FUJI Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

FUJI Bundle

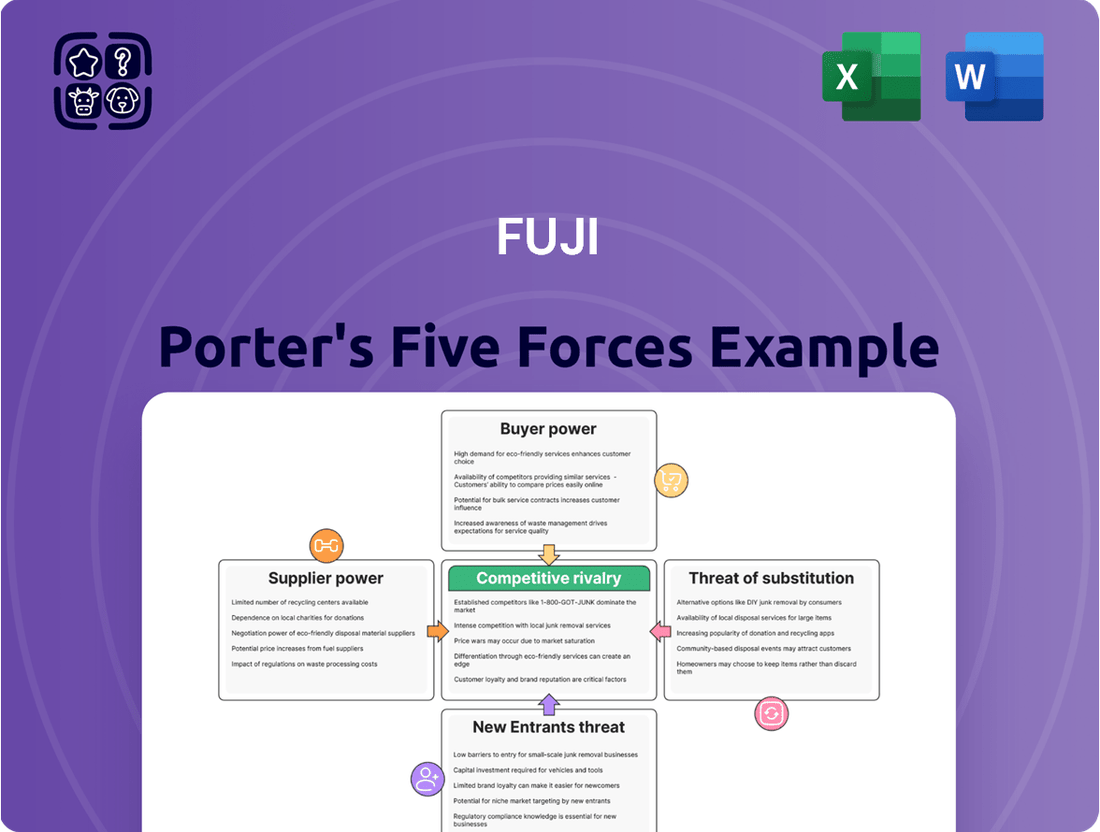

FUJI's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of new entrants. Understanding these dynamics is crucial for navigating the market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore FUJI’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Fuji's reliance on a concentrated group of suppliers for critical, high-precision robotics components and advanced sensors significantly amplifies supplier bargaining power. When only a handful of manufacturers can produce these specialized inputs, they hold considerable leverage, which can translate into increased costs for Fuji. For example, in the semiconductor industry, a sector vital for advanced electronics, the top 10 companies accounted for an estimated 60% of global revenue in 2024, illustrating the potential for supplier concentration to drive up prices.

For Fuji, the bargaining power of suppliers is amplified by substantial switching costs. If Fuji needs to change suppliers for components that are deeply integrated into its products or are proprietary, the expenses can be considerable. These costs often involve redesigning existing products, retooling manufacturing facilities, and rigorously re-qualifying new components, all of which significantly bolster the suppliers' leverage.

When suppliers offer unique, patented, or highly differentiated components that are essential for Fuji's advanced automation solutions, their bargaining power increases significantly. For instance, if a supplier holds exclusive rights to a critical sensor technology used in Fuji's robotics, they can command higher prices. The lack of readily available substitutes for these specialized inputs empowers such suppliers to dictate terms more effectively, impacting Fuji's cost structure and profitability.

