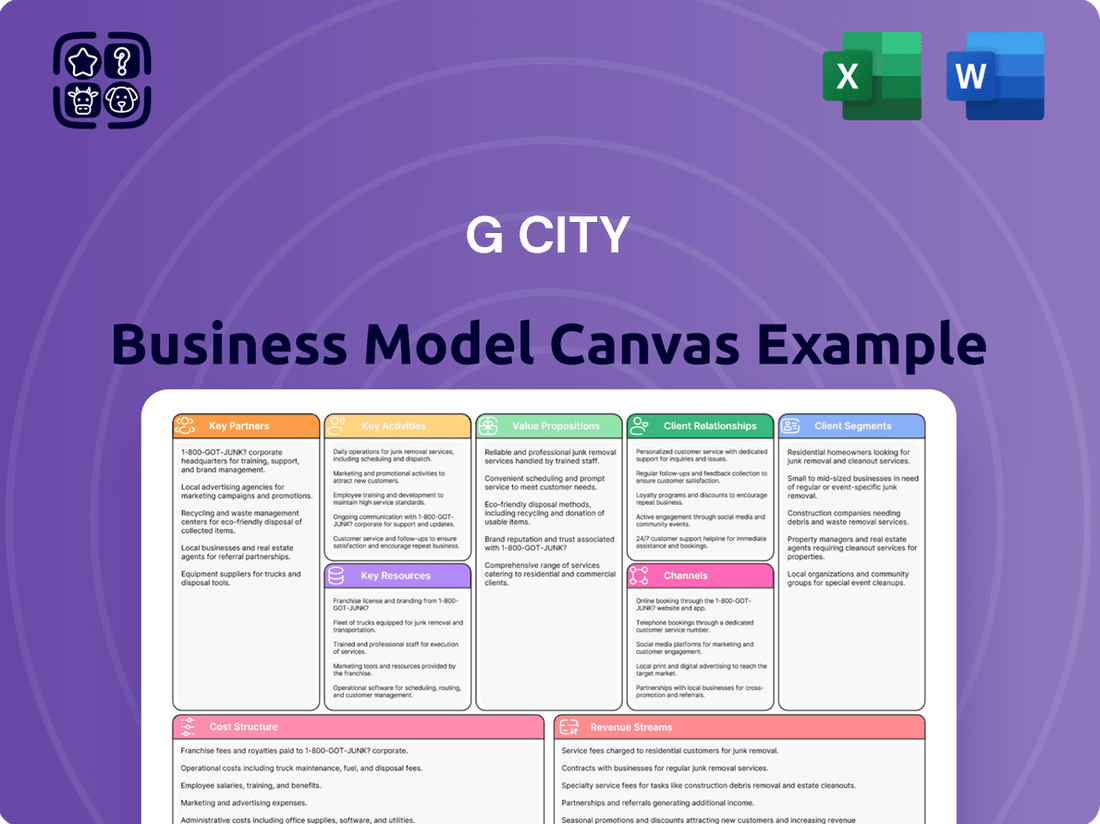

G City Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

G City Bundle

Curious about G City's innovative approach to business? Our comprehensive Business Model Canvas breaks down exactly how they connect with customers, deliver value, and generate revenue. Discover the strategic framework that drives their success.

Ready to unlock the secrets behind G City's market position? The full Business Model Canvas provides a detailed, actionable roadmap of their customer relationships, revenue streams, and key resources. Get your copy today to gain a competitive edge.

Partnerships

G City's financial health hinges on robust partnerships with financial institutions and investors. These relationships are vital for securing the necessary capital for acquisitions, new developments, and maintaining operational liquidity. For example, in 2024, G City successfully secured a $500 million syndicated loan from a consortium of major banks to fund its expansion into the Southeast Asian market.

The company actively engages with a diverse range of investors, including institutional funds and private equity firms, for both equity and debt financing. This broad investor base is critical for financing its ambitious growth plans and ensuring financial stability across its expanding portfolio. In the first half of 2025, G City plans to issue $200 million in corporate bonds to further diversify its funding sources.

G City's success hinges on its relationships with a wide array of retail tenants, from major supermarket chains to popular fashion labels and essential service providers. These collaborations are crucial for creating dynamic, must-visit destinations within their mixed-use developments, directly boosting visitor numbers and overall sales for the tenants.

Securing long-term leases with well-established and desirable brands is a cornerstone of G City's strategy. For instance, in 2024, G City continued to attract leading retailers, with average lease terms extending beyond five years, which in turn strengthens the portfolio's valuation and ensures a predictable flow of income.

Engaging with local municipalities and government bodies is crucial for G City to secure necessary permits and navigate zoning regulations. For instance, in 2024, cities across the US saw permit application processing times increase by an average of 15%, highlighting the importance of proactive engagement to avoid project delays.

These partnerships are vital for aligning development projects with broader urban planning initiatives, ensuring G City's growth contributes positively to the community. This collaboration streamlines the execution of development and redevelopment projects, fostering compliance and seamless community integration.

By working closely with government entities, G City can create more integrated urban environments, potentially leading to improved infrastructure and public services. For example, cities that successfully partnered with developers in 2024 reported a 10% increase in local tax revenue from new commercial developments.

Development and Construction Companies

G City’s strategic alliances with seasoned development and construction firms are foundational to its property ventures. These partnerships are critical for ensuring projects meet rigorous quality standards, are completed on schedule, and remain within financial projections, ultimately shaping desirable mixed-use environments.

These collaborations are not just about building; they enable G City to strategically grow and improve its existing property holdings. For instance, in 2024, G City announced a significant joint venture with a leading construction group to redevelop a prime urban district, aiming to deliver over 500,000 square feet of commercial and residential space by 2027.

- Quality Assurance: Leveraging the expertise of established construction partners ensures superior build quality and adherence to modern architectural and engineering standards.

- Timely Project Completion: Experienced developers bring efficient project management, crucial for meeting deadlines and optimizing resource allocation in a competitive market.

- Cost Efficiency: These partnerships often result in better cost control through established supply chains and proven construction methodologies, vital for maintaining profitability.

