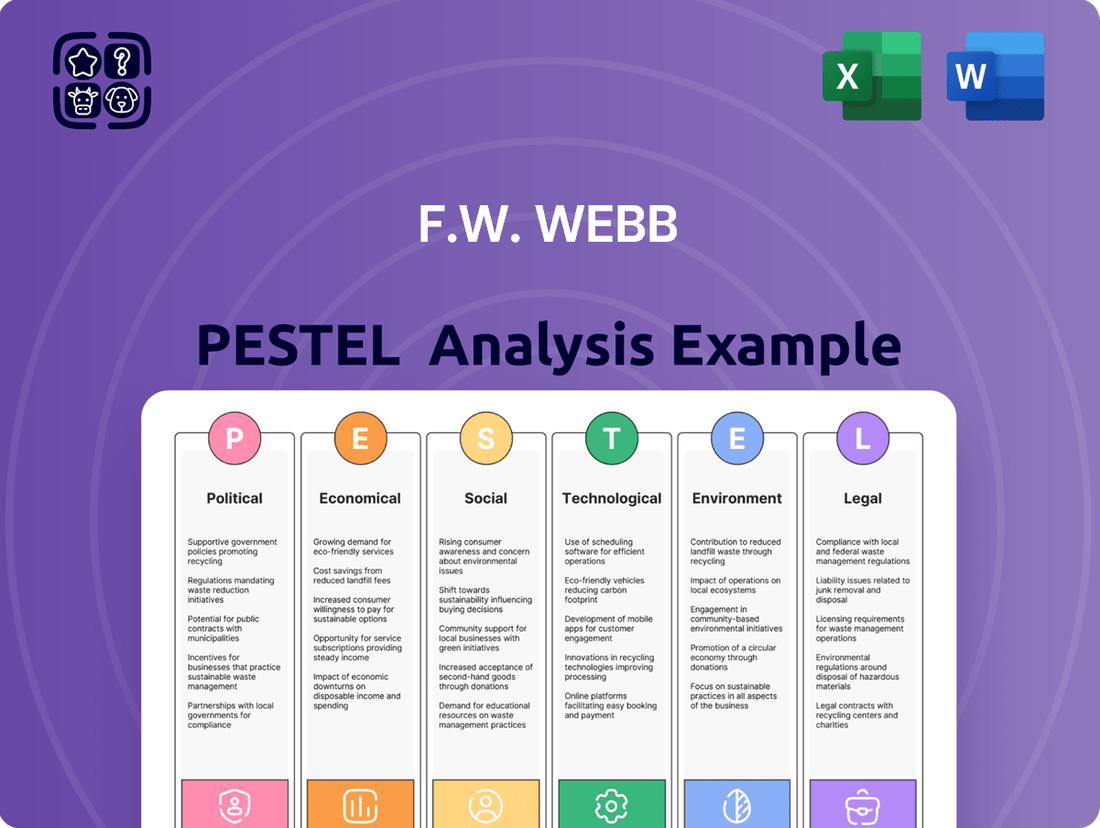

F.W. Webb PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

F.W. Webb Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping F.W. Webb's trajectory. Our expertly crafted PESTLE analysis provides a comprehensive overview of these external forces, empowering you to anticipate market shifts and make informed strategic decisions. Don't just react to change—lead it. Download the full version now for actionable intelligence.

Political factors

Government investment in infrastructure projects significantly influences the demand for F.W. Webb's product lines, particularly those in the Plumbing, Valves, and Fittings (PVF) and Heating, Ventilation, and Air Conditioning (HVAC) sectors. For instance, the U.S. Bipartisan Infrastructure Law, enacted in 2021, allocates substantial funds towards upgrading roads, bridges, public transit, and water systems, directly boosting the need for the materials and equipment distributed by companies like F.W. Webb.

Increased government spending on public buildings, transportation networks, and utility upgrades stimulates the construction industry. This heightened activity translates into greater sales volumes for wholesale distributors as contractors and developers require more PVF and HVAC components. The American Society of Civil Engineers' 2021 Report Card for America's Infrastructure highlighted a D+ grade, underscoring the significant need for investment, which suggests continued demand for Webb's offerings.

Conversely, any reduction or slowdown in public infrastructure spending can lead to a noticeable decline in demand for construction materials and equipment. A contraction in government-funded projects directly impacts the pipeline of work for contractors, subsequently reducing their procurement of PVF and HVAC systems from wholesale distributors like F.W. Webb.

