FXCM, Inc. PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FXCM, Inc. Bundle

Gain a critical edge with our comprehensive PESTLE analysis of FXCM, Inc. Understand the intricate web of political stability, economic fluctuations, societal shifts, technological advancements, evolving environmental regulations, and legal frameworks impacting the forex brokerage. These external forces are not just trends; they are the bedrock of FXCM's strategic landscape. Download the full version now to unlock actionable intelligence that will empower your market strategy and forecast future opportunities.

Political factors

FXCM's operations are heavily influenced by the stability of political regimes and the predictability of regulatory environments in its primary markets. For instance, in 2024, the European Union continued to refine its MiFID II regulations, impacting how retail forex brokers operate and report client data, a factor FXCM must actively manage. Fluctuations in regulatory oversight can directly affect compliance costs and the ease of market access.

Geopolitical tensions, such as ongoing trade disputes or localized conflicts, can dramatically increase volatility in currency and commodity markets, which are the core of FXCM's business. For example, continued uncertainty surrounding global trade policies in late 2024 and early 2025 creates an environment where currency pairs can experience sharp, unpredictable movements, impacting trading volumes and client risk exposure.

FXCM's strategic response necessitates continuous monitoring of these global political shifts. By tracking developments like potential changes in central bank policies due to political pressures or the impact of international sanctions on specific currencies, FXCM can better adapt its trading strategies and refine its risk management protocols to navigate an ever-changing landscape.

Government intervention in financial markets is a significant political factor for FXCM. For instance, during periods of economic instability, governments might impose capital controls, as seen in some emerging markets in 2023 and early 2024 to prevent capital flight. Such measures can restrict the free flow of currency, directly impacting FXCM's trading volumes and liquidity.

Direct market interventions, like central banks buying or selling their own currency to influence exchange rates, also pose challenges. In 2024, the Bank of Japan has been observed intervening in currency markets to support the Yen, a move that can lead to increased volatility and affect the pricing of currency pairs FXCM offers.

Currency pegging, where a country fixes its exchange rate to another currency, can also limit opportunities for FX traders. While major economies generally allow currencies to float, smaller economies may still utilize pegging, altering the trading landscape for FXCM.

FXCM must closely monitor these government actions, as they can directly influence their ability to provide tight spreads and ensure efficient trade execution for their clients. For example, a sudden imposition of capital controls could halt trading in a specific currency pair, impacting revenue streams.

Shifting international trade dynamics, such as the recent updates to the EU-UK Trade and Cooperation Agreement or potential new trade pacts emerging in 2024-2025, directly impact currency valuations. For instance, a strengthening trade relationship could boost a nation's currency, creating opportunities for FXCM clients. Conversely, new tariffs or trade disputes can introduce volatility and risk.

Economic sanctions imposed by major economies, like those seen in recent geopolitical events, can drastically reroute global capital flows and affect commodity prices, which are closely tied to currency markets. FXCM must monitor these sanctions closely, as they can create trading imbalances and influence demand for certain currency pairs, potentially impacting client trading strategies and the company's risk exposure.

The company's strategic planning must incorporate the potential impact of evolving trade policies and sanctions. For example, if a significant trading bloc imposes new restrictions, FXCM needs to analyze how this will affect liquidity in affected currency markets and adjust its product offerings or risk management protocols accordingly to support its diverse client base, from individual traders to institutional investors.

Taxation Policies on Financial Transactions

Government decisions on taxes directly impact FXCM's bottom line and client trading incentives. For example, changes to capital gains tax rates can significantly alter how profitable trading is for FXCM's clientele, influencing their overall activity levels on the platform.

Higher taxes on financial transactions, such as stamp duties or financial transaction taxes (FTTs), could deter trading volume. Conversely, supportive tax environments can stimulate market participation. For instance, the UK's stamp duty reserve tax on share purchases, while not directly on FX, sets a precedent for how such levies can impact trading costs.

FXCM must meticulously incorporate these evolving tax policies into its financial forecasts and strategic pricing models. This ensures the company remains competitive and can accurately project revenue streams amidst varying fiscal landscapes. The firm’s ability to adapt its fee structures or service offerings in response to tax changes is crucial for sustained profitability.

Key considerations for FXCM regarding taxation policies include:

- Impact of capital gains taxes on client trading volumes and retention rates.

- Potential effects of financial transaction taxes on overall market liquidity and FXCM's revenue from spreads and commissions.

- The influence of corporate tax rates on FXCM's net profit margins and reinvestment capabilities.

- How differential tax treatments across jurisdictions affect FXCM's global operational strategy and client acquisition efforts.

Political Influence on Central Bank Policies

The degree of political independence a central bank possesses significantly shapes its monetary policy. For instance, in 2024, the European Central Bank (ECB) maintained its independence amidst political debates regarding inflation control, directly impacting Eurozone interest rates and, consequently, currency valuations. This independence allows central banks to focus on price stability rather than short-term political gains.

Political pressure can inject considerable volatility into currency markets. In mid-2024, some emerging market central banks faced intense pressure from their governments to lower interest rates to boost economic growth, despite rising inflation. This divergence from inflation-targeting mandates created significant currency fluctuations, a dynamic FXCM closely tracks to inform its clients.

FXCM, Inc. actively monitors how political factors influence central bank actions. By analyzing government mandates and political discourse surrounding monetary policy, FXCM aims to provide clients with foresight into potential interest rate changes and inflation trends.

- 2024: Emerging market central banks, under political pressure, sometimes prioritized growth over inflation control, leading to currency volatility.