Threat of forward integration by suppliers

The threat of suppliers integrating forward into FUJI's business, specifically in manufacturing electronic component mounting machines or machine tools, is generally considered low for most component suppliers. This means that typical suppliers of raw materials or standard parts are unlikely to start building the complex machinery FUJI produces.

However, for providers of highly specialized software or critical sub-systems, this threat could see a slight increase. If a supplier offers a unique, indispensable component or software that is difficult for FUJI to source elsewhere, that supplier might gain leverage. For instance, a company providing advanced AI-driven control software for mounting machines could, in theory, consider developing its own integrated machine solution, although the capital investment and expertise required would be substantial.

This potential for forward integration, while limited, can incrementally increase the bargaining leverage of these specialized sub-system providers. They might use this as a point of negotiation for pricing or terms, knowing FUJI relies on their unique offering.

For example, in the semiconductor equipment industry, which shares some parallels with electronic component mounting machinery, companies that develop proprietary lithography software or advanced metrology systems have historically held significant sway. While not direct forward integration into machine building, their control over critical intellectual property grants them considerable bargaining power. In 2024, the market for advanced automation software for manufacturing saw significant investment, with some niche players reporting revenue growth exceeding 20%, highlighting the increasing value of specialized technological components.

- Low Threat for General Component Suppliers: Most suppliers of standard parts or raw materials face minimal incentive or capability to enter FUJI's complex machinery manufacturing sector.

- Increased Leverage for Specialized Providers: Suppliers of unique software or critical sub-systems may possess incrementally higher bargaining power due to the difficulty of replication or substitution.

- Capital and Expertise Barriers: The significant capital investment and specialized engineering knowledge required to produce electronic component mounting machines act as a substantial deterrent to most potential suppliers considering forward integration.

- Industry Trends: Growth in specialized manufacturing software in 2024, with some segments experiencing over 20% revenue increases, underscores the rising importance and potential leverage of niche technology providers within complex supply chains.

Importance of Fuji as a customer to suppliers

Fuji's significance as a customer directly influences the bargaining power it wields over its suppliers. When Fuji constitutes a substantial percentage of a supplier's overall sales, that supplier is more inclined to offer competitive pricing and favorable contract terms to retain Fuji's business. This is because a disruption in sales to a major client like Fuji could significantly impact the supplier's financial stability and profitability.

Conversely, if Fuji represents a minor portion of a supplier's revenue stream, the supplier has less incentive to concede to Fuji's demands. In such scenarios, the supplier's dependence on Fuji is minimal, allowing them to maintain a stronger negotiating position. This dynamic is crucial in understanding the supplier's willingness to absorb costs or offer concessions.

For example, consider a supplier that derives 30% of its annual revenue from Fuji. This supplier would likely prioritize maintaining this relationship, potentially agreeing to lower margins or offering customized solutions. However, if Fuji only accounts for 2% of a supplier's revenue, that supplier might be less flexible, knowing that losing Fuji's business would have a negligible impact on its operations.

This customer concentration is a key factor in assessing supplier power:

- High Customer Concentration: If a supplier heavily relies on Fuji for its revenue, Fuji gains significant leverage.

- Low Customer Concentration: If Fuji is just one of many clients for a supplier, Fuji's bargaining power is diminished.

- Impact on Pricing: A large customer like Fuji can often negotiate better prices due to the volume of its purchases.

- Supplier Dependency: The degree to which a supplier depends on Fuji's orders shapes the negotiation landscape.

The bargaining power of suppliers for Fuji is considerable, particularly for specialized components crucial to its advanced robotics and automation solutions. When suppliers offer unique, patented, or difficult-to-replicate inputs, their leverage increases, allowing them to command higher prices. This is exacerbated by high switching costs for Fuji, which involve significant investment in redesign and re-qualification if a supplier change is necessary, further empowering these providers.

The threat of suppliers integrating forward into Fuji's core business of manufacturing complex machinery is generally low due to substantial capital and expertise barriers. However, providers of highly specialized software or critical sub-systems might possess incrementally higher bargaining power. For instance, niche players in advanced manufacturing software saw revenue growth exceeding 20% in 2024, highlighting the increasing value and potential leverage of specialized technological components.

