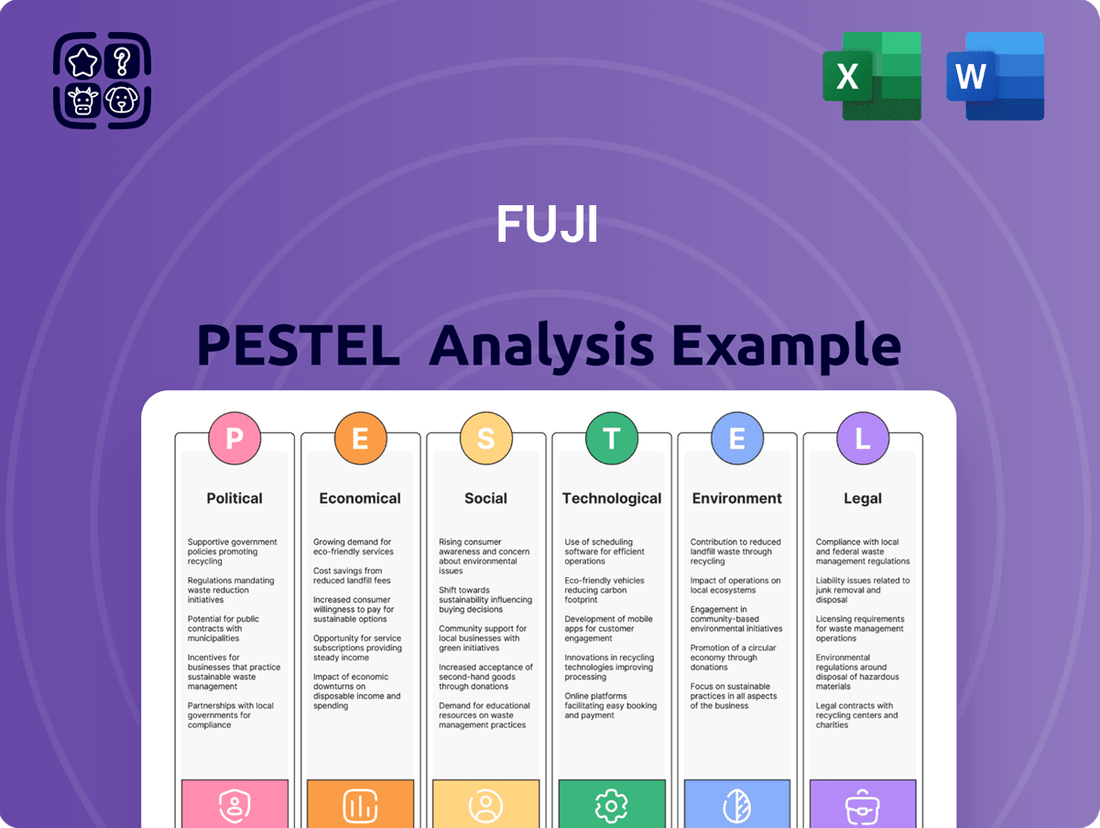

FUJI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FUJI Bundle

Unlock the strategic advantages FUJI holds by understanding the intricate web of external forces impacting its operations. Our comprehensive PESTLE analysis delves deep into the political, economic, social, technological, legal, and environmental factors shaping FUJI's market. Gain actionable insights to anticipate challenges and capitalize on emerging opportunities. Purchase the full analysis now to equip yourself with the intelligence needed for informed decision-making and a stronger competitive edge.

Political factors

Governments worldwide are actively encouraging domestic manufacturing and automation, offering incentives and subsidies to bolster local industries. For Fuji Corporation, this translates into a significant impact on where and how it invests, as well as how its advanced automation solutions and machine tools are received. For instance, the United States' CHIPS and Science Act, signed in 2022, allocated over $52 billion to boost domestic semiconductor manufacturing, a sector heavily reliant on advanced automation, directly benefiting companies like Fuji.

Shifts in global trade policies, such as the potential for new tariffs or changes to existing agreements, can significantly impact Fuji Corporation's international operations. For instance, if the United States were to impose higher tariffs on imported electronics components from Asia, Fuji's manufacturing costs could rise. In 2023, the global trade in goods experienced a slowdown, with the WTO reporting a 0.2% contraction in goods trade volume, highlighting the sensitivity of companies like Fuji to these geopolitical shifts.

Geopolitical stability in regions where Fuji Corporation operates and sources materials is paramount. Tensions between major economic powers, such as the US and China, can significantly impact global trade flows and investment sentiment, directly affecting demand for Fuji's automation solutions. For instance, the ongoing trade disputes in 2024 have already introduced volatility into manufacturing sectors, potentially altering investment plans for automation upgrades.