- 2024: The ECB's continued independence was a key factor in its interest rate decisions, influencing the Euro's stability.

- Market Insight: Political interference can lead to unexpected policy shifts, impacting currency pairs.

Government stability and regulatory clarity are paramount for FXCM, directly impacting operational costs and market access. For example, in 2024, the EU's ongoing MiFID II refinements required FXCM to adapt reporting protocols, highlighting the direct link between regulatory evolution and compliance demands.

Geopolitical events and trade disputes, such as those surrounding global trade policies in late 2024 and early 2025, significantly increase currency market volatility. This heightened unpredictability affects FXCM's trading volumes and client risk management.

Government intervention, including capital controls or direct currency market operations by central banks like the Bank of Japan in 2024 to support the Yen, can disrupt trading liquidity and affect pricing for FXCM clients.

Shifting trade dynamics and economic sanctions, as observed throughout 2023-2025, directly influence currency valuations and capital flows, necessitating FXCM's continuous monitoring to manage risk and client strategies.

What is included in the product

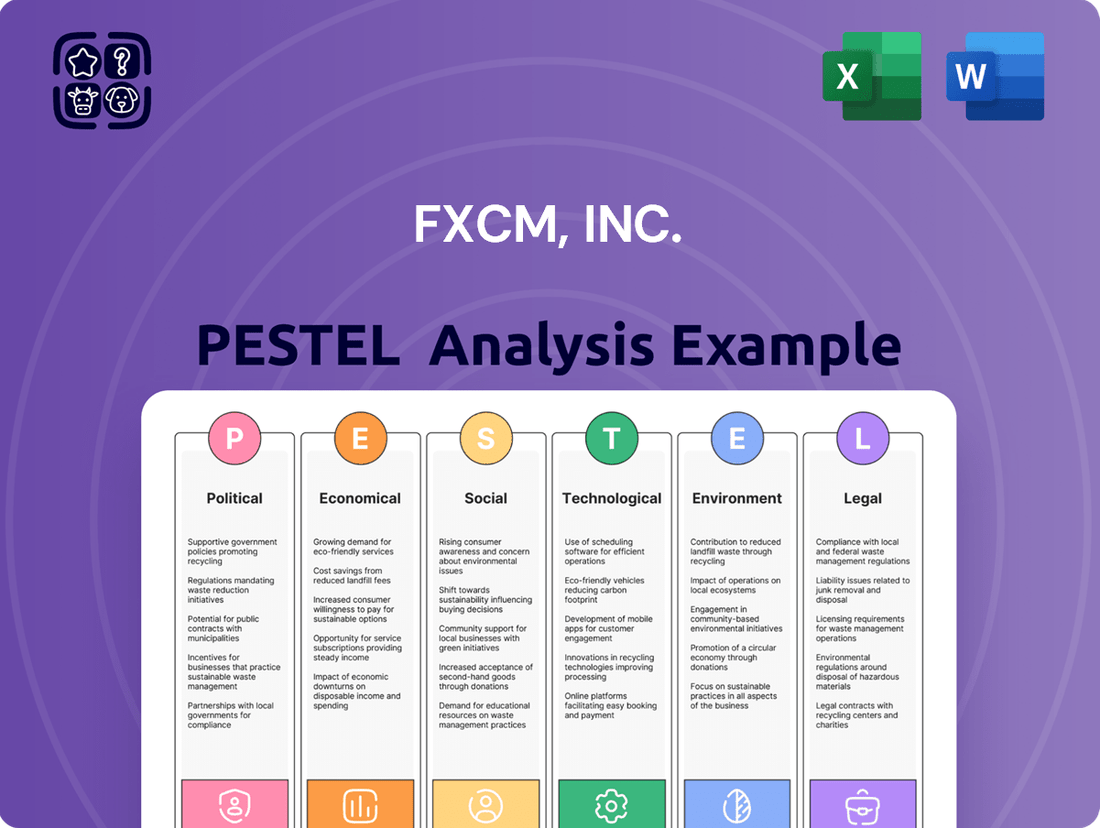

This PESTLE analysis examines the external macro-environmental factors impacting FXCM, Inc. across Political, Economic, Social, Technological, Environmental, and Legal dimensions, providing actionable insights for strategic decision-making.

This FXCM PESTLE analysis offers a concise, easily digestible summary of external factors, serving as a crucial pain point reliever by streamlining complex market dynamics for quick referencing and informed decision-making during strategy sessions.

Economic factors

The global economic landscape in 2024 and early 2025 presents a mixed picture, with varying GDP growth forecasts impacting investor sentiment. While some regions anticipate moderate expansion, others face heightened recession risks. For instance, the International Monetary Fund's projections for 2024 suggest global growth around 3.2%, a slight slowdown from previous years, but with significant regional disparities.

These economic conditions directly shape trading activity. Stronger growth environments often correlate with increased client engagement and potentially higher trading volumes as individuals and institutions feel more confident deploying capital. Conversely, a global economic slowdown or recessionary pressures can lead to a more cautious approach, with clients reducing speculative positions and prioritizing capital preservation, thereby impacting FXCM's trading volumes.

Data from late 2024 indicates a cautious optimism in some developed markets, yet persistent inflation and geopolitical uncertainties continue to fuel concerns about potential economic contractions. This environment necessitates adaptive strategies for financial service providers like FXCM, focusing on risk management tools and educational resources to support clients through fluctuating market conditions.

