FXCM, Inc. Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FXCM, Inc. Bundle

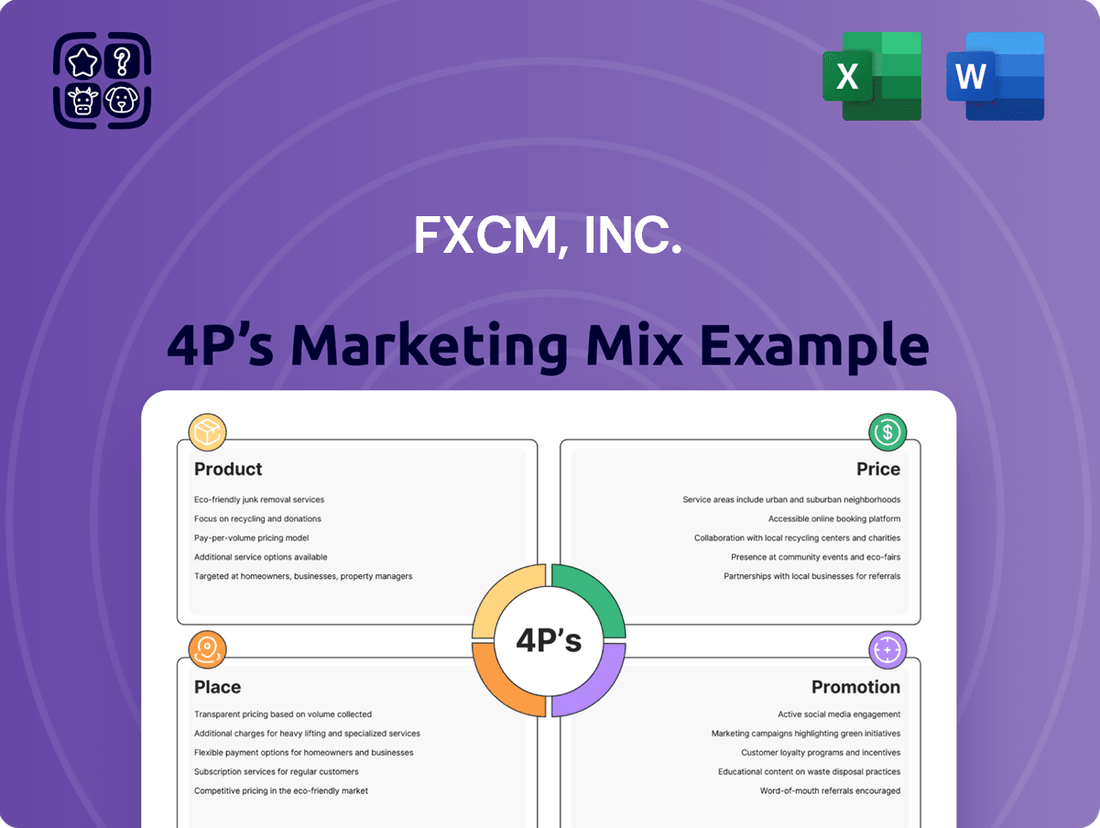

Unlock the secrets behind FXCM, Inc.'s market dominance with our comprehensive 4Ps Marketing Mix Analysis. We delve into their product offerings, pricing strategies, distribution channels, and promotional efforts, revealing the synergistic approach that drives their success.

Go beyond the basics and gain actionable insights into how FXCM, Inc. crafts its market presence. This in-depth analysis is perfect for business professionals, students, and consultants seeking to understand and replicate effective marketing tactics.

Save hours of valuable research time. Our ready-made, editable report provides a structured framework and real-world examples, empowering you with the knowledge to benchmark or plan your own strategies.

Discover the intricate details of FXCM, Inc.'s marketing architecture, from their product positioning to their communication mix. Understand what makes their approach tick and how you can adapt these winning strategies.

Get instant access to a professionally written, presentation-ready 4Ps analysis of FXCM, Inc. This editable document is tailored for both business and academic applications, offering a clear and concise overview.

The full report offers a detailed view into FXCM, Inc.’s market positioning, pricing architecture, channel strategy, and communication mix. Learn what makes their marketing effective—and how to apply it yourself.

