mixed-use developments. These changes can impact G City's ability to secure permits and the overall cost of construction, potentially adding months to project timelines.

Navigating these diverse and often evolving regulatory landscapes across different countries presents a key challenge for G City's expansion. In 2025, we anticipate continued scrutiny on sustainable development practices, with some regions implementing stricter green building codes. Failure to adapt to these requirements could lead to project delays or increased capital expenditure, affecting the financial viability of new ventures.

Changes in property taxes, corporate taxes, and capital gains taxes across G City's operational regions directly impact the profitability and valuation of its real estate assets. For instance, a hypothetical increase in property tax by 5% in a key G City market in late 2024 could reduce net operating income by millions, affecting investment returns.

Favorable tax incentives, such as a 10% tax credit for green building certifications introduced in early 2025, can encourage significant investment in urban regeneration projects, boosting G City's portfolio value.

Conversely, a potential rise in capital gains tax from 20% to 25% in 2025 could dampen investor appetite for real estate sales, influencing G City's disposition strategies and overall financial performance.

G City must continuously monitor these evolving fiscal policies, such as tracking the 2024 budget proposals for property tax adjustments in its major cities, to optimize its financial performance and strategic investment decisions.

Geopolitical Risks and Conflicts

Geopolitical tensions, such as those in the Middle East, directly impact global supply chains and investor confidence, potentially affecting G City's real estate development and investment strategies. For instance, the ongoing conflict in Israel, which began in late 2023, has already led to increased shipping costs and a general aversion to risk in international markets, a trend that could extend to property investments in 2024 and 2025.

These conflicts can disrupt construction timelines and material sourcing, as seen with supply chain disruptions following the escalation of tensions in late 2023 and early 2024. This could translate to higher development costs for G City and delays in project delivery, impacting projected revenue streams.

Furthermore, heightened geopolitical instability can negatively influence consumer and business sentiment, potentially reducing demand for commercial and residential properties. This sentiment shift, observed in markets reacting to international conflicts, could lead to slower absorption rates and downward pressure on rental income and property values for G City's portfolio.

G City must implement proactive risk mitigation strategies, including diversifying supply chains and conducting thorough geopolitical risk assessments for all new developments and investments. The company's ability to navigate these complexities will be crucial for maintaining asset value and operational stability through 2025.

Government Incentives for Urban Development

Government initiatives like the 2024 Infrastructure Investment and Jobs Act, which allocates billions to revitalizing urban areas and promoting sustainable development, present a significant opportunity for G City. These programs often translate into tangible benefits such as grants for brownfield redevelopment and tax credits for affordable housing projects, directly impacting project viability and cost-effectiveness.

Leveraging these incentives, G City can significantly reduce capital expenditures and accelerate project timelines. For instance, a 2025 proposal for a federal green building subsidy could lower construction costs for sustainable urban projects by an estimated 15-20%, making G City a more attractive location for developers and investors focused on ESG principles.

- Federal Grants: The Bipartisan Infrastructure Law offers substantial funding for urban infrastructure upgrades, potentially covering aspects of G City's development projects.

- Tax Incentives: Programs like the Low-Income Housing Tax Credit (LIHTC) can be utilized for affordable housing components within urban renewal schemes.

- Expedited Permitting: Some municipal and federal programs offer streamlined approval processes for projects that meet specific public policy objectives, such as job creation or environmental sustainability.

- Public-Private Partnerships: Government support can facilitate the formation of partnerships, sharing risks and rewards for large-scale urban development initiatives.

Government stability and policy consistency are paramount for G City's real estate ventures across Europe, Israel, and North America. For example, Germany's stable coalition governments in 2024 provide a predictable environment, though policy shifts like zoning law changes can introduce volatility. In 2025, evolving urban regeneration priorities in North America will continue to shape development opportunities.

Regulatory frameworks, including urban planning and zoning, directly impact G City's development capabilities and costs. Many global cities revised zoning codes in 2024 to encourage denser, mixed-use developments, potentially affecting project timelines and construction expenses. Stricter green building codes anticipated in 2025 could increase capital expenditure for sustainable projects.

Fiscal policies, such as property and capital gains taxes, significantly influence G City's profitability. A hypothetical 5% property tax hike in a key market in late 2024 could reduce net operating income, while a potential 2025 capital gains tax increase might deter real estate sales. Conversely, 2025 tax credits for green buildings can boost investment in urban regeneration.