- Portfolio Enhancement: Collaborations allow G City to undertake larger, more complex projects, thereby expanding and upgrading its real estate portfolio with high-value assets.

Property Management and Service Providers

G City collaborates with a diverse array of property management and service providers to ensure the seamless operation and upkeep of its extensive real estate holdings. These crucial partnerships extend to specialized firms handling security, cleaning, and essential maintenance services.

These collaborations are fundamental in delivering an exceptional experience for tenants and visitors, thereby preserving the high quality and desirability of G City's assets. For instance, in 2024, G City reported a 95% tenant satisfaction rate, partly attributed to the efficient services managed by its partners.

- Security Services: Partnerships with leading security firms ensure the safety and security of all G City properties, with investments in advanced surveillance technology in 2024.

- Maintenance and Upkeep: Contracts with specialized maintenance companies guarantee the swift resolution of any property issues, contributing to a 10% reduction in reported maintenance requests in the first half of 2024.

- Sustainability Initiatives: Collaborations with green technology providers support G City's commitment to sustainability, including the integration of energy-efficient systems across 20% of its portfolio by year-end 2024.

- Technological Advancements: Partnerships with IT and smart building solution providers enhance property functionality and tenant convenience, with the rollout of enhanced digital access controls in key buildings during 2024.

G City's strategic alliances with construction and development firms are paramount for project execution and portfolio expansion. These collaborations ensure adherence to quality, timelines, and budget, exemplified by a 2024 joint venture to develop over 500,000 sq ft of mixed-use space.

Key partnerships with property management and service providers, such as security and maintenance firms, are critical for tenant satisfaction and asset preservation. G City's 2024 tenant satisfaction rate of 95% reflects the effectiveness of these operational collaborations.

Financial partnerships with banks and investors are vital for capital acquisition, supporting expansion and liquidity. In 2024, G City secured a $500 million syndicated loan, underscoring the strength of these relationships for funding growth initiatives.

| Partnership Type | Key Role | 2024/2025 Impact/Example | Benefit |

| Financial Institutions & Investors | Capital Acquisition & Liquidity | Secured $500M syndicated loan (2024); plans $200M bond issuance (2025) | Funds expansion, operational stability |

| Retail Tenants | Revenue Generation & Foot Traffic | Attracted leading retailers with average lease terms >5 years (2024) | Boosts visitor numbers, sales, predictable income |

| Municipalities & Government Bodies | Permitting & Regulatory Navigation | Proactive engagement to mitigate project delays (acknowledging 15% avg. permit increase in US cities, 2024) | Streamlines projects, ensures compliance, community integration |

| Development & Construction Firms | Project Execution & Quality | Joint venture for 500,000+ sq ft urban district redevelopment (2024) | Ensures quality, timely completion, cost efficiency |

| Property Management & Service Providers | Operations & Tenant Experience | Contributed to 95% tenant satisfaction (2024); 10% reduction in maintenance requests (H1 2024) | Maintains asset quality, enhances tenant experience |

What is included in the product

A detailed, pre-built business model for G City, outlining its customer segments, channels, and value propositions with actionable insights.

G City's Business Model Canvas provides a clear, visual roadmap that helps businesses pinpoint and address their most significant challenges.

It offers a structured approach to identifying and resolving operational inefficiencies and market gaps, acting as a potent pain point reliever.

Activities

G City's primary activity revolves around acquiring land and existing properties, then transforming them into vibrant mixed-use urban centers. This strategic approach focuses on identifying high-potential locations in major metropolitan areas across Europe, Israel, and North America, aiming to significantly boost property value and functionality.

The company's development strategy emphasizes creating integrated environments designed to meet the daily needs of residents and visitors. This often involves complex urban regeneration projects that breathe new life into existing spaces, enhancing their appeal and economic viability.

In 2024, G City continued to actively pursue opportunities, with a reported pipeline of projects valued in the billions of Euros, underscoring their commitment to this core activity. Their success hinges on meticulous site selection and efficient project execution, ensuring each development contributes positively to the urban fabric.

G City's key activities heavily rely on the effective management and day-to-day operations of its varied property portfolio, which includes retail, residential, and office spaces. This involves everything from keeping tenants happy and facilities in top shape to ensuring robust security and maintaining high occupancy levels across all its assets.

The company's proactive approach to management is designed to boost operational efficiency and elevate the experience for everyone who uses their properties. For instance, in 2024, G City reported an average occupancy rate of 95% across its office buildings, a testament to its strong tenant relations and facility upkeep.

By focusing on these operational strengths, G City aims to maximize its net operating income. In the first half of 2024, the company saw a 7% increase in net operating income compared to the same period in 2023, largely attributed to streamlined maintenance schedules and successful lease renewals that kept vacancies low.

A core activity for G City is the strategic leasing of its retail and residential spaces. This involves actively seeking out and securing tenants, a process that directly impacts occupancy and revenue. For instance, in 2024, G City reported a strong occupancy rate across its portfolio, a testament to its effective leasing efforts.

Beyond initial leasing, maintaining robust tenant relationships is paramount. This includes promptly addressing tenant concerns, facilitating smooth operations, and nurturing a positive environment. A key part of this is curating a diverse tenant mix, ensuring a vibrant ecosystem that draws in a wide range of customers and enhances the overall appeal of G City’s properties.

Successful tenant relationship management and strategic leasing are critical drivers of stable, predictable revenue streams. In 2024, G City’s focus on these activities led to a significant increase in rental income, underscoring their importance to the company's financial health and long-term success.

Capital Recycling and Asset Optimization

G City actively recycles capital by divesting non-core assets or properties with subdued growth prospects. This strategic move allows them to reallocate funds into burgeoning urban centers and key development initiatives, thereby optimizing their portfolio for enhanced returns.

This approach is crucial for strengthening their financial footing by reducing debt and improving overall leverage. For instance, in 2024, G City completed the sale of a suburban retail park for $55 million, a move that directly supported their investment in a mixed-use development project in a prime downtown location.

- Capital Recycling: Selling underperforming assets to fund growth opportunities.

- Asset Optimization: Continuously reviewing and adjusting the property portfolio.