Interest rate differentials are a cornerstone of foreign exchange market dynamics. For instance, in early 2024, the European Central Bank kept its key interest rates unchanged while the US Federal Reserve signaled potential rate cuts later in the year, creating a widening differential that typically favors the US dollar.

Monetary policy shifts by central banks, like the Bank of England's approach to inflation management in 2024, directly influence currency valuations. Decisions on quantitative easing or tightening can lead to substantial currency appreciation or depreciation, presenting both risks and opportunities for traders.

FXCM's value proposition is significantly enhanced by its capacity to deliver real-time data and analytical tools that help clients navigate the volatility surrounding these monetary policy events. Understanding these shifts allows for more informed trading decisions, especially during periods of anticipated central bank announcements.

Inflationary pressures, such as the 3.4% annual inflation rate reported in the US as of April 2024, erode the purchasing power of currencies. This can prompt central banks, like the Federal Reserve, to increase interest rates to curb price increases. Higher interest rates often strengthen a currency as they attract foreign investment seeking better yields, creating a more favorable trading environment for FXCM clients focused on currency appreciation.

Conversely, deflation, a sustained decrease in the general price level, can signal economic weakness and declining consumer demand. For instance, if a major economy experienced deflation, it might indicate a contraction, leading to reduced trading volumes and increased volatility. FXCM must closely monitor these deflationary risks, as they can negatively impact client trading activity and overall market liquidity.

The interplay between inflation and deflation significantly shapes market sentiment and asset valuations, directly impacting the trading strategies employed by FXCM's diverse clientele. For example, if inflation remains elevated, leading to anticipated rate hikes, traders might favor currencies of countries with hawkish monetary policies, such as the US Dollar. Conversely, deflationary concerns could lead investors to seek safe-haven assets, altering currency pair dynamics.

FXCM's clients, ranging from individual traders to institutional investors, must adapt their approaches to capitalize on or mitigate the effects of these economic pressures. Understanding whether inflation is accelerating or decelerating, and its potential impact on central bank actions, is paramount for successful trading in the foreign exchange market.

Currency Volatility and Liquidity

Currency volatility directly influences the trading landscape for FXCM's clientele, shaping both opportunities and inherent risks. For instance, during periods of heightened uncertainty, such as geopolitical events or unexpected economic data releases, currency pairs can experience sharp price swings, creating potential for rapid gains or losses. In 2024, major currency pairs like EUR/USD and GBP/USD have demonstrated significant intraday movements, with some experiencing fluctuations exceeding 1% on single news events.

Higher volatility often translates into wider bid-ask spreads, a cost incurred by traders. This can also lead to increased margin requirements from brokers like FXCM, necessitating larger capital outlays to maintain open positions. For example, during periods of extreme market stress in late 2023 and early 2024, some currency pairs saw their standard margin requirements double or even triple temporarily.

Market liquidity, the ability to trade currencies efficiently without significantly impacting their price, is paramount for FXCM's operational success and client satisfaction. FXCM actively seeks to provide access to deep liquidity pools, aiming to offer competitive pricing and reliable trade execution. As of mid-2024, the foreign exchange market as a whole continues to see substantial daily trading volumes, averaging over $7.5 trillion globally, underscoring the importance of robust liquidity provision.

- Increased Volatility: Major currency pairs like EUR/USD and GBP/USD have shown daily trading ranges of over 1% in 2024.

- Impact on Spreads: High volatility can widen spreads, increasing trading costs for FXCM clients.

- Margin Requirements: Periods of extreme market stress have historically led to temporary increases in margin requirements by brokers.

- Liquidity Importance: Access to deep liquidity pools is crucial for FXCM to ensure competitive pricing and efficient trade execution.

- Global FX Market Size: The global FX market trades an average of over $7.5 trillion daily, highlighting the need for strong liquidity.

Consumer Spending and Disposable Income

Consumer spending and disposable income are crucial for FXCM, as higher levels generally mean more potential clients can afford to trade online. For instance, in the first quarter of 2024, U.S. real disposable personal income saw an increase, indicating greater capacity for discretionary spending. This trend directly impacts FXCM's retail client base, affecting their willingness and ability to invest in financial markets.

Consumer confidence also plays a significant role. When consumers feel secure about their financial future, they are more likely to allocate funds towards trading activities. The Conference Board's Consumer Confidence Index reported a reading of 100.4 in April 2024, showing a degree of optimism that can translate into increased trading volumes for platforms like FXCM.

FXCM's growth trajectory is intrinsically linked to the overall economic health of its target demographics. Economic stability and growth foster higher consumer spending, which in turn can lead to more individuals participating in the online trading space. This correlation influences FXCM's strategies for client acquisition and marketing efforts, ensuring they align with prevailing economic conditions.

Factors influencing consumer spending and disposable income relevant to FXCM include:

- Disposable Income Trends: Rising disposable income provides individuals with more capital available for investment and trading.

- Consumer Confidence Levels: Positive consumer sentiment encourages greater participation in financial markets.

- Economic Growth: A strong economy typically supports increased consumer spending and investment activity.

- Inflation Rates: High inflation can erode purchasing power, potentially limiting funds available for trading.

Global economic growth forecasts for 2024 and early 2025 remain varied, with the IMF projecting around 3.2% global growth for 2024, highlighting regional disparities. These economic conditions directly influence client trading activity, with stronger growth correlating to higher engagement and recessions leading to more cautious behavior, impacting FXCM's volumes.

