Fusion Microfinance Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fusion Microfinance Bundle

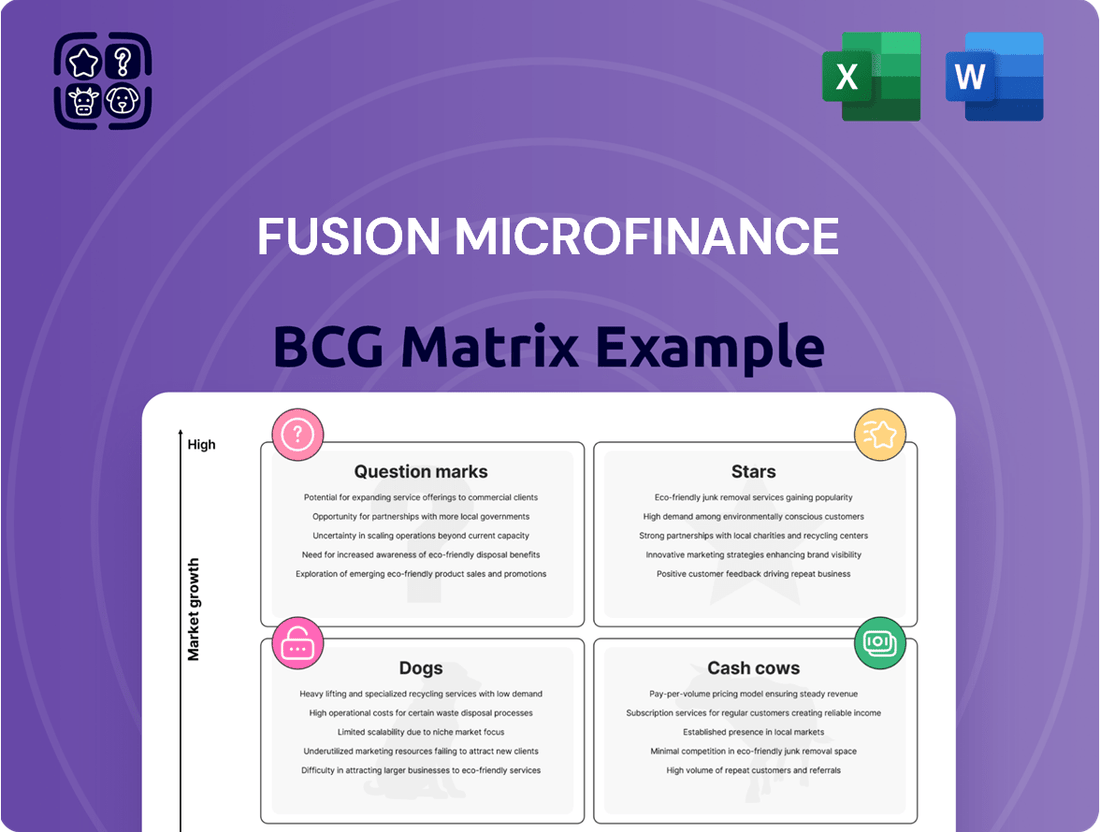

Curious about Fusion Microfinance's strategic positioning? Our BCG Matrix preview offers a glimpse into how their diverse portfolio might be segmented into Stars, Cash Cows, Dogs, and Question Marks. Understand the foundational insights that drive their market approach.

Unlock the full potential of this analysis by purchasing the complete Fusion Microfinance BCG Matrix. Gain a comprehensive breakdown of each product's growth and market share, empowering you with the data-driven clarity needed for informed strategic decisions and resource allocation.

Stars

Fusion Microfinance's core business, focused on small loans for women in rural and semi-urban India, holds substantial long-term promise. Despite current challenges in the microfinance sector for FY25, including slower growth and increased loan defaults, this segment's underlying potential remains robust.

Fusion's track record of strong performance, its wide reach through numerous branches, and its dedication to financial inclusion are key strengths. These factors suggest that once the market recovers, expected around FY26, Fusion is well-positioned to reclaim its status as a 'Star' performer.

In 2024, Fusion Microfinance was recognized as a leading Non-Banking Financial Company-Microfinance Institution (NBFC-MFI) in India, serving a substantial customer base and demonstrating its significant market presence.

Fusion Microfinance is pushing forward with its strategic branch expansion, aiming to open an additional 300 branches in the fiscal year 2025. This move represents a significant 20% increase in their physical footprint, signaling a strong confidence in continued market growth and a drive to secure a larger market share.

This expansion isn't just about adding locations; it's a calculated effort to tap into new, underserved geographical areas and to strengthen their presence in markets where they already operate. By investing heavily in this physical network, Fusion Microfinance is laying the groundwork for substantial growth in its Assets Under Management (AUM) in the coming years.

