F.W. Webb SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.W. Webb Bundle

F.W. Webb's market position is strong, leveraging its extensive product lines and established distribution network. However, understanding the competitive landscape and potential operational challenges is crucial for sustained growth.

Want the full story behind F.W. Webb's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

F.W. Webb boasts an extensive product portfolio, encompassing plumbing, heating, HVAC, refrigeration, and industrial pipe, valves, and fittings (PVF). This broad inventory, as evidenced by their continuous expansion of product lines and supplier partnerships throughout 2024 and into early 2025, allows them to serve a wide range of customer needs and project scopes. Their ability to act as a single-source supplier for such a diverse set of offerings is a significant advantage.

This comprehensive product selection directly translates into customer convenience and loyalty. By offering a one-stop shop for essential supplies across multiple trades, F.W. Webb minimizes the need for customers to engage with various suppliers. This integrated approach, which has been a cornerstone of their strategy in the 2024-2025 period, helps to solidify market share and build stronger relationships.

F.W. Webb boasts a significant regional footprint across the Northeastern United States, operating a robust network of wholesale branches and customer-focused showrooms. This extensive presence, particularly strong in key economic hubs, translates to enhanced brand visibility and deep market penetration.

Their localized strategy allows for efficient supply chain management and rapid product delivery, crucial for serving the fast-paced needs of contractors and facility managers. This proximity fosters stronger customer relationships and a better understanding of regional market demands.

By 2024, F.W. Webb operated over 100 locations, a testament to their commitment to regional accessibility. This widespread network is a significant competitive advantage, enabling them to provide tailored service and support that larger, less localized competitors often struggle to match.

F.W. Webb’s diverse customer base, encompassing contractors, engineers, and facility managers, is a significant strength. This broad reach across residential, commercial, and industrial sectors ensures robust revenue stability. For instance, in 2024, the company reported continued growth in its commercial and industrial segments, offsetting slower residential construction cycles.

Established Supply Chain and Logistics

F.W. Webb's established supply chain and logistics are a significant strength, underpinned by its extensive network of branches and showrooms. This robust infrastructure ensures efficient product delivery and effective inventory management, crucial for success in wholesale distribution. In 2024, the company continued to invest in optimizing its distribution centers, aiming for even faster order fulfillment times.

This well-oiled machine translates into tangible benefits for customers and the company alike.

- Timely Deliveries: The company's logistics network supports prompt delivery of a wide range of products, meeting customer deadlines effectively.

- Inventory Efficiency: Advanced inventory management systems minimize stockouts and reduce carrying costs, contributing to profitability.

- Service Reliability: A dependable supply chain enhances customer trust and loyalty, a key differentiator in the competitive market.

Comprehensive Support Services

F.W. Webb goes beyond just supplying products, offering a suite of comprehensive support services designed for their professional clientele. These services, including vital technical assistance, specialized training programs, and dedicated project support, are crucial differentiators in a competitive market. This commitment to customer success helps build lasting relationships and reinforces F.W. Webb's position as a trusted partner.

These value-added services are key to customer retention and loyalty. For instance, in 2023, F.W. Webb reported a significant increase in engagement with its online training modules, indicating a strong demand for accessible skill enhancement. This focus on support allows them to capture a larger share of their customers' project needs, moving beyond simple transactional sales.

The benefits of these support services are evident in customer feedback and repeat business. By providing expert guidance and problem-solving capabilities, F.W. Webb empowers its customers to complete projects efficiently and successfully. This proactive approach not only solves immediate issues but also cultivates a deeper, more collaborative partnership.

Key support offerings include:

- Technical Assistance: Expert advice on product selection, installation, and troubleshooting.

- Training Programs: Educational sessions covering new technologies, product updates, and best practices.

- Project Support: Assistance with planning, design, and execution of complex projects.

- Online Resource Library: Access to manuals, guides, and technical specifications.

F.W. Webb's extensive product portfolio, covering plumbing, HVAC, and industrial supplies, acts as a significant draw, positioning them as a single-source provider for diverse customer needs. This comprehensive offering, continually expanded through new supplier partnerships in 2024-2025, simplifies procurement for clients. Their ability to meet a wide array of project requirements from one supplier fosters customer loyalty.

The company's substantial regional presence, with over 100 locations by 2024 across the Northeastern US, ensures accessibility and efficient service. This broad network allows for localized support and rapid delivery, crucial for contractors and facility managers. Their deep market penetration in key economic areas strengthens brand recognition and customer relationships.

