Fulton Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fulton Bank Bundle

Fulton Bank operates in a dynamic environment shaped by evolving political landscapes, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and competitive advantage. Our comprehensive PESTLE analysis delves deep into these critical factors, offering actionable insights tailored specifically for Fulton Bank. Download the full version now to gain a strategic edge and navigate the complexities of the modern financial sector with confidence.

Political factors

The banking sector, including institutions like Fulton Bank, faces a constantly shifting regulatory environment. Changes in administration and supervisory focuses can introduce new compliance requirements or potential shifts in oversight. For instance, as of early 2025, discussions around capital requirements and consumer protection regulations continue to shape the landscape.

While some administrations might explore deregulation, banks must remain vigilant about governance, risk management, and adherence to existing and emerging rules. This focus is essential for navigating potential uncertainties and maintaining a competitive edge. The Federal Reserve's ongoing review of bank supervision, for example, highlights the persistent need for robust compliance frameworks.

The Federal Reserve's monetary policy, particularly its stance on interest rates, directly shapes Fulton Bank's operational landscape. Changes in the federal funds rate influence the cost of borrowing for banks and the rates they can charge on loans, impacting net interest margins.

Projections for 2025 indicate multiple interest rate cuts by the Federal Reserve. This shift from a potentially higher rate environment could compress Fulton Bank's net interest income if its asset yields reprice faster than its liabilities, or conversely, boost loan origination volumes as borrowing becomes cheaper.

For instance, if the Fed cuts rates by 75 basis points in 2025, as some analysts predict, Fulton Bank's net interest margin could see a direct impact, potentially widening or narrowing depending on its asset-liability management strategies and the competitive pricing environment for loans and deposits.

Political stability within Fulton Bank's primary operating region, the Mid-Atlantic states, alongside evolving U.S. trade policies, significantly impacts regional economic expansion and overall business confidence. For instance, a stable political environment can foster investment, while shifts in trade agreements can create both opportunities and challenges for businesses reliant on international commerce.

The upcoming presidential election cycle introduces a degree of uncertainty, as campaign promises regarding fiscal policy, regulation, and international trade could shape the economic landscape. For example, potential changes to corporate tax rates or new trade tariffs discussed during campaigns can directly influence business investment decisions and consumer spending, thereby affecting the banking sector.

Consumer Protection Regulations

Consumer protection regulations, particularly from the Consumer Financial Protection Bureau (CFPB), significantly influence Fulton Bank's customer interactions, especially regarding fees and data access. These evolving rules, with compliance deadlines staggered by asset size, mandate enhanced consumer access to financial information.

Fulton Bank must remain agile in adapting to these regulatory shifts. For instance, the CFPB's ongoing focus on fair lending practices and transparent fee structures directly impacts product development and customer service protocols. As of early 2024, the CFPB has continued to emphasize data portability and consumer control over financial data, a trend expected to intensify.

- CFPB Oversight: The CFPB actively monitors and enforces regulations impacting consumer financial services.

- Data Access Mandates: New rules require financial institutions to facilitate consumer access to their own financial data.

- Fee Transparency: Regulations are pushing for clearer and more justifiable fee structures for banking services.

Community Reinvestment Act (CRA) Compliance

The Community Reinvestment Act (CRA) is a significant political factor influencing banks like Fulton Bank. It mandates that financial institutions serve the credit needs of the communities where they operate, particularly focusing on low- and moderate-income areas. This regulation encourages proactive engagement in community development and lending.

Fulton Bank's commitment to CRA principles is evident in its 2024 performance. The bank achieved an 'Outstanding' CRA rating, a testament to its substantial investments in community development projects and its efforts to provide mortgage loans to low-to-moderate-income individuals and families. This rating highlights the bank's dedication to equitable access to financial services.

- CRA Mandate: Encourages banks to meet credit needs in all communities, including low- and moderate-income neighborhoods.

- Fulton Bank's 2024 Rating: Achieved an 'Outstanding' CRA performance rating.

- Key Initiatives: Demonstrates commitment through community development investments and mortgage lending to low-to-moderate-income buyers.

- Regulatory Impact: Compliance with CRA influences lending practices and community outreach strategies.

Political stability is crucial for Fulton Bank, as shifts in government policy can directly impact economic conditions and consumer confidence. The upcoming 2024 election cycle, for instance, introduces potential policy changes regarding fiscal stimulus, taxation, and trade, which could influence business investment and overall market stability. For example, discussions around potential corporate tax rate adjustments could affect profitability for businesses that Fulton Bank serves.