Changes in international trade policies, including tariffs, directly impact F.W. Webb's operational costs. For instance, the U.S. imposed tariffs on steel and aluminum in 2018, which could increase the cost of HVAC equipment and plumbing supplies sourced from affected countries. These tariffs, if maintained or expanded, can ripple through the supply chain, affecting F.W. Webb's procurement expenses and potentially leading to price adjustments for their customers.

Changes in building codes, especially those focusing on energy efficiency and safety, directly impact the product demand for F.W. Webb's customers. For instance, stricter energy codes enacted in 2024 across several U.S. states are increasing the need for high-efficiency HVAC components and water-saving plumbing fixtures.

F.W. Webb needs to ensure its extensive product catalog, which includes plumbing, heating, and HVAC supplies, consistently meets these evolving regulatory landscapes. This ensures they can support clients who are adapting to new compliance mandates, potentially boosting sales of compliant technologies.

Taxation Policies

Corporate tax rates directly influence F.W. Webb's bottom line and its capacity for reinvestment. For instance, the U.S. federal corporate tax rate currently stands at 21%, a figure that has remained consistent since the Tax Cuts and Jobs Act of 2017. State-level corporate taxes vary significantly, adding another layer of complexity to financial planning.

Sales taxes and other fiscal policies also play a crucial role. Changes in these taxes can impact consumer spending on plumbing supplies and equipment, potentially affecting F.W. Webb's sales volume. For example, a rise in state sales tax rates could dampen demand for discretionary purchases, while exemptions or lower rates on essential goods might boost sales.

Favorable tax incentives, such as those for energy-efficient building or infrastructure projects, can be a significant boon for F.W. Webb. These incentives can stimulate demand for the company's products by making construction and renovation projects more financially attractive. Conversely, an increase in the overall tax burden on businesses or individuals could lead to reduced disposable income, thereby contracting market demand for F.W. Webb's offerings.

- Federal Corporate Tax Rate: 21% (as of 2024)

- Impact of Sales Tax: Affects consumer purchasing power and demand for F.W. Webb's products.

- Incentive Influence: Tax breaks for green building or infrastructure can drive sales growth.

- Economic Sensitivity: Higher taxes can reduce disposable income, potentially lowering market demand.

Energy Efficiency Incentives

Government incentives and rebates for energy-efficient products, such as those for high-efficiency HVAC systems or plumbing fixtures, are a significant political factor influencing demand. For instance, the Inflation Reduction Act of 2022 in the US offers substantial tax credits for homeowners and businesses installing energy-saving equipment, potentially driving sales for F.W. Webb's eligible product lines. These programs directly encourage the adoption of technologies that reduce energy consumption, aligning with broader national sustainability objectives and creating market opportunities.

F.W. Webb can leverage these political initiatives by actively promoting and stocking products that qualify for these incentives. By educating their contractor and engineer clients about available rebates and tax credits, the company can help them secure more projects that incorporate energy-efficient solutions. This strategic positioning allows F.W. Webb to capitalize on government policy designed to accelerate the transition to a greener economy.

- Government Support for Energy Efficiency: Federal and state programs, like those established by the Inflation Reduction Act, provide financial incentives for energy-efficient upgrades, boosting demand for relevant products.

- Market Opportunity for F.W. Webb: The company can gain a competitive edge by stocking and promoting products that qualify for these incentives, aiding its clients in winning more energy-focused projects.

- Alignment with Sustainability Goals: These incentives are often tied to broader environmental policies, creating a favorable market climate for businesses that support sustainable building practices.

Government investment in infrastructure, such as the Bipartisan Infrastructure Law, directly fuels demand for F.W. Webb's PVF and HVAC products. Stricter building codes, like those enacted in 2024 for energy efficiency, also increase the need for compliant materials. Changes in trade policies, including tariffs, can affect procurement costs, while tax rates and incentives, like those from the Inflation Reduction Act of 2022, significantly impact the company's profitability and market opportunities.

| Political Factor | Impact on F.W. Webb | Supporting Data/Examples |

| Infrastructure Spending | Increased demand for PVF and HVAC | Bipartisan Infrastructure Law (2021) allocates billions to upgrades. |

| Building Codes | Demand for energy-efficient and safety-compliant products | New state energy codes in 2024 mandate higher efficiency. |

| Trade Policies | Potential impact on material costs | Tariffs on steel/aluminum (2018) could increase equipment prices. |

| Taxation & Incentives | Affects profitability and sales growth | Inflation Reduction Act (2022) offers credits for energy-efficient upgrades. U.S. corporate tax rate is 21% (2024). |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting F.W. Webb, examining Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy.

