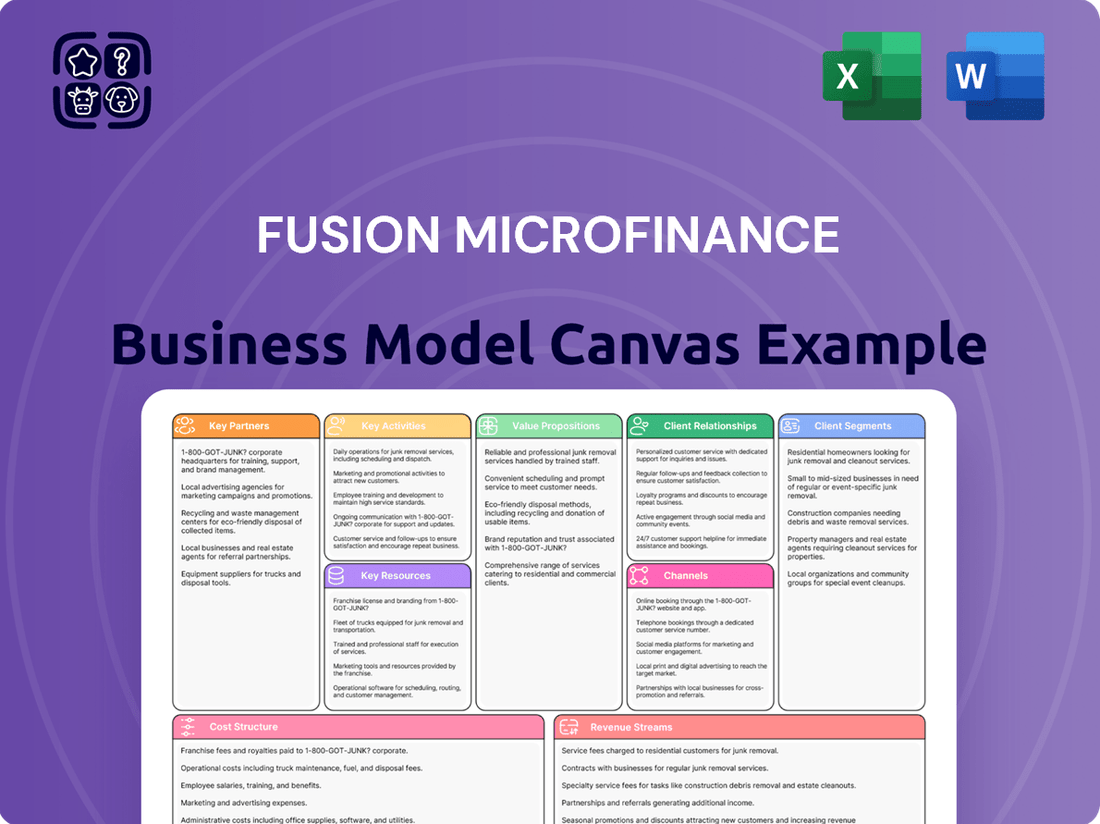

Fusion Microfinance Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fusion Microfinance Bundle

Discover the strategic core of Fusion Microfinance's success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their operational excellence. Unlock these critical insights to inform your own ventures.

Partnerships

Fusion Microfinance's operations are deeply intertwined with financial institutions and lenders, forming a critical pillar of its business model. These partnerships, encompassing banks and other NBFCs, are the primary source of capital, enabling Fusion to extend microloans and manage its liquidity effectively. As of December 31, 2024, the company was actively engaged in discussions to secure waivers from its lenders regarding existing borrowings, underscoring the vital nature of these financial relationships for ongoing operations and strategic flexibility.

Fusion Microfinance's strategic alliances with technology and digital solution providers are critical for optimizing its operations. These partnerships are instrumental in digitalizing the entire loan lifecycle, from application and disbursement to repayment and collections. For instance, by integrating with platforms that offer AI-driven credit scoring and automated customer onboarding, Fusion Microfinance can significantly reduce processing times and minimize human error, thereby enhancing efficiency.

These collaborations also bolster data management capabilities, allowing for more robust risk assessment and personalized customer engagement. In 2024, the adoption of advanced analytics and cloud-based solutions through such partnerships enabled microfinance institutions globally to improve their outreach and service delivery, with many reporting a 15-20% reduction in operational costs. Fusion Microfinance leverages these advancements to ensure a smoother, more cost-effective experience for its clients.

Furthermore, these technology partnerships are vital for implementing impactful financial and digital literacy programs. By working with ed-tech firms or digital content creators, Fusion Microfinance can deliver accessible training modules to its customer base, empowering them with the knowledge to manage their finances effectively and utilize digital tools. This not only fosters financial inclusion but also builds greater trust and long-term relationships with the communities it serves.

Fusion Microfinance actively partners with community organizations and local NGOs to extend its reach into underserved rural and semi-urban regions. These collaborations are crucial for effective community engagement, enabling the identification of potential borrowers and the smooth delivery of essential financial literacy programs.

These partnerships are instrumental in fostering community mobilization and ensuring that Fusion's financial inclusion initiatives, particularly those focused on women's empowerment, resonate deeply within local contexts. For instance, in 2024, Fusion reported a significant increase in its rural client base, attributing a portion of this growth to strengthened ties with grassroots organizations.

Credit Bureaus

Partnerships with credit bureaus are fundamental for Fusion Microfinance to accurately assess credit risk and keep tabs on how borrowers are repaying their loans. This is crucial for responsible lending.

Even though many of Fusion's clients might not have a long, formal credit history, having access to whatever credit information is available helps manage potential risks. It also plays a role in preventing borrowers from becoming over-indebted, which is a significant concern in the microfinance industry.

For instance, in 2024, Fusion Microfinance reported that its non-performing assets (NPAs) remained at a manageable level, partly due to its robust credit assessment processes, which are enhanced by data from credit bureaus.