Interest rate differentials, such as those between the US Federal Reserve and the European Central Bank in early 2024, create significant currency market movements. Central bank monetary policies, including inflation management strategies like those of the Bank of England in 2024, directly impact currency valuations and trading opportunities.

Inflationary pressures, with the US reporting 3.4% annual inflation in April 2024, affect currency purchasing power and can lead to interest rate hikes that strengthen currencies. Conversely, deflation signals economic weakness and can reduce trading volumes, necessitating FXCM's close monitoring of these risks.

Currency volatility, with major pairs like EUR/USD showing daily ranges exceeding 1% in 2024, creates both opportunities and risks, potentially widening spreads and increasing margin requirements. Robust market liquidity, with the global FX market trading over $7.5 trillion daily, is essential for FXCM to offer competitive pricing and ensure efficient trade execution.

Full Version Awaits

FXCM, Inc. PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of FXCM, Inc. This detailed breakdown explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing actionable insights into the global forex market landscape. You will gain a clear understanding of the external forces shaping FXCM's business environment.

The content and structure shown in the preview is the same document you’ll download after payment, meticulously researched to highlight key trends and potential challenges. This ensures you have a robust tool for strategic planning and risk assessment related to FXCM.

Sociological factors

Younger generations, particularly Gen Z and Millennials, are increasingly engaging with financial markets. By the end of 2024, it's estimated that over 40% of retail investors will be under the age of 40, a significant shift from previous decades. This demographic often prefers digital-first experiences and may have varying degrees of prior financial education, creating a need for platforms like FXCM to adapt.

FXCM must therefore refine its educational content and platform interface to resonate with these new investors. Offering simplified guides, interactive tutorials, and mobile-friendly tools can bridge the gap in financial literacy and enhance user experience. For instance, a 2024 survey indicated that 65% of new retail traders cited ease of use and educational support as key factors in choosing a broker.

Public trust in online trading platforms is a crucial element for FXCM's growth. A 2024 survey revealed that 65% of potential retail investors consider a broker's reputation and security measures as primary decision factors. Negative publicity from past market events, such as those involving other firms, can cast a shadow, making transparency and strong regulatory compliance paramount.

Building and maintaining this trust requires FXCM to actively demonstrate its commitment to client protection. In 2025, regulatory bodies are increasing oversight, with new measures focused on preventing fraud and ensuring fair trading practices. FXCM's proactive approach to these regulations, including clear communication about risk management and dispute resolution, directly influences its ability to attract and retain a loyal client base.

Social media and online forums are powerful forces shaping trader sentiment and influencing investment choices. Platforms like Reddit's WallStreetBets, which famously rallied around GameStop in early 2021, demonstrated the significant impact of coordinated online activity on stock prices. FXCM can tap into these communities for educational outreach and client engagement, but must also remain vigilant against potential market manipulation.

Work-Life Balance and Accessibility of Trading

The growing emphasis on work-life balance is a significant sociological driver, prompting many to seek flexible income opportunities. Online trading, particularly forex, has become an attractive avenue for individuals looking to supplement their primary employment or build wealth on their own terms. This trend is evident as more people search for ways to manage their careers and personal lives effectively.

FXCM's operational model directly addresses this societal shift by offering 24-hour trading, five days a week. This constant availability, coupled with advanced mobile trading platforms, ensures that clients can engage with the markets irrespective of their geographical location or daily commitments. For instance, in 2024, mobile trading app usage continued to surge, with reports indicating that over 70% of retail forex traders utilize mobile devices for executing trades, highlighting the importance of accessibility.

The convenience and ease of access provided by platforms like FXCM are paramount in attracting a diverse clientele. As of early 2025, surveys suggest that over 60% of new retail trading accounts are opened by individuals aged 18-34, a demographic that highly values digital solutions and flexible work arrangements. This preference for accessible trading solutions underscores the sociological demand for financial tools that integrate seamlessly into modern lifestyles.

- Increased Demand for Flexible Income: Societal pressure for better work-life integration fuels interest in alternative income streams like online trading.

- 24/5 Trading Accessibility: FXCM's continuous trading hours meet the needs of individuals with varying work schedules and personal commitments.

- Mobile Trading Dominance: Over 70% of retail forex traders used mobile platforms in 2024, demonstrating the critical role of mobile accessibility.

- Attracting Younger Demographics: The convenience of online trading appeals to younger generations seeking financial autonomy, with a significant portion of new accounts opened by those under 35.

Ethical Considerations and Responsible Trading

Societal expectations are increasingly pushing financial service providers like FXCM to champion ethical practices and caution against excessive risk-taking, especially with the growing prominence of responsible investing. This shift means companies are scrutinized not just for their financial performance but also for their commitment to client well-being and market integrity.

FXCM has a crucial role in educating its clientele about the inherent risks associated with leveraged trading. By offering clear, accessible information, the company helps foster a more informed and responsible trading environment. For instance, a significant portion of retail investor accounts lose money when trading CFDs, underscoring the need for robust educational initiatives.

To support responsible trading, FXCM provides essential tools designed to help clients manage their exposure and prevent potential losses. These tools are vital for empowering traders to make calculated decisions rather than impulsive ones.

- Risk Management Features: FXCM offers tools like stop-loss orders and negative balance protection, which are critical for limiting potential downsides in volatile markets.

- Educational Resources: The company provides webinars, articles, and trading guides to enhance client understanding of market dynamics and risk management strategies.

- Self-Exclusion Options: For clients who feel they are trading excessively, FXCM offers options to temporarily or permanently exclude themselves from trading activities, promoting healthier financial habits.