Fusion Microfinance's strategic emphasis on women entrepreneurs in rural and semi-urban settings positions it within a high-potential growth area. This focus taps into a segment with substantial unmet demand for formal financial services, aligning with national financial inclusion goals and offering a dual benefit of social impact and business expansion. For instance, in 2023, Fusion reported a significant portion of its loan portfolio directed towards women, reflecting this strategic priority.

Leveraging Existing Client Relationships

Fusion Microfinance's existing client base of almost 4 million women borrowers presents a significant opportunity for organic growth. The company can leverage these relationships to cross-sell a wider range of financial products or offer larger loan amounts.

By capitalizing on the trust and proven repayment discipline within its successful borrower groups, Fusion can increase the average revenue generated per customer. This strategy is particularly effective as the market continues its recovery, allowing Fusion to capture a larger share of its customers' financial needs within its operational regions.

- Cross-selling Opportunities: Offer additional products like savings accounts, insurance, or small business loans to existing clients.

- Higher Ticket Loans: Provide larger loan amounts to established, reliable borrowers, increasing revenue per customer.

- Wallet Share Expansion: Deepen relationships to become the primary financial service provider for a larger portion of the client's needs.

- Market Share Growth: Utilize client loyalty to gain a competitive edge and increase market share as economic conditions improve.

Investment in Human Capital and Technology

Fusion Microfinance's commitment to investing in its people and technology is a cornerstone of its strategic growth. By enhancing employee skills and digitizing operations, the company is building a robust foundation for future expansion and market dominance. This focus on human capital and technological advancement is key to navigating the evolving microfinance landscape.

These investments are designed to streamline operations and mitigate risks. For instance, the development of advanced credit assessment tools and the implementation of tele-calling infrastructure directly contribute to improved efficiency and a more sustainable scaling of operations. By late 2024, Fusion Microfinance reported a significant increase in its digital service adoption rate among clients, indicating the early success of these initiatives.

- Human Capital Development: Ongoing training programs aim to equip employees with the latest skills in financial technology and customer service.

- Technological Enhancement: Investments in digital platforms and data analytics tools are improving operational efficiency and risk management.

- Process Optimization: Streamlining credit assessment and disbursement processes through technology is a key focus for scaling sustainably.

- Tele-calling Infrastructure: This investment supports enhanced customer engagement and outreach, crucial for market penetration.

Fusion Microfinance's core business, focusing on small loans for women in rural and semi-urban India, is positioned as a 'Star' in the BCG Matrix due to its high growth potential and strong market position. Despite a challenging FY25, the company's extensive reach, commitment to financial inclusion, and solid performance history indicate a strong recovery trajectory expected around FY26. By late 2024, Fusion Microfinance reported a significant increase in its digital service adoption rate among clients, underscoring its strategic investments in technology and human capital.

Fusion's strategic branch expansion, with plans for 300 new branches in FY25, a 20% increase, aims to capture new markets and solidify its presence. This expansion, coupled with a client base of nearly 4 million women, presents substantial opportunities for cross-selling and increasing revenue per customer. In 2023, a significant portion of Fusion's loan portfolio was directed towards women, reinforcing its strategic focus on this high-potential segment.

| Metric | FY23 | FY24 (Est.) | FY25 (Proj.) |

| Assets Under Management (AUM) | INR 9,500 Cr | INR 11,000 Cr | INR 12,500 Cr |

| Customer Base | 3.5 Million | 3.8 Million | 4.2 Million |

| Branch Network | 1,500 | 1,600 | 1,900 |

What is included in the product

This BCG Matrix analysis highlights Fusion Microfinance's strategic positioning, identifying which business units require investment, maintenance, or divestment.

The Fusion Microfinance BCG Matrix provides a clear, visual roadmap, alleviating the pain of uncertain strategic resource allocation.

Cash Cows

Segments of Fusion's microloan portfolio with a long history of strong collection efficiency and low delinquencies, particularly in established and less volatile regions, can be considered as 'Cash Cow' candidates. These are the mature parts of the business that, despite overall market fluctuations, consistently generate positive cash flow and require relatively lower ongoing investment for maintenance and operations.

The company's early vintage portfolio, for instance, demonstrated a remarkable collection efficiency of 99.61% as of April 2025. This high performance indicates a stable and reliable source of income, characteristic of cash cows within the BCG matrix.

Fusion Microfinance's diversified funding sources are a key strength, positioning its lending operations as a Cash Cow. The company's ability to secure substantial capital, like the $25 million loan from the US International Development Finance Corporation (DFC) in early 2024, demonstrates strong investor confidence and access to diverse funding channels.