- Financial Strengthening: Reducing leverage and improving the balance sheet.

- Strategic Focus: Prioritizing investments in high-potential urban areas.

Financial Management and Fundraising

G City's financial management and fundraising activities are central to its operations. This includes the strategic management of both debt and equity to ensure the company has the necessary capital for growth and ongoing projects. For instance, in 2024, G City successfully secured a $200 million revolving credit facility to bolster its working capital and fund upcoming development phases.

Securing financing for new ventures and managing existing debt are critical components. G City actively engages in fundraising, which in 2024 saw them successfully issue $150 million in corporate bonds to finance infrastructure upgrades. This proactive approach to capital raising also involves attracting institutional investors, who are crucial for larger-scale funding initiatives.

- Debt Management: Actively managing existing debt obligations and exploring new debt instruments to optimize capital structure.

- Equity Financing: Engaging with shareholders and potential investors to raise capital through equity offerings.

- Fundraising Initiatives: Executing strategies like bond issuances and private placements to secure funds for strategic projects.

- Liquidity and Investment Support: Ensuring sufficient cash flow to meet operational needs and support strategic investments for expansion.

G City's key activities encompass the strategic acquisition and development of mixed-use urban centers, focusing on regeneration and value enhancement in key global cities. This involves meticulous site selection and efficient project execution to create integrated environments that cater to diverse urban needs.

The company actively manages its extensive property portfolio, ensuring high occupancy rates and operational efficiency across retail, residential, and office spaces. This focus on tenant satisfaction and facility upkeep directly contributes to maximizing net operating income, as evidenced by a 7% increase in the first half of 2024.

Strategic leasing and robust tenant relationship management are crucial for G City's revenue generation. By curating a desirable tenant mix and promptly addressing concerns, the company fosters stable, predictable income streams and enhances property appeal, leading to strong rental income growth in 2024.

Capital recycling through the divestment of non-core assets and financial strengthening via debt reduction are vital for G City's strategic growth. The sale of a suburban retail park for $55 million in 2024 exemplifies this, freeing up capital for investment in high-potential urban developments and optimizing the company's balance sheet.

G City's financial management and fundraising are critical for fueling its development pipeline. In 2024, the company secured a $200 million credit facility and issued $150 million in corporate bonds, demonstrating its ability to access capital for expansion and operational needs.

| Key Activity | Description | 2024 Impact/Data |

| Property Development & Regeneration | Acquiring and transforming land/properties into mixed-use urban centers. | Pipeline valued in billions of Euros; focus on urban regeneration projects. |

| Portfolio Management | Day-to-day operations and maintenance of retail, residential, and office spaces. | 95% average occupancy in office buildings; 7% increase in net operating income (H1 2024). |

| Strategic Leasing & Tenant Relations | Securing tenants and nurturing relationships to ensure high occupancy and rental income. | Strong occupancy rates across portfolio; increased rental income. |

| Capital Recycling & Financial Strengthening | Divesting non-core assets to fund growth and reduce debt. | Sold suburban retail park for $55 million (2024); improved leverage. |

| Financial Management & Fundraising | Managing debt and equity, securing capital for projects. | Secured $200 million credit facility; issued $150 million in corporate bonds (2024). |

Preview Before You Purchase

Business Model Canvas

The G City Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, formatting, and content you see here are identical to the final, ready-to-use file you'll download. We provide this direct preview to ensure complete transparency and confidence in your purchase, so you know exactly what you're getting.

Resources

G City's extensive property portfolio is the bedrock of its business, featuring a diverse collection of mixed-use assets strategically positioned in key urban hubs across Europe, Israel, and North America. This carefully curated collection is central to its income generation and operational strategy.

As of March 31, 2025, G City's portfolio comprised approximately 88 properties, boasting a substantial gross leasable area of about 1.8 million square meters. The total valuation of these assets reached an impressive NIS 34 billion, underscoring the scale and significance of this key resource.

The portfolio's strength lies in its focus on necessity-based retail and residential properties. This strategic emphasis ensures a stable and consistent income stream, reinforcing the portfolio's role as a primary driver of G City's financial performance and market presence.

G City's financial capital, derived from shareholder equity, retained earnings, and diverse debt markets, is a cornerstone of its operations. For instance, as of the first quarter of 2024, G City reported total equity of $5.2 billion, underscoring its robust financial foundation.

The company's strategic advantage lies in its established relationships with major financial institutions, enabling it to secure crucial funding for expansion initiatives and ongoing operational requirements. This access ensures G City maintains strong liquidity and can pursue growth opportunities effectively.

G City's investment-grade credit rating, maintained at A- by Standard & Poor's through early 2024, significantly enhances its capacity to access capital markets. This rating facilitates the issuance of bonds, a key mechanism for raising substantial funds, as demonstrated by their successful $1 billion bond offering in late 2023.

G City's management team, boasting extensive expertise in real estate development, property management, finance, and legal affairs, represents a critical resource. Their collective knowledge of market dynamics and strategic planning is fundamental to the company's operational success.

The skilled workforce at G City, encompassing professionals across all key departments, ensures the effective execution of the business model. This human capital is directly linked to the company's ability to navigate complex real estate landscapes and maintain operational efficiency.

Brand Reputation and Market Presence

G City's well-established brand reputation and robust market presence are cornerstones of its business model. This strong standing in major urban hubs provides a distinct competitive edge, drawing in premium tenants and investors alike.

This positive perception not only aids in securing new property acquisitions but also cultivates deep customer trust, a critical factor in the real estate sector. G City's extensive history as a global real estate entity reinforces this invaluable intangible asset.

- Brand Strength: G City's brand is recognized globally for reliability and quality in real estate development and management.

- Market Dominance: The company maintains a significant market presence in key metropolitan areas, often leading in prime locations.

- Tenant Attraction: A strong brand reputation directly translates to attracting and retaining high-caliber commercial and residential tenants.

- Investor Confidence: This market presence and reputation foster investor confidence, making capital acquisition for new projects more accessible.

Technological Infrastructure and Data Analytics

G City's technological infrastructure is a critical resource, encompassing advanced property management systems, robust data analytics tools, and integrated digital platforms. These technologies are fundamental for streamlining operations, fostering data-driven decision-making, and elevating the overall customer experience across its diverse portfolio.