Fuji's bargaining power over its suppliers is directly tied to its significance as a customer. When Fuji represents a substantial portion of a supplier's revenue, the supplier is more motivated to offer favorable terms to retain the business. Conversely, if Fuji is a minor client, the supplier's negotiation position strengthens, as they have less dependence on Fuji's orders.

| Factor | Impact on Fuji | Example/Data Point |

| Supplier Concentration | Increases supplier power | Top 10 semiconductor equipment suppliers held ~60% of global revenue in 2024. |

| Switching Costs | Increases supplier power | High costs for redesign, retooling, and re-qualification of integrated components. |

| Component Differentiation | Increases supplier power | Suppliers of patented or unique technologies essential for Fuji's products. |

| Forward Integration Threat | Generally low, but higher for specialized software/sub-systems | Capital and expertise barriers limit integration into complex machinery manufacturing. |

| Fuji's Customer Importance | Fuji's leverage increases if it's a major customer | Supplier prioritizing Fuji's business if it constitutes a significant revenue share (e.g., >30%). |

What is included in the product

A comprehensive examination of FUJI's competitive environment, analyzing the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes.

Instantly visualize competitive intensity across all five forces with a dynamic, interactive dashboard.

Streamline strategic planning by pinpointing key pressures and identifying areas for competitive advantage.

Customers Bargaining Power

Fuji's customer bargaining power is significantly influenced by customer concentration and the sheer volume of orders. When major global players in electronics manufacturing or the automotive sector procure numerous SMT lines or high-value machine tools, they wield considerable leverage. This substantial buying power allows them to negotiate more aggressively on pricing and contractual terms, directly impacting Fuji's profitability.

Customers investing in Fuji's complex and integrated SMT lines or machine tool solutions typically face high switching costs. These costs include the initial capital outlay, training, integration with existing factory systems, and potential disruption to production, which reduces their immediate bargaining power.

For instance, a company adopting Fuji's advanced semiconductor manufacturing equipment might have invested millions in machinery and specialized training for its workforce. The process of retooling for a competitor's products, including new hardware, software, and retraining, can easily run into hundreds of thousands or even millions of dollars, along with significant downtime. This financial and operational commitment makes it difficult for customers to switch to alternative suppliers, thereby limiting their ability to demand lower prices or better terms from Fuji.

Fuji's strategic focus on product differentiation, particularly through advanced automation software and superior precision in its manufacturing equipment, significantly curtails customer bargaining power. When Fuji's technology offers distinct advantages, such as enhanced efficiency or novel capabilities, customers become less sensitive to price competition and more reliant on Fuji's specialized offerings.

For instance, in the competitive semiconductor manufacturing sector, where Fuji Electric is a key player, the ability to deliver equipment with unparalleled speed and accuracy is a major differentiator. This technological edge means that customers who integrate Fuji's advanced systems into their production lines gain a substantial competitive advantage, making them hesitant to switch to less sophisticated or less precise alternatives solely for cost savings.

Customer price sensitivity and industry profitability

Customer price sensitivity plays a crucial role in determining industry profitability, especially for equipment suppliers like Fuji. In sectors such as electronics manufacturing or general machining, where competition is fierce, customers often face significant pressure to cut costs. This directly translates into demands for lower prices from their suppliers.

However, the degree of price sensitivity can vary. If a particular piece of equipment is critical for maintaining high performance and reliability in a customer's operations, the customer might be less inclined to prioritize price over these essential attributes. For instance, in the semiconductor industry, the precision and uptime of manufacturing equipment are paramount, often outweighing minor price differences.

- Price Sensitivity Impact: In 2024, the global industrial automation market, which includes machinery like Fuji's, continued to see strong demand driven by efficiency needs. However, economic headwinds in some regions led to increased customer negotiation on capital expenditures, particularly for standard or less critical equipment.

- Performance vs. Price: For high-value, specialized machinery critical for advanced manufacturing processes, like those used in aerospace or medical device production, customers in 2024 demonstrated a lower price sensitivity, prioritizing technological advancement and long-term operational efficiency.

- Industry Benchmarks: In competitive sectors like automotive parts manufacturing, customers often seek price reductions of 3-5% annually from their key equipment suppliers, putting pressure on margins for machinery providers if value-added services or unique features are not clearly demonstrated.

Availability of alternative suppliers for customers

The availability of alternative suppliers for electronic component mounting machines and machine tools significantly influences customer bargaining power. When customers have numerous viable options from competitors offering comparable performance and features, their ability to negotiate more favorable terms with Fuji is amplified.