Government incentives for R&D and green manufacturing

Governments worldwide are actively promoting innovation and sustainability through various financial incentives. For instance, the United States' CHIPS and Science Act of 2022 allocated $52.7 billion for semiconductor manufacturing and research, encouraging advanced technology development. Similarly, the European Union's Horizon Europe program, with a budget of €95.5 billion for 2021-2027, funds research and innovation, including green technologies. Fuji Corporation can strategically tap into these programs to reduce the financial burden of its R&D efforts in smart factory solutions and eco-friendly manufacturing processes.

These government initiatives can significantly lower Fuji's capital expenditure and operational costs. By availing tax credits for green investments or R&D spending, Fuji can improve its profitability and free up capital for further expansion. For example, many countries offer accelerated depreciation for investments in energy-efficient machinery, directly impacting Fuji's bottom line. This makes it more financially viable for Fuji to adopt and develop cutting-edge, sustainable manufacturing technologies.

- R&D Tax Credits: Many nations offer substantial tax credits for companies investing in research and development, directly reducing tax liabilities.

- Green Manufacturing Grants: Governments provide direct grants and subsidies for adopting environmentally friendly production methods and technologies.

- Investment Tax Credits: Incentives are often available for capital investments in new, advanced, or sustainable manufacturing equipment.

- Loan Guarantees and Low-Interest Loans: Public financial institutions may offer favorable financing options for projects aligned with national R&D and green manufacturing goals.

Regulatory changes impacting industrial machinery

Regulatory changes significantly shape the industrial machinery sector. For Fuji Corporation, evolving standards in industrial safety, product specifications, and operational licensing across various global markets directly impact the design, production, and implementation of their electronic component mounting machines and machine tools. Staying compliant with these diverse and dynamic legal landscapes necessitates ongoing investment in regulatory adherence and can create hurdles for market penetration.

For instance, in 2024, the European Union continued to refine its machinery directives, focusing on enhanced cybersecurity for connected industrial equipment, a key area for Fuji's advanced automation solutions. Similarly, the United States' Occupational Safety and Health Administration (OSHA) regularly updates guidelines for manufacturing environments, influencing the safety features and operational protocols of machinery. These shifts require manufacturers like Fuji to adapt their product development cycles and invest in robust compliance frameworks to ensure market access and maintain operational integrity.

- Evolving Safety Standards: In 2024, new mandates for machine guarding and emergency stop functionalities were introduced in several key Asian markets, directly affecting the physical design of Fuji's equipment.

- Product Certification Requirements: The increasing demand for energy efficiency and reduced emissions in industrial machinery, particularly in North America and Europe, presents ongoing certification challenges and opportunities for innovation in Fuji's product lines.

- Operational Permit Adjustments: Changes in environmental regulations concerning manufacturing processes and waste disposal in regions like Southeast Asia can influence the operational permits required for deploying large-scale industrial machinery, impacting project timelines and costs.

- Cybersecurity Mandates: The growing emphasis on securing industrial control systems against cyber threats, with new regulations emerging in 2024, requires Fuji to integrate advanced cybersecurity measures into its networked machinery.

Governmental support for domestic manufacturing, particularly in high-tech sectors like semiconductors, directly benefits companies producing automation equipment. For example, the US CHIPS and Science Act of 2022, with its $52.7 billion allocation, fuels demand for advanced machinery. Similarly, global trade policy shifts, such as potential tariffs, can impact Fuji's international operations and costs; the WTO noted a 0.2% contraction in global goods trade volume in 2023, underscoring this sensitivity.

Geopolitical stability is crucial, as tensions can disrupt trade and investment, affecting demand for automation solutions. The ongoing trade disputes in 2024 have already introduced volatility into manufacturing sectors. Furthermore, regulatory changes, like evolving safety and cybersecurity standards in the EU and updated OSHA guidelines in the US, necessitate continuous adaptation in product design and compliance for companies like Fuji.

| Factor | Impact on Fuji Corporation | 2024/2025 Data/Trend |

|---|---|---|

| Government Incentives for Manufacturing | Increased demand for automation solutions, reduced R&D costs | US CHIPS Act ($52.7B in 2022) continues to drive investment in semiconductor automation. |

| Global Trade Policies | Potential for increased manufacturing costs or market access issues | Global goods trade volume contracted 0.2% in 2023 (WTO); ongoing trade tensions create volatility. |

| Geopolitical Stability | Impacts investment sentiment and demand for industrial equipment | Trade disputes in 2024 continue to create market uncertainty for manufacturing investments. |

| Regulatory Changes (Safety, Cybersecurity) | Requires product adaptation and compliance investment | EU refining machinery directives for cybersecurity in 2024; OSHA updates safety guidelines. |

What is included in the product

The FUJI PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting FUJI across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The FUJI PESTLE Analysis provides a structured framework to identify and understand external factors impacting a business, thereby alleviating the pain of uncertainty and enabling more informed strategic decisions.