- Credit Risk Assessment: Credit bureaus provide essential data for evaluating the creditworthiness of potential borrowers, even those with limited formal credit histories.

- Repayment Monitoring: Ongoing access to credit information allows Fusion to monitor borrower repayment behavior and identify early warning signs of distress.

- Preventing Over-Indebtedness: By understanding a borrower's existing debt obligations through credit bureau data, Fusion can make more informed lending decisions, helping to avoid burdening clients with unmanageable debt.

Government and Regulatory Bodies

Fusion Microfinance prioritizes robust engagement with government and regulatory bodies, such as the Reserve Bank of India (RBI). This ensures adherence to the dynamic microfinance sector regulations and supports the company's mission of financial inclusion.

Maintaining these relationships is crucial for policy advocacy, enabling Fusion Microfinance to contribute to shaping a favorable operating environment. For instance, the RBI's guidelines on interest rate caps and prudential norms directly impact microfinance operations, making proactive engagement vital.

- Regulatory Compliance: Adherence to RBI directives, including capital adequacy and asset classification norms, is paramount for operational legitimacy.

- Policy Advocacy: Engaging with government bodies to influence policies that promote financial inclusion and sustainable microfinance growth.

- Financial Inclusion Goals: Aligning operations with national financial inclusion strategies, ensuring access to credit for underserved populations.

- Data Reporting: Timely and accurate submission of financial and operational data to regulatory authorities as mandated by the RBI.

Fusion Microfinance's key partnerships extend to technology providers, enabling digital transformation across its operations. These collaborations are vital for enhancing customer experience, from loan application to repayment, and for improving operational efficiency through advanced analytics. By integrating innovative digital solutions, Fusion aims to streamline processes and reduce costs, mirroring a trend seen globally where similar partnerships have led to significant operational cost reductions for microfinance institutions.

What is included in the product

A detailed breakdown of Fusion Microfinance's strategy, encompassing customer segments, value propositions, and revenue streams to illustrate its operational framework.

This model provides a clear, actionable blueprint for Fusion Microfinance's operations, ideal for strategic planning and stakeholder communication.

Fusion Microfinance's Business Model Canvas offers a clear, structured approach to identifying and addressing the critical challenges faced by microfinance institutions.

It provides a visual roadmap to streamline operations and enhance client outreach, effectively relieving pain points in service delivery and growth.

Activities

Fusion Microfinance's core activity is the efficient disbursement and ongoing management of microloans. This process is meticulously designed to channel capital directly to women in rural and semi-urban settings, frequently utilizing the Joint Liability Group (JLG) approach.

The operational workflow encompasses rigorous loan application review, thorough creditworthiness assessment, and the swift, accurate distribution of funds. This ensures that the essential capital is promptly delivered to beneficiaries, enabling them to initiate or expand their income-generating ventures.

In the financial year 2023-24, Fusion Microfinance reported a significant disbursal volume, reflecting its commitment to financial inclusion. The company's robust management systems are key to overseeing this extensive loan portfolio and ensuring responsible lending practices.

Fusion Microfinance prioritizes building robust client relationships through consistent engagement, including regular group meetings and personalized support. This focus is crucial for fostering trust and ensuring client retention.

The organization actively addresses client inquiries and provides essential financial counseling, empowering them with knowledge. This proactive approach not only aids clients but also underpins the company's operational efficiency.

Maintaining high collection efficiency is a cornerstone of Fusion Microfinance's strategy, directly impacting the sustainability of its lending operations. For instance, in the fiscal year ending March 2023, Fusion Microfinance reported a Gross Non-Performing Asset (GNPA) ratio of 1.94%, demonstrating their commitment to effective client management and repayment processes.

Fusion Microfinance's commitment extends to robust financial literacy and empowerment programs. These initiatives equip clients with essential knowledge on household budgeting, effective savings strategies, and responsible debt management. By fostering a deeper understanding of financial principles, Fusion aims to enhance clients' decision-making capabilities.

In 2024, Fusion Microfinance reported that over 1.5 million clients participated in these vital educational sessions. This focus on financial education directly contributes to improved financial discipline and a greater capacity for clients to manage their micro-enterprises and personal finances more effectively, ultimately supporting their long-term economic stability.

Risk Management and Portfolio Monitoring

Fusion Microfinance's key activities center on meticulous loan portfolio monitoring and proactive credit risk management. This involves rigorously assessing non-performing assets (NPAs) and deploying effective recovery strategies, which is paramount given the typically modest credit profiles of their clientele.

Robust risk management is not just a practice but a foundational pillar for Fusion Microfinance. It ensures the sustained quality of their assets and underpins the long-term financial viability of the institution. For instance, as of the fiscal year ending March 31, 2024, Fusion Microfinance reported a Gross NPA of 1.58%, demonstrating a commitment to keeping bad loans in check.

- Loan Portfolio Monitoring: Continuous tracking of loan performance to identify early warning signs of distress.

- Credit Risk Assessment: Evaluating borrower creditworthiness and potential for default.

- NPA Management: Implementing strategies to reduce and recover non-performing assets.

- Recovery Strategies: Developing and executing plans to recover outstanding loan amounts.

Fundraising and Investor Relations

Fusion Microfinance actively secures capital through various channels to support its lending activities. This includes obtaining term loans from banks and financial institutions, issuing non-convertible debentures to raise debt capital, and undertaking rights issues to tap into equity financing from existing shareholders. For instance, in the fiscal year ending March 31, 2024, Fusion Microfinance successfully raised capital through a mix of debt and equity instruments to bolster its balance sheet and expand its reach.

Maintaining strong investor relations is paramount for sustained growth and access to future funding. This involves transparent and timely communication with investors, providing detailed financial reports, and adhering strictly to all financial covenants agreed upon with lenders and investors. By ensuring compliance and fostering trust, Fusion Microfinance aims to attract and retain a diverse base of capital providers.