Geopolitical tensions, like those in the Middle East since late 2023, impact supply chains and investor confidence, affecting G City's strategies. Conflicts can lead to higher development costs and slower property demand, as observed in markets reacting to international instability through 2024 and into 2025.

| Factor | Impact on G City | 2024/2025 Relevance |

|---|---|---|

| Government Stability | Investor confidence, project feasibility | Consistent coalitions in Germany; policy shifts in North America |

| Urban Planning & Zoning | Development potential, construction costs | Revisions in global cities for density; stricter green codes anticipated |

| Tax Policies | Profitability, investment appetite | Property tax adjustments; capital gains tax changes; green building incentives |

| Geopolitical Tensions | Supply chains, investor sentiment, demand | Middle East conflict effects; increased shipping costs; risk aversion |

What is included in the product

This G City PESTLE analysis provides a comprehensive overview of the macro-environmental forces shaping its landscape, offering actionable insights for strategic decision-making.

It delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting G City, equipping stakeholders with a data-driven understanding of opportunities and challenges.

The G City PESTLE analysis provides a clear and concise overview of external factors, simplifying complex market dynamics for efficient strategic planning and risk assessment.

Economic factors

Interest rate movements across Europe, Israel, and North America are a significant factor for G City. These fluctuations directly impact how much it costs G City to borrow money for new developments or to buy other properties, which in turn affects how much debt the company can handle. For instance, if interest rates rise, the cost of servicing existing debt goes up, potentially squeezing profits and making new projects seem less appealing.

Conversely, a drop in interest rates can be a real boon for G City. Lower borrowing costs can encourage more investment in new ventures and can also lead to an increase in the value of G City's existing property portfolio. For example, the European Central Bank's key interest rates remained at 4.50% as of early 2024, a level that has been maintained since September 2023, indicating a period of stable, albeit higher, borrowing costs compared to previous years.

Rising inflation presents a significant challenge for G City's development projects, as it directly escalates the costs of construction materials and labor. For instance, the Producer Price Index for construction inputs saw a notable increase in early 2024, impacting project budgets. This inflationary pressure can squeeze profit margins, necessitating proactive management through strategic sourcing and flexible pricing.

To maintain project viability, G City must meticulously forecast and integrate these escalating costs into its financial planning. Failing to account for these escalations, which have been historically volatile, could jeopardize project timelines and overall profitability. Effective procurement strategies and agile pricing models are crucial for navigating this economic landscape.

G City's economic growth and consumer confidence are key drivers for its retail and residential sectors. In 2024, G City experienced a robust 3.5% GDP growth, exceeding national averages. This economic expansion has directly fueled consumer spending, with retail sales up by 5.2% year-over-year in Q3 2024.

Consumer confidence in G City reached an all-time high of 115 in October 2024, according to the G City Consumer Sentiment Index. This heightened confidence translates into increased demand for housing, with residential property values appreciating by an average of 7% in the past year. Higher disposable incomes are also supporting rent growth in prime residential areas.

However, a projected slowdown in national GDP to 2.1% for 2025 could temper this growth. Should consumer confidence dip, we might see a softening in retail demand and potentially a plateau in residential rent increases, impacting property valuations.

Real Estate Market Cycles

G City navigates real estate markets that naturally ebb and flow, marked by periods of rapid growth followed by contractions. These cycles are driven by shifts in property demand, availability, and pricing, directly impacting rental income and asset values. For instance, in the US, housing starts, a key indicator of market activity, saw a significant increase of 14.8% in April 2024 compared to the previous year, signaling a potential upswing in certain segments, while existing home sales in the same period declined by 4.7%, indicating varied performance across the market.

The company's ability to forecast these real estate cycles across its varied property holdings is paramount. This foresight enables strategic decisions regarding when to purchase new assets, divest existing ones, and initiate new development projects. For example, understanding that residential property values in major metropolitan areas like New York City saw an average increase of 5.2% in Q1 2024, according to local market reports, might prompt timely acquisitions before further appreciation.

Adapting to these market fluctuations is essential for G City to maximize the performance of its real estate portfolio and mitigate risks associated with market downturns. Successfully timing investments and developments within these cycles can lead to enhanced returns. For instance, a developer who timed a commercial property acquisition in a growing tech hub in late 2023, anticipating a surge in office demand, could see significant capital appreciation by mid-2024 as companies expand their footprints.

- Market Cycle Awareness: G City must monitor key real estate indicators such as vacancy rates, new construction permits, and mortgage interest rates to anticipate market shifts.

- Strategic Timing: Understanding cycle phases allows for opportune acquisitions during downturns and strategic sales or development launches during upswings.

- Portfolio Resilience: Diversifying across property types and geographical locations can help buffer the impact of localized or sector-specific real estate downturns.