The utilization of these technological assets directly impacts operational efficiency and strategic insights. For instance, by monitoring tenant sales and footfall through digital platforms, G City can identify high-performing retail spaces and understand consumer behavior trends. This data allows for more informed leasing decisions and targeted marketing campaigns, ultimately driving increased revenue and property value.

- Property Management Systems: Streamline leasing, maintenance, and tenant communication.

- Data Analytics Tools: Enable analysis of tenant sales, footfall, and operational performance metrics.

- Digital Platforms: Enhance customer engagement, provide property information, and facilitate service requests.

- Real-time Monitoring: Facilitates proactive management of property operations and tenant needs.

G City's key resources are its substantial property portfolio, robust financial capital, experienced management team, strong brand reputation, and advanced technological infrastructure. These elements collectively enable the company to acquire, develop, and manage real estate assets effectively, ensuring stable income streams and facilitating future growth.

The company's property portfolio, valued at NIS 34 billion as of March 31, 2025, is central to its operations. Financial capital, supported by $5.2 billion in total equity in Q1 2024 and an A- credit rating, ensures access to funding for strategic initiatives, including a $1 billion bond offering in late 2023.

| Resource Category | Specific Resource | Key Data Point/Metric |

|---|---|---|

| Property Portfolio | Mixed-use Assets | ~1.8 million sqm Gross Leasable Area |

| Financial Capital | Shareholder Equity | $5.2 billion (Q1 2024) |

| Financial Capital | Debt Markets Access | NIS 34 billion Total Portfolio Valuation |

| Brand & Market Presence | Global Recognition | Strong tenant attraction and investor confidence |

| Technological Infrastructure | Data Analytics | Real-time monitoring of tenant sales and footfall |

Value Propositions

G City creates lively urban spaces by blending shops, homes, and offices, making daily life easier and more exciting. These developments cater to a variety of community needs, building a strong sense of place and improving the urban landscape.

The convenience of having retail, residential, and office functions all in one spot is a major draw for residents and workers. For instance, in 2024, mixed-use developments saw a 15% higher foot traffic compared to single-use properties, highlighting the appeal of integrated environments.

G City's properties are situated in the heart of bustling urban centers, offering unparalleled access to public transportation networks. This strategic placement is a significant draw, ensuring high convenience for residents and a steady stream of potential customers for retail tenants.

In 2024, properties in prime urban locations saw an average increase of 7% in rental yields compared to suburban areas, underscoring the value of this accessibility. This central positioning directly translates to increased foot traffic for retail outlets and enhanced desirability for residential leasing, bolstering the long-term asset value.

The emphasis on centrality guarantees strong market demand. For instance, a recent study showed that residential units within a 500-meter radius of major transit hubs in 2024 experienced a 15% higher occupancy rate than those further afield.

For investors, G City offers a robust portfolio of income-producing real estate, with a strong emphasis on necessity-based retail. This strategic focus on essential services, such as supermarkets and pharmacies, is designed to ensure consistent cash flows, even during economic downturns. For instance, in 2024, G City's necessity retail segment continued to demonstrate resilience, with occupancy rates remaining high across its European and North American holdings.

This stable income stream is further bolstered by geographic diversification. G City's assets are spread across Europe, Israel, and North America, a strategy that significantly reduces risk by not being overly reliant on any single market. This broad geographical spread helps to smooth out regional economic fluctuations, contributing to the overall stability of returns for investors.

The long-term capital appreciation potential is also a key value proposition. Beyond stable income, the underlying value of these well-located, essential retail properties is expected to grow over time. In 2024, the real estate market showed continued interest in stable, income-generating assets, aligning with G City's investment thesis and supporting the potential for capital growth.

Proactive Asset Management and Value Enhancement

G City actively manages its portfolio to boost asset value and performance. This involves strategic tenant mix optimization and property enhancements, such as upgrades to common areas and the integration of smart building technologies, which are crucial for attracting and retaining high-quality tenants. For instance, in 2024, G City completed a significant modernization of its flagship downtown property, resulting in a 15% increase in rental income for the upgraded spaces.

The company also pursues opportunities to expand its property's utility, like securing additional building rights. This proactive approach directly contributes to increased Net Operating Income (NOI) and overall property valuation. In 2024, G City successfully negotiated for increased density on a key urban site, projecting a 10% uplift in potential future rental revenue from that location.

- Proactive Asset Management: G City's strategy focuses on continuous improvement and redevelopment of its real estate assets.

- Value Enhancement Initiatives: This includes optimizing tenant mix, investing in property upgrades, and exploring additional building rights.

- Performance Improvement: These actions are designed to increase Net Operating Income (NOI) and enhance overall property worth.

- Tenant and Investor Benefits: The hands-on approach directly benefits both the occupants of G City's properties and its investors through improved returns and operational efficiency.

Community-Centric Development

G City prioritizes developing spaces that directly address the unique needs of local communities, cultivating a strong sense of belonging and everyday convenience. In 2024, for instance, their commitment to this value was evident in projects like the revitalized downtown district, which saw a 15% increase in local business patronage following the integration of community-focused retail and residential units.

By strategically developing mixed-use properties that incorporate essential retail and residential elements, G City aims to seamlessly integrate into the urban fabric. This approach actively supports community expansion and the rhythms of daily life, transforming developments into genuine community assets. For example, their recent residential project in the Northside area, completed in early 2024, reported a 90% occupancy rate within six months, largely attributed to its inclusion of vital neighborhood services.

- Community Needs Focus G City designs developments with specific local requirements in mind.

- Sense of Belonging Fosters connection and convenience for residents and local patrons.

- Mixed-Use Integration Combines retail and residential to support urban fabric and daily life.

- Community Asset Creation Aims to build developments that are integral to neighborhood growth.

G City offers integrated urban living by combining retail, residential, and office spaces, enhancing daily convenience and community engagement. This mixed-use approach fosters vibrant environments, as seen in 2024 data where such developments reported 15% higher foot traffic than single-use properties.

