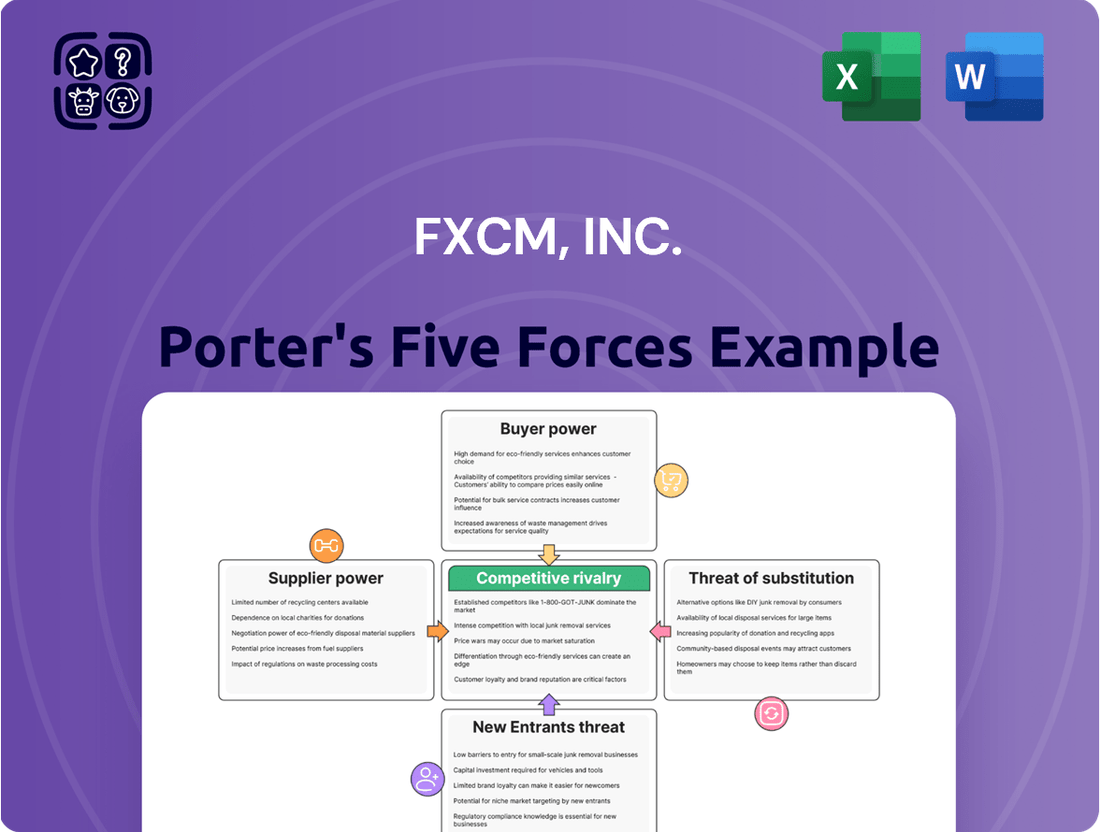

FXCM, Inc. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FXCM, Inc. Bundle

FXCM, Inc. operates in a dynamic financial services landscape, facing significant competitive pressures. The threat of new entrants is moderate due to high capital requirements and regulatory hurdles, yet the ease of digital onboarding poses a persistent challenge. Bargaining power of buyers is also considerable, as clients can readily switch between brokers offering similar services.

The bargaining power of suppliers, particularly technology providers and liquidity aggregators, can impact FXCM's operational costs. Furthermore, the threat of substitutes, such as decentralized finance (DeFi) platforms, is growing, offering alternative ways to access financial markets. The intensity of rivalry among existing players, including large, established institutions and agile fintech firms, is a defining characteristic of this industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore FXCM, Inc.’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The online forex and CFD market's structure means that a few large liquidity providers (LPs) often hold significant sway. If FXCM, Inc. finds itself reliant on a small number of these LPs, those providers gain considerable bargaining power. This concentration could result in FXCM facing increased costs for accessing liquidity or less advantageous pricing for its clients.