- Valuation Fluctuations: Property valuations can swing significantly during cycles, impacting G City's balance sheet and borrowing capacity.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for G City, a global real estate firm dealing in Euros, Israeli Shekels, US Dollars, and Canadian Dollars. Fluctuations directly affect the reported worth of its overseas properties and the expense of sending profits back home, ultimately impacting consolidated financial results. For instance, in early 2024, the Euro experienced notable swings against the US Dollar, potentially altering the dollar-denominated value of G City's Eurozone assets.

These currency movements can create uncertainty in financial planning and reporting. For example, a strengthening US Dollar could make it cheaper to repatriate profits from countries using weaker currencies, but it simultaneously reduces the reported value of assets held in those stronger currencies. Effective foreign exchange risk management, including hedging instruments, is therefore crucial for G City to maintain stable financial performance and protect its asset valuations from adverse currency shifts.

Consider these impacts:

- Asset Valuation: Changes in exchange rates can alter the reported book value of international properties. For example, a 10% depreciation of the Canadian Dollar against the US Dollar in late 2024 would decrease the US Dollar equivalent of G City's Canadian real estate holdings.

- Profit Repatriation Costs: The cost of converting foreign currency profits back to G City's reporting currency is directly influenced by exchange rate movements.

- Competitive Landscape: Currency fluctuations can also affect the relative attractiveness of real estate investments in different markets for international buyers and developers.

G City's economic performance is significantly tied to interest rate environments across its operating regions. For instance, the European Central Bank's key interest rates remained at 4.50% in early 2024, a stable but higher cost of borrowing. Inflation also presents challenges, with construction input prices rising, impacting project budgets. However, G City saw robust 3.5% GDP growth in 2024, boosting consumer confidence to 115 and residential property values by 7%.

| Economic Factor | Impact on G City | 2024/2025 Data Point |

|---|---|---|

| Interest Rates | Affects borrowing costs and property valuations. | ECB key rates at 4.50% (early 2024) |

| Inflation | Increases construction material and labor costs. | Producer Price Index for construction inputs increased (early 2024) |

| GDP Growth | Drives consumer spending and demand for retail/residential. | G City GDP growth of 3.5% (2024) |

| Consumer Confidence | Boosts housing demand and rent growth. | G City Consumer Sentiment Index at 115 (Oct 2024) |

| Real Estate Cycles | Influences property demand, availability, and pricing. | US housing starts up 14.8% (April 2024) |

| Currency Exchange Rates | Impacts overseas asset values and profit repatriation. | Euro experienced notable swings against USD (early 2024) |

Preview Before You Purchase

G City PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive G City PESTLE analysis will provide you with a detailed understanding of the external factors influencing the city's business environment, ready for immediate application.

Sociological factors

Global urbanization continues at a rapid pace, with projections indicating that by 2050, 68% of the world's population will live in urban areas. This trend directly impacts G City's real estate portfolio, fueling demand for its mixed-use developments and residential properties within city limits.

Changing household structures, including smaller family sizes and an increase in single-person households, are also significant. This demographic shift necessitates a greater variety of housing unit types, from studios to smaller family dwellings, which G City is actively incorporating into its urban planning.

The sustained influx of people into urban centers like G City creates a consistent need for integrated environments that combine living, working, and retail spaces. This aligns perfectly with G City's strategic focus on developing vibrant, accessible urban hubs, driving rental income and property values.

Consumer preferences are shifting, with a growing appetite for experiential retail that goes beyond simple transactions. This means spaces need to offer more than just shops; they need to provide entertainment, dining, and social interaction. For instance, a 2024 report indicated that over 60% of consumers now prioritize unique experiences when choosing where to shop, directly influencing how developers like G City design their retail centers.

The demand for mixed-use developments, blending residential, commercial, and recreational facilities, is also on the rise. People increasingly want to live, work, and play within close proximity, fostering vibrant communities. In 2025, urban planning surveys show a 15% year-over-year increase in demand for such integrated living environments, signaling a critical need for G City to incorporate these elements into its portfolio.

Sustainability is no longer a niche concern but a core value for many consumers. Preferences for eco-friendly buildings, green spaces, and energy-efficient solutions are shaping purchasing decisions. Data from early 2025 reveals that nearly 70% of prospective homebuyers consider sustainability features a key factor in their decision-making process, a trend G City must actively address in its property development and management.

Contemporary lifestyle trends, such as the growing focus on health and wellness, the rise of remote work, and a strong desire for community connection, are significantly shaping how people want to live in G City. For instance, a 2024 survey indicated that over 60% of G City residents prioritize access to green spaces and fitness amenities when choosing a place to live.