F.W. Webb benefits from a diverse customer base spanning residential, commercial, and industrial sectors, providing revenue stability. Growth in their commercial and industrial segments during 2024 helped balance any slowdowns in residential construction. This broad market engagement ensures resilience.

Their robust supply chain and logistics, supported by an extensive branch network, are a key operational strength. Investments in distribution center optimization in 2024 aimed to further enhance order fulfillment speed. This reliable infrastructure ensures timely deliveries and efficient inventory management, vital for customer satisfaction and operational efficiency.

| Strength Area | Description | Impact |

|---|---|---|

| Product Breadth | Extensive inventory across multiple trades (plumbing, HVAC, industrial). | Single-source supplier advantage, customer convenience. |

| Regional Footprint | Over 100 locations by 2024, strong Northeastern presence. | Enhanced accessibility, efficient logistics, localized support. |

| Customer Diversification | Serves residential, commercial, and industrial sectors. | Revenue stability, resilience against market fluctuations. |

| Supply Chain & Logistics | Well-established network, ongoing optimization efforts. | Timely deliveries, inventory efficiency, service reliability. |

What is included in the product

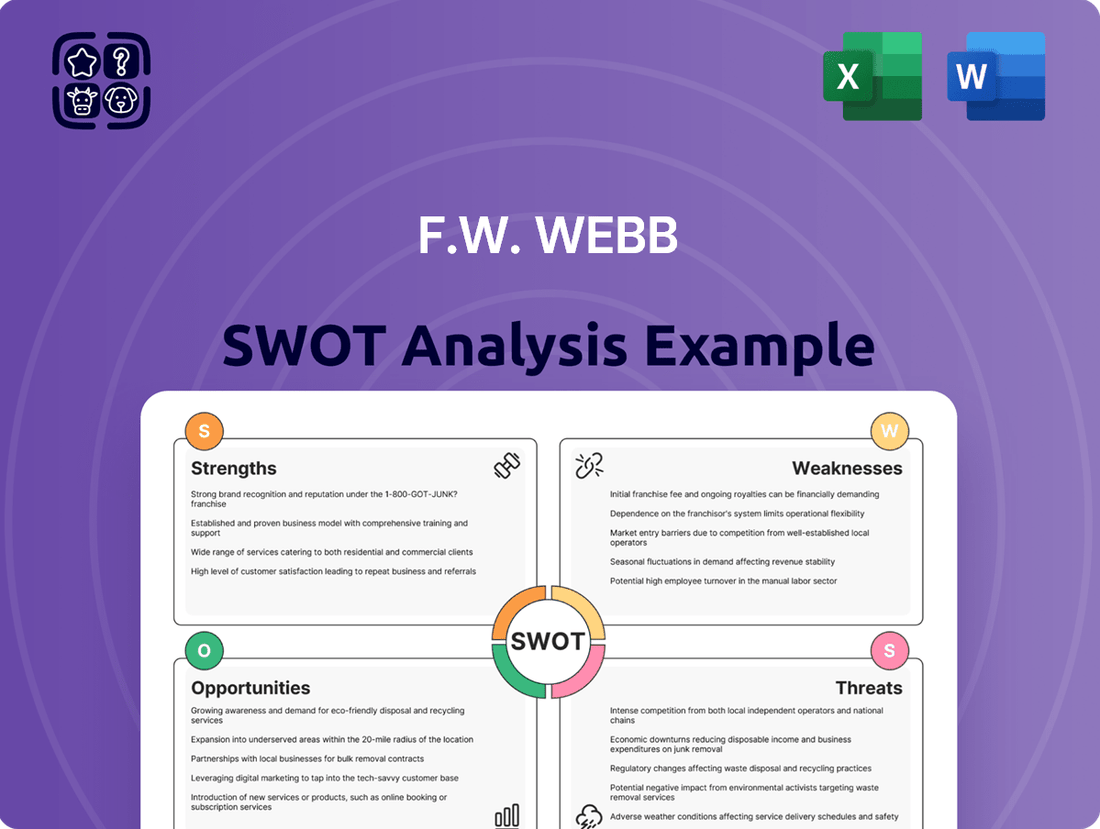

Delivers a strategic overview of F.W. Webb’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Offers a clear, organized framework to identify and address key challenges within F.W. Webb's operations.