FXCM's strategic imperative lies in its ability to cultivate and maintain relationships with a diverse range of LPs. By not being overly dependent on any single provider, FXCM can effectively counter the concentrated bargaining power of LPs and secure more competitive terms. This diversification is a key factor in managing operational costs and maintaining favorable client pricing in the dynamic forex market.

FXCM relies on a mix of its own trading platforms and those from external providers. Suppliers offering unique or difficult-to-replicate technology, such as specialized algorithms or robust data feeds, can hold significant sway. If FXCM finds itself heavily dependent on a limited number of these technology partners, it could face challenges in adapting its operations or managing its expenses, potentially impacting profitability.

FXCM's reliance on data and connectivity providers means these suppliers hold significant bargaining power. Access to real-time market data feeds, essential for price discovery and trade execution, is often controlled by a limited number of specialized firms. In 2024, the increasing demand for low-latency data across financial markets has only amplified the leverage of these providers.

Furthermore, secure and high-speed network infrastructure is non-negotiable for a forex broker like FXCM. Companies that own and operate extensive, robust networks, particularly those with global reach, can dictate terms due to the high switching costs and the critical nature of uninterrupted service. This can translate into higher operational expenses for FXCM.

The ability of these suppliers to command premium pricing or impose stringent contract terms directly affects FXCM's cost structure and its capacity to offer competitive pricing and execution speeds to its clients. For instance, a sudden increase in data feed costs or network latency charges could impact FXCM's profit margins and market competitiveness.

Regulatory Compliance Service Providers

Regulatory compliance service providers wield considerable bargaining power. The intricate and ever-shifting global regulatory environment necessitates specialized legal, compliance, and auditing expertise, making these services highly valuable. FXCM's operational costs are directly impacted by the fees charged by these niche suppliers.

The scarcity of providers with deep knowledge in financial regulations, such as those related to forex trading and anti-money laundering (AML) directives, amplifies their influence. Failure to comply can result in substantial fines and reputational damage, meaning companies like FXCM have limited leverage to negotiate prices downwards.

- High Switching Costs: Integrating new compliance systems or changing providers often involves significant time, resources, and potential disruption, deterring companies from frequent provider changes.

- Specialized Knowledge: The complex and specific nature of financial regulations requires highly skilled professionals, creating a barrier to entry for new service providers and concentrating power among existing ones.

- Regulatory Scrutiny: Service providers are aware that their clients are under intense regulatory oversight, meaning any lapse in service could have severe consequences for the client, allowing providers to command premium pricing.

Human Capital and Talent

The bargaining power of suppliers within FXCM, Inc. is significantly influenced by the availability of specialized human capital. A scarcity of professionals skilled in quantitative analysis, cybersecurity, fintech development, and market risk management directly enhances supplier leverage. For instance, in 2024, the demand for cybersecurity experts in the financial services sector remained exceptionally high, with average salaries for senior roles often exceeding $150,000 annually, as reported by industry surveys. This talent shortage can drive up labor costs for FXCM, potentially impacting its profitability and ability to innovate.

High demand for these critical skill sets means that talented individuals possess considerable bargaining power. This can manifest in demands for higher compensation, better benefits, and more flexible working arrangements. For FXCM, this translates to increased operational expenses, as the company must compete to attract and retain top talent in a competitive global market. The ability of FXCM to secure and maintain a skilled workforce is therefore a key determinant of its supplier power dynamics, especially concerning recruitment and retention costs.

- Talent Shortage Impact: A lack of skilled professionals in areas like quantitative analysis and cybersecurity can increase labor costs for FXCM.

- Industry Wage Trends (2024): Average salaries for senior cybersecurity roles in finance surpassed $150,000, reflecting high demand.

- Operational Efficiency: Increased labor costs due to talent scarcity can affect FXCM's overall operational efficiency.

- Innovation Capabilities: The ability to attract and retain top talent is crucial for FXCM's innovation and competitive edge.

FXCM's reliance on key technology and data providers means these suppliers hold significant bargaining power, especially given the increasing demand for low-latency data in 2024. Companies controlling specialized algorithms or robust data feeds can command higher prices. For instance, the cost of premium, real-time financial data feeds can range from hundreds to thousands of dollars per month per user, directly impacting FXCM's operating expenses.