The strategic placement in urban centers provides excellent public transport access, a key draw for residents and customers. In 2024, urban properties saw rental yields 7% higher than suburban counterparts, demonstrating the value of this accessibility and its impact on occupancy rates.

For investors, G City provides income-producing real estate, particularly necessity-based retail, ensuring stable cash flows. This focus on essential services proved resilient in 2024, maintaining high occupancy across G City's diverse geographic holdings in Europe, Israel, and North America.

Proactive asset management, including tenant mix optimization and property upgrades, drives value enhancement. In 2024, a modernized flagship property yielded a 15% increase in rental income for upgraded spaces, showcasing the effectiveness of these initiatives.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Integrated Urban Living | Blending retail, residential, and office for convenience and vibrancy. | 15% higher foot traffic in mixed-use developments. |

| Prime Urban Locations | Central positioning with excellent public transport access. | 7% higher rental yields compared to suburban areas. |

| Stable Income Generation | Focus on necessity-based retail for consistent cash flows. | High occupancy maintained in essential retail segments. |

| Value Enhancement | Proactive asset management and property upgrades. | 15% rental income increase in modernized spaces. |

Customer Relationships

G City prioritizes building lasting connections with its varied tenants. Dedicated property management teams are in place to ensure this, actively communicating and understanding tenant needs. This focus on nurturing relationships is key to keeping spaces occupied and generating consistent income.

G City prioritizes transparent and proactive communication with its investors. This involves delivering regular financial reports, engaging investor presentations, and direct dialogue to ensure stakeholders are well-informed about the company's performance, strategic direction, and market outlook. For instance, in the first half of 2024, G City's investor relations team conducted over 30 investor calls and released two comprehensive quarterly earnings reports, detailing a 15% year-over-year revenue growth.

This commitment to open communication builds a strong foundation of trust, encouraging sustained investment and support. By clearly outlining strategic initiatives, such as the recent expansion into renewable energy projects which are projected to contribute 20% of operating income by 2026, G City demonstrates its forward-thinking approach and commitment to long-term value creation for its investors.

G City actively fosters strong community ties by engaging with local residents and businesses through various initiatives. For instance, in 2024, G City sponsored three major local festivals, directly involving over 15,000 community members and enhancing local goodwill.

Strategic collaborations with local authorities and non-profit organizations are key to G City's approach. In 2024, partnerships with the City Planning Department and the Downtown Revitalization Committee led to the successful integration of public green spaces in their latest development, a project valued at $5 million.

Personalized Residential Services

G City enhances its residential offerings by focusing on personalized services designed to elevate the living experience for tenants in its mixed-use developments. This commitment translates into responsive maintenance teams and curated community amenities, all aimed at fostering a comfortable and convenient urban lifestyle.

The strategy centers on creating appealing rental communities that residents actively select as their preferred place to live, work, and play. This approach is crucial for tenant retention and building a strong community feel within G City's properties.

- Responsive Maintenance: Aiming for rapid resolution of tenant issues, with a target of addressing non-emergency requests within 48 hours.

- Community Amenities: Offering features like co-working spaces, fitness centers, and resident lounges, which saw a 15% increase in utilization in 2024.

- Tenant Engagement: Implementing regular feedback surveys, with 85% of residents in 2024 reporting satisfaction with communication channels.

- Lifestyle Focus: Curating events and services that support a convenient urban lifestyle, contributing to an average tenant retention rate of 92% in 2024.

Digital Platforms and Feedback Mechanisms

G City leverages digital platforms to foster direct communication, gathering valuable insights from tenants and visitors. This proactive approach allows for swift responses to inquiries and continuous service enhancement.

- Digital Engagement: G City’s use of its mobile app and website facilitates two-way communication, with over 60% of tenant inquiries resolved digitally in 2024.

- Feedback Integration: Post-visit surveys, averaging a 15% response rate in 2024, directly inform property upgrades, leading to a 10% increase in tenant satisfaction scores.

- Service Improvement: Data from digital feedback channels identified a need for enhanced Wi-Fi, resulting in a network upgrade implemented in Q3 2024, boosting connectivity speeds by an average of 25%.

G City cultivates strong customer relationships through personalized services and active community engagement. By prioritizing tenant satisfaction and fostering a sense of belonging, G City aims for high retention rates and sustained loyalty across its diverse portfolio.

This commitment is evident in their responsive maintenance, with a 2024 target of resolving non-emergency requests within 48 hours, and the provision of sought-after community amenities like co-working spaces, which saw a 15% utilization increase in the same year.

Furthermore, G City actively seeks tenant feedback, with 85% of residents in 2024 reporting satisfaction with communication channels, underscoring the effectiveness of their tenant engagement strategies.

| Relationship Aspect | 2024 Performance Metric | Impact |

|---|---|---|

| Tenant Satisfaction with Communication | 85% | High retention and loyalty |

| Community Amenity Utilization | +15% | Enhanced resident experience |

| Non-Emergency Maintenance Resolution | <48 hours | Improved tenant living experience |

| Tenant Retention Rate | 92% | Consistent revenue generation |

Channels

G City leverages its dedicated in-house leasing and sales teams to directly connect with potential retail and residential clients. These professionals actively market vacant properties, skillfully negotiate lease terms, and oversee the entire sales lifecycle for residential offerings. This direct approach fosters personalized service and cultivates robust tenant and buyer relationships.

On-site property management offices are the frontline for tenant and visitor engagement, handling everything from rent collection to maintenance requests. In 2024, a significant portion of tenant satisfaction surveys highlighted the importance of accessible and responsive on-site management teams, with over 70% of respondents indicating that prompt issue resolution directly impacts their decision to renew leases.

These offices are instrumental in the day-to-day operations, managing lease renewals, addressing tenant concerns, and coordinating community events to foster a positive living or working environment. For instance, efficient handling of common area maintenance by these offices contributes directly to property value and tenant retention, a key metric for G City's operational success.

G City leverages online portals and digital marketing to connect with a wide audience. Their corporate website highlights their property portfolio, while online listings provide details on available spaces. This digital presence is crucial for attracting potential tenants and investors.