- Client Account Protection: In 2024, regulatory bodies continued to emphasize robust client asset segregation and protection measures, a key ethical consideration for all financial institutions.

Younger demographics, including Gen Z and Millennials, are increasingly entering financial markets, with projections indicating over 40% of retail investors will be under 40 by year-end 2024. These digitally native individuals often prioritize user-friendly platforms and readily available educational resources, influencing FXCM's need to adapt its service offerings.

Public trust is paramount, with a 2024 survey showing 65% of potential retail investors consider a broker's reputation and security as key decision factors. FXCM must therefore maintain transparency and robust regulatory compliance to foster confidence amidst evolving oversight in 2025, which focuses on fraud prevention and fair trading.

The societal shift towards valuing work-life balance has made online trading, especially forex, an attractive flexible income avenue. FXCM's 24/5 trading availability and advanced mobile platforms cater to this trend, with mobile trading app usage continuing to surge, with over 70% of retail forex traders utilizing mobile devices in 2024.

There's a growing societal expectation for financial institutions to promote ethical practices and responsible investing. FXCM addresses this by providing educational resources and risk management tools, such as stop-loss orders, to empower clients in making informed decisions and mitigating potential losses, a critical aspect given that a significant portion of retail investor accounts lose money when trading CFDs.

Technological factors

Continuous innovation in trading platform technology is paramount for FXCM to maintain its competitive edge, ensuring superior speed, unwavering reliability, and a suite of advanced features. This ongoing development encompasses faster trade execution, enhanced charting capabilities, more sophisticated order management systems, and smoother integration with vital third-party financial tools and data providers.

By staying ahead in platform development, FXCM can significantly elevate the user experience, making its offerings more attractive to discerning traders who demand performance and functionality. For instance, the global retail forex market saw trading volumes reach an estimated $2.4 quadrillion in 2024, highlighting the critical need for platforms that can handle such high-frequency activity efficiently.

FXCM's integration of Artificial Intelligence (AI) and Machine Learning (ML) is set to transform trading operations. These technologies are key to developing advanced predictive analytics and sophisticated algorithmic trading strategies. This means FXCM can offer clients more insightful trading tools and automate many repetitive tasks, leading to greater efficiency.

By leveraging AI and ML, FXCM can significantly bolster its risk management framework. The ability of these systems to process vast amounts of data quickly allows for real-time fraud detection and more accurate identification of potential market risks. This proactive approach is crucial in today's fast-paced financial markets, offering a substantial competitive advantage.

The application of AI extends to personalized client support, enhancing the user experience. Machine learning algorithms can analyze client behavior and preferences to tailor services and educational content. For example, in 2024, the global AI market was projected to reach over $200 billion, with a significant portion dedicated to financial services, indicating strong industry adoption and potential for growth.

As an online financial service provider, FXCM faces constant and evolving cybersecurity threats, such as hacking, phishing, and data breaches. Protecting client funds and sensitive personal information requires a robust cybersecurity infrastructure and strict protocols.

In 2024, the financial services sector experienced a significant increase in cyberattacks, with reports indicating that the average cost of a data breach reached $4.73 million globally, a figure that underscores the financial imperative for strong defenses.

Compliance with data protection regulations like GDPR and CCPA is crucial for FXCM. Failure to adhere to these stringent rules can result in substantial fines, potentially impacting profitability and client confidence.

Maintaining client trust is directly linked to data security. A single significant breach could severely damage FXCM's reputation, leading to client attrition and making it harder to attract new customers in a competitive market.

Mobile Trading and Connectivity Enhancements

The pervasive adoption of smartphones means financial trading is no longer confined to desktops. FXCM's mobile platforms are crucial for capturing this trend, demanding high performance, user-friendliness, and robust security to deliver a full trading experience anywhere. By early 2025, global mobile internet usage is projected to surpass 60% of the total population, underscoring the critical need for advanced mobile trading solutions.

Continued advancements in mobile network speeds, such as the rollout of 5G, and the increasing power of mobile devices directly fuel the demand for more sophisticated and responsive mobile trading applications. This technological evolution enables FXCM to offer features previously only available on desktop platforms, directly to traders' hands. In 2024, mobile trading accounted for over 40% of all retail trades in major markets, a figure expected to climb.

- Mobile Dominance: Over 70% of retail trading activity is now initiated or managed via mobile devices, highlighting FXCM's need for a superior mobile user experience.

- Connectivity Fuels Demand: Enhanced mobile connectivity, with average global mobile download speeds reaching over 30 Mbps in 2024, supports real-time trading and complex charting on the go.

- Feature Parity: The expectation is for mobile apps to offer near-complete functionality, including advanced order types and research tools, mirroring desktop capabilities.

- Security is Paramount: With increased mobile trading, FXCM must prioritize multi-factor authentication and encryption to protect user data and funds.

Blockchain Technology and Cryptocurrency Evolution

The increasing adoption of blockchain technology and cryptocurrencies presents a dynamic landscape for FXCM. As of early 2025, the global cryptocurrency market capitalization hovers around $2 trillion, indicating significant growth and mainstream interest. This trend offers FXCM an opportunity to provide regulated and secure access to this burgeoning asset class for its clients.

FXCM's strategic advantage lies in its capacity to navigate the complexities of cryptocurrency trading within a compliant framework. As more individuals and institutions embrace digital assets, offering a trusted platform for trading popular cryptocurrencies like Bitcoin and Ethereum, which saw average daily trading volumes exceeding $50 billion in late 2024, becomes crucial. This positions FXCM as a key player in facilitating access to this evolving market.