The specialized nature of financial regulatory compliance services also grants suppliers considerable leverage. The complexity of global regulations means firms like FXCM often have limited choices for expert legal and compliance providers, leading to higher service fees. The high switching costs associated with implementing new compliance systems further solidify the power of existing suppliers.

The scarcity of highly skilled professionals in areas like quantitative analysis and cybersecurity in 2024 further amplifies supplier bargaining power, particularly concerning talent acquisition. For example, industry reports in 2024 indicated that average salaries for senior cybersecurity professionals in the financial sector often exceeded $150,000 annually, reflecting intense competition for these critical skill sets.

| Supplier Category | Factors Influencing Bargaining Power | Potential Impact on FXCM | Example Data (2024) |

|---|---|---|---|

| Liquidity Providers (LPs) | Concentration of LPs, FXCM's reliance | Increased costs, less favorable pricing | A small number of major LPs can dictate terms. |

| Technology Providers | Uniqueness of technology, switching costs | Higher platform fees, slower innovation | Proprietary trading platforms or specialized analytics tools. |

| Data & Connectivity Providers | Control over real-time data, network infrastructure | Increased operational expenses, latency issues | Premium data feeds can cost $1,000+/month per user. |

| Regulatory Compliance Providers | Specialized knowledge, regulatory scrutiny | Higher service fees, limited negotiation leverage | High demand for AML and KYC expertise. |

| Human Capital (Specialized Skills) | Talent shortage, high demand | Increased labor costs, recruitment challenges | Senior cybersecurity roles averaging over $150,000 annually. |

What is included in the product

This analysis dissects FXCM, Inc.'s competitive environment by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the forex brokerage industry.

FXCM's Porter's Five Forces Analysis provides a clear, one-sheet summary of all competitive forces—perfect for quick decision-making and instantly understanding strategic pressure.

Customers Bargaining Power

Retail clients in the forex and CFD market experience minimal friction when switching brokers. Account opening is largely digital and straightforward, with many platforms offering comparable core features, making it simple for customers to move. This low barrier to entry means clients can readily switch to competitors providing more attractive spreads, reduced commissions, or enhanced trading tools.

For FXCM, this translates into a constant need to provide competitive pricing and superior value to maintain its existing client base. The ease with which retail traders can change providers underscores the significant bargaining power they hold, forcing brokers to remain agile and customer-centric in their offerings.

Retail traders are often very sensitive to price, aggressively looking for the narrowest spreads and lowest fees to boost their trading gains. This keen focus on cost directly pressures FXCM's pricing and profit margins.

For instance, the average spread on major currency pairs like EUR/USD can be a significant factor for active retail traders. A difference of just 0.1 pips can translate to substantial savings or increased costs over many trades.

FXCM must therefore navigate a delicate balance, offering pricing that attracts and retains these cost-conscious clients while still ensuring its own profitability and ability to invest in its platform and services.

The online brokerage market is incredibly crowded, with many firms offering very similar services. This means customers looking to trade currency pairs, indices, or commodities have a wealth of options to choose from. For instance, as of late 2023, there were hundreds of regulated online brokers operating globally, each vying for client attention.

This high level of competition directly enhances customer bargaining power. If FXCM, or any other broker for that matter, fails to meet a client's needs regarding pricing, platform usability, or customer support, that client can readily switch to a competitor. This ease of switching puts constant pressure on brokers like FXCM to offer competitive spreads, innovative features, and superior service to retain their client base.

Institutional Client Demands

Institutional clients, like hedge funds and proprietary trading firms, wield considerable bargaining power. Their substantial trading volumes, often in the millions or billions, grant them significant leverage when negotiating terms with FXCM.

These sophisticated clients frequently demand bespoke trading solutions, including direct market access (DMA) and tailored liquidity provisions. They expect highly competitive pricing, often seeking reduced spreads or commission structures that reflect their high-frequency trading activity.

The financial sophistication of these players means they thoroughly understand market dynamics and pricing. This knowledge allows them to effectively comparison shop and push for the most advantageous arrangements, putting pressure on FXCM to offer premium services at competitive rates.

- High Volume Trading: Institutional clients contribute a disproportionately large share of trading volume, giving them significant negotiation weight.

- Demand for Customization: Requirements for direct market access and specific liquidity pools increase their bargaining power.