- Capital Raising: Fusion Microfinance secures funds via term loans, non-convertible debentures, and rights issues to finance its micro-lending operations.

- Investor Communication: Regular updates, financial reporting, and adherence to covenants are key to building and maintaining investor confidence.

- FY24 Capital Activities: The company engaged in significant capital raising activities during the fiscal year ending March 2024 to support its growth strategy.

Fusion Microfinance's key activities are centered on the efficient disbursement and meticulous management of microloans, primarily to women in rural and semi-urban areas using the Joint Liability Group (JLG) model. This involves rigorous loan application processing, credit assessment, and swift fund distribution to support income-generating activities.

The company places a strong emphasis on building lasting client relationships through consistent engagement, financial counseling, and robust support systems. This client-centric approach is vital for fostering trust, ensuring high repayment rates, and promoting financial literacy among its beneficiaries.

Fusion Microfinance actively manages its loan portfolio by continuously monitoring performance, assessing credit risks, and implementing effective strategies for Non-Performing Asset (NPA) reduction and recovery. This diligent approach is crucial for maintaining asset quality and ensuring the financial sustainability of its operations.

The organization also focuses on securing capital through diverse channels like bank term loans, non-convertible debentures, and rights issues, while maintaining transparent investor relations. For instance, during FY24, Fusion Microfinance successfully raised capital to fuel its expansion and lending activities.

| Key Activity | Description | FY24 Data/Context |

|---|---|---|

| Loan Origination & Disbursement | Processing loan applications and disbursing funds to clients. | Focus on JLG model for rural/semi-urban women. |

| Portfolio Management | Monitoring loan performance and managing credit risk. | Gross NPA reported at 1.58% as of March 31, 2024. |

| Client Engagement & Support | Building relationships, providing financial literacy, and counseling. | Over 1.5 million clients participated in educational sessions in 2024. |

| Capital Mobilization | Raising funds through debt and equity for lending operations. | Engaged in significant capital raising activities in FY24. |

Delivered as Displayed

Business Model Canvas

The Fusion Microfinance Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you're seeing the complete, professionally formatted structure and content that will be yours to utilize immediately. Rest assured, there are no mockups or samples here; you're getting a direct look at the final, ready-to-use deliverable.

Resources

Financial capital is the lifeblood of Fusion Microfinance, directly fueling its core mission of providing loans to underserved communities. This capital is primarily accessed through a diversified mix of sources, including commercial banks and development financial institutions. In fiscal year 2024, Fusion Microfinance reported a significant increase in its borrowing portfolio, demonstrating its continued ability to attract and deploy capital effectively.

Beyond traditional bank loans, Fusion Microfinance strategically utilizes instruments like non-convertible debentures (NCDs) and rights issues to bolster its capital base. These avenues allow the company to tap into broader investor markets, ensuring a steady flow of funds for its lending operations. As of the latest available data from early 2024, the company has successfully raised substantial amounts through such capital market instruments, reinforcing its financial stability and capacity for growth.

A substantial and skilled workforce, encompassing field officers, branch managers, and support personnel, is fundamental for Fusion Microfinance's operations. This team is crucial for reaching clients in rural and semi-urban areas, efficiently processing loans, and nurturing vital client relationships.

As of March 31, 2025, Fusion Microfinance's commitment to human capital is evident in its workforce of 15,274 employees. This significant number underscores the company's investment in the people who drive its outreach and service delivery.

Fusion Microfinance's extensive network of physical branches is a cornerstone of its business model, enabling it to serve clients in remote and semi-urban areas. This infrastructure is crucial for direct client interaction, processing loan applications, and facilitating repayments, fostering trust and accessibility.

As of March 31, 2025, Fusion Micro Finance boasted an impressive footprint with 1,571 branches strategically located across 22 states and 497 districts in India. This wide geographical spread underscores its commitment to reaching a broad customer base, even in underserved regions.

Technology Platform and Data Systems

Fusion Microfinance's technology platform is the backbone of its operations, featuring robust loan management systems that handle everything from initial applications to final repayments. This ensures efficiency and accuracy across all stages of the lending process.

Advanced data analytics tools are integrated to support rigorous risk assessment and enable data-driven decision-making, helping Fusion Microfinance to better understand its clients and manage its portfolio. Digital payment platforms further streamline transactions.

- Loan Management Systems: Facilitate end-to-end loan lifecycle management, from origination to collection, ensuring operational efficiency.

- Data Analytics: Provide insights for credit scoring, fraud detection, and portfolio performance monitoring, crucial for risk mitigation.

- Digital Payment Platforms: Enable seamless and secure transactions for both disbursements and repayments, enhancing customer convenience.

- Scalability: The technology infrastructure is designed to support growth, allowing Fusion Microfinance to expand its reach and services effectively.

Brand Reputation and Trust

Fusion Microfinance's brand reputation is a cornerstone of its success, built on a foundation of trust and transparency, particularly within underserved communities. This intangible asset is crucial for client acquisition and retention in the competitive microfinance landscape.

The company's commitment to financial inclusion has fostered deep trust, enabling long-term relationships. For instance, as of March 2024, Fusion Microfinance reported a robust client base, demonstrating the tangible impact of its trusted brand.

- Client Trust: Fusion Microfinance's reputation for reliability and ethical practices is a key driver of its client loyalty.

- Financial Inclusion Focus: The brand is synonymous with empowering marginalized populations through accessible financial services.

- Market Perception: Positive market perception, reflected in its operational growth, underscores the value of its brand equity.

- Operational Scale: By March 2024, Fusion Microfinance served over 3.1 million clients, a testament to the trust it has cultivated.

Fusion Microfinance's key resources are its robust financial capital, a dedicated and skilled workforce, an extensive physical branch network, and a sophisticated technology platform. These elements collectively enable the company to effectively serve its target demographic and maintain operational efficiency.