This competitive landscape means customers can readily switch if Fuji's pricing or terms are not attractive. For instance, in 2024, the global market for surface-mount technology (SMT) equipment saw continued innovation from players like ASM Assembly Systems, Hanwha Precision Machinery, and Mirae Corporation, offering Fuji direct competition and thus bolstering customer leverage.

- Increased competition in the SMT equipment market provides customers with a wider array of choices.

- Customers can leverage alternative supplier offerings to negotiate better pricing and terms with Fuji.

- The presence of strong competitors in 2024, such as ASM Assembly Systems and Hanwha Precision Machinery, directly enhances customer bargaining power.

- Fuji must remain competitive in its offerings and pricing to mitigate the impact of customers having readily available alternatives.

Fuji's customers possess considerable bargaining power, particularly large-scale manufacturers in sectors like electronics and automotive. Their ability to negotiate is amplified by the availability of numerous alternative suppliers offering comparable SMT and machine tool solutions. This competitive environment, evident in 2024 with strong showings from competitors like ASM Assembly Systems and Hanwha Precision Machinery, allows customers to readily seek better pricing and terms.

| Factor | Impact on Fuji's Customer Bargaining Power | 2024 Context/Example |

|---|---|---|

| Customer Concentration & Order Volume | High concentration of large buyers increases leverage. | Major electronics manufacturers placing bulk orders for SMT lines. |

| Switching Costs | High costs (training, integration) reduce customer power. | Millions invested in Fuji's advanced semiconductor equipment limit immediate switching. |

| Product Differentiation | Unique features (automation, precision) lessen price sensitivity. | Fuji's superior speed and accuracy in semiconductor equipment provide a competitive edge. |

| Price Sensitivity | High sensitivity in competitive markets pressures margins. | Automotive parts manufacturers seeking 3-5% annual price reductions. |

| Availability of Alternatives | Numerous competitors empower customers to negotiate. | Strong competition in SMT market from ASM, Hanwha, Mirae in 2024. |

What You See Is What You Get

FUJI Porter's Five Forces Analysis

This preview showcases the complete FUJI Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive instantly after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The electronic component mounting machine and machine tool sectors are dominated by a handful of major global companies. This concentrated landscape intensifies competition as these established players, such as Panasonic, Yamaha, ASM Pacific Technology, DMG Mori, Mazak, and Okuma, vigorously pursue market share.

The Surface Mount Technology (SMT) and broader automation sectors are dynamic, with ongoing technological advancements. However, the growth rates within specific segments, particularly for traditional chip mounters and established machine tools, can vary significantly. For instance, while the global industrial automation market was projected to reach approximately $234.7 billion in 2024, according to some market analyses, the mature segments within this market might exhibit more modest growth.

This differential growth can indeed intensify competitive rivalry. When core markets mature and growth slows, companies often find themselves vying for a more limited customer base. This scarcity can naturally lead to increased price competition as firms attempt to capture market share and maintain sales volumes, impacting profitability for all players.

Competitive rivalry within the semiconductor equipment industry, including Fuji's market, is heavily influenced by product differentiation and continuous technological innovation. Companies like Fuji compete fiercely on advanced features, speed, precision, automation capabilities, and software integration, pushing for innovation to gain an edge.

In 2024, the relentless pursuit of smaller, more powerful, and energy-efficient chips fuels this rivalry. For instance, advancements in lithography, etching, and deposition technologies are critical differentiators, with significant R&D investments by major players reflecting this focus. Companies are investing billions to stay ahead.

High fixed costs and capacity utilization

The electronic component mounting and machine tool sectors are characterized by significant fixed costs. These investments are necessary for research and development, maintaining advanced manufacturing facilities, and establishing comprehensive global sales and service infrastructure. For instance, a leading manufacturer of electronic component mounting machines might invest hundreds of millions of dollars in R&D and state-of-the-art production lines annually.

These high fixed costs create a strong incentive for companies to achieve high capacity utilization. Operating at near-maximum capacity helps spread these costs over a larger output, thereby reducing the per-unit cost. This pressure to utilize capacity can intensify competitive rivalry, especially when demand softens.

- High R&D and Capital Expenditures: Companies in these industries often spend a substantial portion of their revenue on innovation and advanced machinery. For example, in 2023, major players in the semiconductor equipment sector reported R&D spending ranging from 15% to over 20% of their annual revenue.