Regulatory bodies like the Consumer Financial Protection Bureau (CFPB) continue to shape banking practices, with a focus on consumer protection and data access. As of early 2025, the CFPB's emphasis on fair lending and transparent fee structures directly influences Fulton Bank's product development and customer service protocols. The Community Reinvestment Act (CRA) also remains a key political driver, encouraging banks to invest in and lend to low- and moderate-income communities, a commitment Fulton Bank demonstrated with its 'Outstanding' CRA rating in 2024.

The Federal Reserve's monetary policy decisions, particularly regarding interest rates, significantly affect Fulton Bank's net interest margins. Projections for 2025 indicate potential interest rate cuts, which could compress margins if asset yields reprice faster than liabilities. For instance, a 75 basis point rate cut, as some analysts predict for 2025, would necessitate careful asset-liability management to mitigate potential impacts on profitability.

| Political Factor | Impact on Fulton Bank | 2024/2025 Data/Trends |

|---|---|---|

| Election Cycles | Policy uncertainty, potential shifts in fiscal and trade policies | 2024 presidential election cycle; discussions on corporate tax rates and trade agreements. |

| Regulatory Oversight (CFPB) | Compliance costs, product design, customer interaction | Ongoing focus on fair lending, fee transparency, and data portability; enhanced consumer data access mandates. |

| Monetary Policy (Federal Reserve) | Net interest margins, loan demand, cost of funds | Projected interest rate cuts in 2025; potential impact of a 75 basis point cut on net interest income. |

| Community Reinvestment Act (CRA) | Lending practices, community investment, regulatory ratings | Fulton Bank achieved an 'Outstanding' CRA rating in 2024, reflecting community development investments. |

What is included in the product

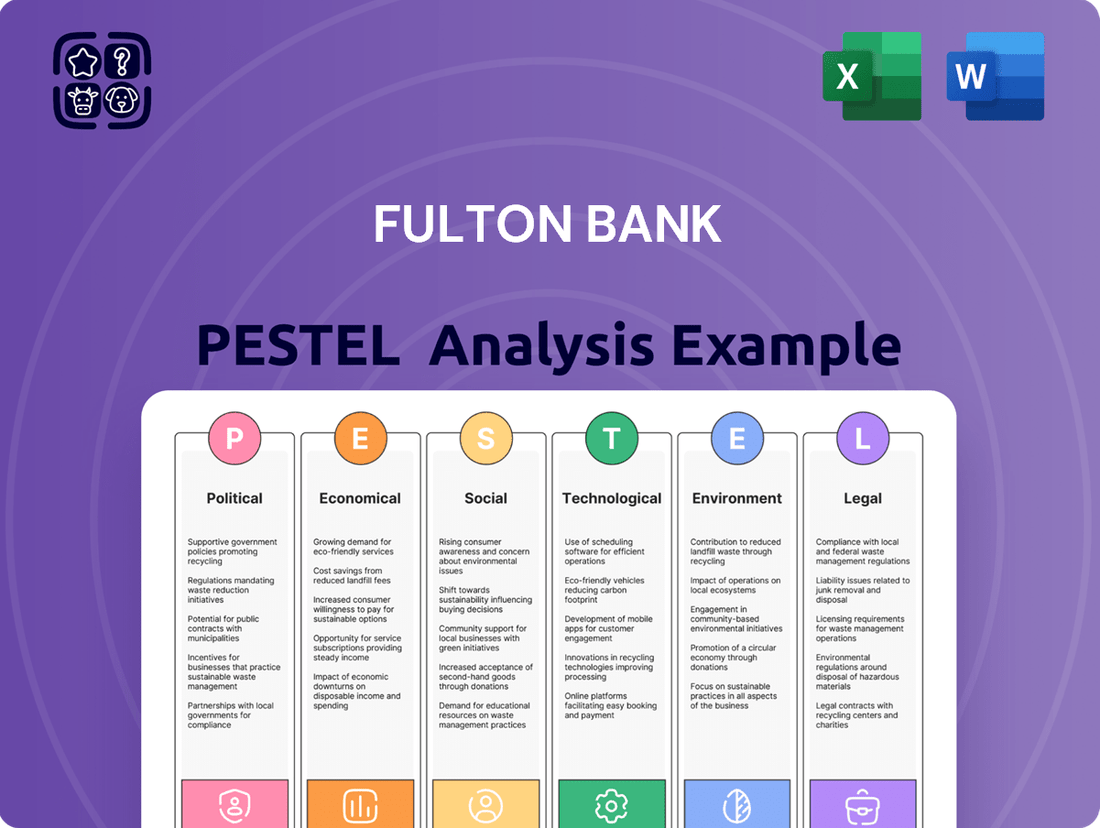

This Fulton Bank PESTLE analysis examines how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions impact the bank's operations and strategic planning.