Economic factors

The health of the residential housing market is a critical driver for F.W. Webb, as new housing starts and existing home sales directly correlate with demand for plumbing and HVAC products. In early 2024, the U.S. housing market showed signs of stabilization, with existing home sales projected to rebound modestly from 2023 lows, potentially reaching around 4.5 million units. Renovation activity also remains a significant contributor, with homeowners continuing to invest in upgrades, further bolstering demand.

Interest rate fluctuations directly affect F.W. Webb's cost of capital and the affordability of projects for its customers. For instance, the Federal Reserve's target range for the federal funds rate, a benchmark for many lending rates, remained at 5.25-5.50% as of early 2024, reflecting a period of elevated borrowing costs. This can translate to higher financing expenses for contractors and developers, potentially delaying or scaling back new construction and renovation work, which in turn impacts F.W. Webb's sales volumes.

Conversely, easier access to credit can act as a significant stimulus for F.W. Webb's business. When interest rates are lower and lending standards are more accommodating, contractors are more likely to secure financing for larger projects, and homeowners feel more confident taking out loans for renovations. This increased investment and purchasing activity directly boosts demand for F.W. Webb's products and services.

The overall growth of commercial, industrial, and residential construction is a major economic engine for F.W. Webb. A robust construction pipeline across these sectors directly translates into sustained demand for their wholesale building materials and plumbing supplies.

For instance, in 2024, the U.S. construction industry saw significant activity, with total construction spending projected to reach $2.07 trillion, according to the U.S. Census Bureau. This healthy market environment is crucial for companies like F.W. Webb, ensuring a steady flow of business.

Key economic indicators such as rising construction spending and an increase in new building permits issued are vital for F.W. Webb to forecast future demand and manage inventory effectively. The National Association of Home Builders reported that housing starts in early 2025 are showing positive trends, indicating continued demand in the residential sector.

Inflation and Material Costs

Inflationary pressures directly impact F.W. Webb by increasing the cost of the raw materials and finished goods they distribute. For instance, the Producer Price Index (PPI) for construction materials saw a significant increase in 2024, with some categories experiencing double-digit percentage rises year-over-year. This surge in input costs can squeeze F.W. Webb's profit margins if they are unable to fully pass these higher prices onto their customers. Effective inventory management and dynamic pricing strategies are therefore paramount to navigate these challenging economic conditions and maintain profitability.

Supply chain disruptions, often intertwined with inflationary trends, further compound these cost pressures. Extended lead times and increased freight charges, which remained elevated throughout much of 2024 for many industries, add to the overall cost of goods sold. F.W. Webb must adeptly manage these complexities to ensure product availability while mitigating the financial impact of these volatile factors.

- Inflationary Impact: Rising costs for plumbing, heating, and HVAC supplies directly affect F.W. Webb's cost of goods sold.

- Margin Squeeze: Difficulty in fully passing on increased material costs to customers can reduce profit margins.

- Inventory Management: Strategic inventory control is crucial to balance holding costs against potential price increases and stock-outs.

- Pricing Strategy: Agile pricing models are necessary to respond to fluctuating supplier costs and market demand.

Regional Economic Stability (Northeastern US)

The economic stability of the Northeastern US, F.W. Webb's core market, is a critical factor. As of early 2024, the region has shown continued resilience, with several states reporting robust job growth, particularly in sectors that drive construction and home improvement. For instance, Massachusetts unemployment remained low, hovering around 3.5% in Q1 2024, indicating a healthy labor market.

Disposable income levels in the Northeast have generally trended upward, supporting consumer spending on home renovations and new construction projects. This trend is vital for F.W. Webb, as higher disposable income often translates to increased demand for plumbing, heating, and cooling services and products. The region’s economic outlook for 2024-2025 suggests continued, albeit moderate, growth, which bodes well for sustained market activity.

Business investment within the Northeastern corridor also plays a significant role. Increased commercial construction and development projects directly benefit F.W. Webb's B2B operations. Data from late 2023 indicated a uptick in commercial real estate development in urban centers like Boston and New York City, signaling a positive environment for the company's expansion and service offerings.

- Northeastern US Unemployment Rate (Q1 2024): Averaged approximately 3.8%, indicating a strong labor market.