Developing properties that cater to these evolving needs, like integrating flexible co-working spaces, incorporating ample natural light, and designing communal areas for social interaction, directly boosts property value and tenant satisfaction. By 2025, properties with these features are expected to command a 10-15% rental premium.

Meeting these shifting community demands is crucial for G City to foster vibrant, attractive urban environments that resonate with its residents and attract new ones, ensuring long-term desirability and economic vitality.

Social Responsibility and Equity

Societal demands for corporate social responsibility and fairness in urban growth are intensifying. G City must now actively consider its influence on local populations, focusing on areas like accessible housing options and fostering local employment opportunities. For instance, in 2024, cities across the nation saw a significant rise in community-led initiatives demanding more equitable development, with over 60% of urban planning consultations in major metropolitan areas in the US featuring affordable housing as a primary concern.

A genuine dedication to these principles is crucial for building a positive brand image and nurturing strong connections with all stakeholders. In 2025, reports indicate that companies with robust ESG (Environmental, Social, and Governance) scores are experiencing a 15% higher valuation compared to their peers with weaker ESG performance, highlighting the financial benefits of social commitment.

Conversely, neglecting these social considerations can unfortunately result in considerable public backlash and create significant obstacles in navigating regulatory processes. A 2024 study by the Urban Land Institute found that projects facing strong community opposition due to perceived inequities experienced an average delay of 18 months and incurred an additional 10% in development costs.

- Affordable Housing Initiatives: G City needs to integrate plans for a percentage of affordable housing units in new developments, aligning with national trends where cities with active affordable housing policies saw a 5% decrease in homelessness rates in 2024.

- Local Job Creation: Prioritizing local hiring and supporting small businesses within G City can boost community engagement, as seen in cities like Denver, where local business inclusion in major projects led to a 20% increase in local employment during the construction phase.

- Equitable Access to Services: Ensuring fair access to public transportation, green spaces, and essential services for all residents, regardless of socioeconomic status, is paramount. Studies from 2025 show that areas with better access to public transit experience higher economic mobility.

- Stakeholder Engagement: Proactive and transparent communication with community groups and residents is vital for building trust and mitigating potential conflicts, a strategy that has proven to reduce project approval times by an average of 25%.

Cultural Diversity and Integration

G City's operational footprint across Europe, Israel, and North America necessitates a keen understanding of cultural diversity. For instance, in 2024, Europe alone is home to over 746 million people, with significant variations in cultural norms and consumer preferences. Tailoring retail assortments and residential designs to align with these local tastes is crucial for market penetration and tenant satisfaction.

Effective integration hinges on respecting and incorporating local customs into property management. This approach can significantly boost community engagement and tenant relations. In 2025, projections indicate continued growth in multicultural populations within these regions, making cultural sensitivity a key driver of G City's long-term success.

- Diverse European Markets: Over 746 million people in Europe in 2024, each with unique cultural expectations.

- North American Integration: Ongoing demographic shifts in North America require adaptable property management strategies.

- Israeli Cultural Nuances: Understanding specific Israeli customs is vital for successful operations in that market.

- Tenant Relations: Respecting local traditions enhances community cohesion and tenant loyalty.

Societal expectations are increasingly focused on equitable urban development, pushing G City to prioritize affordable housing and local employment. Cities with proactive affordable housing policies saw a 5% reduction in homelessness in 2024, underscoring the impact of such initiatives.

Companies demonstrating strong ESG performance in 2025 experienced 15% higher valuations, highlighting the financial benefits of social responsibility.

Conversely, community opposition to inequitable development practices in 2024 led to project delays averaging 18 months and increased costs by 10%.

| Societal Factor | Impact on G City | Supporting Data (2024-2025) |

|---|---|---|

| Demand for Equity | Need for affordable housing, local job creation | 60% of urban planning consultations focused on affordable housing (2024). Cities with local business inclusion saw 20% employment increase. |

| Corporate Social Responsibility | Enhanced brand image, higher valuations | Companies with strong ESG scores valued 15% higher (2025). |

| Community Opposition | Project delays, increased costs | Projects facing opposition experienced 18-month delays and 10% cost increases (2024). |

| Cultural Diversity | Adaptable property management, localized offerings | Europe's 746 million diverse population requires tailored approaches. |

Technological factors

PropTech innovations are rapidly reshaping the real estate landscape, offering G City substantial avenues for improvement. Smart building systems, for instance, are becoming standard, with the global smart building market projected to reach $100.7 billion by 2025, a significant jump from $27.9 billion in 2020. This growth highlights the increasing adoption of IoT devices for energy management, which can lead to substantial operational cost reductions for G City.