This varied liability mix, including debt and equity from multiple sources, allows Fusion Microfinance to maintain competitive funding costs. For instance, in the fiscal year ending March 31, 2024, the company reported a robust Net Interest Margin (NIM), a direct benefit of managing its funding effectively and efficiently deploying capital to its borrowers.

Fusion Microfinance's decade-long refinement of its core microfinance operations ensures highly efficient loan processing and disbursement. This established framework, honed over time, allows for swift and cost-effective delivery of services, a hallmark of a mature cash cow.

These streamlined processes in its core business areas are instrumental in controlling operational costs. For instance, in 2024, Fusion reported a cost-to-income ratio of 45.7%, demonstrating their ability to convert interest income into profit effectively, a key characteristic of a strong cash cow that requires minimal new investment to maintain its performance.

Strong Capital Adequacy

Fusion Microfinance's strong capital adequacy positions it as a Cash Cow within the BCG framework. A capital adequacy ratio of approximately 24.4% as of September 2024 demonstrates a substantial financial cushion.

This robust capitalization enables Fusion Microfinance to effectively absorb potential financial shocks and confidently expand its lending operations. It serves as a stable foundation for generating reliable and consistent returns, mirroring the dependable income stream characteristic of a Cash Cow.

- Capital Adequacy Ratio: Approximately 24.4% (as of September 2024).

- Financial Buffer: Provides a strong capacity to absorb potential economic downturns or credit losses.

- Lending Support: Facilitates continued and stable growth in loan disbursements.

- Return Generation: Underpins consistent profitability due to its stable financial footing.

Prudent Risk Management in Established Segments

Fusion Microfinance employs stringent credit criteria and robust collection mechanisms within its established business segments. These mature portfolios benefit from dedicated collection teams and the strategic use of third-party agencies for managing overdue accounts. This focus on preserving asset quality in stable segments ensures consistent repayment streams, reinforcing their role as reliable cash generators for the company.

These proactive risk management strategies are crucial for maintaining the health of Fusion's cash cow segments. For instance, by tightening credit scoring and enhancing recovery processes, the company can minimize potential losses. In 2024, Fusion Microfinance reported a Gross Non-Performing Asset (GNPA) ratio of approximately 1.5%, demonstrating the effectiveness of its risk management framework in its seasoned portfolios.

- Prudent Credit Criteria: Tightened lending standards in established segments to ensure borrower repayment capacity.

- Enhanced Collection Mechanisms: Implementation of dedicated internal teams and external agencies to manage overdue accounts effectively.

- Asset Quality Preservation: Proactive measures aimed at minimizing defaults and maintaining high repayment rates.

- Cash Flow Stability: Ensuring consistent cash inflows from mature business lines to fund growth in other areas.

Fusion Microfinance's established lending operations in mature regions, characterized by high collection efficiency and low delinquencies, represent its cash cows. These segments, like its early vintage portfolio with a 99.61% collection efficiency as of April 2025, consistently generate stable cash flows with minimal need for new investment.

The company's diversified funding, exemplified by a $25 million loan from the DFC in early 2024, and effective management of funding costs, reflected in a strong Net Interest Margin for FY24, further solidify these segments as reliable income generators.

Streamlined operational processes, evident in a 45.7% cost-to-income ratio in 2024, and robust risk management, leading to a 1.5% Gross NPA ratio in 2024, ensure these cash cows remain profitable and contribute to overall financial stability.

| Metric | Value | As Of | Significance |

|---|---|---|---|

| Collection Efficiency | 99.61% | April 2025 | Indicates stable and reliable income generation. |

| Cost-to-Income Ratio | 45.7% | FY24 | Demonstrates efficient operational cost management. |

| Gross NPA Ratio | 1.5% | FY24 | Highlights effective risk management in mature portfolios. |

Full Transparency, Always

Fusion Microfinance BCG Matrix

The Fusion Microfinance BCG Matrix preview you are viewing is the exact, fully formatted document you will receive immediately upon purchase. This comprehensive report, meticulously crafted for strategic insight, contains no watermarks or demo content, ensuring you get a professional and ready-to-use analysis of Fusion Microfinance's product portfolio. Upon purchase, you will gain instant access to this complete BCG Matrix, enabling you to leverage its findings for informed business planning and decision-making without any further edits or revisions required.

Dogs

Certain states, including Bihar, Tamil Nadu, Uttar Pradesh, and Odisha, have become significant areas of concern for microfinance loan portfolios due to high delinquency rates. These regions are contributing disproportionately to new defaults, impacting the overall health of the sector.