- Capacity Utilization Pressure: When demand fluctuates, companies may resort to aggressive pricing strategies to ensure their factories and equipment are running at optimal levels, aiming to cover fixed overheads.

- Impact on Pricing: This dynamic can lead to price wars during economic downturns or periods of oversupply, as firms prioritize covering their substantial fixed costs over short-term profit margins.

Exit barriers and industry consolidation

High exit barriers, including specialized assets and substantial R&D investments, compel companies to stay in the market even when facing difficulties. This persistence can fuel ongoing intense competition, although the industry may see consolidation as stronger firms acquire weaker ones.

For instance, in the semiconductor industry, the immense cost of advanced manufacturing facilities and the lengthy development cycles for new chip designs create significant exit barriers. Companies like TSMC, with billions invested in leading-edge foundries, are unlikely to exit easily, contributing to a concentrated market structure where competition remains fierce among a few dominant players.

The automotive sector also exemplifies this. The capital required for global supply chains, extensive dealer networks, and ongoing investment in electric vehicle technology makes exiting prohibitively expensive for established manufacturers. This often leads to strategic alliances and mergers, as seen with the Stellantis formation, to share the burden of these high exit costs and R&D demands.

- High Capital Investment: Specialized machinery, like those used in pharmaceutical manufacturing or advanced materials production, represents a sunk cost that discourages exit.

- Long-Term Contracts & Relationships: Established supplier agreements or deep customer loyalty in sectors like enterprise software can make it difficult for firms to disengage.

- Brand Reputation & Goodwill: Companies with strong brand recognition have invested heavily in building that equity, and exiting would mean abandoning this valuable intangible asset.

- Government Regulations: Certain industries, like aerospace or defense, have regulatory hurdles and specialized certifications that make it complex and costly to cease operations.

Competitive rivalry in the electronic component mounting and machine tool sectors is intense due to a concentrated market dominated by a few global players like Panasonic and DMG Mori. This rivalry is fueled by continuous technological innovation, with companies investing heavily in R&D to differentiate their offerings, especially in areas like advanced features and automation capabilities.

High fixed costs associated with advanced manufacturing and R&D create pressure for high capacity utilization, often leading to aggressive pricing to cover overheads, particularly during demand downturns. For instance, major semiconductor equipment players reported R&D spending between 15% and over 20% of revenue in 2023.

Furthermore, high exit barriers, including substantial capital investments and specialized assets, mean companies are less likely to leave the market, perpetuating fierce competition. The automotive sector, for example, sees high exit costs due to investments in EV technology and global supply chains, leading to consolidation.

| Industry Segment | Key Players | Competitive Intensity Drivers | 2024 Market Insight |

|---|---|---|---|

| Electronic Component Mounting Machines | Panasonic, Yamaha, ASM Pacific Technology | Technological innovation, speed, precision, automation | Global industrial automation market projected around $234.7 billion, with mature segments showing more moderate growth. |

| Machine Tools | DMG Mori, Mazak, Okuma | Advanced features, software integration, precision, R&D investment | Companies invest hundreds of millions annually in R&D and advanced production lines. |

| Semiconductor Equipment | Various global leaders | Continuous innovation (lithography, etching), R&D spending (15-20%+ of revenue in 2023) | Intense competition driven by demand for smaller, more powerful chips. |

SSubstitutes Threaten

The threat of substitutes for Fuji's electronic component mounting machines is growing as alternative assembly technologies emerge. While Surface Mount Technology (SMT) is the current standard, advancements in areas like advanced robotics for placing unconventional components or even additive manufacturing for electronics present different production pathways.

For instance, while SMT dominated approximately 95% of the electronics assembly market in 2024, the increasing sophistication of robotic systems capable of handling larger or irregularly shaped components, often referred to as odd-form components, directly challenges the need for specialized SMT machines in certain applications.

Furthermore, the burgeoning field of additive manufacturing, or 3D printing for electronics, is slowly gaining traction. While not yet a direct replacement for high-volume SMT production, its ability to create integrated circuits and components on demand could disrupt niche markets or specific prototyping needs, thereby posing a potential future threat.

The viability of substitute solutions for Fuji's SMT equipment hinges on their price-performance ratio. If alternatives can match or exceed Fuji's precision, speed, and reliability at a lower cost, they pose a significant threat, especially for mass production scenarios. For instance, while general-purpose automation might be cheaper initially, its lower throughput and specialized integration needs could negate cost savings for high-volume electronics manufacturing.