- Regional Disposable Income Growth (2023-2024): Estimated at 4.2%, supporting consumer spending on home improvements.

- Commercial Construction Permits (Northeast, Q4 2023): Saw a 5.5% increase year-over-year, boosting business demand.

- New England GDP Growth Forecast (2024): Projected at 2.1%, suggesting continued economic expansion.

Economic factors significantly shape F.W. Webb's performance, with the housing market and construction spending being primary drivers. Inflationary pressures and interest rates directly influence costs and customer affordability, while regional economic health, particularly in the Northeast, underpins demand for their products.

The company benefits from robust construction activity and consumer spending on renovations, both of which are tied to broader economic conditions like employment and disposable income. Navigating supply chain volatility and managing pricing strategies are crucial for maintaining profitability amidst these economic influences.

| Economic Factor | Impact on F.W. Webb | 2024/2025 Data/Trend |

|---|---|---|

| Housing Market Health | Drives demand for plumbing and HVAC products | U.S. existing home sales projected to reach ~4.5 million units in 2024; renovation activity remains strong. |

| Interest Rates | Affects cost of capital and project affordability | Federal funds rate target range at 5.25-5.50% in early 2024, increasing borrowing costs. |

| Construction Spending | Major driver for wholesale building materials | U.S. construction spending projected at $2.07 trillion in 2024; housing starts show positive trends in early 2025. |

| Inflation | Increases cost of goods sold | Producer Price Index for construction materials saw double-digit rises in some categories in 2024. |

| Regional Economy (Northeast) | Core market demand | Northeastern U.S. unemployment low (~3.5% in MA Q1 2024); disposable income growth estimated at 4.2% (2023-2024). |

Same Document Delivered

F.W. Webb PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This F.W. Webb PESTLE Analysis provides a comprehensive overview of the external factors impacting the company, presented with professional structure and clear insights.

Sociological factors

The Northeast region, F.W. Webb's primary market, is experiencing significant demographic shifts. Population growth, though moderate, combined with an aging demographic, is reshaping housing demand. As the population ages, there's a greater need for accessible housing modifications and specialized plumbing and HVAC solutions for senior living facilities and existing homes, presenting new avenues for product development and sales.

Migration patterns also play a crucial role. While some areas see out-migration, others are experiencing influxes of younger families or professionals, influencing the demand for both new construction and renovations. For instance, in 2024, states like Massachusetts and New Hampshire have seen steady population growth, indicating a continued need for housing stock and associated building materials, which directly benefits F.W. Webb's core business.

Consumers are increasingly prioritizing sustainability, with a significant portion of buyers willing to pay more for eco-friendly products. This trend directly impacts the building materials sector, pushing contractors and facility managers towards greener options. For instance, a 2024 survey indicated that over 60% of consumers consider environmental impact when making purchasing decisions.

F.W. Webb can leverage this by expanding its inventory to include more water-saving plumbing fixtures and energy-efficient HVAC units. The demand for such products is fueled by both long-term cost savings from reduced utility bills and a growing environmental consciousness among the public. This presents a clear opportunity for F.W. Webb to differentiate itself in the market.

A significant shortage of skilled labor in trades like plumbing and HVAC directly impacts the construction and renovation sectors. This scarcity can slow down projects, which in turn affects the demand for products like those offered by F.W. Webb. In 2024, reports indicated a widening gap, with some estimates suggesting millions of unfilled skilled trade positions across the US by 2028, a trend that continued into early 2025.

This labor crunch also limits F.W. Webb's clients, such as contractors, in their ability to take on new work, potentially reducing order volumes. The company may need to explore strategies like investing in or supporting trade school programs, or developing product lines that are easier to install, thereby mitigating the reliance on highly specialized labor.

Urbanization and Suburban Growth Patterns

Urbanization and suburban growth patterns significantly shape F.W. Webb's operational landscape. In the Northeast, a region with established metropolitan areas and expanding exurbs, construction and renovation activity is increasingly concentrated in these evolving residential and commercial zones. This dynamic necessitates strategic placement of branches and adaptable distribution networks to effectively serve both densely populated urban cores and the burgeoning suburban communities.

F.W. Webb's logistics and inventory management must account for the distinct product demands of these varied locales. For instance, urban projects might lean towards high-density housing and commercial renovations requiring specific plumbing and HVAC components, while suburban growth often involves single-family homes and new developments with different material needs. The U.S. Census Bureau reported in 2023 that while major cities continue to attract residents, suburban areas saw substantial population increases, highlighting the need for a balanced distribution approach.