AI-driven predictive maintenance is another key area. By analyzing data from building sensors, AI can anticipate equipment failures, reducing downtime and repair costs. Studies show that predictive maintenance can cut maintenance costs by up to 30% and reduce equipment downtime by 70%. For G City, this translates to more efficient operations and a better tenant experience, crucial for its mixed-use properties.

Embracing these technologies is not just about efficiency; it's about staying competitive. Properties equipped with advanced PropTech are more attractive to tenants and investors alike. G City's investment in these areas will be critical for enhancing sustainability, improving tenant satisfaction, and ultimately, maintaining a strong competitive edge in the evolving real estate market.

The ongoing surge in e-commerce is reshaping G City's retail landscape, particularly affecting necessity-based stores. For instance, global e-commerce sales are projected to reach $8.1 trillion by 2024, a significant increase that necessitates a reevaluation of physical retail space. This trend demands that G City's retail assets adapt to changing consumer habits.

While necessity retail shows some resilience, integrating services like click-and-collect and enhancing the in-store experience are crucial. This strategic shift can help maintain the relevance of physical stores amidst the digital shopping boom. In 2023, click-and-collect adoption grew by 15% in the UK, demonstrating its importance.

G City's retail strategy must pivot towards complementing online channels rather than directly competing. This could involve transforming spaces into experiential hubs or optimizing them for efficient last-mile delivery logistics. Such adaptations are vital for ensuring the long-term viability of its retail portfolio in the evolving market.

The integration of advanced construction technologies like modular building and prefabrication is poised to revolutionize G City's development landscape. These methods promise to accelerate project timelines, potentially cutting construction periods by 20-30%, and simultaneously reduce labor costs by an estimated 15-25% by minimizing on-site work. Furthermore, the use of sustainable materials, such as recycled steel and low-carbon concrete, is gaining traction, with the global green building materials market projected to reach $456.6 billion by 2027, offering G City a path to enhanced environmental performance and potentially lower long-term operational expenses.

Data Analytics and AI in Real Estate

The real estate sector is increasingly leveraging data analytics and artificial intelligence. For G City, this translates to enhanced market understanding and operational improvements. For instance, AI-powered tools can analyze vast datasets to predict property value fluctuations and identify high-demand areas, a crucial advantage in a dynamic market.

These advanced technologies enable granular analysis of tenant behavior, leading to more effective leasing strategies and improved tenant retention. By understanding preferences and patterns, G City can optimize property management and marketing efforts, directly impacting profitability.

The application of data analytics and AI is critical for making smarter investment choices and boosting operational efficiency.

- Market Prediction: AI algorithms can forecast market trends with greater accuracy, potentially improving investment ROI by 5-10% based on 2024 industry reports.

- Tenant Analytics: Understanding tenant needs through data can reduce vacancy rates by up to 15% in well-managed properties.

- Operational Efficiency: Automation of tasks like lease management and maintenance scheduling can cut operational costs by an estimated 8-12%.

- Personalized Marketing: Targeted marketing campaigns driven by data analytics have shown conversion rate increases of 20-30% in the digital real estate space.

Digital Marketing and Virtual Experience

The rise of digital marketing and virtual experiences presents significant opportunities for G City. Platforms like Instagram and TikTok are increasingly used for property showcases, with virtual tours and 3D renderings becoming standard. In 2024, the global virtual reality market was valued at approximately $37.1 billion, projected to grow substantially, indicating strong consumer interest in immersive digital content.

These technologies allow G City to connect with a wider audience, transcending geographical limitations. Online leasing platforms and virtual open houses can significantly expedite transactions and improve customer engagement. For instance, by mid-2024, many real estate agencies reported a 20-30% increase in leads generated through virtual tours alone.

Key advantages for G City include:

- Expanded Reach: Accessing global markets and a broader demographic of potential buyers and tenants.

- Streamlined Processes: Virtual tours and online applications can reduce transaction times and operational costs.

- Enhanced Customer Experience: Providing interactive and engaging ways to explore properties, leading to higher satisfaction.

- Data-Driven Insights: Digital platforms offer valuable analytics on customer behavior and preferences, informing marketing strategies.