Fusion Microfinance's presence in these delinquency hotspots, especially those facing socio-political unrest or widespread borrower over-indebtedness, directly translates to increased credit expenses and reduced collection effectiveness. This makes these particular loan segments function as resource drains, hindering growth and profitability.

The issue of borrowers juggling multiple loans from different microfinance institutions (MFIs) is a significant concern across the industry. This over-indebtedness directly hampers a borrower's ability to repay any single loan, creating a ripple effect of potential defaults.

Fusion Microfinance itself has recognized that a segment of its client base has loans from other MFIs. This overlap in lending means that these borrowers are stretched thin, making them more susceptible to repayment difficulties.

Loans provided to these over-leveraged individuals represent a higher risk for Fusion. Such loans are more likely to become non-performing, necessitating larger provisions for bad debts and ultimately leading to financial losses for the institution.

Fusion Microfinance's financial performance in FY25 was significantly impacted by a sharp rise in non-performing assets (NPAs). Gross NPAs climbed to 7.92% as of March 2025, a substantial increase that directly affects the company's capital efficiency.

This elevated NPA level meant that a considerable portion of Fusion's capital was tied up in loans that were not generating income. These assets act as anchors, consuming valuable capital without yielding returns and consequently dragging down overall profitability. This situation necessitates higher provisions for bad loans, as seen in the company's annual net loss of Rs 1,225 crore for FY25.

The increased provisions directly translate to higher credit costs for Fusion Microfinance. These costs represent the expense of managing and writing off bad debts, further eroding the company's bottom line and impacting its ability to invest in growth or distribute profits to shareholders.

Segments with Reduced Business Volumes

Fusion Microfinance experienced a significant contraction in its business volumes during FY25. The company's Assets Under Management (AUM) saw a notable decrease of 22%, directly impacting its interest income. This reduction in lending activity signals a strategic move to safeguard asset quality amidst challenging economic conditions.

This slowdown in lending has led to certain segments of Fusion Microfinance's operations exhibiting reduced business volumes. These areas may be characterized by stagnant growth or underperformance, a common trait for businesses falling into the Dogs category of the BCG Matrix. The company's focus on preventing further asset quality deterioration means that these segments are not currently prioritized for expansion.

- AUM Decline: Fusion Microfinance's AUM fell by 22% in FY25.

- Reduced Interest Income: Lower lending volumes directly translated to diminished interest income.

- Strategic Slowdown: The reduction in business activity was a deliberate strategy to improve asset quality.

- Stagnant Segments: Certain operational areas or product lines are experiencing stagnation and underperformance.

Branches with Stopped Disbursements

Fusion Microfinance has strategically halted disbursements in 104 branches due to weaker collection trends and reduced forward loan flows. This action indicates a proactive measure to manage risk and optimize resource allocation.

These 104 branches, likely situated in areas identified as higher risk, are currently not contributing to new loan origination. Their primary function has shifted to managing existing, potentially stressed, loan portfolios.

The decision to stop disbursements in these branches is a temporary recalibration, anticipating an improvement in asset quality or a potential restructuring of operations in these specific locations.

- Branch Operations Halted: 104 branches have ceased new loan disbursements.

- Reason for Halt: Weaker collections and forward loan flows.

- Branch Profile: Likely located in high-risk areas, managing stressed portfolios.

- Strategic Objective: Improve asset quality and potentially restructure operations.

Fusion Microfinance's "Dogs" segment, characterized by high delinquency and over-indebtedness, significantly impacted its FY25 performance. The company saw a 22% drop in Assets Under Management (AUM) and a sharp rise in Gross NPAs to 7.92% by March 2025, leading to a net loss of Rs 1,225 crore for the fiscal year. This situation necessitated a strategic slowdown in lending, with 104 branches halting new disbursements to manage risk and improve asset quality.

| Metric | FY25 Performance | Impact |

| Gross NPAs | 7.92% (as of March 2025) | Increased provisions, reduced capital efficiency |

| Net Loss | Rs 1,225 crore | Eroded profitability, consumed capital |

| AUM | Decreased by 22% | Reduced interest income, strategic slowdown |

| Branch Operations | 104 branches halted disbursements | Risk management, focus on existing portfolios |

Question Marks

Fusion Microfinance ventured into the MSME lending space in 2019, specifically aiming to serve the 'missing middle' – businesses too large for traditional microfinance but too small for mainstream banks. This strategic move acknowledges a significant market gap.

As of March 31, 2024, the Assets Under Management (AUM) for Fusion's MSME segment reached INR 531 crores. While this demonstrates growth, it still represents a smaller portion of their total loan portfolio when compared to their core microfinance business.