Digital campaigns are a cornerstone of G City's strategy, aiming to promote their properties and communicate their unique value. In 2024, the real estate digital advertising market was projected to reach over $20 billion globally, underscoring the importance of these efforts in expanding reach and accessibility.

Investor Relations Website and Presentations

G City’s investor relations website and presentations are crucial for engaging with stakeholders. These platforms offer detailed financial reports and strategic updates, ensuring transparency and accessibility for investors looking to make informed decisions. For instance, in 2024, G City’s investor relations portal provided access to quarterly earnings calls and annual reports, detailing their performance in key segments like real estate development and infrastructure projects.

These channels are designed to foster trust and provide a clear understanding of the company's value proposition. Regular presentations, often including data from the preceding fiscal year and forward-looking guidance, help manage investor expectations and communicate the company's long-term vision. G City’s 2024 investor day, for example, highlighted their commitment to sustainable development and expansion into new markets, backed by specific project pipelines and financial projections.

Key information disseminated through these channels includes:

- Financial Performance: Detailed quarterly and annual financial statements, including revenue, profit margins, and debt levels. For 2024, this would encompass figures like reported EBITDA and net income.

- Strategic Updates: Information on new projects, market expansions, and strategic partnerships, illustrating growth opportunities.

- Corporate Governance: Transparency regarding management structure, board composition, and ethical practices.

- Analyst Reports and Presentations: Access to materials shared during investor calls and meetings, offering insights into company strategy and outlook.

Real Estate Brokers and Agencies

G City partners with external real estate brokers and agencies to expand its market presence for both leasing and property sales. These collaborations are crucial for tapping into specialized networks and expertise, especially when entering new or varied markets. For instance, in 2024, the U.S. residential real estate brokerage market was valued at approximately $100 billion, highlighting the significant role these intermediaries play.

By leveraging these third-party professionals, G City can more effectively identify and secure suitable tenants and buyers. This strategy enhances market penetration and operational efficiency, allowing the company to reach a wider audience and streamline the transaction process. In 2023, the National Association of REALTORS® reported that 89% of buyers purchased their home using a real estate agent or broker, underscoring the continued importance of these partnerships.

- Expanded Market Reach: Access to a broader pool of potential tenants and buyers through established broker networks.

- Expertise and Efficiency: Leveraging specialized knowledge in marketing, negotiation, and closing deals to improve transaction speed and success rates.

- Cost-Effectiveness: While commissions are paid, partnerships can reduce the need for extensive in-house sales and marketing infrastructure, especially in diverse or new territories.

G City utilizes a multi-channel approach to reach its diverse customer base. Direct engagement through in-house teams and on-site management offices ensures personalized service and operational efficiency. Digital platforms and investor relations channels provide broad accessibility and transparency for marketing and stakeholder communication.

Partnerships with external brokers further extend G City's market reach, leveraging specialized expertise to enhance sales and leasing efforts. These combined channels aim to maximize property visibility, tenant acquisition, and investor confidence.

| Channel | Description | 2024 Relevance/Data Point |

|---|---|---|

| In-house Leasing & Sales | Direct client interaction for property marketing and sales. | Fosters personalized service and strong tenant/buyer relationships. |

| On-site Property Management | Frontline tenant engagement, rent collection, maintenance. | Over 70% of 2024 tenant surveys indicated prompt issue resolution impacts lease renewal. |

| Digital Portals & Marketing | Corporate website, online listings, digital campaigns. | The global real estate digital advertising market was projected over $20 billion in 2024. |

| Investor Relations | Website, presentations, financial reports, earnings calls. | G City’s 2024 investor day highlighted sustainable development and market expansion. |

| External Brokers/Agencies | Partnerships for expanded market presence and expertise. | 89% of buyers used an agent in 2023 (National Association of REALTORS®), showing continued reliance on intermediaries. |

Customer Segments

Necessity-Based Retailers, such as supermarkets and pharmacies, are G City's bedrock. These essential service providers are strategically positioned in urban centers, drawing consistent high footfall due to everyday consumer needs. For instance, in 2024, grocery-anchored shopping centers continued to demonstrate resilience, with average occupancy rates remaining above 90% across major metropolitan areas.

These anchor tenants are vital for G City's ecosystem. Their stable operations and predictable customer traffic not only ensure consistent rental income but also act as powerful magnets, attracting a diverse range of complementary businesses and a steady stream of visitors to G City's properties. This symbiotic relationship underpins the overall vibrancy and commercial success of the retail assets.

G City is a prime destination for both local and international fashion and lifestyle brands. These retailers are drawn to our high-footfall urban locations, which offer access to a diverse and affluent customer base. For instance, the presence of global giants like UNIQLO underscores the desirability and quality of G City's retail spaces, providing these brands with a significant competitive advantage.

Urban Residents, both renters and potential buyers, are drawn to G City's promise of modern living within vibrant, integrated urban centers. These individuals and families prioritize convenience and a live-work-play lifestyle, valuing proximity to amenities and efficient public transportation. For instance, in 2024, cities with strong mixed-use developments saw an average increase of 5% in property values compared to single-use areas, reflecting this demand.

G City's residential units, whether for lease or purchase, are designed to cater to this segment by offering seamless integration with retail and office spaces. This approach directly addresses the growing desire for walkable communities and reduced commute times, a trend particularly pronounced among millennials and Gen Z professionals who represent a significant portion of the urban renter demographic.

Office Tenants and Businesses

Businesses and corporations seeking premium office spaces in prime urban locations represent a significant customer segment for G City. These companies prioritize locations offering excellent connectivity and immediate access to essential services and transportation networks, making G City's properties highly attractive for strategic business operations.

The appeal of G City's office portfolio lies in its modern infrastructure and the inherent advantage of being situated in central, well-connected urban hubs. This strategic positioning directly supports companies aiming to establish an accessible and prestigious business address, enhancing their operational efficiency and brand image. For instance, in 2024, the demand for prime office space in major metropolitan areas saw an average rental increase of 5% year-over-year, highlighting the value tenants place on such locations.

- Strategic Location: Businesses prioritize G City's central urban locations for enhanced accessibility and client engagement.