Product

FXCM's product strategy centers on providing robust online trading platforms for both Forex and Contracts for Difference (CFDs). This dual offering allows clients to speculate on currency movements and gain exposure to a broad spectrum of global assets like indices, commodities, and cryptocurrencies, catering to a wide client base.

In 2024, the retail Forex market continued its expansion, with global trading volumes remaining significant. FXCM's ability to offer CFDs on diverse assets like oil and Bitcoin in late 2024 provided crucial diversification opportunities for traders navigating volatile markets.

FXCM's product offering is robust, granting access to over 40 currency pairs, a core component of its forex trading services. This extensive selection allows traders to engage with a wide array of global currency markets.

Beyond forex, FXCM provides Contracts for Difference (CFDs) on a diverse range of assets. This includes major global indices like the S&P 500 and FTSE 100, offering exposure to broader market movements.

The product portfolio also encompasses precious metals such as gold and silver, alongside energy commodities like oil. This diversification caters to traders looking to hedge against inflation or capitalize on commodity price fluctuations.

Furthermore, FXCM has integrated cryptocurrency trading into its platform, allowing clients to speculate on digital assets. This expansion reflects the growing interest in alternative asset classes within the financial markets.

This comprehensive suite of trading instruments, from traditional forex to emerging cryptocurrencies, positions FXCM to serve a broad spectrum of client needs and trading strategies, enhancing its market appeal.

FXCM's proprietary Trading Station platform serves as a core product, embodying the 'Product' element of the marketing mix. Its availability across desktop, web, and mobile ensures broad accessibility for traders. Key features like automated trading, pre-loaded strategies, and backtesting capabilities cater to active traders seeking efficiency and advanced tools. This focus on innovation and user-friendliness underpins its appeal in the competitive forex market.

Integration with Third-Party Platforms and Tools

FXCM's integration strategy extends beyond its proprietary offerings, allowing traders to connect with widely adopted third-party platforms like MetaTrader 4 (MT4), NinjaTrader, and TradingView. This approach acknowledges the diverse preferences and established workflows of its user base, particularly those who rely on the advanced charting and algorithmic trading capabilities these platforms provide. For instance, MT4 remains a dominant force, with millions of active users globally, many of whom FXCM can now readily serve.

This interoperability is a key component of FXCM's product strategy, enhancing the overall value proposition by offering flexibility. Traders can leverage their existing expertise and custom tools on familiar interfaces while still accessing FXCM's liquidity and execution services. This is particularly relevant for active traders who have invested time in developing strategies on specific platforms.

Further enriching this ecosystem, FXCM offers exclusive tools through FXCM PLUS, such as:

- Trading Signals: Providing actionable buy/sell alerts.

- Volume Data: Offering insights into market participation.

- Trader Sentiment Analysis: Gauging the prevailing mood of the market.

These proprietary tools, when combined with the flexibility of third-party platform integration, create a comprehensive trading environment. By accommodating a broader range of trader needs and preferences, FXCM aims to broaden its market appeal and customer retention, a strategy that has proven effective in the competitive online brokerage landscape.

Educational Resources and Demo Accounts

FXCM's educational resources are a cornerstone of their product offering, designed to elevate trader proficiency. This includes comprehensive courses covering FX trading fundamentals, advanced strategies, and technical analysis, alongside access to proprietary data and premium market insights. For instance, in early 2024, FXCM reported a significant increase in engagement with its educational webinars, noting a 20% year-over-year rise in participation as traders sought to sharpen their skills.

The provision of a free demo account is a critical component, enabling users to familiarize themselves with FXCM's trading platforms and test various trading strategies without financial risk. These accounts are typically provisioned with substantial virtual capital, allowing for realistic practice scenarios. Data from late 2023 indicated that over 70% of new FXCM accounts opened were demo accounts, highlighting their importance in the user acquisition and education funnel.

- Comprehensive FX Trading Courses: Covering everything from beginner basics to advanced technical analysis.

- Proprietary Data Access: Providing unique market insights and research tools.

- Premium Resources: Including exclusive market commentary and trading signals.

- Risk-Free Demo Accounts: Allowing practice with virtual funds up to $50,000, facilitating strategy testing and platform familiarization.