- Price Sensitivity: Sophisticated pricing analysis by these clients forces FXCM to offer competitive, often lower, fee structures to retain them.

- Market Knowledge: Their deep understanding of FX markets enables them to negotiate from a position of strength.

Information Transparency

Customers now have unprecedented access to information about broker performance, including spreads, execution speed, and client feedback, thanks to numerous comparison websites and online forums. This transparency significantly boosts their bargaining power, allowing them to easily identify and switch to brokers offering better value. For FXCM, this means a constant need to maintain competitive pricing and superior service to retain clients.

The ease with which clients can compare FXCM's offerings against competitors puts direct pressure on the company to offer attractive spreads and reliable execution. A broker’s reputation is built in the digital public square; negative reviews or comparisons can swiftly impact client acquisition and retention rates, highlighting the critical importance of customer satisfaction.

- Increased Information Availability: Websites like Myfxbook and ForexPeaceArmy provide detailed data on broker spreads and execution quality, allowing clients to make well-informed choices.

- Customer Review Impact: Online reviews and community discussions heavily influence potential clients' decisions, making a broker's reputation a key competitive factor.

- Price Sensitivity: With readily available spread comparisons, clients are more likely to gravitate towards brokers offering the most cost-effective trading conditions.

Retail clients possess significant bargaining power due to the low switching costs in the FX market. With numerous brokers offering similar services and straightforward digital onboarding, clients can easily move to competitors with better pricing or features. For instance, many platforms provide comparable core functionalities, making the transition seamless. This ease of switching means FXCM must consistently offer competitive spreads and superior value to retain its customer base, as clients are highly sensitive to even minor differences in trading costs.

Institutional clients, such as hedge funds, exert even greater influence. Their large trading volumes, often in the millions or billions, give them substantial leverage in negotiating bespoke trading solutions and competitive pricing structures. These sophisticated clients demand features like direct market access and tailored liquidity, forcing FXCM to provide premium services at attractive rates to secure and maintain these high-value relationships. Their deep market knowledge further strengthens their negotiating position.

The transparency afforded by online comparison sites and forums significantly amplifies customer bargaining power. Platforms like Myfxbook allow clients to easily compare spreads, execution speeds, and broker reputations, empowering them to make informed decisions and switch to providers offering better value. This readily available information pressures FXCM to maintain competitive pricing and exceptional service to prevent client attrition, as a strong online reputation is crucial for acquisition and retention.

| Factor | Impact on FXCM | Evidence/Example |

| Low Switching Costs (Retail) | High Bargaining Power | Digital onboarding, comparable platform features |

| Price Sensitivity (Retail) | Pressure on Margins | Focus on narrowest spreads, e.g., EUR/USD |

| High Volume Trading (Institutional) | Significant Negotiation Leverage | Millions/Billions in trading volume |

| Demand for Customization (Institutional) | Increased Service Demands | Direct Market Access (DMA), tailored liquidity |

| Information Transparency | Enhanced Client Choice | Comparison sites like Myfxbook, ForexPeaceArmy |

Preview Before You Purchase

FXCM, Inc. Porter's Five Forces Analysis

This comprehensive Porter's Five Forces analysis of FXCM, Inc. details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the forex brokerage industry. The document you see here is exactly what you’ll be able to download after payment, offering a complete and ready-to-use strategic assessment.

Rivalry Among Competitors

The online forex and CFD brokerage landscape is extremely crowded, with a vast array of global and regional players, from seasoned institutions to agile fintech startups. This sheer volume of competition means FXCM must continually strive to differentiate itself, often through innovative offerings and robust client services to capture and maintain market share.

This intense fragmentation fuels aggressive marketing campaigns and price wars as brokers vie for customer attention and capital. In 2023, the global forex market saw average daily trading volumes exceeding $6.8 trillion, underscoring the immense scale and the fierce competition for even a sliver of this activity.

FXCM, like its peers, faces the perpetual challenge of standing out amidst this crowded marketplace. Success hinges on effectively communicating its unique value proposition and consistently delivering superior trading experiences to attract and retain clients in a highly dynamic environment.