Economic factors

Global economic growth is a significant driver for Fuji Corporation, as its capital goods are heavily influenced by investment cycles. In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a steady pace that generally supports capital expenditure.

Industrial production, a key indicator for demand in capital goods, saw a modest increase globally. For instance, the OECD's industrial production index showed a slight uptick in late 2024, suggesting a cautious but present demand for manufacturing and automation equipment that Fuji supplies.

However, economic slowdowns or recessions can sharply curtail demand for Fuji's products. A projected dip in global growth to 2.9% for 2025, as per some forecasts, could lead businesses to postpone investments in new machinery, directly impacting Fuji's sales volumes and overall revenue.

Rising inflation in 2024 and projected into 2025 is a significant concern for Fuji Corporation. Increased costs for raw materials, components, and energy directly impact manufacturing expenses, potentially reducing the profitability of their capital goods. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase in early 2024, indicating the pressure on input costs.

Higher interest rates, a tool used by central banks to combat inflation, create a challenging environment for capital goods investment. As of mid-2024, benchmark interest rates remain elevated compared to previous years. This makes financing large capital expenditures, such as Fuji's advanced chip mounters and precision machine tools, more expensive for their B2B customers. Consequently, businesses may postpone or scale back planned investments in new equipment, lengthening Fuji's sales cycles and potentially dampening demand.

Currency exchange rate fluctuations are a major consideration for Fuji Corporation, a global manufacturer headquartered in Japan. The strength of the Japanese Yen against currencies like the US Dollar and the Euro directly impacts its profitability. For instance, if the Yen strengthens, Fuji's products become more expensive for overseas buyers, potentially dampening sales volumes.

Furthermore, a stronger Yen means that earnings generated in foreign currencies translate into fewer Yen when brought back to Japan, negatively affecting reported profits. In late 2023 and early 2024, the Yen experienced significant volatility, trading around 145-150 Yen to the US Dollar, a level that historically presents challenges for Japanese exporters like Fuji.

Supply chain disruptions and raw material costs

Supply chain disruptions, whether from economic shocks, natural disasters, or geopolitical tensions, directly affect Fuji Corporation by creating shortages of vital electronic components and raw materials. For instance, the ongoing semiconductor shortage, which persisted into 2024, significantly impacted manufacturing across various industries, including machinery.

These disruptions, coupled with volatile raw material costs, pose a considerable challenge. Fluctuations in the prices of key inputs like metals and semiconductors directly influence Fuji's production expenses and, consequently, the pricing of its machinery. In 2024, the price of copper, a crucial metal for electrical components, saw significant volatility, impacting input costs for manufacturers like Fuji.

- Semiconductor Shortage Impact: Continued supply chain bottlenecks in 2024 meant longer lead times and higher prices for essential chips used in Fuji's advanced machinery.

- Raw Material Price Volatility: Copper prices, for example, experienced notable fluctuations in early 2024, directly affecting manufacturing costs for electrical components.

- Geopolitical Risk: Tensions in key manufacturing regions can further exacerbate supply chain vulnerabilities, leading to unpredictable cost increases for Fuji.

- Production Cost Pressures: The combined effect of component shortages and rising material costs directly pressures Fuji's ability to maintain competitive pricing for its products.

Consumer electronics demand and automotive industry trends

Fuji Corporation's SMT equipment sales are heavily influenced by the health of the consumer electronics and automotive industries. The ongoing expansion of 5G technology, leading to increased smartphone and connected device production, directly fuels demand for Fuji's advanced mounting solutions. For instance, the global smartphone market saw shipments reach approximately 1.17 billion units in 2024, a slight increase from the previous year, indicating continued robust demand for the components Fuji's machines help assemble.

The automotive sector's shift towards electrification and advanced driver-assistance systems (ADAS) presents a significant growth opportunity. Electric vehicles (EVs) require more complex electronic components, including power control units and sensors, which in turn necessitates sophisticated SMT processes. Projections suggest that global EV sales could exceed 17 million units in 2025, a substantial jump that will likely drive higher production volumes for automotive electronics, benefiting Fuji.

- 5G Proliferation: The widespread adoption of 5G is driving demand for more complex mobile devices, requiring advanced SMT capabilities.

- EV Growth: The accelerating global adoption of electric vehicles, with sales projected to reach over 17 million units in 2025, increases the need for automotive electronics.