FXCM's product strategy emphasizes a diverse range of tradable instruments, including over 40 currency pairs, CFDs on indices, commodities, and cryptocurrencies. This broad offering, accessible through proprietary and third-party platforms like MetaTrader 4, caters to a wide array of trading preferences and market access needs.

In 2024, FXCM continued to enhance its product suite by integrating features like trading signals and volume data via FXCM PLUS. These additions provide traders with proprietary insights to complement their strategies, reinforcing the value proposition of its platform offerings.

The company's commitment to trader education and risk mitigation is evident through its comprehensive courses and widely utilized free demo accounts. These resources are crucial for onboarding new clients and enabling experienced traders to test strategies in a simulated environment, as demonstrated by the over 70% of new accounts being demo accounts in late 2023.

FXCM's product ecosystem is designed for accessibility and advanced functionality, supporting automated trading and backtesting on its Trading Station platform. This focus on user-centric design, coupled with integration capabilities for popular platforms like MT4 and TradingView, ensures FXCM remains a competitive choice for retail traders globally.

What is included in the product

This analysis delves into FXCM, Inc.'s marketing mix, examining its product offerings, pricing strategies, distribution channels, and promotional activities to provide a comprehensive understanding of its market positioning.

It offers a structured breakdown of FXCM, Inc.’s marketing efforts, ideal for professionals seeking to benchmark or understand the company's competitive strategies.

FXCM's 4P's Marketing Mix Analysis acts as a pain point reliever by clearly identifying and addressing critical market gaps, enabling strategic adjustments for enhanced customer acquisition and retention.

Place

FXCM's primary distribution channel is its robust digital platform, establishing global online accessibility for its clientele. This online-first approach dismantles geographical limitations, enabling traders to connect and operate from virtually anywhere with an internet connection. As of early 2024, FXCM served clients in over 180 countries, highlighting its extensive international reach.

FXCM provides clients with a robust selection of trading platforms, acting as crucial access points to the financial markets. These include the proprietary Trading Station available in Desktop, Web, and Mobile versions, alongside the widely adopted MetaTrader 4. This multi-platform approach caters to a broad spectrum of trading styles and technical proficiencies.

Furthermore, FXCM's integration with TradingView and ZuluTrade expands these access points, offering clients advanced charting tools and social trading capabilities. As of early 2025, MetaTrader 4 remains a dominant platform in the retail forex space, with millions of active users globally, highlighting FXCM's commitment to providing industry-standard tools.

The mobile trading applications are particularly vital, enabling clients to manage their portfolios and execute trades anytime, anywhere. This focus on mobile accessibility is critical, as global mobile trading volume has seen consistent year-over-year growth, with projections indicating continued expansion through 2025.

FXCM's strategic international offices are a cornerstone of its global operations, enabling localized service and market penetration. With a presence spanning continents, this expansive network is reinforced by stringent regulation from bodies like the UK's Financial Conduct Authority (FCA) and Australia's ASIC. This diverse regulatory footprint, covering key financial hubs, builds significant trust with a broad international client base.

This robust regulatory compliance is vital for fostering confidence and ensuring adherence to varying regional financial standards. The company's deliberate decision not to accept US residents highlights a focus on specific, well-regulated markets, allowing for deeper engagement and tailored support. FXCM's global reach, therefore, is not just about physical presence but also about navigating complex international financial landscapes effectively.

Client Support Infrastructure

FXCM's client support is built around a 24/5 global network, ensuring traders can access help regardless of their location or the time of day. This round-the-clock availability is crucial in the fast-paced forex market, where timely assistance can prevent significant losses. For instance, in 2024, FXCM reported a median response time of under 2 minutes for their live chat support, a key metric for client satisfaction.

The accessibility of support is primarily digital, with a strong emphasis on online resources and direct messaging. This digital-first approach allows FXCM to efficiently manage a high volume of client inquiries while maintaining service quality. Surveys from early 2025 indicated that over 85% of client support interactions were resolved through digital channels, highlighting the effectiveness of this infrastructure.

- 24/5 Global Support: Offices strategically located to cover major trading sessions.

- Digital First Approach: Emphasis on live chat, email, and comprehensive FAQs.

- Rapid Response Times: Aiming for minimal delay in addressing client queries, with average chat response times under 2 minutes in 2024.