- Northeast Urban Growth: Cities like Boston and New York continue to see development, particularly in multi-family housing and infrastructure upgrades.

- Suburban Expansion: Many Northeast suburbs experienced population growth exceeding 5% between 2020 and 2023, driving demand for residential building materials.

- Logistical Challenges: Servicing both dense urban centers with traffic congestion and sprawling suburban areas requires optimized delivery routes and strategically located distribution hubs.

- Inventory Specialization: Differentiating product stock based on urban versus suburban project requirements can improve efficiency and customer satisfaction.

Customer Preferences for Digital Services

Contractors and facility managers increasingly expect seamless digital interactions. They want to order online, manage their accounts easily, and access product details instantly, reflecting a broader societal trend towards digital convenience. For instance, a 2024 survey indicated that 75% of B2B buyers prefer digital self-service options for purchasing decisions.

F.W. Webb must prioritize investments in its e-commerce capabilities and digital tools to align with these changing customer preferences. This isn't just about keeping up; it's about enhancing operational efficiency and accessibility for their client base.

- Digital Demand: Over 70% of B2B purchasing decisions in 2024 involved online research and ordering.

- Efficiency Gains: Companies with strong e-commerce platforms report an average 15% reduction in order processing time.

- Competitive Edge: Failing to offer robust digital services risks losing market share to more digitally adept competitors.

Sociological factors significantly influence F.W. Webb's market, particularly in the Northeast. An aging population, projected to continue its growth through 2025, increases demand for accessible housing modifications and specialized products for senior living. Simultaneously, evolving consumer preferences for sustainability, with over 60% of buyers in 2024 considering environmental impact, push demand towards eco-friendly plumbing and HVAC solutions.

Technological factors

Continuous innovation in HVAC systems, such as the growing adoption of high-efficiency heat pumps and smart thermostats, directly shapes F.W. Webb's product offerings. The market for smart thermostats alone was projected to reach over $5 billion globally by 2024, indicating a significant demand for connected home solutions.

Similarly, advancements in plumbing fixtures, including low-flow toilets and touchless faucets, are driven by sustainability mandates and consumer preference for hygiene and water conservation. For instance, the global smart plumbing market is expected to grow substantially in the coming years, reflecting this trend.

F.W. Webb's ability to stay ahead of these technological shifts by offering cutting-edge, efficient, and sustainable solutions is crucial for maintaining its competitive edge. This necessitates ongoing investment in product education for their sales teams and customers to effectively communicate the benefits of these new technologies.

F.W. Webb is leveraging digitalization to streamline its supply chain and logistics operations. Implementing advanced digital tools for inventory management, warehousing, and transportation is crucial for enhancing operational efficiency and reducing costs. For instance, the adoption of IoT devices for real-time tracking of goods and AI for more accurate demand forecasting can significantly improve speed and precision in product delivery. These technological advancements are designed to optimize F.W. Webb's extensive distribution network, ensuring timely and cost-effective movement of products across its service areas.

The surge in e-commerce for wholesale distribution is a significant technological factor for F.W. Webb. By 2024, B2B e-commerce sales are projected to reach $3.6 trillion, underscoring the critical need for robust online platforms. F.W. Webb's investment in a user-friendly, comprehensive online ordering system is essential to capitalize on this trend, offering customers 24/7 access to products, pricing, and real-time order tracking.

This digital transformation not only expands market reach but also significantly enhances customer convenience, directly supporting F.W. Webb's existing physical branch network. A strong, integrated online presence is no longer optional; it's a competitive necessity in today's wholesale landscape.

Smart Home and Building Automation Integration

The increasing integration of smart home and building automation technologies is a significant technological factor influencing F.W. Webb's market. This trend directly boosts demand for HVAC, plumbing, and control systems that can seamlessly connect with these smart platforms. For instance, the global smart home market was projected to reach over $150 billion by 2024, with building automation systems forming a substantial part of this growth.

F.W. Webb can capitalize on this by positioning itself as a crucial supplier of these interconnected solutions. This requires a deep understanding of product interoperability and a curated selection of smart-enabled products. The shift is moving beyond individual components to sophisticated, networked systems designed for enhanced efficiency and user experience.

- Increased Demand: The smart building market is expanding rapidly, with projections indicating significant growth in connected devices and automated systems by 2025.

- Interoperability is Key: Success hinges on offering products that easily integrate with popular smart home ecosystems and building management platforms.