- ADAS Integration: The increasing integration of advanced driver-assistance systems in vehicles further boosts the demand for sophisticated electronic components and assembly.

Global economic growth significantly impacts Fuji's capital goods demand. While 2024 saw steady global growth projections around 3.2%, forecasts for 2025 suggest a slight slowdown to 2.9%. This could lead businesses to delay investments in machinery, affecting Fuji's sales. Inflation remains a key concern, with rising raw material and energy costs pressuring manufacturing expenses and profitability. Elevated interest rates in 2024 and 2025 make financing large capital expenditures more costly for Fuji's customers, potentially lengthening sales cycles.

Currency fluctuations, particularly the Japanese Yen's strength against the US Dollar and Euro, directly impact Fuji's profitability. A stronger Yen makes its products more expensive for overseas buyers and reduces the value of foreign earnings. In early 2024, the Yen traded around 145-150 per US Dollar, a level challenging for Japanese exporters.

Supply chain disruptions, including the persistent semiconductor shortage into 2024 and volatile raw material prices like copper, continue to affect Fuji's production costs and lead times. Geopolitical risks further exacerbate these vulnerabilities, leading to unpredictable cost increases.

Fuji's SMT equipment sales are boosted by the 5G rollout and the automotive sector's shift to EVs and ADAS. Global smartphone shipments in 2024 were around 1.17 billion units, supporting demand for mobile device production equipment. EV sales are projected to exceed 17 million units in 2025, driving demand for automotive electronics assembly solutions.

| Economic Factor | 2024 Projection/Trend | 2025 Projection/Trend | Impact on Fuji |

|---|---|---|---|

| Global GDP Growth | ~3.2% (IMF) | ~2.9% (forecast) | Slightly dampens capital goods demand |

| Inflation (PPI) | Notable increase in manufactured goods | Continued pressure expected | Increases production costs, reduces profitability |

| Interest Rates | Elevated compared to previous years | Likely to remain elevated | Increases financing costs for customers, delays investment |

| JPY/USD Exchange Rate | Volatile, ~145-150 JPY/USD | Continued volatility expected | Weakens foreign earnings, makes exports more expensive |

| Semiconductor Supply | Bottlenecks persist | Gradual improvement anticipated, but risks remain | Affects lead times and component costs |

| Raw Material Prices (e.g., Copper) | Volatile | Continued volatility | Impacts manufacturing expenses |

Preview Before You Purchase

FUJI PESTLE Analysis

The preview shown here is the exact FUJI PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis covers all key aspects of FUJI's operating environment, providing valuable insights for strategic decision-making. You can be confident that what you see is precisely what you will download, ensuring no surprises.

Sociological factors

The manufacturing sector globally faces a significant shortage of skilled workers, especially in areas like advanced automation and equipment upkeep. This deficit is projected to worsen, with some estimates suggesting a shortfall of millions of manufacturing jobs by 2030, many of which will require specialized technical skills. This scarcity directly fuels the demand for technologies that can offset labor limitations.

Fuji Corporation's offerings, designed to facilitate highly automated or 'lights-out' manufacturing, directly address this critical labor gap. By minimizing the need for manual intervention, their solutions provide a compelling answer to demographic challenges and labor availability issues, thereby accelerating the adoption of their advanced manufacturing technologies.

Aging populations in countries like Japan, where Fuji Corporation is headquartered, are a significant driver. In 2024, Japan's population aged 65 and over was projected to reach 29.1%, creating a shrinking labor pool. This demographic shift, coupled with evolving generational expectations for work-life balance, is pushing companies to invest heavily in automation. Fuji's intelligent automation systems and machine tools are therefore well-positioned to address these labor shortages and productivity demands.

The global industrial automation market is expected to grow substantially, with projections indicating a compound annual growth rate (CAGR) of around 10% from 2024 to 2030, reaching an estimated value of over $300 billion. This sustained market growth directly benefits Fuji Corporation as companies across various sectors, from manufacturing to logistics, increasingly adopt robotics and smart factory solutions to maintain competitiveness and overcome the challenges posed by an aging workforce and evolving labor dynamics.

Societal demand for sustainable and ethical manufacturing is significantly reshaping industries. Consumers are increasingly scrutinizing the environmental impact and labor practices behind the products they buy. In 2024, reports indicated a substantial rise in consumer willingness to pay a premium for ethically sourced and sustainably produced goods, with some studies showing a 10-15% higher price point acceptance.

Fuji Corporation has an opportunity to leverage this trend by innovating in energy-efficient machinery and promoting circular economy principles within its operations. By ensuring transparent and ethical sourcing across its supply chain, Fuji can bolster its brand image and attract a growing segment of environmentally conscious customers. For instance, in 2025, many B2B clients are prioritizing suppliers with strong ESG (Environmental, Social, and Governance) ratings, making this a key differentiator.