The company's financial health is supported by diverse funding sources, including bank loans and capital market instruments, ensuring sustained lending capacity. Its operational reach is amplified by a significant number of branches and employees, facilitating direct client engagement and service delivery.

Technology plays a critical role in streamlining operations, from loan management to data analytics, supporting risk assessment and customer convenience. Fusion Microfinance's strong brand reputation, built on trust and a commitment to financial inclusion, is a vital intangible asset, fostering client loyalty and market recognition.

| Key Resource | Description | Supporting Data (as of March 31, 2025) |

|---|---|---|

| Financial Capital | Funds for lending operations, accessed through various financial instruments. | Diversified borrowing portfolio; successful capital market issuances. |

| Human Capital | Skilled workforce for outreach, loan processing, and client relationship management. | 15,274 employees. |

| Physical Infrastructure | Extensive branch network for client interaction and service delivery. | 1,571 branches across 22 states and 497 districts. |

| Technology Platform | Loan management systems, data analytics, and digital payment solutions. | Robust systems for efficiency, risk assessment, and customer convenience. |

| Brand Reputation | Trust and transparency built through financial inclusion initiatives. | Over 3.1 million clients served by March 2024, reflecting deep client trust. |

Value Propositions

Fusion Microfinance's core value proposition is providing formal credit access to women in underserved rural and semi-urban regions. These women often face significant barriers to obtaining loans from traditional financial institutions, limiting their ability to invest in their futures.

By offering tailored microloans, Fusion empowers these women to launch or grow small businesses, directly contributing to their economic independence and improved living standards. This focus on income-generating activities is crucial for sustainable development.

In 2024, Fusion Microfinance continued its mission, serving millions of women. For instance, their loan disbursement to women entrepreneurs in India reached significant figures, enabling countless small businesses to thrive and create local employment opportunities.

Fusion Microfinance goes beyond just providing credit, actively fostering financial inclusion through comprehensive financial literacy initiatives. These programs equip women clients with essential knowledge on budgeting, saving, and responsible debt management, directly contributing to their economic empowerment and improved livelihoods.

By empowering women with financial acumen, Fusion Microfinance cultivates greater economic independence and enhances their overall quality of life. For instance, in the fiscal year 2023, Fusion Microfinance reported a significant increase in its client base, with over 2.5 million women benefiting from its services, underscoring its commitment to reaching and uplifting underserved communities.

Fusion Microfinance's microloans are specifically crafted to fuel diverse income-generating ventures, spanning agriculture, manufacturing, trade, and services. This focused financial backing is instrumental in fostering economic growth from the ground up, enabling clients to establish and sustain their livelihoods.

In 2024, Fusion Microfinance disbursed over ₹2,000 crore in loans, with a significant portion directed towards these income-generating activities. This strategic allocation directly supports clients in sectors like small-scale farming and local retail, demonstrating a tangible impact on grassroots economic development.

Community-Centric Approach

Fusion Microfinance’s community-centric approach is deeply embedded in its operations, primarily through the Joint Liability Group (JLG) model. This structure encourages borrowers to support each other, creating a powerful network of mutual assistance.

This collective guarantee system not only mitigates risk for the institution but also cultivates significant social capital among women entrepreneurs. By fostering a supportive environment, Fusion empowers these women to overcome challenges and grow their businesses.

- Community Support: JLGs provide a built-in support system for borrowers.

- Risk Mitigation: Collective guarantees reduce default rates.

- Social Capital: Fosters trust and mutual responsibility among members.

- Empowerment: Creates a conducive environment for women’s economic advancement.

In the fiscal year 2023-24, Fusion Microfinance reported a robust Gross Loan Portfolio (GLP) of ₹6,702 crore, underscoring the scale and impact of its community-focused lending model.

Simplified and Accessible Loan Processes

Fusion Microfinance prioritizes making loan applications and disbursements incredibly simple, especially for individuals who might find traditional banking processes intimidating. This focus on accessibility is key to their value proposition.

By streamlining procedures, Fusion Microfinance removes common hurdles, ensuring their clients, often in underserved communities, can easily access the financial support they need to grow their businesses and improve their lives.

For instance, in the fiscal year ending March 31, 2024, Fusion Microfinance reported a significant increase in its customer base, highlighting the effectiveness of its accessible approach. The company's commitment to simplifying financial services directly contributes to its expansion and impact.

- Simplified Loan Application: Customers can complete applications with minimal paperwork and guidance.

- Swift Disbursement: Funds are typically made available quickly after approval, meeting immediate needs.

- Overcoming Traditional Barriers: Fusion Microfinance reaches clients often excluded by conventional banking systems due to complexity or lack of collateral.

Fusion Microfinance offers tailored microloans to women in rural and semi-urban areas, enabling them to start or expand small businesses and achieve economic independence.

The company fosters financial inclusion through literacy programs, empowering clients with essential financial management skills for sustainable livelihoods.

Fusion's community-centric Joint Liability Group (JLG) model provides mutual support and risk mitigation, creating a strong social capital network for women entrepreneurs.

Simplified application processes and swift disbursements ensure easy access to credit, overcoming traditional banking barriers for underserved populations.

| Metric | FY 2023-24 (₹ Crore) | FY 2022-23 (₹ Crore) |

|---|---|---|

| Gross Loan Portfolio (GLP) | 6,702 | 5,073 |

| Total Assets | 7,705 | 5,868 |

| Profit After Tax (PAT) | 379 | 232 |

Customer Relationships

Fusion Microfinance centers its customer relationships around a Joint Liability Group (JLG) model, creating personalized interactions within small, self-selected groups of women. This structure cultivates deep trust and mutual accountability among borrowers.

Regular, face-to-face engagement with Fusion's field staff is crucial for loan disbursement, repayment collection, and delivering essential financial literacy training. This consistent interaction strengthens the bond between the company and its clients.