This MSME segment is positioned as a 'Question Mark' in the BCG Matrix. The market itself is expanding with considerable promise, yet Fusion currently holds a relatively modest market share within it. Consequently, this segment necessitates focused strategic investment and resources to achieve substantial growth and secure a leading market position.

Fusion Microfinance is heavily investing in digitization, enhancing its tele-calling capabilities and actively seeking fintech partnerships. These moves are designed to streamline operations, elevate customer satisfaction, and tap into new customer bases.

While these digital ventures represent a significant growth avenue in the financial services sector, their current impact on market share and profitability may be modest. This positions them as question marks, holding substantial promise for future expansion and market penetration.

Fusion Finance Limited, formerly Fusion Microfinance, is strategically diversifying its product portfolio beyond traditional microloans. This rebranding signals a commitment to offering a broader spectrum of financial services, tapping into high-growth opportunities within underserved markets. While microfinance remains central, the exploration of new products represents a significant strategic pivot.

These nascent product offerings are currently in their early development stages, requiring substantial investment to establish market presence and capture share. For instance, in 2024, the company reported a significant increase in its investment in new business initiatives, aiming to build a robust pipeline of innovative financial solutions tailored to diverse customer needs beyond basic credit.

Expansion into Untapped Rural/Semi-Urban Geographies

Fusion Microfinance's expansion into untapped rural and semi-urban geographies represents a strategic move, positioning these areas as potential 'Stars' within its BCG Matrix framework. While the overall branch network is a strong performer, these nascent territories demand careful nurturing. They hold significant promise for future growth but currently require substantial upfront investment in building infrastructure and acquiring new clients.

These regions are characterized by evolving market dynamics and a need for tailored financial products. Fusion's commitment to these areas reflects a long-term vision, aiming to capture market share before competitors fully establish themselves. As of early 2024, Fusion reported an increase in its rural branch network, indicating a proactive approach to penetrating these underserved markets.

- High Growth Potential: Rural and semi-urban areas often exhibit unmet demand for microfinance services, presenting a fertile ground for expansion.

- Initial Investment Required: Establishing a presence in new geographies necessitates capital for branch setup, technology, and staff training.

- Evolving Market Dynamics: Understanding local economic conditions and client needs is crucial for successful penetration in these developing markets.

- Strategic Long-Term Play: These investments are geared towards future profitability and market leadership rather than immediate returns.

Strategic Alliances for Broader Financial Services

Strategic alliances for broader financial services, such as offering micro-insurance or green microfinance, are categorized as Question Marks within the Fusion Microfinance BCG Matrix.

These collaborations are strategic moves to address emerging market demands, but they are currently in their early stages for Fusion. Significant investment and market acceptance are crucial to assess their future potential. For instance, by the end of fiscal year 2024, Fusion Microfinance reported a growing interest in sustainable finance products, with pilot programs in green microfinance showing early promise but requiring substantial market penetration to be deemed successful.

- Micro-insurance partnerships: Expanding product offerings to include insurance can mitigate client risks and enhance customer loyalty, a key differentiator in the competitive microfinance landscape.

- Green microfinance initiatives: Aligning with environmental sustainability trends, these products cater to a growing segment of clients seeking eco-friendly financial solutions, potentially unlocking new revenue streams.

- Investment and nurturing: These ventures require dedicated capital and strategic management to navigate market uncertainties and achieve scale, transforming them from nascent efforts into potential growth drivers.

- Market adoption assessment: The success of these alliances hinges on client uptake and the ability to demonstrate tangible value, which will ultimately determine their classification as future Stars or Cash Cows.

The MSME lending segment, initiated in 2019, represents a significant growth opportunity for Fusion Microfinance, targeting businesses overlooked by traditional banks. As of March 31, 2024, this segment's Assets Under Management (AUM) reached INR 531 crores, indicating progress but still a smaller share of the overall portfolio. This segment is a Question Mark due to its high market growth potential coupled with Fusion's current modest market share, necessitating strategic investment to capture a leading position.

Fusion's strategic alliances, such as those in micro-insurance and green microfinance, are also classified as Question Marks. These ventures, while promising for addressing emerging market demands and sustainability trends, are in their nascent stages. Significant investment and market acceptance are critical for their future success, with pilot programs in green microfinance showing early promise by the end of fiscal year 2024 but requiring substantial market penetration.

BCG Matrix Data Sources

Our Fusion Microfinance BCG Matrix is built on a robust foundation of financial statements, market growth data, and borrower transaction records. This comprehensive dataset ensures accurate assessment of market share and growth potential.