Weaknesses

F.W. Webb's significant concentration in the Northeastern United States presents a notable weakness, as it ties their performance heavily to regional economic health. A slowdown in key sectors like construction or manufacturing in this area, which are vital to their business, could lead to a disproportionate hit to their overall revenue and profits. For instance, if the Northeast experiences a recession, F.W. Webb's sales could be severely impacted, unlike a more geographically diversified competitor.

F.W. Webb's reliance on the construction, industrial, and commercial sectors makes it particularly vulnerable to economic cycles. During economic downturns, reduced spending in these areas directly impacts demand for F.W. Webb's products, leading to potential sales volatility. For instance, a projected slowdown in US nonresidential construction spending for 2024, estimated by some industry reports to be around 2-3%, could translate to a noticeable dip in demand for plumbing and HVAC supplies.

The wholesale distribution landscape for plumbing, HVAC, and industrial supplies is exceptionally crowded. F.W. Webb contends with formidable rivals, from national powerhouses to agile regional specialists, all vying for market dominance. This intense competition directly impacts F.W. Webb's ability to maintain healthy profit margins and secure market share, as it necessitates constant vigilance on pricing strategies, ensuring consistent product availability, and upholding superior service standards.

Inventory Management Complexity

Managing F.W. Webb's extensive and varied product range across numerous locations presents a significant challenge. This complexity necessitates advanced inventory management solutions to avoid issues like excessive carrying costs, product obsolescence, or frustrating stockouts, all of which directly impact the company's bottom line and customer loyalty.

The sheer diversity of products makes accurate demand forecasting particularly intricate. For instance, in 2024, the wholesale distribution sector, which F.W. Webb operates within, faced ongoing supply chain volatility, making precise inventory planning even more critical. Companies in this sector reported an average inventory turnover ratio of 6-8 times annually, highlighting the importance of efficient stock management to avoid capital being tied up in slow-moving goods.

- Broad Product Assortment: Handling thousands of SKUs across plumbing, HVAC, and building materials.

- Multi-Branch Operations: Distributing inventory effectively to over 100 locations.

- Demand Volatility: Predicting customer needs for diverse product categories, influenced by seasonal trends and economic factors.

Potential for Digital Transformation Lag

F.W. Webb might face challenges keeping pace with digital advancements. Competitors who are quicker to adopt new e-commerce platforms, sophisticated supply chain management software, or advanced customer data analytics could gain an edge. This digital lag could affect operational efficiency and how well they connect with customers in today's increasingly online marketplace.

For instance, while many in the wholesale distribution sector are investing heavily in digital transformation, a slower adoption rate could mean F.W. Webb misses out on optimizing inventory management or providing seamless online ordering experiences. By Q4 2024, e-commerce sales in the wholesale distribution sector were projected to reach $1.5 trillion globally, highlighting the critical nature of digital presence.

- Slower adoption of advanced digital tools

- Risk of falling behind agile competitors in e-commerce

- Potential impact on operational efficiency and customer experience

- Competitive disadvantage in an increasingly digital market

F.W. Webb's heavy reliance on the Northeast region makes it susceptible to localized economic downturns, unlike more diversified competitors. This regional concentration means that a slowdown in key industries like construction or manufacturing within this specific area can disproportionately impact the company's overall financial performance.

The company's exposure to economic cycles is a significant weakness, as reduced spending in the construction and industrial sectors directly affects demand for its products. For example, a projected 2-3% dip in US nonresidential construction spending for 2024, as indicated by industry reports, could translate into decreased sales for F.W. Webb.

| Weakness | Description | Impact |

| Regional Concentration | Over-reliance on the Northeastern US market. | Vulnerability to regional economic slowdowns. |

| Economic Sensitivity | Dependence on construction and industrial sectors. | Sales volatility during economic downturns. |

| Intense Competition | Presence of national and regional rivals. | Pressure on profit margins and market share. |

| Inventory Management Complexity | Managing a vast product range across many branches. | Risk of high carrying costs, obsolescence, or stockouts. |

| Digital Transformation Lag | Slower adoption of e-commerce and digital tools. | Potential loss of efficiency and customer engagement to competitors. |

Same Document Delivered

F.W. Webb SWOT Analysis

The preview you see is the actual F.W. Webb SWOT analysis document you’ll receive upon purchase. This ensures you know exactly what you're getting—a professionally structured and insightful report. No surprises, just the comprehensive analysis you need.