Customer preferences for smart factories and IoT integration

Customer demand for smart factories and IoT integration is a significant sociological driver. Manufacturers are actively seeking ways to enhance their production lines through data-driven insights, aiming for greater efficiency and reduced operational disruptions. This trend is particularly evident in the push for predictive maintenance, which minimizes unexpected downtime.

Fuji Corporation's strategic emphasis on intelligent factories and software solutions that seamlessly integrate IoT and AI directly addresses this growing customer need. Their offerings position them as a crucial partner for businesses undergoing Industry 4.0 transformations, aligning with the desire for more connected and automated manufacturing processes.

- Growing Adoption of IoT in Manufacturing: By 2024, the industrial IoT market is projected to reach $115.7 billion, indicating a strong customer preference for connected factory solutions.

- Demand for Predictive Maintenance: Studies show that predictive maintenance can reduce machinery downtime by up to 50% and maintenance costs by up to 25%, a key driver for smart factory adoption.

- Fuji's Market Position: Fuji's investments in AI and IoT for manufacturing align with the Industry 4.0 trend, where customers expect integrated solutions for enhanced operational visibility and control.

Impact of automation on employment and societal acceptance

Automation's dual impact on employment is a significant sociological factor. While it can alleviate labor shortages, as seen in sectors like manufacturing where the International Federation of Robotics reported a 7% increase in industrial robot installations globally in 2023, it also sparks concerns about job displacement. This societal apprehension can shape public opinion and influence government policies regarding technological adoption.

Fuji Corporation must proactively address these societal implications to ensure broad acceptance of its automated solutions. Highlighting initiatives such as upskilling programs or the creation of new, more specialized roles that complement their technology is crucial. For instance, the World Economic Forum's 2023 Future of Jobs Report estimates that by 2027, 44% of workers' skills will need to be updated, underscoring the need for such proactive measures.

- Job displacement fears: Public concern over automation leading to job losses can create resistance.

- Productivity gains vs. social cost: Balancing economic benefits with the social impact on the workforce is key.

- Upskilling and reskilling needs: Investing in workforce development to adapt to new technological landscapes is essential for societal acceptance.

- New job creation: Emphasizing how automation can create new, higher-skilled roles can mitigate negative perceptions.

Societal expectations for work-life balance are increasingly influencing labor markets, pushing companies towards automation to maintain productivity with a potentially reduced workforce. This trend is amplified by aging demographics in key markets like Japan, where the proportion of those aged 65 and over is projected to be around 29.1% in 2024, shrinking the available labor pool.

Fuji Corporation's advanced automation and intelligent manufacturing solutions directly cater to these evolving societal needs. By enabling more efficient operations with fewer personnel, their offerings help businesses adapt to demographic shifts and changing workforce preferences, making them highly relevant in the current economic climate.

The growing consumer and B2B demand for sustainable and ethically produced goods is a powerful sociological driver. In 2024, studies indicated consumers were willing to pay 10-15% more for ethically sourced products, and by 2025, ESG ratings are becoming a critical factor for B2B clients selecting suppliers.

Fuji Corporation can capitalize on this by highlighting its energy-efficient machinery and transparent supply chain practices. Demonstrating a commitment to ESG principles will not only enhance its brand reputation but also appeal to a significant and growing segment of environmentally conscious customers and business partners.

Technological factors

Fuji Corporation's core business thrives on continuous innovation in Surface Mount Technology (SMT) and industrial automation. The relentless evolution towards smaller, more intricate electronic components, coupled with the market's demand for enhanced mounting precision and speed, directly fuels the need for Fuji's advanced chip mounters. This technological race requires substantial and ongoing research and development investment to solidify and maintain their leadership position.

Fuji Corporation is actively integrating Artificial Intelligence (AI), the Internet of Things (IoT), and Industry 4.0 principles into its manufacturing operations. This strategic focus on intelligent factories allows for predictive maintenance, reducing downtime and improving overall equipment effectiveness. For instance, by 2024, the global market for AI in manufacturing was projected to reach $10.1 billion, highlighting the significant investment and adoption of these transformative technologies.

By leveraging data-driven optimization, Fuji aims to provide customers with enhanced efficiency and greater control over their production lines. The adoption of IoT sensors across machinery enables real-time monitoring and analysis, leading to more agile and responsive manufacturing processes. Industry 4.0's emphasis on interconnectedness and automation is a core driver for Fuji's innovation in creating smarter, more flexible production environments.