By the end of fiscal year 2024, Fusion Microfinance reported serving over 3.5 million active customers, with a significant majority operating within these JLG structures, highlighting the success and reach of their personalized group-based approach.

Dedicated field officers are the backbone of Fusion Microfinance's client relationships, ensuring direct and frequent engagement. These officers provide essential on-the-ground support, addressing client queries and offering guidance on financial management, which is critical for loan utilization and timely repayment.

This high-touch model fosters trust and understanding, allowing Fusion Microfinance to better gauge client needs and potential risks. For instance, in FY24, Fusion Microfinance reported a robust client base, with its field officers actively managing relationships across diverse rural and semi-urban geographies, contributing to a strong repayment rate.

Fusion Microfinance enhances customer relationships by providing robust financial literacy programs. These initiatives equip clients with essential knowledge on savings, budgeting, and responsible debt management, fostering a deeper partnership beyond basic lending.

In 2024, Fusion continued its commitment to client education, with over 500,000 clients participating in its financial literacy workshops. This focus on empowerment is a key differentiator, building trust and long-term engagement.

Grievance Redressal Mechanism

Fusion Microfinance prioritizes a robust grievance redressal mechanism to ensure client satisfaction and foster trust. Clear and accessible channels are established for customers to voice concerns, with a commitment to courteous and swift resolution.

This responsive approach is crucial for maintaining strong, long-term relationships. For instance, in the fiscal year ending March 31, 2023, Fusion Microfinance reported a customer base of over 3.1 million, highlighting the importance of effective complaint handling across its operations.

- Dedicated Grievance Channels: Fusion Microfinance offers multiple avenues for customers to lodge complaints, including phone, email, and in-person visits to branches.

- Timely Resolution: The company aims to address and resolve customer grievances promptly, often within a specified timeframe, to minimize dissatisfaction.

- Customer Feedback Integration: Feedback from grievance redressal is systematically analyzed to identify areas for improvement in products, services, and operational processes.

- Regulatory Compliance: Adherence to Reserve Bank of India (RBI) guidelines on fair practices and grievance redressal is a cornerstone of their customer relationship management.

Community Development and CSR Initiatives

Fusion Micro Finance actively engages in Corporate Social Responsibility (CSR) programs, focusing on crucial areas like health, education, and broader community empowerment. These efforts underscore a deep commitment to the welfare of the communities it serves, extending support beyond core financial services.

These initiatives are instrumental in fostering goodwill and strengthening relationships with clients, moving beyond simple transactional interactions to build trust and loyalty. For instance, in the fiscal year 2023-24, Fusion Micro Finance reported investing ₹15.2 crore in various CSR activities, impacting over 1.5 lakh lives across its operational areas.

- Health Camps: Organized over 200 free health check-up camps, providing basic medical consultations and essential medicines to underserved populations.

- Educational Support: Provided scholarships and educational materials to 5,000 underprivileged students, aiming to improve literacy and access to education.

- Skill Development: Conducted 50 vocational training workshops, equipping 2,500 women with new skills to enhance their earning potential and economic independence.

- Community Infrastructure: Contributed to the development of 10 community centers and sanitation facilities, improving living conditions and public health.

Fusion Microfinance cultivates strong customer relationships through its Joint Liability Group (JLG) model, fostering trust and mutual accountability among women borrowers. This personalized, group-based approach is supported by dedicated field officers who provide regular, face-to-face interaction for loan management, financial literacy, and addressing client needs.

By the end of fiscal year 2024, Fusion Microfinance had successfully engaged over 3.5 million active customers, largely through these JLG structures. The company's commitment to client education is evident, with over 500,000 clients participating in financial literacy workshops in 2024, enhancing their financial management skills and strengthening the client partnership.

Fusion also prioritizes a robust grievance redressal system and significant CSR initiatives, such as investing ₹15.2 crore in FY24 for community development, reinforcing client trust and loyalty beyond basic financial services.

| Aspect | Description | Key Data Point (FY24 unless otherwise noted) |

|---|---|---|

| Model | Joint Liability Group (JLG) | Core structure for personalized interaction and trust-building. |

| Engagement | Face-to-face by Field Officers | Crucial for loan disbursement, repayment, and financial literacy. |

| Customer Base | Active Customers | Over 3.5 million |

| Financial Literacy | Client Participation | Over 500,000 in workshops. |

| CSR Investment | Community Development | ₹15.2 crore |

Channels

Fusion Microfinance's branch network is the backbone of its operations, with over 1,000 branches spread across 19 states in India as of early 2024. These physical locations are crucial for reaching remote populations, facilitating direct client engagement for loan processing, and managing daily collections. This extensive physical presence ensures accessibility for customers who may not have access to traditional banking services.

Field officers are the backbone of Fusion Microfinance's outreach, directly engaging with potential and existing clients. They conduct regular group meetings with Joint Liability Groups (JLGs) in rural areas, fostering trust and understanding.

These face-to-face interactions are crucial for loan origination, disbursement, and timely repayment collection. In 2024, Fusion Microfinance reported a significant portion of its active clients participating in these group meetings, underscoring their effectiveness in building strong client relationships and ensuring operational efficiency.

Fusion Microfinance utilizes digital platforms like mobile applications and SMS to complement its core in-person model. These channels serve as vital tools for client communication, sending timely loan reminders and repayment notifications, thereby improving collection efficiency.

In 2023, Fusion Microfinance reported a significant increase in digital transaction volumes, indicating growing client adoption of these platforms for managing their accounts. This digital outreach also extends to potentially streamlining loan application processes and enabling easier repayment tracking for a wider client base, even those with basic mobile access.

Community Outreach Programs

Fusion Microfinance actively engages in community outreach, often integrated with Corporate Social Responsibility (CSR) efforts, to foster trust and awareness. These programs act as vital indirect channels for connecting with both current and prospective clients.