- Supplier Role: F.W. Webb can become a vital link in the supply chain for these advanced, integrated building solutions.

- Beyond Basic Components: The focus is shifting from individual pipes and fixtures to comprehensive, intelligent building infrastructure.

Data Analytics for Inventory and Sales Forecasting

Leveraging advanced data analytics offers F.W. Webb significant advantages in understanding sales patterns and customer preferences. By analyzing vast datasets, the company can refine inventory management, ensuring popular items are readily available while minimizing excess stock. This data-driven approach is crucial for an industry where product availability directly impacts customer satisfaction and sales volume.

The adoption of predictive analytics tools allows F.W. Webb to forecast demand with greater precision. For instance, by analyzing historical sales data, seasonal trends, and external market indicators, the company can anticipate fluctuations. This capability helps in optimizing stock levels, reducing carrying costs, and preventing stockouts, thereby enhancing operational efficiency. In 2024, companies heavily investing in AI-powered forecasting saw an average reduction in inventory holding costs by 10-15%.

- Improved Forecasting Accuracy: Data analytics can enhance sales forecasting by identifying complex patterns and correlations invisible to traditional methods.

- Inventory Optimization: Predictive models help F.W. Webb maintain optimal stock levels, reducing both overstock and stockout situations.

- Customer Behavior Insights: Analyzing customer purchase history and behavior provides granular insights for targeted marketing and product recommendations.

- Supply Chain Responsiveness: Anticipating market shifts through data analytics allows for proactive adjustments in the supply chain, ensuring timely product delivery.

Technological advancements are reshaping F.W. Webb's operational landscape, from product innovation to customer interaction. The increasing integration of smart home and building automation technologies, for example, directly drives demand for interconnected HVAC, plumbing, and control systems. The global smart home market was projected to exceed $150 billion by 2024, highlighting this significant trend.

Furthermore, the surge in B2B e-commerce, with sales expected to reach $3.6 trillion by 2024, necessitates robust online platforms for F.W. Webb to maintain competitiveness and enhance customer convenience.

Data analytics and AI are also pivotal, enabling F.W. Webb to refine inventory management, optimize stock levels, and enhance supply chain responsiveness. Companies leveraging AI for forecasting have seen inventory holding cost reductions of 10-15% in 2024.

The company's ability to adapt to these technological shifts, particularly in offering integrated smart solutions and leveraging digital platforms, is critical for its future growth and market position.

| Technology Trend | Impact on F.W. Webb | Market Data/Projection |

|---|---|---|

| Smart Home & Building Automation | Increased demand for integrated systems; need for interoperable products. | Global smart home market projected over $150 billion by 2024. |

| B2B E-commerce Growth | Necessity for robust online ordering platforms; enhanced customer convenience. | B2B e-commerce sales projected to reach $3.6 trillion by 2024. |

| Data Analytics & AI | Improved inventory management, demand forecasting, and supply chain efficiency. | AI-powered forecasting can reduce inventory holding costs by 10-15% (2024). |

Legal factors

Environmental protection laws significantly influence F.W. Webb's product offerings and operational practices. Regulations concerning emissions, waste management, and chemical use in manufacturing and installation directly impact the types of plumbing and HVAC products the company can distribute and how they are handled. For instance, the EPA's phasedown of hydrofluorocarbons (HFCs) under the AIM Act, which began in 2022 and continues through 2025, necessitates a shift towards lower global warming potential refrigerants, affecting the HVAC equipment F.W. Webb stocks and promotes.

Compliance with these environmental mandates is paramount for F.W. Webb and its clientele. This includes adhering to standards like the Safe Drinking Water Act concerning lead in plumbing components, as well as regulations on wastewater discharge from construction and maintenance activities. The company must ensure that the products it sells, such as pipes and fittings, meet lead-free requirements, a standard that has been in place for years but continues to be rigorously enforced, with potential fines for non-compliance.

Building and safety codes are constantly evolving, impacting product specifications for companies like F.W. Webb. For instance, updates to fire suppression and ventilation standards in 2024 and 2025 necessitate adjustments in the types of materials and systems they offer. Ensuring their inventory adheres to these national, state, and local mandates is crucial to prevent costly fines and project disruptions for their clientele.

Changes in labor laws, such as potential minimum wage hikes in key states like Massachusetts and Rhode Island, directly influence F.W. Webb's operational expenses and human resource strategies. For instance, a federal minimum wage increase to $15 per hour, a topic of ongoing discussion, would significantly impact labor costs across its numerous locations.