- Customer Satisfaction Focus: Support infrastructure directly impacts client retention and overall trading experience.

API Trading and Algorithmic Access

FXCM’s API trading and algorithmic access represent a key element in its marketing mix, specifically within the 'Place' dimension, by offering advanced trading infrastructure. This caters to a sophisticated client base, including institutional traders and experienced retail traders who demand direct market access and the ability to automate trading strategies.

Through robust APIs like FIX, Java, and Forex Connect, FXCM allows clients to build custom trading applications and connect directly to its price servers. This enables high-frequency trading and algorithmic execution, significantly enhancing the speed and efficiency of trade placement and management.

This offering directly addresses the needs of a discerning market segment. For instance, in the first half of 2024, the demand for low-latency trading solutions saw a marked increase, with many institutional players actively seeking platforms that support automated strategies for capturing micro-price movements. FXCM's API services are designed to meet this growing demand.

- Direct Server Connection: Enables high-speed data feeds and order execution.

- Automated Strategy Execution: Facilitates algorithmic and high-frequency trading.

- Customizable Applications: Allows traders to build tailored trading tools.

- Expanded Trade Placement: Offers alternative and efficient methods for managing trades.

FXCM's 'Place' in the marketing mix is defined by its expansive digital footprint and strategic physical presence, ensuring global accessibility and localized support for its diverse clientele. This dual approach, combining online reach with international offices, underpins its ability to serve traders across over 180 countries as of early 2024.

The company's commitment to providing multiple, user-friendly trading platforms, including proprietary and industry-standard options like MetaTrader 4, further solidifies its accessibility. This multi-platform strategy, enhanced by integrations with TradingView and ZuluTrade, caters to varied trading preferences and technical needs, reflecting the evolving landscape of digital finance.

Furthermore, FXCM's focus on mobile trading applications and robust API access caters to the increasing demand for on-the-go trading and algorithmic execution. By prioritizing low-latency solutions and customizable tools, FXCM positions itself as a key enabler for both retail and institutional traders seeking efficient market participation.

| Aspect | Description | Data Point (2024/2025) |

|---|---|---|

| Digital Reach | Online platform accessibility | Serves clients in over 180 countries (early 2024) |

| Trading Platforms | Proprietary & Third-party access | MetaTrader 4 remains dominant; FXCM offers Trading Station, TradingView, ZuluTrade integration |

| Mobile Accessibility | On-the-go trading capabilities | Consistent year-over-year growth in mobile trading volume, projected expansion through 2025 |

| Physical Presence | Strategic international offices | Presence across continents, supporting localized service and regulatory compliance (e.g., FCA, ASIC) |

| Algorithmic Access | API for automated trading | Increased demand for low-latency solutions in H1 2024; FIX, Java, Forex Connect APIs offered |

Full Version Awaits

FXCM, Inc. 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive FXCM, Inc. 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll gain a clear understanding of FXCM's strategic approach to each element. It’s the same ready-made Marketing Mix document you'll download immediately after checkout, providing actionable insights.

Promotion

FXCM leverages content marketing extensively, offering in-depth market analysis, trading guides, and educational materials via its 'Insights' hub, live webinars, and podcasts such as FXCM Market Talk. This approach establishes FXCM as a thought leader, drawing in new customers and fostering loyalty among existing ones by delivering timely and relevant expertise.

The company's dedication to client education is highlighted by initiatives like the 'Crypto Market Outlook 2025' webinar, signaling a commitment to keeping clients informed on emerging trends. Such content is crucial for building trust and demonstrating value in the competitive online trading landscape.

FXCM, Inc. leverages digital advertising across platforms like Google Ads, social media, and financial news sites to boost brand visibility and direct potential clients to its trading services. This digital push is crucial for reaching a global audience of traders.

The company prominently features its accolades, such as being named 'Best In Class 2024' by ForexBrokers.com and receiving recognition for being the 'Most Transparent Forex Broker.' These awards, reflecting strong performance and industry trust, are key components of their promotional strategy to build credibility.

By highlighting these distinctions, FXCM aims to differentiate itself in the crowded forex market, signaling to both novice and experienced traders the company's commitment to quality and reliability. This strategic use of awards in advertising directly supports their customer acquisition efforts.