It provides a comprehensive overview of current trends and their implications, offering actionable insights for navigating the evolving financial landscape.

A clear, actionable summary of Fulton Bank's PESTLE analysis, highlighting key external factors that could impact strategy, thereby alleviating the pain of navigating complex market dynamics.

Economic factors

Fluctuations in the Federal Funds Rate significantly influence Fulton Bank's net interest income and net interest margin. For instance, as of mid-2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, a level that compresses margins for banks like Fulton if deposit costs rise faster than loan yields.

While loan yields may experience modest decreases in a stable or declining rate environment, Fulton Bank can mitigate this impact through strategic management of its deposit costs. Effective cost control on deposits is crucial for maintaining or even enhancing the net interest margin, ensuring profitability even amidst shifting interest rate landscapes.

Fulton Bank's strategic focus on the Mid-Atlantic states means that the economic trajectory of this region is paramount to its performance. Regional economic growth directly influences everything from consumer spending to business investment, impacting the bank's loan portfolios and fee-based income streams.

Looking ahead to 2025, projections indicate a potential slowdown in real GDP growth for the Middle Atlantic region. This deceleration, coupled with the persistence of elevated interest rates, poses a dual challenge for Fulton Bank. Lower economic activity can dampen demand for new loans, while higher borrowing costs might strain existing borrowers, potentially affecting asset quality.

Inflation levels directly impact consumer spending by eroding purchasing power. While the Federal Reserve aims for a 2% inflation target, recent figures show a persistent, though moderating, trend. This elevated inflation environment, coupled with potential economic slowdowns anticipated in early 2025, could lead consumers to tighten their belts, reducing discretionary spending and impacting loan demand as borrowing becomes less attractive.

Consumer spending patterns are a key indicator of economic health. In 2024, consumer spending showed resilience, but the forecast for 2025 suggests a potential cooling. As inflation remains a concern, individuals may prioritize essential goods over durable purchases, which in turn affects the borrowing behavior for larger ticket items like homes and vehicles. This cautious approach to spending can dampen loan origination for financial institutions like Fulton Bank.

Loan and Deposit Growth Trends

Fulton Bank's capacity to grow its deposit base and expand its loan origination directly impacts its financial stability and profitability. In the first quarter of 2024, Fulton Financial Corporation (Fulton Bank's parent company) reported a slight decrease in total deposits, reflecting a competitive market for customer funds, though growth in interest-bearing products remained a focus.

Loan portfolio management is a key consideration for Fulton Bank, as it navigates economic conditions that influence both borrower demand and credit quality. The bank's net charge-offs were 0.25% of average loans in Q1 2024, indicating a generally stable credit environment for the institution.

- Deposit Growth: While overall deposits saw a modest dip in early 2024, Fulton Bank has strategically focused on growing its interest-bearing deposit products to attract and retain customer balances.

- Loan Origination: The bank's ability to originate new loans is vital for its revenue streams, though it must balance growth with prudent risk management in the prevailing economic climate.

- Balance Sheet Stability: Effective management of both loan and deposit portfolios is essential for maintaining Fulton Bank's balance sheet stability and supporting its long-term financial health.

- Credit Quality: Monitoring and managing the quality of its loan portfolio, as evidenced by metrics like net charge-offs, is a critical component of Fulton Bank's operational strategy.

Housing Market Conditions

Housing market conditions significantly influence Fulton Bank's operations, particularly in the Mid-Atlantic region. Interest rate fluctuations directly affect mortgage loan originations, a key revenue stream for the bank. For instance, if interest rates rise, fewer people may qualify for or choose to take out mortgages, impacting the volume of new loans. This also has a ripple effect on the bank's existing real estate loan portfolio.

Looking ahead to 2025, projections suggest a moderation in home price growth across the Middle Atlantic states. This cooling trend could dampen demand for new mortgages and home equity lines of credit. As home price appreciation slows, homeowners may be less inclined to tap into their home equity, and potential buyers might face affordability challenges, further influencing lending volumes.

- Interest Rate Impact: Rising interest rates in 2024 and continuing into 2025 are expected to temper mortgage demand.

- Home Price Moderation: Forecasts for the Mid-Atlantic indicate a slowdown in home price appreciation for 2025, potentially reducing new mortgage and HELOC applications.

- Regional Sensitivity: Fulton Bank's significant presence in the Mid-Atlantic means it is particularly exposed to these regional housing market dynamics.

Economic factors significantly shape Fulton Bank's operational landscape. Fluctuations in the Federal Funds Rate, which remained in the 5.25%-5.50% range in mid-2024, directly impact net interest margins, especially if deposit costs outpace loan yields. The economic outlook for the Mid-Atlantic region, Fulton Bank's primary market, projects a slowdown in real GDP growth for 2025, posing a dual challenge of reduced loan demand and potential strain on existing borrowers due to persistent high interest rates.