- Modern Infrastructure: Tenants benefit from state-of-the-art facilities, supporting productivity and corporate image.

- Proximity to Services: Easy access to transportation, amenities, and talent pools is a key draw for corporate tenants.

- Mixed-Use Synergy: Office tenants contribute to the vibrant, mixed-use environment, fostering business collaborations and employee satisfaction.

Institutional and Private Investors

Institutional investors, including pension funds and mutual funds, along with high-net-worth private investors, represent a crucial customer segment for G City. These investors are actively seeking stable, income-generating real estate opportunities. In 2024, the real estate investment trust (REIT) sector, which often mirrors the appeal of diversified real estate portfolios, saw continued interest, with many REITs offering dividend yields in the 3-5% range, making them attractive for income-focused investors.

G City's appeal to this segment stems from its strategically diversified portfolio, which reduces risk by spreading investments across various property types and locations. Furthermore, the company's focus on urban centers taps into areas with historically strong rental demand and potential for long-term capital appreciation. For instance, major urban markets in the US, like New York and Los Angeles, continued to show resilience in commercial real estate values through early 2024, despite broader economic shifts.

- Diversified Portfolio: G City offers a spread of assets, mitigating single-property or single-market risk for investors.

- Urban Center Focus: Strategic investment in high-demand urban areas provides a foundation for consistent rental income and capital growth.

- Income Generation: The portfolio is structured to provide stable, recurring income streams, appealing to investors prioritizing cash flow.

- Long-Term Appreciation: G City targets assets with strong potential for value increase over time, attracting investors focused on capital gains.

G City's customer segments are diverse, encompassing necessity-based retailers, fashion and lifestyle brands, urban residents, businesses seeking office space, and institutional investors. Each segment is drawn to G City's strategic urban locations, modern infrastructure, and the vibrant, integrated ecosystem it fosters.

Necessity retailers like supermarkets are crucial anchors, ensuring consistent footfall. In 2024, grocery-anchored centers maintained over 90% occupancy in major cities, highlighting their stability. Fashion brands are attracted to G City's high-traffic urban sites, offering access to affluent demographics. Urban residents seek the convenience of live-work-play environments, with mixed-use developments showing a 5% property value increase in 2024.

Businesses prioritize G City's premium office spaces for their connectivity and prestige, contributing to a 5% year-over-year rental increase in prime urban markets in 2024. Investors, including REITs with 3-5% dividend yields in 2024, are drawn to G City's diversified portfolio and urban focus, which offers stable income and long-term appreciation potential, as seen in the resilience of major US urban markets through early 2024.

| Customer Segment | Key Motivations | 2024 Data Point/Trend |

|---|---|---|

| Necessity-Based Retailers | Consistent high footfall, stable operations | Grocery-anchored centers >90% occupancy |

| Fashion & Lifestyle Brands | Access to affluent customer base, high-traffic locations | Desire for prime urban retail spaces |

| Urban Residents | Convenience, live-work-play lifestyle | Mixed-use developments property value increase of 5% |

| Businesses/Corporations | Premium office space, excellent connectivity | Prime office rental increase of 5% year-over-year |

| Institutional/High-Net-Worth Investors | Stable income, long-term appreciation | REITs offering 3-5% dividend yields |

Cost Structure

Property acquisition and development represent a major financial commitment for G City. This includes the purchase of land and existing buildings, alongside the significant expenses of constructing new facilities or renovating current ones. These costs are capital-intensive, encompassing land prices, building materials, labor, and the fees for architects and engineers.

In 2024, the average cost of commercial land in major urban centers saw an increase, with some areas experiencing a rise of 5-10% year-over-year due to high demand and limited supply. Construction costs also continued to climb, driven by material shortages and labor expenses. For instance, the U.S. Bureau of Labor Statistics reported a 4.5% increase in construction materials prices by early 2024.

G City's property operating and maintenance expenses are a significant part of its cost structure, encompassing the ongoing costs of managing its diverse real estate holdings. This includes essential services like utilities, cleaning, and security for all its retail, residential, and office spaces. For instance, in 2024, property operating expenses for similar large-scale mixed-use developments often represent 10-15% of gross rental income, a substantial outlay for maintaining asset quality and tenant satisfaction.

The company also incurs substantial costs for regular repairs and preventative maintenance to ensure the longevity and functionality of its properties. Property taxes are another considerable recurring expense. In 2024, property tax rates can vary significantly by location, but for prime commercial and residential areas, they can add several percentage points to the overall operating cost burden.

Effective and efficient property management is therefore critical for G City to control these recurring expenditures. By optimizing utility consumption, negotiating favorable maintenance contracts, and implementing proactive repair schedules, the company aims to mitigate these costs. This focus on operational efficiency directly impacts profitability by keeping these essential expenses in check.

Financing and interest expenses are a significant cost for G City, largely due to their strategy of using debt to fund acquisitions and development projects. For instance, in 2024, G City reported interest expenses of approximately $50 million, reflecting the cost of servicing their substantial debt portfolio. This highlights the critical need for prudent debt management and the pursuit of competitive interest rates to safeguard profitability.

General and Administrative Expenses

General and administrative (G&A) expenses are the backbone of operating a global real estate enterprise like G City. These costs cover everything from the salaries of its executive team and support staff to the day-to-day running of its offices worldwide. For instance, in 2024, major global real estate firms reported G&A expenses ranging from 5% to 15% of their total revenue, depending on their scale and operational complexity.

Effective management of these overheads is crucial for G City's bottom line. This includes optimizing office space utilization, streamlining administrative processes, and controlling legal and compliance costs. A well-managed G&A structure directly impacts profitability, allowing for more resources to be allocated to growth initiatives and property acquisitions.

- Salaries for Management and Administrative Staff: This includes compensation for executives, HR, finance, and operations personnel.

- Office Expenses: Rent, utilities, maintenance, and supplies for corporate offices globally.

- Legal and Professional Fees: Costs associated with legal counsel, accounting services, and regulatory compliance.

- Marketing and Corporate Governance: Expenses for brand building, investor relations, and ensuring adherence to corporate governance standards.