Beyond client offerings, FXCM can explore blockchain's potential for internal operational improvements. Applications in streamlining settlement processes, enhancing data security, and improving transparency in financial transactions are significant considerations. By potentially leveraging blockchain for back-office functions, FXCM could achieve greater efficiency and cost savings.

Key technological considerations for FXCM include:

- Regulatory Compliance: Ensuring adherence to evolving regulations surrounding cryptocurrency trading platforms globally.

- Platform Integration: Developing or integrating robust systems to offer a seamless trading experience for cryptocurrencies alongside traditional forex products.

- Security Measures: Implementing advanced cybersecurity protocols to protect client assets and data in the digital asset space.

- Market Volatility Management: Establishing effective risk management strategies to handle the inherent volatility of cryptocurrency markets.

Technological advancements are critical for FXCM's platform development, focusing on speed, reliability, and advanced features to enhance user experience. With the global retail forex market's trading volumes estimated at $2.4 quadrillion in 2024, efficient platforms are essential.

AI and ML integration are transforming FXCM's operations, enabling sophisticated analytics and algorithmic trading, while also bolstering risk management through real-time fraud detection and market risk identification. The global AI market, projected to exceed $200 billion in 2024, shows strong financial services adoption.

Mobile trading is paramount, with over 70% of retail trading activity conducted via mobile devices by early 2025. Enhanced mobile connectivity, with average download speeds over 30 Mbps in 2024, supports sophisticated on-the-go trading, and mobile platforms must offer near-complete desktop functionality securely.

Blockchain and cryptocurrencies present opportunities, with the market capitalization around $2 trillion in early 2025. FXCM can offer regulated access to digital assets, with Bitcoin and Ethereum daily volumes exceeding $50 billion in late 2024, and explore blockchain for internal efficiencies like streamlined settlements.

| Technological Factor | Description | 2024/2025 Data Point | Impact on FXCM | Strategic Implication |

| Platform Innovation | Continuous enhancement of trading platforms for speed, reliability, and features. | Global retail forex market trading volumes: $2.4 quadrillion (2024 est.) | Essential for handling high-frequency trading and meeting user demands. | Maintain competitive edge through superior user experience and performance. |

| AI & Machine Learning | Integration for analytics, algorithmic trading, and risk management. | Global AI market size: Over $200 billion (2024 proj.) | Enables advanced insights, automated trading, and proactive risk mitigation. | Offer clients cutting-edge tools and improve operational efficiency. |

| Mobile Trading | Development of high-performance, user-friendly mobile trading applications. | Mobile trading activity: Over 70% of retail trading (early 2025) | Crucial for capturing a significant segment of the trading population. | Ensure comprehensive functionality and security on mobile devices. |

| Blockchain & Crypto | Exploring opportunities in digital assets and potential internal applications. | Crypto market cap: Approx. $2 trillion (early 2025) | Opens avenues for new product offerings and operational efficiencies. | Navigate regulatory complexities and leverage technology for growth. |

Legal factors

FXCM, Inc. navigates a complex web of global financial regulatory frameworks, a critical element for its operations. The company must adhere to specific laws and oversight from bodies like the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Investments Commission (ASIC), and the National Futures Association (NFA) in the United States, among others.

Compliance with these diverse and often stringent regulations governing forex and contract for difference (CFD) trading is not just a formality; it's fundamental to maintaining FXCM's licenses and ability to operate in these key markets. For instance, as of late 2023, regulatory bodies globally have been scrutinizing leverage limits and client fund segregation more closely, impacting how firms like FXCM structure their offerings.

Failure to meet these legal obligations can result in significant consequences. These can range from substantial financial penalties, such as the multi-million dollar fines levied by regulators in the past for compliance breaches, to the complete revocation of operating licenses, severely impacting market access and business continuity.

Moreover, regulatory adherence directly influences FXCM's reputation. A strong track record of compliance builds trust with clients and stakeholders, whereas a history of regulatory issues can lead to significant reputational damage, deterring new business and potentially alienating existing customers who prioritize security and regulatory certainty.

Legal requirements for segregating client funds from operational capital are paramount for safeguarding client assets and fostering trust. FXCM, like all regulated brokers, must strictly follow these rules, ensuring client investments remain protected even if the company faces financial difficulties. For instance, in the EU, MiFID II regulations mandate robust client asset protection measures.

These regulations dictate how client money is held and managed, often requiring it to be kept in separate bank accounts, distinct from the firm's own funds. This segregation is a cornerstone of client protection, preventing the commingling of assets and providing a crucial safeguard against misuse.

Transparency in reporting these segregation practices is also a key legal component. Clients need assurance that their funds are being handled appropriately, and regulatory bodies demand clear disclosures on how client money is held and protected, often through annual audits and public statements.

FXCM, like all financial institutions, operates under strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These rules mandate rigorous client identity verification and ongoing transaction monitoring to detect and prevent illicit financial activities. For instance, in 2024, the Financial Action Task Force (FATF) continued to emphasize the importance of robust AML/KYC frameworks globally.

Compliance with AML and KYC is not merely a regulatory burden but a fundamental requirement for maintaining operational legitimacy and safeguarding the global financial system's integrity. Failure to adhere to these standards can lead to severe penalties. In 2023, numerous financial firms faced substantial fines, with some reaching tens of millions of dollars, for deficiencies in their AML/KYC programs.