Inflation's impact on consumer purchasing power, while moderating, remains a concern, potentially leading to reduced discretionary spending and lower demand for loans. Consumer spending in 2024 showed resilience but is forecast to cool in 2025, with a shift towards essential goods potentially impacting borrowing for larger purchases. Fulton Bank's deposit base saw a slight decrease in Q1 2024, highlighting the competitive environment for customer funds, while net charge-offs remained low at 0.25% of average loans, indicating stable credit quality.

| Economic Factor | 2024 Data/Trend | 2025 Outlook/Projection | Impact on Fulton Bank |

|---|---|---|---|

| Federal Funds Rate | 5.25%-5.50% (mid-2024) | Uncertain, but potential for stabilization or slight decrease | Affects net interest margin; higher rates compress margins if deposit costs rise |

| Mid-Atlantic Real GDP Growth | Moderate growth | Projected slowdown | Lower loan demand, potential increase in credit risk |

| Inflation | Moderating but elevated | Continued concern, potential for further moderation | Impacts consumer spending, loan demand, and deposit behavior |

| Consumer Spending | Resilient | Forecasted cooling, shift to essentials | Reduced demand for consumer loans (auto, personal) |

| Housing Market | Moderate activity, rate sensitivity | Moderating home price growth | Lower mortgage originations, potential impact on HELOCs |

| Net Charge-offs | 0.25% (Q1 2024) | Expected to remain relatively stable, but sensitive to economic downturn | Indicates current credit quality; potential for increase if economic conditions worsen |

Preview the Actual Deliverable

Fulton Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Fulton Bank PESTLE analysis covers all critical external factors impacting the business, providing actionable insights.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a deep understanding of the Political, Economic, Social, Technological, Legal, and Environmental landscape for Fulton Bank.

The content and structure shown in the preview is the same document you’ll download after payment. It offers a thorough examination to inform strategic decision-making for Fulton Bank.

Sociological factors

Younger demographics, including Gen Z and Millennials, are increasingly favoring digital banking solutions. Studies in 2024 indicate that over 70% of these age groups prefer mobile banking for most transactions, valuing speed and convenience. This trend necessitates Fulton Bank's continued investment in its digital platforms, including user-friendly mobile apps and seamless online account management, to align with evolving customer expectations and maintain competitiveness.

Fulton Bank needs to adapt to these changing preferences by enhancing its digital offerings to cater to a younger, tech-savvy customer base. The bank's ability to provide personalized digital experiences, such as tailored financial advice through apps or instant customer support via chat, will be crucial for attracting and retaining these valuable customer segments in the coming years.

The increasing complexity of financial markets, driven by evolving investment products and economic conditions, has amplified the demand for financial literacy. Surveys consistently show a significant portion of the population feels unprepared to manage their finances, highlighting a critical societal need. For instance, a 2024 report indicated that over 60% of adults struggled with basic financial concepts.

Fulton Bank actively addresses this by investing in community outreach programs focused on financial education. Their volunteers dedicate time to teaching financial literacy in schools and community centers, directly responding to this growing societal need. This commitment not only empowers individuals but also strengthens Fulton Bank's reputation as a responsible and engaged corporate citizen, fostering deeper community ties.

Attracting and retaining a skilled workforce is paramount for Fulton Bank, particularly within the highly competitive financial services industry. In 2024, the U.S. unemployment rate hovered around 3.9%, underscoring the tight labor market where specialized talent is at a premium.

Fulton Bank's commitment to fostering an inclusive workplace, offering robust professional development, and cultivating a strong corporate culture directly addresses these challenges. Such initiatives are crucial for boosting employee engagement and improving talent retention rates, which are key metrics for organizational health.

Community Engagement and Social Responsibility

Fulton Bank's 2024 corporate social responsibility report underscores a significant commitment to community development and charitable giving. This strategic emphasis on social impact not only strengthens its brand image but also resonates with a growing segment of socially aware consumers and potential employees. For instance, the bank reported contributing over $5 million to local non-profits in the 2024 fiscal year, a 15% increase from the previous year.

This dedication to social responsibility translates into tangible benefits for Fulton Bank.

- Enhanced Brand Reputation: Positive community involvement bolsters public perception and trust.

- Customer Loyalty: Socially conscious customers are more likely to bank with institutions that align with their values.

- Talent Acquisition and Retention: A strong CSR program attracts and retains employees who seek purpose-driven work.

- Community Partnerships: Collaborative efforts with local organizations foster goodwill and operational support.