Customer willingness to embrace entirely new production paradigms in place of existing SMT lines remains largely subdued. This reluctance stems from the substantial capital outlay required for new equipment, the extensive re-tooling processes, and the rigorous re-qualification procedures necessary to ensure product quality and reliability. For instance, a significant shift could involve investing millions in new machinery and training, impacting operational efficiency during the transition.

However, a notable exception emerges when considering novel product categories or highly specialized applications. In these niche markets, customers may exhibit a greater openness to investigating alternative assembly methods. This willingness is often driven by the potential for performance enhancements, cost reductions, or the enablement of entirely new product functionalities that traditional SMT may not efficiently support. For example, the burgeoning field of advanced semiconductor packaging for AI hardware might see early adopters exploring novel assembly techniques.

Evolution of manufacturing paradigms

The broader evolution of manufacturing paradigms, such as highly flexible robotic cells or distributed manufacturing models, could indirectly act as substitutes for traditional chip mounter operations. These shifts might influence the demand for high-volume SMT lines by offering alternative production methods.

For instance, advancements in additive manufacturing and modular production systems are enabling more localized and on-demand production. This could reduce the reliance on centralized, high-throughput SMT lines, especially for certain product types or lower-volume runs.

- Robotic Cells: Increased adoption of highly flexible robotic cells can handle a wider variety of assembly tasks, potentially reducing the need for specialized chip mounters in some applications.

- Distributed Manufacturing: The rise of distributed manufacturing models, supported by technologies like 3D printing and advanced automation, allows for production closer to the point of consumption, potentially bypassing traditional SMT facilities.

- On-Demand Production: These evolving paradigms facilitate on-demand and customized manufacturing, which may not align with the economies of scale typically associated with high-volume SMT lines.

- Impact on Demand: While not direct replacements, these trends could subtly alter the demand for traditional chip mounters by offering alternative pathways for product creation and assembly.

Outsourcing of manufacturing services

The threat of substitutes for FUJI's manufacturing services is amplified by the increasing trend of customers outsourcing electronic assembly to contract manufacturers, also known as Electronic Manufacturing Services (EMS) providers. This allows customers to avoid significant capital expenditure on SMT equipment and the associated expertise needed to operate it.

This outsourcing trend effectively presents a substitute for customers who might otherwise consider in-house manufacturing. The global EMS market is substantial and growing; for instance, the market was valued at approximately $650 billion in 2023 and is projected to reach over $800 billion by 2028, indicating a strong demand for these outsourced solutions.

- Reduced Capital Outlay: Customers can avoid the upfront costs of purchasing and maintaining SMT lines, which can run into millions of dollars.

- Access to Expertise: EMS providers offer specialized knowledge in manufacturing processes, quality control, and supply chain management that customers may lack.

- Flexibility and Scalability: Outsourcing allows companies to scale production up or down more easily in response to market demand without being burdened by fixed assets.

- Focus on Core Competencies: By outsourcing manufacturing, companies can concentrate their resources and efforts on product design, research and development, and marketing.

The threat of substitutes for Fuji's SMT machines is moderate but growing, driven by alternative assembly technologies and the rise of EMS providers. While SMT dominated the electronics assembly market in 2024, new robotic systems and additive manufacturing pose potential disruptions, especially in niche applications. The viability of these substitutes hinges on their cost-effectiveness and ability to match SMT's precision and speed.

Customers' reluctance to adopt entirely new production paradigms, due to high capital investment and re-tooling costs, currently limits the threat. However, specialized applications and novel product categories may see earlier adoption of alternatives. The overall trend of outsourcing to EMS providers, a market valued at approximately $650 billion in 2023, also presents a significant substitute for in-house manufacturing, offering customers reduced capital outlay and access to specialized expertise.

| Substitute Technology | Current Market Penetration (Approx.) | Key Advantage | Key Limitation |

| Advanced Robotics (for odd-form components) | Niche (growing) | Handles diverse component shapes | Lower throughput than specialized SMT for high volume |

| Additive Manufacturing (Electronics) | Emerging/Niche | On-demand, integrated production | Not yet suitable for high-volume, complex assemblies |

| Electronic Manufacturing Services (EMS) | Significant and growing | Reduced capital expenditure, access to expertise | Potential loss of direct control over manufacturing process |

Entrants Threaten

The electronic component mounting machine and machine tool sectors demand substantial capital for research, development, cutting-edge production facilities, and establishing worldwide distribution. In 2024, for instance, the global machine tool market was valued at approximately $85 billion, with new entrants needing to invest heavily in precision engineering and automation to even begin competing.