Data Privacy and Protection Laws (e.g., GDPR)

FXCM, like all financial services firms, operates under increasingly stringent data privacy and protection laws. Regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States dictate how FXCM must handle client data. These laws govern the collection, storage, processing, and security of personal information, granting individuals more control over their data. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Adherence to these legal frameworks is not just about avoiding penalties, but also about maintaining client trust and confidence. FXCM must ensure robust data security measures are in place to protect sensitive client information from breaches. This includes transparent policies on data usage and clear consent mechanisms for data processing. For example, as of early 2025, numerous data privacy lawsuits against financial institutions highlight the critical need for proactive compliance.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- CCPA Rights: Consumers can request access to and deletion of their personal information.

- Client Trust: Compliance directly impacts customer confidence and retention.

- Data Security Investment: Companies are investing billions annually in cybersecurity to meet these legal demands.

Advertising and Marketing Compliance

Advertising and marketing in the financial services sector, particularly for leveraged products like Contracts for Difference (CFDs), are subject to stringent legal oversight. Regulations across major jurisdictions, including the EU and UK, mandate clear risk disclosures, prohibit misleading statements, and enforce fair client treatment. For instance, the European Securities and Markets Authority (ESMA) has implemented product intervention measures, including leverage limits and negative balance protection, which directly impact marketing strategies. In 2024, financial regulators continued to emphasize transparency and consumer protection in online advertising, with a particular focus on social media marketing by forex brokers. Failure to comply can result in significant penalties, such as the €3 million fine levied against a UK firm in 2023 for inadequate risk warnings in its advertising.

FXCM, like other financial institutions, must navigate a complex web of advertising and marketing laws. These legal frameworks are designed to protect retail investors from potential losses associated with high-risk financial instruments. Key requirements often include:

- Prominent risk warnings: Ensuring that the risks of trading, including the potential to lose more than invested capital, are clearly and conspicuously displayed.

- Prohibition of misleading claims: Preventing advertisements from suggesting guaranteed profits or downplaying the inherent risks.

- Fair representation: Marketing materials must accurately reflect the services offered and the potential outcomes for clients.

- Jurisdictional compliance: Adhering to the specific advertising regulations of each country in which FXCM operates, which can vary significantly.

In 2025, the trend towards stricter enforcement of advertising standards is expected to continue, with regulators in key markets like Australia and Singapore scrutinizing digital marketing campaigns. FXCM's commitment to meticulous compliance in its advertising and marketing efforts is crucial for maintaining regulatory approval and fostering investor confidence.

FXCM, Inc. operates within a stringent legal and regulatory environment that directly shapes its business practices. Compliance with global financial authorities like the FCA, ASIC, and NFA is paramount, impacting everything from client fund segregation to leverage limits. For instance, in 2024, increased regulatory focus on retail investor protection led to tighter rules on marketing leveraged products.

These legal obligations are not merely guidelines but enforceable mandates. Past penalties, such as substantial fines for compliance breaches, underscore the severe consequences of non-adherence. Furthermore, regulatory standing significantly influences client trust; a history of compliance issues can irreparably damage reputation and market access.

Key legal areas for FXCM include robust Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures, essential for preventing illicit financial activities. In 2023, global financial crime enforcement saw significant fines for AML deficiencies. Data privacy laws like GDPR and CCPA also impose strict data handling requirements, with potential penalties reaching millions.

Advertising and marketing of financial products, especially CFDs, are heavily regulated to ensure transparency and prevent misleading claims. Jurisdictional differences in advertising laws require careful navigation. The ongoing trend in 2025 points towards continued stricter enforcement, particularly concerning digital marketing by forex brokers.

| Regulatory Body | Key Focus Areas (2024-2025) | Potential Impact on FXCM |

|---|---|---|

| FCA (UK) | Leverage limits, CFD product intervention, advertising standards | Restricted marketing strategies, potential for fines if non-compliant |

| ASIC (Australia) | Retail client protection, product suitability, market conduct | Stricter suitability checks, review of promotional materials |

| NFA (USA) | Net capital requirements, customer protection, anti-fraud measures | Ongoing capital adequacy scrutiny, enhanced compliance reporting |

| ESMA (EU) | Leverage caps, negative balance protection, marketing disclosures | Standardized risk warnings across EU operations, impact on product offerings |

Environmental factors

The financial industry, including online forex trading platforms like FXCM, is experiencing a significant shift towards Environmental, Social, and Governance (ESG) investing. This means investors and clients are increasingly scrutinizing companies' sustainability and ethical practices. For instance, by the end of 2024, global ESG assets were projected to exceed $37 trillion, indicating a massive reallocation of capital driven by these principles.

While FXCM's direct environmental impact might be less pronounced than traditional industries, the company is not immune to ESG pressures. Stakeholders, including institutional investors and even retail clients, are likely to demand transparency and demonstrable commitment to responsible business conduct. This could involve policies on data privacy, fair labor practices, and corporate governance structures.

As of early 2025, a growing number of asset managers are integrating ESG factors into their investment decisions. This trend necessitates that FXCM, even as an online entity, showcases its adherence to ethical operations and potentially its efforts in areas like digital security and employee well-being to maintain its appeal to a broader investor base.

Climate change introduces significant volatility into commodity markets, which directly affects FXCM's CFD offerings. For instance, extreme weather events like prolonged droughts or severe floods in major agricultural regions, such as the US Midwest or Brazil in 2024, can decimate crop yields, leading to sharp price increases for agricultural commodities like corn and soybeans.