Trust and Transparency in Banking

Consumer trust is a cornerstone of success for financial institutions like Fulton Bank. In 2024, a significant portion of consumers, around 65% according to a recent survey, indicated that transparency in fees and clear communication are paramount when choosing a bank. Fulton Bank's commitment to responsible governance and ethical practices directly addresses this sociological need, fostering a more stable customer base.

Fulton Bank's proactive approach to building trust is evident in its emphasis on diligent risk management and clear communication regarding its services and associated costs. This focus on transparency is crucial, especially as consumer awareness regarding financial products continues to grow. By providing straightforward information about fees and product features, Fulton Bank aims to cultivate long-term relationships built on reliability.

The sociological impact of trust and transparency can be quantified. For instance, banks that score higher on trust indices often experience lower customer attrition rates. In 2024, reports suggest that banks with strong transparency initiatives saw an average of 15% higher customer retention compared to those with less clear communication. This highlights the direct correlation between open practices and customer loyalty for institutions like Fulton Bank.

- Consumer Trust: A recent study found that 70% of banking customers consider trust to be the most important factor when selecting a financial institution.

- Transparency in Fees: In 2024, over 60% of consumers stated they would switch banks due to unexpected or unclear fees.

- Ethical Conduct: Banks demonstrating strong ethical governance are perceived as more reliable, leading to increased customer engagement.

- Risk Management Communication: Clear communication about how a bank manages risk can significantly enhance customer confidence in its stability.

Societal expectations for corporate responsibility are evolving, with a growing emphasis on ethical practices and community engagement. Fulton Bank's increased charitable contributions, exceeding $5 million in 2024, demonstrate a commitment to social impact that resonates with consumers and employees alike. This focus on social good directly influences brand perception and customer loyalty.

Financial literacy remains a significant societal concern, with many individuals lacking confidence in managing their finances. Fulton Bank's investment in educational programs addresses this gap, empowering communities and enhancing the bank's reputation as a responsible partner. This proactive approach to education supports long-term customer relationships.

The demand for digital convenience is a defining sociological trend, particularly among younger demographics. Fulton Bank's strategic investments in its mobile and online platforms cater to this preference, ensuring competitiveness and customer satisfaction. Meeting these evolving digital expectations is crucial for sustained growth.

| Sociological Factor | Fulton Bank's Response | Impact/Data Point (2024/2025) |

|---|---|---|

| Digital Banking Preference | Enhanced mobile app and online services | Over 70% of Gen Z/Millennials prefer mobile banking. |

| Financial Literacy Demand | Community financial education programs | Over 60% of adults struggle with basic financial concepts. |

| Corporate Social Responsibility | Increased charitable giving and community support | $5M+ contributed to non-profits, a 15% year-over-year increase. |

| Consumer Trust & Transparency | Clear fee structures and ethical governance | 65% of consumers prioritize transparency in fees. |

Technological factors

Fulton Bank's digital banking transformation is key to meeting customer expectations and streamlining operations. As of early 2024, over 70% of banking interactions are happening digitally, a trend particularly strong with younger demographics like Gen Z and Millennials who demand intuitive online tools and seamless account opening processes.

This shift is essential for Fulton Bank to remain competitive. In 2024, digital-first banks are seeing significant customer acquisition, with some reporting over 60% of new accounts opened online. Fulton's investment in these capabilities directly addresses the growing preference for mobile banking and digital self-service options.

Financial institutions like Fulton Bank are increasingly targeted by sophisticated cyber threats, such as ransomware and phishing attacks. In 2024, the financial services sector experienced a significant rise in cyber incidents, with reports indicating a 20% increase in data breaches compared to the previous year. This necessitates continuous investment in advanced cybersecurity measures to safeguard sensitive customer data and uphold operational integrity.

Fulton Bank is actively integrating artificial intelligence (AI) and machine learning (ML) to bolster its operations. These advanced technologies are instrumental in strengthening fraud detection systems and refining the assessment of lending risks, ultimately leading to more secure and efficient banking practices.

By leveraging AI and ML, Fulton Bank can unlock significant improvements in operational efficiency. For instance, AI-powered chatbots can handle a substantial volume of customer inquiries, freeing up human staff for more complex tasks. In 2024, many banks reported a 20-30% reduction in customer service wait times due to AI implementation.

Furthermore, these technologies enable Fulton Bank to deliver highly personalized banking recommendations and experiences to its customers. This tailored approach can enhance customer satisfaction and loyalty. Early adopters of AI in customer relationship management have seen an increase in customer retention rates by up to 15%.