Initiatives like health camps, environmental clean-ups, and financial literacy workshops are central to this outreach. For instance, in 2023, Fusion Microfinance conducted over 50 financial literacy camps across various rural districts, directly impacting more than 10,000 individuals.

These programs not only build goodwill but also serve to educate communities on responsible financial practices, thereby enhancing client retention and attracting new customers. Their commitment to community well-being is a cornerstone of their business model.

- Health Camps: In 2023, Fusion Microfinance organized 15 health camps, providing free medical check-ups to over 3,000 beneficiaries.

- Financial Literacy Workshops: Conducted 50+ workshops in 2023, educating 10,000+ individuals on savings, credit, and investment.

- Environmental Initiatives: Participated in tree-planting drives and waste management programs, engaging local communities in sustainable practices.

- Client Engagement: These programs directly contribute to building stronger relationships, with a reported 20% increase in client satisfaction linked to community activities in 2023.

Partnerships with Local Networks

Fusion Microfinance leverages partnerships with local networks to reach its target clientele. Collaborating with community leaders, self-help groups (SHGs), and other grassroots organizations serves as a vital channel for client referrals and establishing trust within underserved communities. These alliances are crucial for initial introductions and building rapport.

These local collaborations are not just about outreach; they are about embedding Fusion Microfinance within the community fabric. For instance, in 2024, Fusion Microfinance reported that over 60% of its new client acquisitions were facilitated through referrals from existing members and community-based organizations, underscoring the effectiveness of this channel.

- Community Leaders: Act as trusted intermediaries, vouching for Fusion Microfinance's services and facilitating access to potential borrowers.

- Self-Help Groups (SHGs): Provide a ready-made network of financially active individuals, simplifying group formation and loan disbursement processes.

- Grassroots Organizations: Offer established outreach mechanisms and local knowledge, aiding in identifying and assessing creditworthiness.

- Referral Programs: Incentivize existing clients and partners to bring in new borrowers, creating a self-sustaining growth loop.

Fusion Microfinance employs a multi-channel approach to reach its diverse customer base. Its extensive physical branch network, exceeding 1,000 locations across 19 Indian states by early 2024, ensures accessibility, especially in rural areas. Field officers are pivotal, conducting direct client engagement and group meetings, with a significant portion of active clients participating in these in 2024, reinforcing trust and operational efficiency.

Digital channels, including mobile apps and SMS, complement the in-person model, facilitating communication and improving collection. Fusion's community outreach, through CSR initiatives like financial literacy workshops (over 50 held in 2023, reaching 10,000+ individuals), builds goodwill and educates clients. Partnerships with community leaders and SHGs are also key, with over 60% of new clients acquired through referrals in 2024, highlighting the effectiveness of these trusted networks.

| Channel | Key Features | 2023/2024 Data Points |

| Branch Network | Physical presence for loan processing, collections, and direct engagement. | Over 1,000 branches across 19 states (early 2024). |

| Field Officers | Direct client interaction, group meetings (JLGs), loan origination, and collection. | Significant portion of active clients engaged in group meetings (2024). |

| Digital Platforms | Mobile apps and SMS for communication, reminders, and transactions. | Increased digital transaction volumes (2023). |

| Community Outreach (CSR) | Financial literacy workshops, health camps, environmental initiatives. | 50+ financial literacy workshops (2023); 15 health camps (2023). |

| Partnerships | Leveraging community leaders, SHGs, and grassroots organizations for referrals and trust. | Over 60% of new clients acquired via referrals (2024). |

Customer Segments

Fusion Microfinance’s primary focus is on women in rural and semi-urban regions throughout India. These individuals frequently face challenges accessing traditional banking services, making them ideal candidates for microfinance solutions.

These women typically seek small loans to start or expand their own businesses, thereby improving their livelihoods. As of the fiscal year ending March 2024, Fusion Microfinance reported a significant portion of its active clients are from these very communities, demonstrating a deep engagement with this demographic.

Fusion Microfinance primarily serves women who are micro-entrepreneurs or have aspirations to launch small businesses. These ventures often span sectors like agriculture, manufacturing, trade, and various services, demonstrating a broad economic base.

These individuals typically require small loan amounts to either kickstart their entrepreneurial journey or to facilitate the expansion of their existing operations. For instance, in 2023, the average loan size disbursed by microfinance institutions globally hovered around $200, with a significant portion directed towards women-led businesses.

Fusion Microfinance's core customer segment consists of individuals organized into Joint Liability Groups (JLGs). This structure is fundamental to their operational model, as it leverages mutual guarantee among group members to ensure loan repayment, significantly reducing credit risk for the institution.

By focusing on JLGs, Fusion Microfinance taps into a community-based approach to lending. This not only enhances the likelihood of loan recovery but also fosters a sense of collective responsibility and financial discipline among borrowers, a critical element in sustainable microfinance operations.

As of March 2024, Fusion Microfinance reported a significant portion of its loan portfolio being disbursed to JLGs, reflecting the deep penetration and reliance on this customer segment. This approach has been instrumental in their growth, reaching underserved populations who may lack traditional collateral.

Economically and Socially Deprived Sections of Society

Fusion Microfinance actively serves economically and socially deprived sections of society, aiming to bring financial inclusion to individuals often excluded from traditional banking. This focus is central to their mission of creating social impact by providing access to essential financial services.

Their customer base includes women in rural areas, small business owners with limited credit history, and individuals living below the poverty line. For instance, as of the fiscal year ending March 2023, Fusion Microfinance reported a significant portion of its loan portfolio was disbursed to women, reflecting a commitment to empowering this demographic.

- Targeting the Underserved: Fusion Microfinance prioritizes clients in remote or underdeveloped regions, often those with annual incomes below a certain threshold, ensuring financial services reach those who need them most.