Opportunities

F.W. Webb can capitalize on its proven business model and operational know-how to explore expansion into new geographic territories. This move beyond its current Northeast stronghold presents a chance to tap into previously unreached customer segments and diversify revenue sources, thereby mitigating risks associated with regional over-reliance. For instance, similar plumbing supply distributors have seen substantial growth by entering markets like the Southeast or Midwest in recent years, with some reporting double-digit revenue increases in those new regions within their first three years of operation.

Investing further in robust e-commerce platforms and digital sales channels presents a significant opportunity for F.W. Webb to reach a broader customer base and enhance customer convenience. The global e-commerce market is projected to reach $8.1 trillion by 2024, indicating a substantial digital shift in purchasing behavior.

A strong online presence can streamline ordering processes, reduce operational costs, and cater to the evolving preferences of professional buyers who increasingly seek efficiency and 24/7 access to products and information.

The increasing global emphasis on sustainability presents a significant opportunity for F.W. Webb to expand into renewable energy and smart technologies. Markets for heat pumps and solar thermal systems are experiencing robust growth; for instance, the global heat pump market was valued at approximately $50 billion in 2023 and is projected to reach over $100 billion by 2030, with a compound annual growth rate (CAGR) exceeding 10%.

By integrating these advanced solutions into their existing product portfolio, F.W. Webb can cater to the rising demand for eco-friendly building practices and smart home automation. This strategic move allows them to capture market share in high-growth sectors, positioning the company as an innovative leader in plumbing, heating, and cooling solutions.

Strategic Acquisitions and Partnerships

F.W. Webb can significantly boost its market presence and capabilities by strategically acquiring smaller, specialized distributors. This approach allows for rapid expansion into niche markets and the integration of unique product lines. For instance, acquiring a company with expertise in smart plumbing technology could provide immediate access to a growing segment of the market.

Forming partnerships with innovative technology providers presents another key opportunity. Collaborations can lead to the development of advanced inventory management systems or e-commerce platforms, streamlining operations and improving customer experience. In 2024, the building materials distribution sector saw increased investment in digital transformation, with companies reporting an average of 15% revenue growth from enhanced online channels.

- Acquire specialized distributors to gain immediate market share and product diversity.

- Partner with tech firms to integrate advanced solutions like AI-driven inventory management.

- Leverage inorganic growth to accelerate entry into high-demand product categories.

- In 2024, the wholesale trade sector saw a 7% increase in M&A activity, highlighting a favorable environment for strategic acquisitions.

Enhancing Value-Added Services

F.W. Webb can significantly boost its market position by expanding its value-added services. Offering advanced technical training, specialized project design assistance, and energy efficiency consulting can set them apart from competitors. These enhanced offerings not only command higher profit margins but also foster deeper customer relationships, moving beyond transactional sales to create a more loyal and engaged clientele.

For instance, by providing comprehensive logistics solutions, F.W. Webb could streamline supply chains for its clients. This could include just-in-time delivery, inventory management, and customized kitting services. Such integrated support can be a major differentiator, particularly for contractors and businesses focused on project efficiency.

The company's focus on value-added services aligns with industry trends. In 2024, the professional services sector within the building materials industry saw a notable increase in demand for specialized support, with some firms reporting revenue growth upwards of 15% from these offerings. This indicates a strong market appetite for expertise beyond basic product provision.

- Advanced Technical Training: Offering specialized courses on new product installations or system diagnostics.

- Project Design Support: Providing expert consultation on system layouts and component selection for complex projects.

- Energy Efficiency Consulting: Assisting clients in identifying and implementing solutions that reduce energy consumption and operational costs.

- Comprehensive Logistics Solutions: Streamlining delivery, inventory management, and on-site material staging.

F.W. Webb can expand its reach by entering new geographic markets, tapping into untapped customer bases and diversifying revenue streams. The company can also enhance its customer engagement and sales by investing in and improving its e-commerce platforms and digital sales channels, aligning with the growing trend of online purchasing.

Furthermore, F.W. Webb has an opportunity to capitalize on the increasing demand for sustainable solutions by expanding its offerings in renewable energy and smart technologies, positioning itself as an innovator in eco-friendly building practices.

Strategic acquisitions of smaller, specialized distributors can accelerate F.W. Webb's entry into niche markets and broaden its product portfolio, while partnerships with technology providers can lead to operational improvements and enhanced customer experiences.

Threats

Significant economic slowdowns and market volatility, particularly within the construction and industrial sectors, represent a substantial threat to F.W. Webb's revenue streams and overall profitability. For instance, a projected 1.5% contraction in US GDP for late 2024 could significantly curb demand.