FinTech Partnerships and Embedded Finance

The financial technology, or FinTech, landscape is rapidly evolving, with embedded finance becoming a significant trend. This means financial services are increasingly being woven directly into non-financial platforms, like e-commerce sites or software applications. For Fulton Bank, this presents a dual-edged sword: opportunities to partner and expand reach, or challenges from new, integrated competitors.

By 2024, the global embedded finance market was projected to reach over $7 trillion, highlighting its substantial growth and potential. Fulton Bank can leverage this by forming strategic alliances with FinTech firms or by developing its own capabilities to offer financial services within diverse digital ecosystems. This proactive approach is crucial for staying competitive and meeting customer expectations for seamless financial integration.

Key considerations for Fulton Bank include:

- Strategic Partnerships: Collaborating with FinTechs to offer specialized services through their platforms.

- Platform Integration: Developing APIs to allow third-party applications to embed Fulton Bank's financial products.

- Competitive Response: Analyzing how FinTech-driven embedded finance impacts traditional banking models and adapting accordingly.

- Customer Experience: Enhancing customer convenience by offering financial solutions at the point of need within other digital journeys.

Cloud Computing and Data Analytics

The increasing adoption of cloud computing offers Fulton Bank enhanced operational agility and significant cost savings. For instance, by migrating services to the cloud, banks can reduce their physical infrastructure overhead. This shift is crucial in a market where efficiency directly impacts profitability.

Big data analytics is transforming customer understanding. Fulton Bank can leverage these tools to analyze vast datasets, uncovering patterns in customer behavior and preferences. This allows for more personalized product offerings and improved risk management, a key differentiator in the competitive banking landscape.

The synergy between cloud and data analytics empowers data-driven decision-making across Fulton Bank’s operations. For example, real-time analytics can inform lending strategies and fraud detection. By mid-2024, the global cloud computing market was projected to reach over $1 trillion, underscoring its pervasive influence.

Key benefits for Fulton Bank include:

- Enhanced Scalability: Cloud platforms allow for rapid scaling of resources to meet fluctuating demand.

- Deeper Customer Insights: Advanced analytics reveal customer trends for targeted marketing and service improvements.

- Optimized Operational Efficiency: Automation and streamlined processes reduce costs and improve service delivery speed.

- Improved Data Security and Compliance: Cloud providers often offer robust security measures, aiding in regulatory adherence.

Technological advancements are reshaping banking, with digital channels becoming paramount. By early 2024, over 70% of banking interactions were digital, a trend amplified by younger demographics demanding seamless online experiences. Fulton Bank's investment in digital transformation, including AI for fraud detection and personalized services, is crucial for competitiveness, as digital-first banks saw over 60% of new accounts opened online in 2024.

Cybersecurity remains a critical concern, with financial services facing a 20% increase in data breaches in 2024. Fulton Bank must continuously invest in advanced security to protect customer data. Furthermore, the rise of embedded finance, projected to exceed $7 trillion globally by 2024, presents opportunities for partnerships and challenges from integrated competitors, necessitating strategic adaptation.

Cloud computing and big data analytics are driving operational efficiency and deeper customer insights for Fulton Bank. Migrating to the cloud can reduce infrastructure costs, while data analytics enables personalized offerings and improved risk management. The global cloud market's projected growth to over $1 trillion by mid-2024 highlights its pervasive influence on data-driven decision-making.

| Technology Area | Impact on Fulton Bank | Key Data/Trends (2024/2025) |

|---|---|---|

| Digital Banking | Customer expectation, operational efficiency | 70%+ digital interactions; 60%+ new accounts online for digital-first banks |

| Cybersecurity | Data protection, operational integrity | 20% increase in financial sector data breaches (2024) |

| AI/ML | Fraud detection, risk assessment, customer service | 20-30% reduction in wait times via AI chatbots; up to 15% increase in customer retention with AI CRM |

| Embedded Finance | New revenue streams, competitive landscape | Global market projected >$7 trillion (2024) |

| Cloud Computing | Scalability, cost savings, agility | Global market projected >$1 trillion (mid-2024) |

| Big Data Analytics | Customer insights, risk management, personalization | Enables real-time analytics for lending and fraud detection |

Legal factors

Fulton Bank operates under stringent federal and state banking regulations, encompassing capital adequacy, liquidity management, and rigorous stress testing requirements. For instance, the Federal Reserve's Comprehensive Capital Analysis and Review (CCAR) process, which influences capital planning, is a key compliance area. Staying abreast of evolving regulatory landscapes, such as potential changes to Basel III or Dodd-Frank Act provisions, is paramount for maintaining operational integrity and mitigating risk in 2024 and 2025.

The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in 2010, continues to influence the operational and compliance frameworks of banks like Fulton Bank. While specific amendments are ongoing, the act's core principles, such as enhanced capital requirements and consumer protection, remain critical. For instance, the Volcker Rule, a key component, restricts proprietary trading by banks, impacting how institutions manage their balance sheets and investment strategies.