Ensuring compliance with evolving workplace safety regulations, like those from OSHA, is critical for maintaining a secure and efficient workforce at F.W. Webb's distribution hubs and retail branches. This commitment to safety also extends to the contractor clients who rely on Webb for compliant workforce solutions.

Product Liability and Warranty Laws

Product liability and warranty laws are critical for F.W. Webb as a distributor, defining their obligations for the goods they supply. Compliance ensures they meet customer expectations and mitigate potential legal exposure. For instance, in 2024, product liability lawsuits in the U.S. continued to be a significant concern across various sectors, with manufacturers and distributors facing scrutiny over product safety and performance claims.

Adherence to these regulations means F.W. Webb must verify that the products they distribute, from plumbing fixtures to HVAC equipment, align with their advertised specifications and are safe for their intended applications. Failure to do so can result in costly recalls, legal battles, and damage to brand reputation. The increasing complexity of supply chains in 2025 also places a greater onus on distributors to ensure upstream compliance.

- Product Safety Standards: Ensuring all distributed products meet or exceed relevant safety certifications and regulations, such as those from ANSI or NSF.

- Warranty Enforcement: Clearly communicating and honoring manufacturer warranties, and managing customer claims efficiently.

- Recall Management: Establishing robust procedures for handling product recalls promptly and effectively to protect consumers and F.W. Webb.

- Consumer Protection Laws: Complying with federal and state consumer protection statutes that govern fair trade practices and advertising.

Contractual Agreements and Compliance

The legal framework governing F.W. Webb's operations, particularly its supply chain contracts, customer agreements, and vendor partnerships, is paramount. Compliance with commercial law ensures that all contractual arrangements are legally sound, thereby mitigating potential disputes and safeguarding the company's interests. This necessitates meticulous review of terms and conditions across all business relationships.

For instance, in 2024, the U.S. Department of Justice actively pursued antitrust investigations into various industries, underscoring the importance of fair competition clauses in vendor contracts. F.W. Webb must remain vigilant in ensuring its agreements adhere to these evolving regulatory landscapes. A robust compliance program, potentially including regular legal audits of key contracts, can prevent costly litigation and maintain operational stability.

- Contractual Integrity: Ensuring all supply chain and customer agreements are legally robust prevents future disputes.

- Regulatory Adherence: Staying compliant with commercial law, including antitrust regulations, is critical for stable operations.

- Risk Mitigation: Thorough legal review of terms and conditions protects F.W. Webb's financial and operational interests.

- Vendor Relationships: Clear, legally sound contracts foster trust and efficiency with business partners.

F.W. Webb must navigate a complex web of product safety and consumer protection laws, ensuring all distributed items meet rigorous standards. Compliance with regulations like the Safe Drinking Water Act, particularly regarding lead content in plumbing, is non-negotiable. Furthermore, adherence to evolving building and safety codes, including those for fire suppression and ventilation, is crucial to avoid fines and project delays for clients.

Environmental factors

The growing emphasis on energy conservation is significantly boosting demand for energy-efficient products like HVAC systems, water heaters, and insulation. F.W. Webb can capitalize on this trend by stocking and actively promoting ENERGY STAR® certified items and other energy-saving alternatives. This strategy directly addresses both regulatory mandates and evolving consumer desires for sustainability.

Regulations surrounding construction waste and packaging disposal directly influence F.W. Webb's operational costs and supply chain logistics. For instance, the EPA's Resource Conservation and Recovery Act (RCRA) sets standards for hazardous waste management, which can apply to certain materials handled by F.W. Webb, such as refrigerants. Failure to comply can result in significant fines, impacting profitability.

F.W. Webb may need to invest in or facilitate programs for responsible recycling of materials like scrap metal from plumbing installations or old HVAC equipment. The increasing focus on circular economy principles, as seen in state-level initiatives aiming to divert construction and demolition debris from landfills, means companies like F.W. Webb must adapt their waste handling strategies. Some states, like California, have ambitious recycling goals for C&D waste, pushing for higher diversion rates.

Climate change is a significant driver reshaping building design, pushing for greater resilience against increasingly extreme weather. This trend directly impacts the demand for specialized materials and systems that can endure harsher environmental conditions. For instance, the increasing frequency of severe storms and heatwaves necessitates buildings that can better withstand wind loads and manage thermal stress.