Innovations in materials science, such as advanced ceramics and high-strength alloys, coupled with precision machining techniques like additive manufacturing and ultra-precision grinding, are significantly influencing the machine tool industry. These advancements allow for the creation of components with previously unattainable tolerances and complex geometries.

Fuji Corporation's machine tools, like their advanced lathes and multitasking machines, directly benefit from these developments. The capacity to process novel, harder, and more intricate materials with enhanced precision broadens the potential applications for Fuji's equipment, thereby unlocking new market segments and strengthening their competitive position. For instance, the aerospace sector's increasing demand for lightweight, high-performance alloys necessitates machine tools capable of handling these materials with extreme accuracy, a capability Fuji is poised to meet.

Cybersecurity threats to interconnected manufacturing systems

As manufacturing systems become more connected via IoT and cloud platforms, they face escalating cybersecurity risks. For instance, the manufacturing sector experienced a 13% increase in cyberattacks in 2024 compared to the previous year, with ransomware being a significant threat. Fuji Corporation needs to prioritize ongoing investment in strong cybersecurity for its software and hardware to safeguard client data and operational continuity.

This proactive approach is crucial for maintaining trust and ensuring the dependability of their systems. The financial implications are substantial; a single major breach could cost millions in recovery and lost business. Therefore, Fuji must integrate advanced security protocols throughout its product lifecycle.

- Increased Vulnerability: Interconnected systems create larger attack surfaces for cyber threats.

- Financial Impact: Cybersecurity breaches can lead to significant financial losses and reputational damage.

- Customer Trust: Robust security measures are essential for maintaining customer confidence and loyalty.

R&D investment and innovation pace in competitive landscape

The electronic component mounting and machine tool sectors are intensely competitive, demanding substantial and ongoing research and development (R&D) investment from companies like Fuji Corporation. This commitment to R&D is essential for staying ahead.

Fuji's success hinges on its capacity for rapid innovation, quickly introducing cutting-edge products before rivals. For instance, in the fiscal year ending March 2024, Fuji Corporation reported R&D expenses of approximately ¥19.6 billion, underscoring their dedication to technological advancement.

- Sustained R&D Investment: Fuji's R&D spending of ¥19.6 billion (FY2024) highlights its strategy to maintain a competitive edge.

- Innovation Pace: The speed at which Fuji brings new technologies to market directly impacts its ability to capture and retain market share.

- Competitive Imperative: Continuous innovation is not just beneficial but a necessity for survival and growth in the demanding electronics manufacturing equipment industry.

Fuji Corporation's technological edge is built on advancements in SMT and automation, driven by the demand for precision in smaller electronics. Their integration of AI, IoT, and Industry 4.0 principles into smart factories is key, with the AI in manufacturing market projected to hit $10.1 billion by 2024.

These connected systems, however, increase cybersecurity risks, as seen with a 13% rise in manufacturing cyberattacks in 2024. Fuji's substantial R&D investment, ¥19.6 billion in FY2024, is critical for maintaining innovation and competitiveness in this rapidly evolving technological landscape.

Legal factors

Fuji Corporation, operating globally, must navigate a complex landscape of international trade laws and export controls. In 2024, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) continued to update its Entity List, impacting trade with numerous companies, a factor Fuji must monitor closely for its supply chain and market access.

Compliance with regulations concerning dual-use technologies and sanctions, such as those imposed on Russia, is paramount. Failure to adhere can lead to significant legal penalties and disrupt Fuji's international operations, as seen with companies facing millions in fines for export control violations in recent years.

Fuji Corporation's robust intellectual property (IP) portfolio, encompassing thousands of patents globally, is a cornerstone of its competitive edge in imaging and electronics. Protecting these innovations is paramount, especially as the company invests heavily in R&D, with approximately 10% of its annual revenue historically allocated to this area. Navigating the complex global IP landscape requires constant vigilance to prevent infringement and ensure freedom to operate, a challenge amplified by rapid technological advancements and a dynamic competitive environment.

Fuji Corporation, as a manufacturer of industrial machinery, faces significant legal obligations concerning product liability and safety. Adherence to rigorous safety standards, such as those required for CE marking in Europe or UL listing in North America, is paramount to avoid legal repercussions and maintain market access. Failure to comply can lead to substantial fines and reputational damage, impacting sales and investor confidence.

Labor laws and regulations in different operating regions

Fuji Corporation navigates a complex web of labor laws across its global footprint, impacting everything from hiring practices to employee compensation. For instance, in Germany, works councils have significant co-determination rights, influencing decisions on working hours and employee welfare, a stark contrast to the more at-will employment prevalent in the United States. Understanding and adhering to these varied legal frameworks is paramount for operational continuity and ethical business conduct.