FXCM actively cultivates strategic partnerships to boost its market presence and customer experience. A key example is their March 2024 collaboration with AU10TIX Limited, aimed at streamlining Know Your Customer (KYC) processes, directly contributing to a smoother onboarding for new clients. This move enhances operational efficiency and indirectly acts as a promotional tool by improving the initial customer journey.

Further promotional reach is achieved through integrations with popular trading platforms like TradingView and ZuluTrade. By embedding FXCM's services within these widely adopted trading environments, the company gains significant exposure to a global user base of active traders. These collaborations are crucial for expanding FXCM's visibility and reinforcing its standing in the competitive forex market.

Value Proposition Communication

FXCM's communication strategy for its value proposition centers on tangible benefits for its financially literate clientele. Core messaging consistently emphasizes competitive pricing, highlighted by their 'zero-commission trading for CFDs, shares, and forex' where available, a significant draw for cost-conscious traders. This directness aims to attract sophisticated investors looking for an edge.

Further reinforcing their offering, FXCM promotes advanced trading tools and unwavering regulatory compliance across key financial markets. For instance, their emphasis on 'real-time execution' directly addresses the critical need for speed and reliability in active trading environments. This focus on performance and security resonates with decision-makers prioritizing dependable platforms.

- Competitive Pricing: Zero-commission trading on key instruments.

- Advanced Tools: Emphasis on real-time execution and platform capabilities.

- Regulatory Compliance: Highlighting adherence to multiple jurisdictions.

- Targeted Messaging: Tailored to financially literate individuals.

Targeted Account Types and Incentives

FXCM offers distinct account types, like Standard and Active Trader accounts, to cater to diverse client needs and trading styles. This segmentation is key to their promotional strategy.

Active Trader accounts come with compelling incentives designed to attract high-volume traders. These benefits often include tighter spreads, personalized customer support, and access to advanced trading tools like API connectivity. For instance, as of early 2024, FXCM’s Active Trader accounts could offer spreads as low as 0.1 pips on major currency pairs, a significant draw for active participants.

This tiered account structure enables FXCM to craft highly targeted marketing campaigns. By understanding the potential trading volume and capital of different client segments, they can tailor promotional messages and offers to maximize engagement and conversion.

- Standard Accounts: Aimed at new or less frequent traders, offering a balanced trading experience.

- Active Trader Accounts: Designed for high-volume traders, providing benefits like lower spreads and priority support.

- Incentives: Reduced spreads, API access, and dedicated account management are key attractions for Active Traders.

- Targeting: Tiered offerings allow for customized promotions based on client activity and capital.

FXCM's promotional efforts focus on establishing credibility through industry recognition, such as being named 'Best In Class 2024' by ForexBrokers.com, and highlighting their commitment to transparency. They also leverage digital advertising across platforms like Google Ads and social media to reach a global audience of traders, directly driving potential clients to their trading services.

Strategic partnerships, like the March 2024 collaboration with AU10TIX Limited for streamlined KYC processes, enhance the client onboarding experience, indirectly promoting FXCM through improved customer journeys. Furthermore, integrations with platforms such as TradingView and ZuluTrade expose FXCM's services to a vast user base of active traders, bolstering their market presence.

FXCM communicates its value proposition through clear benefits like zero-commission trading on CFDs, shares, and forex where available, appealing to cost-conscious traders. They also emphasize advanced trading tools and real-time execution, critical factors for decision-makers prioritizing speed and reliability.

The company differentiates its offerings through tiered account types, notably the Active Trader account, which offers incentives like spreads as low as 0.1 pips on major currency pairs as of early 2024. This segmentation allows for highly targeted marketing campaigns, tailoring promotions to specific client segments based on trading volume and capital.

Price

FXCM's pricing strategy centers on competitive spreads, the core mechanism for revenue generation. This difference between buying and selling prices directly impacts trader profitability and FXCM's income.

For standard accounts, FXCM aims for tight spreads, with major currency pairs like EUR/USD typically ranging from 0.78 to 1.3 pips. This range can fluctuate based on the specific FXCM entity serving the client and the overall volatility in the financial markets.

Offering such tight spreads is a key tactic to attract and retain a wide range of clients, from beginners to experienced traders. This focus on cost-effectiveness makes FXCM an appealing choice in the forex market.