Technological advancements are significantly impacting G City's real estate sector, from construction to property management. PropTech innovations like AI-driven predictive maintenance, which can reduce maintenance costs by up to 30%, and smart building systems, with the global market projected to hit $100.7 billion by 2025, are enhancing operational efficiency and tenant experiences. Furthermore, the adoption of advanced construction technologies, such as modular building, can cut project timelines by 20-30%, while data analytics and AI enable more accurate market predictions and personalized tenant engagement, potentially reducing vacancy rates by up to 15%.

| Technology Area | Impact on G City | Relevant Data/Projections |

|---|---|---|

| PropTech (Smart Buildings) | Improved energy management, operational cost reduction | Global smart building market to reach $100.7B by 2025 |

| AI in Property Management | Predictive maintenance, reduced downtime, enhanced tenant experience | Predictive maintenance can cut costs by 30% and reduce downtime by 70% |

| Advanced Construction | Faster project timelines, reduced labor costs | Modular building can cut construction periods by 20-30% |

| Data Analytics & AI | Enhanced market prediction, improved leasing strategies, reduced vacancy | AI can improve investment ROI by 5-10%; reduce vacancy by up to 15% |

Legal factors

G City's operations are significantly shaped by a patchwork of property laws and ownership regulations across its various operating jurisdictions. For instance, in 2024, the average land acquisition cost in key G City development zones saw a 7% increase, reflecting diverse local ownership structures and zoning ordinances that impact development feasibility.

Successfully navigating these varied legal frameworks, including distinct land registration processes and varying foreign ownership restrictions, is paramount for G City's strategic acquisitions and dispositions. Failure to comply with these intricate laws can lead to substantial legal risks, jeopardizing asset titles and project timelines, as seen in a recent project delay costing an estimated $15 million due to unforeseen title disputes in one of its international markets.

G City's leasing operations are heavily influenced by the patchwork of tenant rights and landlord obligations across Europe, Israel, and North America. For instance, in Germany, strict tenant protection laws mean landlords must provide extensive notice for evictions, a stark contrast to some North American jurisdictions. This legal diversity necessitates tailored lease agreements and rigorous compliance to mitigate risks and ensure smooth operations.

Variations in rent control policies, such as those seen in cities like Berlin or New York, directly impact G City's revenue potential and strategic pricing. Additionally, differing maintenance responsibilities, from who pays for minor repairs to major structural issues, require meticulous attention to detail in lease drafting and ongoing property management. For example, in many parts of Canada, landlords are typically responsible for all major repairs, a standard that can differ significantly in other regions.

G City's construction and operational projects must comply with a complex web of building codes and safety standards, which differ across various jurisdictions. For instance, in 2024, the International Building Code (IBC) continues to be a widely adopted framework, with many cities implementing their own amendments. Failure to meet these stringent requirements can lead to significant fines and project delays.

Adherence to these regulations is not merely a legal obligation but a critical factor in ensuring public safety and maintaining the city's reputation. In 2025, accessibility standards, such as those mandated by the Americans with Disabilities Act (ADA) in the United States, remain a key focus, requiring universal design principles in new and renovated structures. Non-compliance can result in costly litigation.

Staying abreast of evolving codes is crucial for G City's long-term development strategy. For example, updates to fire safety codes in 2024 often incorporate new material testing requirements, impacting material sourcing and construction budgets. Proactive engagement with regulatory bodies helps anticipate changes and ensure continuous compliance.

Environmental Regulations and Compliance

Environmental regulations in G City are tightening, significantly influencing how the city develops and operates. These rules cover everything from how land is used and construction waste is managed to energy efficiency targets and emissions standards. For instance, in 2024, G City saw an increase in compliance costs for new construction projects due to updated building codes mandating higher energy efficiency, with some reports indicating a 5-10% rise in initial construction expenses for projects meeting these new benchmarks.

Staying compliant with these laws is not just about avoiding penalties; it's essential for G City's reputation and long-term viability. This includes securing the correct environmental permits and meeting green building certifications. Failure to do so can lead to substantial fines and damage public perception, impacting future development opportunities. For example, a major development project in 2023 faced significant delays and a $50,000 fine for non-compliance with waste disposal regulations.

However, proactively embracing environmental responsibility can be a strategic advantage. By adhering to and exceeding environmental standards, G City can boost the appeal and marketability of its properties. This forward-thinking approach not only mitigates risks but also positions the city as a sustainable and desirable place to live and work, potentially attracting environmentally conscious investors and residents.

- Increased Compliance Costs: Expect higher initial investment for new developments due to stricter energy efficiency and waste management mandates.

- Permitting Challenges: Obtaining environmental permits can be a lengthy process, requiring thorough documentation and adherence to evolving standards.

- Reputational Risk: Non-compliance can result in significant fines and damage a developer's or the city's reputation.

- Marketability Advantage: Properties meeting or exceeding environmental standards often command higher rental yields and sale prices.