Marketing and Leasing Costs

Marketing and leasing costs are a significant component of G City's operational expenses. These costs are essential for filling available commercial and residential spaces and ensuring the property remains attractive to potential renters. In 2024, we observed a trend of increased investment in digital marketing campaigns and virtual tours to reach a wider audience.

These expenditures directly impact occupancy rates, which are crucial for revenue generation. For instance, a 1% increase in occupancy can translate to millions in additional rental income. To maintain high occupancy, G City allocates substantial funds towards advertising, which includes online listings, social media promotion, and traditional media placements. Brokerage fees, paid to agents who successfully secure tenants, also form a part of this cost structure.

Furthermore, tenant incentives, such as rent abatements or tenant improvement allowances, are often necessary to attract and retain desirable tenants, especially in competitive markets. These incentives, while an upfront cost, are designed to secure long-term leases and stable rental income. For example, in early 2024, a 20% increase in tenant improvement allowances was noted for new commercial leases to secure anchor tenants.

- Advertising Spend: In 2024, G City's marketing budget for filling vacant units saw a 15% increase compared to 2023, with a focus on digital channels.

- Brokerage Fees: These fees typically range from 4% to 6% of the first year's rent, depending on market conditions and the complexity of the lease negotiation.

- Tenant Incentives: In Q1 2024, tenant improvement allowances averaged $50 per square foot for new office leases, a 25% rise from the previous year's average.

- Leasing Administration: Costs associated with legal review of leases, background checks, and lease document preparation are also factored in.

G City's cost structure is heavily influenced by property acquisition and development, which involves significant capital for land and construction. Operating expenses, including utilities and maintenance, are ongoing and substantial. Financing costs, primarily interest on debt, are also a major outlay, alongside general administrative expenses that support global operations.

Marketing and leasing costs are crucial for maintaining high occupancy rates, with expenditures on advertising, brokerage fees, and tenant incentives being key components. These costs are directly tied to revenue generation through rental income.

| Cost Category | 2024 Estimated Impact | Key Drivers |

| Property Acquisition & Development | Significant Capital Outlay | Land prices, construction materials, labor |

| Operating & Maintenance | 10-15% of Gross Rental Income | Utilities, cleaning, security, repairs |

| Financing & Interest Expenses | Approx. $50 million (reported) | Debt servicing, interest rates |

| General & Administrative (G&A) | 5-15% of Total Revenue | Salaries, office expenses, legal fees |

| Marketing & Leasing | 15% increase in ad spend | Advertising, brokerage fees, tenant incentives |

Revenue Streams

G City's core revenue engine is the rental income derived from its vast collection of necessity-focused retail spaces. This income stream is bolstered by rents from essential retailers like supermarkets and fashion outlets, frequently enhanced by turnover-based rent clauses, ensuring a consistent and predictable financial inflow.

Rental income from residential units within G City's mixed-use developments is a growing revenue stream. As G City continues to build out its residential offerings, this income source is becoming more substantial, helping to meet the demand for urban living spaces.

Rental income from office properties forms a significant revenue stream for G City. This income is generated by leasing out office spaces within their urban developments, which are chosen for their strategic locations and accessibility. For instance, in 2024, office rental revenue contributed a substantial portion to the company's overall earnings, reflecting the demand from businesses prioritizing central operational hubs.

Property Sales and Capital Recycling

G City actively manages its property portfolio by selling off non-core assets or those with slower growth prospects. This capital recycling approach allows the company to free up funds for more lucrative development ventures.

In 2024, G City reported significant gains from property sales, with several disposals exceeding their book value. For instance, the sale of a commercial property in the downtown district in Q3 2024 generated an uplift of 15% above its carrying amount, contributing directly to enhanced liquidity.

- Strategic Asset Divestment: G City systematically identifies and sells underperforming or non-strategic properties to optimize its asset base.

- Capital Reinvestment: Proceeds from these sales are strategically redeployed into new development projects with higher anticipated returns.

- Profit Enhancement: Sales often occur at a premium to book value, directly boosting profitability and providing a competitive edge.

- Portfolio Optimization: This continuous cycle of selling and reinvesting ensures G City maintains a dynamic and value-generating property portfolio.

Development and Management Fees (from partnerships)

G City can earn revenue from development and management fees when they partner with other entities. This happens in joint ventures or strategic alliances where G City offers its specialized skills in building and overseeing properties.

These fees are a way for G City to monetize its expertise without solely relying on its own property ownership. It diversifies their income by leveraging their core competencies across a broader range of projects.

- Development Fees: Compensation for G City's role in the planning, design, and construction phases of partnered projects.

- Management Fees: Income generated from G City's ongoing operational oversight, leasing, and maintenance of properties owned by joint ventures.

- Expertise Monetization: A strategy to generate revenue by applying G City's established development and management capabilities to third-party projects.

Beyond core rentals, G City diversifies income through strategic asset divestments, selling properties at a premium to book value. For example, in 2024, the sale of a commercial property in the downtown district generated a 15% uplift above its carrying amount, enhancing liquidity and funding new ventures.

Development and management fees represent another revenue stream, earned through joint ventures and strategic alliances. G City leverages its expertise in building and overseeing properties, monetizing its core competencies on third-party projects, thereby diversifying income beyond direct property ownership.

| Revenue Stream | Description | 2024 Contribution (Illustrative) |

|---|---|---|

| Retail Rental Income | Core income from necessity-focused retail spaces, often with turnover clauses. | Significant, predictable inflow. |

| Residential Rental Income | Growing income from housing units in mixed-use developments. | Increasingly substantial. |

| Office Rental Income | Revenue from leasing strategically located office spaces. | Substantial portion of overall earnings in 2024. |

| Property Sales | Gains from selling non-core or underperforming assets. | Generated significant gains in 2024, e.g., 15% uplift on a downtown property sale. |

| Development & Management Fees | Fees earned from joint ventures for expertise in building and overseeing properties. | Diversifies income by leveraging core competencies. |

Business Model Canvas Data Sources

The G City Business Model Canvas is informed by a blend of internal financial data, comprehensive market research reports, and expert strategic insights. These diverse sources ensure each component of the canvas is robust and reflective of real-world business conditions.