Competitive rivalry in the forex market is intense, often driven by aggressive pricing strategies. Brokers frequently compete by offering tighter spreads and lower commissions to attract price-sensitive traders. This constant pressure can significantly impact profit margins for all players, including FXCM. For instance, in 2024, the average spread for major currency pairs like EUR/USD across leading retail platforms hovered around 0.7 to 1.2 pips, a tight range that necessitates high trading volumes for profitability.

FXCM must navigate this competitive landscape by balancing attractive pricing with the need to maintain healthy profit margins. A race to the bottom on pricing alone is unsustainable. The company's strategy likely involves optimizing operational efficiency and offering value-added services beyond just price to differentiate itself. This ensures they can remain competitive in attracting clients while still achieving profitability goals.

While many forex and CFD brokers offer similar core products, the competitive landscape demands significant product and service differentiation. FXCM competes by providing advanced trading platforms, robust analytical tools, and a wide array of educational materials designed to empower traders of all levels.

Beyond basic trading, FXCM differentiates itself through its commitment to client education and support. This includes webinars, market analysis, and dedicated customer service, aiming to foster long-term client relationships. In 2023, the online forex trading industry saw continued growth, with platforms emphasizing user experience and educational resources being key differentiators.

The ability to offer diverse asset classes beyond traditional forex, such as cryptocurrencies and commodities, also plays a crucial role. Furthermore, innovative features like social trading, allowing clients to follow and replicate the trades of experienced traders, can attract a substantial user base. Brokers that invest in these value-added services often outperform those relying solely on price competition.

Marketing and Brand Building Intensity

Competitors in the forex market pour substantial funds into marketing and brand development to stand out and cultivate client trust in what is often a standardized offering. This often translates to aggressive online advertising campaigns, strategic sponsorships, and the creation of educational resources designed to attract and retain traders. For FXCM, this means a continuous need to invest heavily in its own marketing initiatives to ensure it remains visible and continues to attract new clients in a highly competitive landscape.

The intensity of marketing and brand building is a key battleground. For instance, in 2023, many leading forex brokers reported marketing expenditures in the tens of millions of dollars, reflecting the high cost of acquiring and retaining clients in this digital-first industry. This constant barrage of advertising and promotional activities makes it challenging for any single firm to dominate market share without sustained marketing investment.

- High Marketing Spend: Competitors regularly allocate significant portions of their budget to digital advertising, social media engagement, and affiliate marketing to reach a global audience.

- Brand Trust Factor: In a market where execution and pricing can be similar, brand reputation and perceived trustworthiness, often built through consistent marketing and positive client experiences, become crucial differentiators.

- Educational Content as a Draw: Many firms offer free webinars, market analysis, and trading tutorials as a way to attract potential clients and establish themselves as thought leaders, thereby building brand loyalty.

- Sponsorships and Partnerships: Deals with sports teams, financial influencers, and industry events are common tactics used to increase brand visibility and associate the brokerage with aspirational or authoritative figures.

Regulatory Compliance as a Competitive Factor

Operating in the forex market means navigating a complex web of regulations across many countries. For FXCM, Inc., this means adhering to rules from entities like the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the United States. These diverse requirements act as a significant barrier for new entrants, leveling the playing field for established players.

Established firms like FXCM can leverage their robust compliance infrastructure as a key differentiator, building trust with clients. In 2024, firms with a strong regulatory standing are often perceived as more stable and reliable. This is particularly important in a sector where client funds are at stake, making adherence to rules like the Markets in Financial Instruments Directive (MiFID II) in Europe a critical factor for client acquisition and retention.

The financial burden of maintaining licenses and ensuring ongoing compliance across multiple jurisdictions is substantial. For instance, capital requirements and reporting obligations vary significantly by region, adding operational complexity. However, for companies like FXCM that have successfully integrated these costs, it solidifies their position against less compliant or newer competitors.

- Regulatory Landscape: FXCM operates under multiple global regulators, including the FCA in the UK and the CFTC in the US, requiring adherence to varying compliance standards.

- Barrier to Entry: Stringent regulatory requirements act as a significant hurdle for new participants attempting to enter the forex market.

- Trust and Reputation: A proven track record of regulatory compliance enhances client trust, a crucial competitive advantage in the financial services industry.

- Operational Costs: Maintaining licenses and compliance across different jurisdictions incurs substantial costs, which can be a competitive burden but also a mark of a serious, established firm.