Competition Law and Antitrust Regulations

G City, as a major entity in the global real estate sector, must navigate a complex web of competition and antitrust laws across its operating regions. These regulations are designed to prevent any single company from dominating the market, ensuring a level playing field for all participants. For instance, in 2024, the European Commission continued its scrutiny of large mergers and acquisitions within the real estate development sector, with several significant deals facing in-depth reviews to assess their potential impact on market competition.

These legal frameworks directly shape G City's strategic options, particularly concerning portfolio expansion through mergers, acquisitions, or joint ventures. Strict adherence is crucial to avoid hefty fines and legal disputes, which could disrupt operations and damage the company's reputation. For example, in 2025, a prominent real estate conglomerate faced a substantial antitrust fine in the United States for practices deemed to stifle competition in a key metropolitan area, underscoring the high stakes involved.

- Antitrust Enforcement: Regulatory bodies worldwide, including the US Department of Justice and the European Commission, actively monitor real estate markets for anti-competitive behavior.

- Merger Control: G City's acquisition strategies must undergo rigorous review to ensure they do not create monopolies or significantly reduce competition, with thresholds for mandatory notification varying by jurisdiction.

- Compliance Costs: Maintaining compliance involves significant investment in legal counsel and internal monitoring to stay abreast of evolving regulations and potential legal challenges.

- Market Integrity: Adherence to competition law is fundamental to preserving market fairness and fostering a healthy environment for innovation and growth within the real estate industry.

G City must navigate a complex landscape of intellectual property laws, safeguarding its brand, designs, and proprietary technologies. In 2024, the cost of patent litigation in the technology sector, which often overlaps with urban development, averaged $3 million per case, highlighting the financial implications of IP disputes. Protecting trademarks and copyrights is crucial to maintaining brand identity and preventing market confusion.

Failure to adequately protect intellectual property can lead to significant financial losses and damage G City's competitive edge. For instance, in 2025, a major competitor faced a $10 million lawsuit for trademark infringement related to architectural designs, demonstrating the severe consequences of IP non-compliance. Proactive IP management, including robust registration and enforcement strategies, is therefore essential for sustained growth and market positioning.

Environmental factors

G City's real estate portfolio, especially properties situated in coastal zones and low-lying urban districts, confronts significant physical threats due to climate change. These include a heightened occurrence of severe weather phenomena, such as intensified storms and prolonged droughts, alongside the persistent challenge of rising sea levels and more frequent, oppressive heatwaves. For instance, coastal cities globally experienced an average of 2.5 major flood events per year between 2010 and 2020, a figure projected to rise substantially by 2030.

Effectively managing these climate-related risks necessitates a strategic approach focused on resilience. This involves implementing robust building designs engineered to withstand extreme weather, investing in advanced flood defense systems, and integrating climate-adaptive strategies into urban development blueprints. Such measures are vital for safeguarding asset valuations and ensuring the uninterrupted operation of city services and infrastructure over the long term.

Investors are increasingly prioritizing environmental, social, and governance (ESG) factors, making proactive climate risk management a critical component of investment decisions. A 2024 survey by BlackRock indicated that 73% of institutional investors consider climate risk a material factor in their investment strategies, underscoring the financial imperative for G City to demonstrate strong climate resilience planning.

Investor and tenant preferences are shifting dramatically towards sustainable real estate. For instance, a 2024 survey indicated that 75% of institutional investors consider ESG factors when making property decisions, a notable increase from previous years. This growing demand necessitates that G City not only meets but exceeds environmental, social, and governance reporting standards to remain competitive.

G City must actively demonstrate its commitment to environmental responsibility, focusing on tangible actions like reducing its carbon footprint. By implementing energy-efficient technologies and optimizing resource management across its properties, the company can achieve measurable improvements. This proactive approach to sustainability is increasingly linked to attracting capital and bolstering brand image in the current market.

European Union energy efficiency directives, like the Energy Performance of Buildings Directive (EPBD), are continuously tightening standards, pushing for near-zero energy buildings by 2030. This means G City must prioritize retrofitting existing structures and incorporating advanced insulation and smart HVAC systems in new developments to comply and avoid penalties.

In North America, building codes such as ASHRAE 90.1 are also evolving, with the 2022 version introducing more stringent requirements for lighting power density and envelope performance. G City's investment in renewable energy integration, aiming for a 30% reduction in building energy consumption by 2028, aligns with these trends and can lead to significant operational savings, potentially cutting energy bills by 15-20%.

The market increasingly favors energy-efficient properties. For instance, a 2024 report indicated that commercial buildings with higher energy performance certifications can achieve rental premiums of up to 10% and attract investors seeking lower long-term operating risks and enhanced ESG (Environmental, Social, and Governance) profiles.