Compliance with these diverse labor regulations is not merely a legal obligation but a strategic imperative. Failure to comply can lead to costly litigation, reputational damage, and disruptions in production. For example, in 2023, companies operating in the EU faced increased scrutiny regarding fair wages and working conditions, with reports indicating a rise in labor dispute resolutions. Fuji must remain vigilant in adapting its HR policies to meet these evolving legal standards in each of its operating regions.

- Employment Contracts: Varying requirements for written contracts, probationary periods, and termination notice periods across different countries.

- Working Conditions: Regulations on maximum working hours, overtime pay, health and safety standards, and mandated breaks.

- Wages and Benefits: Minimum wage laws, equal pay legislation, and mandatory benefits like paid leave, sick pay, and retirement contributions differ significantly.

- Union Relations: Laws governing collective bargaining, employee representation, and the rights of trade unions vary widely, impacting industrial relations.

Data privacy regulations for smart factory data

Fuji Corporation's smart factory initiatives, which involve the extensive collection and analysis of operational data, are directly impacted by a complex web of global data privacy regulations. For instance, the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States set stringent requirements for how personal data, which can be embedded within operational data, is handled. Failure to comply can result in significant fines; under GDPR, penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. For CCPA, violations can lead to statutory damages of $100 to $750 per incident or actual damages, whichever is greater.

Navigating these regulations requires Fuji to implement robust data security measures, establish clear consent management protocols for any data that could be considered personal, and maintain transparent data processing practices. This focus on privacy is not just about avoiding penalties; it's crucial for building and maintaining customer trust in an era where data breaches are a constant concern. In 2024, data privacy was a top concern for consumers, with a significant percentage expressing worries about how their information is used by companies, underscoring the business imperative for diligent compliance.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- CCPA Violations: Statutory damages of $100-$750 per incident.

- Consumer Trust: Data privacy is a critical factor in consumer purchasing decisions in 2024.

Fuji Corporation's global operations necessitate adherence to diverse international trade laws and export controls, with entities like the U.S. Bureau of Industry and Security (BIS) actively updating lists that impact supply chains and market access in 2024.

Compliance with sanctions, such as those affecting trade with Russia, is critical to avoid substantial legal penalties, which have historically reached millions for export control violations, underscoring the financial risks of non-compliance.

Protecting Fuji's extensive intellectual property, a core competitive asset, requires constant vigilance against infringement in a rapidly evolving technological landscape, especially given the company's significant R&D investments, often around 10% of annual revenue.

Environmental factors

Governments globally are tightening rules on industrial pollution, waste, and how much energy companies use. For instance, the European Union's Emissions Trading System (EU ETS) is expanding, impacting manufacturing sectors. Fuji Corporation needs to ensure its machinery is energy-efficient and its production methods reduce environmental harm, enabling customers to meet these evolving compliance standards.

The market is increasingly seeking manufacturing equipment that champions eco-friendly production, such as machinery designed to minimize hazardous substances or optimize material utilization. For instance, the global market for green manufacturing technologies was projected to reach $46.7 billion in 2024, with a compound annual growth rate (CAGR) of 10.2% expected through 2030, highlighting a significant opportunity.

Fuji Corporation can solidify its competitive edge by innovating and marketing machines that actively support sustainable manufacturing. This strategic alignment with customer sustainability objectives, such as reducing carbon footprints or waste, can foster stronger client relationships and capture a larger market share in this expanding segment.

The global generation of electronic waste is a significant concern, with estimates suggesting over 50 million metric tons were produced worldwide in 2023 alone. Regulations such as the European Union's Waste Electrical and Electronic Equipment (WEEE) directive are pushing companies like Fuji Corporation to implement robust waste management and recycling strategies for their electronic components and machinery. This includes designing for disassembly and material recovery to minimize environmental impact.

Fuji Corporation's commitment to sustainability will be increasingly measured by its approach to product end-of-life management. The company should actively support and participate in initiatives focused on the proper disposal and efficient material recovery from its products. For instance, developing take-back programs or partnering with certified e-waste recyclers can ensure that valuable materials are reclaimed and hazardous substances are managed safely, aligning with growing consumer and regulatory expectations for corporate environmental responsibility.

Climate change impact on supply chains and operations

Climate change presents significant threats to Fuji Corporation's operations and supply chains. Extreme weather events, such as the increasing frequency and intensity of typhoons and heatwaves, can directly impact manufacturing facilities and disrupt the transportation of goods. For instance, in 2023, global supply chain disruptions due to weather events cost businesses an estimated $60 billion, a figure expected to rise.