Economies of scale for incumbent players represent a significant barrier for new entrants into the photography and imaging industry. Established companies like Fujifilm benefit from massive cost advantages across their operations. This includes lower per-unit costs in research and development, manufacturing, raw material sourcing, and distribution networks built over decades.

For example, Fujifilm's extensive global supply chain and high-volume production allow them to negotiate better prices for components and materials. In 2023, Fujifilm reported revenue of approximately $24.5 billion, underscoring the scale of their operations. Newcomers would find it incredibly challenging to match these cost efficiencies without achieving a comparable market share, which is difficult to attain quickly.

This cost disadvantage means that any new company entering the market would likely have to price their products higher or accept lower profit margins to compete. Fujifilm's established brand recognition and customer loyalty further amplify this advantage, making it harder for new entrants to gain traction and build the necessary volume to overcome the scale-based cost barriers.

Fuji's significant investment in proprietary technology and patents, particularly in high-precision automation and surface-mount technology (SMT), creates a substantial barrier to entry. Developing comparable capabilities requires years of dedicated research and development, along with substantial capital, making it difficult for newcomers to compete effectively.

Access to established distribution channels and customer relationships

New entrants often struggle to replicate the extensive global distribution networks and established customer relationships that incumbents like Fuji have cultivated over many years. These deep-seated connections represent a significant barrier, as building trust and reliable sales channels from scratch is a time-consuming and resource-intensive endeavor.

For instance, Fuji's established partnerships with major retailers and service providers worldwide mean that new competitors must invest heavily to even gain initial access to markets, let alone achieve comparable reach. This entrenched advantage makes it difficult for new players to compete effectively on distribution and customer loyalty.

- Established Distribution: Fuji benefits from decades of building relationships with global distributors and retailers, ensuring broad product availability.

- Customer Loyalty: Long-standing customer relationships fostered through reliable service and product quality create a significant hurdle for new entrants to overcome.

- Infrastructure Costs: The cost and time required to build a comparable global sales and service infrastructure are prohibitive for most new companies.

Regulatory hurdles and industry standards

The threat of new entrants for companies like FUJI, particularly in sectors like photography and medical imaging, is significantly influenced by regulatory hurdles and industry standards. These industries demand adherence to rigorous quality control, certifications, and often country-specific regulations, creating substantial barriers.

For instance, medical imaging equipment must meet strict FDA (U.S. Food and Drug Administration) or CE (Conformité Européenne) marking requirements, which involve extensive testing and documentation. In 2024, the cost and time associated with obtaining these approvals can easily run into hundreds of thousands or even millions of dollars, deterring smaller players.

- Stringent Quality Standards: Industries like medical imaging require ISO 13485 certification for quality management systems, a process that can take years and significant investment.

- Regulatory Compliance Costs: Navigating global regulations for imaging products, such as those from the European Medicines Agency (EMA) or Japan's Pharmaceuticals and Medical Devices Agency (PMDA), adds complexity and expense.

- Product Certification Timelines: Obtaining necessary certifications can delay market entry by 18-24 months or more, representing a significant opportunity cost for new entrants.

- Intellectual Property Protection: FUJI's extensive patent portfolio in areas like sensor technology and image processing further solidifies its market position, making it challenging for newcomers to innovate without infringement.

The threat of new entrants into FUJI's markets, such as electronic component mounting machines and medical imaging, is significantly mitigated by high capital requirements and established economies of scale. For example, the global machine tool market's approximate $85 billion valuation in 2024 highlights the substantial initial investment needed for precision engineering and automation. Furthermore, FUJI's 2023 revenue of $24.5 billion illustrates the immense scale advantage that translates into lower per-unit costs for established players.

Porter's Five Forces Analysis Data Sources

Our FUJI Porter's Five Forces analysis is built on a foundation of diverse data sources, including financial reports from public companies, industry-specific market research, and government economic indicators. This comprehensive approach ensures a robust understanding of competitive pressures.