Consequently, F.W. Webb can expect a heightened demand for advanced HVAC and plumbing solutions engineered for durability and efficiency in fluctuating climates. Products like high-performance insulation, robust piping systems resistant to freeze-thaw cycles, and energy-efficient climate control units that adapt to extreme temperatures will be crucial. The company's ability to supply these evolving product needs will be key to its success.

Green Building Certifications and Standards

The growing demand for green building certifications, such as LEED and BREEAM, is significantly shaping the construction materials market. These standards encourage the use of specific environmentally friendly products, creating a direct opportunity for F.W. Webb. By stocking and promoting materials that meet these rigorous criteria, F.W. Webb can position itself as a key supplier for sustainable building projects, which saw a notable increase in activity throughout 2024 and are projected to continue this trend into 2025.

F.W. Webb can capitalize on this trend by offering a curated selection of compliant materials and systems. This strategic move requires deep product knowledge and a keen awareness of current certification requirements. For instance, the U.S. Green Building Council reported that over 100,000 LEED projects were certified globally by the end of 2024, highlighting the scale of this market segment.

- LEED Certification Growth: Over 100,000 LEED projects certified globally by end of 2024.

- BREEAM Adoption: BREEAM continues to be a dominant standard in Europe, with significant project pipelines for 2025.

- Passive House Demand: The Passive House standard is gaining traction, driving demand for high-performance building envelopes and HVAC systems.

- Supplier Advantage: F.W. Webb can gain market share by aligning its product offerings with these sustainability mandates.

Water Conservation Initiatives

Growing concerns about water scarcity are significantly impacting the plumbing industry, with a notable surge in demand for water-saving fixtures. For instance, in 2024, water-efficient appliances saw a 15% increase in consumer interest compared to the previous year, driven by both environmental awareness and rising utility costs.

F.W. Webb can capitalize on this trend by actively promoting and stocking a comprehensive range of low-flow toilets, water-efficient faucets, and smart irrigation systems. These products directly address customer needs for conservation and compliance with increasingly stringent local water usage regulations, which are becoming more common across many states by 2025.

- Increased Demand for Water-Saving Products: Consumer interest in water-efficient plumbing solutions rose by an estimated 15% in 2024.

- Regulatory Compliance: Local water usage regulations are tightening, pushing consumers and businesses towards conservation.

- Product Offering: F.W. Webb can offer low-flow toilets, efficient faucets, and smart irrigation to meet this demand.

- Customer Benefits: Supporting these initiatives helps customers achieve conservation goals and adhere to local ordinances.

Environmental regulations are increasingly shaping the construction and renovation landscape, pushing for greater sustainability. F.W. Webb must navigate evolving waste management rules, such as those concerning construction and demolition debris, which aim to divert materials from landfills. For example, California's ambitious recycling goals for C&D waste are setting a precedent for other regions.

The company's product offerings are directly influenced by climate change adaptation needs, driving demand for resilient building materials and efficient climate control systems. Furthermore, the growing adoption of green building certifications like LEED and BREEAM, with over 100,000 LEED projects certified globally by the end of 2024, creates a significant market for eco-friendly products. Water scarcity concerns are also boosting sales of water-saving plumbing fixtures, with consumer interest up 15% in 2024.

| Environmental Factor | Impact on F.W. Webb | 2024/2025 Data/Trend |

|---|---|---|

| Energy Conservation Push | Increased demand for energy-efficient products (HVAC, water heaters). | Growing consumer and regulatory focus on ENERGY STAR® certified items. |

| Waste Management Regulations | Higher operational costs, need for adapted supply chain logistics. | EPA's RCRA impacts handling of materials like refrigerants; state initiatives for C&D waste diversion. |

| Climate Change Adaptation | Demand for resilient building materials and advanced HVAC/plumbing. | Increased need for products enduring extreme weather and freeze-thaw cycles. |

| Green Building Certifications | Opportunity to supply compliant, eco-friendly materials. | Over 100,000 LEED projects certified globally by end of 2024; BREEAM strong in Europe. |

| Water Scarcity Concerns | Surge in demand for water-saving fixtures and smart irrigation. | 15% increase in consumer interest for water-efficient appliances in 2024; tightening local water usage regulations. |

PESTLE Analysis Data Sources

Our PESTLE analysis for F.W. Webb is built on a robust foundation of data from industry-specific trade publications, government economic reports, and environmental regulatory bodies. We incorporate market research from leading analytics firms and track legislative changes impacting the plumbing and HVAC sectors.