Recessions or periods of economic instability directly impact consumer spending and business investment, leading to project delays or cancellations. This, in turn, reduces the demand for the wholesale plumbing, heating, and HVAC supplies that F.W. Webb specializes in, as seen in the 8% year-over-year decline in new housing starts reported in Q3 2024.

These macroeconomic factors are largely external and beyond the direct control of F.W. Webb, making proactive mitigation challenging. The impact of a potential 2025 recession, with forecasts suggesting inflation could remain above 3.5%, further amplifies this threat.

The plumbing and HVAC supply industry faces increasing pressure from major online retailers and large national chains. These competitors leverage significant buying power and advanced logistics networks to offer competitive pricing and wider product availability, directly challenging F.W. Webb's established market position. For instance, Home Depot's Pro Xtra program offers bulk discounts and dedicated services, while online giants like Amazon Business provide a vast selection and rapid delivery, impacting customer acquisition and retention.

Global supply chain vulnerabilities, exacerbated by geopolitical events and fluctuating raw material costs for items like metals and plastics, pose a significant threat to F.W. Webb. These issues can directly translate into product shortages, higher procurement expenses, and delayed deliveries.

The impact of these disruptions on F.W. Webb's operations is substantial, affecting inventory management, the ability to fulfill customer orders promptly, and ultimately, the company's bottom line. For instance, the semiconductor shortage in 2021-2022 led to production delays across various industries, a challenge that likely extended to components used in plumbing and HVAC systems.

Managing these external risks requires constant vigilance and adaptive strategies, as the interconnected nature of global trade means that localized problems can quickly escalate. The cost of shipping, a key component of supply chain expenses, saw significant increases in 2021 and 2022, adding further pressure.

Technological Disruption and Obsolescence

F.W. Webb faces the threat of rapid technological advancements in building systems, HVAC, and industrial processes. Failure to adapt could make current product lines obsolete. For instance, the increasing integration of smart technology in plumbing and HVAC systems, a trend accelerating through 2024 and projected to continue into 2025, demands constant updates to F.W. Webb's inventory and service offerings.

Staying relevant requires continuous investment in new inventory and employee training. The building materials sector, for example, saw significant innovation in sustainable and smart materials throughout 2024. Companies that don't update their stock and train their staff on these new materials risk losing market share to more agile competitors. This necessitates a proactive approach to technology adoption and workforce development.

- Technological obsolescence: Rapid advancements in HVAC and building automation systems pose a risk to F.W. Webb's existing product lines.

- Investment in new technologies: Continuous investment in smart systems and new materials is crucial for inventory relevance.

- Employee training needs: Keeping staff updated on new technologies and materials requires ongoing training initiatives.

- Market adaptation: Failure to adapt to technological shifts could lead to a loss of competitive advantage in the market.

Regulatory Changes and Environmental Compliance

Evolving environmental regulations, building codes, and industry standards concerning energy efficiency, emissions, and material safety present a significant threat. These changes could introduce new compliance burdens and associated costs for F.W. Webb and its clientele, potentially impacting product demand and operational flexibility.

For instance, the increasing focus on embodied carbon in construction materials, a trend gaining momentum through 2024 and projected to intensify, could necessitate investments in sourcing or developing lower-emission alternatives. Failure to adapt to these evolving standards, such as stricter EPA emissions limits or updated ASHRAE energy efficiency guidelines, risks penalties and a decline in market share for non-compliant offerings.

- Increased operational costs: Adapting to new environmental and safety standards often requires investment in new technologies, training, and potentially material sourcing changes, all of which can raise operational expenses.

- Reduced product demand: Products that do not meet updated energy efficiency, emissions, or material safety regulations may face decreased demand from contractors and consumers who are increasingly prioritizing sustainable and compliant options.

- Potential for penalties: Non-compliance with regulatory changes can lead to fines, legal challenges, and reputational damage, directly impacting profitability and business continuity.

Intensifying competition from both online retailers and large national chains poses a significant threat. Competitors like Home Depot and Amazon Business offer aggressive pricing, extensive product selections, and efficient logistics, directly challenging F.W. Webb's market position and customer loyalty. This competitive pressure could lead to reduced market share and thinner profit margins.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from F.W. Webb's financial statements, comprehensive market research reports, and insights from industry experts to ensure a thorough and accurate assessment.