The global energy transition, driven by climate policies aimed at reducing carbon emissions, also plays a crucial role. The ongoing shift away from fossil fuels is impacting oil and gas prices, with investments in renewable energy sources accelerating. This transition can create unpredictable price swings in energy markets, influencing the value of oil and natural gas CFDs offered by FXCM.

FXCM must monitor these environmental factors closely for effective risk management and to provide clients with accurate market insights. For example, understanding the potential impact of a hurricane season on Gulf Coast oil production in 2025 is vital for managing exposure to energy-related CFDs.

These climate-driven market shifts highlight the importance of robust risk assessment and continuous client education regarding the environmental influences on commodity pricing and potential trading volatility.

FXCM, as a global financial services provider, faces growing expectations to go beyond mere regulatory adherence and actively engage in Corporate Social Responsibility (CSR). This includes supporting community development, fostering financial education, and implementing sustainable operational practices where feasible. For instance, many financial firms in 2024 have reported significant investments in digital literacy programs aimed at underserved communities. Such efforts are crucial for building a positive brand image and attracting talent that values ethical business conduct.

Operational Energy Consumption and Carbon Footprint

FXCM, like many online businesses, relies heavily on data centers and IT infrastructure, which are significant energy consumers and contribute to its carbon footprint. While not directly tied to its forex trading operations, there's an increasing global demand for companies to actively manage and lower their environmental impact.

This trend necessitates FXCM considering strategies to mitigate its energy usage and emissions. For instance, adopting energy-efficient hardware and partnering with data center providers committed to renewable energy sources are becoming crucial steps.

- Global Data Center Energy Consumption: Data centers globally are estimated to consume hundreds of terawatt-hours of electricity annually, a figure projected to rise significantly.

- Corporate Sustainability Initiatives: Many large corporations, including those in the financial sector, are setting ambitious targets for carbon neutrality, often by 2030 or 2040.

- IT Sector's Environmental Impact: The IT sector's carbon emissions are comparable to those of the aviation industry, highlighting the need for efficiency improvements.

Regulatory Focus on Green Finance and Disclosure

Governments worldwide are stepping up their focus on green finance, pushing financial institutions to be more transparent about their climate-related risks and opportunities. This movement is particularly strong in major economies. For instance, by the end of 2024, the European Union is expected to have its Corporate Sustainability Reporting Directive (CSRD) fully implemented, mandating detailed environmental disclosures for a vast number of companies, including those in financial services.

While FXCM, as a forex broker, might not be directly subject to the same stringent disclosure rules as major banks or asset managers, it's not immune to these evolving environmental trends. The broader financial ecosystem is increasingly prioritizing sustainability. This means that even indirect pressures, such as client expectations or the need to align with industry best practices, could influence FXCM's operational approach and reporting in the coming years.

The growing emphasis on green finance can be seen in the significant increase in sustainable investment flows. In 2024, global sustainable investment assets under management were projected to exceed $50 trillion, signaling a strong market demand for environmentally conscious financial products and services. This trend could lead to greater scrutiny of all financial intermediaries.

- Increased Regulatory Scrutiny: Expect more regulations globally requiring climate risk disclosures from financial firms.

- Growing Investor Demand: A significant portion of investors, estimated to be over 70% in some surveys from 2024, now consider ESG factors in their investment decisions.

- Industry Best Practices: Financial institutions are increasingly adopting voluntary frameworks for environmental reporting to maintain competitiveness.

- Potential Indirect Impact: While not directly regulated, FXCM may need to adapt to evolving client and partner expectations regarding environmental responsibility.

Environmental factors significantly influence FXCM's operational landscape and client demand. The global push for green finance, exemplified by the EU's CSRD implementation by end-2024, pressures financial institutions to disclose climate risks. Growing ESG investing, projected to surpass $37 trillion by end-2024, means clients increasingly scrutinize sustainability, impacting FXCM's appeal.

Climate change directly impacts FXCM's CFD offerings by creating volatility in commodity markets, such as agricultural goods and energy. For instance, extreme weather events in 2024 impacted crop yields, causing price surges in corn and soybeans. The global energy transition also influences oil and natural gas prices, leading to unpredictable swings for FXCM's clients.

FXCM's reliance on data centers means its carbon footprint is a growing concern, with global data center energy consumption rising significantly. As many corporations aim for carbon neutrality by 2030-2040, FXCM may need to adopt energy-efficient practices and renewable energy sources for its IT infrastructure.

| Factor | Impact on FXCM | Supporting Data (2024/2025 Projections/Trends) |

| Green Finance & Regulation | Increased disclosure requirements, pressure to align with sustainable practices. | EU's CSRD fully implemented by end-2024; over 70% of investors consider ESG factors (2024 surveys). |

| Climate Change & Market Volatility | Fluctuations in commodity prices affecting CFD trading (e.g., agriculture, energy). | Extreme weather events impacting crop yields; ongoing energy transition affecting oil/gas prices. |

| Corporate Carbon Footprint | Need to manage energy consumption of IT infrastructure and data centers. | Global data center energy consumption is rising; IT sector emissions comparable to aviation. |

| ESG Investing Growth | Client demand for ethical and sustainable business practices. | Global ESG assets projected to exceed $37 trillion by end-2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for FXCM, Inc. is meticulously constructed using data from reputable financial news outlets, regulatory filings with bodies like the SEC, and reports from leading market research firms specializing in the financial services sector. We prioritize sources that provide current insights into economic trends, technological advancements, and evolving legal landscapes impacting forex trading.