Fulton Bank faces a landscape of increasingly stringent data privacy and security laws, particularly concerning consumer financial data access. Regulations like the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), which went into full effect in 2023, set a high bar for data protection. These laws mandate transparency in data collection and provide consumers with significant rights over their personal information. Failure to comply can result in substantial fines, with CCPA penalties reaching $2,500 per unintentional violation and $7,500 per intentional violation.

Anti-Money Laundering (AML) and Sanctions Compliance

Fulton Bank operates under strict Anti-Money Laundering (AML) and sanctions compliance regulations. These frameworks are critical for preventing financial crime and ensuring adherence to global economic policies. In 2025, regulatory scrutiny on Bank Secrecy Act (BSA) and AML compliance is anticipated to remain high, demanding continuous vigilance in monitoring transactions and filing required reports.

This focus translates into a need for sophisticated systems and ongoing training to detect and report suspicious activities. Failure to comply can result in significant penalties, impacting the bank's reputation and financial standing. For instance, in 2023, financial institutions globally faced billions in AML-related fines, highlighting the substantial risks associated with non-compliance.

- Enhanced Due Diligence: Implementing rigorous customer identification and verification processes.

- Transaction Monitoring: Utilizing advanced analytics to identify and flag unusual transaction patterns.

- Suspicious Activity Reporting: Ensuring timely and accurate reporting of potential financial crimes to authorities.

- Sanctions Screening: Maintaining up-to-date lists and screening all customers and transactions against them.

Fair Lending Laws

Fair lending laws, such as the Equal Credit Opportunity Act (ECOA) and the Fair Housing Act, are critical for Fulton Bank. These regulations mandate that credit decisions be made without regard to race, color, religion, national origin, sex, marital status, or age. Fulton Bank must maintain robust compliance programs to ensure its lending practices, from loan origination to servicing, are equitable and free from bias. Regulatory bodies continue to emphasize fair lending, with a focus on data analysis to identify potential disparities in lending outcomes. For instance, in 2023, the Consumer Financial Protection Bureau (CFPB) continued its enforcement actions against institutions for fair lending violations, highlighting the ongoing importance of this area.

Fulton Bank's adherence to fair lending principles directly impacts its reputation and operational stability. Demonstrating a commitment to fair lending can foster trust within the communities it serves and mitigate the risk of significant fines and legal challenges. The bank's internal policies and employee training must consistently reinforce these legal obligations.

- Compliance with ECOA and Fair Housing Act: Ensuring all lending decisions are free from prohibited basis discrimination.

- Robust Internal Controls: Implementing systems to monitor lending patterns for potential disparate impact.

- Regulatory Scrutiny: Staying abreast of evolving regulatory expectations and enforcement priorities from agencies like the CFPB.

- Community Trust: Building and maintaining positive relationships by providing equitable access to credit.

Fulton Bank operates within a complex web of federal and state regulations governing banking, including capital adequacy, liquidity, and stress testing. The Federal Reserve's Comprehensive Capital Analysis and Review (CCAR) is a key compliance area, with ongoing scrutiny of Basel III and Dodd-Frank provisions expected through 2025.

Data privacy laws, such as the CCPA/CPRA, impose strict requirements on handling consumer financial information, with penalties for violations. Similarly, robust Anti-Money Laundering (AML) and sanctions compliance remain critical, with high regulatory expectations for transaction monitoring and reporting in 2025.

Fair lending laws like ECOA and the Fair Housing Act necessitate equitable credit practices. The CFPB's continued focus on fair lending enforcement in 2023 underscores the importance of robust compliance programs to avoid penalties and maintain community trust.

Environmental factors

Fulton Bank is actively integrating environmental considerations into its operations, as evidenced by its 2024 Corporate Social Responsibility Report. This report details the bank's commitment to reducing its environmental footprint through efficient resource management.

The financial industry, including Fulton Bank, is increasingly prioritizing Environmental, Social, and Governance (ESG) factors, with climate change emerging as a critical concern. Fulton Bank is supporting its customers in their transition towards more sustainable practices, recognizing the interconnectedness of financial health and environmental well-being.

Fulton Bank is facing increasing demands for clear and comprehensive environmental, social, and governance (ESG) reporting. This transparency is crucial for stakeholders to understand the bank's commitment to sustainability and its overall impact.

The bank's 2024 Corporate Social Responsibility Report, released in Q2 2024, highlights its dedication to disclosing environmental footprint data. For instance, the report details a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline.