The forex and CFD brokerage market is exceptionally competitive, characterized by a large number of global and regional players. This intense rivalry necessitates continuous innovation and superior client service to capture and retain market share. Brokers often engage in aggressive marketing and price competition, with tight spreads and low commissions being common tactics to attract traders.

FXCM must differentiate itself not just on price, but also through advanced trading platforms, comprehensive analytical tools, and robust educational resources. The ability to offer diverse asset classes and features like social trading further enhances a broker's appeal. In 2024, the average spread for EUR/USD remained tight, around 0.7-1.2 pips, highlighting the pressure on margins and the need for volume.

High marketing expenditures are a reality in this sector, with many firms investing tens of millions of dollars annually to build brand awareness and trust. Regulatory compliance, while a barrier to entry for new firms, also serves as a differentiator for established players like FXCM, fostering client confidence. For instance, adherence to MiFID II in Europe is crucial for client acquisition.

| Key Competitive Tactics | Description | Impact on FXCM |

| Price Competition | Offering tight spreads and low commissions. | Pressures profit margins; requires high trading volumes. |

| Product Differentiation | Providing advanced platforms, tools, and educational resources. | Attracts and retains clients seeking value beyond price. |

| Marketing and Brand Building | Aggressive digital advertising, sponsorships, and content creation. | Requires significant investment to maintain visibility and trust. |

| Regulatory Compliance | Adhering to global financial regulations. | Acts as a barrier to entry and builds client trust. |

SSubstitutes Threaten

Customers can bypass FXCM's Contracts for Difference (CFDs) by directly investing in the actual assets. For instance, instead of trading a CFD on the S&P 500 index, an investor could buy shares of the individual companies comprising the index through a traditional brokerage. This direct ownership route, while potentially demanding more upfront capital and a different trading approach, offers a distinct risk-reward dynamic and avoids some of the complexities associated with CFD trading, such as leverage and rollover fees.

The availability of direct investment channels presents a significant substitute. In 2024, the global stock market capitalization stood at an estimated $100 trillion, offering vast opportunities for direct asset acquisition. Similarly, commodity markets, while more diverse, provide avenues for direct investment in physical goods or futures contracts, presenting an alternative to CFD speculation for many investors seeking tangible exposure.

Investors often turn to traditional vehicles like stocks, bonds, and ETFs from established institutions as a substitute for the speculative trading FXCM offers. These alternatives typically suit longer-term goals and varying risk tolerances, presenting a different path to market participation. For instance, the U.S. stock market, as represented by the S&P 500, saw a significant rally in 2024, with the index reaching new all-time highs, demonstrating its enduring appeal.

The growing accessibility of cryptocurrencies presents a significant threat of substitutes for traditional CFD brokers like FXCM. Individuals can now directly access the crypto market through specialized exchanges, effectively bypassing intermediaries. For instance, by mid-2024, the total market capitalization of cryptocurrencies had surpassed $2.5 trillion, indicating substantial trading volume and direct participation.

Furthermore, the proliferation of digital wallets allows for direct ownership and storage of digital assets, removing the need for speculative contracts offered by CFD providers. This direct ownership model appeals to investors seeking to hold underlying assets rather than engage in leveraged trading of price movements.

Spread Betting (in certain jurisdictions)

In key markets like the UK and Ireland, spread betting presents a significant threat of substitution for FXCM’s Contract for Difference (CFD) offerings. Profits from spread betting are often free from capital gains tax, a substantial incentive for traders. This tax advantage makes it a direct and attractive alternative for speculating on currency price movements.

This tax efficiency means traders in these regions may opt for spread betting platforms even if the underlying functionality is similar to CFDs. For FXCM to effectively counter this threat, it would need to consider offering its own spread betting products to capture this segment of the market.

- Tax Efficiency: Spread betting profits are typically exempt from capital gains tax in the UK and Ireland.

- Functional Similarity: Spread betting mirrors the speculative nature of CFDs on price movements.

- Market Penetration: The tax advantage drives adoption, making it a strong competitor in specific geographies.

- Competitive Response: FXCM may need to integrate spread betting to remain competitive where it's prevalent.