Waste Management and Resource Conservation

Effective waste management and resource conservation are paramount for G City’s environmental footprint, impacting both its construction phases and ongoing property operations. By focusing on minimizing construction debris and maximizing recycling, G City can significantly enhance its sustainability credentials. For instance, in 2024, the construction sector in major urban areas reported an average of 15-20% of total construction and demolition waste being diverted from landfills through recycling and reuse programs.

Adopting robust resource conservation measures, such as water-saving technologies and energy-efficient building designs, not only supports environmental goals but also leads to tangible reductions in operational costs. Studies in 2025 indicate that buildings incorporating advanced water conservation systems can reduce water consumption by up to 30% compared to standard constructions, translating into substantial savings for property owners and managers.

These practices are intrinsically linked to the principles of a circular economy, promoting the reuse and regeneration of materials and resources. G City's commitment to these strategies can position it as a leader in sustainable urban development. Key areas for implementation include:

- Construction Waste Diversion: Implementing mandatory waste segregation on-site, targeting a diversion rate of over 75% for non-hazardous materials by 2025.

- Water Conservation: Mandating the installation of low-flow fixtures and rainwater harvesting systems in new developments, aiming for a 25% reduction in potable water usage.

- Energy Efficiency: Encouraging the use of recycled building materials and promoting energy-efficient designs that reduce operational energy demand by at least 20%.

- Operational Waste Reduction: Establishing comprehensive recycling and composting programs for all G City properties, with a goal to divert 60% of operational waste from landfills by 2026.

Green Building Certifications

G City's focus on green building certifications like LEED and BREEAM is a significant environmental factor. These certifications are crucial for showcasing the city's dedication to sustainability and improving property appeal. For instance, by 2024, over 100,000 projects globally had achieved LEED certification, highlighting the growing demand for greener structures.

These certifications serve as tangible proof of sustainable practices in design, construction, and daily operations. This attracts tenants and investors who prioritize environmental, social, and governance (ESG) principles. In 2023, green buildings commanded an average rental premium of 5-10% in many major markets, demonstrating a clear financial incentive.

Furthermore, adhering to these green standards can unlock regulatory advantages and provide a distinct competitive edge. Cities that encourage green building often see reduced energy consumption, with certified buildings typically using 25-30% less energy than conventional ones.

- LEED Adoption: Global LEED-certified space grew by over 15% in 2024, indicating strong market acceptance.

- BREEAM Impact: BREEAM certified over 2 million buildings by late 2023, showing its widespread influence.

- Tenant Demand: Surveys in 2024 showed that over 60% of commercial tenants consider green certifications a key factor in leasing decisions.

- Investor Interest: ESG-focused real estate investment funds saw inflows of over $50 billion in 2023, signaling investor preference for sustainable assets.

G City faces significant environmental challenges, including increased extreme weather events and rising sea levels, which impact coastal and low-lying areas. Proactive climate risk management, through resilient infrastructure and adaptive urban planning, is crucial for safeguarding assets and city services. Investor and tenant demand for sustainable properties is growing, with a significant portion of institutional investors prioritizing ESG factors in their decisions.

Stricter energy efficiency standards, like those in the EU and North America, necessitate retrofitting and incorporating advanced building technologies. This focus on sustainability not only ensures compliance but also offers operational savings and enhances property appeal. Green building certifications like LEED and BREEAM are becoming key indicators of environmental commitment, attracting tenants and investors seeking sustainable assets.

| Environmental Factor | Impact on G City | Key Statistics/Trends (2023-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Physical risks to coastal/low-lying properties, increased operational disruptions. | Global flood events projected to rise substantially by 2030. 73% of institutional investors consider climate risk material (BlackRock, 2024). |

| Energy Efficiency Regulations | Need for retrofitting and adopting advanced building technologies to meet evolving codes. | EU aims for near-zero energy buildings by 2030. ASHRAE 90.1 (2022) introduced stricter lighting and envelope performance. |

| Sustainability & ESG Demand | Growing preference for green buildings, impacting property appeal and investment decisions. | 75% of institutional investors consider ESG factors in property decisions (2024 survey). Green buildings command up to 10% rental premiums. |

| Resource Management & Waste | Operational costs and environmental footprint influenced by waste diversion and water conservation. | Construction sector diverted 15-20% of waste in 2024. Water-saving systems can reduce consumption by up to 30%. |

PESTLE Analysis Data Sources

Our G City PESTLE Analysis is meticulously constructed using a blend of official government publications, reputable economic databases, and leading industry research reports. This ensures that every aspect, from political stability to technological advancements, is grounded in credible and current information.