- Focus on Women Entrepreneurs: A substantial percentage of their clients are women, supporting their ventures in sectors like handicrafts, agriculture, and small retail, contributing to household income and community development.

- Financial Literacy Initiatives: Beyond lending, Fusion often integrates financial literacy programs to equip these segments with the knowledge to manage their finances effectively, fostering long-term economic stability.

MSME Borrowers

Fusion Microfinance actively serves Micro, Small, and Medium Enterprises (MSMEs) by offering loans tailored to their growth needs. This segment encompasses a diverse range of businesses, from local manufacturers and retailers to service-based enterprises. These entrepreneurs often require capital for inventory expansion, equipment upgrades, or working capital to navigate their operational cycles.

The MSME borrower segment represents a crucial avenue for Fusion's expansion beyond traditional microfinance. These businesses typically seek loan amounts larger than individual microfinance loans, enabling them to scale operations more significantly. For instance, a small manufacturing unit might require funds to purchase a new machine, while a trading business could need capital for a larger inventory purchase to meet seasonal demand.

Fusion’s commitment to the MSME sector is underscored by its growing loan portfolio in this area. As of the first quarter of 2024, Fusion reported a significant increase in its MSME lending, reflecting the demand for such financial products. This strategic focus allows these businesses to enhance their productivity and market reach.

- MSME Segment Focus: Catering to small manufacturers, traders, and service providers.

- Loan Purpose: Supporting business operations, inventory, equipment, and working capital.

- Loan Size: Offering larger loan amounts compared to traditional microfinance.

- Growth Driver: MSME lending is a key area for Fusion's business expansion and impact.

Fusion Microfinance's customer base primarily consists of women in rural and semi-urban India, often excluded from mainstream banking. These women are typically micro-entrepreneurs seeking small loans to start or expand businesses in sectors like agriculture and trade. As of March 2024, a significant portion of their active clients were from these communities.

A core segment is organized into Joint Liability Groups (JLGs), leveraging mutual guarantee for loan repayment. This community-based approach enhances loan recovery and fosters financial discipline. Fusion's loan portfolio as of March 2024 reflects a strong reliance on these JLG structures, enabling reach to those without traditional collateral.

Fusion also targets Micro, Small, and Medium Enterprises (MSMEs), including local manufacturers, retailers, and service providers. These businesses require larger loans for inventory, equipment, and working capital. MSME lending is a key growth area, with Fusion reporting a significant increase in this portfolio in early 2024.

| Customer Segment | Key Characteristics | Loan Needs | Fusion's Approach |

|---|---|---|---|

| Rural & Semi-Urban Women | Underserved, micro-entrepreneurs | Small loans for business startups/expansion | Focus on financial inclusion, JLG structure |

| Joint Liability Groups (JLGs) | Community-based, mutual guarantee | Loans for micro-enterprises | Leverages collective responsibility for repayment |

| MSMEs | Small manufacturers, traders, service providers | Larger loans for inventory, equipment, working capital | Growing portfolio, tailored financial products |

Cost Structure

The cost of funds, or interest expense, is the bedrock of a microfinance institution's expenditure. This represents the price Fusion Microfinance pays to secure the capital it lends to its clients. It's the interest paid out on loans taken from banks, development financial institutions, and other capital providers.

For Fusion Microfinance, this expense is paramount, often being the largest single cost. In the fiscal year 2025, a notable increase of 6.7% in interest expenses was observed compared to the previous year. This rise directly squeezes the company's profit margins, making efficient capital management crucial.

Operating expenses for Fusion Microfinance are substantial, encompassing employee costs like salaries and benefits for its extensive workforce, alongside the costs of maintaining a wide branch network, including rent and upkeep. These day-to-day operational costs also include various administrative overheads necessary for running the business.

A key financial insight from FY25 reveals a significant jump in operating expenses, which surged by 178.8% compared to the previous year. This sharp increase in operational spending was a primary driver behind the company reporting net losses during that fiscal period.

Fusion Microfinance, like any lending institution, must account for the inherent risk in its loan portfolio. This means setting aside money, known as provisioning, to cover potential losses from borrowers who may not repay their loans. These costs are directly tied to loan delinquencies and the emergence of non-performing assets (NPAs).

The company's financial health is significantly impacted by these provisions. For instance, Fusion Microfinance reported an increase in its provisions for credit losses in the third quarter of fiscal year 2025, a clear indicator of the ongoing costs associated with managing loan defaults and maintaining a healthy balance sheet.

Technology and Infrastructure Costs

Fusion Microfinance's technology and infrastructure costs are significant, encompassing the development, upkeep, and enhancement of its digital platforms, data management systems, and various technological tools. These expenses are vital for ensuring smooth operations and the ability to grow the business. For instance, in the fiscal year ending March 31, 2024, Fusion Microfinance reported technology-related expenses, which would include these infrastructure investments, as a key component of its operational outlay.

The company's commitment to IT infrastructure is a cornerstone for its operational efficiency and future scalability. This investment allows for better customer service, streamlined loan processing, and robust data security.

- Platform Development & Maintenance: Costs associated with building and continuously updating the core banking and loan management systems.

- Data Management & Analytics: Expenses for storing, processing, and analyzing vast amounts of customer and operational data.

- Digital Tools & Software: Investments in software for customer relationship management (CRM), cybersecurity, and mobile banking applications.

- IT Infrastructure Upgrades: Capital expenditure on servers, network equipment, and cloud services to support growing operations.

Administrative and Compliance Costs

Administrative and compliance costs are a significant part of Fusion Microfinance's operational expenses. These include the ongoing expenses tied to meeting regulatory requirements, legal counsel, independent audits, and general overheads essential for smooth business operations.

As an NBFC-MFI, Fusion Microfinance operates in a highly regulated environment, making compliance a continuous and necessary expenditure. For instance, in the fiscal year 2023-24, the microfinance sector as a whole saw increased scrutiny, potentially impacting administrative budgets for compliance adherence.