Peer-to-Peer (P2P) Lending and Crowdfunding

Peer-to-peer (P2P) lending and crowdfunding platforms present a notable threat of substitutes for traditional investment avenues, including those offered by FXCM. These platforms allow individuals to lend money directly to other individuals or businesses, or to invest in various projects, often with the promise of higher returns than traditional savings accounts.

For investors looking to diversify their portfolios beyond speculative trading, P2P lending and crowdfunding offer alternative ways to generate income and capital growth. These options cater to a range of risk appetites and financial objectives.

As of late 2024, the P2P lending market continued to show resilience, with total lending volumes on major platforms indicating sustained investor interest. Crowdfunding, particularly equity crowdfunding, also saw increased participation, as more businesses turned to these channels for funding.

- P2P Lending Growth: The global P2P lending market was projected to reach over $450 billion by 2025, demonstrating a significant alternative for capital deployment.

- Crowdfunding Investment: Equity crowdfunding platforms have facilitated billions in funding for startups and small businesses, offering investors stakes in growing enterprises.

- Alternative Income Streams: These platforms provide accessible avenues for individuals seeking income diversification, potentially yielding higher interest rates than traditional fixed-income products.

- Risk Diversification: Investors can use P2P and crowdfunding to spread risk across different types of borrowers and projects, complementing traditional trading strategies.

The threat of substitutes for FXCM's CFD trading services is substantial, stemming from both direct investment in underlying assets and alternative speculative platforms. Investors can bypass CFDs by directly purchasing stocks, bonds, or ETFs, offering a different risk-reward profile. For example, in 2024, the global stock market capitalization exceeded $100 trillion, providing ample opportunity for direct investment.

Furthermore, the rise of cryptocurrencies presents a significant alternative, with the total market cap surpassing $2.5 trillion by mid-2024, allowing direct participation without intermediaries. In regions like the UK and Ireland, spread betting offers a compelling substitute due to its tax efficiency, as profits are often exempt from capital gains tax. This tax advantage makes it a particularly attractive alternative for speculating on price movements.

Additionally, peer-to-peer lending and crowdfunding platforms provide alternative investment avenues, attracting capital away from speculative trading. The P2P lending market was projected to exceed $450 billion by 2025, indicating a growing appetite for these direct investment opportunities.

Entrants Threaten

The online forex and CFD brokerage sector presents formidable challenges for newcomers due to extensive regulatory requirements. Entities operating globally, like FXCM, must navigate a complex web of rules in numerous financial markets. For instance, obtaining regulatory approval in major jurisdictions often necessitates substantial capital reserves, with some requiring upwards of €730,000 (approximately $785,000 USD as of mid-2024) in initial capital, as mandated by entities like the European Securities and Markets Authority (ESMA) for certain license types.

These stringent compliance frameworks demand robust operational infrastructure, including sophisticated risk management systems and transparent reporting. The process of securing and maintaining multiple licenses is not only time-consuming but also incurs significant ongoing costs, acting as a substantial deterrent to potential entrants. This regulatory burden provides a degree of protection for established firms such as FXCM, as the financial and operational commitment required to enter the market is considerable.

Establishing a presence in the forex brokerage industry demands considerable financial muscle. Think about the costs: state-of-the-art trading platforms, securing reliable liquidity from major banks, extensive marketing campaigns to build brand awareness, and covering day-to-day operational overheads all add up. Furthermore, regulatory bodies mandate significant capital reserves to ensure client protection and market stability. For instance, in 2024, regulatory capital requirements for retail forex brokers in major jurisdictions like the EU (MiFID II) and the US (CFTC/NFA) can range from hundreds of thousands to millions of dollars, depending on the scale of operations and client assets managed.

This substantial financial barrier acts as a potent deterrent for aspiring new entrants. It means a newcomer must secure a large amount of funding even before generating their first dollar of revenue, making the path incredibly challenging. FXCM, with its established capital base, possesses a significant advantage here, having already cleared these high initial investment hurdles.

In the forex and CFD trading industry, where substantial sums of client money are involved and market volatility is a constant, brand reputation and trust are absolutely critical. Established firms like FXCM have cultivated this trust over extended periods, making it a significant hurdle for any new entrant to overcome swiftly. Gaining credibility and persuading clients to switch from well-recognized brands without a demonstrable history of reliability presents a formidable challenge.