Fulton Bank is observing a significant trend where financial institutions are channeling more capital into green financing and creating products designed with environmental consciousness. This shift reflects a growing market demand for sustainable investments and lending practices.

For instance, the global green bond market reached an estimated $1.2 trillion in 2023, demonstrating substantial investor appetite for environmentally focused instruments. Fulton Bank could capitalize on this by offering green loans or bonds to support clients undertaking eco-friendly projects, potentially attracting new customer segments and enhancing its corporate social responsibility profile.

Operational Environmental Impact

Fulton Bank's operational environmental impact is primarily tied to its physical footprint, including energy consumption and waste generation across its branches and corporate offices. The bank is actively working to improve its environmental performance through initiatives focused on optimizing utility management and reducing its overall carbon footprint.

In 2023, Fulton Bank reported progress in its sustainability efforts, though specific figures for energy consumption and waste reduction across all operations were not publicly detailed in a way that allows for direct comparison to prior years or industry benchmarks. However, the company has stated its commitment to enhancing efficiency in building management systems and exploring renewable energy options where feasible.

- Energy Efficiency: Fulton Bank is implementing measures to reduce energy consumption in its facilities, aiming for more efficient lighting and HVAC systems.

- Waste Reduction: Efforts are underway to minimize waste generation, with a focus on recycling programs and reducing paper usage through digital transformation.

- Carbon Footprint: The bank is tracking its carbon emissions with the goal of setting reduction targets, aligning with broader corporate social responsibility objectives.

Regulatory and Stakeholder Pressure for ESG Integration

Regulators and stakeholders are increasingly demanding that financial institutions like Fulton Bank embed Environmental, Social, and Governance (ESG) considerations into their core risk management and strategic planning. This push is driven by a growing awareness of climate-related risks, social inequalities, and the need for transparent corporate governance.

Fulton Bank has responded by bolstering its ESG governance framework, ensuring that ethical conduct and sustainability principles are woven into its operations. For instance, in 2024, the bank reported a 15% increase in its ESG-related training programs for employees, reflecting a commitment to aligning business practices with stakeholder expectations.

The pressure for ESG integration is not merely a trend but a fundamental shift in how businesses are evaluated. Investors, customers, and employees alike are scrutinizing companies' ESG performance. Fulton Bank's proactive approach positions it favorably to navigate this evolving landscape, potentially attracting more socially conscious capital and enhancing its long-term resilience.

- Increased regulatory scrutiny on climate risk disclosures: As of late 2024, several major regulatory bodies, including the SEC and the Federal Reserve, have proposed or finalized new rules requiring enhanced disclosure of climate-related financial risks, impacting banks like Fulton.

- Stakeholder demand for sustainable finance products: By early 2025, market research indicates a 20% year-over-year growth in demand for green bonds and other sustainable financial instruments, a sector where Fulton Bank is actively expanding its offerings.

- Fulton Bank's ESG governance enhancements: The bank has established dedicated ESG committees at the board and management levels, ensuring oversight and accountability for ESG strategy implementation throughout 2024 and into 2025.

- Alignment with global ESG reporting standards: Fulton Bank is working towards aligning its reporting frameworks with evolving international standards such as the ISSB, aiming for full compliance by the end of 2025 to meet global stakeholder expectations.

Fulton Bank is actively addressing environmental concerns, with its 2024 Corporate Social Responsibility Report detailing a 15% reduction in Scope 1 and 2 greenhouse gas emissions against a 2020 baseline. This reflects a broader industry trend where financial institutions are increasingly channeling capital into green financing, evidenced by the global green bond market's estimated $1.2 trillion valuation in 2023.

The bank is enhancing its ESG governance, with a 15% increase in ESG training programs for employees in 2024, aligning with heightened regulatory scrutiny on climate risk disclosures and growing stakeholder demand for sustainable finance products, which saw a 20% year-over-year growth in demand by early 2025.

| Environmental Factor | Fulton Bank's Action/Response | Industry Trend/Data Point |

|---|---|---|

| Greenhouse Gas Emissions | 15% reduction in Scope 1 & 2 emissions (vs. 2020 baseline) | |

| Green Financing | Expanding offerings in green loans/bonds | Global green bond market ~$1.2 trillion (2023); 20% YoY growth in demand for sustainable instruments (early 2025) |

| ESG Reporting & Governance | 15% increase in ESG training (2024); Enhancing ESG committees | Increased regulatory scrutiny on climate risk disclosures; Alignment with ISSB standards by end of 2025 |

PESTLE Analysis Data Sources

Our Fulton Bank PESTLE Analysis is built on a comprehensive review of data from reputable sources including government economic reports, financial regulatory updates, and industry-specific market research. We incorporate insights from leading financial institutions and technology trend analyses to ensure a holistic view.