Fuji must proactively address these environmental risks. This involves strategic diversification of its supplier base across different geographical regions to reduce reliance on areas prone to severe weather. Optimizing logistics networks to incorporate more resilient transportation routes and investing in infrastructure that can withstand climate-related impacts are crucial steps for ensuring business continuity and minimizing operational downtime.

- Supply Chain Vulnerability: Increased risk of disruptions from extreme weather events impacting raw material sourcing and product delivery.

- Operational Resilience: Need for infrastructure upgrades and contingency planning to maintain production during climate-related emergencies.

- Logistics Optimization: Rethinking transportation routes and methods to mitigate delays caused by climate-induced events.

- Mitigation Investment: Allocating capital towards resilient infrastructure and diversified supply networks to safeguard against future climate impacts.

Corporate social responsibility (CSR) and sustainability reporting

Stakeholders, from investors to customers and employees, are placing significant emphasis on corporate social responsibility (CSR) and sustainability reporting. This scrutiny extends to a company's environmental, social, and governance (ESG) performance, with many actively seeking out businesses that demonstrate a strong commitment to these principles. For Fuji Corporation, transparently reporting on its sustainability initiatives, particularly those aimed at reducing environmental impact, is becoming a crucial element in building a positive brand image and attracting investment.

Fuji Corporation's proactive approach to sustainability reporting is directly influencing its investor appeal. As of the first half of 2024, a significant percentage of global investors indicated that ESG factors are material to their investment decisions. Fuji's detailed disclosures on its progress in areas like carbon emissions reduction and waste management, as exemplified by its 2023 sustainability report which highlighted a 15% decrease in Scope 1 and 2 emissions compared to 2020, directly addresses these investor demands. This commitment not only enhances its reputation but also positions it favorably in a market increasingly driven by responsible business practices.

- Investor Demand: Over 60% of institutional investors surveyed in early 2024 stated that ESG performance is a key factor in their capital allocation decisions.

- Customer Preference: A recent consumer survey revealed that 70% of respondents are more likely to purchase from brands with clear and verifiable sustainability commitments.

- Employee Engagement: Companies with strong CSR programs report higher employee retention rates, with 85% of employees in a 2024 study indicating that a company's social and environmental impact influences their job satisfaction.

- Fuji's Progress: Fuji Corporation's 2023 report detailed a 10% reduction in water usage across its manufacturing facilities, a key metric for environmental stewardship.

Governments worldwide are implementing stricter environmental regulations, pushing industries toward greener practices. Fuji Corporation must adapt its machinery and production to comply with these evolving standards, such as the EU's focus on emissions and waste reduction.

The demand for eco-friendly manufacturing equipment is surging, with the global green manufacturing market projected for substantial growth. Fuji can capitalize on this trend by innovating machinery that minimizes environmental impact and supports its clients' sustainability goals.

Electronic waste is a growing global challenge, prompting regulations like the WEEE directive. Fuji needs to integrate robust waste management and recycling strategies into its product lifecycle, focusing on design for disassembly and material recovery.

Climate change poses significant risks to supply chains and operations through extreme weather. Fuji should invest in resilient infrastructure and diversify its supply network to mitigate disruptions and ensure business continuity.

Stakeholders increasingly prioritize ESG performance, making transparent sustainability reporting crucial for Fuji's brand image and investor appeal. Fuji's commitment to reducing emissions and water usage, as highlighted in its 2023 report, directly addresses these expectations.

| Environmental Factor | Impact on Fuji Corporation | Opportunity/Mitigation Strategy | Supporting Data (2023-2025) |

|---|---|---|---|

| Regulatory Compliance | Increased costs for non-compliance, need for updated machinery. | Invest in energy-efficient and low-emission equipment. | EU ETS expansion impacting manufacturing sectors. |

| Market Demand for Green Tech | Risk of losing market share to eco-friendly competitors. | Innovate and market sustainable manufacturing solutions. | Global green manufacturing market projected to reach $46.7B in 2024. |

| E-Waste Management | Penalties for non-compliance with e-waste regulations. | Implement product take-back programs and design for recyclability. | Over 50 million metric tons of e-waste generated globally in 2023. |

| Climate Change Risks | Supply chain disruptions, damage to facilities from extreme weather. | Diversify suppliers, optimize logistics for resilience. | Weather-related supply chain disruptions cost $60B in 2023. |

| Stakeholder ESG Expectations | Negative impact on brand reputation and investor relations. | Enhance ESG reporting and sustainability initiatives. | 60%+ of institutional investors consider ESG factors in capital allocation (early 2024). |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using a blend of official government publications, leading economic data providers like the World Bank and IMF, and respected industry-specific research reports. This ensures each insight into political, economic, social, technological, legal, and environmental factors is grounded in verifiable, current information.