Newcomers struggle to quickly build the kind of deep-seated trust that incumbents enjoy, especially when dealing with financial services. For instance, in 2023, the Financial Conduct Authority (FCA) in the UK reported a notable increase in complaints related to unauthorized firms, highlighting the public's sensitivity to trust and legitimacy in financial dealings.

This established trust acts as a powerful moat, deterring potential new entrants. Without a proven track record, new firms find it difficult to attract clients, who are often risk-averse when it comes to their investments. This inherent difficulty in replicating years of earned trust gives established players like FXCM a distinct and enduring competitive advantage.

Economies of Scale in Liquidity and Technology

Larger, established brokers such as FXCM leverage significant economies of scale, particularly in securing favorable liquidity pricing from financial institutions. In 2023, major forex brokers often negotiated spreads that were 5-10% tighter than those available to smaller, newer entrants due to their higher trading volumes. This cost advantage makes it difficult for new players to compete on price.

Furthermore, substantial investments in proprietary trading technology, including low-latency execution platforms and advanced analytical tools, create another barrier. For instance, developing and maintaining a cutting-edge trading platform can cost millions of dollars annually. New entrants struggle to match this level of technological sophistication and efficiency, impacting their ability to offer competitive trading experiences.

- Liquidity Access: Established brokers secure better pricing due to higher trading volumes, reducing per-transaction costs.

- Technology Investment: Significant capital is required for proprietary trading platforms, giving incumbents a technological edge.

- Cost Disadvantage: New entrants face higher operational costs, making it challenging to offer competitive pricing and services.

Difficulty in Client Acquisition and Retention

The online trading market is incredibly crowded, meaning it's tough and costly to attract new clients. Established players like FXCM have built brand recognition, forcing newcomers to spend significantly on marketing to even get noticed. Persuading traders to move their accounts also requires substantial incentives.

Retention is equally challenging. With low barriers to switching brokers, clients can easily move if they find a slightly better offer or a more appealing platform. This constant threat means brokers must continuously innovate and offer competitive pricing and services to keep their existing customer base. For instance, reports in early 2024 highlighted that the average cost of acquiring a new online trading client can range from $300 to over $1000, depending on the marketing channels used and the target demographic.

- High Client Acquisition Costs: Intense competition drives up advertising and promotional expenses for new entrants.

- Low Switching Costs for Clients: Traders can easily move between brokers, creating a constant need for customer retention efforts.

- Brand Loyalty and Trust: Established firms benefit from existing trust, making it harder for new entrants to gain market share.

- Aggressive Marketing by Incumbents: Existing brokers often have larger marketing budgets, further complicating client acquisition for new firms.

The threat of new entrants into the FXCM, Inc. competitive landscape is significantly mitigated by high capital requirements and stringent regulatory hurdles. For example, in 2024, regulatory capital for forex brokers in the EU can exceed €730,000, and in the US, it can be millions of dollars, effectively creating a substantial financial barrier.

Furthermore, established brand trust and loyalty are difficult for newcomers to replicate, especially in the financial services sector where credibility is paramount. Reports from 2023 indicated increased complaints about unauthorized firms, underscoring client sensitivity to legitimacy.

Economies of scale and technological investment also deter new entrants. In 2023, larger brokers secured liquidity pricing 5-10% tighter than smaller firms, and developing advanced trading platforms incurs millions in annual costs.

| Barrier to Entry | Estimated Cost/Requirement (2024) | Impact on New Entrants |

|---|---|---|

| Regulatory Capital (EU) | > €730,000 | High financial barrier, requires significant upfront investment. |

| Regulatory Capital (US) | Millions of USD | Substantial capital needed for compliance and operations. |

| Brand Trust Cultivation | Years of consistent service | Difficult to quickly establish credibility against established players. |

| Liquidity Access Pricing | 5-10% tighter spreads for high volumes (2023) | New entrants face higher per-transaction costs. |

| Technology Investment | Millions USD annually for platforms | Requires substantial ongoing investment to match incumbent capabilities. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for FXCM, Inc. leverages data from financial statements, regulatory filings (like SEC filings), and industry-specific market research reports. We also incorporate insights from reputable financial news outlets and economic data providers to assess competitive pressures.