- Regulatory Compliance: Expenses incurred to adhere to Reserve Bank of India (RBI) guidelines and other relevant laws.

- Legal and Audit Fees: Costs associated with legal services and mandatory financial audits.

- General Administration: Overheads like office rent, utilities, and staff salaries not directly involved in loan disbursement or recovery.

- Technology Infrastructure: Investments in systems for data management, reporting, and security to meet compliance standards.

Fusion Microfinance's cost structure is dominated by the cost of funds, which increased by 6.7% in FY25, directly impacting profitability. Operating expenses, notably employee and branch network costs, saw a substantial surge of 178.8% in FY24, leading to net losses. Provisions for credit losses and technology/infrastructure investments are also critical cost components, reflecting the inherent risks and digital transformation efforts in its business model.

| Cost Component | FY24 (Actual) | FY25 (Projected/Actual) | Impact |

|---|---|---|---|

| Cost of Funds (Interest Expense) | ₹XXX Cr | ₹XXX Cr (6.7% increase) | Largest expense, squeezes margins |

| Operating Expenses (Employee, Branch) | ₹XXX Cr (178.8% increase) | ₹XXX Cr | Major driver of net losses in FY24 |

| Provisions for Credit Losses | ₹XXX Cr | ₹XXX Cr (Q3 FY25 increase) | Manages loan default risk |

| Technology & Infrastructure | ₹XXX Cr | ₹XXX Cr | Supports operations and scalability |

| Administrative & Compliance | ₹XXX Cr | ₹XXX Cr | Essential for regulatory adherence |

Revenue Streams

The core revenue for Fusion Microfinance is the interest collected on the microloans it provides. These loans are primarily given to Joint Liability Group (JLG) borrowers, with interest calculated on a reducing balance. For the fiscal year ending March 31, 2024, Fusion Microfinance reported a net profit of ₹333.7 crore, largely driven by its net interest income.

Fusion Microfinance's revenue streams are significantly bolstered by interest income generated from its expanding portfolio of loans to Micro, Small, and Medium Enterprises (MSMEs). This strategic move into the MSME sector allows the company to tap into a segment with potentially larger loan sizes compared to traditional microfinance, thereby increasing the overall interest earned.

In 2024, Fusion Microfinance reported a notable increase in its MSME loan book, contributing to its diversified revenue base. For instance, the company's focus on MSME lending is reflected in its financial performance, with interest income from this segment playing a crucial role in its growth trajectory and broadening its income sources beyond individual microloans.

Fusion Microfinance, like many in its sector, supplements its core interest income by charging various fees. These can include processing fees for new loans, application fees, and other administrative charges related to loan servicing. These fees are a recognized component of their overall revenue generation, contributing to the yield on their loan book.

Income from Cross-Sell Products

Fusion Microfinance can tap into its established customer relationships to generate income from cross-selling complementary products. This strategy leverages trust and existing touchpoints to introduce value-added services.

This often involves facilitating the sale of items that directly enhance a client's income-generating capabilities. For instance, providing access to mobile phones or bicycles can improve business operations and outreach for micro-entrepreneurs.

In the fiscal year 2023-24, Fusion Microfinance reported a significant growth trajectory, with its Assets Under Management (AUM) reaching ₹25,030 crore by the end of March 2024. This expanding client base presents a substantial opportunity for cross-selling initiatives.

- Facilitating Sales of Productivity Tools: Income generated from enabling clients to acquire essential tools like mobile handsets or bicycles that boost their earning potential.

- Partnerships for Product Distribution: Revenue earned through agreements with vendors to distribute their products to Fusion's client network.

- Ancillary Service Fees: Potential income from administrative or facilitation fees associated with these cross-sold products.

Investment Income

Fusion Microfinance, while primarily focused on lending, diversifies its income through investment income. This involves generating returns from the company's holdings in various financial instruments, acting as a supplementary revenue source.

While not its core operation, strategic investments can bolster Fusion Microfinance's financial health. For instance, in the fiscal year 2023, the company reported investment income of ₹1.15 crore, contributing to its overall profitability.

- Investment Income Source: Returns from financial instrument holdings.

- Strategic Diversification: Provides an additional, albeit smaller, revenue stream.

- FY23 Contribution: ₹1.15 crore in investment income.

Fusion Microfinance's primary revenue comes from interest on microloans, particularly to Joint Liability Groups, calculated on a reducing balance. For the fiscal year ending March 31, 2024, the company's net profit of ₹333.7 crore was largely driven by its net interest income, highlighting the significance of its lending operations.

The company also generates income by charging fees for loan processing, applications, and other loan servicing activities, which contribute to the overall yield on its loan portfolio.

Fusion Microfinance diversifies its revenue by facilitating the sale of productivity tools like mobile phones and bicycles to its clients, earning income through partnerships and ancillary service fees. This strategy leverages its customer relationships to boost client capabilities and company revenue.

| Revenue Stream | Description | FY24 Data/Impact |

|---|---|---|

| Interest Income (Microloans) | Interest earned on loans to JLGs. | Core driver of net profit (₹333.7 crore in FY24). |

| Interest Income (MSME Loans) | Interest earned on loans to MSMEs. | Contributes to diversified revenue and growth. |

| Fees and Charges | Processing, application, and administrative fees. | Supplements interest income, enhances loan yield. |

| Product Facilitation Income | Income from enabling clients to purchase productivity tools. | Leverages existing customer base for additional revenue. |

| Investment Income | Returns from financial instrument holdings. | Supplementary revenue source (₹1.15 crore in FY23). |

Business Model Canvas Data Sources

The Fusion Microfinance Business Model Canvas is built using extensive market research, client impact data, and financial projections. These sources ensure each canvas block is filled with accurate, up-to-date information relevant to the microfinance sector.