FXCM's commission-based pricing for active traders is a key element of its marketing strategy, directly impacting the Product and Price elements of the 4Ps. This model is specifically tailored for high-volume traders, offering a potential reduction in overall trading expenses. For instance, while raw spreads might be as low as 0.28 pips, the addition of a commission per round-turn trade brings the effective spread to approximately 0.74 pips, a structure designed to be competitive for active participants in the forex market.

FXCM, as part of its pricing strategy, prioritizes a transparent fee structure. Clients can clearly see all costs, from spreads and commissions to overnight financing fees for CFDs. This commitment to no hidden charges is vital for fostering trust and staying competitive in the forex arena.

Account Tiers and Volume Discounts

FXCM's pricing strategy is built around account tiers and volume discounts, aiming to incentivize higher trading activity. This tiered structure means that the more a client trades or the higher their account equity, the better their pricing conditions can become. For example, Active Trader clients can benefit from rebates, with potential earnings of $5 to $25 per million traded, depending on their monthly volume. This rewards loyalty and encourages substantial trading participation.

This approach allows FXCM to effectively segment its client base. High-volume traders, often more sophisticated and active in the market, receive preferential treatment. This can translate into benefits like tighter spreads or reduced commission fees, making trading more cost-effective for these clients. It's a clear strategy to attract and retain significant market players.

- Tiered Account Structures: Benefits increase with trading volume or account equity.

- Active Trader Rebates: Clients can earn $5-$25 per million traded based on monthly volume.

- Market Segmentation: Rewards high-volume traders and encourages loyalty.

- Cost-Effectiveness: Aims to make trading more economical for active participants.

No Deposit Fees and Variable Rollover Costs

FXCM, as part of its product offering, eliminates deposit fees, making it easier for traders to fund their accounts without upfront charges. This accessibility is a key draw for many new and active traders looking to minimize initial investment friction. For instance, in 2024, many retail traders prioritize platforms with low barrier to entry, making fee-free deposits a significant competitive advantage.

However, the cost structure shifts for positions held overnight. FXCM charges variable rollover costs, also known as swap fees, for leveraged positions in Contracts for Difference (CFDs). These fees are calculated based on prevailing interest rates and the size of the open position. For example, during periods of fluctuating interest rates in late 2024 and early 2025, these rollover costs can significantly impact the profitability of longer-term trades.

- No Deposit Fees: FXCM waives charges for depositing funds, enhancing account accessibility.

- Variable Rollover Costs: Overnight CFD positions incur financing charges, which fluctuate with market interest rates.

- Transparency: These costs are clearly communicated to clients, ensuring full awareness of trading expenses.

- Impact on Strategy: Rollover fees are a critical consideration for traders employing strategies that involve holding positions beyond a single trading day.

FXCM's pricing is multifaceted, prioritizing competitive spreads and transparent commissions to attract a broad client base. For active traders, a commission-based model with potentially lower raw spreads, like 0.28 pips, aims to be cost-effective. Tiered account structures and volume-based rebates, offering up to $25 per million traded in 2024, further incentivize higher trading activity and reward loyal clients.

| Pricing Component | Description | Typical Range (2024/2025) | Notes |

|---|---|---|---|

| Spreads | Difference between buy and sell prices, core revenue | EUR/USD: 0.78-1.3 pips (Standard) EUR/USD: ~0.28 pips (Raw, Commission Accounts) |

Varies by entity and market volatility |

| Commissions | Fee for specific account types (e.g., Active Trader) | Included in effective spread for commission accounts | Adds to raw spread for effective pricing |

| Deposit Fees | Charges for funding accounts | None | Enhances accessibility |

| Overnight Financing (Rollover) | Interest charged for holding leveraged CFD positions | Variable, based on interest rates | Impacts profitability of longer-term trades |

| Active Trader Rebates | Discounts or credits based on trading volume | $5-$25 per million traded (based on monthly volume) | Incentivizes high-volume trading |

4P's Marketing Mix Analysis Data Sources

Our FXCM 4P's analysis is grounded in publicly available data, including regulatory filings, investor relations materials, and official company announcements. We also incorporate insights from industry reports and competitive analysis to ensure a comprehensive view of FXCM's marketing strategies.